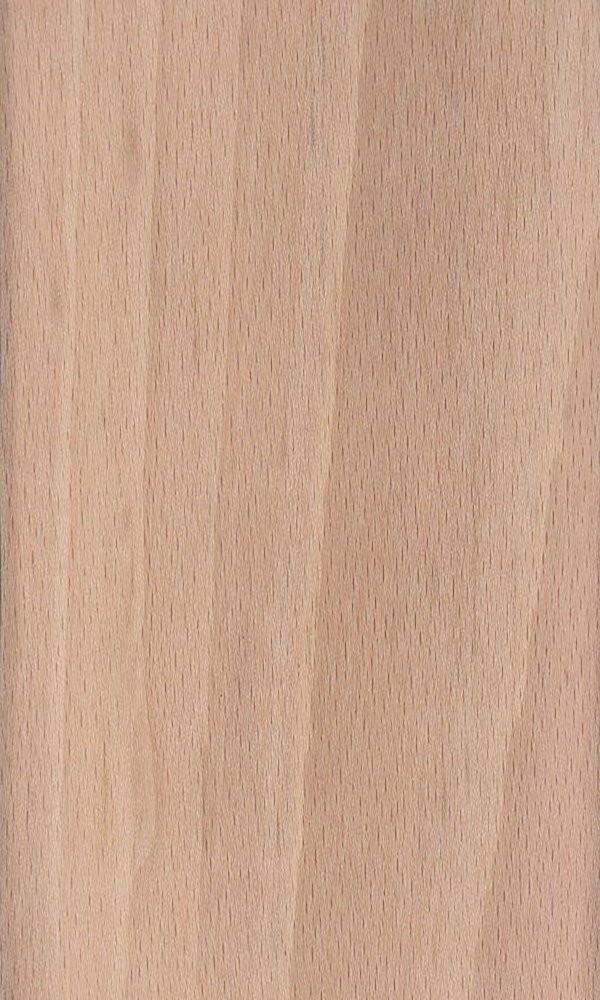

The global hardwood lumber market, driven by consistent demand in furniture, flooring, and specialty woodworking, is witnessing steady expansion, with beech wood emerging as a preferred material due to its strength, fine grain, and versatility. According to a 2023 report by Mordor Intelligence, the global hardwood lumber market is projected to grow at a CAGR of 4.8% over the forecast period (2023–2028), fueled by rising demand in construction and interior design across North America and Europe—regions where European beech (Fagus sylvatica) is both abundant and widely processed. Grand View Research further underscores this trend, noting that the global wood products market, valued at over USD 560 billion in 2022, continues to benefit from sustainable forestry practices and the growing preference for renewable materials in manufacturing. With beech wood’s favorable machinability and widespread use in cabinetry, tool handles, and bentwood furniture, the supply chain for high-quality beech lumber has become increasingly vital. This growing demand has elevated the role of specialized manufacturers who combine sustainable sourcing with precision milling. Below is a curated list of the top nine beech wood lumber manufacturers leading in quality, output, and industry innovation.

Top 9 Beech Wood Lumber Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Beech Timber

Domain Est. 1998

Website: pollmeier.com

Key Highlights: Beech timber from world market leader and Europe’s largest hardwood producer. Uniform colour, ideal moisture content 7-9%, pre-sanded, square-edged….

#2 Lumber and Hardwood Materials

Domain Est. 2002 | Founded: 1994

Website: peachstatelumber.com

Key Highlights: Purchase your lumber and hardwood products at Peach State Lumber Products Inc. Delivery available. Open since 1994. Competitive pricing. Call or visit us….

#3 Beechwood Timber

Domain Est. 2017

Website: beechwoodtimber.com

Key Highlights: Lafor is an integrated beechwood timber manufacturer. From sawmilling to the beechwood edge-glued panels, Lafor does it all!…

#4 Midwest Hardwood Company

Domain Est. 1998

Website: midwesthardwood.com

Key Highlights: Midwest Hardwood has a full gallery of professionally photographed packs of lumber. Packs are available to view in a variety of species and grades….

