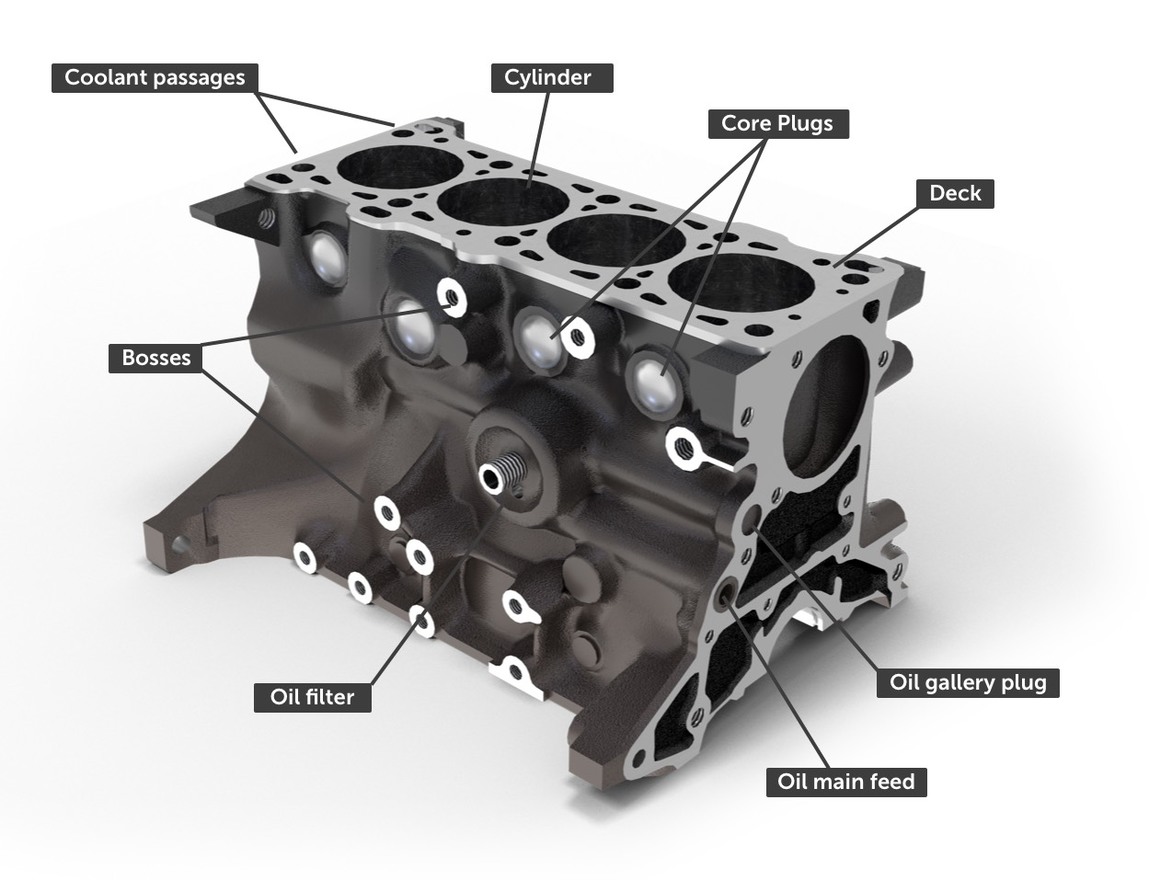

The global block engine parts market is experiencing robust growth, driven by rising automotive production, increased demand for fuel-efficient engines, and expanding aftermarket needs. According to a report by Grand View Research, the global automotive engine market was valued at USD 176.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. Similarly, Mordor Intelligence projects steady growth in engine component manufacturing, supported by advancements in engine technology and growing vehicle electrification that still require internal combustion components in hybrid models. As demand for durable and high-performance engine blocks and related parts rises across OEM and replacement segments, a select group of manufacturers has emerged as leaders in innovation, scalability, and quality. The following list highlights the top 10 block engine parts manufacturers shaping the industry’s future through technological leadership and global supply chain integration.

