The global bindery equipment market is experiencing steady growth, driven by rising demand for high-quality printed materials, automation in print finishing, and increased efficiency requirements across commercial printing and publishing sectors. According to a 2023 report by Grand View Research, the global printing machinery market—encompassing bindery equipment—was valued at USD 21.8 billion and is expected to expand at a compound annual growth rate (CAGR) of 3.7% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of approximately 3.5% for the printing machinery market over the forecast period 2024–2029, citing technological advancements such as digital integration, smart manufacturing, and energy-efficient systems as key growth enablers. Within this evolving landscape, bindery equipment manufacturers are playing a critical role by introducing innovative solutions for cutting, folding, binding, and finishing that meet the throughput and precision demands of modern print environments. As the industry shifts toward modular, automated, and digitally connected workflows, the leading manufacturers are distinguishing themselves through reliability, R&D investment, and comprehensive service ecosystems. Here, we highlight the top nine bindery equipment manufacturers shaping the future of print finishing.

Top 9 Bindery Equipment Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Spiral Book Binding and Laminating Supply Store

Domain Est. 1995

Website: spiralbinding.com

Key Highlights: A curated collection of bindery, lamination, and office equipment and supplies for businesses of all kinds and sizes….

#2 Binding Machines

Domain Est. 1997

Website: gbc.com

Key Highlights: 1-day delivery 30-day returnsCreate professional-looking, custom presentations with minimal effort with GBC binding machines, punches, finishers, coil inserters and comb openers….

#3 LBS

Domain Est. 1997

Website: lbsbind.com

Key Highlights: LBS is a leading supplier of bookbinding and luxury packaging materials. Explore cover boards, endsheets, adhesives, premium cover materials, and more….

#4 Bindery Parts

Domain Est. 1998

Website: binderyparts.com

Key Highlights: Bindery Parts Incorporated provides many brands of New and Used Bindery Equipment, but we do not stop with just selling equipment. We also provide Technical ……

#5 IBIS Bindery Systems

Domain Est. 2000

Website: ibis-bindery.com

Key Highlights: The Smart-binder (SB) includes many innovative features such as the option for ISG cold-glue binding. It may be used in-line with the highest speed printers, or ……

