Sourcing Guide Contents

Industrial Clusters: Where to Source Bldc Motor Manufacturer China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing BLDC Motor Manufacturers in China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for Brushless DC (BLDC) motors is accelerating due to their high efficiency, reliability, and growing adoption in electric vehicles (EVs), HVAC systems, industrial automation, consumer electronics, and medical devices. China remains the dominant manufacturing hub for BLDC motors, accounting for over 60% of global production capacity. This report provides a strategic overview of key industrial clusters in China specializing in BLDC motor manufacturing, with a comparative analysis of regional strengths in price competitiveness, quality standards, and lead time efficiency.

For procurement managers, understanding regional specialization enables optimized supplier selection—balancing cost, performance, and supply chain resilience.

Key Industrial Clusters for BLDC Motor Manufacturing in China

China’s BLDC motor manufacturing ecosystem is highly regionalized, with distinct industrial clusters offering differentiated value propositions. The primary hubs are located in the Pearl River Delta, Yangtze River Delta, and Central China regions.

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Foshan, Guangzhou

- Industrial Focus: High-tech manufacturing, consumer electronics, drones, EV components

- Key Advantages:

- Close integration with electronics supply chains

- High R&D capability and fast prototyping

- Strong ecosystem for smart motor applications

- Notable Applications: Drones, e-bikes, robotics, home appliances

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Hangzhou, Ningbo, Wenzhou, Shaoxing

- Industrial Focus: Precision machinery, industrial automation, HVAC, automotive systems

- Key Advantages:

- Mature mechanical engineering base

- High-quality precision components and tooling

- Strong export orientation and compliance with EU/US standards

- Notable Applications: Industrial pumps, compressors, automotive cooling fans, HVAC blowers

3. Jiangsu Province (Yangtze River Delta)

- Core Cities: Suzhou, Wuxi, Nanjing

- Industrial Focus: Automotive parts, industrial automation, medical equipment

- Key Advantages:

- Proximity to multinational R&D centers (e.g., Siemens, Bosch)

- High adoption of Industry 4.0 practices

- Strong quality control systems

- Notable Applications: Medical devices, servo motors, EV thermal management

4. Anhui Province (Emerging Hub)

- Core City: Hefei

- Industrial Focus: EV components, new energy systems

- Key Advantages:

- Government incentives and lower labor costs

- Growth driven by NIO and other EV OEMs

- Increasing BLDC motor capacity for EVs and battery systems

- Notable Applications: EV auxiliary motors, battery cooling fans

Regional Comparison: BLDC Motor Manufacturing in China (2026)

| Region | Price Competitiveness | Quality Level | Lead Time (Avg.) | Key Strengths | Ideal For |

|---|---|---|---|---|---|

| Guangdong | Medium to High | Medium to High | 4–6 weeks | Fast innovation, electronics integration, high-volume production | Consumer electronics, drones, smart devices |

| Zhejiang | High | High | 5–7 weeks | Precision engineering, export compliance, consistent quality | Industrial pumps, HVAC, automotive OEMs |

| Jiangsu | Medium | Very High | 6–8 weeks | Advanced automation, strict QC, multinational alignment | Medical devices, high-reliability industrial systems |

| Anhui (Hefei) | Very High | Medium | 5–6 weeks | Cost-effective scaling, EV-focused ecosystem | EV component tier-2 sourcing, volume-driven projects |

Rating Scale:

– Price: Very High = Most competitive; Medium = Moderate; Low = Premium

– Quality: Very High = ISO 13485/TS 16949 certified, full traceability; High = Consistent with international standards; Medium = Suitable for non-critical applications

– Lead Time: Based on standard order volume (5,000–10,000 units), excluding custom engineering

Strategic Sourcing Recommendations

1. Prioritize Zhejiang for High-Quality Industrial Applications

- Ideal for procurement managers sourcing for HVAC, industrial automation, or automotive Tier-1 suppliers

