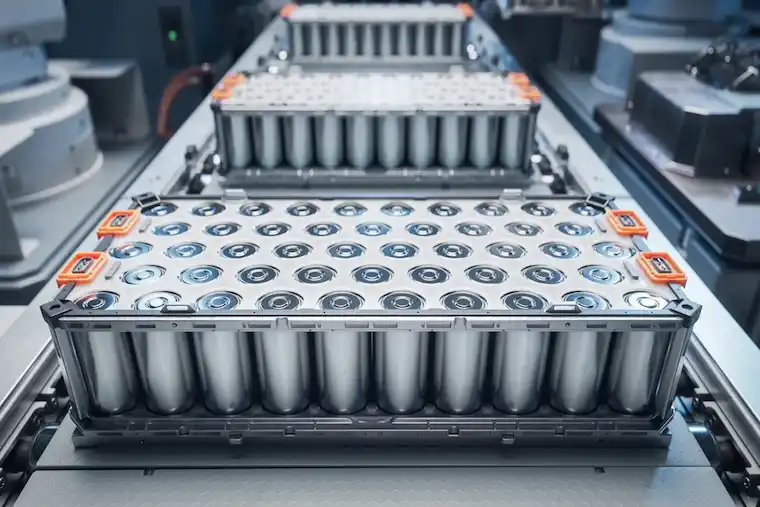

The global battery laser manufacturing market is experiencing robust growth, driven by surging demand for high-precision joining and structuring processes in lithium-ion battery production for electric vehicles (EVs), consumer electronics, and energy storage systems. According to Grand View Research, the global laser welding market size was valued at USD 4.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030, with battery manufacturing emerging as a key growth driver. Similarly, Mordor Intelligence projects that the industrial laser market will register a CAGR of over 7% during the forecast period 2023–2028, citing increased automation and the EV boom as primary catalysts. As battery producers prioritize energy density, cycle life, and production efficiency, laser technologies—particularly in cutting, welding, and cleaning—are becoming indispensable. This accelerating demand has propelled a new wave of innovation among battery laser manufacturers, positioning them at the forefront of advanced manufacturing in the clean energy transition.

Top 10 Battery Laser Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Industrial Laser Solutions for the Battery Industry

Website: laserax.com

Key Highlights: Laser technology is a pillar in this transition, helping the battery industry improve its cost-effectiveness, production cycle times, and battery performance….

#2 Laser Processing Solutions

Website: novantaphotonics.com

Key Highlights: Discover laser processing solutions by Novanta, experts in advanced Laser technology. Learn more about our industrial & medical laser solutions….

#3 Laser Company for Industrial Laser Solutions

Website: laserline.com

Key Highlights: The leading laser company for integrated & customized diode laser manufacturing solutions for various industries & applications….

#4 Laser Photonics

Website: laserphotonics.com

Key Highlights: Laser Photonics manufactures reliable, safe, and eco-friendly Laser Cleaning, Laser Cutting, Laser Engraving, Laser Marking, and Laser Welding solutions….

#5 About Us

Website: global.hymson.com

Key Highlights: Hymson has been deeply engaged in laser and automation, it has been recognized as one of the top comprehensive solution suppliers in the industry….

#6 of Huiyao Laser, professional lithium Battery Pack …

Website: yaolaser.com

Key Highlights: Huiyao Laser is a leading battery laser welding machine manufacturer offering professional battery pack and battery module welding solutions for many fields, ……

#7 IPG Photonics

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

#8 Laser system components for battery production

Website: innotech-laser.de

Key Highlights: Overall, battery manufacturing with Laser offers exciting possibilities for battery production that can improve the performance and efficiency of batteries….

#9 EV Battery Manufacturing

Website: coherent.com

Key Highlights: Powering Battery Production from Start to Finish. Choose from the broadest available range of laser welding systems to get the optimum solution for every ……

#10 Lithium Battery PACK Assembly

Website: huiyaolaser.com

Key Highlights: Use our Lithium Battery PACK Assembly, Lithium Battery Making Machine, and Laser Welding Machine to build superior, high-performance batteries with ……

Expert Sourcing Insights for Battery Laser

H2: 2026 Market Trends for Battery Laser Technology

The battery laser market is poised for significant transformation by 2026, driven by the global shift toward electrification, advancements in battery manufacturing, and the increasing demand for precision in production processes. Laser technologies are becoming integral to lithium-ion and next-generation battery manufacturing—particularly in welding, cutting, structuring, and cleaning processes. Below is an analysis of key market trends expected to shape the battery laser sector in 2026:

1. Rising Demand for High-Precision Laser Welding in EV Batteries

With the electric vehicle (EV) market projected to grow at a CAGR exceeding 20% through 2026, battery production capacity is expanding rapidly. Laser welding—especially using fiber and blue lasers—is increasingly preferred for its precision, speed, and reliability in joining battery cells, busbars, and battery packs. By 2026, demand for high-power, low-heat-input lasers will surge to ensure stronger, safer, and more efficient battery connections.