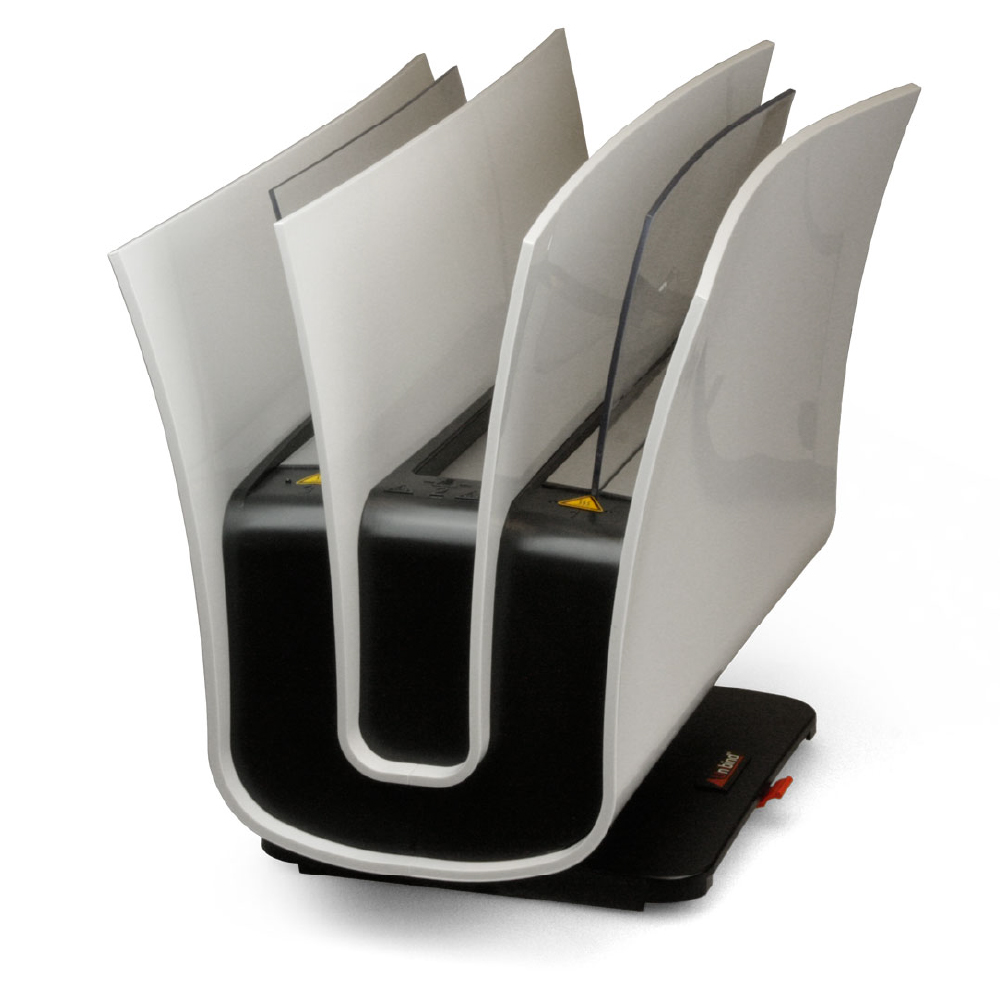

#6 Peleman Industries

Domain Est. 2000

Website: peleman.com

Key Highlights: Peleman is specialised in binding solutions, photo solutions and services. But we find it very important that we listen to different needs of different people….

#7 Coil Binding and Laminating Store, Binding Machines, Shredders …

Domain Est. 2002

#8 Bindery Tools, LLC

Domain Est. 2002

Website: binderytools.com

Key Highlights: We sell, New, Restored, Repair and manufacture hand operated bookbinding & Letterpress equipment/hand tools. Rebuilding consists of dissembling and ……

#9 Best Graphics

Domain Est. 1999

Website: bestgraphics.net

Key Highlights: Discover a wide range of new/used packaging, bindery, and finishing equipment at Best Graphics Group. Your trusted source for top-quality equipment….

Expert Sourcing Insights for Bindery Equipment

2026 Market Trends for Bindery Equipment

The bindery equipment market in 2026 is poised for significant transformation, driven by the convergence of technological innovation, evolving customer demands, and the ongoing adaptation of print service providers to a hybrid digital-physical landscape. Key trends shaping the industry include the acceleration of automation, heightened demand for personalization, integration with digital workflows, sustainability imperatives, and the rise of short-run, on-demand production.

Increasing Automation and Smart Manufacturing

By 2026, automation will be a cornerstone of competitive bindery operations. Equipment manufacturers are integrating AI-driven predictive maintenance, real-time job changeovers, and robotic assistance to minimize downtime and reduce labor dependency. Smart bindery systems that communicate with prepress and finishing workflows via Industry 4.0 protocols (such as OPC UA and JDF/JMF) will become standard, enabling end-to-end job tracking and greater operational efficiency. This shift not only improves throughput but also supports workforce challenges by allowing fewer operators to manage complex finishing lines.

Demand for Customization and Short-Run Flexibility

The growing need for personalized print—evident in marketing, education, and packaging—will drive demand for bindery equipment capable of handling variable data and short to medium runs profitably. In 2026, modular and reconfigurable bindery solutions will gain traction, allowing print shops to switch quickly between saddle stitching, perfect binding, and softcover case binding with minimal setup. Inline finishing integrated with digital presses will further enable cost-effective customization at scale.

Integration with Digital and Web-to-Print Platforms

Seamless integration between bindery equipment and digital front-ends (DFEs), MIS systems, and web-to-print portals will be critical. By 2026, bindery machines equipped with API connectivity will automatically receive job specifications, adjust settings, and report completion status without manual input. This end-to-end digital workflow reduces errors and accelerates turnaround times, meeting customer expectations for speed and accuracy.

Focus on Sustainability and Eco-Friendly Solutions

Environmental concerns will influence equipment design and material choices. In 2026, bindery manufacturers will emphasize energy-efficient drives, reduced solvent use in adhesives, and compatibility with eco-friendly substrates and glues. Equipment designed for easy recycling or reconditioning, along with features that minimize waste (e.g., precision trimming, optimized sheet utilization), will appeal to environmentally conscious businesses and B2B clients with green procurement policies.