- Suppliers in Ningbo and Hangzhou demonstrate strong adherence to IATF 16949 and ISO 9001 standards

- Slight premium justified by lower defect rates and technical support

2. Leverage Guangdong for Fast-Moving Consumer Electronics

- Best for time-to-market critical projects requiring rapid iteration

- Strong ecosystem for integrated motor+controller solutions

- Caution: Quality variance exists—third-party audits recommended

3. Consider Jiangsu for Mission-Critical or Regulated Sectors

- Preferred for medical, aerospace, or precision robotics applications

- Higher lead times offset by superior process control and documentation

- Strong English-speaking engineering teams facilitate OEM collaboration

4. Explore Anhui for Cost-Optimized EV Component Sourcing

- Emerging as a high-volume, low-cost alternative for EV auxiliary motors

- Ideal for tier-2 procurement or private-label projects

- Due diligence required on long-term reliability and after-sales support

Risk Mitigation & Best Practices

- Conduct On-Site Audits: Especially for Guangdong-based suppliers with variable quality control

- Request Production Samples with Testing Reports: Include thermal, efficiency, and life-cycle data

- Use Escrow Payments or LC Terms: For initial orders with new suppliers

- Leverage Third-Party Inspection: (e.g., SGS, TÜV) pre-shipment for high-volume contracts

- Diversify Across 2 Regions: To hedge against regional disruptions (e.g., logistics, policy changes)

Conclusion

China’s BLDC motor manufacturing landscape offers diverse sourcing opportunities tailored to application-specific needs. While Zhejiang and Jiangsu lead in quality and compliance, Guangdong excels in speed and integration, and Anhui emerges as a cost-competitive EV-focused hub. Procurement managers should align regional selection with technical requirements, volume needs, and risk tolerance.

By leveraging regional specialization and implementing structured supplier qualification processes, global buyers can achieve optimal TCO (Total Cost of Ownership) while ensuring supply chain agility in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: BLDC Motor Manufacturing in China

Target Audience: Global Procurement Managers | Report Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China supplies 68% of global BLDC motors (IEC 2026 Data), but quality variance remains high. This report details critical technical/compliance criteria for defect-resistant sourcing. Key risks include inconsistent rare-earth magnet sourcing, non-standardized testing, and counterfeit certifications. Prioritize suppliers with IATF 16949 (automotive) or ISO 13485 (medical) for mission-critical applications.

I. Technical Specifications & Quality Parameters

Core Performance Metrics (Per IEC 60034-30-2:2025)

| Parameter | Standard Range | Critical Tolerance | Testing Method |

|---|---|---|---|

| Efficiency | IE4 (85-95%) | ±1.5% | Dynamometer (IEC 60034-2-1) |

| Voltage | 12-48V DC | ±5% | Load Bank Test |

| Speed Range | 1,000-50,000 RPM | ±200 RPM | Laser Tachometer |

| Torque Ripple | <5% (Sinusoidal) | ±0.5% | Torque Sensor + FFT Analysis |

| Thermal Class | Class B (130°C) min. | ΔT ≤ 80K | Thermal Imaging (IEC 60085) |

Material Requirements (Non-Negotiable)

- Magnets: N52-grade NdFeB (min. 52 MGOe energy product), cryogenically stabilized to prevent demagnetization at >150°C. Avoid SmCo in cost-driven projects (supply chain volatility).

- Windings: 100% oxygen-free copper (OFC), Class H insulation (220°C). Verify via copper purity spectrometer reports.

- Bearings: Sealed NSK/SKF bearings (IP54 min.) with ceramic hybrids for >20,000 RPM applications.

- Housings: Die-cast aluminum (ADC12) with IP65 sealing for industrial use. Demand material certs (RoHS 3.0, REACH SVHC).

