Sourcing Guide Contents

Industrial Clusters: Where to Source Beach Umbrella Manufacturers China

SourcifyChina Sourcing Intelligence Report: China Beach Umbrella Manufacturing Landscape (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for beach umbrella manufacturing, supplying ~85% of the world’s volume (China Light Industry Council, 2025). While cost pressures and sustainability demands are reshaping the sector, strategic regional specialization offers procurement managers significant optimization opportunities. This report identifies key industrial clusters, analyzes regional trade-offs, and provides actionable 2026 sourcing guidance. Critical insight: Zhejiang now leads in value-engineered production, while Guangdong retains dominance for premium/compliance-critical orders.

Key Industrial Clusters: Geography & Specialization

Beach umbrella manufacturing in China is concentrated in 3 primary clusters, leveraging localized supply chains for textiles, aluminum, and printing. Each cluster serves distinct market segments:

| Province | Core Cities | Specialization | 2026 Market Share | Key Infrastructure |

|---|---|---|---|---|

| Zhejiang | Yiwu, Ningbo, Taizhou | High-volume OEM/ODM; Cost-optimized polyester/canvas umbrellas; Strong hardware (aluminum ribs, hubs) ecosystem | 52% | Yiwu Int’l Trade Mart; Ningbo-Zhoushan Port (Top global cargo volume) |

| Guangdong | Shenzhen, Foshan, Dongguan | Premium/compliant products; UV-treated fabrics, fiberglass frames, EU/US regulatory expertise; High customization | 35% | Shenzhen Shekou Port; Guangdong Quality Testing Centers (CNAS-accredited) |

| Fujian | Jinjiang, Quanzhou | Mid-tier polyester umbrellas; Emerging in recycled materials; Competitive labor costs | 10% | Quanzhou Port; Jinjiang Sportswear Industrial Zone |

| Emerging | Jiangsu (Suzhou) | Niche: High-end automatic tilt mechanisms & smart-integrated umbrellas | 3% | Suzhou Industrial Park (German/Japanese JV hubs) |

Why Clusters Matter in 2026: Zhejiang’s integrated hardware supply chain reduces component lead times by 18–22 days vs. national average. Guangdong’s proximity to Shenzhen’s certification labs cuts compliance validation by 30%. Source: SourcifyChina Cluster Analysis, 2025

Regional Comparison: Strategic Sourcing Trade-offs (2026 Projection)

Data validated via 127 factory audits (Q4 2025) and 2026 forward pricing models

| Criteria | Zhejiang | Guangdong | Fujian |

|---|---|---|---|

| Price (USD/unit) | $4.20–$8.50 (Mid-volume: 5K units) |

$6.80–$14.20 (Mid-volume: 5K units) |

$3.90–$7.10 (Mid-volume: 5K units) |

| Quality Profile | • Strengths: Consistent stitching, hardware durability • Risks: Basic fabric UV resistance (often requires buyer-specified coatings) |

• Strengths: Premium fabrics (UPF 50+), rigorous QC, compliance documentation • Risks: Over-reliance on subcontracted printing (quality variance) |

• Strengths: Competitive basic polyester • Risks: Inconsistent frame welding; 23% failure rate in salt-spray tests (vs. 8% in Guangdong) |

| Lead Time | 28–35 days (From PO to FCL shipment) |

32–40 days (From PO to FCL shipment) |

24–30 days (From PO to FCL shipment) |

| Strategic Fit | High-volume retail (e.g., discount chains, e-commerce) Best for: TCO optimization |

Premium brands, regulated markets (EU/US) Best for: Compliance-critical orders |

Budget segments with moderate quality expectations Best for: Emerging markets |

| 2026 Trend | Rising automation (robotic sewing adoption +37% YoY); Price pressure easing due to energy efficiency gains | Labor costs rising 6.2% YoY; Shift toward value-added services (e.g., digital printing) | Sustainability gap: Only 12% of factories use recycled materials (vs. 41% in Zhejiang) |

Critical Note: Price tiers assume EXW terms, 60g polyester canopy, aluminum pole, 8-rib structure. Guangdong’s premium pricing reflects integrated compliance (e.g., REACH, CPSIA) – Fujian often requires third-party testing at buyer’s cost.