2. Adoption of Blue and Green Lasers for Copper Processing

Copper’s high reflectivity has historically made it difficult to process with traditional infrared lasers. However, blue (450 nm) and green (515–532 nm) lasers offer better absorption in copper, enabling cleaner and more efficient welding and cutting. Companies like Coherent, NUBURU, and TRUMPF are advancing blue laser technology, and by 2026, these lasers are expected to gain substantial adoption in battery manufacturing, particularly in cell-to-pack (CTP) and cell-to-chassis (CTC) architectures.

3. Integration of AI and In-Process Monitoring

Laser systems in battery manufacturing are becoming smarter. By 2026, integration with AI-driven process monitoring and real-time quality control will be standard. Technologies such as laser-induced breakdown spectroscopy (LIBS) and inline coherent imaging (ICI) will enable defect detection during welding, reducing scrap rates and improving battery safety—a critical factor as automakers demand higher quality standards.

4. Growth in Solid-State and Sodium-Ion Battery Production

Next-generation batteries, including solid-state and sodium-ion, require novel manufacturing techniques. These chemistries often involve sensitive materials and thinner layers, necessitating ultra-precise laser ablation and structuring. By 2026, laser micromachining and selective laser ablation will be essential in electrode patterning and separator processing, driving demand for pulsed and ultrafast lasers (e.g., picosecond and femtosecond systems).

5. Expansion of Gigafactories and Regionalization of Supply Chains

The construction of gigafactories across North America, Europe, and Asia is accelerating. Governments are incentivizing local battery production to reduce dependency on imports. This regionalization is increasing demand for localized laser equipment suppliers and service providers. By 2026, laser OEMs with strong regional support and scalable solutions will gain competitive advantages.

6. Sustainability and Energy Efficiency Focus

As environmental regulations tighten, the energy efficiency of laser systems is under scrutiny. Manufacturers are shifting toward more energy-efficient diode and fiber lasers with improved wall-plug efficiency. Additionally, laser reconditioning and recycling of battery components—such as electrode recovery—are emerging applications that may expand by 2026, contributing to circular economy goals.

7. Consolidation and Strategic Partnerships

The battery laser market is witnessing increased collaboration between laser manufacturers, battery producers, and automation companies. By 2026, strategic partnerships—such as those between laser suppliers and EV OEMs—are expected to deepen, enabling co-development of customized laser solutions optimized for specific battery formats and production speeds.

Conclusion

By 2026, the battery laser market will be shaped by technological innovation, regulatory pressures, and the scaling of EV and energy storage industries. Laser systems will evolve from mere tools to intelligent, integrated components of smart battery manufacturing lines. Companies that invest in advanced laser wavelengths, process control, and sustainable solutions will lead the market, capturing value in a rapidly electrifying world.

Common Pitfalls in Sourcing Battery Lasers: Quality and Intellectual Property Risks

Sourcing battery lasers—critical components in battery manufacturing for processes such as welding, cutting, and cleaning—presents unique challenges. Buyers and OEMs must navigate both quality inconsistencies and intellectual property (IP) vulnerabilities. Overlooking these pitfalls can lead to production delays, legal disputes, and compromised product performance.

Quality-Related Pitfalls

Inconsistent Laser Performance and Reliability

Battery manufacturing demands high-precision and uninterrupted laser operation. A common pitfall is sourcing lasers with inconsistent output power, beam quality, or thermal stability. Low-tier suppliers may provide devices that pass initial inspection but degrade rapidly under continuous operation, leading to increased downtime and defective battery cells.

Lack of Industry-Specific Certification and Testing

Many suppliers offer generic industrial lasers not optimized for battery production environments. These may lack essential certifications (e.g., CE, UL, ISO standards) or fail rigorous testing for electrochemical compatibility, dust resistance, or thermal cycling—critical in cleanroom battery assembly lines.

Inadequate Documentation and Traceability

Poor-quality suppliers often provide incomplete technical documentation, including missing calibration records, maintenance logs, or material composition data. This lack of traceability complicates quality audits, failure analysis, and compliance with automotive or energy storage safety standards.

Mismatched Specifications and Real-World Performance

Suppliers may advertise peak performance metrics under ideal lab conditions that don’t reflect actual production environments. Buyers risk overestimating throughput or precision, leading to bottlenecks or subpar weld quality in high-speed battery line operations.

Intellectual Property (IP) Pitfalls

Use of Unlicensed or Infringing Technology

Some suppliers, particularly in regions with lax IP enforcement, may incorporate patented laser diodes, control algorithms, or optical designs without proper licensing. Sourcing from such vendors exposes buyers to third-party infringement claims, potentially resulting in costly litigation, import bans, or forced redesigns.

Ambiguous IP Ownership in Custom Solutions

When co-developing custom laser systems, unclear contracts may leave IP rights unresolved. Suppliers could retain ownership of key innovations or software, limiting the buyer’s freedom to modify, service, or scale the technology independently.

Reverse Engineering and Data Security Risks

Sharing detailed technical requirements with potential suppliers increases the risk of design theft or reverse engineering. Without robust non-disclosure agreements (NDAs) and secure data protocols, sensitive information about proprietary battery architectures or processes may be compromised.

