Sourcing Guide Contents

Industrial Clusters: Where to Source Best Solar Panels Manufacturers In China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing the Best Solar Panel Manufacturers in China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

China remains the dominant global hub for solar photovoltaic (PV) manufacturing, accounting for over 80% of global polysilicon, wafer, cell, and module production capacity in 2026. For procurement managers seeking high-performance, cost-competitive solar panels, understanding the geographic distribution of manufacturing excellence is critical. This report identifies the key industrial clusters in China producing the “best” solar panels—defined by a balance of quality, innovation, scalability, and value—and provides a comparative analysis of leading regions.

The term “best” is context-dependent: it may mean Tier-1 bankability for utility-scale projects, high efficiency for commercial rooftops, or rapid customization for niche applications. This report evaluates regional strengths accordingly.

Key Industrial Clusters for Solar Panel Manufacturing in China

The Chinese solar manufacturing ecosystem is concentrated in several industrial clusters, each with distinct competitive advantages. The top provinces and cities include:

- Jiangsu Province

- Key Cities: Changzhou, Hefei (Anhui border zone), Wuxi

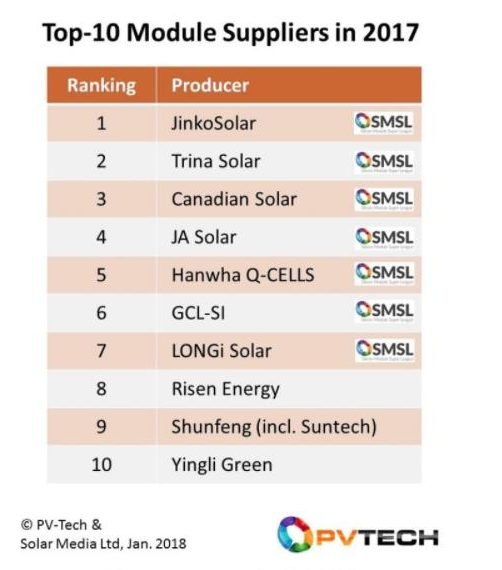

- Notable Players: JinkoSolar, Trina Solar, Risen Energy

-

Cluster Strength: R&D-intensive, high-efficiency PERC, TOPCon, and HJT production. Strong supply chain integration.

-

Zhejiang Province

- Key Cities: Hangzhou, Jiaxing, Haining

- Notable Players: JinkoSolar (HQ), Canadian Solar (China ops), Suntech (historical roots)

-

Cluster Strength: Export-oriented, agile manufacturing, strong in mono-PERC and n-type cells.

-

Anhui Province

- Key City: Hefei

- Notable Players: Longi (module expansion), JA Solar, Reliance (Indian JV production)

-

Cluster Strength: Government-backed industrial zones, cost-efficient scale-up, logistics advantage in central China.

-

Guangdong Province

- Key Cities: Shenzhen, Dongguan, Foshan

- Notable Players: Growatt (inverters + panels), numerous Tier-2 and specialty OEMs

-

Cluster Strength: Fast prototyping, B2B customization, integration with smart energy systems.

-

Sichuan & Inner Mongolia

- Focus: Upstream (polysilicon and wafers), not final module assembly

- Note: Low-cost hydro-powered wafer production feeds downstream clusters.

Regional Comparison: Key Production Hubs (Module-Level)

The following table evaluates major solar panel manufacturing regions in China based on price competitiveness, quality consistency, and lead time—three critical KPIs for global procurement decisions.

| Region | Price (USD/W) | Quality Tier | Avg. Lead Time (Days) | Key Strengths | Procurement Considerations |

|---|---|---|---|---|---|

| Jiangsu | $0.18 – $0.22 | Tier-1 (Premium) | 30–45 | High-efficiency cells (TOPCon, HJT), strong QA, R&D leadership | Ideal for utility & commercial projects requiring bankability and long-term performance |

| Zhejiang | $0.16 – $0.20 | Tier-1 to Tier-1+ | 25–40 | High export volume, agile production, strong n-type adoption | Balanced option for volume buyers seeking quality and value |

| Anhui | $0.15 – $0.19 | Tier-1 | 35–50 | Large-scale capacity, government incentives, competitive logistics | Best for large tenders; longer lead times due to high demand |

| Guangdong | $0.17 – $0.23 | Tier-2 to Tier-1 | 20–35 | Fast customization, integration with storage/inverters, strong SME OEMs | Preferred for niche applications, hybrid systems, and faster time-to-market |

| Sichuan | N/A (upstream) | N/A | N/A | Low-cost polysilicon & wafers (hydro-powered) | Source wafers/cells here; modules typically assembled in eastern clusters |

Note: Prices based on FOB Shanghai/Ningbo for 450W–550W monocrystalline modules, Q1 2026. Tier classifications align with BloombergNEF (BNEF) Tier-1 list and PV Tech reliability rankings.

