The global clean energy sector is experiencing unprecedented growth, driven by accelerating decarbonization goals, supportive government policies, and declining technology costs. According to a 2023 report by Mordor Intelligence, the global renewable energy market was valued at USD 1.2 trillion and is projected to expand at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2028. Meanwhile, Grand View Research estimates that the market could reach USD 2.2 trillion by 2030, fueled by rising investments in solar, wind, and energy storage solutions. As demand surges, a select group of manufacturers has emerged as industry leaders, scaling production, driving innovation, and shaping the future of sustainable energy infrastructure worldwide. These top 10 clean energy companies are not only at the forefront of technological advancement but also instrumental in enabling the global transition to a low-carbon economy.

Top 10 Biggest Clean Energy Companies Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

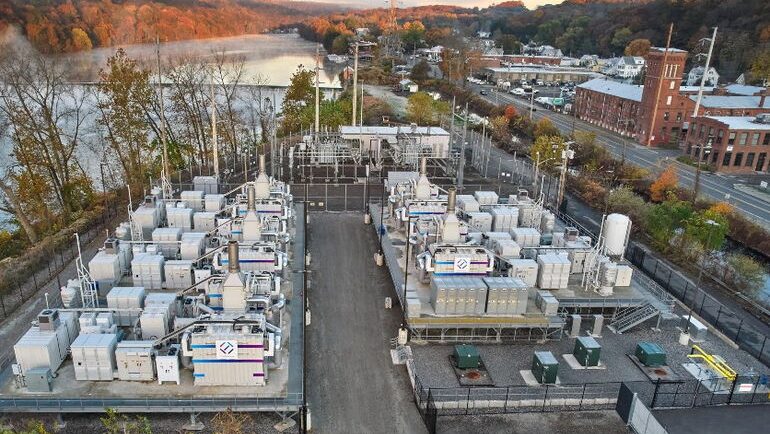

#1 FuelCell Energy

Domain Est. 1999

Website: fuelcellenergy.com

Key Highlights: FuelCell Energy is an American clean technology and manufacturing company providing large-scale, always-on, power solutions and emissions management….

#2 Constellation Energy

Domain Est. 1999

Website: constellationenergy.com

Key Highlights: Constellation is nation’s largest producer of clean and reliable energy and provides energy solutions to homes, businesses and public-sector customers….

#3 AES

Domain Est. 1993

Website: aes.com

Key Highlights: AES is the largest global supplier of clean energy to corporations. Discover our suite of tailored carbon-free solutions delivering competitive energy at scale….

#4 10 Biggest Renewable Energy Companies in the World

Domain Est. 1999

Website: investopedia.com

Key Highlights: Large renewable energy companies are headquartered in Spain, Denmark, China, the United States, and Canada. These are the 10 biggest renewable energy companies….

#5 Ameresco

Domain Est. 2000

Website: ameresco.com

Key Highlights: Ameresco is a renewable energy and energy efficiency company offering ESPC-funded energy solutions for public and private organizations….

#6 Ørsted

Domain Est. 2004

Website: us.orsted.com

Key Highlights: Ørsted is a leading clean energy company that develops, constructs, and operates renewable projects, including wind, solar, and battery storage….

#7 NextEra Energy

Domain Est. 2007

Website: nexteraenergy.com

Key Highlights: Discover how NextEra Energy is leading America’s energy evolution using an all forms of energy strategy to keep prices low for customers….

#8 Apex Clean Energy

Domain Est. 2010

Website: apexcleanenergy.com

Key Highlights: Expanding clean energy across North America through utility-scale wind, solar, and storage, distributed energy resources, and green fuels….

#9 Atlas Renewable Energy

Domain Est. 2016

Website: atlasrenewableenergy.com

Key Highlights: Our team is formed by industry experts and innovators who strive for excellence to take your company’s clean energy goals from concept to reality….

#10 Clearway Energy

Domain Est. 2018

Website: clearwayenergygroup.com

Key Highlights: We’re a leading independent clean power developer and operator with over 350 clean energy projects across America….

Expert Sourcing Insights for Biggest Clean Energy Companies

H2: 2026 Market Trends for the Biggest Clean Energy Companies

As the global push toward decarbonization accelerates, the clean energy sector is poised for transformative growth by 2026. The world’s largest clean energy companies—including NextEra Energy, Ørsted, Enel, Iberdrola, and Brookfield Renewable—are expected to play a central role in shaping the future energy landscape. Several key market trends are anticipated to influence their strategies, investments, and market positioning in 2026.