Limited Access to Firmware and Software Updates

Many laser systems rely on proprietary control software. Vendors may restrict access to source code or updates, creating dependency risks and preventing integration with in-house manufacturing execution systems (MES). This also hampers long-term maintenance and cybersecurity patching.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough supplier audits, including on-site factory inspections and sample batch testing under real conditions.

– Require full compliance with industry standards (e.g., IATF 16949 for automotive batteries).

– Perform IP due diligence, including patent landscape analysis and supplier warranties against infringement.

– Establish clear contractual terms on IP ownership, data rights, and software access.

– Partner with established laser integrators with proven track records in the battery sector.

Proactively addressing quality and IP concerns ensures reliable, scalable, and legally secure laser integration in battery production.

Logistics & Compliance Guide for Battery Laser

Overview

This guide provides essential information for the safe, legal, and efficient transportation and handling of Battery Laser products. Due to the integration of battery technology and laser components, these devices are subject to strict international and regional regulations. Compliance with these standards is mandatory to ensure safety, avoid shipment delays, and prevent legal penalties.

Regulatory Classification

Battery Laser devices typically fall under dual regulatory oversight:

– Battery Components: Regulated under UN/DOT 38.3 for lithium batteries (UN3480 or UN3481, depending on configuration).

– Laser Components: Classified under IEC 60825-1 and FDA 21 CFR 1040.10 (in the U.S.) or equivalent standards (e.g., IEC 60825 in the EU).

Ensure each unit is labeled with appropriate hazard symbols and regulatory compliance marks (e.g., CE, FCC, RoHS).

Packaging Requirements

All Battery Laser units must be packaged to meet the following standards:

– Battery Protection: Prevent short circuits by insulating terminals and securing batteries to avoid movement. Use non-conductive materials.

– Laser Safeguarding: Lasers must be secured in a de-energized state; protective caps or housings must cover emission points.

– Outer Packaging: Use UN-certified packaging for lithium batteries if shipped separately or as part of equipment. Include “Lithium Battery Handling Label” and “Class 1 Laser Product” markings as required.

Transportation Guidelines

- Air Transport: Comply with IATA Dangerous Goods Regulations (DGR). Shipments must include:

- Proper shipping name (e.g., “Lithium ion batteries contained in equipment”)

- UN number (UN3481)

- Shipper’s Declaration for Dangerous Goods (if required)

- Class 9 hazard label

- Ground & Sea Transport: Follow ADR (Europe) or IMDG Code (maritime) as applicable. Ensure documentation aligns with local regulations.

Note: Some carriers may impose additional restrictions—confirm with your logistics provider.

Documentation Requirements

Prepare the following for all shipments:

– Safety Data Sheet (SDS) compliant with GHS

– Certificate of Compliance for laser safety (IEC 60825)

– UN 38.3 test summary for batteries

– Commercial invoice with detailed product description and HS code (e.g., 8504.40 for power supplies with batteries)

– Packing list including battery type, quantity, and energy content (Wh)

Import & Customs Compliance

- Verify country-specific import regulations (e.g., FCC certification in the U.S., CE marking in the EU).

- Declare laser class and battery specifications accurately to customs authorities.

- Be aware of restrictions in sensitive markets (e.g., China, India, and Brazil may require additional product approvals).

Storage & Handling

- Store in a cool, dry environment away from flammable materials.

- Maintain temperatures between 15°C and 25°C; avoid exposure to direct sunlight.

- Handle with ESD-safe procedures to protect electronic components.

- Train personnel on emergency response for battery fire (Class D extinguisher recommended).

Disposal & End-of-Life

- Follow WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions.

- Batteries must be recycled through certified e-waste facilities; do not dispose of in general waste.

- Lasers may contain hazardous materials—dismantle only by trained technicians.

Compliance Monitoring & Updates

Regulations evolve frequently. Establish a process to:

– Monitor updates from IATA, IMDG, FDA, and EU regulatory bodies.

– Conduct annual compliance audits.

– Maintain records of certifications and training for a minimum of five years.

Adherence to this guide ensures safe, legal, and efficient logistics operations for Battery Laser products worldwide.

Conclusion for Sourcing Battery Laser Equipment:

Sourcing battery laser equipment is a strategic and critical step in establishing or enhancing a battery manufacturing process, particularly for applications in electric vehicles, energy storage systems, and consumer electronics. The selection of appropriate laser systems—such as laser welding, cutting, cleaning, or structuring machines—must align with technical requirements, production volume, material compatibility, and quality standards.

Key considerations in the sourcing process include laser precision, reliability, automation compatibility, energy efficiency, and total cost of ownership. Engaging with reputable suppliers who offer robust technical support, proven industry experience, and compliance with safety and environmental regulations is essential. Additionally, evaluating after-sales service, training, and scalability options ensures long-term operational success.

Ultimately, a well-executed sourcing strategy for battery laser equipment not only improves production efficiency and product quality but also supports innovation and competitiveness in the rapidly growing battery market. Continuous evaluation and adaptation to emerging laser technologies will further drive advancements in battery manufacturing capabilities.