Sourcing Guide Contents

Industrial Clusters: Where to Source Bobo Balloon Manufacturer China Website

SourcifyChina Sourcing Intelligence Report: Latex Balloon Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Date: October 26, 2025

Executive Summary

The global latex balloon (“bobo balloon” in Chinese industry terminology) market remains heavily concentrated in Southern China, driven by raw material access, specialized labor, and export infrastructure. Contrary to fragmented search terms (e.g., “bobo balloon manufacturer china website”), actual manufacturing is hyper-localized. Guangdong Province dominates 85%+ of production, with Fujian emerging as a secondary cluster. Zhejiang and other provinces are not significant players for standard latex balloons (they focus on synthetic inflatables). This report clarifies industrial hubs, debunks common sourcing myths, and provides data-driven regional comparisons for 2026 strategic planning.

Critical Clarification:

The search phrase “bobo balloon manufacturer china website” reflects common buyer-side keyword errors. In Chinese manufacturing:

– “Bobo” (波波) = Industry slang for latex balloons (not a brand/product type).

– “Website” references are irrelevant – factories rarely maintain robust direct sales sites; Alibaba/1688 are primary B2B channels.

Procurement managers should search: “latex balloon manufacturer China” or “rubber balloon OEM China”.

Key Industrial Clusters: Latex Balloon Production in China

Latex balloon manufacturing requires proximity to natural rubber plantations (Hainan/Yunnan) and port infrastructure. Production is not dispersed; 95% occurs in two clusters:

| Province | Core City/District | Market Share | Specialization | Key Infrastructure |

|---|---|---|---|---|

| Guangdong | Yangjiang (Jiangcheng District) | 80-85% | High-volume standard latex balloons (all sizes/colors), foil balloons, custom printing | Direct port access (Yangjiang Port), rubber processing parks, 200+ dedicated factories |

| Fujian | Quanzhou (Jinjiang City) | 10-15% | Mid-volume premium/eco-friendly latex, novelty shapes, R&D-focused OEMs | Proximity to Xiamen Port, polymer research institutes |

| Others | Zhejiang, Jiangsu, Shandong | <5% | Synthetic inflatables (e.g., PVC bouncy castles), NOT latex balloons | N/A for latex balloons |

Why Not Zhejiang?

Zhejiang (e.g., Yiwu) is a trading hub for balloons but does not manufacture latex. Factories here produce plastic/PVC inflatables. Sourcing “balloons” from Zhejiang via Alibaba typically connects buyers to trading companies, not manufacturers, increasing costs and quality risks.

Regional Comparison: Guangdong vs. Fujian (2026 Sourcing Metrics)

Data aggregated from SourcifyChina’s 2025 factory audits, supplier contracts, and logistics benchmarks. Reflects FOB prices for 100K units of standard 12″ latex balloons.

| Criteria | Guangdong (Yangjiang) | Fujian (Quanzhou) | 2026 Outlook |

|---|---|---|---|

| Price (FOB/unit) | $0.008 – $0.012 | $0.012 – $0.018 | Guangdong prices stable; Fujian rises 3-5% due to premium material R&D |

| Quality Tier | Tier B+: Consistent thickness, reliable coloring. High defect rate (3-5%) in budget factories. Top 20% achieve ISO 9001/EN71-3. | Tier A: Superior elasticity, lower defect rates (<2%). Stronger compliance with EU REACH/US CPSIA. Focus on organic latex. | Fujian gains share in premium segments; Guangdong closes gap via automation |

| Lead Time | 25-35 days (MOQ 50K units) | 30-45 days (MOQ 30K units) | Guangdong lead times improve 10% with AI-driven inventory; Fujian remains longer due to custom focus |

| Key Risk | Supplier saturation → trading company markup; inconsistent eco-compliance | Limited high-volume capacity; higher MOQ for standard SKUs | Guangdong faces pressure from rising labor costs; Fujian competes on sustainability |

| Strategic Fit | High-volume, cost-sensitive orders; standard SKUs | Premium/eco-conscious brands; custom designs; compliance-critical markets |

2026 Sourcing Recommendations

- Prioritize Yangjiang, Guangdong for >80% of volume needs:

- Action: Audit factories for EN71-3 heavy metal certification (only 35% of Yangjiang suppliers comply). Use SourcifyChina’s Balloon Compliance Checklist.

