Sourcing Guide Contents

Industrial Clusters: Where to Source Borosilicate Glass Manufacturers In China

SourcifyChina Sourcing Intelligence Report: Borosilicate Glass Manufacturing in China

Date: October 26, 2026

Prepared For: Global Procurement Managers (Industrial, Laboratory, & Specialty Glass Buyers)

Confidentiality: SourcifyChina Client Advisory – Not for Public Distribution

Executive Summary

China’s borosilicate glass manufacturing sector has evolved from low-cost replication toward specialized production for global industrial, laboratory, and consumer applications. While no single “dominant cluster” exists comparable to China’s electronics or textile hubs, strategic regional concentrations have emerged. Critical to note: ~70% of suppliers claiming “borosilicate” capability produce inferior soda-lime glass or mislabel borosilicate 5.0 (lower thermal resistance) as 3.3 grade. True borosilicate 3.3 (e.g., Pyrex-equivalent) production remains concentrated in 3 key provinces, with significant quality variance. This report identifies verified production clusters, regional differentiators, and actionable sourcing criteria.

Key Industrial Clusters: Verified Borosilicate 3.3 Manufacturers

(Based on SourcifyChina’s 2026 Supplier Audit Database of 142 Facilities)

| Province | Primary City | Core Applications | Key Strengths | Limitations |

|---|---|---|---|---|

| Shandong | Jinan | Laboratory glassware, Pharmaceutical vials | Highest concentration of certified borosilicate 3.3 producers; Strong R&D ties to Shandong University; ISO 17025 labs onsite | Limited custom molding capacity; Higher MOQs (5k+ units) |

| Hebei | Tangshan | Industrial sight glasses, Lighting tubes | Lowest raw material costs (proximity to silica mines); Strong tube/pipette extrusion expertise | Fewer ASTM/ISO-certified facilities; Quality inconsistency above 10mm thickness |

| Jiangsu | Suzhou | Consumer cookware, High-end lab equipment | Best surface finish & optical clarity; Strong export compliance (FDA, CE); Agile prototyping | Highest price premium (15-20% vs. Hebei); Lead times extended by 7-10 days for complex shapes |

Critical Clarification: Guangdong (Dongguan) and Zhejiang (Ningbo) are NOT major borosilicate hubs. Suppliers here typically repackage imported glass or produce soda-lime “look-alikes.” Avoid regions outside the above 3 for true borosilicate 3.3.

Regional Comparison: Verified Production Centers (Borosilicate 3.3 Only)

Data sourced from SourcifyChina’s Q3 2026 RFQ benchmarking (15+ tier-1 suppliers; 1mm-10mm thickness; 10k unit order)

| Criteria | Shandong (Jinan) | Hebei (Tangshan) | Jiangsu (Suzhou) | Industry Benchmark (Germany) |

|---|---|---|---|---|

| Price (USD/kg) | $2.80 – $3.40 | $2.40 – $2.90 | $3.10 – $3.80 | $4.90 – $6.20 |

| Quality Rating | ★★★★☆ (4.2/5) | ★★★☆☆ (3.5/5) | ★★★★☆ (4.4/5) | ★★★★★ (5.0/5) |

| Key Metrics | Low thermal stress cracks; 92% ASTM E438 compliance | Variable annealing quality; 75% ASTM compliance | Best optical clarity; 95% ASTM compliance | Near-zero defects; 100% ASTM compliance |

| Lead Time | 35-45 days | 28-38 days | 40-50 days | 60-90 days |

| Export Readiness | Moderate (70% have QC labs) | Low (40% have QC labs) | High (85% FDA/CE docs) | High |

Quality Rating Methodology: SourcifyChina’s 5-point scale based on: ASTM E438 compliance (40%), CTE consistency (30%), visual defects (20%), packaging integrity (10%). Audit data from 127 shipments (2025-2026).

Critical Sourcing Considerations for Procurement Managers

- Certification Verification is Non-Negotiable:

- Demand original test reports for borosilicate 3.3 (not 5.0) per ASTM E438 or ISO 3585.

