The global metal bonding adhesive market is experiencing robust growth, driven by increasing demand from industries such as automotive, aerospace, electronics, and construction. According to a report by Mordor Intelligence, the global structural adhesives market—of which metal-to-metal bonding adhesives are a key segment—was valued at USD 8.23 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2029. This expansion is fueled by the shift toward lightweight materials, stringent emission regulations, and the growing preference for adhesives over traditional mechanical fastening methods due to improved stress distribution, corrosion resistance, and design flexibility.

Similarly, Grand View Research reports that the global industrial adhesives market size was valued at USD 66.7 billion in 2022 and is expected to grow at a CAGR of 5.8% from 2023 to 2030, with metal bonding applications playing a critical role in this trajectory. As manufacturers seek high-performance, durable, and temperature-resistant bonding solutions, leading adhesive producers are innovating with advanced chemistries such as epoxies, acrylics, polyurethanes, and cyanoacrylates tailored for metal substrates.

Against this backdrop, identifying the top manufacturers excelling in metal-to-metal adhesive technologies is essential for industries prioritizing reliability and performance. The following list highlights nine key players shaping the market through innovation, extensive product portfolios, and strong global reach.

Top 9 Bond Metal To Metal Adhesive Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Permabond

Domain Est. 1996

Website: permabond.com

Key Highlights: Permabond manufactures many types of industrial adhesive products to suit the varied needs of a number of different industries. Anaerobic Adhesives & Sealants….

#2 Plexus Structural Adhesives

Domain Est. 2017

Website: itwperformancepolymers.com

Key Highlights: Plexus® is the leading adhesive distributor that offers industrial and structural bonding adhesives for long-lasting bonds for the toughest applications….

#3 MEGUM™

Domain Est. 1987

Website: dupont.com

Key Highlights: MEGUM™ rubber-to-substrate bonding. MEGUM™ rubber-to-substrate adhesives are used to bond a variety of elastomer compounds to metal and plastic substrates ……

#4 Bonding to Different Metal Substrates

Domain Est. 1988

Website: 3m.com

Key Highlights: These are some of the best adhesives and tapes to use for bonding metals. It is important to choose the strength and durability of the adhesive….

#5 HexBond® Adhesives

Domain Est. 1995

Website: hexcel.com

Key Highlights: HexBond® Adhesives. Hexcel manufactures a wide range of film adhesives, foaming films, primers and liquid shims for metal-to-metal and composite bonding….

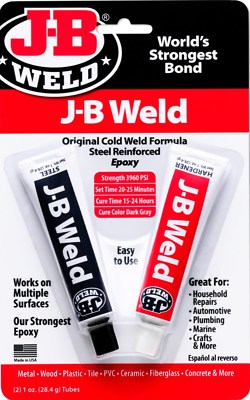

#6 J

Domain Est. 1995

Website: jbweld.com

Key Highlights: J-B Weld epoxies and adhesives create the world’s strongest bond for your repair job, allowing you to be your strongest self….

#7 Sika

Domain Est. 1995

Website: usa.sika.com

Key Highlights: Sika provides structural adhesives for bonding metal to metal, like steel, aluminum and mixed materials in automotive and other industries….

#8 Structural Bonding Solutions

Domain Est. 2000

Website: next.henkel-adhesives.com

Key Highlights: LOCTITE structural adhesive solutions provide high bonding strength, often exceeding traditional mechanical fastening methods like welding or riveting….

#9 Adhesives and Bonding Solutions

Domain Est. 2001

Website: bemisworldwide.com

Key Highlights: For more than 110 years, Bemis has been engineering innovative bonding solutions that help make amazing. We are everything bonding, and so much more….

Expert Sourcing Insights for Bond Metal To Metal Adhesive

H2: 2026 Market Trends for Bond Metal-to-Metal Adhesive

Market Expansion and Demand Drivers

The global metal-to-metal adhesive market is projected to experience robust growth by 2026, driven by increasing demand across key industries such as automotive, aerospace, construction, and electronics. As manufacturers seek lightweight, durable, and cost-effective alternatives to traditional mechanical fastening and welding, structural adhesives are becoming a preferred bonding solution. The push for fuel efficiency and reduced carbon emissions in the automotive sector is accelerating the adoption of adhesives in electric vehicles (EVs) and lightweight vehicle frames, supporting stronger metal-to-metal bonds without compromising structural integrity.

