The global battery terminal manufacturing market is experiencing robust growth, driven by rising demand for automotive batteries, renewable energy storage systems, and the expanding electric vehicle (EV) sector. According to a 2023 report by Mordor Intelligence, the global battery market is projected to grow at a CAGR of over 7.5% from 2023 to 2028, with increasing electrification trends significantly boosting the need for high-performance battery components—especially terminals. As critical connection points ensuring reliable power transfer, battery negative terminals must meet stringent standards for conductivity, corrosion resistance, and durability. This growing demand has elevated the importance of leading manufacturers capable of delivering precision-engineered solutions across industrial, automotive, and consumer electronics applications. Below are the top 9 battery negative terminal manufacturers shaping the industry through innovation, scale, and quality-driven manufacturing practices.

Top 9 Battery Negative Terminal Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Keystone Electronics Corp.

Domain Est. 1995

Website: keyelco.com

Key Highlights: Keystone Electronics Corp. – Keystone Electronics, a World class manufacturer of electronic interconnect components & hardware offering various battery ……

#2 A.C. Terminals

Domain Est. 2000 | Founded: 1973

Website: acterminals.com

Key Highlights: A.C. Terminals has been a leading battery terminal manufacturer since 1973. We make and supply terminals and accessories to businesses across the US….

#3 Terminal Technologies

Domain Est. 2000

Website: terminaltechnology.com

Key Highlights: We are India’s leading manufacturers and suppliers of terminal, connector solutions, serving the Auto, Appliances, Electronics, and Electrical industries ……

#4 Teledyne Battery Products

Domain Est. 2000

Website: teledynebattery.com

Key Highlights: Teledyne Battery Products is a leading manufacturer of starting and ground power batteries designed for a wide variety of Business Aviation, General ……