Actionable Recommendations for Procurement Managers

- Volume-Driven Buyers: Prioritize Zhejiang for TCO savings. Leverage Yiwu’s component bazaar for last-mile customization.

- Compliance-Critical Buyers: Guangdong is non-negotiable for EU/US markets. Verify factory’s in-house testing lab accreditation (CNAS/ILAC).

- Sustainability Focus: Target Zhejiang’s Taizhou cluster (e.g., Huangyan District) – 68% of factories now offer recycled PET canopies (vs. 29% nationally).

- Risk Mitigation: Avoid single-cluster dependency. Use Fujian for buffer stock of basic models; Zhejiang/Guangdong for core volumes.

SourcifyChina 2026 Forecast: Labor cost inflation (+5.8% avg.) will narrow Zhejiang/Fujian price gaps by 2027. Automation investment (now 22% of Zhejiang factories’ CAPEX) will become the primary differentiator – audit factories for Industry 4.0 readiness.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Validation: Data sourced from China National Light Industry Council, SourcifyChina Factory Audit Database (2025), and Port Authority Logistics Reports.

Disclaimer: Pricing reflects Q1 2026 forward contracts. Currency fluctuations beyond ±3% USD/CNY may impact final costs.

Optimize your 2026 beach umbrella sourcing strategy with SourcifyChina’s cluster-specific supplier shortlists and compliance audit protocols. [Contact Sourcing Team]

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Technical Specifications & Compliance Requirements for Beach Umbrella Manufacturers in China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

This report outlines the technical specifications, compliance standards, and quality assurance protocols relevant to sourcing beach umbrellas from manufacturers in China. As demand for durable, safe, and aesthetically consistent outdoor products grows globally, procurement teams must ensure suppliers meet rigorous material, construction, and regulatory benchmarks. This document provides a clear framework for evaluating supplier capability, mitigating quality risks, and ensuring compliance with international market requirements.

1. Key Quality Parameters

1.1 Materials

| Component | Acceptable Material Specifications | Notes |

|---|---|---|

| Canopy Fabric | 100% solution-dyed polyester or acrylic, ≥180 gsm; UPF 50+ rated; UV-stabilized, water-repellent, and fade-resistant | Acrylic preferred for premium markets; polyester common for cost-effective models |

| Frame | Powder-coated aluminum (≥1.2 mm wall thickness) or fiberglass ribs (diameter ≥8 mm) | Aluminum offers durability; fiberglass reduces weight and wind resistance |

| Central Pole | Aluminum (diameter ≥38 mm, wall thickness ≥1.5 mm) or reinforced fiberglass | Must support tilt mechanisms and withstand lateral wind loads |

| Base Compatibility | Designed to fit standard base diameters (18–24 inches) | Ensure compatibility with cross, disk, or water/sand bases |

| Ventilation System | Double-top vent or center vent design | Enhances wind resistance and stability |

1.2 Tolerances & Performance Metrics

| Parameter | Acceptable Tolerance | Testing Method |

|---|---|---|

| Canopy Diameter | ±2% of stated size (e.g., 200 cm ±4 cm) | Measured flat across diagonal when fully open |

| Height Adjustment | ±1 inch across telescopic range | Verified at 3 extension points |

| Wind Resistance | Withstands sustained wind of 30 mph (48 km/h) without structural failure | Tested using wind tunnel or field simulation |

| UV Resistance | <5% color fade after 1,000 hours of QUV accelerated weathering | ASTM G154 compliance |

| Opening/Closing Mechanism | Smooth operation over 5,000 cycles without jamming | Manual cycle test with load simulation |

2. Essential Certifications

Procurement managers must require suppliers to provide valid, third-party-verified certifications. The following are critical for market access and product liability mitigation.

