The global bearings market is experiencing robust growth, driven by rising demand from automotive, industrial machinery, and renewable energy sectors. According to Mordor Intelligence, the market was valued at USD 89.27 billion in 2023 and is projected to reach USD 118.64 billion by 2029, growing at a CAGR of 4.92% during the forecast period. This expansion is fueled by technological advancements, increasing automation, and the need for high-performance components in critical applications. As industries prioritize efficiency, durability, and precision, leading manufacturers are scaling innovation in materials, lubrication, and smart bearing solutions. In this competitive landscape, a select group of companies dominate both in terms of market share and engineering excellence. Based on market performance, technological capability, and global reach, the following list highlights the top 10 bearings manufacturers shaping the future of motion control.

Top 10 Bearings Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 New Hampshire Ball Bearings, Inc.

Domain Est. 1995

Website: nhbb.com

Key Highlights: (NHBB) is a leading manufacturer of precision bearings and complex bearing assemblies for the global aerospace, defense, medical, and high technology markets….

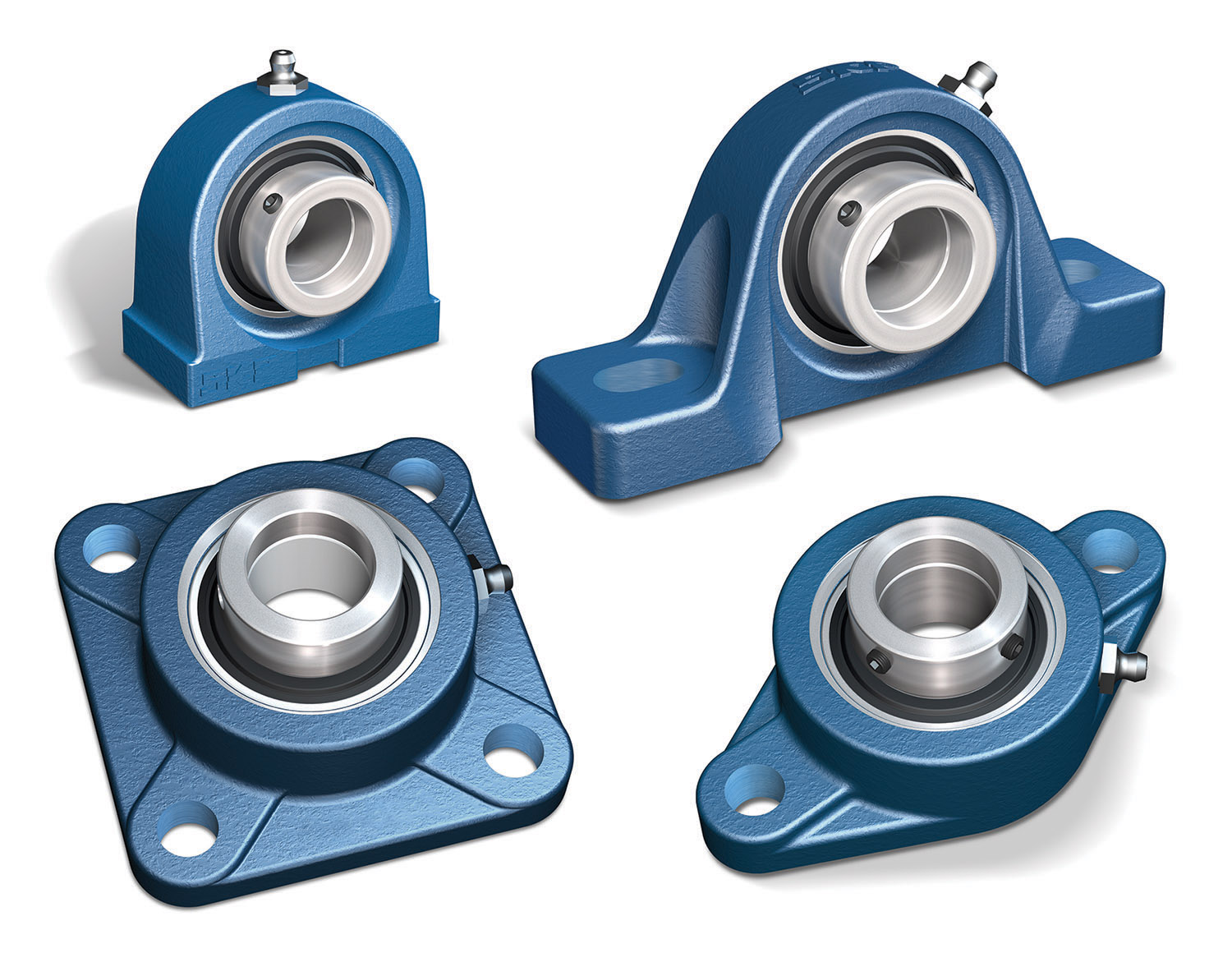

#2 Mounted Ball Bearings

Domain Est. 2001

Website: amibearings.com

Key Highlights: AMI Bearings, Inc. is a World Class Manufacturer of Mounted Ball Bearings Serving the North American Market. Featuring the broadest possible combination of ……