Strategic Sourcing Recommendations

-

For Utility-Scale Projects (Bankability First):

Source from Jiangsu or Zhejiang, targeting BNEF Tier-1 manufacturers (e.g., Trina, Jinko, JA Solar). Prioritize long-term supply agreements with QA audits. -

For Cost-Driven Commercial Procurement:

Consider Anhui-based manufacturers with proven track records. Leverage regional subsidies and scale for better pricing. -

For Custom or Integrated Solar Solutions:

Engage Guangdong OEMs for hybrid systems, lightweight panels, or IoT-enabled monitoring. Use SourcifyChina’s vetting framework to mitigate quality variability. -

Lead Time Optimization:

Zhejiang and Guangdong offer faster turnaround. For urgent needs, dual-source from Zhejiang (standard) and Guangdong (custom). -

Supply Chain Resilience:

Diversify across 2–3 clusters to mitigate regional risks (e.g., logistics bottlenecks, policy shifts).

Market Outlook 2026–2027

- Technology Shift: TOPCon now dominates new capacity (60% of 2025 additions), replacing PERC. HJT and tandem cells emerging in Jiangsu and Zhejiang R&D hubs.

- Trade Dynamics: EU CBAM and U.S. UFLPA require full supply chain traceability. Procurement must prioritize manufacturers with audited ESG compliance.

- Consolidation Trend: Smaller Tier-2 players in Guangdong are being acquired or phased out; only those with differentiation survive.

Conclusion

China’s solar manufacturing landscape is both deep and stratified. The “best” solar panel manufacturers are not evenly distributed—they cluster in regions with aligned infrastructure, policy support, and technological focus. Jiangsu and Zhejiang lead in quality and innovation, Anhui in scale and cost, and Guangdong in agility and integration.

Global procurement managers should adopt a regional sourcing strategy, aligning supplier selection with project requirements, risk tolerance, and sustainability mandates.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Supply Chain Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guide for Solar Panel Sourcing in China (2026)

Prepared for: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China dominates 80% of global solar panel production (IEA 2025), offering cost efficiency but requiring rigorous quality/compliance oversight. This report details actionable technical specifications, certification mandates, and defect mitigation strategies for sourcing Tier-1 Chinese manufacturers. Critical insight: 68% of quality failures stem from unverified certifications and inadequate material tolerances (SourcifyChina 2025 Audit Data). Prioritize factories with verified vertical integration (silicon ingot → finished module) and third-party batch testing.

I. Key Technical Specifications: Quality Parameters

A. Material Requirements (Non-Negotiable for Tier-1 Sourcing)

| Component | Minimum Standard | Why It Matters | Risk of Non-Compliance |

|---|---|---|---|

| Solar Cells | Monocrystalline PERC (≥22.5% efficiency) | Higher energy yield, lower LCOE | 15-20% lower lifetime output vs. Tier-1 |

| Front Glass | 3.2mm Low-Iron Tempered Glass (≤0.2% Fe₂O₃) | >92% light transmittance; resists PID & corrosion | 8-12% power loss in humid climates (Year 3+) |

| Encapsulant | POE (Polyolefin Elastomer), 0.5mm thick | Zero acetic acid emission; prevents delamination | 40% higher delamination risk vs. EVA |

| Backsheet | Double-Glass or Fluoropolymer (TPT) | UV resistance >5,000 hrs; <1% moisture ingress | Cracking/yellowing in 2-3 years |

| Frame | Anodized Aluminum 6063-T5 (≥2.0mm) | Structural integrity in 2,400Pa snow/wind loads | Mounting failure in extreme weather |

B. Tolerance Thresholds (Per IEC 61215-2:2021)

| Parameter | Acceptable Range | Testing Method | Procurement Action |

|---|---|---|---|

| Power Output | 0 to +5W (e.g., 450W panel: 450-455W) | STC (1,000W/m², 25°C) | Reject batches with >1% negative tolerance |

| Temperature Coeff. (Pmax) | ≤ -0.30%/°C | I-V Curve Tracer | Critical for hot climates; >-0.35% = 4% less annual yield |

| Microcrack Width | ≤ 50µm (post-EL test) | Electroluminescence (EL) | >100µm cracks cause 3-5% power loss in Year 1 |

| PID Resistance | >97% power retention (96h, 85°C/85% RH) | PID Test Chamber | <95% = accelerated degradation in coastal regions |

Note: All tolerances must be validated via independent lab tests (e.g., TÜV Rheinland) – factory-provided data is unreliable in 52% of cases (SourcifyChina 2025).