Top 10 Block Engine Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

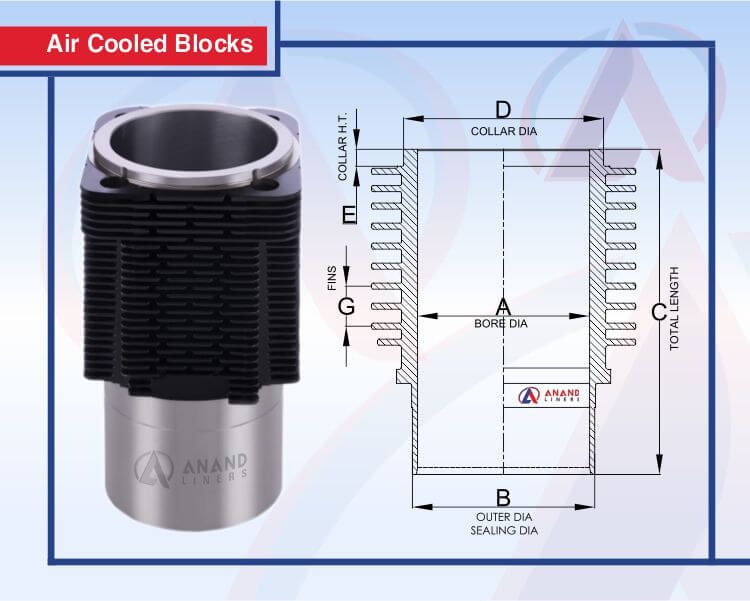

#1 Anand Liners

Domain Est. 2013

Website: anandliners.com

Key Highlights: We are the leading Automotive Engine Parts Manufacturer, Exporter and OEM Supplier of Cylinder Liners, Sleeves and Air Cooled Block, with a proven history ……

#2 Heavy Duty Powertrain Components

Domain Est. 1993

Website: pai.com

Key Highlights: PAI’s powertrain line includes block components (pistons, liners, rings, rods, bearings, gaskets, etc.), cylinder head components (heads, valves, guides, ……

#3 Bill Mitchell Products

Domain Est. 2008

Website: billmitchellproducts.com

Key Highlights: Bill Mitchell Products has been a leading manufacturer, Engine builder and seller of High Performance Engine Blocks, Heads, Manifolds and go fast parts since ……

#4 Atrac Engineering: Cylinder Liner Manufacturers

Domain Est. 2017

Website: atracparts.com

Key Highlights: We offer various types of Cylinder Liners, Pistons, Engine Valves, Sleeves, Piston rings, Air Cooled Blocks & Other Engine Parts according to OE specifications, ……

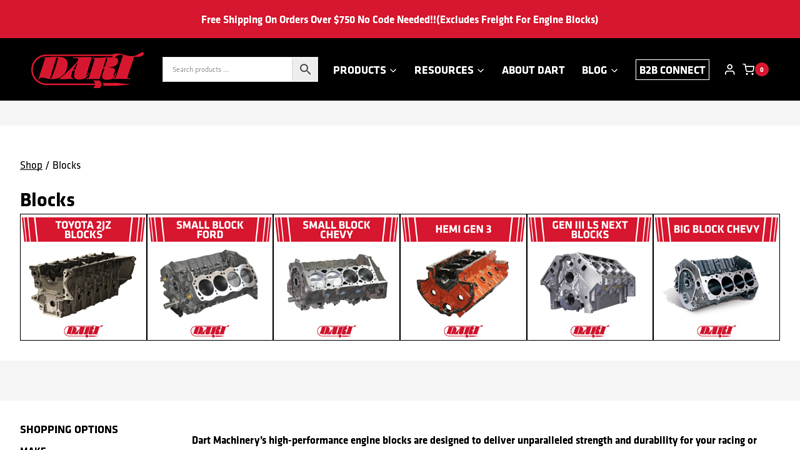

#5 Engine Blocks

Domain Est. 1996

Website: dartheads.com

Key Highlights: Free delivery over $750Dart offers a wide selection of meticulously engineered engine blocks, including cast iron and aluminum options, crafted to handle maximum power reliably….