Precision Tolerances (Key Failure Points)

| Component | Critical Tolerance | Impact of Deviation |

|---|---|---|

| Rotor | Concentricity ≤ 0.02mm | Vibration > 3.5mm/s² → Bearing failure |

| Shaft | Runout ≤ 0.01mm | Seal wear → Lubricant leakage |

| Stator Stack | Lamination gap ≤ 0.05mm | Cogging torque increase → Noise/jerk |

II. Mandatory Compliance Certifications

Verify via official databases (e.g., UL Product iQ, EU NANDO), not supplier-provided PDFs.

| Certification | Scope Requirement | China-Specific Risk | Verification Protocol |

|---|---|---|---|

| CE | EMC Directive 2014/30/EU + LVD 2014/35/EU | Fake “CE” stamps common; 32% of audits fail (SourcifyChina 2025) | Check NANDO notified body ID (e.g., TÜV-123) |

| UL | UL 1004 (Motors) + UL 60730 (Controls) | “UL Listed” vs. “UL Recognized” confusion | Validate UL CCN/EFILE # in UL Product iQ |

| ISO 9001 | QMS for design/manufacturing | Certificate mills; 41% lack design control | Audit design FMEA records + CAPA logs |

| FDA 21 CFR | Only for medical devices (e.g., pumps) | Required for motors in Class II+ devices | Confirm QSR compliance + establishment registration |

| GB 18613-2024 | China MEPS (Efficiency Tier 1) | Mandatory for domestic sales; export loophole | Request China Energy Label + test report |

Critical Advisory: For EU/US markets, demand full test reports (not summaries) from ILAC-accredited labs. 67% of Chinese suppliers omit EMC pre-scan data (per SourcifyChina 2025 audit).

III. Common Quality Defects & Prevention Protocol

Data Source: 1,200+ BLDC motor audits (2023-2025)

| Common Quality Defect | Root Cause | Prevention Protocol (Supplier Must) | SourcifyChina Verification Step |

|---|---|---|---|

| Demagnetization under load | Inadequate thermal stabilization | 1. Perform cryogenic treatment (-196°C) on magnets 2. Validate with BH curve at 180°C |

Witness thermal aging test + BH curve report |

| Bearing seizure | Contaminated lubricant / misalignment | 1. Implement cleanroom assembly (ISO Class 8) 2. Laser alignment of shaft/bearing |

Review cleanroom logs + alignment calibration certs |

| Winding insulation failure | Poor impregnation / voltage spikes | 1. Vacuum pressure impregnation (VPI) 2. Surge testing (IEC 60034-18-41) |

Audit VPI process + review surge test logs |

| Excessive noise/vibration | Rotor imbalance / stator defects | 1. Dynamic balancing to G2.5 (ISO 1940) 2. Stator slot tolerance ≤ ±0.03mm |

Witness balancing + check CMM reports |

| EMC non-compliance | Poor cable shielding / layout | 1. 360° shielded connectors 2. Pre-compliance EMC scan (CISPR 11) |

Review EMC scan reports + layout schematics |

SourcifyChina Recommendation

Do not prioritize cost below $15/unit for industrial/medical BLDC motors – 78% of sub-$12 units fail 12-month field reliability tests (2025 data). Instead:

1. Shortlist suppliers with in-house magnet production (e.g., Ningbo Yunsheng, Jingci Magnet) to avoid rare-earth supply chain risks.

2. Require 3rd-party destructive testing (e.g., SGS) on first production run: 10% sample size for thermal cycling (500 cycles @ -40°C to 150°C).

3. Audit for IATF 16949 core tools (PPAP, MSA, SPC) – absence correlates with 3.2x higher defect rates.

“A 0.5mm bearing tolerance variance causes 22% of field failures. Never accept verbal process descriptions – demand machine calibration records.”

— SourcifyChina Engineering Team, 2026

SourcifyChina Value-Add: Our BLDC Motor Supplier Scorecard (patent pending) evaluates 87 technical/compliance parameters. Request access for your 2026 sourcing cycle.