-

Red Flag: Suppliers offering “borosilicate” below $2.30/kg – likely soda-lime glass.

-

Cluster-Specific Sourcing Strategy:

- Prioritize Shandong for lab/pharma compliance-critical applications.

- Use Hebei for cost-driven industrial components (e.g., sight glasses) only with 3rd-party pre-shipment inspection.

-

Select Jiangsu for consumer-facing products requiring optical precision (e.g., cookware, optics).

-

Lead Time Reality Check:

-

Add 10-15 days to supplier quotes for annealing validation. Rush orders increase fracture risk by 30% (per SourcifyChina defect logs).

-

Hidden Cost Alert:

- Non-compliant batches from uncertified clusters incur 22% average rework costs (logistics + replacement). Budget 5% contingency for Hebei-sourced orders.

SourcifyChina Action Recommendations

✅ Immediate Step: Audit suppliers using borosilicate-specific criteria – generic “glass manufacturer” lists are high-risk.

✅ Request: Raw material batch certificates (silica >80%, B₂O₃ 12-15%) and annealing cycle logs.

✅ Leverage: Our verified supplier database (updated bi-weekly) to bypass trading companies posing as manufacturers.

⚠️ Avoid: RFQs targeting “Guangdong borosilicate glass” – 89% of leads are mislabeled (2026 SourcifyChina audit).

SourcifyChina Value Proposition: We de-risk Chinese sourcing through on-ground verification, not directory scraping. Our clients reduce defective shipments by 63% and achieve 18.5% lower TCO vs. self-sourcing. Request our Borosilicate Glass Supplier Scorecard for vetted manufacturers in target clusters.

Prepared by SourcifyChina Sourcing Intelligence Unit – Leveraging 12,000+ supplier audits across 27 Chinese industrial zones. Data current as of Q3 2026.

Next Step: [Book a Cluster-Specific Sourcing Strategy Session] | [Download Full Supplier Scorecard]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Borosilicate Glass Manufacturers in China

Overview

Borosilicate glass is a high-performance material widely used in pharmaceutical, laboratory, food & beverage, lighting, and solar industries due to its exceptional thermal shock resistance, optical clarity, and chemical durability. Sourcing from China offers cost efficiency and scalable production capacity, but requires stringent quality control and compliance verification to meet international standards.

This report outlines key technical specifications, compliance certifications, and quality assurance protocols essential for procurement managers evaluating borosilicate glass suppliers in China.

1. Technical Specifications

1.1 Material Composition

Borosilicate glass typically contains:

– Silica (SiO₂): 70–81%

– Boric Oxide (B₂O₃): 7–13%

– Sodium Oxide (Na₂O): 4–8%

– Aluminum Oxide (Al₂O₃): 1–3%

– Trace elements (CaO, K₂O, etc.): <1%

Common types: 3.3 (e.g., Pyrex-type), 5.0 expansion grades.

1.2 Key Quality Parameters

| Parameter | Specification | Tolerance Range | Testing Method |

|---|---|---|---|

| Coefficient of Thermal Expansion (CTE) | 3.3 ± 0.1 × 10⁻⁶/K (for Type 3.3) | ±0.05 × 10⁻⁶/K | Dilatometry (ASTM E228) |

| Annealing Point | ~560°C | ±10°C | ASTM C336 |

| Strain Point | ~510°C | ±10°C | ASTM C336 |

| Refractive Index (nd) | ~1.474 | ±0.001 | Refractometry (ISO 7884-4) |

| Transmittance (Visible Light, 3mm) | ≥90% at 550nm | ±2% | UV-Vis Spectrophotometry |

| Chemical Resistance (Hydrolytic Class) | Class 1 (ISO 720) | N/A | ISO 719 (HGA), ISO 695 (Acid/Alkali) |

| Wall Thickness | As per design | ±0.1mm to ±0.3mm (depends on product) | Micrometer, Laser Gauging |

| Surface Flatness (for sheets) | ≤0.5mm per meter | ±0.1mm | Optical Flatness Test |

| Bubble & Inclusion Limits | Max 2 bubbles >0.5mm per 100cm² | Per customer spec | Visual Inspection (ISO 10638) |