#3 Precision Roller Bearings Manufacturer

Domain Est. 1997 | Founded: 1919

Website: rbcbearings.com

Key Highlights: Founded in 1919, RBC Bearings Incorporated is an international manufacturer and marketer of highly engineered precision bearings and products, which are ……

#4 Bearing Headquarters

Domain Est. 1997

Website: bearingheadquarters.com

Key Highlights: We specialize in the industrial repair, refurbishments and rebuilds of wheel bearings, construction equipment, gear reducers and more….

#5 American Bearings Manufacturers Association

Domain Est. 2006

Website: americanbearings.org

Key Highlights: ABMA is the global advocate and the network for technical standards, education and business information for bearings manufacturers, suppliers, and end-users….

#6 NTN Americas

Domain Est. 2012

Website: ntnamericas.com

Key Highlights: At NTN Bearing Corp., we manufacture and supply the most comprehensive range of ball bearings and other industrial and automotive equipment….

#7

Domain Est. 1996

Website: nsk.com

Key Highlights: Shop bearings, linear motion products, and accessories with fast ordering, real-time availability, and trusted NSK quality. Order Now. NSK Online Catalogue for ……

#8 SKF Group homepage

Domain Est. 1996

Website: skf.com

Key Highlights: Bearings, seals, lubrication systems and surrounding equipment for enhanced reliability and performance. View products. Services. Engineering, maintenance ……

#9 PEER Bearing

Domain Est. 1999

Website: peerbearing.com

Key Highlights: We offer a full line product offering of bearings for the conveyor, food & beverage wash down, and elevator sub-markets….

#10 Bearing Manufacturing Company

Domain Est. 2000

Website: bmcbearing.com

Key Highlights: At BMC you get a one-stop solution for all your bearings needs, including modification, manufacturing, and repair. With a full warranty, you’ll get the ……

Expert Sourcing Insights for Bearings

H2: 2026 Market Trends for Bearings – Innovation, Electrification, and Resilience Driving Growth

As the global industrial and automotive landscapes evolve rapidly, the bearings market is poised for significant transformation by 2026. Driven by technological advancements, shifting end-user demands, and macroeconomic factors, several key trends are shaping the industry’s trajectory. This H2 analysis highlights the most impactful developments expected to define the bearings market in 2026.

1. Accelerated Shift to Electrification and E-Mobility

The rise of electric vehicles (EVs) is fundamentally altering bearing requirements. Unlike internal combustion engines, EVs demand bearings optimized for higher rotational speeds, reduced noise, vibration, and harshness (NVH), and enhanced electrical insulation to prevent stray current corrosion. By 2026, manufacturers are expected to offer specialized product lines—such as hybrid ceramic bearings and insulated deep groove ball bearings—tailored specifically for electric motors, transmissions, and wheel hubs. This trend is not limited to passenger cars; electric buses, trucks, and two-wheelers will further expand demand in this niche.

2. Integration of Smart and Condition-Monitoring Bearings

The Industry 4.0 revolution is promoting the adoption of smart bearings embedded with sensors and IoT connectivity. By 2026, predictive maintenance enabled by real-time data on temperature, vibration, and load will become standard in critical applications across wind energy, manufacturing, and rail. These intelligent systems reduce unplanned downtime, extend bearing life, and lower total cost of ownership. Major players are partnering with digital solution providers to offer integrated monitoring platforms, moving beyond pure component supply to value-added services.

3. Focus on Sustainability and Circular Economy

Environmental regulations and corporate sustainability goals are pushing the bearings industry toward greener practices. This includes the development of longer-lasting, recyclable materials, energy-efficient designs, and reduced lubrication needs. By 2026, OEMs will increasingly favor suppliers with strong ESG (Environmental, Social, and Governance) credentials. Closed-loop recycling of bearing steel and the use of bio-based or synthetic lubricants will gain momentum, driven by both regulatory pressures and customer demand.

4. Regional Manufacturing Reshoring and Supply Chain Diversification

Geopolitical tensions and supply chain disruptions have highlighted the risks of over-concentration in manufacturing. By 2026, there will be a continued trend toward regionalization—particularly in North America and Europe—where companies invest in local production to improve resilience. Simultaneously, emerging markets in Southeast Asia and India are expanding their bearing manufacturing capabilities, offering cost-effective alternatives and serving as regional hubs. This dual trend fosters a more balanced, agile global supply chain.