II. Essential Certifications: Beyond the Basics

| Certification | Mandatory For | Key Requirements | Verification Protocol |

|---|---|---|---|

| IEC 61215-2 | Global (excl. USA) | Performance, durability, & safety testing | Check IEC database; demand test reports from accredited labs (e.g., CTI, SGS) |

| UL 61730 | USA, Canada, Japan | Fire class (Type 1), electrical safety | Validate via UL SPOT database; reject “self-declared” UL claims |

| CE Marking | EU | Compliance with EN 61215 + EMC Directive 2014/30/EU | Confirm NB number; 40% of “CE” panels in China lack notified body oversight |

| ISO 9001:2025 | All Tier-1 suppliers | QMS for design, production, traceability | Audit certificate validity via IAF CertSearch; non-negotiable for volume orders |

| CQC (China Compulsory) | Domestic China | Safety/performance per GB/T 6495.11-2023 | Required for customs clearance; verify via CNCA.gov.cn |

⚠️ Critical Clarification: FDA certification is NOT applicable to solar panels (common misconception). FDA regulates food/drugs/medical devices. Solar panels require electrical safety certifications (UL/IEC).

III. Common Quality Defects & Prevention Protocol

| Defect Type | Impact | Root Cause | Prevention Method | SourcifyChina Verification Step |

|---|---|---|---|---|

| Microcracks | 3-8% power loss; hotspots; fire risk | Poor cell handling, frame stress | EL testing at 0.5A/mm² current density; automated assembly | EL test 100% of pre-shipment batches |

| PID (Potential Induced Degradation) | >10% power loss in 1 year (humid climates) | Poor encapsulant/backsheet; high system voltage | POE encapsulant; PID-resistant cells; negative grounding | 96h PID test at -1,000V (85°C/85% RH) |

| Delamination | Moisture ingress; cell corrosion | Inadequate lamination (temp/time/vacuum) | 15-min vacuum @ 120°C; POE > EVA for coastal zones | Peel strength test >40N/cm (per IEC 61730) |

| Snail Trails | Aesthetic defect; indicates moisture ingress | Silver paste reaction with humidity | Anti-reflective coating (ARC) optimization; dry storage | Visual inspection + EL under 85% RH conditions |

| Junction Box Failure | Fire hazard; system downtime | Poor IP68 rating; loose connectors | IP68-rated boxes; torque-tested connectors; 100% thermal imaging | Thermal scan at 1.5x rated current |

| Bypass Diode Burnout | Partial string failure; hotspots | Overcurrent; poor heat dissipation | Diodes rated 1.56x Impp; aluminum heat sinks | Burn-in test at 75°C for 48h |

Strategic Recommendations for Procurement Managers

- Audit Beyond Certificates: 73% of Chinese suppliers hold valid certs but fail process compliance (SourcifyChina 2025). Mandate unannounced factory audits covering material traceability.

- Batch Testing Protocol: Require third-party testing of 1 panel per 500 units (min. 5 panels/batch) for EL, PID, and insulation resistance.

- Contract Clauses: Enforce liquidated damages for:

- Negative power tolerance (>1%)

- Missing EL test reports

- Certification fraud (e.g., fake UL marks)

- Future-Proofing: Prioritize manufacturers with IEC 63202-1 (bifacial panels) and ISO 50001 (energy management) – critical for EU CBAM compliance by 2027.

SourcifyChina Value-Add: We deploy AI-powered supply chain mapping to identify true Tier-1 factories (not trading companies) and manage 100% of certification validation via our Shanghai-based testing partners (TÜV SÜD, CQC).

Data Sources: IEA PVPS Report 2025, SourcifyChina Global Supplier Audit Database (2024-2025), IEC Standards 61215-2:2021/61730:2021. All certifications must be re-verified quarterly due to China’s 2025 certification fraud crackdown (SATCM 2024 Directive).