Growth in Hybrid and Niche Applications

Beyond traditional commercial printing, bindery equipment will see increased use in emerging sectors such as photobooks, custom packaging prototypes, and educational kits. The rise of e-commerce fulfillment and direct-to-consumer publishing models will spur demand for compact, agile bindery systems suitable for in-house production. Additionally, niche technologies like PUR binding and soft-touch lamination will gain popularity for premium product finishes.

Regional Market Dynamics and Aftermarket Services

While North America and Western Europe lead in adopting advanced bindery automation, Asia-Pacific will experience strong growth due to expanding print-on-demand infrastructure and rising consumer demand. In 2026, equipment vendors will increasingly focus on service-led business models, offering predictive maintenance contracts, remote diagnostics, and equipment leasing to lower entry barriers and improve customer retention.

In conclusion, the 2026 bindery equipment market will be defined by intelligence, flexibility, and sustainability. Success will belong to manufacturers and integrators who deliver connected, user-friendly solutions that empower print providers to compete in an increasingly dynamic and personalized marketplace.

Common Pitfalls When Sourcing Bindery Equipment (Quality, IP)

Sourcing bindery equipment—whether new or used—requires careful due diligence to avoid costly mistakes. Two critical areas where buyers often encounter problems are quality inconsistencies and intellectual property (IP) risks. Overlooking these aspects can lead to operational disruptions, legal exposure, and reduced return on investment.

Quality-Related Pitfalls

-

Inadequate Inspection of Used Equipment

Many buyers focus on price when purchasing pre-owned bindery machines but skip thorough inspections. Hidden wear in critical components like grippers, feeders, or gear systems can lead to frequent breakdowns and high maintenance costs post-purchase. -

Lack of Standardized Quality Benchmarks

Without clear quality criteria (e.g., machine hours, maintenance logs, parts replaced), it’s difficult to objectively compare equipment from different suppliers. This increases the risk of acquiring underperforming or outdated machinery. -

Insufficient Testing Before Acceptance

Failing to conduct live demonstrations or performance tests under real production conditions can result in unexpected quality issues. Machines may appear functional but struggle with specific materials or binding techniques. -

Overlooking After-Sales Support and Spare Parts Availability

Even high-quality equipment can degrade quickly without access to timely technical support and genuine spare parts. Sourcing from suppliers with poor service networks can compromise long-term reliability.

Intellectual Property (IP) Pitfalls

-

Purchasing Counterfeit or Unauthorized Equipment

Some suppliers, especially in unregulated markets, offer equipment that infringes on patented designs or trademarks. Using such machinery can expose the buyer to legal liability, product seizures, or forced shutdowns. -

Use of Unlicensed Software or Control Systems

Modern bindery equipment often includes proprietary software for automation and calibration. Sourcing machines with pirated or unlicensed software not only violates IP laws but may also create cybersecurity vulnerabilities and prevent firmware updates. -

Lack of Documentation for IP Compliance

Buyers may fail to obtain proper documentation proving the equipment’s authenticity and legal origin. Without proof of licensed technology or authorized distribution, organizations risk enforcement actions from IP holders. -

Third-Party Modifications Infringing on Patents

Refurbished or modified machines may include aftermarket components that violate existing patents (e.g., upgraded feeding mechanisms or binding heads). The end user can be held liable even if unaware of the infringement.

To mitigate these risks, conduct thorough supplier vetting, request equipment history and IP documentation, involve legal and technical experts in the procurement process, and prioritize reputable manufacturers and certified resellers.

Logistics & Compliance Guide for Bindery Equipment

This guide outlines essential logistics and compliance considerations for the shipment, installation, and operation of bindery equipment such as binders, folders, cutters, stitchers, and perfect binders. Adhering to these guidelines ensures safe transportation, regulatory compliance, and smooth integration into your production environment.

Equipment Handling and Transportation

Bindery equipment is often heavy, large, and sensitive to shock and vibration. Proper handling during transport is critical to prevent damage.

- Crating and Packaging: Ensure equipment is shipped in manufacturer-approved, custom-fitted crates with adequate internal bracing and shock-absorbing materials.

- Lifting and Rigging: Use appropriate lifting equipment (e.g., forklifts, cranes, pallet jacks) with sufficient capacity. Follow OEM lifting points; never lift by control panels or delicate components.

- Site Access Assessment: Confirm door widths, ceiling heights, elevator capacities, and floor load ratings at the delivery location prior to shipment.