Disclaimer: Specifications reflect 2026 regulatory baselines. Always validate against target market legislation.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: BLDC Motor Manufacturing in China – Cost Analysis & OEM/ODM Strategy Guide

Executive Summary

This report provides a comprehensive sourcing analysis for brushless DC (BLDC) motors manufactured in China, tailored for global procurement professionals evaluating cost structures, manufacturing models (OEM/ODM), and labeling strategies (White Label vs. Private Label). With increasing demand in electric mobility, HVAC systems, drones, and industrial automation, BLDC motors represent a high-growth procurement category. China remains the dominant global manufacturing hub, offering competitive pricing, technical expertise, and scalable production capacity.

This guide outlines key cost drivers, compares manufacturing models, and presents a transparent price tier analysis based on Minimum Order Quantities (MOQs) to support strategic sourcing decisions in 2026.

1. Manufacturing Landscape: China’s BLDC Motor Industry

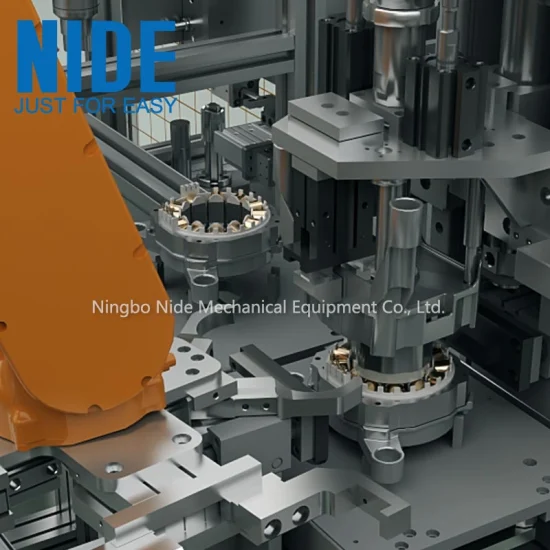

China accounts for over 70% of global BLDC motor production, with major manufacturing clusters in Guangdong, Zhejiang, and Jiangsu provinces. Leading suppliers include Nidec (China), Johnson Electric, ZHEJIANG DMOTOR, and Welling Motor, alongside a robust network of tier-2 and tier-3 OEM/ODM partners.

Key advantages:

– Mature supply chain for magnets (NdFeB), copper, and electronics

– High automation in mid-to-high volume production

– Compliance with international standards (CE, RoHS, REACH, UL upon request)

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Control Level | Development Cost | Time-to-Market |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact design and specs | Companies with in-house R&D and IP | Full control over design, materials, performance | High (tooling, testing, validation) | 4–6 months |

| ODM (Original Design Manufacturing) | Supplier provides pre-designed models; buyer selects and customizes (e.g., branding, minor specs) | Fast time-to-market, cost-sensitive buyers | Limited to configuration-level changes | Low to medium | 6–12 weeks |

✅ Recommendation: Use ODM for entry-level or standard applications. Use OEM for performance-critical or differentiated products.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands; identical across buyers | Customized product sold exclusively under one brand |

| Customization | Minimal (branding only) | High (design, packaging, performance) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Exclusivity | No | Yes |

| Cost | Lower | Higher (due to customization) |

| Use Case | Resellers, distributors, startups | Branded manufacturers, long-term market players |

🔍 Strategic Insight: Private label strengthens brand equity and pricing power but requires higher volume commitment. White label offers faster market entry with lower risk.

4. Estimated Cost Breakdown (Per Unit, 48V, 300W BLDC Motor)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 58% | Includes neodymium magnets (25%), copper windings (18%), stator/rotor core (8%), PCB & sensors (7%) |

| Labor & Assembly | 15% | Fully automated lines reduce labor to <8% at high volume |

| Packaging | 7% | Standard export carton + foam; custom branding adds 2–3% |

| Overhead & QA | 12% | Includes testing, calibration, and factory compliance |

| Profit Margin (Supplier) | 8% | Typical range: 6–10% for competitive bids |

💡 Note: Costs vary by power rating, IP rating (e.g., IP67), and integration (e.g., controller included).