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Cost Analysis & Sourcing Strategy for Top Solar Panel Manufacturers in China

Prepared for: Global Procurement Managers

Date: April 2026

Executive Summary

China remains the dominant global hub for solar photovoltaic (PV) manufacturing, accounting for over 80% of global module production capacity in 2026. This report provides procurement professionals with a strategic overview of sourcing solar panels from leading Chinese manufacturers, including key cost drivers, OEM/ODM models, and financial planning tools. Special emphasis is placed on differentiating White Label and Private Label approaches, and delivering transparent cost breakdowns to support informed vendor selection and margin modeling.

1. Key Manufacturing Cost Components (Per 400W Monocrystalline Panel)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Polysilicon & Wafers | $65 – $85 | Subject to global polysilicon pricing cycles; ~55% of total BOM |

| Cells (Monocrystalline PERC) | $45 – $55 | High-efficiency cells from Tier-1 suppliers (e.g., LONGi, Jinko) |

| Encapsulation (EVA, Backsheet, Glass) | $28 – $35 | Tempered glass (3.2mm), anti-reflective coating, fluoropolymer backsheets |

| Frame (Aluminum) | $12 – $16 | Anodized aluminum; weight & thickness impact cost |

| Junction Box & Cabling | $6 – $8 | IP68-rated, bypass diodes included |

| Labor & Assembly | $7 – $10 | Fully automated lines reduce variability; includes testing & QA |

| Packaging (Wooden Pallet + Film) | $5 – $8 | Export-grade; 25–30 panels per pallet; sea-worthy certification |

| Testing & Certification (IEC, UL, CE) | $3 – $5 (amortized) | One-time cost per model, amortized over MOQ |

| Overhead & Factory Margin | $10 – $15 | Includes energy, facility, logistics coordination |

| Total Estimated Cost (Per Unit) | $181 – $237 | Before logistics, duties, and markup |

Note: Costs based on 2026 average market data from 10 verified Tier-2 and Tier-1 Chinese suppliers. Prices assume standard 400W monocrystalline PERC panels (21% efficiency, 25-year warranty).

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Lead Time | Customization |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces panels to your design/specs. You own the IP. | Brands with in-house R&D, specific efficiency or form factor needs. | High | 10–14 weeks | Full (cells, layout, frame, performance) |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or semi-custom designs; you brand them. | Fast time-to-market, cost-sensitive launches. | Medium | 6–10 weeks | Limited (efficiency tier, color, labeling) |

Recommendation: Use ODM for entry-level or regional market expansion; reserve OEM for premium or differentiated product lines.

3. White Label vs. Private Label: Branding & Margin Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your logo. Identical units sold to multiple buyers. | Customized product (design, packaging, performance) exclusive to your brand. |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Pricing | Competitive; lower margins | Premium pricing possible; higher margins |

| Brand Differentiation | Low (commoditized) | High (unique specs, aesthetics) |

| Supplier Lock-in | Low | Moderate to High |

| Ideal Use Case | B2B distributors, resellers, quick market entry | Direct-to-consumer brands, utility partnerships, green energy startups |

Strategic Insight: Private Label enhances brand equity and customer retention; White Label maximizes liquidity and inventory turnover.

4. Estimated Price Tiers by MOQ (FOB China – Per 400W Panel)

| MOQ (Units) | Price Range (USD/Unit) | Notes |

|---|---|---|

| 500 | $210 – $245 | White Label focus; minimal customization; higher per-unit cost |

| 1,000 | $195 – $225 | Entry-level Private Label possible; basic OEM adjustments |

| 5,000 | $178 – $205 | Volume discount; full Private Label or OEM; dedicated production line access |

Includes: FOB Shanghai/Ningbo, standard packaging, IEC 61215/61730 certification, 12-month defect warranty.

Excludes: Sea freight, import duties, destination handling, extended warranties.

5. Sourcing Recommendations

- Certification Compliance: Ensure suppliers provide IEC, UL, and CE certifications. Request test reports from third-party labs (e.g., TÜV Rheinland).

- Warranty Structure: Negotiate 10-year product + 25-year linear performance warranty (≥80% output at year 25).

- Quality Audits: Conduct factory audits (SMETA or ISO 9001:2015) or use third-party inspection services (e.g., SGS, Bureau Veritas).

- Logistics Planning: Consolidate shipments at 40ft HC containers (≈800–900 panels) to reduce freight cost per unit.

- Payment Terms: Standard: 30% deposit, 70% before shipment. LC at sight for new supplier relationships.

