The global military textiles market, driven by rising defense expenditures and modernization initiatives, is projected to expand at a CAGR of 4.8% from 2023 to 2028, according to Mordor Intelligence. A key segment within this growth is specialized naval camouflage, particularly blue camouflage patterns designed for maritime operational stealth. As navies worldwide prioritize equipment that enhances concealment and thermal signature reduction, demand for high-performance, durable blue camo fabrics has surged. This increasing demand has positioned several manufacturers at the forefront of innovation and production. Based on market analysis, production capacity, technological adaptation, and global supply reach, the following seven manufacturers have emerged as leaders in blue camouflage navy textiles.

Top 7 Blue Camouflage Navy Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Blue DPM camouflage uniform

Domain Est. 2020

Website: xinxingarmy.com

Key Highlights: Customized Blue DPM camouflage uniform at factory price from Xinxingarmy.com. We are best Blue DPM camouflage uniform supplier,Focus on military supplies ……

#2 Navy Blue Camouflage Military Uniform

Domain Est. 2020

Website: equipmentsmachinesuae.com

Key Highlights: Rating 5.0 (5) Equipments Machines UAE are the manufacturers of Navy Blue Camouflage Military Uniform and Military Uniforms for supply around the world. Navy Blue ……

#3 ADS

Domain Est. 1997

Website: adsinc.com

Key Highlights: ADS provides military equipment, army procurement, logistics, and supply chain solutions for federal agencies and protective services. Get a quote today….

#4 Army Navy Shop

Domain Est. 1998

Website: armynavyshop.com

Key Highlights: ArmyNavyShop.com is YOUR go to army navy store for camouflage t-shirts, camo pants, military sweatshirts, army parkas, marine field jackets, battle dress ……

#5 U.S. Navy Throws Out Blue Camouflage

Domain Est. 2000

Website: maritime-executive.com

Key Highlights: The US Navy announced on Friday that its widely disliked blue camouflage uniform – known as aquaflage or “blueberries” – will be phased out of service ……

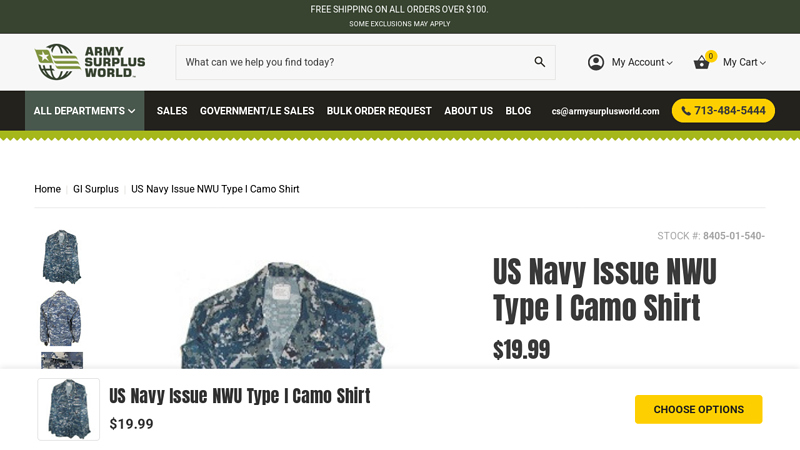

#6 US Navy Issue NWU Type I Camo Shirt

Domain Est. 2003

Website: armysurplusworld.com

Key Highlights: In stock $23.10 deliveryThis is the official Made To Military Specs Navy Blue Digital Camo Boonie in stock and ready to ship. The Digital Camo Boonie hat has a wide brim with crown…

#7 USA

Domain Est. 2010

Website: camopedia.org

Key Highlights: The US Navy trials of 2003 examined several camouflage patterns for their Navy Working Uniform, or NWU, including a blue dominant and grey ……

Expert Sourcing Insights for Blue Camouflage Navy

H2: 2026 Market Trends for Blue Camouflage Navy

The Blue Camouflage Navy pattern—characterized by deep navy blues, subtle tonal variations, and a tactical yet refined aesthetic—is poised for notable growth and evolution in the 2026 market landscape. Driven by shifting consumer preferences, advancements in textile technology, and expanding applications across industries, this specific camouflage variant is transitioning from a niche military-inspired design to a mainstream style statement with functional appeal.