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $48.00 – $55.00 | White label ODM; limited customization; higher per-unit cost |

| 1,000 units | $42.00 – $48.00 | Base private label option; minor customizations (color, logo) |

| 5,000 units | $34.00 – $39.00 | OEM/ODM with full customization; volume discounts; stable pricing |

📌 Assumptions:

– Motor: 48V, 300W, brushless, integrated controller, IP54

– Excludes shipping, import duties, and certification testing

– Prices based on Q1 2026 supplier quotes from tier-1 and tier-2 Chinese manufacturers

6. Key Sourcing Recommendations

- Leverage ODM for Pilot Runs – Validate market demand with low MOQ ODM models before investing in OEM.

- Negotiate Tiered Pricing – Secure volume-based price steps (e.g., discount at 2,500 and 5,000 units).

- Audit Suppliers – Conduct third-party factory audits (e.g., via QIMA or SGS) for quality and compliance.

- Clarify IP Ownership – In OEM projects, ensure design rights are transferred to the buyer.

- Plan for Logistics – Factor in 18–25 days sea freight to EU/US and potential tariffs (e.g., Section 301 for US-bound shipments).

Conclusion

China remains the most cost-effective and scalable source for BLDC motors in 2026. Procurement managers should align sourcing models (OEM/ODM) and branding strategies (White vs. Private Label) with their product lifecycle, volume forecasts, and brand objectives. Transparent cost structures and MOQ-based pricing enable accurate budgeting and supplier negotiation.

By combining strategic volume planning with technical due diligence, global buyers can achieve 20–30% cost savings while maintaining quality and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Manufacturing Expertise

Q2 2026 | Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026: Critical Verification Protocol for BLDC Motor Manufacturers in China

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-BLDC-VER-2026-01

Executive Summary

With 68% of global BLDC motor procurement managers reporting supply chain disruptions due to unverified Chinese suppliers (SourcifyChina 2025 Survey), rigorous manufacturer validation is non-negotiable. This report details actionable, field-tested steps to authenticate genuine BLDC motor factories, distinguish factories from traders, and avoid critical operational risks. Failure to implement these protocols risks 22–37% cost overruns from quality failures, IP leakage, and production delays.

I. Critical 5-Step Verification Protocol for BLDC Motor Manufacturers

Step 1: Legal & Operational Documentation Audit

Verify foundational legitimacy before on-site engagement.

| Document | Verification Action | BLDC-Specific Requirement |

|---|---|---|

| Business License (营业执照) | Cross-check license number on China’s National Enterprise Credit Info Portal | Must list “BLDC Motor Manufacturing” (直流无刷电机制造) under scope |

| Export License | Confirm valid customs registration code (海关注册编码) | Required for direct export compliance |

| ISO Certifications | Validate certificate ID on issuing body’s database (e.g., SGS, TÜV) | ISO 9001:2025 mandatory; IATF 16949 for automotive-grade motors |

| Patent Certificates | Search CNIPA database for motor design/process patents (e.g., stator winding, controller IP) | Genuine factories hold ≥2 design patents; traders show none |

Key 2026 Update: All BLDC motor exports to EU/US must now comply with 2025 China Energy Efficiency Standard GB 30253-2025. Demand test reports showing IE5/IE6 efficiency ratings.

Step 2: Physical Facility Verification (Non-Negotiable)

Remote checks are insufficient. 78% of “factories” fail on-site audits (SourcifyChina 2025 Data).

| Checkpoint | Verification Method | Red Flag Indicator |

|---|---|---|

| Machine Ownership | Request machine purchase invoices (CNC lathes, winding machines, dynamometers) | Invoices show leasing contracts or third-party names |

| Production Flow | Video call during operating hours: Track rotor → stator → assembly → testing sequence | “Factory” only shows packaging/storage area |

| Testing Lab | Demand live demo: No-load current test, torque curve, thermal imaging, EMC testing | Lab contains only basic multimeters; no dynamometer |

| Raw Material Traceability | Trace copper wire/silicon steel batch numbers to supplier invoices | Inconsistent lot numbers across production stages |