#5 Beech Hardwood Lumber

Domain Est. 1999

#6 Beech Lumber

Domain Est. 2000

#7 European Beech Wood

Domain Est. 2001

Website: madar.com

Key Highlights: In stockSourced from sustainable forests in Germany, Romania, and Bosnia, our premium European Beech Wood is ideal for high-quality furniture, flooring, and interior ……

#8 Beech Wood Lumber for Sale

Domain Est. 2005

Website: mtewood.com

Key Highlights: We take pride in being a sustainably sourced Beech lumber supplier and offer wholesale pricing on all of our lumber products….

#9 Beech Creek Timber

Domain Est. 2018

Website: beechcreektimber.com

Key Highlights: Beechcreek Timber Co supplies aged barn wood, hand hewn lumber, circular sawn beams, live-edged slabs, and more for commercial and home projects….

Expert Sourcing Insights for Beech Wood Lumber

H2: 2026 Market Trends for Beech Wood Lumber

The global market for beech wood lumber is expected to experience steady growth and notable shifts by 2026, driven by evolving consumer preferences, sustainability demands, and regional industrial developments. This analysis explores key trends shaping the beech wood lumber sector in the coming years.

-

Rising Demand in Furniture and Cabinetry

Beech wood remains a top choice in the furniture and cabinetry industries due to its strength, fine grain, and ease of finishing. By 2026, demand is projected to increase, particularly in Europe and North America, where mid-to-high-end furniture manufacturers favor beech for its durability and aesthetic versatility. The resurgence of solid wood furniture—fueled by consumer desire for long-lasting, eco-friendly products—will further bolster market demand. -

Growth in the Flooring and Joinery Sectors

Engineered hardwood flooring and interior joinery applications are emerging as significant end-use segments. Beech’s light color and uniform texture make it ideal for modern, minimalist designs gaining popularity in residential and commercial construction. As urbanization continues and renovation activities rise, particularly in Western Europe, beech wood is expected to gain traction as a cost-effective alternative to more expensive hardwoods. -

Sustainability and Certification Driving Market Access

Environmental regulations and consumer awareness are pushing industry players toward sustainable sourcing. By 2026, certification through bodies such as the Forest Stewardship Council (FSC) and Programme for the Endorsement of Forest Certification (PEFC) will be increasingly critical for market access, especially in the EU and North America. Beech forests in Central and Eastern Europe—where sustainable forestry practices are well-established—are poised to become key supply hubs. -

Impact of Supply Chain Dynamics and Trade Policies

Geopolitical factors and trade policies may influence beech lumber availability and pricing. Eastern European countries such as Poland, Romania, and the Baltic states are major suppliers. However, transportation costs, labor shortages, and export restrictions could affect supply stability. Additionally, the EU’s Green Deal and carbon border adjustments may incentivize local processing, boosting domestic value-added manufacturing over raw log exports. -

Technological Advancements in Processing

Innovations in kiln drying, adhesive bonding, and digital wood grading systems are enhancing the efficiency and consistency of beech lumber production. By 2026, increased adoption of automation and Industry 4.0 technologies in sawmills will improve yield and reduce waste, making beech more competitive against alternative materials. -

Competition from Alternative Materials

While demand is rising, beech wood faces competition from engineered wood products (e.g., MDF, plywood) and alternative hardwoods like birch and maple. However, its favorable mechanical properties and lower cost compared to some hardwoods will help maintain its market position, especially in applications prioritizing workability and strength.

Conclusion

By 2026, the beech wood lumber market is expected to benefit from sustained demand in furniture, flooring, and joinery, supported by strong sustainability credentials and technological improvements. Proactive adaptation to regulatory changes, supply chain resilience, and value-added processing will determine the success of market participants. Overall, beech wood is well-positioned to remain a vital resource in the global hardwood industry.

Common Pitfalls When Sourcing Beech Wood Lumber (Quality and Intellectual Property)

Sourcing high-quality beech wood lumber requires attention to detail, as several pitfalls can impact both material performance and legal compliance. Being aware of these issues helps ensure a reliable supply chain and protects against costly mistakes.