5. Material and Design Innovation

Advanced materials such as high-purity steels, ceramics, and polymer composites are enabling bearings to perform under extreme conditions—high temperatures, corrosive environments, and heavy loads. By 2026, innovations like surface coatings (e.g., DLC – Diamond-Like Carbon) and optimized internal geometries will be more widespread, improving efficiency and durability. Additive manufacturing (3D printing) may begin to play a role in prototyping and low-volume, high-complexity bearing components.

6. Rising Demand from Renewable Energy and Automation

Wind turbine installations—especially offshore—will continue to drive demand for large, high-performance bearings capable of withstanding harsh environments. Simultaneously, the growth of robotics, automated guided vehicles (AGVs), and smart factories increases the need for precision miniature and thin-section bearings. These high-growth sectors are expected to outpace traditional industrial markets in terms of value and innovation by 2026.

Conclusion

By 2026, the bearings market will be characterized by a strategic pivot toward smarter, more sustainable, and application-specific solutions. Success will depend on manufacturers’ ability to innovate rapidly, adapt to electrification trends, leverage digital technologies, and ensure supply chain resilience. Companies that embrace these H2 trends—balancing technological advancement with operational sustainability—will be best positioned to lead in the next era of industrial and mobility transformation.

Common Pitfalls When Sourcing Bearings: Quality and Intellectual Property (IP) Risks

Sourcing bearings—critical components in machinery across industries—can be fraught with challenges, particularly concerning product quality and intellectual property integrity. Failing to address these pitfalls can lead to equipment failure, safety hazards, legal disputes, and reputational damage. Below are key risks to consider.

Substandard Quality and Counterfeit Products

One of the most prevalent risks in bearing sourcing is receiving substandard or counterfeit products, especially when procuring from low-cost or unverified suppliers. Counterfeit bearings often mimic reputable brands (e.g., SKF, FAG, Timken) but are manufactured using inferior materials and processes, leading to premature wear, increased downtime, and potential system failures. These fake products may lack proper heat treatment, use low-grade steel, or have inaccurate tolerances, all of which compromise performance and safety.

Buyers may unknowingly purchase counterfeit bearings due to deceptive packaging, falsified certificates of authenticity, or misleading supplier claims. This is particularly common in gray market channels or when sourcing through third-party distributors without direct brand authorization.

Lack of Traceability and Certifications

Reliable bearing suppliers should provide full traceability, including batch numbers, material certifications (e.g., ISO 9001, ISO/TS 16949), and test reports. A common pitfall is sourcing from suppliers who cannot provide verifiable documentation, making it impossible to confirm compliance with industry standards or investigate failures. Without proper certifications, organizations risk non-compliance with regulatory requirements, especially in highly regulated sectors such as aerospace, automotive, or medical devices.

Intellectual Property (IP) Infringement

Sourcing bearings from unauthorized manufacturers or suppliers can lead to intellectual property violations. Many high-performance bearings are protected by patents, trademarks, and trade secrets. Using or distributing counterfeit or cloned bearings infringes on these rights and may expose the buyer to legal liability, including fines, product seizures, or injunctions.

Even if a buyer is unaware of the infringement, ignorance is typically not a legal defense. Sourcing from suppliers that reverse-engineer branded designs without licensing can place downstream users at risk, particularly in international trade where customs authorities actively screen for IP violations.

Inadequate Supplier Vetting and Due Diligence

Many organizations fall into the trap of prioritizing cost over supplier credibility. Skipping thorough due diligence—such as verifying supplier credentials, auditing manufacturing facilities, or checking references—increases exposure to quality and IP risks. Authorized distributors and direct OEM sourcing remain the safest routes, but even these channels require verification to prevent unauthorized resellers or unauthorized production runs.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Source bearings only from authorized distributors or directly from OEMs.

– Request and verify material certifications, test reports, and traceability data.

– Conduct supplier audits and use third-party inspection services when necessary.

– Implement procurement policies that include IP compliance checks.

– Train procurement teams to identify red flags such as unusually low pricing or vague technical documentation.

By proactively addressing quality and IP concerns, businesses can ensure reliable performance, legal compliance, and long-term cost savings in their bearing supply chains.

Logistics & Compliance Guide for Bearings

Overview

Bearings are critical mechanical components used across industries such as automotive, aerospace, manufacturing, and energy. Efficient logistics and strict compliance with international regulations are essential to ensure timely delivery, product integrity, and legal adherence. This guide outlines key considerations for the global shipping, handling, and regulatory compliance of bearings.

Classification and Harmonized System (HS) Codes

Accurate classification under the Harmonized System (HS) is vital for customs clearance and determining import duties. Bearings are generally classified under the following HS codes:

– 8482.10: Ball bearings

– 8482.20: Roller bearings (cylindrical)

– 8482.30: Tapered roller bearings

– 8482.40: Needle roller bearings

– 8482.50: Other roller bearings

– 8482.80: Parts of ball or roller bearings

– 8482.91 – 8482.99: Other bearing types and components

Note: HS codes may vary slightly by country. Always verify with local customs authorities.

