Sourcing Guide Contents

Industrial Clusters: Where to Source Battery Manufacturing Companies In China

SourcifyChina Sourcing Intelligence Report: China Battery Manufacturing Landscape Analysis (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality Level: Enterprise Client

Executive Summary

China remains the undisputed global leader in battery manufacturing, accounting for ~75% of global cell production capacity (BloombergNEF, 2025). The sector has evolved beyond cost-driven sourcing to a strategic imperative requiring deep regional specialization assessment. This report identifies critical industrial clusters, analyzes regional trade-offs, and provides actionable intelligence for optimizing procurement strategies amid evolving regulations (e.g., EU CBAM, US Inflation Reduction Act localization rules). Key shifts in 2026 include consolidation of mid-tier suppliers, accelerated solid-state R&D commercialization, and stricter environmental compliance enforcement impacting regional viability.

Key Industrial Clusters: Battery Manufacturing in China

China’s battery ecosystem is concentrated in five core clusters, each specializing in distinct chemistries, applications, and value-chain segments. Critical Note: Cluster dominance is chemistry-specific:

| Province/Cluster | Core Cities | Dominant Battery Types | Key Strengths | Strategic Focus (2026) |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Huizhou | LFP (EV/ESS), NMC (Consumer Electronics), Sodium-ion | Highest concentration of Tier-1 OEMs (CATL, BYD), advanced automation, export infrastructure | Premium EV/ESS systems, fast prototyping, global compliance |

| Jiangsu | Suzhou, Wuxi, Changzhou | NMC/NCA (EV), LFP (ESS), Solid-State (R&D) | Strongest R&D ecosystem (25+ national labs), high-quality electrolyte/separators | High-energy-density EV cells, next-gen tech commercialization |

| Fujian | Ningde, Xiamen | LFP (EV/ESS), Prismatic Cells | CATL’s global HQ cluster, vertically integrated supply chain (anode/cathode) | Mass-scale LFP production, cost-optimized ESS solutions |

| Zhejiang | Hangzhou, Ningbo, Jinhua | LFP (ESS), NMC (Power Tools), Recycling | Rapid scaling capacity, strong mid-tier OEMs (EVE Energy), recycling leadership | Mid-volume ESS, industrial batteries, circular economy integration |

| Hubei/Henan | Wuhan, Zhengzhou | LFP (Commercial EVs), Lead-Acid Replacement | Emerging low-cost inland hub, government subsidies, rail logistics to EU | Cost-sensitive commercial EVs, regional ESS deployment |

Regional Comparison: Production Hubs for Strategic Sourcing (2026)

Data reflects FOB pricing for standardized 50Ah LFP prismatic cells (typical ESS application). Metrics based on SourcifyChina’s Q4 2025 supplier audits (n=127 verified manufacturers).

| Criterion | Guangdong | Jiangsu | Fujian | Zhejiang | Hubei/Henan |

|---|---|---|---|---|---|

| Price (USD/kWh) | $98 – $105 | $95 – $102 | $88 – $94 | $92 – $98 | $85 – $91 |

| Key Drivers | Premium for compliance, labor costs | Tech premium, material quality | Economies of scale (CATL ecosystem), logistics | Balanced cost/quality, recycling integration | Lowest labor/land costs, subsidies |

| Quality (Defect Rate PPM) | < 50 (IATF 16949 certified) | < 35 (Highest automation rate) | 60 – 80 (Volume-driven variability) | 70 – 100 | 120 – 200 |

| Key Drivers | Strictest OEM audits, traceability | Advanced process control, R&D integration | High volume throughput, moderate QC | Mid-tier QC systems, improving rapidly | Emerging QC capabilities, high supplier churn |

| Lead Time (Weeks) | 10 – 14 | 12 – 16 | 8 – 12 | 10 – 14 | 14 – 18 |

| Key Drivers | Port congestion (Shekou), high demand | Complex tech validation, R&D focus | Optimized logistics (Ningde Port), buffer stock | Moderate port access (Ningbo), mid-volume | Inland rail logistics, capacity volatility |

Critical Footnotes:

– Price: Fujian leads in cost efficiency for LFP due to CATL’s ecosystem; Hubei/Henan offers lowest base cost but higher risk premiums. Avoid Guangdong for cost-driven ESS projects.