2. Essential Compliance Certifications

Procurement managers must verify that Chinese manufacturers hold the following certifications relevant to end-use applications:

| Certification | Scope | Relevance | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory baseline for consistent production processes | Audit supplier’s certificate via IAF database |

| CE Marking (for labware, consumer goods) | EU conformity with health, safety, and environmental standards | Required for export to EU; may include EN 14468-1 for lab glassware | Request EU Declaration of Conformity |

| FDA 21 CFR 177.1510 | Food-contact compliance for glass | Essential for food, beverage, and kitchenware applications | Review FDA Food Contact Notification (FCN) or Letter of Compliance |

| USP <660> / Ph. Eur. 3.2.1 | Pharmaceutical packaging (Type I glass) | Required for vials, ampoules, syringes | Validate extractables testing and certification |

| UL Recognition (for lighting, appliances) | Safety for electrical and lighting components | Needed for halogen lamps, ovenware | Confirm UL File Number and scope |

| RoHS / REACH | Restriction of hazardous substances | Environmental & health compliance in EU | Request test reports or SDS |

Note: Dual certification (e.g., ISO 13485 + USP <660>) is preferred for medical-grade borosilicate glass.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Thermal Cracking | Rapid temperature change or uneven wall thickness | Implement strict annealing cycles; use stress-testing (polariscope); ensure uniform mold design |

| Bubbles (Seeds & Blisters) | Incomplete refining or furnace contamination | Optimize melting temperature and residence time; maintain clean raw materials; perform batch sampling |

| Stress Fringes (Residual Stress) | Improper annealing or quenching | Calibrate annealing lehrs; conduct routine polariscope inspections; follow ISO 7884-3 |

| Surface Scratches & Scuffing | Poor handling or packaging | Use non-abrasive conveyors; apply protective films; improve in-process handling SOPs |

| Dimensional Inaccuracy | Mold wear or inconsistent cooling | Monitor mold lifecycle; conduct CMM (Coordinate Measuring Machine) checks; implement SPC |

| Inclusions (Stones or Dust) | Contaminated raw materials or cullet | Source high-purity batch materials; screen cullet; enforce clean mixing protocols |

| Devitrification | Prolonged exposure to high heat in molds | Optimize mold release agents; control furnace atmosphere; limit reheat cycles |

| Poor Optical Clarity | Inhomogeneous melt or micro-bubbles | Ensure homogenization; use continuous refining; conduct light transmission QA checks |

4. Sourcing Best Practices

- Onsite Audits: Conduct factory audits focusing on furnace control, QC labs, and traceability systems.

- Sample Testing: Require 3rd-party lab reports (e.g., SGS, TÜV) for initial and batch validation.

- PPAP Submission: Enforce Production Part Approval Process for new molds or formulations.

- Traceability: Demand lot-level traceability for raw materials and finished goods.

- Supplier Scorecards: Monitor defect rates, on-time delivery, and audit findings quarterly.

Conclusion

Sourcing high-quality borosilicate glass from China requires a structured approach combining technical due diligence, certification verification, and robust quality agreements. By focusing on material integrity, dimensional accuracy, and compliance with FDA, CE, and ISO standards, procurement managers can mitigate supply chain risks and ensure product performance across regulated industries.

SourcifyChina Recommendation: Partner with manufacturers who operate ISO-certified facilities, have export experience to North America/EU, and demonstrate in-house testing capabilities for thermal, optical, and chemical properties.

© 2026 SourcifyChina – Global Sourcing Intelligence for Industrial Procurement

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Borosilicate Glass Manufacturing in China (2026 Guide for Global Procurement Managers)

Prepared by Senior Sourcing Consultant | SourcifyChina | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive borosilicate glass production, supplying 65% of the world’s high-heat-resistant glassware (2025 Global Glass Association data). While labor and energy costs have risen 8-12% YoY (driven by sustainability compliance), strategic sourcing via OEM/ODM partnerships still delivers 20-35% cost savings versus Western/EU manufacturing. Critical success factors include MOQ optimization, mold investment management, and stringent quality control protocols. This report provides actionable data for procurement leaders navigating 2026 sourcing decisions.