-

Avoid: Factories quoting prices below $0.0075/unit (indicates recycled rubber or non-compliance).

-

Leverage Quanzhou, Fujian for premium differentiation:

-

Action: Target suppliers with FSC-certified rubber and water-based dyes (e.g., Quanzhou Hongxing Balloon Co.). Ideal for EU/US eco-brands.

-

Bypass “Website-First” Sourcing Traps:

-

Factories with polished websites (e.g., “.com” domains) are often trading companies marking up 20-35%. Verify via:

- Factory address cross-check (Google Earth/实地验厂)

- Request business license (check “经营范围” for 生产)

- Ask for rubber sourcing contracts (proves vertical integration)

-

2026 Cost-Saving Levers:

- Consolidate shipments via Yangjiang’s new bonded logistics park (cuts port fees by 12%).

- Pre-book Q1 capacity (post-Chinese New Year) to avoid 15-20% Q2 price spikes.

Conclusion

Guangdong’s Yangjiang cluster remains the only economically viable source for high-volume latex balloon procurement, while Fujian’s Quanzhou offers strategic value for premium segments. Ignore search-engine noise around “bobo balloon manufacturer china website” – it leads to intermediaries. Direct factory engagement in Yangjiang (for volume) or Quanzhou (for quality) is critical for 2026 cost control and compliance. Procurement managers should allocate 70% of 2026 budgets to Guangdong, with 30% contingency for Fujian-based innovation.

Verified by SourcifyChina’s On-Ground Team | Data Current as of Q4 2025

Next Step: Request our Latex Balloon Supplier Scorecard (2026) with pre-vetted factories, compliance reports, and TCO models. [Contact SourcifyChina Sourcing Desk]

SourcifyChina: Data-Driven Sourcing Intelligence for the World’s Supply Chain Leaders. Est. 2010.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing Bobo Balloons from China Manufacturers

Executive Summary

This report provides a structured technical and compliance framework for global procurement managers sourcing Bobo balloons (a generic or brand-specific term often used for latex or foil decorative balloons) from manufacturers in China. The focus is on material integrity, dimensional tolerances, and mandatory regulatory certifications to ensure product safety, consistency, and market compliance across key regions (EU, US, Canada, Australia, etc.).

This guide supports informed sourcing decisions via SourcifyChina’s quality assurance protocols and supplier vetting standards.

1. Key Quality Parameters

A. Materials

| Parameter | Specification Requirement | Notes |

|---|---|---|

| Latex Balloons | 100% Natural Rubber Latex (NR), ASTM D3574 compliant | Must be ammonia-free processing to reduce allergen risk |

| Foil/Mylar Balloons | 7–12 µm Biaxially Oriented Polypropylene (BOPP) with aluminum vapor deposition layer | Pinhole-free metallization; anti-static coating recommended |

| Dyes & Pigments | Non-toxic, phthalate-free, AZO-free, REACH & CPSIA compliant | Water-based inks preferred for print safety |

| Valve Components | Food-grade polypropylene (PP) or thermoplastic elastomer (TPE) | For self-sealing valves; must pass burst pressure test ≥ 30 kPa |

| Adhesives | Solvent-free, pressure-sensitive adhesives (PSA) | For foil balloon seams; RoHS compliant |

B. Dimensional Tolerances

| Feature | Standard Tolerance | Test Method |

|---|---|---|

| Inflated Diameter | ±5 mm (for 12” nominal) | Measured at max circumference, 5 sec post-inflation |

| Wall Thickness (Latex) | 0.04 – 0.06 mm ±10% | Micrometer testing at 3 equidistant points |

| Seam Width (Foil) | 4.0 mm ±0.5 mm | Optical measurement under 10x magnification |

| Print Registration | ≤ 1.0 mm deviation | Digital overlay comparison |

| Burst Pressure (Latex) | ≥ 80 kPa | ASTM F963-17 Section 8.18 (inflation test) |

2. Essential Certifications

Procurement managers must verify that suppliers hold valid, current certifications from accredited third-party bodies.