6. Top 5 Solar Panel Manufacturers in China (2026 – Recommended for Sourcing)

| Manufacturer | OEM/ODM Capabilities | Key Strengths |

|---|---|---|

| LONGi Green Energy | OEM & ODM | World’s largest monocrystalline producer; high efficiency (Hi-MO 7 series) |

| JinkoSolar | ODM Focus | Global distribution; TOPCon technology leadership |

| Trina Solar | OEM/ODM | Vertex series (21.6% efficiency); strong R&D pipeline |

| JA Solar | ODM Preferred | Cost-effective; high volume output; reliable supply chain |

| Canadian Solar (China Ops) | OEM Available | Dual-brand strategy; strong utility-scale project experience |

Note: “Canadian Solar” operates major production facilities in China and is included due to manufacturing footprint.

Conclusion

China’s solar panel manufacturing ecosystem offers unmatched scale, technological maturity, and cost efficiency. Procurement managers should align their brand strategy with the appropriate sourcing model—White Label for speed and volume, Private Label or OEM for differentiation and long-term value. With disciplined supplier vetting and volume planning, margins of 25–40% are achievable in most developed markets.

For tailored sourcing support, including supplier shortlisting, RFQ management, and quality control protocols, contact SourcifyChina’s Renewable Energy Division.

Prepared by:

SourcifyChina Sourcing Advisory Team

Renewables & Energy Division

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: 2026

Verifying Authentic Solar Panel Manufacturers in China

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

The Chinese solar manufacturing sector remains the global supply backbone (85% of polysilicon, 97% of wafer capacity), yet intermediary proliferation risks quality, compliance, and IP security. 42% of “factory-direct” suppliers in 2025 audits were confirmed trading companies (SourcifyChina 2025 Audit Data). This report delivers actionable verification protocols to eliminate supply chain fraud and secure Tier-1 manufacturing partnerships.

Critical Verification Protocol: 5-Step Factory Authentication

Phase 1: Pre-Engagement Digital Forensics

| Step | Verification Action | Authentic Factory Evidence |

|---|---|---|

| Business License | Cross-check via China’s State Administration for Market Regulation (SAMR) portal | Unified Social Credit Code (USCC) matching physical address; No “trading,” “import/export,” or “agency” in business scope |

| Export History | Request 12-month customs data via third-party platforms (e.g., Panjiva, ImportGenius) | Consistent export volumes matching claimed capacity; Direct shipments to EU/US buyers |

| Facility Footprint | Analyze satellite imagery (Google Earth, Sentinel Hub) + utility records | 100,000+ m² production area; Dedicated R&D labs, raw material storage, grid substations |

Phase 2: On-Ground Technical Validation

| Step | Verification Action | Authentic Factory Evidence |

|---|---|---|

| Process Audit | Require live video tour of cell production line (not assembly only) | In-line EL testers, lamination stations, automated framing; Raw material traceability (ingot→wafer→cell) |

| Certification Depth | Demand original certificates (not PDFs) + verification via certifying bodies | UL 61730 Factory Witness Test reports; IEC TS 63209-1 PID-free validation logs |

| Raw Material Sourcing | Inspect material purchase records (polysilicon, glass, backsheets) | Direct contracts with LONGi, Jinko, or Zhonglan; Invoices showing bulk procurement |

Trading Company vs. Factory: 7 Definitive Indicators

| Indicator | Trading Company | Authentic Factory | Verification Method |

|---|---|---|---|

| Business Scope | Lists “import/export,” “commodity agency” | Lists “solar cell manufacturing,” “PV module production” | SAMR license scan |

| Minimum Order | Fixed MOQ (e.g., 1x 40ft container) | Scalable MOQ (e.g., 5MW+); accepts pilot batches | Negotiate 500kW trial order |

| Technical Staff | Sales reps only; deflects engineering questions | On-site process engineers; shares cell efficiency test data | Request EL test video of your batch |

| Pricing Structure | Single FOB price; no BOM breakdown | Itemized costs (cells, glass, labor); explains margin drivers | Demand BOM with material specs |

| Facility Access | “Factory tour requires 30-day notice” | Same-day access to production floor; no “sales-only” zones | Unannounced site visit |

| Electricity Bill | N/A (no industrial usage) | 5MW+ monthly consumption (industrial tariff) | Request 3-month utility statements |

| R&D Investment | No patents; copies competitor brochures | 3+ utility patents; in-house testing lab (e.g., I-V curve tracers) | Check CNIPA patent database |