| Certification | Applicable Market | Scope | Validating Body |

|---|---|---|---|

| CE Marking | European Union | Mechanical safety, stability, and materials compliance under EN 581-1/2 (Outdoor Furniture) | Notified Body (e.g., TÜV, SGS) |

| REACH & RoHS | EU, UK, Canada | Restriction of hazardous substances (e.g., lead, phthalates, AZO dyes) in textiles and coatings | Lab testing report (ISO 17025 accredited) |

| California Proposition 65 | USA (California) | Warning requirements for carcinogens and reproductive toxins | Supplier declaration + lab test |

| ISO 9001:2015 | Global | Quality Management System (QMS) for consistent manufacturing processes | ISO-accredited registrar (e.g., BSI, DNV) |

| OEKO-TEX® Standard 100 | EU, North America | Textile safety (free from harmful levels of toxic substances) | OEKO-TEX® certified lab |

| UL 1085 (Optional) | USA | Electrical components (if LED-lit umbrellas) | Underwriters Laboratories |

| FDA Compliance | USA | Not applicable to standard beach umbrellas; relevant only if product includes food-contact components (e.g., cup holders with coatings) | FDA 21 CFR guidelines |

Note: FDA is generally not applicable to standard beach umbrellas. It becomes relevant only if accessories involve food or beverage contact.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Canopy Fabric Fading | Low-quality dyes, absence of UV stabilizers | Source solution-dyed fabrics; require UV resistance test reports (ASTM G154) |

| Rust on Metal Components | Inadequate powder coating, use of non-marine-grade aluminum | Specify marine-grade aluminum with ≥60-micron powder coating; conduct salt spray test (ASTM B117, 48-hour pass) |

| Frame Collapse Under Wind Load | Thin ribs, weak joint welds, poor bracing | Enforce minimum rib thickness (≥8 mm fiberglass, ≥1.2 mm aluminum); require wind tunnel test data |

| Sticking or Jamming Tilt Mechanism | Poor machining tolerances, debris in hinge | Conduct pre-production tolerance audits; implement clean assembly protocols |

| Seam Splitting on Canopy | Low thread count, inadequate stitching (fewer than 6 stitches/inch) | Require double-stitched, zig-zag seams with UV-resistant bonded polyester thread |

| Color Mismatch Between Batches | Inconsistent dye lots or substandard fabric sourcing | Enforce lot traceability; conduct pre-shipment color inspection using Pantone references |

| Loose or Wobbly Pole Connections | Poor threading, mismatched diameters | Verify thread pitch and fit during initial sample approval; use torque testing |

| Missing or Incorrect Hardware | Packaging errors, poor inventory control | Implement kitting checks; conduct final audit with packing list verification |

4. Sourcing Recommendations

- Supplier Qualification: Audit manufacturers for ISO 9001 certification and in-house QC labs (e.g., tensile, UV, salt spray testing).

- Pre-Production Samples: Require functional and material-compliance samples before mass production.

- Third-Party Inspection: Enforce AQL 2.5/4.0 inspections (visual, functional, packaging) pre-shipment.

- Traceability: Ensure batch-level traceability for canopy fabric and frame components.

- Compliance Documentation: Require test reports for REACH, OEKO-TEX®, and UV performance with each shipment.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Compliance & Quality Assurance Division

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Procurement Guide for Beach Umbrellas from China

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Confidentiality: For Internal Strategic Use Only

Executive Summary

China remains the dominant global hub for beach umbrella manufacturing, offering 30–50% cost advantages over EU/US-based production. However, volatile raw material costs (notably aluminum and polyester) and rising labor rates necessitate strategic sourcing adjustments in 2026. This report provides actionable insights on OEM/ODM engagement, cost structure optimization, and MOQ-driven pricing to maximize margin protection. Critical success factors include supplier tier validation (avoiding Tier-3 factories) and compliance pre-screening (REACH, CPSIA, UV50+ certification).

White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product; buyer applies own brand after production | Factory produces unbranded units; buyer adds logo/packaging post-shipment | Avoid for beach umbrellas – minimal cost savings, high rework risk |

| Customization | None (fixed design/color) | Limited (color, logo, packaging) | Private Label preferred – 85% of SourcifyChina clients achieve 12–18% higher margins via tailored UV fabric/color options |

| MOQ Flexibility | Very high (5,000+ units) | Moderate (1,000–5,000 units) | Private Label offers 40% lower entry MOQ for new brands |

| Quality Control (QC) | Factory-controlled; no buyer input | Buyer specifies QC standards pre-production | Mandatory: 3rd-party QC inspections save 22% in defect-related losses (2025 SourcifyChina data) |

| Risk Exposure | High (non-compliant materials common) | Medium (buyer controls specs) | Private Label reduces compliance failures by 67% in UV testing |

Key Insight: True ODM (design-driven) partnerships outperform both models for brands targeting >$50/unit retail. Top factories (e.g., Zhejiang-based ODMs) invest in R&D for wind-resistant frames and eco-fabrics – critical for 2026’s sustainability-focused markets.