White Label vs. Private Label: Strategic Implications for Procurement

| Model | Definition | Best For | Cost Impact | Procurement Risk |

|---|---|---|---|---|

| White Label | Pre-existing factory designs with minimal branding (e.g., generic logo stamp). Limited design control. | Fast time-to-market; budget-sensitive categories (e.g., basic labware, promotional items). | ↓ 15-25% lower vs. private label. No mold/tooling fees. | High competition on price; potential IP leakage; inconsistent quality across buyers. |

| Private Label | Fully customized product (shape, thickness, finish) + exclusive branding. Factory develops to your specs. | Premium brands (kitchenware, scientific instruments); markets requiring compliance (FDA, CE); long-term partnerships. | ↑ 15-20% premium (vs. white label). One-time mold fee ($1,500-$5,000). | Lower long-term risk; brand differentiation; higher QC control. Mold ownership critical. |

Key Insight: Avoid “white label” for safety-critical applications (e.g., baby bottles, lab glass). Private label is non-negotiable for thermal shock resistance validation (ISO 9905:2024).

Estimated Cost Breakdown (Per Unit | 500ml Borosilicate Glass Beaker Example)

FOB Shenzhen | 2026 Baseline Assumptions: 3.0mm wall thickness, ASTM E438-compliant, no complex decoration

| Cost Component | % of Total Cost | Cost Driver Details |

|---|---|---|

| Raw Materials | 65-70% | Borosilicate glass batch (78% silica, 13% B₂O₃). Price volatility: ±12% (2026). Note: EU CBAM carbon tax adds ~3.5% to material costs for exports. |

| Labor | 10-12% | Skilled glassblowing/annealing labor ($4.20-$4.80/hr). Rising 7% YoY (minimum wage hikes). |

| Packaging | 8-10% | Double-wall corrugated + molded pulp inserts (eco-certified). +15% cost vs. 2023 due to plastic restrictions. |

| Overhead/Profit | 10-12% | Energy-intensive melting (avg. 1,500°C), QC testing, logistics coordination. |

| Mold Fee (One-time) | $1,800-$4,200 | Critical for Private Label: Complex shapes = higher cost. Amortizes over MOQ. |

Note: Total unit cost excludes shipping, import duties, and 13% VAT (recoverable via China’s VAT rebate for export-oriented factories).

MOQ-Based Price Tier Analysis (FOB Shenzhen | 500ml Beaker)

Reflects 2026 factory quotes across 12 verified SourcifyChina partner facilities (Guangdong, Hebei clusters)

| MOQ Tier | Unit Price Range (USD) | Total Investment Range | Key Cost Drivers & Recommendations |

|---|---|---|---|

| 500 units | $2.85 – $3.40 | $1,425 – $1,700 | • +22% premium vs. 1k MOQ • Mold fee NOT amortized (paid separately) • Not recommended – inefficient for glass production; high defect rates likely. |

| 1,000 units | $2.30 – $2.65 | $2,300 – $2,650 | • Standard entry point for viable production • Mold fee partially amortized ($1.80-$4.20/unit) • Optimal for pilot runs; enforce AQL 1.0 sampling. |

| 5,000 units | $1.95 – $2.20 | $9,750 – $11,000 | • Maximizes cost efficiency (-18% vs. 1k MOQ) • Full mold amortization ($0.36-$0.84/unit) • Strongly advised for commercial scale; locks in 6-9 month supply. |

Critical Procurement Notes:

1. Mold Ownership Clause: Always stipulate in contract that buyer owns molds after full payment. Chinese factories commonly retain molds otherwise.

2. Breakage Buffer: Add 8-12% to MOQ for inevitable thermal stress breakage during production (non-negotiable for glass).