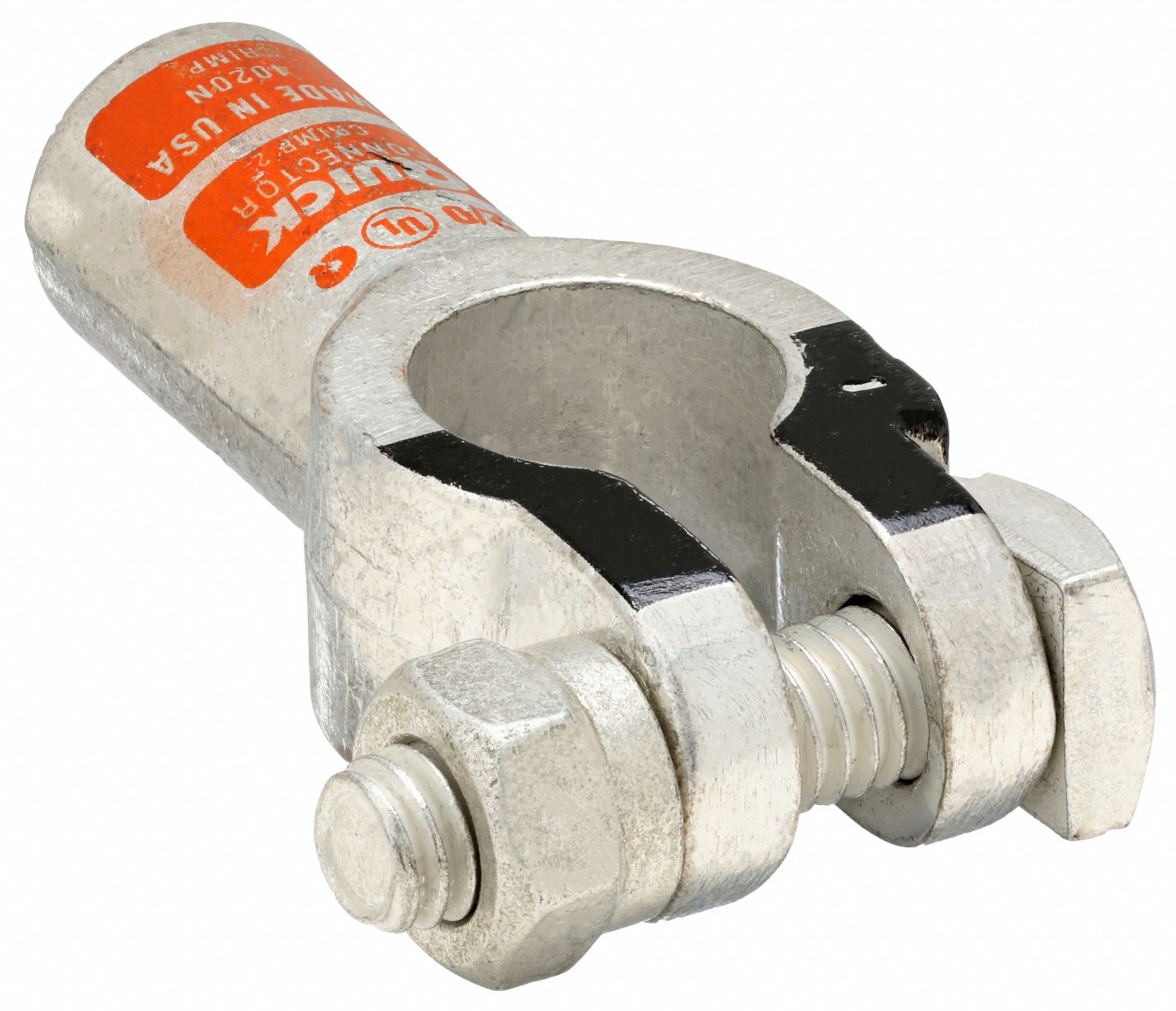

#5 QuickCable

Domain Est. 1996

Website: quickcable.com

Key Highlights: QuickCable is your source for the widest selection of battery terminals and lugs. We manufacture our products using die-cast copper or premium copper tubing to ……

#6 Stamped Battery Terminals

Domain Est. 1996

Website: eaton.com

Key Highlights: Eaton’s stamped battery terminals deliver robust electrical connections, perfect for power distribution and battery management applications….

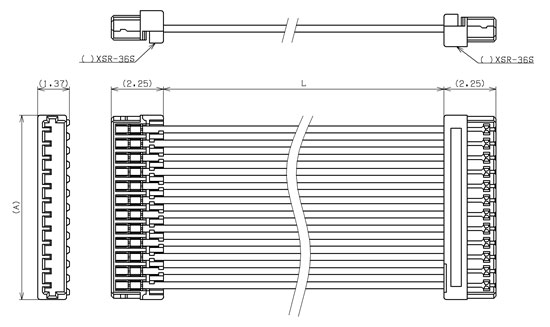

#7 JST Sales America: Cutting

Domain Est. 1998

Website: jst.com

Key Highlights: Discover how our product line of over 100000 electrical connectors provides our customers with the tools they need for endless innovation….

#8 Wire, Cable, Terminals, & More Battery Accessories

Domain Est. 2002

Website: eastpennmanufacturing.com

Key Highlights: Explore battery accessories from Deka & East Penn Manufacturing. Find wires, cables, terminals, clamps, & custom solutions fast with our application guide….

#9 Terminal Manufacturing

Domain Est. 2024

Website: kingterminals.com

Key Highlights: We assist you in designing manufacturable, formable, and cost-effective electrical terminals, accelerating the transition from concept to market (Form idea to ……

