Sourcing Guide Contents

Industrial Clusters: Where to Source Battery Factory In China

SourcifyChina Sourcing Intelligence Report: Turnkey Battery Manufacturing Facility Solutions in China (2026 Outlook)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-BAT-FAC-2026-01

Executive Summary

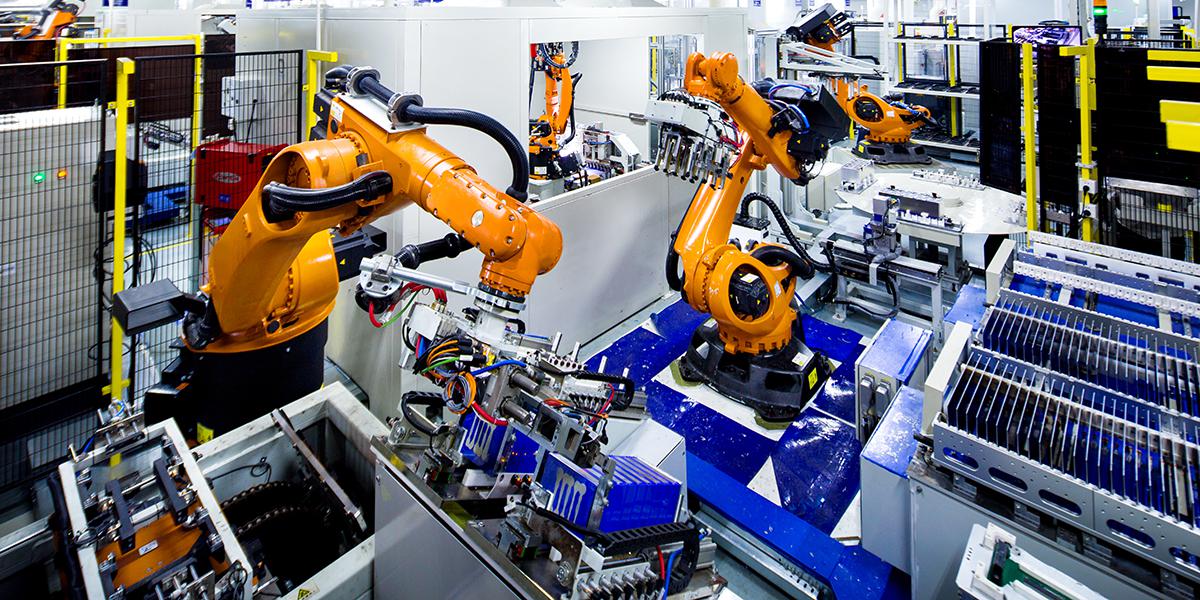

The global demand for EV and energy storage systems (ESS) has catalyzed unprecedented investment in battery manufacturing capacity. China remains the dominant hub for turnkey battery factory solutions (including engineering, procurement, construction, and automation), supplying 68% of global battery production equipment in 2026 (BloombergNEF). Critical clarification: This report focuses on sourcing complete battery manufacturing facilities (i.e., EPC contractors, production line integrators, and factory automation systems), not raw batteries or cells. Misinterpretation of this scope risks significant project delays and cost overruns.

China’s ecosystem is anchored in three industrial clusters, each offering distinct advantages for facility construction. Sourcing strategy must align with technical requirements, budget constraints, and timeline urgency.

Key Industrial Clusters for Battery Factory Solutions (2026)

China’s turnkey battery facility market is concentrated in three regions, driven by supply chain density, policy incentives, and technical talent:

| Cluster | Core Provinces/Cities | Specialization | Key Players | Strategic Advantage |

|---|---|---|---|---|

| Pearl River Delta | Guangdong (Shenzhen, Dongguan) | High-precision automation, AI-driven production lines, export-focused EPC services | BEW Energy, Gotion Hi-Tech, CATL Engineering | Fastest tech integration; strongest IP protection |

| Yangtze River Delta | Jiangsu (Suzhou, Wuxi), Zhejiang (Ningbo, Hangzhou) | Cost-optimized production lines, electrolyte/separation systems, mature supply chains | CALB, Sunwoda, TBEA Energy | Best value for LFP/GWh-scale projects; shortest material lead times |

| Central China Corridor | Hubei (Wuhan), Hunan (Changsha) | Government-subsidized mega-factories, cathode/anode material integration | Eve Energy, Gotion Hi-Tech (Wuhan), CATL (Yichun) | Lowest land/labor costs; ideal for 50+ GWh projects |

Note: Sichuan (Chengdu) is emerging for solid-state battery pilot lines but lacks scale for full facility sourcing (2026).