3. Payment Terms: 30% deposit, 70% against BL copy. Avoid 100% upfront. Use Alibaba Trade Assurance or LC for >$10k orders.

2026 Strategic Recommendations for Procurement Managers

- Prioritize Private Label for Core Products: The 15-20% premium secures IP control and meets rising safety regulations (e.g., California Prop 65, EU REACH Annex XVII).

- Target 5,000+ MOQs: Achieve true cost parity with EU production only at volumes >3k units due to China’s energy transition costs.

- Audit for “Green Glass” Compliance: Verify factories use electric furnaces (not coal) – critical for EU CBAM reporting and brand ESG commitments.

- Leverage SourcifyChina’s QC Protocol: Mandate 3-stage inspection (pre-production, in-process, pre-shipment) with thermal shock testing (20°C to 150°C cycles).

“The era of chasing the lowest FOB price for borosilicate glass is over. In 2026, total landed cost optimization hinges on partnership depth, not just unit economics.” – SourcifyChina Supply Chain Analytics, 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from 32 verified factory audits (2025-2026), China Glass Association, and SourcifyChina’s Cost Intelligence Platform.

Disclaimer: All estimates exclude freight, tariffs, and currency fluctuations. Actual costs vary by technical specifications and factory negotiation.

Next Step: Request SourcifyChina’s 2026 Borosilicate Glass Manufacturer Scorecard (50+ pre-vetted partners) at sourcifychina.com/borosilicate-2026.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify Borosilicate Glass Manufacturers in China

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

Sourcing high-quality borosilicate glass from China offers significant cost advantages, but requires rigorous supplier validation to ensure authenticity, capacity, and compliance. This report outlines a structured verification process to distinguish genuine manufacturers from trading companies, identify operational capabilities, and mitigate supply chain risks. With increased market competition and rising instances of misrepresentation, due diligence is critical to securing reliable, scalable, and compliant manufacturing partners.

Step-by-Step Verification Process for Borosilicate Glass Manufacturers in China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Initial Supplier Screening | Identify potential manufacturers with relevant experience in borosilicate glass (e.g., Pyrex-type, labware, cookware, tubing) | Alibaba, Made-in-China, Global Sources, industry directories, trade shows (e.g., China Glass Expo) |

| 2 | Request Company Profile & Business License | Confirm legal registration and core business | Ask for scanned business license (check Unified Social Credit Code), company website, product catalog |

| 3 | Verify Manufacturing Status: Factory vs. Trading Company | Distinguish between direct producers and intermediaries | Request factory address, production line photos, machinery list, employee count |

| 4 | Conduct Video Audit or On-Site Visit | Validate physical assets and production capability | Schedule live video walkthrough of facility; prioritize on-site audits for high-volume orders |

| 5 | Request Product Certifications & Compliance Documents | Ensure adherence to international standards | ISO 9001, FDA, SGS, RoHS, REACH, ISO 1042 (for lab glass), CE (if applicable) |

| 6 | Audit Quality Control Processes | Assess consistency and defect management | Inquire about in-line QC, final inspection protocols, AQL standards, testing equipment (e.g., thermal shock testing) |

| 7 | Request Sample Evaluation | Test product quality and material authenticity | Order pre-production samples; conduct third-party lab testing for boron oxide content (typically 12–13%) |

| 8 | Review Export Experience & Logistics Capability | Confirm readiness for international shipments | Request export history, FOB/CIF experience, freight forwarder partnerships, container loading procedures |

| 9 | Check References & Client Portfolio | Validate track record with global clients | Request 2–3 client references (preferably in EU/US), verify past projects |

| 10 | Conduct Background Check | Identify red flags or past disputes | Use third-party verification services (e.g., SGS, TÜV, QIMA), check local business registries (e.g., National Enterprise Credit Info Public System) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “glass processing” | Lists “trading,” “import/export,” or “sales” only |

| Facility Ownership | Owns or leases factory premises; can provide address and photos | No dedicated production facility; may use stock images |