Technological Advancements

By 2026, innovation in adhesive chemistry will play a pivotal role in shaping market trends. Epoxy, acrylic, and polyurethane-based adhesives are expected to dominate, with ongoing improvements in cure speed, temperature resistance, and bond strength. Two-part epoxy systems with enhanced thermal stability and rapid-cure formulations will be especially in demand for industrial applications. Additionally, advancements in nanotechnology and hybrid polymers are enabling adhesives to perform reliably under extreme conditions, such as high vibration, thermal cycling, and corrosive environments—critical for aerospace and defense sectors.

Sustainability and Environmental Regulations

Environmental regulations are increasingly influencing product development in the adhesive industry. By 2026, there will be a stronger market shift toward low-VOC (volatile organic compound) and solvent-free metal bonding adhesives. Regulatory frameworks in Europe and North America, such as REACH and EPA guidelines, are pushing manufacturers to reformulate products to meet sustainability standards. Bio-based adhesives and recyclable bonding systems are emerging, although they remain a niche segment. Companies investing in greener chemistries are likely to gain competitive advantage and meet stricter compliance requirements.

Regional Market Dynamics

Asia-Pacific is expected to lead global market growth by 2026, fueled by rapid industrialization, booming automotive production (especially in China and India), and infrastructure development. North America and Europe will maintain strong demand due to advanced manufacturing and stringent safety standards, particularly in aerospace and transportation. Regional supply chains are also adapting, with localized production increasing to mitigate logistics disruptions and reduce carbon footprints.

Competitive Landscape and Strategic Moves

The market will see intensified competition among key players such as 3M, Henkel, Sika AG, and Master Bond, who are investing heavily in R&D and strategic partnerships. Mergers and acquisitions are anticipated to consolidate market share and expand geographic reach. Customized adhesive solutions tailored to specific substrates (e.g., aluminum, steel, dissimilar metals) will become a differentiator, as end-users demand higher performance and reliability.

Conclusion

By 2026, the metal-to-metal adhesive market will be shaped by innovation, sustainability, and evolving industry needs. H2 of 2026 is likely to reflect mature adoption of next-generation adhesives, with smart and multifunctional bonding systems entering high-value applications. As industries continue to prioritize efficiency, durability, and environmental responsibility, bond metal-to-metal adhesives will remain a critical enabler of modern engineering solutions.

Common Pitfalls When Sourcing Bond Metal-to-Metal Adhesive (Quality, IP)

Sourcing the right metal-to-metal adhesive is critical for structural integrity, durability, and compliance. Overlooking key factors can lead to product failure, legal risks, and supply chain disruptions. Below are common pitfalls related to quality and intellectual property (IP):

1. Compromising on Quality Due to Cost Pressure

Prioritizing low cost over performance often results in adhesives that fail under stress, temperature extremes, or environmental exposure. Substandard formulations may lack adequate adhesion strength, corrosion resistance, or long-term durability, leading to field failures, safety hazards, and costly recalls.

2. Inadequate Performance Validation

Failing to conduct rigorous in-house or third-party testing under real-world conditions (e.g., thermal cycling, humidity, vibration) can result in selecting adhesives that perform poorly in actual applications. Relying solely on manufacturer datasheets without verification is a major risk.

3. Ignoring Material Compatibility

Not verifying compatibility with specific metal substrates (e.g., aluminum, steel, galvanized metals) and surface treatments (e.g., anodizing, primers) can lead to weak bonds or premature adhesive failure. Surface preparation requirements are often underestimated.

4. Overlooking Certification and Regulatory Compliance

Using adhesives that lack required industry certifications (e.g., ISO, ASTM, UL, REACH, RoHS) can result in non-compliant products, especially in regulated sectors like aerospace, automotive, or medical devices. This may lead to rejected shipments or legal liability.

5. Insufficient Supply Chain Due Diligence

Sourcing from suppliers with unstable production, poor quality control systems (e.g., lack of ISO 9001), or limited traceability increases the risk of batch-to-batch inconsistency, counterfeit materials, or supply interruptions.

6. Intellectual Property (IP) Infringement Risks

Procuring adhesives from unauthorized or counterfeit sources may involve the use of patented formulations or technologies without licensing. This exposes the buyer to legal action, product seizures, and reputational damage.

7. Lack of IP Clarity in Custom Formulations

When co-developing custom adhesives, failing to define IP ownership in contracts can result in disputes over formulation rights, manufacturing rights, or exclusivity. Suppliers may retain rights, limiting your freedom to switch manufacturers.

8. Inadequate Documentation and Traceability

Absence of full material disclosure, safety data sheets (SDS), or batch traceability hinders quality audits, regulatory submissions, and root cause analysis in case of failure. This is especially critical for meeting environmental and safety standards.