-

Accelerated Renewable Deployment

By 2026, solar and wind energy capacity is projected to expand significantly, driven by declining technology costs and supportive government policies. The biggest clean energy firms are expected to dominate utility-scale solar and offshore wind development, particularly in North America, Europe, and parts of Asia-Pacific. For instance, NextEra Energy will likely maintain its leadership in U.S. solar installations, while Ørsted continues to expand its offshore wind footprint across the U.S. and Taiwan. -

Grid Modernization and Energy Storage Integration

As intermittent renewable sources grow, integrating battery storage and modernizing grid infrastructure will be critical. Major companies are investing heavily in battery energy storage systems (BESS) and smart grid technologies. Iberdrola and Enel are expected to lead in hybrid projects combining renewables with storage, enhancing grid stability and energy dispatchability. -

Green Hydrogen and Electrification Initiatives

The commercialization of green hydrogen—produced using renewable electricity—is gaining momentum. By 2026, large clean energy players are likely to launch or scale pilot projects in collaboration with industrial partners. Ørsted and Enel are already exploring hydrogen production in Europe and Latin America, aiming to decarbonize hard-to-abate sectors like heavy industry and transportation. -

Regulatory and Policy Tailwinds

Global commitments under the Paris Agreement and national net-zero targets (e.g., U.S. Inflation Reduction Act, EU Green Deal) will continue to provide financial incentives and regulatory support. These policies are expected to boost project pipelines and attract private capital, benefiting established clean energy firms with proven development capabilities. -

Consolidation and Strategic Partnerships

Market consolidation is likely to increase as companies seek scale and diversification. Brookfield Renewable and other institutional investors may acquire smaller developers to expand geographic reach. Strategic alliances with technology firms and utilities will also grow, particularly in digital energy management and distributed energy resources. -

Focus on ESG and Sustainable Financing

Environmental, Social, and Governance (ESG) performance will remain a key differentiator. The largest clean energy companies are expected to leverage their strong ESG profiles to access green bonds and sustainability-linked loans, further lowering their cost of capital. -

Emerging Market Expansion

While developed markets remain core, growth in emerging economies—especially in Latin America, Southeast Asia, and Africa—will attract investment. Enel and Iberdrola are likely to expand their renewable portfolios in these regions, supported by improving regulatory frameworks and rising energy demand.

In conclusion, by 2026, the biggest clean energy companies will be at the forefront of a rapidly evolving energy transition. Their ability to scale renewable deployment, integrate new technologies, and navigate complex regulatory environments will determine leadership in the global clean energy economy.

Common Pitfalls When Sourcing from the Biggest Clean Energy Companies (Quality, IP)

When engaging with major clean energy firms—whether as a supplier, partner, or customer—organizations must navigate several critical risks related to quality assurance and intellectual property (IP) protection. Despite their reputations, even the largest players present unique challenges that, if overlooked, can lead to costly setbacks. Below are key pitfalls to avoid:

Overlooking Supply Chain Quality Variability

Even top-tier clean energy companies often rely on global, multi-tiered supply chains. Assumptions about consistent quality across all components or subcontractors can be misleading. Lower-tier suppliers may cut corners to meet aggressive cost or delivery targets, resulting in substandard materials or manufacturing defects—particularly in solar panels, battery cells, or turbine parts. Without rigorous incoming inspection protocols and supplier audits, these inconsistencies can compromise system performance and safety.

Inadequate Due Diligence on Intellectual Property Ownership

Collaborating with large clean energy firms on joint development or custom solutions can blur IP ownership lines. A common pitfall is assuming that pre-existing IP remains solely with the original creator, or that jointly developed IP will be equitably shared. Without clear contractual terms defining IP rights, background IP, and future innovations, organizations risk losing control over proprietary technology or facing infringement claims. This is especially critical in R&D-heavy areas like advanced battery chemistry or next-gen wind turbine design.

Misaligned Quality Standards and Certification Requirements

Global clean energy companies often operate across multiple regulatory environments, each with distinct quality certifications (e.g., IEC, UL, ISO). Suppliers may assume compliance with one standard ensures acceptance everywhere. However, failing to validate region-specific requirements or maintain up-to-date certifications can result in rejected shipments, project delays, or costly rework. Additionally, quality management systems (e.g., ISO 9001) may not be uniformly enforced across all divisions or geographies within a large firm.

Insufficient Protection in Licensing and Technology Transfer Agreements

When licensing technology to or from a major clean energy player, organizations may accept boilerplate agreements that heavily favor the larger party. Pitfalls include overly broad field-of-use restrictions, inadequate confidentiality clauses, or automatic IP assignment upon collaboration. Without legal expertise focused on energy technology, smaller entities may unknowingly surrender valuable rights or expose trade secrets during due diligence or pilot projects.

Neglecting Post-Sale Quality and Warranty Enforcement

Even with strong initial quality controls, performance issues may emerge during installation or operation. Relying solely on a big company’s brand reputation can lead to complacency in documenting defects or enforcing warranty claims. Delays in response, shifting responsibility across departments, or complex claims processes can undermine project ROI. Clear service-level agreements (SLAs) and defined escalation paths are essential to ensure accountability.

By proactively addressing these quality and IP-related pitfalls—through detailed contracts, ongoing audits, and specialized legal oversight—businesses can better safeguard their interests while leveraging the scale and innovation of leading clean energy companies.