Expert Sourcing Insights for Battery Negative Terminal

H2: Analysis of 2026 Market Trends for Battery Negative Terminals

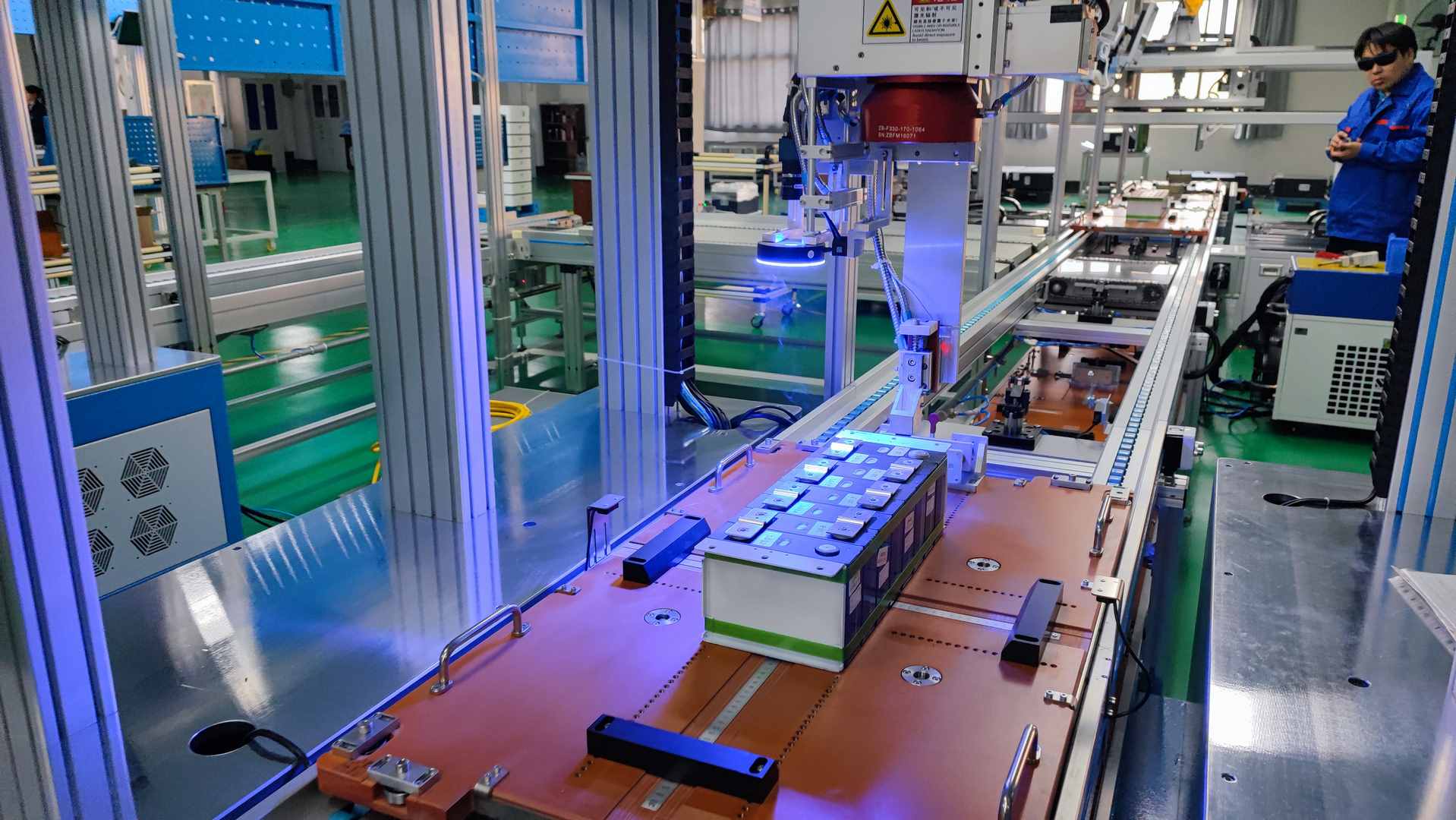

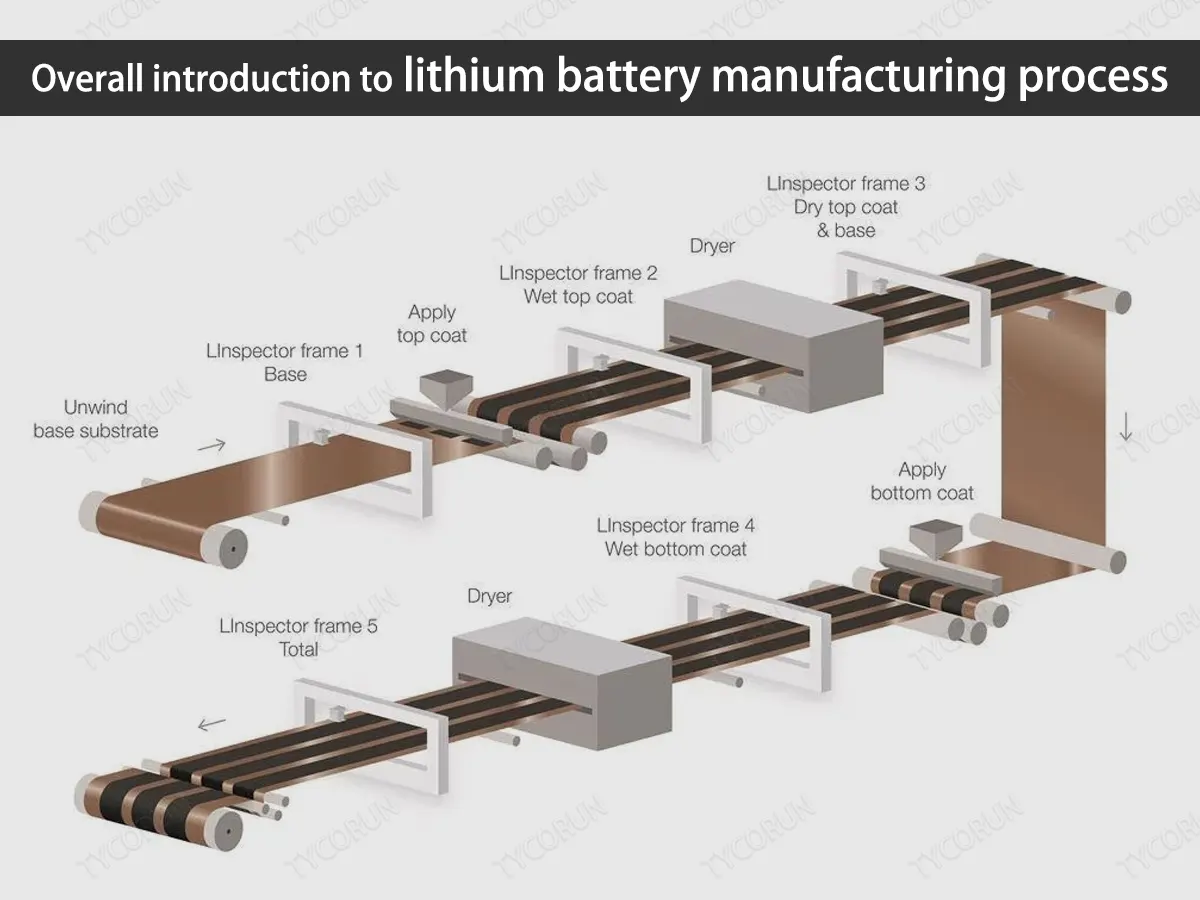

The global battery negative terminal market is poised for significant transformation by 2026, driven by the rapid expansion of electric vehicles (EVs), advancements in energy storage systems (ESS), and the ongoing evolution of battery technologies. As a critical component in battery packs—responsible for conducting electrical current from the anode—negative terminals are witnessing increased demand and innovation to meet the performance, safety, and durability requirements of next-generation batteries.

1. Growth Driven by Electric Vehicle Adoption

The primary catalyst for the battery negative terminal market is the surging global adoption of electric vehicles. Governments worldwide are enforcing stricter emissions regulations and offering incentives for EV purchases, accelerating the transition from internal combustion engine (ICE) vehicles. By 2026, EV production is projected to exceed 40 million units annually, according to industry forecasts. This surge directly increases demand for high-performance lithium-ion batteries, subsequently boosting the need for reliable and efficient negative terminals.