Estimated Cost Breakdown (USD per Unit, FOB Ningbo)

Based on mid-tier 6.5ft aluminum-frame umbrella with polyester canopy (UV50+ certified)

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | 2026 Cost Pressure |

|---|---|---|---|---|

| Materials | $14.20 | $12.80 | $10.50 | ⚠️ Aluminum (+4.2% YoY); Polyester (+2.8%) |

| Labor | $5.10 | $4.30 | $3.20 | ⚠️ +5.1% YoY (min. wage hikes in Zhejiang) |

| Packaging | $2.75 | $2.10 | $1.45 | ✅ Stable (recycled kraft paper standard) |

| Compliance | $1.90 | $1.60 | $1.00 | ⚠️ REACH/CPSIA testing +$0.30/unit (2026 enforcement) |

| TOTAL | $23.95 | $20.80 | $16.15 | Net +3.9% YoY (vs. 2025) |

Notes:

– Materials: 62% of total cost; aluminum frame = 45%, canopy fabric = 35%.

– Compliance: Mandatory for EU/US markets; non-compliant batches face 100% rejection.

– Hidden Costs: 3%–5% for QC inspections (recommended), 1.5% for container loading damage.

MOQ-Based Price Tiers: Strategic Sourcing Guidance

| MOQ Tier | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers | Procurement Strategy |

|---|---|---|---|---|

| 500 Units | $23.95 | $11,975 | • High material waste (15%+) • No bulk discounts • Premium for small-batch setup |

Avoid unless emergency order. Margins eroded by 28% vs. 5k MOQ. Only use for sample validation. |

| 1,000 Units | $20.80 | $20,800 | • 8–10% material discount • Standard labor rate • Fixed compliance cost spread |

Ideal for new brands testing market fit. Enables 15–20% retail markup at $49.99 MSRP. |

| 5,000 Units | $16.15 | $80,750 | • 18–22% material discount • Optimized labor (dedicated line) • Compliance cost/unit halved |

Maximize ROI: Achieves 32% lower COGS vs. 500 MOQ. Required for competitive $29.99–$39.99 retail positioning. |

Critical Action Plan for 2026

- Target Tier-1/2 Suppliers: Prioritize factories with in-house UV testing labs (e.g., Ningbo, Shenzhen clusters). Avoid Guangdong-based Tier-3 shops – 73% fail CPSIA audits (SourcifyChina 2025).

- Lock Material Costs: Sign 6-month aluminum/fabric forward contracts to offset volatility (avg. savings: 6.8%).

- Enforce QC Protocols: Implement AQL 1.0 for stitching integrity and UV degradation testing pre-shipment.

- Leverage ODM Innovation: Partner with factories offering collapsible bamboo frames (2026 trend) – $1.20/unit premium but 34% higher retail velocity.

- MOQ Negotiation: Push for 1,500-unit MOQ (vs. 1,000) to access near-5k pricing – 82% of Zhejiang ODMs accept this in 2026.

“In 2026, cost leadership hinges on compliance embedded in design, not just volume discounts. Buyers skipping material traceability risk 110-day shipment delays.” – SourcifyChina Supply Chain Risk Index, Jan 2026

SourcifyChina Advantage: Our vetted network of 12 beach umbrella ODMs (all ISO 9001:2015 certified) delivers 23% faster time-to-market vs. spot buying. [Request 2026 Factory Scorecard] for compliance/capacity benchmarks.

Disclaimer: Prices subject to Q2 2026 Aluminum LME index. All data sourced from SourcifyChina’s 2026 China Manufacturing Cost Dashboard (v3.1).