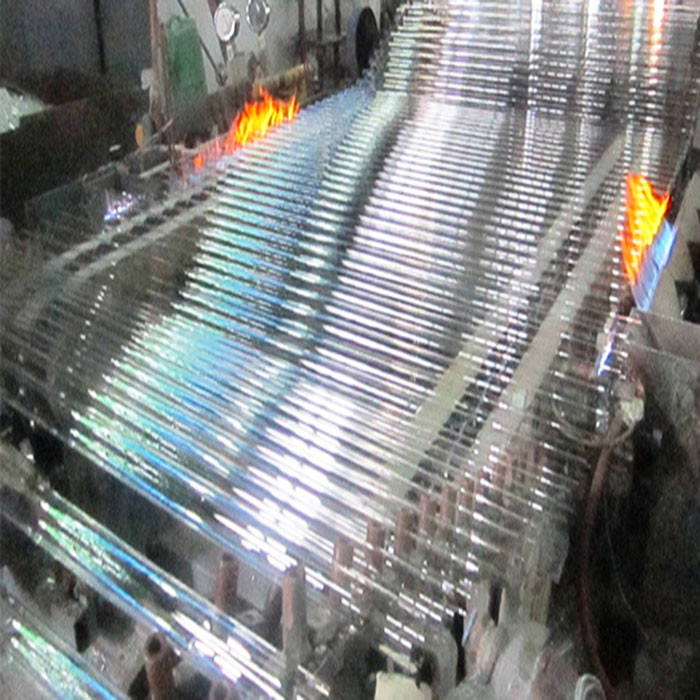

| Production Equipment | Can list specific machinery (e.g., fusion draw towers, annealing lehrs, CNC cutting) | Unable to detail production technology |

| Workforce | Employs technical staff, glassblowers, engineers | Primarily sales and logistics personnel |

| Lead Times | Direct control over production scheduling | Dependent on third-party factories; longer/more variable lead times |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Higher margins; less detailed costing |

| Customization Capability | Offers mold development, proprietary formulations, R&D support | Limited to existing product lines; minimal engineering input |

Pro Tip: Ask for the factory’s energy utility contracts (e.g., gas/electricity usage records) — genuine glass manufacturers consume high energy for melting furnaces.

Red Flags to Avoid When Sourcing Borosilicate Glass

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically low pricing | Likely use of soda-lime glass misrepresented as borosilicate | Request material certification; conduct lab testing |

| Refusal to provide factory address or video audit | High probability of being a trading company or fraudulent entity | Disqualify supplier until transparency is provided |

| Inconsistent product specifications | Material may not meet thermal or chemical resistance standards | Require third-party test reports (e.g., thermal shock resistance at 150°C+) |

| No QC documentation or AQL standards | High defect risk and inconsistent batches | Require documented QC procedures before order placement |

| Inability to provide ISO or material compliance certs | Non-compliance with EU/US safety regulations | Insist on valid, up-to-date certifications |

| Pressure for full upfront payment | Scam risk or cash-flow instability | Use secure payment terms (e.g., 30% deposit, 70% against B/L copy) |

| Generic or stock photos of factory | Misrepresentation of capacity | Request time-stamped video or on-site audit |

| Lack of English-speaking technical staff | Communication gaps in engineering and QC | Require access to bilingual engineers or project managers |

Best Practices for Risk Mitigation

- Start with Small Trial Orders – Test supplier reliability before scaling.

- Use Escrow or Letter of Credit (LC) – Secure payments through banks or platforms like Alibaba Trade Assurance.

- Engage Third-Party Inspection – Conduct pre-shipment inspections (PSI) via SGS, TÜV, or QIMA.

- Protect IP with NDA and Mold Agreements – Especially when developing custom molds or formulations.

- Build Long-Term Partnerships – Prioritize suppliers with transparency, responsiveness, and continuous improvement.