#6 Engine Blocks

Domain Est. 1996

Website: callies.com

Key Highlights: For Officially Licensed Mopar Blocks – please reach out to Callies directly. 419-435-2711. Big Block Chevy Billet Aluminum · LS Billet Aluminum · Small Block ……

#7 Engine Pro

Domain Est. 1996

Website: enginepro.com

Key Highlights: Engine Pro supplies professional engine parts and rebuild components for machine shops and performance builders. Find gaskets, bearings, pistons, and more….

#8 Engine Blocks & Block Parts

Domain Est. 2000

Website: katechengines.com

Key Highlights: 6-day delivery 30-day returnsShop our selection of sleeved blocks, forged rotating assemblies, billet steel main caps, and specialized block components engineered to ……

#9 Remanufactured engines & parts

Domain Est. 2008

Website: agcopower.com

Key Highlights: Remanufactured engines & parts. When planning major engine repairs, the genuine remanufactured AGCO Power engine is a noteworthy alternative….

#10 RELIANCE

Domain Est. 2015

Website: reliancepowerparts.com

Key Highlights: The Trusted Source For Aftermarket Wholesale New & Remanufactured Diesel Engine & Heavy Duty Equipment Parts ; 100,000+. Machine Parts in Stock. Shop Now ; 5,000+….

Expert Sourcing Insights for Block Engine Parts

H2: 2026 Market Trends for Block Engine Parts

The global market for block engine parts is poised for significant transformation by 2026, driven by technological innovation, evolving regulatory landscapes, and shifting consumer demand. As automakers accelerate the transition toward electrification and sustainable manufacturing, traditional internal combustion engine (ICE) components—including engine blocks—are adapting to new performance and efficiency standards. Below are key market trends shaping the Block Engine Parts sector in 2026:

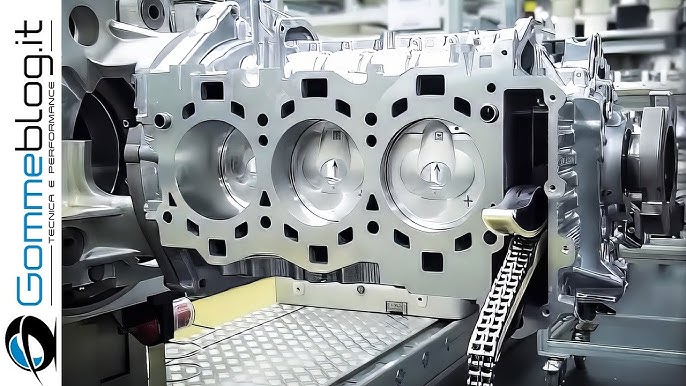

1. Lightweight Material Adoption

A dominant trend in 2026 is the increasing use of lightweight materials such as aluminum alloys, high-strength composites, and advanced cast iron variants. Manufacturers are prioritizing weight reduction to improve fuel efficiency and meet stringent emissions regulations, particularly in North America and Europe. Aluminum engine blocks now dominate in passenger vehicles, while compacted graphite iron (CGI) maintains a strong presence in heavy-duty diesel applications.

2. Electrification Impact and Hybrid Optimization

While the rise of battery electric vehicles (BEVs) reduces demand for traditional ICEs, hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs) continue to rely on high-efficiency internal combustion engines. In 2026, engine block designs are increasingly optimized for hybrid systems—featuring reduced displacement, enhanced thermal efficiency, and modular architecture to support integration with electric drivetrains.

3. Advanced Manufacturing Techniques

The integration of additive manufacturing (3D printing), precision casting, and digital twin technologies enables faster prototyping and improved durability of engine blocks. Foundries are leveraging Industry 4.0 principles to enhance quality control, reduce waste, and customize block designs for performance and efficiency. This shift supports just-in-time production and localized manufacturing, reducing supply chain vulnerabilities.