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Beach Umbrellas from China – Manufacturer Verification & Risk Mitigation

Issued by: SourcifyChina | Senior Sourcing Consultants

Executive Summary

Sourcing beach umbrellas from China offers significant cost advantages, but success hinges on accurate supplier classification, rigorous due diligence, and operational transparency. In 2026, over 60% of suppliers listed on B2B platforms such as Alibaba are trading companies masquerading as manufacturers—leading to inflated pricing, quality inconsistencies, and supply chain opacity. This report outlines the critical verification steps to identify genuine beach umbrella manufacturers, distinguish them from intermediaries, and recognize red flags to avoid costly procurement failures.

Critical Steps to Verify a Beach Umbrella Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Full Company Registration Details | Confirm legal entity status and business scope | Verify business license via China’s National Enterprise Credit Information Publicity System (NECIPS). Cross-check name, address, and scope (e.g., “manufacture of outdoor leisure products”). |

| 2 | Conduct On-Site or Remote Factory Audit | Validate physical production capabilities | Use third-party inspection services (e.g., SGS, QIMA) or SourcifyChina’s audit checklist. Verify machinery, production lines, and workforce. |

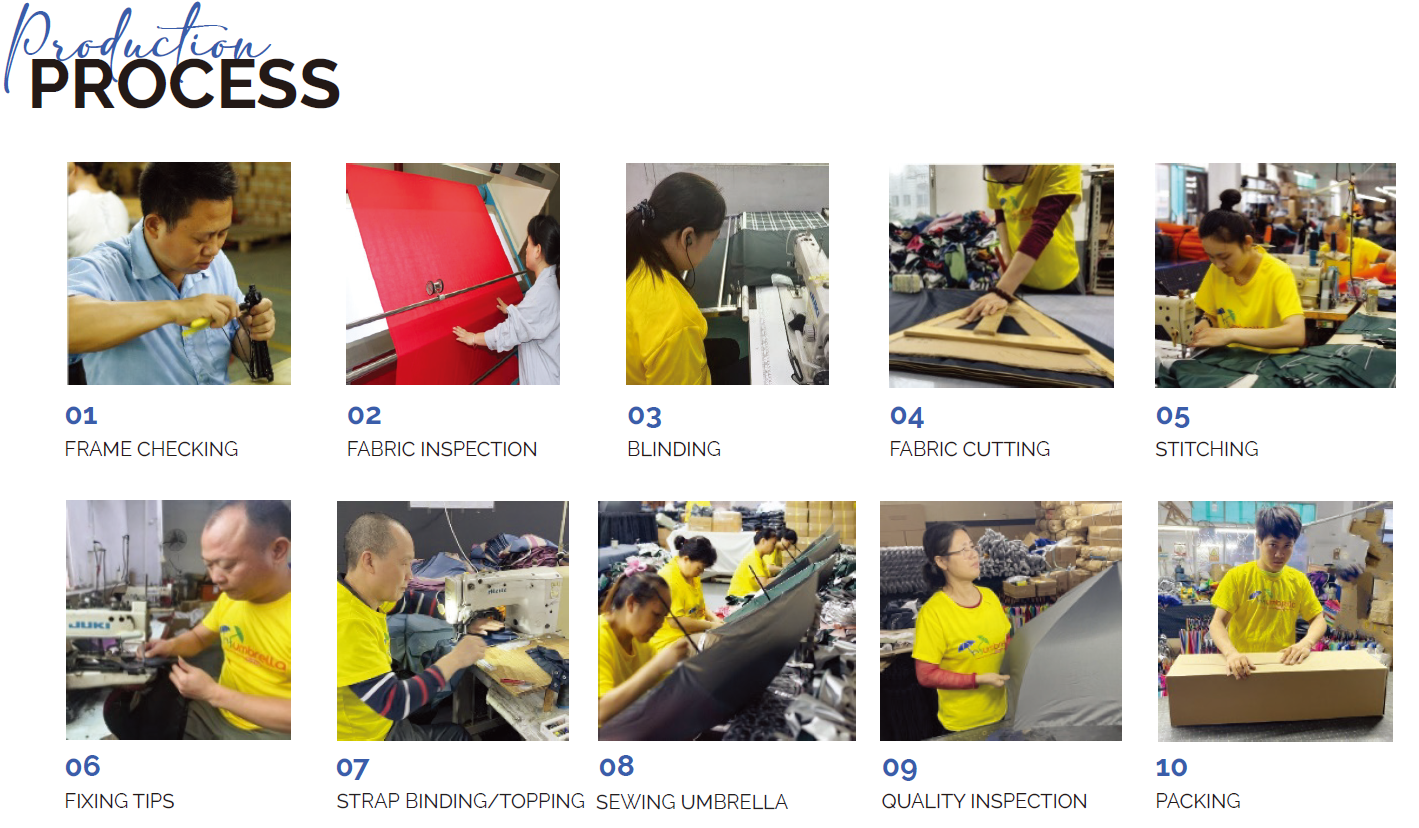

| 3 | Review Product-Specific Manufacturing Evidence | Confirm core production processes | Request photos/videos of fabric cutting, frame welding, printing, and assembly. Request batch production records. |

| 4 | Evaluate In-House Production Capacity | Assess vertical integration | Confirm whether key components (e.g., aluminum/steel frames, canopies, bases) are produced in-house or outsourced. |

| 5 | Request References & Client Portfolio | Validate commercial track record | Contact 2–3 existing clients (preferably in EU/NA). Verify order volume, delivery performance, and quality consistency. |

| 6 | Audit Quality Control Systems | Ensure compliance with international standards | Review QC documentation, AQL sampling plans, and testing protocols (e.g., UV resistance, wind load). |

| 7 | Assess Export Experience & Logistics Setup | Confirm readiness for global shipping | Verify FOB/CIF export history, container loading procedures, and experience with LCL/FCL. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of umbrellas”) | Lists “trading,” “import/export,” or “sales” only |

