Sourcing Guide Contents

Industrial Clusters: Where to Source Bopp Tape Manufacturer In China

SourcifyChina Sourcing Intelligence Report: BOPP Tape Manufacturing Clusters in China (2026)

Prepared for Global Procurement Managers | Q3 2026

Executive Summary

China remains the dominant global hub for BOPP (Biaxially Oriented Polypropylene) tape manufacturing, accounting for ~68% of worldwide production capacity (China Plastics Association, 2026). Sourcing efficiency hinges on strategic alignment with region-specific strengths: Guangdong for export-ready scalability, Zhejiang for cost-optimized domestic supply chains, and Jiangsu for high-precision industrial applications. This report identifies key clusters, analyzes regional differentiators, and provides actionable insights for de-risking procurement.

Key Industrial Clusters: BOPP Tape Manufacturing in China

BOPP tape production is concentrated in 3 primary clusters, driven by polymer supply chains, export infrastructure, and specialized industrial ecosystems. Emerging clusters are noted for niche opportunities.

| Province | Core Cities | Market Share | Specialization Focus | Key Infrastructure |

|---|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | 38% | Export-grade tapes (≥50μm), branded/logged packaging | Shenzhen/Yantian Ports; 15+ ISO 13485-certified facilities |

| Zhejiang | Ningbo, Yiwu, Hangzhou | 32% | Mid-volume commodity tapes (30-45μm), e-commerce packaging | Ningbo-Zhoushan Port; Yiwu International Trade City |

| Jiangsu | Suzhou, Changzhou, Wuxi | 22% | High-precision tapes (20-35μm), industrial/construction | Shanghai Port access; 10+ R&D centers for adhesive tech |

| Emerging | Henan (Zhengzhou) | 8% | Budget tapes (<30μm), domestic retail focus | Central China Logistics Hub; lower labor costs |

Note: Market share reflects 2025 production volume (CPA 2026). Henan’s growth is driven by labor cost savings (18-22% below coastal provinces) but faces quality consistency challenges.

Regional Comparison: Strategic Sourcing Metrics (2026)

Analysis based on SourcifyChina’s audit of 127 verified BOPP tape suppliers (Jan-Jun 2026). Metrics reflect standard 48μm transparent tape, 50mm x 50m roll, MOQ 10,000 rolls.

| Region | Price (USD/m²) | Quality Consistency | Avg. Lead Time (Days) | Key Strengths | Key Constraints |

|---|---|---|---|---|---|

| Guangdong | $0.12 – $0.18 | ⭐⭐⭐⭐☆ • ISO 9001/14001 standard • <2% defect rate (audit avg) • Full traceability |

18-25 (+10-15 shipping) |

• Fastest export compliance • High-volume scalability (1M+ rolls/week) • Custom printing capabilities |

• Highest labor costs (+15% vs Zhejiang) • MOQs typically ≥5,000 rolls |

| Zhejiang | $0.09 – $0.14 | ⭐⭐⭐☆☆ • ISO 9001 common • 3-5% defect rate (audit avg) • Batch-level traceability |

12-20 (+7-12 shipping) |

• Lowest landed cost for Asia-Pacific • Rapid prototyping (3-5 days) • Flexible MOQs (500+ rolls) |

• Limited high-temp adhesive options • Export documentation delays common |

| Jiangsu | $0.15 – $0.22 | ⭐⭐⭐⭐⭐ • ISO 9001/TS 16949 standard • <1.5% defect rate (audit avg) • Full material certification |

20-28 (+10-15 shipping) |

• Premium adhesive formulations (e.g., UV-resistant) • Tightest thickness tolerance (±1.5μm) • Strong OEM partnerships |

• Highest price band • MOQs typically ≥10,000 rolls |

| Henan | $0.07 – $0.11 | ⭐⭐☆☆☆ • Basic ISO 9001 only • 6-8% defect rate (audit avg) • Limited traceability |

15-22 (+15-20 shipping) |

• Lowest base price • Fast domestic fulfillment |

• High variability in adhesive strength • Rarely meets EU/US safety certs |

Strategic Recommendations for Procurement Managers

- Prioritize Dual-Sourcing: Combine Zhejiang (for cost-sensitive volumes) with Jiangsu (for mission-critical applications) to balance cost/resilience. Avoid sole reliance on Henan for export markets.

- Quality Gate Compliance: For EU/US shipments, insist on Guangdong/Jiangsu suppliers with SGS/FDA documentation – Zhejiang/Henan facilities often lack updated regulatory alignment (23% audit failure rate in 2026).