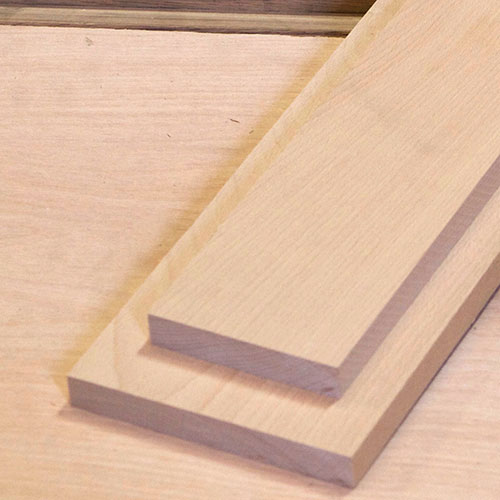

Inconsistent or Poor Wood Quality

One of the most frequent challenges is receiving beech lumber that fails to meet expected quality standards. This can include excessive knots, mineral streaks, wane (bark or missing wood along edges), or variations in moisture content. Beech is prone to warping and checking if not properly kiln-dried, and inconsistent grading across suppliers can result in unusable material for precision applications like furniture or cabinetry.

Misrepresentation of Grade and Species

Suppliers may mislabel lower-grade beech as higher-grade (e.g., Select or FAS), or even substitute beech with similar-looking but inferior hardwoods. Without proper verification—such as mill certifications or third-party grading—buyers risk receiving substandard or incorrect species. This is especially common in international sourcing where oversight is limited.

Inadequate Drying and Moisture Content Issues

Beech wood is dense and retains moisture, making it highly susceptible to movement if not dried correctly. Lumber that hasn’t been uniformly kiln-dried to an appropriate moisture content (typically 6–8% for indoor use) can lead to dimensional instability, warping, or joint failure in finished products. Some suppliers cut corners on drying to save time and cost, compromising long-term quality.

Sustainability and Certification Gaps

Beech is widely available in Europe and North America, but unsustainable harvesting practices still occur. Sourcing without verified certifications (such as FSC or PEFC) risks contributing to deforestation and may conflict with corporate sustainability goals or regulatory requirements in certain markets. Buyers should confirm chain-of-custody documentation to ensure responsible sourcing.

Intellectual Property and Design Infringement Risks

When sourcing beech lumber for use in proprietary furniture, flooring, or engineered wood products, there’s a risk of inadvertently using materials or processing methods protected by intellectual property (IP). For example, certain proprietary treatments, lamination techniques, or finish applications may be patented. Using such methods without licensing can lead to legal disputes, especially when importing finished goods.

Lack of Traceability and Documentation

Without proper documentation—such as origin reports, heat treatment certificates (e.g., ISPM 15 for international shipments), or mill test results—sourcing beech lumber can expose buyers to regulatory risks, import delays, or disputes over quality claims. Traceability is also essential for verifying compliance with environmental regulations and avoiding illegally harvested wood.

Overlooking Regional Variations in Beech Quality

European beech (Fagus sylvatica) and American beech (Fagus grandifolia) differ slightly in density, color, and grain structure. Assuming interchangeability without testing can affect the final product’s appearance and performance. Additionally, regional growing conditions influence wood characteristics, so sourcing from unfamiliar regions without due diligence can yield inconsistent results.

Conclusion

To avoid these pitfalls, buyers should work with reputable suppliers, request detailed specifications and documentation, conduct quality inspections upon delivery, and verify compliance with environmental and IP standards. Proactive due diligence ensures consistent quality and reduces legal and operational risks in beech wood sourcing.

Logistics & Compliance Guide for Beech Wood Lumber

Overview

Beech wood lumber is a popular hardwood used in furniture, cabinetry, flooring, and specialty wood products due to its strength, fine grain, and uniform texture. Efficient logistics and strict compliance with international and national regulations are essential for the sustainable and legal trade of beech lumber. This guide outlines key logistics considerations and compliance requirements for sourcing, transporting, and selling beech wood lumber globally.

Sourcing and Sustainability Compliance

CITES and ITTO Regulations

Beech (Fagus spp.) is not currently listed under CITES (Convention on International Trade in Endangered Species), but sustainable sourcing is critical. Suppliers must ensure compliance with national forestry laws and international frameworks such as the ITTO (International Tropical Timber Organization) guidelines, even though beech is a temperate species. Sourcing from well-managed forests helps prevent illegal logging and supports long-term supply stability.

FSC and PEFC Certification

To meet market demand for responsibly sourced wood, procurement should prioritize FSC (Forest Stewardship Council) or PEFC (Programme for the Endorsement of Forest Certification) certified beech lumber. These certifications verify that the wood comes from sustainably managed forests and help comply with regulations such as the EU Timber Regulation (EUTR) and the U.S. Lacey Act.