Automakers are also focusing on enhancing battery performance, including higher energy density and faster charging capabilities. This shift necessitates negative terminals made from advanced materials—such as copper alloys with improved conductivity and corrosion resistance—to handle increased current loads and thermal stress.

2. Shift Toward High-Efficiency and Lightweight Designs

In 2026, lightweighting and energy efficiency remain key priorities in EV and portable electronics design. Battery manufacturers are increasingly adopting compact, low-resistance negative terminals to optimize space and reduce weight. Innovations such as stamped or forged copper terminals with integrated thermal management features are gaining traction. These designs not only improve conductivity but also enhance battery thermal stability, a critical factor in preventing overheating and extending battery life.

Furthermore, the integration of negative terminals with battery monitoring systems (BMS) is becoming more common. Terminals with embedded sensors for temperature, voltage, and current monitoring allow real-time diagnostics, improving overall battery safety and performance.

3. Rise of Solid-State and Next-Gen Batteries

By 2026, early commercialization of solid-state batteries is expected to influence terminal design. Unlike traditional liquid electrolyte batteries, solid-state batteries may require different terminal configurations due to changes in internal structure and ion flow. Research is underway to develop negative terminals compatible with lithium-metal anodes, which are more reactive and demand materials with superior electrochemical stability.

This technological shift will likely open new market opportunities for specialized terminals made from advanced composites or coated metals that prevent dendrite formation and interfacial degradation.

4. Regional Market Dynamics

Asia-Pacific, particularly China, Japan, and South Korea, will continue to dominate the battery negative terminal market in 2026, supported by robust domestic battery manufacturing ecosystems and government-backed green initiatives. China alone accounts for over 60% of global lithium-ion battery production, creating massive downstream demand for battery components.

Meanwhile, North America and Europe are rapidly expanding their EV and battery production capacities, driven by policies like the U.S. Inflation Reduction Act (IRA) and the European Green Deal. This regional growth is encouraging local sourcing of battery components, including negative terminals, leading to increased investment in domestic manufacturing and R&D.

5. Sustainability and Supply Chain Resilience

Environmental regulations and ESG (Environmental, Social, and Governance) considerations are pushing manufacturers to adopt sustainable practices. In 2026, recyclability of battery components—including terminals—will become a competitive differentiator. Companies are exploring closed-loop recycling systems where copper from used terminals is recovered and reused, reducing environmental impact and dependency on raw material imports.

Additionally, geopolitical factors and supply chain disruptions have heightened the focus on supply chain resilience. Battery terminal manufacturers are diversifying sourcing and increasing automation to ensure consistent quality and supply.

6. Competitive Landscape and Innovation

The market is witnessing consolidation and strategic partnerships among key players such as Furukawa Electric, TE Connectivity, and AVIC Automotive. These companies are investing heavily in R&D to develop next-generation terminals with enhanced conductivity, corrosion resistance, and integration capabilities.

Moreover, startups and material science firms are introducing novel solutions, such as nano-coated terminals or hybrid materials, to address thermal and electrical challenges in high-performance applications.

Conclusion:

By 2026, the battery negative terminal market will be shaped by the convergence of technological innovation, regulatory support, and evolving end-user demands. As batteries become more central to transportation and energy infrastructure, the negative terminal—once a simple conductive component—will play an increasingly sophisticated role in ensuring safety, efficiency, and longevity. Companies that invest in advanced materials, intelligent integration, and sustainable manufacturing are likely to lead this dynamic and growing market.