4. Sustainability and Circular Economy

Environmental regulations are pushing OEMs and suppliers toward sustainable production and end-of-life recyclability. In 2026, recycled aluminum content in engine blocks is rising, and remanufactured block engine parts are gaining market share, particularly in aftermarkets across Europe and Asia-Pacific. Closed-loop recycling systems and carbon footprint tracking are becoming standard in supplier compliance protocols.

5. Regional Market Dynamics

While developed markets (U.S., Germany, Japan) focus on high-efficiency and low-emission engine blocks, emerging economies (India, Brazil, Southeast Asia) still exhibit strong demand for durable, cost-effective cast iron blocks due to continued reliance on ICE vehicles. China remains a pivotal market, balancing rapid EV adoption with sustained production of efficient ICEs for export and domestic use.

6. Aftermarket Growth and Digital Integration

The aftermarket for block engine parts is expanding, fueled by aging vehicle fleets and cost-conscious consumers. In 2026, smart diagnostics and IoT-enabled sensors are being embedded in engine systems, allowing for predictive maintenance and early detection of block-related issues such as cracks or coolant leaks—enhancing part longevity and customer trust.

Conclusion

By 2026, the block engine parts market is navigating a complex landscape of innovation and transition. While long-term demand may decline with full electrification, the interim focus on efficiency, hybridization, and sustainability ensures continued relevance. Companies investing in lightweight materials, smart manufacturing, and circular business models are best positioned to thrive in this evolving ecosystem.

Common Pitfalls Sourcing Block Engine Parts: Quality and Intellectual Property Risks

Sourcing engine block components—whether for replacement, repair, or manufacturing—exposes buyers to significant risks, particularly regarding part quality and intellectual property (IP) compliance. Failure to address these pitfalls can result in performance failures, safety hazards, legal disputes, and reputational damage.

Quality-Related Pitfalls

Substandard Materials and Manufacturing Processes

Many low-cost suppliers use inferior-grade metals or alloys that do not meet OEM specifications, leading to premature wear, cracking, or catastrophic engine failure. Inadequate heat treatment, poor casting techniques, or insufficient machining tolerances can compromise structural integrity and performance.

Inconsistent Dimensional Accuracy

Engine blocks require precise tolerances to ensure proper fitment with pistons, crankshafts, and other critical components. Sourcing from unverified suppliers often results in parts with dimensional inconsistencies, causing alignment issues, oil leaks, or reduced engine efficiency.

Lack of Certification and Testing Documentation

Reputable engine parts should come with material certifications (e.g., ASTM, ISO), pressure test results, and quality assurance documentation. Suppliers who cannot provide verifiable test reports increase the risk of receiving non-compliant or untested components.

Counterfeit or Refurbished Parts Marketed as New

Unscrupulous vendors may sell remanufactured or salvaged engine blocks as new, often with cosmetic refurbishment hiding internal flaws. These parts may have hidden cracks, wear, or previous damage that compromises reliability.

Intellectual Property-Related Pitfalls

Unauthorized Production of Patented Designs

Many engine block designs, especially those from major OEMs, are protected by patents or design rights. Sourcing parts from suppliers who replicate these designs without licensing exposes buyers to IP infringement claims, even if unintentional.

Trademark and Branding Violations

Using OEM logos, part numbers, or branding on non-genuine components constitutes trademark infringement. Suppliers offering “OEM-equivalent” parts with identical markings may be violating intellectual property laws, putting the buyer at legal risk.

Gray Market and Unauthorized Distribution Channels

Purchasing from unauthorized distributors or gray market sources increases exposure to IP violations. These channels may distribute parts produced without OEM consent, potentially infringing on manufacturing rights or distribution agreements.

Lack of IP Warranty or Indemnification

Many third-party suppliers do not provide contractual protection against IP claims. Without indemnification clauses in procurement agreements, buyers may bear full liability if legal action arises from using infringing parts.

Mitigating these risks requires due diligence in supplier vetting, requesting material and test certifications, verifying IP compliance, and sourcing from reputable, authorized vendors. Engaging legal counsel to review supply agreements and IP clauses is also recommended.

