The global aluminium market continues to expand, driven by rising demand in construction, automotive, and consumer electronics sectors, with black aluminium gaining traction due to its aesthetic appeal, corrosion resistance, and thermal performance. According to a 2023 report by Mordor Intelligence, the global aluminium market is projected to grow at a CAGR of 4.3% from 2023 to 2028, fueled by increased urbanization and infrastructure development—particularly in Asia-Pacific and the Middle East. As architectural design trends favor modern, sleek finishes, black anodized and powder-coated aluminium profiles are becoming increasingly popular. This growth is further supported by sustainability initiatives, as aluminium is 100% recyclable with only 5% energy loss in the recycling process. With market demand rising, numerous manufacturers have emerged as leaders in producing high-quality black aluminium solutions. Below are the top 10 black aluminium manufacturers shaping the industry through innovation, scale, and technical expertise.

Top 10 Black Aluminium Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 General Aluminum

Domain Est. 1999

Website: generalaluminum.com

Key Highlights: General Aluminum is a leading tier 1 full-service supplier for Automotive and Industrial OEMs, our goal is to provide high-quality products enabled by our ……

#2 Banco Aluminium

Domain Est. 2004

Website: bancoaluminium.com

Key Highlights: Banco Aluminium is a leading Aluminium Extrusion Manufacturer and Exporter supplying bespoke sections and profiles to OEMs across the world….

#3 Cornerstone Building Brands

Domain Est. 2019

Website: cornerstonebuildingbrands.com

Key Highlights: As North America’s largest manufacturer of exterior building solutions, we are committed to creating value for our customers and our communities….

#4 Black Rhino Manufacturing

Domain Est. 2020

Website: blackrhinotrailer.com

Key Highlights: Black Rhino is an Ohio-based manufacturer, specializing in high-quality trailers made from aluminum. Our trailers are designed to be strong, durable, ……

#5 Black Stainless

Domain Est. 1996

Website: lorin.com

Key Highlights: Black Stainless Aluminum Anodizing (UV) signifies the finish offered by Lorin is UV stable. Black Stainless Short Line Brush…

#6 Gränges circular and sustainable aluminium

Domain Est. 1997

Website: granges.com

Key Highlights: Gränges is a global leader in aluminium rolling and recycling in selected niches. We’re committed to creating circular and sustainable aluminium solutions in ……

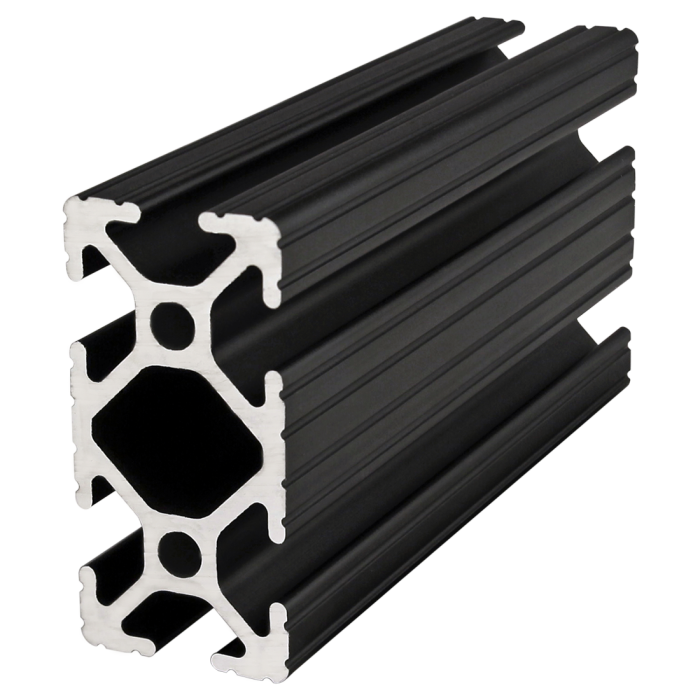

#7 80/20 Aluminum Extrusions

Domain Est. 1997

Website: 8020.net

Key Highlights: Custom aluminum framing from 80/20 lets you design your own machine guarding and enclosures. Learn More…

#8 The Aluminum Association

Domain Est. 1998

Website: aluminum.org

Key Highlights: The U.S. aluminum industry is a key element of the nation’s manufacturing base. Check out our latest study on aluminum’s impact on the American economy….