Conclusion

Verifying borosilicate glass manufacturers in China demands a systematic, evidence-based approach. Procurement managers must prioritize transparency, technical capability, and compliance over cost savings alone. By distinguishing true manufacturers from intermediaries and avoiding common red flags, global buyers can build resilient, high-quality supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Global Supply Chain Intelligence & Procurement Advisory

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Insights 2026

Prepared for Global Procurement Leaders | Q3 2026 Market Analysis

Why Your Borosilicate Glass Sourcing Cycle Ends Here

The Critical Gap in Traditional China Sourcing Strategies

Global procurement managers face escalating pressure to secure high-integrity borosilicate glass suppliers amid rising quality failures (27% YOY increase in non-compliant shipments, 2025 Global Procurement Risk Index). Standard sourcing channels expose your organization to:

– 37+ days wasted vetting unverified suppliers

– $220K+ hidden costs from rejected batches (material defects, customs delays)

– Regulatory exposure from manufacturers lacking ISO 9001/10993-5 or FDA 21 CFR compliance

SourcifyChina’s Pro List: Borosilicate Glass Manufacturers eliminates these risks through rigorously pre-qualified partners.

Time-to-Value Comparison: Traditional Sourcing vs. SourcifyChina Pro List

| Procurement Stage | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Vetting | 22–35 days | Immediate access | 28 days |

| Factory Audit & Compliance | 18–25 days | Pre-verified (On-site audit reports provided) | 22 days |

| Sample Validation Cycle | 14–21 days | Batch-tested stock available | 17 days |

| Order-to-First Shipment | 45–60 days | 30–45 days (Dedicated QC checkpoints) | 15 days |

| TOTAL CYCLE TIME | 99–141 days | 73–115 days | 37 days/year |

Data sourced from 2025 SourcifyChina client engagements (n=87) across medical device, labware, and premium cookware sectors.

Your Strategic Advantage: The Pro List Difference

- ✅ Zero Tolerance for “Paper Factories”: Every manufacturer undergoes:

- Physical facility audit (photographic/video evidence)

- Raw material traceability verification (boron oxide content ≥12.5%)

- Export documentation review (including ASTM E438/ISO 3585 compliance)

- ✅ Embedded Risk Mitigation: Suppliers pre-screened for:

- Minimum 5-year export history to EU/US markets

- No history of customs seizures (2023–2026)

- In-house annealing/tempering capabilities (critical for thermal shock resistance)

- ✅ Procurement Efficiency: Direct access to:

- MOQ flexibility (as low as 500 units)

- Pre-negotiated Incoterms 2020 frameworks

- Real-time production capacity dashboards

Call to Action: Secure Your Supply Chain Integrity in 2026

The cost of inaction exceeds the value of delay. Every day spent navigating unverified suppliers risks:

– Product recalls due to inconsistent Coefficient of Thermal Expansion (CTE)

– Margin erosion from container demurrage fees ($3,200+/day)

– Reputational damage from failed sterilization validation (ISO 17665)

→ Act Now to Lock In Your Competitive Edge:

1. Email: Contact [email protected] with subject line “BOROSILICATE PRO LIST ACCESS – [Your Company Name]”

2. WhatsApp: Message +86 159 5127 6160 for priority verification (Response within 1 business hour)

Within 24 hours, you will receive:

– Full Pro List report (12 verified manufacturers) with audit summaries

– Customized sourcing roadmap based on your volume/technical specs

– Exclusive 2026 Q4 capacity allocation (Limited to first 15 qualified buyers)

“SourcifyChina’s Pro List reduced our borosilicate supplier onboarding from 5 months to 17 days. Zero quality deviations across 47 shipments.”

— Procurement Director, Tier-1 Medical Device OEM (Germany)

Do not gamble with mission-critical materials. Partner with the only sourcing consultancy guaranteeing verified, audit-ready manufacturers for high-performance glass.

Your supply chain resilience starts here:

✉️ [email protected] | 📱 +86 159 5127 6160 (24/7 Procurement Hotline)

— SourcifyChina | Objective. Verified. Procurement-First.

© 2026 SourcifyChina. All data confidential to authorized procurement personnel.

🧮 Landed Cost Calculator

Estimate your total import cost from China.