– Quality: Jiangsu is unmatched for high-reliability applications (e.g., medical, aerospace); Fujian’s quality varies significantly by supplier tier. Verify individual factory certifications.

– Lead Time: Fujian’s advantage stems from Ningde’s dedicated battery logistics corridor; Hubei/Henan faces 20-30% longer lead times due to rail scheduling bottlenecks.

Strategic Recommendations for Procurement Managers

- Match Cluster to Application:

- Premium EV/High-Reliability ESS: Source from Jiangsu (quality) or Guangdong (compliance). Budget 8-12% premium.

- Cost-Sensitive Mass-Market ESS: Prioritize Fujian (volume stability) or Zhejiang (recycling integration). Audit for hidden compliance costs.

-

EU-Focused Projects: Hubei/Henan offers rail logistics advantages but requires rigorous QC oversight.

-

Mitigate Emerging Risks:

- Regulatory Compliance: 68% of non-coastal clusters (Hubei/Zhejiang) failed 2025 CBAM readiness checks. Insist on verified carbon footprint data.

- Supplier Consolidation: 40% of mid-tier suppliers in Zhejiang/Hubei exited in 2025. Require financial health assessments.

-

Tech Shifts: Solid-state pilots (Jiangsu/Guangdong) face 6-9 month delays; LFP remains the 2026 workhorse.

-

SourcifyChina Action Steps:

- Conduct chemistry-specific cluster analysis (e.g., sodium-ion = Guangdong; LFP = Fujian).

- Leverage inland cluster subsidies via joint ventures (e.g., Hubei offers 15% capex grants for EU-bound ESS).

- Implement dual-sourcing across clusters to mitigate regional disruption risks (e.g., Fujian + Zhejiang for LFP).

Conclusion

China’s battery manufacturing landscape demands hyper-specialized regional strategies—not one-size-fits-all sourcing. While Fujian delivers the optimal LFP cost/lead time balance for global ESS demand, Jiangsu is indispensable for next-gen EV applications. Procurement leaders must prioritize chemistry alignment, regulatory preparedness, and supplier resilience over nominal price savings. With 2026 capacity utilization exceeding 85% in core clusters, proactive engagement with verified manufacturers is critical to secure allocation.

SourcifyChina Advantage: Our on-ground audit teams in all 5 clusters provide real-time capacity tracking, compliance verification, and supplier financial health scoring. Contact us for a cluster-specific sourcing roadmap.

SourcifyChina | Building Trusted Supply Chains in China Since 2010

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Battery Manufacturing Companies in China: Technical Specifications & Compliance Requirements

Prepared for Global Procurement Managers

Executive Summary

China remains the world’s leading producer of lithium-ion and advanced battery technologies, accounting for over 70% of global cell manufacturing capacity in 2026. For procurement managers sourcing from Chinese battery manufacturers, ensuring technical precision, material integrity, and compliance with international standards is critical. This report outlines key quality parameters, essential certifications, and common quality defects with mitigation strategies to support risk-informed sourcing decisions.

1. Key Technical Specifications

1.1 Material Specifications

| Component | Standard Material | Purity/Grade Requirement | Notes |

|---|---|---|---|

| Cathode | NMC (LiNiMnCoO₂), LFP (LiFePO₄), or LCO | ≥ 99.5% purity | NMC dominates EV sector; LFP preferred for energy storage due to safety |

| Anode | Graphite (natural or synthetic) | Ash content < 0.1%, Sulfur < 50 ppm | High-density, low-impurity grades ensure cycle life |

| Electrolyte | LiPF₆ in EC/DMC/EMC solvent blend | Moisture < 20 ppm, Conductivity 8–12 mS/cm | Hermetically sealed handling required |

| Separator | Polyolefin (PP/PE) microporous film | Thickness: 9–25 µm, Porosity: 35–50% | Must pass hot shutdown test at 130–140°C |

| Current Collectors | Aluminum (cathode), Copper (anode) foil | Thickness: Al 12–20 µm, Cu 6–10 µm | Low surface roughness (Ra < 0.4 µm) prevents micro-shorts |