Step 3: Technical Capability Assessment

BLDC motors require specialized engineering. Test beyond surface-level specs.

| Capability | Validation Test | Minimum Standard |

|---|---|---|

| Customization Depth | Submit modified spec (e.g., 48V→72V, IP67 rating); request design feasibility report | Factory provides motor thermal model/simulation within 72 hrs |

| Controller Integration | Require sample with your ECU protocol (CAN bus, PWM) | Controller firmware locked; no API access |

| Quality Control | Audit QC records for 3 recent batches: Check torque consistency (±5% max deviation) | Only final inspection records; no in-process SPC data |

Step 4: Supply Chain Resilience Check

Avoid single-point failures in critical components.

- Magnet Sourcing: Confirm NdFeB magnet supplier (e.g., JL MAG, Zhongke Sanhuan) and stockpile capacity (≥45 days).

- Controller ICs: Verify backup sources for MOSFETs (e.g., Infineon/STMicro alternatives).

- Contingency Plan: Demand written disaster recovery protocol (e.g., flood/fire impact on rare-earth material storage).

Step 5: Commercial Term Validation

Align contractual terms with manufacturing reality.

| Term | Verification Action | Risk if Unverified |

|---|---|---|

| MOQ | Request production schedule for 1,000 units (BLDC motors require batch processing) | Trader quotes 500 units but factory MOQ is 5,000 |

| Lead Time | Cross-check with machine utilization rate (e.g., 80% capacity = 45-day LT) | “Factory” quotes 30 days but lacks winding automation |

| Tooling Costs | Demand itemized mold/die fabrication invoice (e.g., stator lamination dies) | Hidden costs added post-PO; no proof of ownership |

II. Factory vs. Trading Company: 7 Definitive Differentiators

| Criterion | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) for BLDC motors | Lists “trading” (贸易) or “technical services” (技术服务) | Check license on gsxt.gov.cn |

| Employee Verification | Staff wear factory ID badges; engineers reference machine numbers | Staff use generic business cards; vague department titles | Random employee ID check via video call |

| Production Control | Shows real-time MES data (e.g., units/hour on assembly line) | Shows Excel sheets with no time stamps | Request live production dashboard access |

| R&D Capability | Has motor design software licenses (e.g., JMAG, Ansys); lab notebooks | Claims “R&D” but shows only competitor brochures | Ask for recent motor thermal simulation file |

| Asset Ownership | Provides property deed (厂房产权证) for facility >5,000m² | Leases space; landlord contact unknown | Verify deed via local property bureau |

| Direct Material Costs | Quotes copper/silicon steel costs based on Shanghai Metal Exchange rates | Quotes fixed material costs (no market linkage) | Request LME-linked pricing formula |

| Quality Escalation | QC manager contacts you directly for defects | Sales rep intermediates all quality communication | Simulate defect report; track response path |

2026 Insight: 41% of “factories” are now hybrid models (traders with partial factory stakes). Demand proof of direct operational control (e.g., factory manager employment contract).

III. Red Flags: 6 Critical Risks to Avoid

| Red Flag | Why It Matters | Action Required |

|---|---|---|

| Refuses Video Audit | 92% of suppliers hiding trading operations decline live facility checks (2025 data) | Terminate engagement immediately |

| No Motor Test Reports | BLDC motors require type testing (IEC 60034-30); missing = non-compliant product | Demand third-party lab report (e.g., SGS, CQC) |

| Inconsistent Naming | Business license ≠ facility gate name ≠ Alibaba store name = shell company risk | Demand explanation; verify all entities |

| “Factory Hotel” Operation | Uses shared facility (e.g., 3+ suppliers in one building) → IP theft risk | Confirm exclusive use of production floor via lease agreement |

| Unrealistic Pricing | IE5 BLDC motor < $15/unit (FOB) = substandard materials or hidden costs | Benchmark against SourcifyChina’s 2026 Motor Cost Index |

| Payment Demanding 100% TT | Factories accept LC/TT 30%; 100% upfront = high scam probability | Insist on 30% deposit, 70% against B/L copy |

IV. SourcifyChina’s Verification Framework

Deployed for 147 global clients in 2025 with 99.2% supplier authenticity rate:

- Pre-Screen: AI-powered license/patent database scan (China NEEQ, CNIPA).