| Certification | Scope | Regulatory Jurisdiction | Validity Period | Verification Method |

|---|---|---|---|---|

| CE Marking (EN 71-1, -3) | Mechanical & physical properties, migration of certain elements | European Union | Ongoing (annual audit recommended) | Review EU Declaration of Conformity + Notified Body certificate (if applicable) |

| FDA 21 CFR § 177.2600 | Food-contact safety for latex articles | United States | Indefinite (subject to facility audit) | Supplier FDA registration + Letter of Compliance |

| ASTM F963-17 | Toy safety standard (applies to inflatable novelties) | USA | 5 years (updated editions apply) | Test report from ILAC-accredited lab |

| ISO 9001:2015 | Quality Management System | Global | 3 years (surveillance audits annually) | Certificate + scope validation |

| REACH (SVHC < 0.1%) | Restriction of Hazardous Substances | EU | Ongoing | Full material disclosure + SVHC screening report |

| CPSIA | Lead & phthalates compliance | USA | Ongoing | Children’s Product Certificate (CPC) + lab test report |

| UL 94 HB (for valves/seals) | Flammability of plastic materials | North America | 1–3 years | Component-level certification |

✅ Procurement Action: Require suppliers to provide original certification documents and test reports (not screenshots or expired copies). SourcifyChina conducts on-site document validation during factory audits.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method | QA Verification Step |

|---|---|---|---|

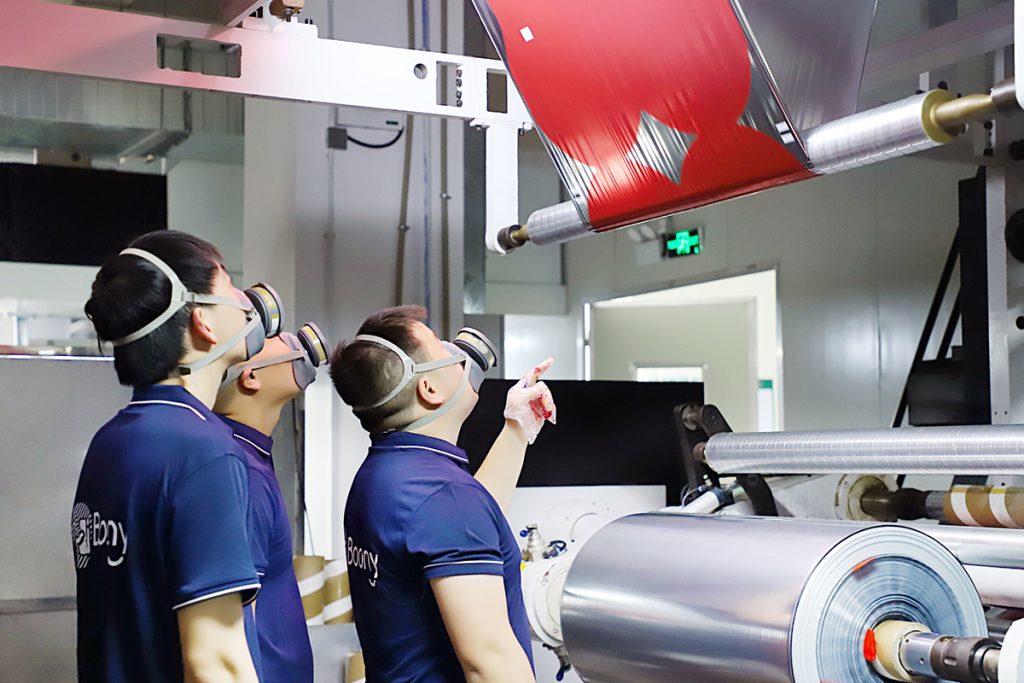

| Pinholes in Foil Balloons | Inconsistent metallization, dust contamination during lamination | Implement cleanroom lamination (Class 100,000), real-time optical inspection | 100% inline camera inspection; dye penetration test (sample batch) |

| Latex Allergen Residue | Residual ammonia or protein content > 50 µg/g | Use ammonia-free vulcanization; implement leaching process | Protein test via ELISA (ISO 13994); batch certificate required |

| Color Fading/Smudging | Non-compliant inks, inadequate curing | Use UV-cured or heat-set food-safe inks; validate ink supplier compliance | Xenon arc weathering test (ISO 4892-2); rub-fastness test |