- Route Planning: Coordinate with freight carriers to avoid low bridges, narrow roads, or weight-restricted routes. Notify local authorities if oversized loads are involved.

Import and Export Compliance

International shipments of bindery equipment must comply with trade regulations and documentation requirements.

- Harmonized System (HS) Codes: Use accurate HS codes (e.g., 8441.40 for bookbinding machinery) for customs declarations to determine tariffs and eligibility for trade agreements.

- Export Controls: Verify if equipment contains controlled components (e.g., high-power motors, automation systems) that may require export licenses under regulations like the Export Administration Regulations (EAR).

- Documentation: Prepare commercial invoices, packing lists, bill of lading/air waybill, certificates of origin, and any required import permits.

- Duties and Taxes: Calculate and budget for applicable import duties, VAT, or GST based on destination country regulations.

Safety and Regulatory Standards

Bindery equipment must meet regional and international safety standards to protect operators and ensure legal operation.

- Electrical Compliance: Equipment must comply with local electrical codes (e.g., NEC in the U.S., IEC standards in Europe). Ensure voltage, phase, and frequency match site power supply.

- Machine Safety Standards: Comply with relevant safety directives such as:

- OSHA 29 CFR 1910 (U.S.)

- Machinery Directive 2006/42/EC (EU)

- CSA Z432 (Canada)

- Guarding and Emergency Stops: Verify that all moving parts are properly guarded and emergency stop functions are operational upon installation.

- Noise and Emissions: Assess noise levels and ventilation needs, especially for glue systems in perfect binders. Comply with OSHA noise standards or EU noise directives.

Installation and Environmental Requirements

Proper site preparation ensures optimal performance and longevity of bindery equipment.

- Foundation and Leveling: Install on a level, vibration-free surface. Heavy equipment may require a concrete foundation or anti-vibration pads.

- Power and Utilities: Provide stable electrical supply with proper grounding. Confirm requirements for compressed air, exhaust, or water cooling if applicable.

- Environmental Conditions: Maintain recommended temperature (typically 68–77°F / 20–25°C) and humidity (40–60% RH) to prevent paper curling and mechanical issues.

- Ventilation: Ensure adequate ventilation, particularly for equipment using adhesives or solvents, to meet indoor air quality standards.

Training and Operational Compliance

Operator training and documented procedures are essential for safe and compliant operation.

- Operator Training: Provide certified training on equipment use, safety protocols, lockout/tagout (LOTO), and emergency procedures.

- Maintenance Records: Maintain logs of inspections, servicing, and repairs per manufacturer recommendations and regulatory requirements.

- Compliance Audits: Conduct periodic safety and compliance audits to ensure adherence to internal policies and external regulations.

Disposal and End-of-Life Management

Proper end-of-life handling ensures environmental compliance and data security.

- Hazardous Materials: Identify and dispose of hazardous components (e.g., oils, adhesives, electronic boards) according to local environmental regulations (e.g., EPA, WEEE Directive).

- Recycling: Recycle metal, plastic, and electronic components through certified e-waste recyclers.

- Data Security: For equipment with digital controls or network connectivity, securely erase stored data before decommissioning.

Following this logistics and compliance guide helps ensure the safe, legal, and efficient lifecycle management of bindery equipment across global operations. Always consult equipment manuals and local regulatory authorities for location-specific requirements.

Conclusion:

Sourcing bindery equipment is a critical decision that directly impacts the efficiency, quality, and scalability of print finishing operations. After evaluating key factors such as production volume, required finishing capabilities, equipment reliability, automation features, aftermarket support, and total cost of ownership, it becomes evident that selecting the right bindery solutions requires a strategic and needs-based approach.

Investing in the appropriate bindery equipment not only enhances workflow integration and productivity but also ensures consistent, professional-quality output that meets customer expectations. Whether opting for in-line or offline systems, manual, semi-automatic, or fully automated machines, organizations must align their equipment choices with both current operational needs and future growth plans.

Furthermore, partnering with reputable suppliers who offer strong technical support, training, and service networks is essential to maximizing equipment uptime and longevity. As automation and digital workflows continue to evolve, integrating smart, adaptable bindery equipment positions businesses to remain competitive in an increasingly dynamic market.

In conclusion, a well-informed sourcing strategy—one grounded in thorough evaluation, future readiness, and long-term value—will yield significant returns in operational excellence and customer satisfaction within the print and finishing industry.