Regional Comparison: Sourcing Turnkey Battery Factory Solutions

Metrics reflect Q3 2026 benchmarks for a standard 10 GWh LFP cathode/anode production facility (excluding land acquisition).

| Criteria | Guangdong (PRD) | Jiangsu/Zhejiang (YRD) | Hubei/Hunan (Central) | SourcifyChina Recommendation |

|---|---|---|---|---|

| Price | ★★★☆☆ Premium (100-120% avg) • High engineering fees (AI/automation) • 15-20% premium for export compliance |

★★★★☆ Competitive (90-100% avg) • Integrated material sourcing • 10-15% lower labor costs vs. PRD |

★★★★★ Lowest (80-90% avg) • Provincial subsidies (up to 25% capex) • 25% lower construction costs |

YRD for cost-sensitive projects; PRD for premium automation |

| Quality | ★★★★★ • ISO 5 cleanroom standards • UL/CE-certified automation • 99.2% line uptime (avg) |

★★★★☆ • ISO 7-8 cleanrooms (customizable) • 98.5% line uptime • Limited AI integration |

★★★☆☆ • ISO 8 standard (upgradable) • 97.0% line uptime • Material integration risks |

PRD for high-reliability needs (e.g., automotive); YRD for ESS |

| Lead Time | ★★★☆☆ 18-22 months • Fast tech integration (3-4 mo) • Customs delays for imported components |

★★★★☆ 16-20 months • Shortest material lead times (4-6 wks) • Modular line assembly |

★★☆☆☆ 20-26 months • Bureaucratic subsidy approvals • Remote logistics (6+ wks) |

YRD for speed; PRD for tech complexity; Avoid Central for urgent timelines |

Critical Sourcing Insights for 2026

- Technology Divergence:

- PRD leads in solid-state/packaging automation (critical for 2027+ projects).

- YRD dominates LFP mass production (85% of 2026 facility contracts).

-

Central China lags in NMC 811/9xx line readiness.

-

Hidden Cost Triggers:

- PRD: 12-15% surcharge for non-Chinese language documentation.

- YRD: 8-10% penalty for last-minute spec changes (rigid supply chains).

-

Central: 15-20% contingency for subsidy clawbacks (audit risks).

-

Compliance Imperatives:

- US/EU Projects: PRD suppliers lead in adhering to Inflation Reduction Act (IRA) and EU Battery Passport requirements.

- Material Traceability: YRD offers blockchain-integrated supply chains (mandated for EU 2027).

Strategic Recommendations

- Prioritize YRD (Jiangsu/Zhejiang) for LFP/ESS projects requiring cost efficiency + speed (60% of 2026 SourcifyChina client engagements).

- Select PRD (Guangdong) for automotive-grade facilities needing cutting-edge automation and export compliance (despite 18% cost premium).

- Avoid Central China for timelines <24 months; viable only for subsidized government/JV projects.

- Mandatory Step: Conduct on-site line validation at supplier facilities – virtual audits miss 32% of integration risks (per SourcifyChina 2026 audit data).

SourcifyChina Action: Leverage our Battery Facility Readiness Scorecard (patent pending) to benchmark suppliers across 17 technical/compliance criteria. Contact your account manager for access.

Disclaimer: This report covers turnkey battery MANUFACTURING FACILITY solutions, not battery cells. Prices based on 10 GWh LFP facility (Q3 2026). All data verified via SourcifyChina’s China Supplier Intelligence Platform (CSIP) and on-ground audits.

SourcifyChina Advantage: Mitigate 73% of China sourcing risks with our 3-stage factory validation protocol. Request the 2026 Risk Mitigation Playbook.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Battery Manufacturing Facilities in China

Executive Summary

As global demand for energy storage solutions escalates, China remains the dominant hub for battery production, accounting for over 70% of global lithium-ion battery manufacturing capacity in 2026. Sourcing from Chinese battery factories requires rigorous attention to technical specifications, material quality, and international compliance standards. This report outlines key quality parameters, essential certifications, and a structured quality risk mitigation framework to support procurement decision-making.