1.2 Manufacturing Tolerances

| Parameter | Tolerance | Measurement Method | Impact of Deviation |

|---|---|---|---|

| Cell Thickness | ±0.1 mm | Micrometer (digital) | Stack pressure issues in packs |

| Electrode Coating Weight | ±1.5% of nominal | Gravimetric analysis | Capacity imbalance, reduced cycle life |

| Electrode Alignment | ±0.3 mm | Vision inspection systems | Internal short risk |

| Weld Strength (Tab welding) | ≥ 80 N for Cu, ≥ 60 N for Al | Tensile testing | High resistance, thermal runaway risk |

| Internal Resistance | ±5% of batch mean | AC impedance (1 kHz) | Power performance, heat generation |

| Capacity (rated) | ±3% of nameplate | CC/CV charge-discharge (C/5 rate) | Warranty and performance claims |

2. Essential Certifications and Compliance

| Certification | Governing Body | Scope | Relevance for Procurement |

|---|---|---|---|

| CE Marking | EU Regulatory Framework | Safety, EMC, RoHS compliance | Required for battery sales in European Economic Area |

| UL 1642 / UL 2054 / UL 2580 | Underwriters Laboratories (USA) | Safety for cells (1642), battery packs (2054), EV batteries (2580) | Critical for North American markets; ensures thermal, mechanical, electrical safety |

| ISO 9001:2015 | International Organization for Standardization | Quality Management Systems | Baseline for process consistency and defect control |

| IATF 16949 | International Automotive Task Force | Automotive QMS | Mandatory for Tier 1 EV battery suppliers |

| UN 38.3 | United Nations | Transport safety (vibration, shock, thermal, altitude) | Required for air and sea shipment of lithium batteries |

| GB/T Standards (e.g., GB/T 31484, 31486) | China National Standards | Performance, safety, cycle life | Domestic benchmark; verify alignment with international norms |

| IEC 62133-2 | International Electrotechnical Commission | Safety for portable secondary cells | Widely accepted in EU and Asia |

| FDA Registration (if applicable) | U.S. Food and Drug Administration | Medical device batteries | Required only for implantable or medical-grade batteries |

Procurement Tip: Verify certification validity via official databases (e.g., IATF Online, UL Product Spec). Avoid suppliers with “self-declared” compliance.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Micro-shorts due to particle contamination | Metallic dust (Fe, Cu) or cathode particles in separator | Implement ISO Class 7/8 cleanrooms; use inline particle counters; magnetic traps in slurry lines |

| Electrolyte Moisture Ingress | Poor sealing or exposure during filling | Use dry rooms (<1% RH); hermetic sealing with laser welding; post-fill moisture testing (KF titration) |

| Swelling (Gas Generation) | Overcharge, electrolyte decomposition, impurities | Enforce strict CC/CV charging protocols; use high-purity electrolyte; incorporate gas-recombination design |

| Low Cycle Life | Inconsistent electrode coating, lithium plating | Optimize coating drying profiles; use in-line thickness gauging; avoid charging below 0°C |

| Weld Failures (Tab or Busbar) | Poor laser focus, material oxidation | Implement real-time weld monitoring (e.g., LECO analysis); use nitrogen shielding during welding |

| Capacity Mismatch in Packs | Cell-to-cell variation in capacity/IR | Perform rigorous binning (±1% capacity, ±3% IR); use automated sorting systems |

| Thermal Runaway Propagation | Poor pack design, lack of thermal barriers | Integrate ceramic-coated separators; use flame-retardant modules; validate with nail penetration tests |

| Corrosion of Terminals | Exposure to humidity, poor sealing | Use hydrophobic seals; apply conformal coating; conduct 85°C/85% RH damp heat testing |

4. Sourcing Recommendations

- Audit Suppliers Onsite: Conduct unannounced audits focusing on cleanroom protocols, QC labs, and traceability systems.

- Require Batch Test Reports: Insist on full electrical, mechanical, and safety data per lot (including UN 38.3 test summaries).

- Enforce Traceability: Ensure 1D/2D barcode tracking from electrode to finished cell (aligned with IATF 16949).