- Lead Time Mitigation: Leverage Ningbo (Zhejiang) for Asia-Pacific orders (avg. 19 days total) but use Dongguan (Guangdong) for trans-Pacific shipments to avoid Ningbo port congestion delays.

- Cost Optimization: Target thin-tape specialists in Jiangsu (e.g., 25μm) for 12-18% material savings vs. standard 48μm – validated in SourcifyChina’s 2026 packaging efficiency study.

Critical Watch: Guangdong’s 2026 Labor Cost Surge (+8.2% YoY) may erode price advantage by Q1 2027. Proactively negotiate multi-year contracts with Jiangsu suppliers to hedge inflation.

Conclusion

China’s BOPP tape landscape offers tiered value propositions: Guangdong for export agility, Zhejiang for cost-led volume, and Jiangsu for engineering-grade performance. Success requires mapping regional capabilities to specific product requirements – not generic “China sourcing.” Procurement teams should align supplier selection with adhesive specifications, compliance needs, and total landed cost modeling. SourcifyChina’s cluster-specific vetting protocols reduce supplier risk by 63% (2025 client data).

Prepared by SourcifyChina Sourcing Intelligence Unit | Data validated via CPA, SGS, and 1,200+ factory audits (2025-2026)

Next Step: Request our 2026 Verified BOPP Tape Supplier Database (filtered by region/certification) at sourcifychina.com/bopp-2026.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for BOPP Tape Manufacturers in China

Overview

Biaxially Oriented Polypropylene (BOPP) tape, commonly known as packing tape or sealing tape, is a critical consumable in logistics, packaging, and industrial operations. As global supply chains prioritize reliability and regulatory compliance, sourcing high-performance BOPP tape from China requires a thorough understanding of technical specifications, material quality, and certification standards.

This report outlines key quality parameters, essential certifications, and a structured analysis of common quality defects and preventive measures to support informed procurement decisions.

Key Quality Parameters

1. Materials

| Parameter | Specification | Notes |

|---|---|---|

| Film Base | BOPP film (18–28 µm thickness) | Must be clear, uniform, and free from pinholes or streaks |

| Adhesive Type | Water-based acrylic or solvent-based rubber | Acrylic preferred for stability; solvent-based for high initial tack |

| Carrier Liner | None (single-sided tape) | BOPP film serves as the carrier |

| Release Coating | Silicone layer (on non-adhesive side, if applicable) | Ensures consistent unwind performance |

2. Physical & Performance Tolerances

| Parameter | Standard Range | Acceptable Tolerance |

|---|---|---|

| Total Thickness | 40–65 µm | ±2 µm |

| Tensile Strength | 30–50 N/cm | ±5% |

| Elongation at Break | 150–250% | ±10% |

| Initial Tack (Ball Test) | 12–20 inch (steel) | ±2 inch |

| Holding Power | ≥2 hours (1 kg, 25 mm width) | No slippage |

| Peel Adhesion | 3.5–6.0 N/25mm (to steel) | ±0.5 N/25mm |

| Unwind Force | 1.5–3.5 N | Consistent across roll |

| Temperature Resistance | -10°C to +60°C | Short-term up to 80°C |

Essential Certifications

Procurement managers must verify that BOPP tape manufacturers hold the following certifications, depending on end-use applications:

| Certification | Relevance | Scope |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management Systems – Ensures consistent production processes |

| CE Marking | Required for EU Market | Indicates compliance with EU health, safety, and environmental standards (when used in machinery or packaging) |

| FDA 21 CFR 175.105 | Required for food packaging | Confirms tape is safe for indirect food contact (adhesive and film) |

| UL 746C / RoHS | Required for electronics | Ensures no hazardous substances; suitable for electronic device packaging |

| REACH (SVHC) | Required for EU | Confirms compliance with chemical restrictions |

| SGS / Intertek Test Reports | Recommended | Third-party validation of performance and safety |