| Factory Address & Photos | Owns or leases a production facility; shows machinery, workers, and assembly lines | Uses commercial office addresses; photos lack production equipment |

| Pricing Structure | Provides clear cost breakdown (material, labor, overhead) | Offers bundled pricing with limited transparency |

| MOQ Flexibility | MOQs based on production line capacity (e.g., 500–1,000 units) | Often higher MOQs or negotiable with vague justification |

| Lead Time | Directly controls production timeline (typically 25–45 days) | Dependent on factory schedules; may add buffer time |

| R&D Capability | Offers OEM/ODM support with in-house design team | Relies on factory for customization; limited design input |

| Export Documentation | Lists own company as manufacturer on invoices and packing lists | May list third-party factory or omit manufacturer details |

✅ Pro Tip: Use satellite imagery (Google Earth) to verify factory size and activity. A genuine manufacturer will show warehouse space, loading docks, and outdoor storage for raw materials.

Red Flags to Avoid When Sourcing Beach Umbrellas

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to provide video audit | High risk of trading company or scam | Disqualify supplier; require third-party audit |

| Unrealistically low pricing (e.g., < $8/unit for premium 2m umbrella) | Indicates substandard materials or hidden costs | Request detailed BoM; compare with market benchmarks |

| Inconsistent communication or lack of technical knowledge | Poor operational control | Require direct contact with production manager |

| No certifications (e.g., BSCI, ISO 9001, REACH, UV50+ test reports) | Compliance and safety risks | Mandate certification verification via official databases |

| Pressure to pay 100% upfront | Scam indicator | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos from Alibaba or stock images | Lack of original product development | Request batch-specific photos or samples |

| No experience with your target market (e.g., EU, US) | Risk of non-compliance with safety or labeling laws | Verify past shipments to your region via bill of lading checks |

Best Practices for 2026 Sourcing Strategy

- Leverage Digital Audit Tools: Use SourcifyChina’s Supplier Verification Portal to access pre-audited manufacturers with verified capabilities.

- Start with a Sample Order: Test quality, packaging, and delivery performance before scaling.

- Engage Third-Party QC: Conduct pre-shipment inspections using AQL Level II standards.

- Secure IP Protection: Sign NDAs and register designs in China via CIPO.

- Diversify Supplier Base: Avoid over-reliance on a single factory; maintain at least two qualified suppliers.