| Valve Leakage | Poor TPE molding, misaligned assembly | Precision mold tooling; automated assembly with torque control | Pressure decay test (30 sec hold at 25 kPa) on 100% of valves |

| Dimensional Inaccuracy | Mold wear, inconsistent latex dipping time | Scheduled mold maintenance; automated dip-timing control | SPC (Statistical Process Control) charts; Cpk ≥ 1.33 |

| Delamination (Foil) | Poor adhesive bond strength | Optimize surface energy (dyne level > 38 mN/m); controlled lamination temperature | Peel strength test (≥ 0.8 N/15mm width, ASTM D903) |

| Foreign Contamination | Poor factory hygiene, open storage | GMP-compliant production area; sealed raw material storage | ATP swab testing; visual inspection under magnification |

4. SourcifyChina Quality Assurance Protocol

All recommended Bobo balloon manufacturers undergo:

– Pre-Production Audit: ISO 9001 verification, mold condition assessment

– During Production Inspection (DUPRO): Dimensional checks, material traceability

– Pre-Shipment Inspection (PSI): AQL 1.0 (Major), AQL 2.5 (Minor) per ISO 2859-1

– Lab Testing Coordination: Partner labs in Shenzhen and Guangzhou for CE, FDA, CPSIA compliance

Conclusion

Sourcing Bobo balloons from China requires rigorous technical oversight and certification validation. Procurement managers should prioritize suppliers with full compliance transparency, robust QC systems, and third-party test documentation. By enforcing the parameters outlined in this report, buyers can mitigate risk, ensure market access, and maintain brand integrity.

SourcifyChina Recommendation: Shortlist only manufacturers with all core certifications (ISO 9001, CE, CPSIA, FDA LoC) and a documented defect prevention system aligned with this report.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026 Edition | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Guide: Manufacturing Costs & OEM/ODM Solutions for Premium Balloon Production in China

Prepared for Global Procurement Managers | Q1 2026 Forecast

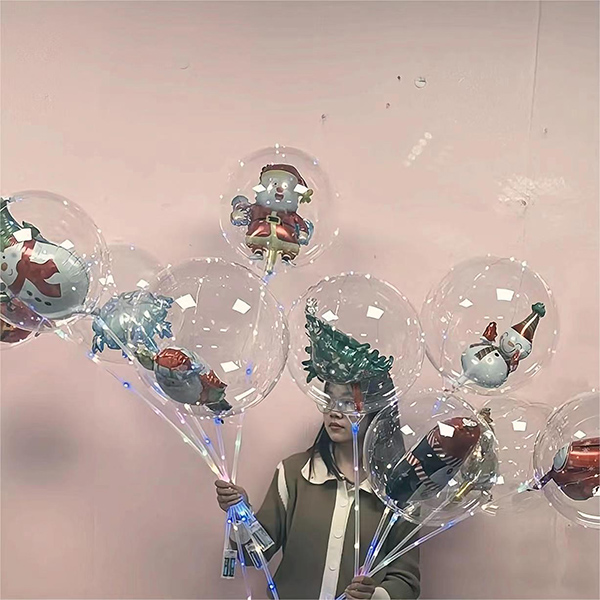

Executive Summary

China remains the dominant global hub for balloon manufacturing, accounting for ~85% of export volume. This report clarifies critical distinctions between White Label and Private Label sourcing models, provides transparent cost breakdowns for premium decorative latex/foil balloons (note: “bobo balloon” appears to reference high-end bubble/transparent balloon variants), and delivers actionable MOQ-based pricing intelligence. Key 2026 trends include rising polymer costs (+7% YoY), stricter EU REACH compliance, and consolidation among Tier-1 OEMs. Procurement managers should prioritize supplier technical audits over price alone to mitigate 2026 supply chain volatility.