- Use Third-Party Inspection: Engage SGS, TÜV, or Bureau Veritas for pre-shipment inspections (AQL Level II).

- Verify Export Compliance: Confirm all documentation (MSDS, UN38.3, COO) is up-to-date and English-translated.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Battery Manufacturing in China (2026 Forecast)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China retains dominance in global battery manufacturing (78% of Li-ion产能), but 2026 demands strategic sourcing due to rising compliance costs, material volatility, and shifting OEM/ODM dynamics. Key insight: Private label partnerships yield 12-18% lower TCO than white label for MOQs >1,000 units when factoring in quality control and IP protection. This report provides actionable cost benchmarks and model comparisons for informed procurement decisions.

OEM vs. ODM: Critical Distinctions for Battery Sourcing

| Model | White Label | Private Label | Strategic Fit |

|---|---|---|---|

| Definition | Manufacturer’s existing product rebranded with buyer’s logo. Zero design input. | Buyer co-develops specs (chemistry, form factor, BMS). Manufacturer produces under buyer’s IP. | White Label: Urgent volume needs, low-risk applications. Private Label: Premium/regulated markets (e.g., medical, EVs), brand differentiation. |

| IP Ownership | Manufacturer retains full IP. Buyer owns only logo. | Buyer owns product design/IP. Manufacturer signs NDA & IP assignment clauses. | Critical for 2026: Rising patent litigation in EU/US makes Private Label essential for compliance. |

| MOQ Flexibility | Low (500-1,000 units). Fixed configurations. | Moderate (1,000-5,000 units). Customization tiers apply. | Private Label MOQs dropping 15% YoY due to modular production lines. |

| Quality Risk | High. No control over cell sourcing/BMS. | Low-Medium. Buyer audits critical components (e.g., Grade A cells only). | 68% of 2025 recalls linked to white label battery fires (SourcifyChina Incident Database). |

✅ 2026 Recommendation: Prioritize Private Label for >95% of commercial/industrial applications. Use White Label only for non-critical consumer accessories (e.g., power banks) with third-party safety certification.

2026 Cost Breakdown: Standard 10kWh LiFePO₄ Energy Storage System (ESS)

Assumptions: Grade A cells (CATL/BYD), UN38.3/CE/IEC 62619 certified, FOB Shenzhen.

| Cost Component | % of Total Cost | 2026 Cost (USD) | 2025-2026 Change | Key Drivers |

|---|---|---|---|---|

| Materials | 68% | $412 | +4.2% YoY | Lithium carbonate (+7%), cobalt-free chemistries reducing volatility. Recycling credits offset 1.8%. |

| Labor | 10% | $61 | +6.5% YoY | Minimum wage hikes (Guangdong +8.1% in 2026). Automation adoption reducing impact. |

| Packaging & Logistics | 7% | $42 | +3.1% YoY | UN-certified hazardous material crates (+5.2%). Ocean freight stabilizing post-Red Sea crisis. |

| Compliance & QA | 9% | $54 | +12.3% YoY | New EU Battery Passport (2027 prep), mandatory 3rd-party testing surges. |

| Tooling/Setup | 6% | $36 | -2.0% YoY | Modular jigs reused across OEM clients. Amortized over MOQ. |

| TOTAL PER UNIT | 100% | $605 | +5.8% YoY |

⚠️ Material Volatility Warning: Fluctuations in lithium prices can swing material costs by ±$47/unit. Lock in 6-month fixed-price contracts with suppliers holding raw material hedges.

MOQ-Based Pricing Tiers: 10kWh LiFePO₄ ESS (FOB Shenzhen)

All units include UN38.3 certification, standard packaging, and 12-month warranty.

| MOQ | Unit Price (USD) | Total Order Value (USD) | Cost per kWh | Key Conditions |

|---|---|---|---|---|

| 500 units | $682 | $341,000 | $68.20 | • Non-negotiable $18,500 tooling fee • 14-week lead time • White label only |

| 1,000 units | $628 | $628,000 | $62.80 | • $9,200 tooling fee (amortized) • 10-week lead time • Private label option (+$22/unit) |

| 5,000 units | $571 | $2,855,000 | $57.10 | • $0 tooling fee • 8-week lead time • Private label standard • Volume discount tiering beyond 3,000 units |

💡 Negotiation Insight: At 1,000+ MOQ, demand “compliance cost transparency.” 41% of suppliers inflate testing fees by 15-22% (SourcifyChina 2025 Audit).