Regulatory Compliance

EU Timber Regulation (EUTR)

Under EUTR, operators placing beech lumber on the European market must implement a due diligence system to minimize the risk of sourcing illegally harvested timber. This includes assessing the risk of illegal origin, taking risk mitigation measures if necessary, and keeping records of suppliers and timber details.

U.S. Lacey Act

The Lacey Act prohibits trade in illegally sourced plants and plant products, including wood. Importers of beech lumber into the U.S. must file a Plant and Plant Product Import Declaration (PPQ Form 505), providing details such as scientific name (Fagus spp.), country of harvest, and quantity. Lack of accurate data can result in seizure or penalties.

Australian and Canadian Regulations

Australia’s Illegal Logging Prohibition Act and Canada’s Sustainable Forest Management practices require importers and exporters to ensure legality throughout the supply chain. Documentation proving legal harvest and chain-of-custody certification is often required.

Logistics and Transportation

Packaging and Protection

Beech lumber should be kiln-dried to a moisture content of 6–8% before shipment to prevent mold, warping, and staining during transport. Boards should be sticker-stacked with spacers for airflow and wrapped in protective materials (e.g., plastic sheeting) to guard against moisture and contamination.

Shipping Methods

- Containerized Shipping: Most common for international trade. Use dry van containers with desiccants to control humidity.

- Break-Bulk or Flat Rack: Suitable for oversized or non-standard bundles.

- Overland Transport: For regional distribution, ensure proper securing and protection from weather using tarps or enclosed trailers.

Handling and Storage

Store beech lumber in dry, well-ventilated warehouses off the ground using wooden skids. Avoid direct exposure to sunlight and rain. Maintain consistent temperature and humidity to prevent checking or splitting.

Documentation Requirements

Essential Export/Import Documents

- Commercial Invoice

- Packing List

- Bill of Lading or Air Waybill

- Phytosanitary Certificate (required by many countries to prevent pest spread)

- Certificate of Origin

- FSC/PEFC Chain-of-Custody Certificate (if applicable)

- Lacey Act Declaration (for U.S. imports)

Pest and Quarantine Considerations

ISPM 15 Compliance

Wood packaging material (e.g., pallets, crates) used in international shipments must comply with ISPM 15 (International Standards for Phytosanitary Measures No. 15). This requires heat treatment or fumigation and official marking to prevent the spread of invasive pests like bark beetles.

Pest Inspections

Some countries require pre-shipment inspections for wood borers and fungal issues. Beech is susceptible to ambrosia beetles and powdery mildew; visual and moisture inspections pre-shipment are recommended.

Environmental and Customs Duties

Carbon Footprint and Green Logistics

Optimize transportation routes and consolidate shipments to reduce emissions. Consider rail or sea freight over air freight to minimize environmental impact.

Tariff Classifications

Beech lumber is typically classified under HS Code 4407 (Sawn or chipped lengthwise, sliced or peeled). Tariff rates vary by country—check local customs databases (e.g., U.S. HTS, EU TARIC) for precise duty rates and preferential treatment under trade agreements.

Best Practices Summary

- Source certified, legally harvested beech timber.

- Maintain complete documentation for traceability.

- Package and store lumber properly to preserve quality.

- Comply with phytosanitary and packaging standards.

- Train staff on regulatory updates and due diligence procedures.

Adhering to these logistics and compliance guidelines ensures smooth operations, minimizes legal risks, and supports sustainable forestry practices in the beech lumber trade.

In conclusion, sourcing beech wood lumber presents a viable and sustainable option for a wide range of woodworking applications, including furniture, cabinetry, flooring, and specialty wood products. Beech is valued for its strength, fine grain, and workability, making it a preferred choice among manufacturers and craftsmen. When sourcing beech lumber, it is essential to prioritize suppliers that practice sustainable forestry and offer certification from recognized bodies such as FSC or PEFC to ensure environmental responsibility. Additionally, factors such as moisture content, grade quality, and regional availability should be carefully evaluated to meet specific project requirements. By partnering with reliable suppliers and considering both economic and ecological impacts, businesses can secure high-quality beech wood lumber that supports long-term success and sustainability goals.