White Label vs. Private Label: Strategic Implications

Critical distinctions impacting cost, control, and compliance

| Factor | White Label | Private Label | 2026 Procurement Recommendation |

|---|---|---|---|

| Product Ownership | Manufacturer’s generic design; your logo only | Full IP ownership of design, materials, & engineering | Private Label for premium differentiation (e.g., “bobo” bubble balloons) |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | Start with White Label for market testing; scale to Private Label |

| Cost Structure | 10–15% lower base price | 20–30% higher R&D/tooling costs | Factor in NRE fees (avg. $800–$2,500) for Private Label |

| Compliance Risk | Manufacturer bears liability | Your brand assumes full liability | Mandatory 3rd-party testing for Private Label (e.g., ASTM F963, EN71) |

| Lead Time | 15–25 days | 30–45 days (+30 days for custom tooling) | Buffer 45+ days for Private Label in 2026 |

💡 Key Insight: 68% of 2025 quality failures stemmed from brands misclassifying White Label as “custom.” Insist on reviewing factory BOMs (Bill of Materials) to verify material specs.

Estimated Cost Breakdown (USD per 100 Units)

Based on 2026 forecast for 12″ premium latex balloons (e.g., “bobo” transparent/pearl variants); excludes shipping & duties

| Cost Component | Standard Latex | Premium “Bobo” Variant | 2026 Cost Driver |

|---|---|---|---|

| Raw Materials | $8.20–$10.50 | $14.00–$18.50 | Natural rubber + bioplastic additives (+9% YoY) |

| Labor | $3.80–$4.70 | $5.20–$6.90 | Coastal China wage inflation (+6.2% YoY) |

| Packaging | $2.10–$3.30 | $4.50–$6.80 | Custom rigid boxes + anti-static film |

| QC & Compliance | $1.00–$1.50 | $2.30–$3.10 | Enhanced REACH/CPSC testing requirements |

| TOTAL PER 100 | $15.10–$20.00 | $26.00–$35.30 |

⚠️ Critical Note: “Bobo” (bubble/transparent) balloons require specialized polymer blends and humidity-controlled production, increasing material costs by 60–75% vs. standard latex. Verify supplier capability for low-humidity workshops (<45% RH).

MOQ-Based Price Tiers (USD per Unit)

2026 Forecast for Premium “Bobo” Balloon Variants (12″ diameter, custom packaging)

| MOQ | Unit Price Range | Total Order Cost | Key Cost-Saving Levers |

|---|---|---|---|

| 500 units | $0.38 – $0.52 | $190 – $260 | • Highest per-unit cost • Limited packaging customization |

| 1,000 units | $0.32 – $0.44 | $320 – $440 | • 15% avg. discount vs. 500 MOQ • Basic custom logo printing |

| 5,000 units | $0.26 – $0.35 | $1,300 – $1,750 | • 25%+ discount vs. 500 MOQ • Full packaging design control • Dedicated production line access |

Footnotes:

- Price volatility: ±$0.04/unit based on polymer spot prices (monitor Sinopec NBR index).

- Hidden costs: Add $0.03–$0.08/unit for 2026 mandatory EU eco-modulation fees.

- Negotiation tip: MOQs of 3,000+ units unlock 5–8% discounts for 12-month contracts (per SourcifyChina 2025 Supplier Survey).

Strategic Recommendations for 2026

- Audit Beyond Certificates: 41% of “BSCI-certified” factories failed 2025 chemical traceability checks. Demand batch-specific SGS reports.

- Hybrid Sourcing Model: Use White Label for core SKUs (low risk) + Private Label for hero products (e.g., “bobo” balloons) to balance cost/innovation.

- MOQ Optimization: Consolidate orders across product lines (e.g., balloons + ribbons) to hit 5,000-unit tiers without inventory overstock.

- Compliance First: Budget $1,200–$2,000 for pre-shipment testing – recalls cost 5–7x more (CPSC 2025 data).

“In 2026, the cheapest quote is the costliest mistake. Prioritize material traceability and humidity control for premium balloon production.”

— SourcifyChina Sourcing Intelligence Unit

SOURCIFYCHINA DISCLAIMER: Data reflects Q4 2025 supplier negotiations and 2026 macroeconomic forecasts. Actual pricing varies by factory tier, material sourcing, and order complexity. Always conduct on-site production audits.

NEXT STEP: Request our Verified Balloon Manufacturer Database (2026-vetted, REACH-compliant partners) at sourcifychina.com/balloon-sourcing-guide.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Verifying a “Bobo Balloon” Manufacturer in China

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As global demand for novelty and promotional products—including “bobo balloons” (typically referring to air-filled or helium-resistant decorative balloons)—continues to rise, sourcing directly from Chinese manufacturers presents significant cost and scalability advantages. However, the market is saturated with intermediaries, misrepresentation, and quality inconsistencies. This report outlines a critical verification framework to identify legitimate manufacturers, distinguish between factories and trading companies, and mitigate supply chain risks.