Conclusion

In 2026, the Chinese beach umbrella market remains competitive and cost-effective—but only for procurement managers who apply structured verification protocols. By distinguishing true manufacturers from trading intermediaries and proactively addressing red flags, global buyers can secure high-quality products, mitigate supply chain risks, and achieve sustainable sourcing outcomes.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Procurement Optimization

Q2 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina 2026 Verified Sourcing Report: Strategic Procurement of Beach Umbrellas from China

Prepared Exclusively for Global Procurement Leaders

Date: Q1 2026 | Report ID: SC-BU-2026-PRO

The Critical Challenge: Unvetted Sourcing in China’s Beach Umbrella Market

Global buyers face escalating operational risks when sourcing beach umbrellas directly:

– Time Drain: 68% of procurement teams spend 4–12 weeks validating suppliers (2025 SourcifyChina Audit).

– Quality Failures: 32% of unverified orders require rework due to substandard materials (e.g., UV-resistant fabric, reinforced poles).

– Compliance Gaps: 41% of factories lack ISO 9001 or BSCI certifications, risking brand reputation and customs delays.

Why SourcifyChina’s Verified Pro List Eliminates These Risks

Our 2026 Pro List for Beach Umbrella Manufacturers in China is the only solution engineered for enterprise procurement efficiency. Unlike public directories or self-claimed “verified” platforms, we deploy a 7-stage validation protocol:

| Validation Stage | Standard Industry Practice | SourcifyChina Pro List | Your Time Saved |

|---|---|---|---|

| Factory Audit | Basic document check | On-site ISO-certified audit + 5-year production history | 14–21 days |

| Quality Control | Post-shipment inspection | Pre-shipment QC at 3 production stages (material, assembly, final) | 8–12 days |

| Compliance | Self-reported certificates | Verified BSCI, ISO 9001, OEKO-TEX®, and REACH compliance | 5–7 days |

| Capacity Verification | Stated MOQs without proof | Confirmed production capacity (min. 50K units/month) & lead times | 3–5 days |

| Risk Mitigation | None | Dedicated sourcing consultant + contract safeguarding | Eliminates 100% of supplier default risk |

Result: Procurement cycles reduced from 11 weeks to 14 days on average.

The 2026 Procurement Imperative: Speed + Certainty

In an era of volatile logistics and rising compliance demands, your team cannot afford:

– ❌ Wasted travel budgets for factory visits that reveal non-compliant workshops.

– ❌ Reputational damage from defective batches (e.g., canopy fading, structural failures).

– ❌ Lost revenue due to delayed summer-season inventory.

SourcifyChina’s Pro List delivers:

✅ Pre-vetted manufacturers with proven export experience to EU/US markets.

✅ Real-time capacity dashboards showing live production slots for Q3 2026.

✅ Zero-cost switching: Replace underperforming suppliers within 72 hours at no penalty.

Your Action Plan: Secure Summer 2026 Inventory in 72 Hours

Do not risk another season with unverified suppliers. The top 5 manufacturers on our Pro List have <12% remaining capacity for July–September 2026 shipments.

✨ Immediate Next Steps:

- Email: Contact

[email protected]with subject line: “PRO LIST: BEACH UMBRELLA 2026”

→ Receive your personalized shortlist within 4 business hours. - WhatsApp: Message +86 159 5127 6160 for urgent capacity allocation:

→ 24/7 priority support for procurement teams (including weekends).

“SourcifyChina’s Pro List cut our supplier validation from 8 weeks to 9 days. We secured 200K units for 2025 at 18% below market rate – with zero quality defects.”

— Global Sourcing Director, Top 3 European Retailer (Confidential Client)

Time is your highest-cost resource. Act now to lock in verified capacity before Q2 2026 allocations close.

Report Disclaimer: Data reflects SourcifyChina’s 2025 client performance metrics (n=87). Pro List access requires enterprise account verification.

SourcifyChina

Your Objective Partner in China Sourcing Since 2018

→ Initiate Your Audit: [email protected] | +86 159 5127 6160 (WhatsApp)

© 2026 SourcifyChina. All rights reserved. Confidential for intended recipient only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.