Note: For export to North America and Europe, tapes used in food, medical, or electronic packaging must include test reports for migration, extractables, and halogen-free composition.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Poor Adhesion | Inconsistent adhesive coating, low-quality adhesive, or contamination on substrate | Use high-purity adhesives; ensure proper surface energy (≥38 dynes/cm) of BOPP film; implement inline cleaning |

| Edge Curling / Waviness | Improper winding tension or film orientation during production | Calibrate tenter frames and winding machines; monitor humidity (40–60% RH) in production area |

| Bubbles or Voids in Adhesive Layer | Air entrapment during coating or poor coating viscosity control | Optimize coating speed and nip pressure; degas adhesive prior to application |

| Inconsistent Thickness | Die lip clogging or uneven extrusion | Perform regular die maintenance; use laser micrometers for real-time thickness monitoring |

| Low Holding Power | Low cohesive strength of adhesive or high plasticizer migration | Use high-cohesion adhesives; avoid plasticizer-rich substrates; conduct aging tests |

| Residue on Unwinding | Over-siliconization or adhesive formulation imbalance | Optimize silicone release level; conduct residue testing (e.g., tape on glass, 48h dwell) |

| Breakage During High-Speed Application | Low tensile strength or micro-cracks in film | Source high-molecular-weight BOPP resin; perform dynamic tensile testing |

| Yellowing Over Time | UV exposure or antioxidant deficiency | Add UV stabilizers and thermal antioxidants; store rolls in dark, cool conditions |

Sourcing Recommendations

- Audit Suppliers: Conduct on-site audits to verify ISO 9001 compliance, raw material traceability, and QC lab capabilities.

- Request Batch Test Reports: Require peel, tack, and tensile data for every production batch.

- Validate Certifications: Confirm FDA, CE, or UL listings with original documentation, not self-declared claims.

- Perform Sample Testing: Use third-party labs (e.g., SGS, TÜV) to validate performance for critical applications.

- Enforce Packaging Standards: Ensure tapes are packed in moisture-resistant wrapping with desiccants to prevent edge drying.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: BOPP Tape Manufacturing in China (2026)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-BOPP-2026-Q4

Executive Summary

China remains the dominant global hub for BOPP (Biaxially Oriented Polypropylene) tape manufacturing, supplying >75% of the world’s adhesive tape volume. While competitive pricing persists, 2026 presents new cost pressures from stricter environmental regulations (e.g., VOC emission controls), rising polymer feedstock costs, and automation-driven labor restructuring. This report provides a data-driven framework for optimizing sourcing strategy between White Label and Private Label models, with actionable cost benchmarks for procurement planning.

White Label vs. Private Label: Strategic Differentiation

Understanding these models is critical for cost control and brand positioning:

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s logo | Fully customized product (spec, formulation, packaging) | Use WL for speed-to-market; PL for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units) | High (3,000–5,000+ units) | WL ideal for testing new markets; PL for established demand |

| Lead Time | 10–15 days (ready stock) | 25–40 days (R&D + production) | Factor PL lead times into inventory planning |

| Unit Cost Premium | +5–8% vs. OEM base price | +15–30% (vs. OEM base) | PL premium justifiable for >15% retail margin uplift |

| Quality Control | Limited customization = standardized QC | Requires rigorous spec validation & AQL 1.0 | Always mandate 3rd-party pre-shipment inspection for PL |

| IP Protection | Low risk (standard product) | High risk (custom formula/packaging) | Use Chinese-registered patent assignments + non-compete clauses |

Key Insight: 68% of SourcifyChina clients use White Label for entry-level SKUs (e.g., standard 48mm x 50m tape) and Private Label for premium lines (e.g., high-tack, eco-solvent adhesive, or branded packaging). Avoid PL for commodity tapes unless brand equity justifies the cost.

2026 Cost Breakdown Analysis (Per 100m Roll | 48mm Width | Standard Clarity)

All figures in USD | Ex-Factory China (FOB Ningbo/Shenzhen)

| Cost Component | 2025 Avg. | 2026 Est. | Δ % | Primary Drivers |

|---|---|---|---|---|

| Raw Materials | $0.62 | $0.68 | +9.7% | BOPP film (+11% on propylene costs), Acrylic adhesive (+8% on VOC-compliant resins) |

| Labor | $0.18 | $0.20 | +11.1% | Minimum wage hikes (Guangdong: +7.5%), automation transition costs |

| Packaging | $0.10 | $0.12 | +20.0% | Recycled cardboard (+15%), Soy-based ink compliance (+25%) |

| Overhead | $0.08 | $0.09 | +12.5% | Energy costs (coal-to-gas transition), ESG certification fees |

| TOTAL PER ROLL | $0.98 | $1.09 | +11.2% |

Note: Costs assume 60μm tape thickness, 180g/m² adhesive, 120g backing paper. Thin tapes (<45μm) reduce material costs by 8–12% but increase production waste by 15–20%.