Logistics & Compliance Guide for the Biggest Clean Energy Companies

Supply Chain Management and Procurement

Large clean energy companies must establish resilient, transparent supply chains to support the global scale of renewable projects. This includes securing reliable sources for critical materials such as lithium, cobalt, rare earth elements, and high-efficiency solar-grade silicon. Companies should implement supplier vetting processes that evaluate environmental practices, labor standards, and geopolitical risks. Utilizing blockchain or other traceability technologies can enhance supply chain transparency and ensure responsible sourcing in compliance with international standards like the OECD Due Diligence Guidance.

Transportation of Renewable Components

The logistics of transporting large-scale renewable energy components—such as wind turbine blades, solar panels, and battery storage units—require specialized planning. Oversized cargo transport must comply with national and international road, rail, and maritime regulations. Coordination with port authorities, customs agencies, and freight partners is essential to avoid delays. Companies should invest in route optimization tools and engage certified carriers experienced in handling delicate or hazardous renewable components, particularly lithium-ion batteries, which are subject to IATA and IMDG regulations.

International Trade Compliance

Clean energy firms operating across borders must adhere to export controls, sanctions, and trade agreements. Components like advanced inverters, energy storage systems, and dual-use technologies may be subject to restrictions under regulations such as the U.S. Export Administration Regulations (EAR) or EU Dual-Use Regulation. Maintaining an internal compliance program with designated trade compliance officers, regular audits, and up-to-date classification of goods ensures adherence to customs requirements and prevents penalties.

Environmental, Health, and Safety (EHS) Regulations

All logistics operations must align with EHS standards, including OSHA (U.S.), REACH and CLP (EU), and local environmental codes. This includes safe handling of hazardous materials during transport and storage, proper waste management at project sites, and minimizing carbon emissions from logistics fleets. Implementing ISO 14001 and ISO 45001 frameworks helps standardize EHS practices across global operations and demonstrates commitment to sustainable logistics.

Customs Clearance and Import/Export Documentation

Accurate and timely preparation of shipping documentation—including commercial invoices, packing lists, certificates of origin, and customs declarations—is crucial. Clean energy companies benefit from utilizing Authorized Economic Operator (AEO) status where available, which can expedite customs processing. Staying informed about tariff classifications and potential duty exemptions for green technologies (e.g., under the WTO Environmental Goods Agreement discussions) helps reduce costs and improve supply chain efficiency.

Regulatory Compliance for Energy Storage and Batteries

Given the rapid growth in battery storage deployment, logistics operations must comply with strict regulations for the transport of lithium-ion batteries. This includes adhering to UN 38.3 testing requirements, proper packaging, labeling (e.g., Class 9 hazard labels), and documentation in line with IATA Dangerous Goods Regulations (air) and IMDG Code (maritime). Companies should train logistics personnel in hazardous materials handling and maintain up-to-date safety data sheets (SDS).

Project Site Logistics and Local Permitting

On-site logistics for wind, solar, and storage installations require coordination with local authorities to secure necessary permits for road closures, heavy vehicle access, and temporary storage. Compliance with local zoning laws, environmental impact assessments (EIAs), and indigenous land rights is essential. Developing community engagement plans and adhering to local labor and contracting regulations further ensures smooth project execution.

Cybersecurity and Data Compliance in Logistics Systems

As logistics operations become increasingly digitized—relying on GPS tracking, IoT sensors, and cloud-based platforms—companies must safeguard data integrity and ensure compliance with data protection laws such as GDPR and CCPA. Securing communication channels and implementing cybersecurity protocols across the supply chain protects against disruptions and preserves stakeholder trust.

Sustainability and Carbon Footprint Reporting

Leading clean energy firms are expected to lead by example in reducing the carbon footprint of their logistics operations. This includes measuring Scope 3 emissions (indirect emissions from transportation and distribution), adopting low-emission fleets, and reporting progress through frameworks like the GHG Protocol and CDP. Transparent sustainability reporting enhances corporate responsibility and meets investor and regulatory expectations.

Audit, Monitoring, and Continuous Improvement

Establishing a regular audit schedule for logistics and compliance processes helps identify risks and areas for improvement. Key performance indicators (KPIs) such as on-time delivery rates, customs clearance times, and safety incident reports should be tracked. Leveraging third-party audits and certifications (e.g., ISO 39001 for road traffic safety) reinforces a culture of continuous improvement and regulatory adherence.

In conclusion, sourcing from the biggest clean energy companies offers significant advantages in terms of reliability, innovation, and scalability in the transition to a sustainable future. These industry leaders—such as NextEra Energy, Ørsted, Enel, Iberdrola, and Siemens Gamesa—are not only at the forefront of renewable energy generation and technology but also demonstrate strong commitments to environmental, social, and governance (ESG) principles. By partnering with or investing in these companies, businesses and governments can ensure access to cutting-edge solutions, stable energy supplies, and support in meeting climate goals. Ultimately, leveraging the expertise and infrastructure of top clean energy providers is a strategic step toward reducing carbon emissions, enhancing energy security, and driving long-term economic and environmental resilience.