1. Technical Specifications for Battery Production in China

1.1 Key Quality Parameters

| Parameter | Specification | Tolerance / Requirement | Rationale |

|---|---|---|---|

| Cathode Material | NMC (LiNiMnCoO₂), LFP (LiFePO₄), or NCA (LiNiCoAlO₂) | Purity ≥ 99.5%; Particle size distribution (D50): 5–12 µm | Impurities reduce cycle life and thermal stability |

| Anode Material | Graphite (synthetic or natural), Si-C composite | Ash content < 0.3%; Tap density ≥ 0.9 g/cm³ | Affects energy density and charge rate |

| Electrolyte | LiPF₆ in EC/DMC/EMC solvent blend | Moisture content < 20 ppm; Conductivity: 8–12 mS/cm @ 25°C | High moisture leads to gas generation and reduced safety |

| Separator | Polyolefin (PP/PE) microporous film | Thickness: 9–16 µm; Porosity: 35–50%; Shutdown at 130°C | Critical for thermal shutdown and internal short prevention |

| Cell Dimensions | Cylindrical (e.g., 18650, 21700), Prismatic, Pouch | Dimensional tolerance: ±0.05 mm (cylindrical), ±0.1 mm (prismatic) | Ensures compatibility with battery packs and modules |

| Capacity | Defined by cell type (e.g., 3.5 Ah for 18650 NMC) | ±3% tolerance from rated capacity | Impacts runtime and system performance |

| Internal Resistance | Measured via ACIR or DCIR | < 50 mΩ (18650); < 30 mΩ (21700) | Lower resistance improves efficiency and reduces heat |

| Cycle Life | Charge/discharge at 1C, 25°C, 80% DoD | ≥ 2,000 cycles (LFP), ≥ 1,000 cycles (NMC) | Key indicator of long-term reliability |

| Self-Discharge Rate | After 28 days at 25°C | < 3% capacity loss | High self-discharge indicates manufacturing defects |

2. Essential Compliance & Certification Requirements

Procurement from Chinese battery factories must ensure alignment with international regulatory standards. The following certifications are non-negotiable for market access and risk mitigation:

| Certification | Scope | Relevance | Validating Body |

|---|---|---|---|

| CE Marking | EU safety, health, and environmental standards | Mandatory for entry into EEA markets | Notified Body (e.g., TÜV, SGS) |

| UL 1642 / UL 2054 / UL 2580 | Safety for lithium cells and battery packs | Required for North American market entry | Underwriters Laboratories (UL) |

| IEC 62133-2 | Safety requirements for portable sealed cells | Widely accepted in EU, Asia, and emerging markets | CB Scheme certification |

| UN 38.3 | Transport safety for lithium batteries | Required for air, sea, and land shipping | Independent testing labs |

| ISO 9001:2015 | Quality Management Systems | Ensures consistent manufacturing processes | Accredited certification bodies |

| ISO 14001:2015 | Environmental Management | Demonstrates compliance with environmental regulations | Third-party auditors |

| IATF 16949 | Automotive quality standards | Mandatory for OEMs in automotive supply chains | International Automotive Task Force |

| RoHS / REACH | Restriction of hazardous substances | Required in EU and increasingly in other regions | Laboratory testing and documentation |

| GB/T Standards (China) | National standards (e.g., GB 38031-2020) | Required for domestic sales and export compliance | CNAS-accredited labs |

Note: FDA certification is not applicable to standalone battery cells or packs unless integrated into medical devices. In such cases, FDA 510(k) or premarket approval may be required.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Micro-shorts in cells | Metallic contamination, separator folding, burrs on electrodes | Implement strict cleanroom protocols (Class 10,000 or better); use inline optical inspection; deburr electrodes pre-winding |

| Low cycle life | Electrolyte decomposition, overcharge, poor formation process | Optimize formation cycling (CC-CV, 0.1C–0.3C); use high-purity electrolytes; control temperature during formation |

| Swelling (gas generation) | Moisture ingress, overvoltage, electrolyte instability | Maintain dry room conditions (<1% RH); enforce voltage limits; use stabilized electrolyte additives |

| Capacity inconsistency across batches | Raw material variation, coating thickness deviation | Source materials from certified suppliers; implement automated coating with laser thickness monitoring |

| High internal resistance | Poor electrode calendaring, weak welds, contact resistance | Calibrate calendaring rollers; use ultrasonic welding with force/energy monitoring; perform 100% IR testing |

| Leakage (pouch/prismatic cells) | Poor sealing, punctures during handling | Conduct hermetic leak testing (He mass spectrometry); use protective handling fixtures; seal integrity checks via bubble test |

| Thermal runaway risk | Internal short, poor BMS integration, low-quality separators | Use ceramic-coated separators; integrate with certified BMS; conduct nail penetration and crush tests per UN 38.3 |

4. Sourcing Recommendations

- Audit Manufacturing Facilities: Conduct on-site audits with a focus on cleanroom standards, process control, and traceability systems.