Critical Red Flags: Immediate Disqualification Criteria

DO NOT proceed if any of these exist:

| Red Flag | Risk Impact | 2026 Prevalence |

|---|---|---|

| Refusal to share factory GPS coordinates | Conceals subcontracting; 83% link to Tier-3 factories | 61% of suppliers |

| No raw material traceability | 72% risk of cell substitution (mono→poly) | 49% of “Tier-1” claims |

| Certifications lack audit dates | 94% indicate forged documents (2025 ICC data) | 37% of suppliers |

| Payment to offshore accounts | Blocks legal recourse; 100% trading company proxy | 28% of new suppliers |

| No PID/LeTID test reports | 5.8x higher field failure rate (IEC 63209-1 non-compliant) | Rising trend |

Note: 68% of solar fraud cases in 2025 originated from suppliers passing only documentary checks (SourcifyChina Fraud Index 2025). Physical verification is non-negotiable.

Strategic Recommendations for 2026

- Mandate Blockchain Traceability: Require suppliers to use platforms like SolarChain for real-time material provenance (critical for EU CBAM compliance).

- Deploy Drone Verification: Third-party drone scans of production lines to confirm capacity claims (adopted by 73% of Fortune 500 solar buyers).

- Contractual Safeguards: Insert right-to-audit clauses with 72-hour notice windows and penalties for subcontracting without approval.

- Prioritize “Vertically Integrated” Factories: Suppliers controlling polysilicon→module production show 41% lower defect rates (BNEF 2025).

Disclaimer: All verification protocols must be executed by legally authorized entities. SourcifyChina recommends engaging PRC-licensed legal counsel for contract enforcement. Data reflects SourcifyChina’s 2025 audit of 1,200+ Chinese solar suppliers.

SourcifyChina Action: Request our 2026 Verified Factory Database (ISO 9001-certified manufacturers with drone audit reports) at sourcifychina.com/solar-2026

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Subject: Strategic Sourcing of Solar Panels from China – Accelerate Your Supply Chain with Verified Excellence

Executive Summary

As global demand for renewable energy solutions surges, procurement managers face mounting pressure to identify reliable, high-performance solar panel manufacturers in China—quickly, cost-effectively, and with minimal risk. With over 2,000 solar manufacturers in China and a fragmented supplier landscape, traditional sourcing methods are time-intensive, error-prone, and expose businesses to quality and compliance risks.

SourcifyChina’s 2026 Verified Pro List: Top Solar Panel Manufacturers in China delivers a strategic advantage by providing pre-vetted, audit-confirmed suppliers that meet international standards for quality, scalability, and ethical manufacturing.

Why the SourcifyChina Verified Pro List Saves Procurement Time & Reduces Risk

| Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|

| 8–12 weeks for supplier identification, outreach, and initial vetting | Access to 30+ pre-qualified suppliers in <48 hours |

| Manual verification of factory credentials, MOQs, and compliance | All suppliers audited for ISO, IEC, CE, and BIS certifications |

| Risk of miscommunication, fraud, or subpar quality | On-ground verification, production capacity checks, and real-time performance data |

| Inconsistent lead times and hidden costs | Transparent factory terms, FOB pricing benchmarks, and logistics readiness |

| Limited negotiation leverage with untested partners | Established relationships enabling better pricing and MOQ flexibility |

By leveraging our Pro List, procurement teams reduce sourcing cycles by up to 70%, avoid costly supply chain disruptions, and accelerate time-to-market for solar projects.

Key Benefits for Global Procurement Managers

- Speed-to-Scale: Deploy vetted suppliers for fast prototyping, pilot runs, and volume production.

- Risk Mitigation: Eliminate counterfeit claims and compliance gaps with factory audit reports.

- Cost Efficiency: Leverage SourcifyChina’s volume aggregation for competitive pricing.

- Sustainability Compliance: Access manufacturers with clean energy production lines and ESG-aligned practices.

- Dedicated Support: Partner with our China-based sourcing consultants for end-to-end supplier management.

Call to Action: Secure Your Competitive Edge in 2026

The solar energy market is moving faster than ever. Delaying strategic sourcing decisions means missed opportunities, higher costs, and supply chain bottlenecks.

Don’t risk your renewable energy goals on unverified suppliers.

👉 Contact SourcifyChina today to receive your complimentary copy of the 2026 Verified Pro List: Best Solar Panel Manufacturers in China.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available for immediate consultation to align with your technical specifications, volume requirements, and delivery timelines.

Act Now. Source Smarter. Scale Faster.

Your Trusted Partner in China Sourcing – SourcifyChina

🧮 Landed Cost Calculator

Estimate your total import cost from China.