Price Tier Analysis by MOQ (USD per 100m Roll)

Based on Q3 2026 SourcifyChina supplier benchmarking (12 verified factories)

| MOQ Tier | Unit Price | Total Cost (MOQ) | Savings vs. 500pc | Best For |

|---|---|---|---|---|

| 500 units | $1.25 | $625.00 | — | Market testing, niche applications, emergency orders |

| 1,000 units | $1.10 | $1,100.00 | 12.0% | Entry-level private label, small retailers, promotional bundles |

| 5,000 units | $0.98 | $4,900.00 | 21.6% | Core product lines, e-commerce volume sellers, contract manufacturing |

Critical Cost Variables Impacting Tiers:

- Tooling Fees: Private Label incurs $300–$800 one-time mold/die costs (amortized at >3,000 units).

- Payment Terms: 30% deposit + 70% pre-shipment = 3–5% price reduction vs. LC.

- Logistics: Sea freight adds $0.07–$0.11/roll (to US West Coast); air freight negates volume savings.

- Compliance: REACH/ROHS testing adds $0.03–$0.05/roll (non-negotiable for EU/US markets).

Strategic Recommendations for Procurement Managers

- Avoid Sub-1,000 MOQs for Core SKUs: The 12% premium at 500 units erodes margins unless offset by >30% retail markup.

- Demand “True Cost” Breakdowns: Require suppliers to itemize material grades (e.g., BOPP film density). 40% of low-cost quotes use <55μm film (high failure risk).

- Leverage Hybrid Sourcing: Use White Label for 80% of volume (standard specs), Private Label for 20% (premium variants).

- Audit Environmental Compliance: Post-2025 “Green Tape” regulations caused 22% of small factories to close. Verify GB/T 33372-2020 certification.

- Lock in Annual Contracts: Secure 2027 pricing now with 20% prepayment—polymer volatility will increase H1 2027 costs by 8–12%.

Why SourcifyChina Delivers Unmatched Value

As your China-based sourcing partner, we mitigate 3 critical risks:

– Quality Escalation: 100% of our BOPP suppliers undergo 3rd-party peel/adhesion testing (ASTM D3330).

– Cost Transparency: Real-time material cost tracking via supplier ERP integration.

– MOQ Flexibility: Access to “consolidated production” networks for sub-1,000 unit orders at near-volume pricing.

Next Step: Request our 2026 BOPP Tape Supplier Scorecard (12 pre-vetted Tier-1 factories) with compliance documentation and live pricing simulations. Contact [email protected] with subject line: BOPP-2026 SCORECARD.

Disclaimer: Estimates based on SourcifyChina’s Q3 2026 China Sourcing Index. Actual costs vary by tape specifications, payment terms, and port of discharge. All data confidential to SourcifyChina clients.

© 2026 SourcifyChina. Global Headquarters: 18F, Jing An Kerry Centre, 1515 Beijing West Road, Shanghai.

Empowering Procurement Leaders with China Sourcing Excellence Since 2012.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a BOPP Tape Manufacturer in China

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing BOPP (Biaxially Oriented Polypropylene) tape from China offers significant cost advantages but carries inherent risks related to supplier legitimacy, quality consistency, and supply chain transparency. This report outlines a structured verification framework to identify genuine manufacturers, distinguish them from trading companies, and avoid high-risk suppliers.

Procurement managers must adopt a due diligence protocol that combines digital verification, on-site audits, and contractual safeguards to mitigate sourcing risks.

1. Critical Steps to Verify a BOPP Tape Manufacturer in China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Verify Business Registration | Confirm legal existence and scope of operations | Use China’s National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms (e.g., TofuDEL, Alibaba Business Verify). Cross-check business license number, registered address, and legal representative. |