#9 Optical black light absorbing and coatings

Domain Est. 2000

Website: acktar.com

Key Highlights: World Leaderin Black Coatings. Acktar Black Coating is a world leader in light absorption, super black materials and blackening of opto-mechanical components….

#10 Aluminum Window Wall Systems From Blackline Aluminum

Domain Est. 2018

Website: blacklinealuminum.com

Key Highlights: Blackline Aluminum provides high-performance aluminum systems for modern buildings — including window walls, curtain walls, sliding doors, custom railings, and ……

Expert Sourcing Insights for Black Aluminium

H2: 2026 Market Trends for Black Anodized Aluminum

The global market for black anodized aluminum is poised for significant evolution by 2026, driven by advancements in surface treatment technologies, rising demand across high-growth industries, and increasing emphasis on sustainability and aesthetics in product design. Black anodized aluminum—distinct from standard aluminum due to its enhanced durability, corrosion resistance, and sleek visual appeal—is increasingly favored in architecture, consumer electronics, automotive, and renewable energy sectors.

1. Growth in Architectural and Construction Applications

By 2026, the architectural sector is expected to remain a primary driver of demand for black anodized aluminum. Urbanization in emerging economies, coupled with a global shift toward modern, minimalist building designs, is fueling the use of black aluminum in window frames, curtain walls, façades, and roofing systems. The material’s ability to withstand harsh weather conditions while retaining its color and finish makes it ideal for both residential and commercial infrastructure. Regulatory support for energy-efficient buildings further enhances its adoption, as aluminum contributes to improved thermal performance when integrated with appropriate glazing systems.

2. Expansion in Consumer Electronics and Premium Devices

The consumer electronics industry continues to favor black anodized aluminum for its premium finish and functional benefits. By 2026, increasing demand for high-end smartphones, laptops, wearables, and audio equipment will sustain market growth. The material offers excellent electromagnetic shielding, thermal dissipation, and structural rigidity—critical for compact and powerful devices. Apple and other leading brands have set a trend that others are following, reinforcing black aluminum as a hallmark of premium product design.

3. Automotive and EV Integration

The automotive industry, particularly the electric vehicle (EV) segment, is expected to significantly boost demand. By 2026, black anodized aluminum will see increased use in EV trims, interior accents, charging ports, and heat sinks for battery management systems. Its lightweight nature supports fuel efficiency and extended range, while the dark finish aligns with the modern, tech-forward aesthetics of EVs. Additionally, the material’s resistance to UV degradation ensures long-term color stability—important for exterior components.

4. Sustainability and Recycling Trends

Environmental regulations and corporate sustainability goals are shaping material choices across industries. Anodized aluminum is 100% recyclable without degradation in quality, making it a favorable choice in circular economy models. By 2026, manufacturers are expected to emphasize low-impact anodizing processes, including the adoption of eco-friendly dyes and reduced energy consumption. Water-based and non-hazardous sealing technologies will gain traction, driven by compliance with EU REACH and RoHS standards.

5. Technological Advancements in Anodizing Processes

Innovations in anodizing techniques—including pulse anodizing, organic acid-based electrolytes, and nano-porous layer enhancements—are expected to improve the consistency, depth, and durability of black finishes. These advancements will reduce production costs and expand application possibilities, particularly in high-wear environments. Integration with digital manufacturing (e.g., Industry 4.0) will also enable real-time quality control and customization, supporting just-in-time production models.

6. Regional Market Dynamics

Asia-Pacific is projected to dominate the black anodized aluminum market by 2026, led by China, India, and Southeast Asia’s rapid industrialization and construction boom. North America and Europe will maintain steady growth, driven by renovations, smart building initiatives, and strong electronics manufacturing. The Middle East is also emerging as a key market due to large-scale urban development projects such as NEOM and Dubai’s smart city initiatives.