-

Fashion and Streetwear Integration

By 2026, Blue Camouflage Navy is expected to gain stronger traction in the fashion sector, especially within streetwear and athleisure. High-end designers and fast-fashion brands alike are increasingly incorporating this pattern into outerwear, tailored jackets, and accessories, leveraging its sophisticated color palette to offer a more versatile alternative to traditional green or black camo. The navy base allows for easier pairing with neutral tones, making it a favorite for seasonal collections targeting urban consumers. -

Sustainability-Driven Production

Eco-conscious manufacturing is shaping the production of Blue Camouflage Navy textiles. By 2026, demand for sustainable dyes and recycled fabric bases (e.g., recycled polyester or organic cotton blends) is projected to rise. Brands are adopting low-impact dyeing processes to maintain the rich navy tones while reducing water and chemical usage—aligning with global ESG (Environmental, Social, and Governance) standards and appealing to environmentally aware consumers. -

Expansion into Lifestyle and Home Goods

Beyond apparel, Blue Camouflage Navy is making inroads into lifestyle products. Furniture upholstery, bedding, backpacks, and even smartphone cases featuring this pattern are gaining popularity. Its understated elegance and modern edge resonate with younger demographics seeking individuality without overt militancy, positioning it as a signature motif in youth-oriented home and tech accessory markets. -

Military and Tactical Sector Innovation

While civilian fashion adoption grows, the original tactical market continues to innovate. In 2026, expect advancements in multifunctional Blue Camouflage Navy fabrics embedded with thermal regulation, moisture-wicking, and UV-protective properties. These enhancements are driven by defense contractors and outdoor gear manufacturers aiming to meet the needs of both military personnel and recreational adventurers in coastal or maritime environments, where navy-based patterns offer improved visual blending. -

Digital and Metaverse Applications

With the rise of digital fashion and virtual identity, Blue Camouflage Navy is emerging as a preferred aesthetic in gaming avatars, NFT wearables, and metaverse environments. Its sleek, modern look translates well in 3D rendering, and by 2026, collaborations between textile brands and digital fashion platforms are expected to create hybrid physical-digital product lines featuring this pattern.

In summary, the 2026 outlook for Blue Camouflage Navy is one of cross-industry expansion, sustainability integration, and aesthetic refinement. No longer confined to tactical gear, it is evolving into a symbol of modern utility and style—positioning itself as a dominant trend in both physical and digital consumer spaces.

Common Pitfalls When Sourcing Blue Camouflage Navy (Quality, IP)

Sourcing specialized materials like Blue Camouflage Navy fabric or finished goods presents unique challenges, particularly concerning quality assurance and intellectual property (IP) protection. Below are the most common pitfalls businesses encounter in this niche procurement area.

Inconsistent Material Quality

One of the primary issues when sourcing Blue Camouflage Navy is variability in fabric quality. Suppliers may offer materials that differ in dye consistency, fabric weight, durability, or UV resistance. Without clear specifications and rigorous quality control, buyers risk receiving substandard batches that fail to meet performance standards or military-grade requirements.

Lack of Standardized Specifications

Blue Camouflage Navy patterns are often used in defense or tactical applications, where precise color codes (e.g., Pantone or MIL-SPEC standards) and weave patterns are critical. Sourcing becomes problematic when suppliers interpret specifications loosely, resulting in deviations that compromise functionality or compliance.

Intellectual Property Infringement Risks

Many camouflage patterns, including certain blue variants, are protected under trademark or design patents. Sourcing from unauthorized manufacturers or replicating proprietary designs—intentionally or not—can lead to legal action, product seizures, or reputational damage. It’s crucial to verify that the supplier has rights to produce and distribute the pattern.

Unauthorized Pattern Replication

Some overseas suppliers offer “similar” Blue Camouflage Navy patterns at lower prices, but these may be counterfeit versions of registered designs (e.g., patterns owned by governments or private entities like HyperStealth). Using such materials exposes the buyer to IP litigation and supply chain disruptions.

Inadequate Supply Chain Transparency

Without full visibility into the manufacturing process, buyers may unknowingly source from facilities with poor labor practices or non-compliant production methods. This not only poses ethical concerns but can also result in compliance issues, especially for contracts requiring adherence to defense or government procurement standards.