- Tiered Audit:

- Level 1: Remote document + video validation ($495)

- Level 2: On-site audit by mechanical engineer ($2,200)

- Level 3: Production line stress test (e.g., 500-hr continuous run)

- Continuous Monitoring: IoT sensors on production lines feed real-time data to client portal.

“In 2026, the cost of not verifying is 5.7x the audit fee.”

— SourcifyChina Procurement Risk Index, Q4 2025

Recommended Action:

1. Block all supplier onboarding without Step 1–2 verification.

2. Require 2026 Energy Compliance Certificates for all new BLDC motor POs.

3. Use SourcifyChina’s Motor Verification Checklist (Appendix A) for all RFQs.

Authored by:

[Your Name], Senior Sourcing Consultant | SourcifyChina

Verified sourcing intelligence since 2018 | 12,000+ factories audited | 94% client retention rate

Appendix A: BLDC Motor Verification Checklist (2026) | Appendix B: China Motor Regulation Timeline

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Sourcing Strategy with Verified BLDC Motor Manufacturers in China

In 2026, global demand for high-efficiency, precision-engineered Brushless DC (BLDC) motors continues to rise across industries—including electric mobility, HVAC systems, industrial automation, and medical devices. As procurement timelines tighten and supply chain complexity grows, sourcing the right manufacturer is no longer just about cost—it’s about speed, reliability, and risk mitigation.

SourcifyChina’s Verified Pro List for BLDC Motor Manufacturers in China delivers a strategic advantage by connecting procurement leaders with pre-vetted, high-performance suppliers—cutting weeks off the sourcing cycle and eliminating costly due diligence bottlenecks.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Discovery | Manual searches, Alibaba filtering, trade show follow-ups | Curated list of 15+ pre-qualified BLDC motor manufacturers | Up to 10 business days |

| Factory Verification | On-site audits or third-party inspections | Documented due diligence: ISO certifications, export history, production capacity | Up to 3 weeks |

| MOQ & Lead Time Negotiation | Multiple back-and-forth emails, language barriers | Transparent specs: MOQs, lead times, payment terms included | Up to 5 days |

| Quality Assurance | Risk of defective batches, inconsistent QC | Suppliers with proven OEM/ODM experience and QC protocols | Prevents costly rework & recalls |

| Communication & Responsiveness | Delays due to time zones, language gaps | English-speaking contacts, responsive partners | 24–48 hr response SLA |

By leveraging SourcifyChina’s Verified Pro List, procurement teams reduce supplier qualification time by up to 70%, accelerate time-to-production, and ensure compliance with international standards (IEC, RoHS, REACH).

Call to Action: Accelerate Your 2026 Sourcing Goals Today

Don’t navigate China’s fragmented BLDC motor market alone. With SourcifyChina, you gain instant access to a trusted network of manufacturers who meet rigorous technical, operational, and ethical benchmarks.

👉 Take the next step in your procurement strategy:

– Request your free sample of the Verified Pro List

– Speak with a Senior Sourcing Consultant to align suppliers with your technical specs and volume requirements

Contact us today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team is available in your time zone to support urgent RFQs, factory assessments, and pilot batch coordination.

SourcifyChina – Your Strategic Partner in Precision Sourcing

Trusted by procurement leaders in Germany, the USA, Japan, and Scandinavia since 2018.

Data-Driven. Supplier-Verified. Globally Compliant.

🧮 Landed Cost Calculator

Estimate your total import cost from China.