Conclusion

By 2026, the black anodized aluminum market will be shaped by a confluence of aesthetic preference, performance requirements, and sustainability imperatives. As industries continue to prioritize lightweight, durable, and visually appealing materials, black anodized aluminum is well-positioned to expand beyond niche applications into mainstream use across multiple high-value sectors. Strategic investments in green manufacturing and surface engineering will be critical for suppliers aiming to capture growing market opportunities.

Common Pitfalls Sourcing Black Anodized Aluminium (Quality, IP)

Sourcing black anodized aluminium components—especially for applications requiring specific quality standards or Ingress Protection (IP) ratings—can be fraught with challenges. Overlooking these pitfalls can lead to performance failures, aesthetic inconsistencies, and increased costs. Below are key areas to watch:

Inconsistent or Poor Anodizing Quality

One of the most frequent issues is variability in the anodizing process. Poor quality control can result in:

– Color mismatch or non-uniform black finish across batches or even within a single part.

– Thin or uneven oxide layers, reducing corrosion resistance and mechanical durability.

– Pitting, streaking, or smudging due to improper pre-treatment, dyeing, or sealing.

Tip: Specify minimum anodizing thickness (e.g., 15–25 µm for architectural or industrial use) and require color standards (e.g., CIE Lab* values) in your procurement documentation.

Misunderstanding Ingress Protection (IP) Requirements

Black anodized aluminium is often used in enclosures requiring IP ratings (e.g., IP65, IP66). However, anodizing alone does not provide sealing against dust or water ingress. Common mistakes include:

– Assuming the anodized layer is sufficient for environmental protection.

– Overlooking the need for proper gaskets, seals, and design features to achieve the target IP rating.

Tip: Ensure that IP compliance is addressed at the system or enclosure level, not just the material. The anodized surface should be compatible with sealing methods and not prone to cracking or flaking under mechanical stress.

Substandard Alloy Selection

Not all aluminium alloys anodize well. Using inappropriate alloys (e.g., high-copper or high-silicon content) can result in:

– Poor adhesion of the oxide layer.

– Discoloration or mottling after anodizing.

– Reduced corrosion resistance.

Tip: Opt for anodizing-friendly alloys like 6061, 6063, or 5052. Clearly specify the alloy grade in technical drawings and material certifications.

Inadequate Sealing Process

After dyeing, the porous anodized layer must be properly sealed (e.g., hot deionized water, nickel acetate, or cold sealants). Inadequate sealing leads to:

– Poor UV and chemical resistance.

– Dye leaching or fading over time.

– Reduced dielectric strength and corrosion protection.

Tip: Request evidence of sealing quality, such as acid dissolution tests or impedance measurements, particularly for outdoor or harsh environment applications.

Lack of Supplier Qualification and Traceability

Relying on unqualified or inconsistent suppliers increases the risk of non-conformance. Issues include:

– Missing or falsified material test reports (MTRs).

– No batch traceability or process documentation.

– Inability to reproduce finishes across production runs.

Tip: Audit suppliers, require process control documentation, and insist on sample approval before full production.

Overlooking Environmental and Regulatory Compliance

Black anodizing may involve dyes and sealants that contain restricted substances (e.g., heavy metals). Non-compliance with RoHS, REACH, or other regulations can lead to shipment rejections.

Tip: Verify that all chemicals used in the anodizing process meet relevant environmental standards, and request compliance documentation.

By addressing these common pitfalls early in the sourcing process—through clear specifications, supplier vetting, and quality verification—you can ensure reliable performance and appearance of black anodized aluminium components, especially in demanding applications involving IP ratings and long-term durability.

Logistics & Compliance Guide for Black Aluminium

Overview of Black Aluminium in Global Trade

Black aluminium, typically anodized or coated to achieve its distinctive dark finish, is widely used in architectural, automotive, and consumer electronics applications. Due to its specialized surface treatment and potential classification under specific regulations, managing its logistics and compliance requires careful attention to material specifications, transportation standards, and international regulatory requirements.