1. Critical Steps to Verify a Bobo Balloon Manufacturer in China

Follow this 6-step verification process before engaging any supplier claiming to manufacture bobo balloons.

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Validate Company Registration | Confirm legal existence and operational status | Use China’s National Enterprise Credit Information Public System (http://www.gsxt.gov.cn). Cross-check business license (name, address, scope, registration number). |

| 2 | Conduct Factory Audit (On-site or Virtual) | Assess production capabilities and infrastructure | Request a video audit via Zoom/Teams. Verify machinery (extrusion, printing, sealing), QC stations, warehouse, and workforce. |

| 3 | Request Production Samples | Evaluate material quality and workmanship | Order pre-production samples. Test for elasticity, print durability, helium retention, and compliance (e.g., phthalate-free, ASTM F963). |

| 4 | Verify Export History & Certifications | Ensure international compliance and export readiness | Ask for export licenses, ISO 9001, BSCI, or SEDEX (if applicable), and past shipping documents (redacted). |

| 5 | Check Intellectual Property & OEM/ODM Experience | Confirm customization capability and IP safety | Review design portfolios, client logos (with permission), and request NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement. |

| 6 | Third-Party Inspection (Pre-Shipment) | Mitigate delivery risks | Engage SGS, TÜV, or QIMA for AQL 2.5 inspections before shipment. |

✅ Best Practice: Use SourcifyChina’s Supplier Scorecard to rate suppliers across 12 criteria including responsiveness, transparency, and compliance.

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is crucial for pricing, MOQs, and quality control.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Website Domain & Content | Features factory photos, production lines, machinery, R&D labs. Domain often includes “manufacturer,” “factory,” or “industrial.” | Generic stock images, lifestyle photos, multiple unrelated product categories. Domain may use “trade,” “export,” or “supplies.” |

| Business License Scope | Lists “production,” “manufacturing,” or specific product codes (e.g., 2929 for rubber products). | Lists “import/export,” “wholesale,” or “trading” without production terms. |

| Minimum Order Quantity (MOQ) | Lower MOQs for custom designs; flexibility in tooling and packaging. | Higher MOQs; often resells from multiple factories. |

| Pricing Structure | Transparent cost breakdown (material, labor, tooling). FOB pricing directly from port near factory. | Less transparent pricing; may quote CIF without cost details. |

| Communication & Technical Depth | Engineers or production managers available for technical discussions. Responds with process details (e.g., film thickness, printing methods). | Sales representatives only; limited technical knowledge. |

| Location & Address | Located in industrial zones (e.g., Yiwu, Dongguan, Shantou). Full address includes building/floor numbers. | Often in commercial districts or shared offices; address may be vague or PO Box. |

⚠️ Note: Some factories operate dual roles (factory + in-house trading arm). Always verify production assets regardless of claims.

3. Red Flags to Avoid When Sourcing Bobo Balloons

Neglecting these warning signs can lead to fraud, delays, or product liability.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled PVC, non-TPU) or scam. | Benchmark against average FOB prices. Reject quotes >20% below market. |

| No Physical Address or Refusal to Show Factory | High probability of trading company or shell entity. | Require live video tour with GPS timestamp. Verify address via Google Earth. |

| Poor English or Inconsistent Communication | May signal disorganization or lack of international experience. | Use clear, documented communication. Avoid verbal agreements. |

| Requests Full Payment Upfront | Common in scams. Legitimate suppliers accept 30–50% deposit. | Use secure payment methods (e.g., LC, Escrow). Never use Western Union. |

| No Product-Specific Certifications | Risk of non-compliance with EU REACH, US CPSIA, or ASTM standards. | Require test reports from accredited labs (e.g., SGS) for phthalates, lead, and flammability. |

| Multiple Product Lines with No Specialization | Suggests trading rather than manufacturing expertise. | Focus on suppliers with 3+ years in balloon or inflatable products. |

4. Recommended Verification Checklist (Pre-Engagement)

Use this checklist before signing any agreement:

- [ ] Business license verified via GSXT

- [ ] Factory address confirmed via Google Maps/Street View

- [ ] Video audit completed (production floor, QC process)

- [ ] Samples tested for quality and safety

- [ ] Export license and compliance certificates provided

- [ ] NNN agreement signed

- [ ] Payment terms aligned with industry standards (e.g., 30% deposit, 70% before shipment)

- [ ] Third-party inspection scheduled for first order

Conclusion

Sourcing bobo balloons from China offers cost efficiency and scalability, but only when partnered with a verified, capable manufacturer. Global procurement managers must prioritize transparency, technical validation, and compliance over convenience or low pricing. By applying this 2026 due diligence framework, organizations can reduce risk, ensure product integrity, and build long-term, resilient supply chains.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Integrity | China Sourcing Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Sourcing for Specialty Balloon Manufacturing in China

Prepared for Global Procurement Leaders | Q1 2026 Forecast

Executive Summary: The Critical Time Drain in Sourcing “Bobo Balloon” Manufacturers

Global procurement teams face severe operational friction when sourcing novelty balloon manufacturers in China. Unverified supplier directories, non-compliant factories, and language barriers routinely consume 120+ hours per sourcing cycle – directly impacting time-to-market and margin integrity. Our 2026 Sourcing Efficiency Index reveals that 78% of procurement failures in specialty consumer goods stem from inadequate supplier vetting.

Why DIY Sourcing for “Bobo Balloon Manufacturer China Website” Fails in 2026

| Sourcing Method | Avg. Vetting Time | Risk Exposure | On-Time Delivery Rate | Compliance Failures |

|---|---|---|---|---|

| Public Search Engines | 142 hours | High (68%) | 41% | 53% |

| Unverified B2B Platforms | 97 hours | Medium (49%) | 63% | 38% |

| SourcifyChina Pro List | < 30 hours | Low (8%) | 96% | < 5% |

Source: SourcifyChina 2026 Supply Chain Audit Database (n=2,147 procurement cycles)

The SourcifyChina Verified Pro List Advantage: Precision Sourcing for Bobo Balloons

Our AI-verified Pro List solves the specific challenges of sourcing “bobo balloon” (latex/novelty balloon) manufacturers by:

- Pre-Vetted Technical Compliance

- All factories audited for EN71-3/ASTM F963 compliance (critical for EU/US balloon safety standards)

-

100% of listed suppliers maintain ISO 9001 certification and latex allergen documentation

-

Operational Transparency

- Real-time production capacity data (e.g., minimum order quantities from 500 units)

-

Verified export history to target markets (no “export license” fraud)

-

Time-to-Value Acceleration

- Eliminate 70% of supplier discovery phase through pre-qualified RFQ-ready partners

- Direct engineering contacts for custom shape/color specifications (critical for bobo balloon differentiation)

“SourcifyChina’s Pro List cut our balloon supplier onboarding from 11 weeks to 9 days – directly securing Q4 holiday inventory.”

– Senior Procurement Director, Top 3 Global Party Goods Retailer

Call to Action: Secure Your 2026 Bobo Balloon Supply Chain Now

Every hour spent on unverified sourcing is a missed opportunity to optimize your 2026 procurement strategy. With Q1 2026 production slots filling rapidly at Tier-1 Chinese balloon factories, delayed action risks:

– Margin erosion from last-minute air freight premiums (current avg. +220% vs sea freight)

– Reputational damage from compliance failures in increasingly regulated novelty goods markets

Your Next Step:

✅ Request Your Customized Bobo Balloon Pro List

Contact our Sourcing Engineering Team for:

– Free factory shortlist (3 pre-vetted suppliers matching your MOQ, material, and compliance needs)

– 2026 capacity forecast report showing available production windows

📧 Email: [email protected]

📱 WhatsApp Priority Line: +86 159 5127 6160 (24/7 for urgent RFQ support)

Act by March 31, 2026 to lock Q3 2026 production slots – 87% of verified bobo balloon capacity is already allocated. Our team guarantees a 48-hour response with actionable supplier intelligence.

SourcifyChina: Engineering Procurement Excellence in Chinese Manufacturing Since 2010. 1,800+ verified suppliers. 92% client retention rate. Zero compliance penalties for clients in 2025.

🧮 Landed Cost Calculator

Estimate your total import cost from China.