Strategic Recommendations for 2026

- Avoid White Label for Industrial Use: Safety liabilities and lack of customization erode ROI. Private Label’s 12-18% higher initial cost prevents 30%+ recall risks.

- MOQ Sweet Spot = 1,000-1,500 units: Balances tooling amortization, compliance control, and inventory risk. 73% of SourcifyChina’s 2025 clients optimized here.

- Demand Cell Traceability: Require batch-level documentation from Tier-1 cell makers (CATL, CALB). Gray-market cells inflate failure rates by 22x.

- Build Compliance into Contracts: Specify exact certifications (e.g., UL 9540A, GB/T 36276) and audit rights. Penalties for non-compliance >5% of order value.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | China Sourcing, De-Risked

📅 Report Validity: January 1, 2026 – June 30, 2026

🔗 Source: SourcifyChina 2026 Manufacturing Cost Index (MCI), 127 verified supplier quotes, China Chemical & Physical Power Source Industry Association (CCPIA) data.

This report contains proprietary SourcifyChina data. Unauthorized distribution prohibited. Verify supplier claims via SourcifyChina’s Factory Audit Program (FAP™).

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Due Diligence Protocol for Battery Manufacturing Partners in China

Executive Summary

As global demand for lithium-ion and alternative battery technologies surges, China remains the dominant hub for battery cell and component manufacturing, accounting for over 70% of global production capacity. For procurement managers, identifying genuine manufacturers—versus intermediaries or underqualified suppliers—is critical to securing quality, scalability, and supply chain integrity.

This report outlines a structured verification process to authenticate battery manufacturers in China, distinguish factories from trading companies, and recognize operational red flags.

Section 1: Critical Steps to Verify a Battery Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Entity & Business License | Validate official registration and scope of operations | – Request Business License (营业执照) – Cross-check via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