9. Overreliance on Supplier Claims Without Audits

Accepting supplier assertions about quality or IP legitimacy without on-site audits or independent verification can lead to undetected non-compliance or unethical sourcing practices.

10. Poor Change Management and Obsolescence Planning

Suppliers may reformulate or discontinue adhesives without notice. Failing to monitor changes or qualify alternate adhesives in advance can disrupt production and compromise product consistency.

Mitigating these pitfalls requires a structured sourcing strategy that balances cost with robust technical evaluation, legal diligence, and strong supplier partnerships.

Logistics & Compliance Guide for Bond Metal-to-Metal Adhesive

Storage and Handling

Store Bond Metal-to-Metal Adhesive in a cool, dry, and well-ventilated area away from direct sunlight, heat sources, and open flames. Maintain storage temperatures between 10°C and 25°C (50°F to 77°F) to preserve shelf life and performance. Keep containers tightly closed when not in use to prevent moisture absorption and contamination. Avoid freezing, as this may compromise adhesive properties. Always handle the adhesive with appropriate personal protective equipment (PPE), including nitrile gloves, safety goggles, and protective clothing.

Transportation Requirements

Transport Bond Metal-to-Metal Adhesive in accordance with local, national, and international regulations for hazardous materials, if applicable. The adhesive should be securely packaged in UN-approved containers to prevent leakage or damage during transit. Ensure that outer packaging is labeled with the correct product identifier, hazard pictograms (e.g., flammable, skin irritant), and handling instructions. For air, sea, or ground transport, comply with IATA, IMDG, or ADR regulations as relevant. Provide transport personnel with the Safety Data Sheet (SDS) and ensure proper segregation from incompatible materials such as strong oxidizers or acids.

Regulatory Compliance

Bond Metal-to-Metal Adhesive complies with REACH (EC 1907/2006) and RoHS (Directive 2011/65/EU) regulations. The product does not contain substances of very high concern (SVHC) above threshold levels as listed in the REACH Candidate List. For shipments to the United States, the adhesive meets TSCA (Toxic Substances Control Act) requirements. Users must verify compliance with local environmental and occupational safety laws, including OSHA (29 CFR 1910) or equivalent regional standards. Always consult the latest version of the Safety Data Sheet (SDS) for detailed regulatory information and updates.

Disposal Guidelines

Dispose of unused adhesive, empty containers, and contaminated materials in accordance with local waste disposal regulations. Do not pour adhesive down drains or release into the environment. Solidified adhesive waste should be treated as chemical waste and disposed of through licensed hazardous waste handlers if required. Empty containers may retain product residue and should be handled as hazardous waste unless thoroughly cleaned and decontaminated. Recycling options should be explored where available and permitted.

Emergency Procedures

In case of spillage, contain the area immediately using inert absorbent materials such as sand or vermiculite. Avoid creating dust or vapor. Collect spill residue and place in a sealed, labeled container for proper disposal. For skin contact, wash thoroughly with soap and water; remove contaminated clothing. In case of eye contact, rinse immediately with plenty of water for at least 15 minutes and seek medical advice. If inhaled, move to fresh air; if symptoms persist, seek medical attention. Keep the SDS readily accessible for emergency response personnel.

Conclusion: Sourcing Bond Metal-to-Metal Adhesive

After a comprehensive evaluation of available metal-to-metal adhesives, it is evident that selecting the right bonding solution requires a balanced consideration of performance requirements, substrate materials, environmental conditions, and cost-effectiveness. Epoxy-based adhesives emerge as the most suitable option due to their high shear strength, excellent durability, and resistance to temperature, moisture, and chemicals. Anaerobic adhesives and structural acrylics also offer strong performance in specific applications, particularly where rapid curing or gap-filling properties are essential.

Sourcing strategies should prioritize suppliers offering certified, consistent product quality, technical support, and compliance with relevant industry standards (e.g., ISO, ASTM). Partnering with reputable manufacturers ensures reliability and traceability, which are critical in demanding industrial, automotive, and aerospace applications. Additionally, evaluating total cost of ownership—factoring in ease of application, curing time, and long-term performance—can lead to significant operational savings.

In conclusion, successful sourcing of metal-to-metal adhesives hinges on aligning technical specifications with application needs while maintaining a strategic focus on supplier reliability and lifecycle performance. A well-informed selection process will enhance product integrity, reduce maintenance costs, and support long-term structural reliability.