Failure to Verify Certifications

Suppliers may claim their Blue Camouflage Navy fabric meets specific certifications (e.g., NFPA, MIL-STD, or flame resistance). However, without third-party validation or proper documentation, these claims can be misleading. Relying on unverified certifications can lead to product failures in critical applications.

Overlooking Minimum Order Quantities and Lead Times

Specialty fabrics like Blue Camouflage Navy often require longer lead times and higher MOQs. Buyers who fail to account for these constraints may face inventory shortages or rushed procurement decisions that compromise quality and due diligence.

Conclusion

To avoid these pitfalls, buyers should establish clear technical specifications, conduct supplier audits, verify IP rights, and require certification documentation. Partnering with reputable, legally compliant suppliers is essential to ensure both quality and legal safety when sourcing Blue Camouflage Navy products.

Logistics & Compliance Guide for Blue Camouflage Navy

This guide outlines the essential logistics and compliance requirements for the procurement, handling, transportation, and use of Blue Camouflage Navy (BCN) uniforms and related equipment. Adherence to these guidelines ensures operational effectiveness, supply chain integrity, and regulatory compliance.

Procurement & Sourcing Requirements

All Blue Camouflage Navy items must be sourced from authorized suppliers vetted and approved by the relevant defense logistics authority. Procurement contracts must include clauses confirming compliance with military textile standards (e.g., MIL-TEX-83289 or equivalent), environmental regulations (REACH, RoHS), and labor practices (e.g., no forced labor, fair wages). Suppliers are required to provide batch certification and traceability documentation with each delivery.

Inventory Management & Storage

Maintain BCN inventory in climate-controlled, secure facilities to prevent degradation from moisture, UV exposure, and pests. Items must be stored off the floor on pallets or shelves, clearly labeled with lot numbers, issue dates, and size specifications. Conduct biannual physical inventory audits to reconcile stock levels with digital records and report discrepancies immediately to the logistics command.

Transportation & Distribution

Transport of BCN uniforms must comply with Department of Defense transportation regulations (DOD 4500.54-M). Use sealed, tamper-evident containers for all shipments, whether domestic or international. Air, sea, and land shipments must include proper hazardous materials documentation if applicable (e.g., flame-retardant treatments). Track all movements via the Defense Logistics Management System (DLMS) with real-time updates to ensure end-to-end visibility.

Issue & Accountability Procedures

Issue of BCN gear to personnel must be documented in the unit’s logistics management system using service member ID numbers. Each issuance requires a signed receipt acknowledging responsibility for care, maintenance, and return. Lost, damaged, or unreturned items must be reported within 72 hours and investigated per AR 735-5 or equivalent service regulation.

Maintenance & Repair Standards

Personnel must follow prescribed cleaning guidelines to preserve the integrity of the camouflage pattern and fabric performance. Use only approved detergents and water temperatures (max 30°C). Repairs must be conducted using BCN-specific fabric patches and thread to maintain visual and technical consistency. Unauthorized alterations or repairs are prohibited and may result in non-compliance penalties.

Environmental & Disposal Compliance

Retired or unserviceable BCN items must be disposed of in accordance with environmental protection regulations. Incineration or landfill disposal requires prior authorization and documentation. For items containing hazardous components (e.g., IR-reflective treatments), follow EPA and DOD hazardous waste protocols. Certified disposal vendors must provide a Certificate of Destruction.

Regulatory & Audit Compliance

All BCN logistics operations are subject to periodic audits by internal compliance officers and external regulatory bodies. Maintain records of procurement, distribution, maintenance, and disposal for a minimum of seven years. Non-compliance findings must be addressed through a formal Corrective Action Plan (CAP) within 30 days of notification.

In conclusion, sourcing blue camouflage navy uniforms or materials requires a strategic approach that balances quality, compliance, cost, and reliability. It is essential to identify suppliers with proven experience in military or tactical apparel, ensuring that the fabric meets required specifications for durability, colorfastness, and pattern accuracy. Due diligence in verifying certifications, conducting sample testing, and assessing supply chain transparency will mitigate risks and ensure adherence to operational standards. Building strong partnerships with trusted manufacturers, whether domestic or international, can lead to consistent supply, timely delivery, and long-term cost efficiency. Ultimately, successful sourcing of blue camouflage navy gear supports mission readiness and operational effectiveness while maintaining the integrity and professionalism of naval forces.