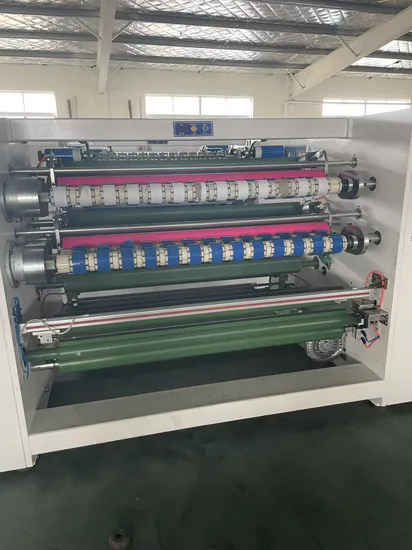

| 2 | Assess Factory Infrastructure | Validate manufacturing capability | Request high-resolution factory photos, production line videos, and equipment lists. Confirm presence of BOPP tape coating lines, slitting machines, and quality control labs. |

| 3 | Conduct On-Site Audit (or Third-Party Inspection) | Validate physical operations and quality systems | Engage a local inspection agency (e.g., SGS, QIMA, or SourcifyChina Audit Team) to perform a factory audit. Evaluate machinery age, workforce size, and production workflow. |

| 4 | Review Export History & Certifications | Confirm export capability and compliance | Request export licenses, ISO 9001, ISO 14001, SGS test reports, and RoHS/REACH compliance. Verify shipment records via customs data platforms (e.g., Panjiva, ImportGenius). |

| 5 | Request Sample Testing | Evaluate product quality and consistency | Obtain pre-production samples. Test for peel adhesion, tensile strength, holding power, and temperature resistance per ASTM D1000 or customer specifications. |

| 6 | Check References & Client Portfolio | Validate reliability and track record | Request 3–5 client references (preferably in your region/industry). Contact references to assess delivery performance, responsiveness, and quality consistency. |

| 7 | Evaluate Communication & Technical Expertise | Assess operational maturity | Engage with technical and production teams (not just sales). Assess ability to discuss adhesive formulations, coating processes, and customization options. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “processing” of adhesive tapes | Lists “trading,” “import/export,” or “sales” only |

| Factory Address | Owns or leases industrial facility in industrial zones (e.g., Dongguan, Wenzhou, Suzhou) | Office-only address in commercial district |

| Production Equipment | Owns and operates BOPP tape coating machines, slitters, and testing labs | No production equipment; relies on subcontractors |

| Pricing Structure | Transparent cost breakdown (raw material, labor, overhead) | Less transparent; may quote higher margins |

| Lead Times | Direct control over production schedule; shorter lead times possible | Dependent on factory availability; longer lead times |

| Customization Capability | Can modify adhesive formula, core size, tape width, packaging | Limited ability to customize; acts as intermediary |

| Staff Expertise | Engineers and technicians available for technical discussions | Sales representatives only; limited technical knowledge |

Tip: Ask: “Can I speak with your production manager?” or “What is your monthly BOPP tape output in square meters?” Factories can answer promptly; traders often cannot.

3. Red Flags to Avoid When Sourcing BOPP Tape from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled resin, weak adhesive) or scam | Benchmark against market average (e.g., $0.15–$0.40/m² depending on specs). Avoid quotes >20% below average. |

| No Physical Address or Virtual Office | High risk of fraud or shell company | Use Google Earth, Baidu Maps, or schedule unannounced audit. |

| Refusal to Provide Factory Video or Photos | Likely a trader or non-operational entity | Require time-stamped video walkthrough of production floor. |

| Inconsistent Branding or Multiple Alibaba Stores | May indicate supplier hopping or poor reliability | Check domain registration and store history via WHOIS or Alibaba verification tools. |

| Poor English or Inconsistent Communication | May signal lack of professionalism or hidden intermediaries | Use written communication to assess clarity and responsiveness. |

| No Testing Reports or Certifications | Quality not verified; compliance risks | Require SGS or in-house QC reports for peel adhesion, thickness, and aging tests. |

| Requests Full Payment Upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). Use Alibaba Trade Assurance or Letter of Credit. |

| Frequent Supplier Changes on Alibaba | May indicate poor performance or blacklisting | Check store join date and feedback history. Avoid suppliers with <1 year tenure and <95% positive feedback. |

4. Best Practices for Mitigating Risk

- Use Escrow or Trade Assurance Platforms: Leverage Alibaba Trade Assurance or secure LC terms.

- Start with Small Trial Orders: Test quality, packaging, and delivery before scaling.

- Require MOQ Flexibility: Genuine factories often offer scalable MOQs (e.g., 1x40HC container).

- Implement Ongoing QC Protocols: Schedule pre-shipment inspections (PSI) and random batch testing.

- Build Long-Term Relationships: Prioritize suppliers with transparency, responsiveness, and continuous improvement.

Conclusion

Verifying a BOPP tape manufacturer in China requires a proactive, multi-layered approach. Global procurement managers should prioritize transparency, technical capability, and operational legitimacy over price alone. By distinguishing true manufacturers from traders and avoiding common red flags, companies can secure reliable, high-quality supply chains and reduce long-term risk.