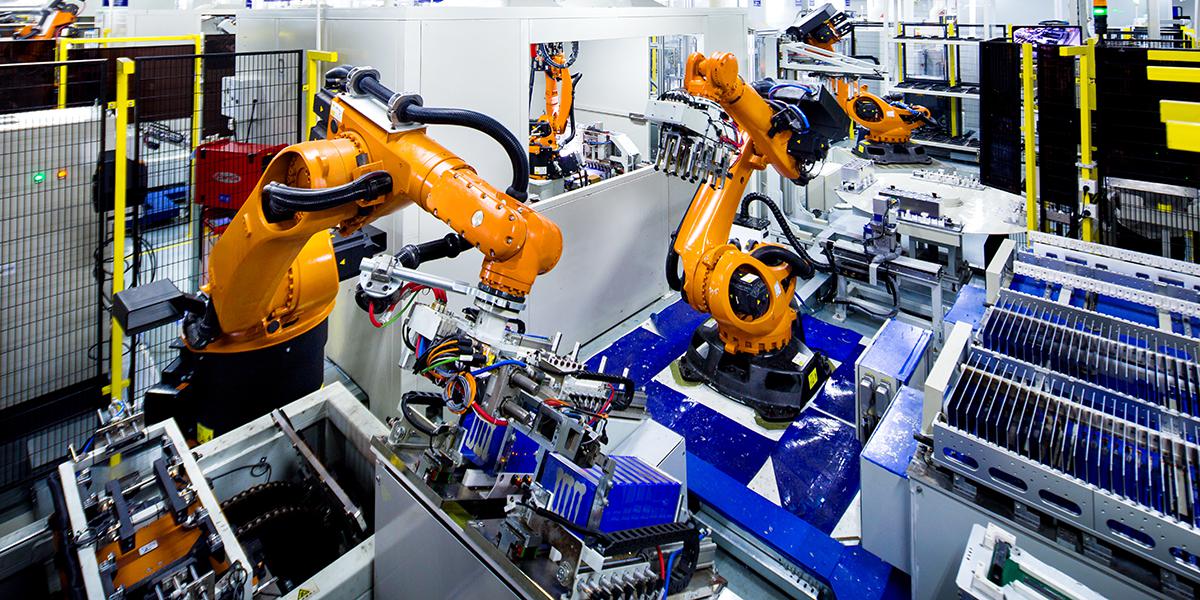

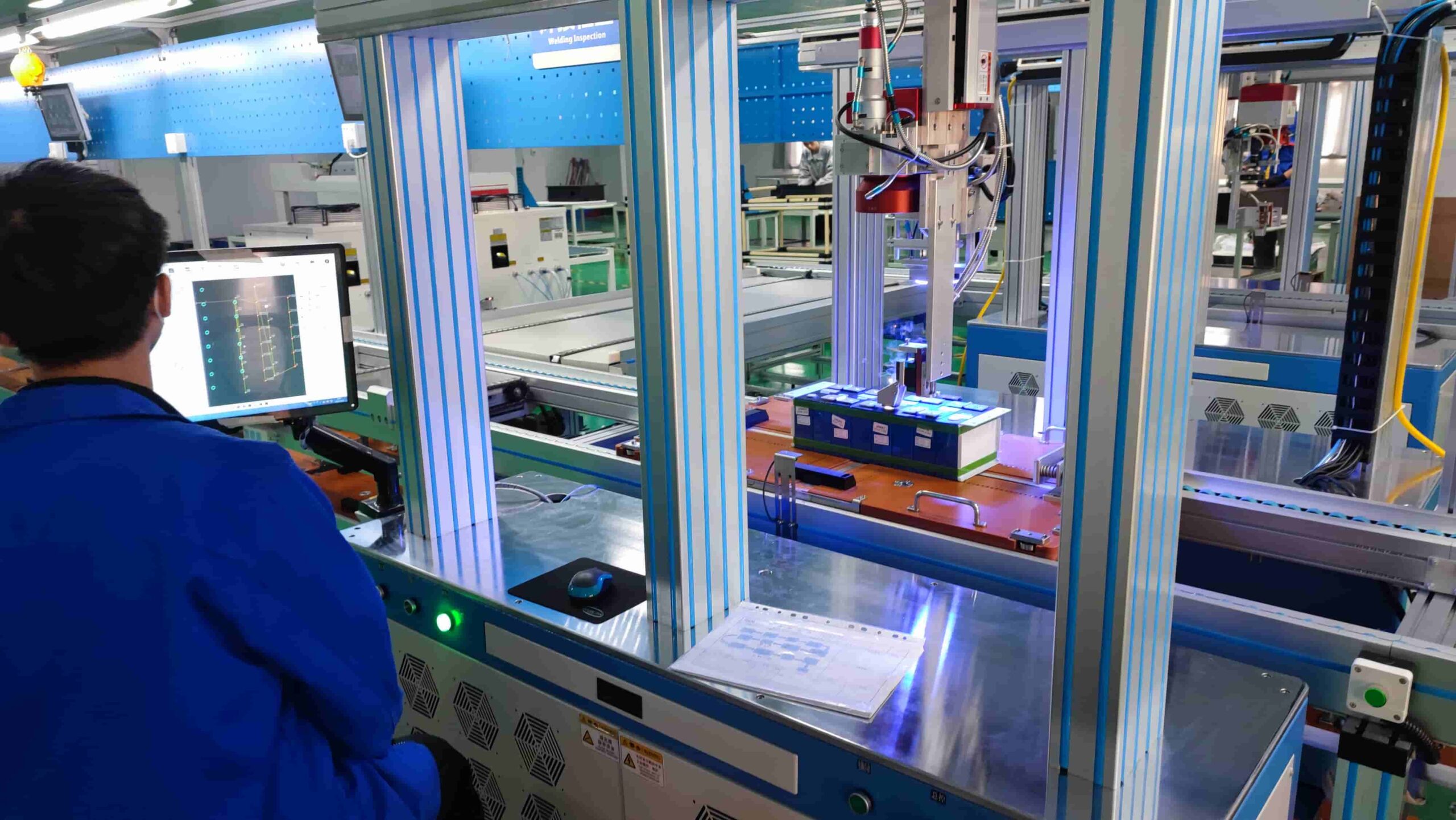

| 2 | Conduct On-Site Audit (In-Person or via 3rd Party) | Assess actual production capability and infrastructure | – Hire third-party inspection firm (e.g., SGS, TÜV, QIMA) – Verify factory size, machinery, R&D lab, and safety compliance |