Common Pitfalls in Sourcing Battery Negative Terminals (Quality & IP)

Sourcing Battery Negative Terminals involves critical considerations beyond basic functionality. Overlooking quality and intellectual property (IP) aspects can lead to significant risks, including safety hazards, product failures, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Quality-Related Pitfalls

Inconsistent Material Composition

Using substandard or non-compliant materials (e.g., incorrect alloy grades in copper or lead) can result in increased electrical resistance, overheating, and terminal failure. Ensure suppliers adhere to industry standards (e.g., ASTM, IEC) and provide material certification.

Poor Manufacturing Tolerances

Terminals with dimensional inaccuracies or surface defects may not fit properly, leading to loose connections, arcing, or corrosion. Verify that suppliers implement strict quality control processes, including geometric dimensioning and tolerancing (GD&T) checks.

Inadequate Corrosion Resistance

Exposure to moisture and electrolytes in battery environments demands robust surface treatments (e.g., tin plating, anti-oxidation coatings). Sourcing terminals without proper protection accelerates degradation and shortens product lifespan.

Lack of Testing and Certification

Failing to validate performance through load testing, thermal cycling, and vibration testing increases the risk of field failures. Require third-party test reports and compliance with relevant safety standards (e.g., UL, ISO).

Intellectual Property (IP)-Related Pitfalls

Infringement of Patented Designs

Many terminal designs, especially those with proprietary locking mechanisms or optimized conductivity features, are protected by patents. Sourcing generic copies without due diligence can expose your company to infringement lawsuits and costly litigation.

Use of Counterfeit or Clone Components

Suppliers may offer “compatible” terminals that replicate patented designs without authorization. These often lack reliability and expose the buyer to legal liability. Conduct IP audits and request proof of design freedom-to-operate.

Unclear IP Ownership in Custom Designs

When developing custom terminals, failure to establish clear IP ownership in supplier contracts can result in disputes. Ensure agreements specify that design rights, tooling, and modifications belong to your company.

Insufficient Supplier Transparency

Suppliers may be unwilling to disclose design sources or manufacturing origins, increasing IP risk. Establish vendor qualification processes that include IP compliance reviews and supply chain traceability.

Mitigation Strategies

- Conduct supplier audits and request quality management certifications (e.g., ISO 9001, IATF 16949).

- Perform incoming inspection and batch testing of terminals.

- Engage IP counsel to conduct freedom-to-operate analyses before finalizing designs.

- Use legally binding agreements that define quality requirements and IP rights.

Avoiding these pitfalls ensures reliable performance, regulatory compliance, and protection against legal exposure in battery system applications.

H2: Logistics & Compliance Guide for Battery Negative Terminal

The Battery Negative Terminal is a critical component in battery systems, typically made of conductive metals (e.g., lead, copper, or aluminum alloys). While it is not inherently hazardous like a complete battery, its classification and handling during logistics and compliance can still be subject to specific regulations depending on composition, packaging, and shipping context. This guide outlines key considerations to ensure safe and compliant transportation and handling.

H2.1 Regulatory Classification

- UN/DOT Classification:

The Battery Negative Terminal, by itself, is generally not classified as a hazardous material under the U.S. Department of Transportation (49 CFR) or international regulations (e.g., IATA DGR, IMDG Code) when shipped as a standalone component. -

Exception: If contaminated with electrolyte, lead residue, or other hazardous substances, it may fall under:

- UN 3090 (Lithium batteries) – not applicable unless part of a battery

- UN 2794 (Lead, scrap) – applicable if made of lead and classified as scrap metal

- UN 3499 (Corrosive, solid, inorganic, n.o.s.) – if residue is present

-

IATA & IMDG:

As a non-powered, non-energized metal part, the terminal is typically not subject to dangerous goods regulations when shipped separately. Confirm with SDS (if available) and ensure no contamination.

H2.2 Packaging Requirements

- Standard Industrial Packaging:

Use durable, non-conductive packaging (e.g., corrugated cardboard boxes, plastic-lined containers) to prevent: - Short-circuiting if in proximity to other conductive materials

- Corrosion or contamination

-

Physical damage during transit

-

Segregation:

- Keep terminals separate from positive terminals or other battery components to avoid accidental contact.