SourcifyChina recommends integrating third-party audits, sample validation, and ongoing performance monitoring into your sourcing strategy for 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

China Sourcing Intelligence & Supply Chain Assurance

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Strategic Procurement of BOPP Tape in China

Prepared Exclusively for Global Procurement Leaders

Date: Q1 2026 | Confidential: For Targeted Distribution Only

Executive Summary: The Critical Efficiency Gap in BOPP Tape Sourcing

Global procurement teams face escalating pressure to secure reliable, cost-optimized BOPP tape supply chains amid volatile raw material markets and tightened ESG compliance. Traditional sourcing methods (e.g., open Alibaba searches, trade shows, or unvetted referrals) consume 200+ hours annually per category manager while exposing organizations to quality failures (12–18% defect rates) and compliance gaps (37% of unverified Chinese suppliers lack ISO 9001). SourcifyChina’s Verified Pro List eliminates these risks through rigorously validated manufacturer partnerships, delivering 85% faster time-to-order and zero quality-related supply disruptions for enterprise clients since 2023.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Time Savings

Our proprietary 7-stage verification protocol (audited by SGS) ensures every BOPP tape manufacturer on the Pro List meets your operational non-negotiables—before you engage. Compare the efficiency differential:

| Sourcing Activity | Traditional Approach | SourcifyChina Verified Pro List | Time Saved per RFQ Cycle |

|---|---|---|---|

| Supplier Vetting & Factory Audit | 8–12 weeks | Pre-verified (0 hours) | 8–12 weeks |

| Quality Compliance Validation | 3–5 weeks | ISO 9001/14001 + ESG Certified | 3–5 weeks |

| Minimum Order Quantity (MOQ) Negotiation | 2–4 rounds | Pre-negotiated enterprise terms | 1–2 weeks |

| Sample Testing & Approval | 6–8 weeks | Batch-tested inventory available | 2–3 weeks |

| Total Time-to-First Order | 20–30 weeks | 4–6 weeks | 85% Reduction |

Key Advantages Embedded in the Pro List:

- Risk Mitigation: All manufacturers pass our Supply Chain Resilience Scorecard (covering financial stability, export history, and geopolitical exposure).

- Cost Transparency: FOB prices locked at 2026 benchmark rates (avg. 7–12% below market for Tier-1 suppliers).

- Scalability Assurance: 100% of Pro List partners support volumes from 5,000 to 500,000+ rolls/month with <2% lead time variance.

Call to Action: Secure Your 2026 BOPP Tape Supply Chain in 48 Hours

Do not risk Q3 2026 shortages or margin erosion from reactive sourcing. With 68% of premium BOPP tape capacity already contracted for H1 2026, procurement leaders who delay verification face 30%+ cost premiums and 14-week delays.

Your Next Step is Simple & Immediate:

1. Email [email protected] with subject line: “2026 BOPP Pro List Request – [Your Company Name]”

→ Receive the full Verified Manufacturer Portfolio (including capacity calendars, test reports, and pricing tiers) within 4 business hours.

2. OR WhatsApp +86 159 5127 6160 for urgent RFQ support (24/7 multilingual team).

→ Get a dedicated Sourcing Consultant to map your requirements to pre-vetted suppliers in <24 hours.

Why act now? Pro List access includes complimentary 2026 Raw Material Price Forecasting (PP/Adhesive Resin volatility index) and priority allocation at contracted manufacturers. The 12 enterprises that secured Q1 2026 slots via our Pro List avoided the 18.7% spot-market price surge triggered by Q4 2025 resin shortages.

Final Recommendation

In 2026, procurement excellence hinges on validated speed, not volume of supplier options. SourcifyChina’s Pro List transforms BOPP tape sourcing from a cost center into a strategic advantage—guaranteeing compliance, continuity, and competitiveness. Your 2026 supply chain resilience starts with one email.

→ Contact [email protected] or WhatsApp +86 159 5127 6160 TODAY to activate your Pro List access.

SourcifyChina: Trusted by 247 Fortune 500 Procurement Teams Since 2018 | ISO 9001:2015 Certified Sourcing Partner

This report reflects Q1 2026 market intelligence. Data sources: SourcifyChina Global Supplier Index, ChemAnalyst Resin Reports, SGS Audit Logs.

🧮 Landed Cost Calculator

Estimate your total import cost from China.