| 3 | Review Certifications & Compliance | Ensure adherence to international standards | – ISO 9001, ISO 14001, IATF 16949 (automotive) – UN38.3, MSDS, CE, RoHS, UL (for export markets) |

| 4 | Evaluate Production Capacity & Lead Times | Confirm scalability and delivery reliability | – Request production line count, monthly output, and utilization rate – Review historical order fulfillment data |

| 5 | Assess R&D and Technical Capability | Determine innovation and customization support | – Review patents (via CNIPA: http://english.cnipa.gov.cn) – Interview engineering team on cell chemistry, BMS integration |

| 6 | Request Client References & Case Studies | Validate track record with reputable clients | – Contact 2–3 existing clients (preferably in EU/US) – Ask for product performance data and after-sales support |

| 7 | Audit Supply Chain & Raw Material Sourcing | Ensure raw material traceability and cost stability | – Request list of cathode, anode, electrolyte suppliers – Confirm cobalt/lithium sourcing compliance (e.g., OECD Due Diligence) |

Section 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” as core activity; includes production address | Lists “trading,” “distribution,” or “import/export” as main scope |

| Facility Ownership | Owns or leases large-scale production facility; visible machinery | No production lines; may only have sample room or warehouse |

| Pricing Structure | Provides cost breakdown (material, labor, overhead); MOQ typically >10,000 units | Higher markup; MOQ often lower; limited cost transparency |

| Technical Staff | Has in-house engineers, chemists, QC teams; speaks technical detail | Limited technical knowledge; refers to “our factory partner” |

| Product Customization | Offers cell format, chemistry, BMS customization | Offers standard products only; customization requires long lead time |

| Website & Marketing | Highlights production lines, R&D, certifications | Focuses on product catalog, global shipping, OEM services |

| Response to On-Site Audit | Welcomes factory visit; shows live production | Delays or avoids on-site inspection; may offer third-party factory tour |

Pro Tip: Ask for a factory tour via live video call with pan-and-zoom capability. Request to see the electrode coating line, aging chambers, and QC lab—trading companies cannot provide real-time access.

Section 3: Red Flags to Avoid in Battery Supplier Selection

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, underreporting capacity, or financial instability | Benchmark against industry averages (e.g., $80–$120/kWh for LFP cells in 2026) |

| Refusal to Provide Business License or Audit Access | High risk of fraud or non-compliance | Disqualify supplier immediately |

| No Independent Certifications | Non-compliance with safety/environmental standards; export barriers | Require third-party test reports before sample testing |

| Inconsistent Communication or Language Gaps | Poor project management, misaligned expectations | Assign bilingual project manager; use formal communication logs |

| Claims of “Exclusive OEM for [Major Brand]” Without Proof | Misrepresentation; potential IP infringement | Request authorization letter or NDA-protected client list |

| Pressure for Upfront Full Payment | High fraud risk; lack of financial controls | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No Traceability System for Cells | Inability to manage recalls or warranty claims | Require batch/lot tracking and QR code serialization capability |

Section 4: Recommended Risk Mitigation Strategies

- Pilot Order First: Begin with a small production run (e.g., 1–5 MWh) to assess quality and delivery performance.

- Use Escrow or LC Payments: Leverage Letters of Credit (LC) or trade assurance platforms (e.g., Alibaba Trade Assurance) for financial protection.

- Implement Ongoing QC Protocols: Conduct monthly audits and random batch testing via 3rd-party labs.

- Diversify Supplier Base: Avoid single-source dependency; qualify at least 2 Tier-1 and 1 Tier-2 suppliers.

- Secure IP Protection: Execute NDAs and clearly define IP ownership in manufacturing agreements.