Packaging and Handling Requirements

Proper packaging ensures bearings arrive undamaged and contamination-free:

– Use anti-corrosion packaging (VCI paper, sealed plastic wraps) to prevent rust.

– Employ rigid outer containers (corrugated boxes, wooden crates) for heavy or oversized bearings.

– Clearly label packages with content description, HS code, weight, and handling instructions (e.g., “Fragile,” “Do Not Stack”).

– Use desiccants in packaging for long-term storage or humid environments.

– Avoid direct exposure to moisture, extreme temperatures, and contaminants during transit.

Transportation Modes and Considerations

Selecting the right transport method depends on volume, urgency, and destination:

– Air Freight: Best for urgent, high-value, or time-sensitive shipments. Compliant with IATA regulations; ensure packaging meets drop and pressure standards.

– Ocean Freight: Cost-effective for large volumes. Use dry, ventilated containers; consider container desiccants and humidity control.

– Land Transport: Ideal for regional distribution. Secure loads to prevent shifting; avoid vibration damage with proper cushioning.

– Intermodal Shipping: Combine modes for cost and efficiency. Maintain consistent packaging and labeling across transitions.

Import and Export Documentation

Complete and accurate documentation prevents delays:

– Commercial Invoice (with detailed product description, value, and HS code)

– Packing List (itemizing contents, weights, dimensions)

– Bill of Lading (for ocean) or Air Waybill (for air)

– Certificate of Origin (required for preferential tariffs under trade agreements)

– Export Declaration (e.g., AES in the U.S., EX-ACT in EU)

– Import License (if required by destination country)

Regulatory Compliance

Bearings must comply with destination country regulations:

– REACH and RoHS (EU): Ensure no restricted substances (e.g., certain metals or lubricants) are present.

– ITAR/EAR (U.S.): Bearings used in defense or aerospace may be subject to export controls. Verify ECCN (Export Control Classification Number).

– Product Standards: Comply with ISO 15, ISO 492, or ANSI/ABMA standards as applicable.

– Labeling Requirements: Include manufacturer, model, dimensions, material, and compliance marks (e.g., CE, UKCA).

Special Handling for High-Precision or Sensitive Bearings

- Maintain cleanroom-like conditions during packaging for precision bearings (e.g., spindle, medical).

- Use tamper-evident seals and serialized tracking for high-value shipments.

- Monitor environmental conditions (temperature, humidity) during transit with data loggers if necessary.

Customs Clearance Best Practices

- Pre-clear shipments using electronic customs platforms (e.g., ACE in the U.S., ATLAS in Germany).

- Assign a licensed customs broker in the destination country.

- Provide detailed technical specifications to avoid misclassification.

- Be prepared for inspections; maintain accessible product compliance documentation.

Sustainability and Disposal Compliance

- Recycle packaging materials in accordance with local regulations (e.g., EU Packaging Waste Directive).

- Follow WEEE guidelines if bearings are part of electronic equipment.

- Use eco-friendly lubricants and packaging where possible to meet ESG goals.

Conclusion

Effective logistics and compliance for bearings require attention to classification, packaging, documentation, and regulatory standards. By adhering to this guide, businesses can minimize delays, reduce costs, and ensure smooth international trade operations. Regular updates on trade regulations and continuous staff training are recommended to maintain compliance.

Conclusion on Sourcing Bearings Manufacturers

Sourcing bearings from reliable manufacturers is a critical decision that directly impacts the performance, durability, and efficiency of mechanical systems across various industries. After evaluating key factors such as product quality, manufacturing capabilities, certifications, cost-efficiency, global reach, and after-sales support, it becomes evident that selecting the right supplier requires a strategic and well-informed approach.

Leading bearing manufacturers, whether global giants like SKF, Schaeffler, NSK, or cost-competitive producers in regions like China and India, each offer distinct advantages. The choice ultimately depends on application requirements, budget constraints, and supply chain resilience. Emphasis should be placed on partnering with manufacturers that adhere to international standards (e.g., ISO, ABEC), invest in R&D, and maintain consistent quality control processes.

Moreover, due diligence—such as site visits, sample testing, and verification of certifications—is essential to mitigate risks related to counterfeit products or inconsistent quality. As industries move toward automation, electrification, and sustainability, bearings suppliers that innovate and offer customized, high-performance solutions will be better positioned as long-term partners.

In conclusion, successful sourcing involves balancing quality, cost, and reliability while aligning with manufacturers who demonstrate technical expertise, ethical practices, and adaptability to future industry trends. A well-chosen bearing supplier not only ensures operational excellence but also contributes to long-term competitiveness and customer satisfaction.