Logistics & Compliance Guide for Block Engine Parts

This guide outlines the essential logistics and compliance procedures for handling, transporting, and managing Block Engine Parts to ensure efficiency, regulatory adherence, and product integrity throughout the supply chain.

Order Processing & Documentation

Ensure all purchase orders and work orders for Block Engine Parts are accurately documented and validated before processing. Required documentation includes part numbers, quantities, material specifications, heat numbers (where applicable), and customer-specific requirements. Maintain a digital record of all transactions for traceability and audit readiness.

Packaging & Handling Standards

Block Engine Parts must be packaged to prevent physical damage, corrosion, and contamination during transit. Use corrosion-inhibiting coatings, protective wraps, and robust wooden crates or steel-reinforced containers. Label all packages with part numbers, handling instructions (e.g., “Do Not Invert,” “Fragile”), and hazard symbols if applicable. Handle parts using appropriate lifting equipment to avoid surface damage or misalignment.

Storage Requirements

Store Block Engine Parts in a climate-controlled, dry environment to prevent moisture-related degradation. Parts should be elevated off the floor on pallets or shelves and segregated by material type, grade, and work status (e.g., raw, machined, inspected). Implement a first-in, first-out (FIFO) inventory system to minimize aging and ensure traceability.

Transportation & Shipping

Use only certified carriers experienced in heavy industrial freight for shipping Block Engine Parts. Secure loads with appropriate bracing and strapping to prevent movement during transit. For international shipments, comply with Incoterms® 2020 (typically FOB or DDP, as agreed). Provide carriers with detailed shipping manifests, packing lists, and safety data sheets (SDS) when required.

Export Compliance

Verify export eligibility for Block Engine Parts under relevant regulatory frameworks such as the Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR), depending on part specifications and destination. Obtain necessary export licenses or authorizations prior to shipment. Maintain records of export transactions for a minimum of five years.

Import & Customs Clearance

Ensure all import documentation is complete and accurate, including commercial invoices, certificates of origin, import licenses (if required), and conformity declarations. Classify Block Engine Parts under the correct Harmonized System (HS) code to determine duties and taxes. Coordinate with customs brokers to facilitate timely clearance and avoid delays.

Quality & Regulatory Compliance

All Block Engine Parts must meet applicable industry standards (e.g., ISO 9001, AS9100 for aerospace applications) and customer-specific technical requirements. Perform in-process and final inspections, documenting results in a quality control dossier. Retain material test reports (MTRs) and inspection certifications with each batch.

Environmental & Safety Regulations

Adhere to OSHA, EPA, and local environmental regulations when handling and storing Block Engine Parts, particularly those involving residual oils, coatings, or machining byproducts. Implement spill containment and proper waste disposal procedures. Train personnel on hazardous material handling if applicable.

Traceability & Recordkeeping

Maintain full traceability for each Block Engine Part through serial or batch numbering, linked to material source, manufacturing date, inspection data, and shipping records. Use a digital inventory management system to support real-time tracking and rapid response to audits or recalls.

Non-Conformance & Returns

Establish a documented process for handling non-conforming parts, including quarantine, root cause analysis, and corrective actions. For customer returns, inspect returned parts, document condition, and update quality and inventory records accordingly. Follow return material authorization (RMA) procedures to ensure compliance and accountability.

Conclusion for Sourcing Block Engine Parts:

Sourcing block engine parts requires a strategic approach that balances quality, cost, availability, and reliability. After evaluating various suppliers, manufacturing standards, and logistical considerations, it is evident that partnering with reputable vendors—whether OEMs, aftermarket specialists, or remanufacturers—plays a crucial role in ensuring engine performance and longevity. Factors such as material specifications, compatibility with existing systems, lead times, and after-sales support must be carefully assessed to minimize downtime and maintenance costs. Additionally, leveraging global supply chains while considering regional regulations and sustainability practices enhances supply resilience. Ultimately, a well-structured sourcing strategy for engine block components not only supports operational efficiency but also contributes to the overall reliability and competitiveness of the end product. Regular supplier audits, continuous market analysis, and strong vendor relationships are essential for maintaining a consistent and high-quality supply of engine block parts.