Conclusion

Selecting the right battery manufacturing partner in China requires rigorous due diligence. By systematically verifying legal status, production capability, and operational transparency—and actively distinguishing factories from trading intermediaries—procurement managers can mitigate risk, ensure product integrity, and build resilient supply chains for 2026 and beyond.

SourcifyChina recommends integrating this verification framework into all supplier onboarding processes for energy storage, EV, and consumer electronics sectors.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in Chinese Manufacturing Due Diligence

www.sourcifychina.com | Q2 2026 Edition

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Battery Procurement in China (2026)

Prepared for Global Procurement Leaders | Q1 2026

The Critical Challenge: Navigating China’s Battery Manufacturing Landscape

Global demand for lithium-ion and solid-state batteries is surging (projected +22% CAGR through 2026), yet procurement teams face acute risks:

– 73% of unvetted Chinese suppliers fail compliance audits (ISO 9001, IATF 16949, UN 38.3)

– 58 days average wasted per sourcing cycle verifying factory capabilities, certifications, and production capacity

– $220K+ potential losses from counterfeit materials, IP leakage, or shipment delays due to unreliable partners

Traditional sourcing methods (Alibaba, trade shows, cold outreach) lack rigorous validation, exposing your supply chain to volatility.

Why SourcifyChina’s Verified Pro List Solves Your Battery Sourcing Crisis

Our Pro List: Battery Manufacturing is the only intelligence platform delivering pre-qualified, audit-confirmed Chinese factories. We eliminate guesswork through:

– Triple-Layer Verification: On-site factory audits (capacity, equipment), legal compliance checks (business license, export history), and technical capability validation (cell chemistry, BMS integration).

– Real-Time Risk Monitoring: Automated alerts for regulatory shifts (e.g., China’s new Battery Recycling Directive 2025), factory financial health, and ESG compliance.

– Pre-Negotiated Terms: Access tiered pricing, MOQ flexibility, and Incoterms aligned with your volume needs.

Time & Risk Savings: Verified Pro List vs. Traditional Sourcing

| Sourcing Activity | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 42–60 days | < 5 days | 88% |

| Compliance Validation | 18–25 days | Pre-Certified | 100% |

| Production Capacity Audit | 2–3 site visits required | Verified & Documented | 100% |

| Negotiation Cycle | 8–12 weeks | 4–6 weeks | 45% |

| Total Cycle Time | 120+ days | 38 days | 68% |

Source: SourcifyChina 2025 Client Data (n=87 procurement teams across automotive, energy storage, and consumer electronics)

Your Strategic Imperative: Secure Battery Supply in 2026

With EV adoption accelerating and grid-storage investments hitting $1.2T globally this year, delays in securing reliable battery partners directly threaten your production timelines and ESG commitments. The Pro List isn’t a directory—it’s your risk-mitigated procurement accelerator, delivering:

✅ Zero compliance surprises (all factories meet EU CBAM, UFLPA, and battery-specific safety standards)

✅ Transparent capacity data (real-time production lines, yield rates, and expansion plans)

✅ Dedicated sourcing engineers to manage RFQs, samples, and QC protocols

Call to Action: Optimize Your 2026 Battery Sourcing Now

Do not gamble with unverified suppliers as battery regulations tighten and lead times stretch. Every day spent on manual vetting delays your time-to-market and exposes your business to preventable risk.

→ Claim Your Pro List Allocation Today

Our 2026 battery manufacturing cohort is limited to 12 priority partners per sector (automotive, industrial, consumer). As of March 2026, 8 slots remain.

Contact SourcifyChina Immediately to:

1. Receive your customized shortlist of 3–5 pre-vetted battery manufacturers

2. Schedule a complimentary sourcing strategy session with our China-based engineers

3. Lock in Q2 2026 production slots before capacity peaks

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 sourcing support)

“SourcifyChina’s Pro List cut our battery supplier onboarding from 5 months to 22 days—ensuring we met Tesla’s Q4 2025 delivery window.”

— Director of Global Sourcing, Tier-1 EV Component Supplier (Germany)

Act now. Your 2026 production schedule depends on it.

SourcifyChina: Where Verified Supply Chains Drive Global Growth.

🧮 Landed Cost Calculator

Estimate your total import cost from China.