Material Classification and HS Code

Black aluminium products are generally classified under the Harmonized System (HS) Code 7606 or 7607 for aluminium plates, sheets, or foils, depending on thickness and form. If coated or anodized, subcategories such as 7606.12 (anodized) may apply. Accurate classification is essential for customs clearance, tariff assessment, and compliance with import/export regulations. Always confirm with local customs authorities or a certified trade advisor.

Packaging and Handling Requirements

Proper packaging is crucial to protect the black finish from scratches, abrasion, and moisture during transit. Use anti-scratch films, edge protectors, and moisture-resistant wrapping. Stack sheets or profiles with spacers, and secure loads on pallets using stretch wrap or strapping. Clearly label packages as “Fragile” and “Surface Protection – Do Not Stack,” and avoid direct contact with steel fasteners to prevent galvanic corrosion.

Transportation and Shipping Considerations

Black aluminium is typically shipped via containerized ocean freight, air freight (for high-value or time-sensitive orders), or overland trucking. Maintain stable temperatures and low humidity during transit to prevent condensation and coating degradation. For international shipments, ensure compatibility with Incoterms® 2020 (e.g., FOB, CIF) and verify any carrier-specific restrictions on coated metals.

Export Controls and Licensing

While raw aluminium is generally not subject to strict export controls, certain high-performance or military-grade black aluminium components may fall under dual-use regulations (e.g., EU Dual-Use Regulation, U.S. EAR). Conduct a classification review to determine if export licenses are required, particularly when shipping to embargoed or high-risk countries.

Environmental and Safety Compliance

Black aluminium production may involve chromate or other chemical conversion coatings, which can be regulated under REACH (EU), RoHS, or TSCA (U.S.). Ensure material declarations (e.g., SVHC compliance) are available. During transport, comply with IMDG Code (sea), IATA-DGR (air), or ADR (road) if hazardous substances are present in residual treatment chemicals.

Customs Documentation and Duties

Prepare accurate documentation including commercial invoices, packing lists, certificates of origin, and material test reports. Highlight the treated nature of the product to avoid misclassification. Be aware of anti-dumping duties that may apply to aluminium imports in certain jurisdictions (e.g., EU, U.S.), especially from specific countries of origin.

Country-Specific Regulations

Compliance requirements vary by destination. For example:

– European Union: Must comply with REACH and construction product regulations (e.g., CE marking if used in building elements).

– United States: Subject to CBP entry procedures and potential Section 232 tariffs on aluminium imports.

– China: Requires CCC certification for certain end-use applications and adherence to GB standards.

Verify local requirements before shipment.

Recordkeeping and Traceability

Maintain traceability of black aluminium batches through production to delivery. Keep records of material certifications, test results, and compliance documentation for a minimum of five years to support audits or customs inquiries.

Sustainability and Recycling Compliance

Aluminium is highly recyclable, but black anodized or painted surfaces may affect recycling streams. Provide recycling guidelines to customers and comply with Extended Producer Responsibility (EPR) schemes where applicable (e.g., in EU member states).

Conclusion

Effective logistics and compliance management for black aluminium involves precise classification, protective handling, adherence to environmental standards, and proactive documentation. Partner with experienced freight forwarders and regulatory consultants to ensure smooth international trade operations and avoid penalties or shipment delays.

In conclusion, sourcing black aluminum requires careful consideration of both the material specifications and the finishing process to achieve the desired aesthetic and functional properties. Black aluminum can be obtained through various methods, such as anodizing with black dye, powder coating, or using pre-painted aluminum sheets, each offering different advantages in terms of durability, scratch resistance, and color consistency. When selecting a supplier, it is essential to evaluate their capability to maintain quality control, adhere to industry standards, and provide consistent finishes. Additionally, factors such as cost, lead times, sustainability, and compliance with environmental regulations should be taken into account. By establishing clear requirements and partnering with reliable suppliers experienced in aluminum processing and surface treatments, businesses can effectively source high-quality black aluminum suited for architectural, industrial, or consumer applications.