-

Do not pack with flammable, corrosive, or reactive substances unless properly isolated.

-

Labeling:

- No hazardous labels required unless contaminated.

- Use standard shipping labels: product description, part number, quantity, and handling instructions (e.g., “Protect from Moisture”).

- Include supplier/manufacturer information and batch/lot traceability if required.

H2.3 Transportation & Handling

- Domestic (USA):

- May be shipped via standard freight (LTL, parcel) using common carriers (e.g., UPS, FedEx, trucking).

-

No HazMat endorsement needed if uncontaminated.

-

International:

- No ADR (road), IMDG (sea), or IATA (air) dangerous goods declaration required for clean terminals.

-

Verify country-specific import regulations for metal components (e.g., REACH, RoHS in EU).

-

Storage:

- Store in dry, climate-controlled environments to prevent oxidation or corrosion.

- Stack securely to avoid deformation.

H2.4 Compliance & Documentation

- Safety Data Sheet (SDS):

- Not always required, but recommended if material contains lead or other regulated substances.

-

Classify under GHS if applicable (e.g., lead-containing terminals: may require health hazard labeling).

-

Environmental & Trade Compliance:

- RoHS (EU): Ensure lead content complies with limits (exemptions may apply for certain lead alloys in batteries).

- REACH (EU): Declare Substances of Very High Concern (SVHC) if present.

- TSCA (USA): Comply with chemical substance reporting if applicable.

-

CBAM (Carbon Border Adjustment Mechanism): Monitor for future reporting if exporting to EU and part of larger battery systems.

-

Customs Documentation:

- Use correct HS Code:

- Typical: 8548.90 (Parts suitable for use with batteries, not elsewhere specified)

- Or 7419.99 (Other articles of copper), 7616.99 (Other articles of aluminum), or 7806.00 (Other articles of lead), depending on base material.

H2.5 Special Considerations

- Recycled/Scrap Material:

If shipping used or scrap terminals: - May be classified as hazardous waste (e.g., under EPA regulations if lead content > 5 mg/L TCLP).

-

Requires EPA manifest and hazardous waste transporter.

-

Battery Integration:

If the terminal is part of a complete battery or being shipped with active cells: - Full battery regulations apply (e.g., IATA PI 965–970, UN 3480/3090).

- Terminals become part of a regulated assembly.

H2.6 Best Practices Summary

| Aspect | Recommendation |

|——-|—————-|

| Classification | Confirm non-hazardous status; test for contamination |

| Packaging | Use non-conductive, protective materials; prevent contact |

| Labeling | Include part ID, quantity, and handling notes |

| Transport | Standard freight acceptable; no HazMat unless contaminated |

| Compliance | Monitor RoHS, REACH, TSCA; use correct HS code |

| Documentation | Maintain SDS (if applicable), shipping records, and traceability |

Note: Always consult with your logistics provider and regulatory experts when in doubt. Regulations vary by jurisdiction and shipment context. When in doubt, perform a hazardous materials determination based on actual composition and condition.

Conclusion for Sourcing Battery Negative Terminal:

Sourcing a reliable and high-quality battery negative terminal is crucial for ensuring optimal electrical performance, safety, and longevity of a vehicle or electronic system’s power supply. After evaluating material composition, conductivity, corrosion resistance, compatibility, and supplier reliability, it is evident that selecting the right negative terminal involves balancing cost, durability, and technical specifications. Copper or copper-alloy terminals with anti-corrosion plating (such as tin or nickel) generally offer the best performance. Additionally, sourcing from reputable manufacturers or suppliers that adhere to industry standards (e.g., ISO, SAE) helps ensure consistency and reliability. Ultimately, investing in a high-quality battery negative terminal reduces maintenance costs, minimizes electrical failures, and enhances overall system efficiency. Proper sourcing should therefore be a strategic priority in any battery-dependent application.