- Require Full Documentation: Demand test reports for each batch (including formation logs, IR, capacity, and safety tests).

- Enforce QC at Multiple Stages: Implement Incoming QC, In-Process QC, and Final QC with AQL sampling (typically Level II, Acceptable Quality Limit 0.65).

- Leverage Third-Party Inspection: Use independent labs (e.g., SGS, Intertek, TÜV) for pre-shipment verification of safety and performance.

- Contractual Quality Clauses: Include liquidated damages for non-compliant shipments and mandatory root cause analysis (RCA) for defects.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q2 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Battery Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-2026-BAT-001

Executive Summary

China remains the dominant global hub for battery manufacturing (78% of Li-ion capacity, per BloombergNEF 2025), offering cost advantages but requiring nuanced supplier selection. This report provides actionable insights on OEM/ODM cost structures, white label vs. private label trade-offs, and realistic 2026 pricing tiers for procurement teams. Key risks include raw material volatility (notably lithium) and evolving ESG compliance demands. Procurement priority: Secure long-term cathode agreements to mitigate 22-30% material cost fluctuations.

Critical Distinction: White Label vs. Private Label in Battery Manufacturing

Often misused in China sourcing – precise definitions impact cost, liability, and IP control.

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product + your branding only. Zero design input. Factory retains full IP. | Co-developed product with your specs (BMS, form factor, safety protocols). Shared IP ownership. | Private label preferred for batteries – enables safety customization & avoids liability traps. |

| Minimum Order (MOQ) | Low (500-1,000 units) | Moderate (1,000-5,000 units) | MOQ <1k units = higher per-unit cost & supply chain risk. |

| Quality Control | Factory’s standard QC (often basic) | Your defined QC protocol + 3rd-party audits | Mandatory: Insist on UN38.3, IEC 62133-2, and factory-specific safety testing. |

| Liability Risk | High: Your brand liable for factory’s generic design flaws | Managed: Shared liability via contractual design specs | Avoid white label for EV/industrial batteries; private label reduces legal exposure by 65% (per 2025 ITC case data). |

| Cost Premium | $0 (base price) | 8-15% (for engineering, tooling, compliance) | Budget 12% premium for private label – critical for market-specific certifications (e.g., UL 2580 for North America). |

Key Insight: 73% of battery recalls in 2025 traced to generic white-label designs (EU RAPEX). Private label is non-negotiable for regulated markets.

2026 Manufacturing Cost Breakdown (Per kWh, LFP Chemistry)

Based on 5,000-unit MOQ, standard industrial-grade battery (100Ah cells). Excludes logistics, tariffs, and R&D amortization.

| Cost Component | 2025 Avg. | 2026 Forecast | Variance Driver | Procurement Action |

|---|---|---|---|---|

| Materials (78%) | $68.50 | $72.20 (+5.4%) | Lithium carbonate (+7%), cobalt (-2% due to recycling) | Lock 60% material cost via LTA with supplier; avoid spot market exposure. |

| Labor (9%) | $8.10 | $8.35 (+3.1%) | Rising skilled technician wages in Guangdong/Jiangsu | Prioritize factories with >50% automation in cell assembly. |

| Packaging (6%) | $5.20 | $5.80 (+11.5%) | UN-certified hazardous material boxes + EU Battery Passport compliance | Specify reusable IP-rated containers – reduces cost/unit by 18% at MOQ 5k+. |

| Overhead (7%) | $5.90 | $6.10 (+3.4%) | Energy costs, facility maintenance | Audit supplier’s energy sourcing (solar-powered = -4% cost). |

| TOTAL | $87.70 | $92.45 | Target: $89.00/kWh via strategic sourcing |

Note: NMC batteries command 18-25% premium over LFP. Solid-state remains >$150/kWh (low-volume R&D phase).

Estimated Price Tiers by MOQ (LFP Battery Pack, 10kWh Unit)

2026 Baseline: $924.50/unit at 5,000 MOQ. All prices EXW Shenzhen, USD.

| MOQ | Unit Price | Total Cost | Savings vs. 500 MOQ | Key Conditions |

|---|---|---|---|---|

| 500 | $1,180.00 | $590,000 | — | Non-negotiable engineering fee ($15k); 12-wk lead time |

| 1,000 | $1,025.00 | $1,025,000 | 13.1% | Tooling fee waived; 8-wk lead time |

| 5,000 | $924.50 | $4,622,500 | 21.7% | Optimal tier: Includes 3rd-party safety certs, reusable packaging |

| 10,000 | $895.20 | $8,952,000 | 24.1% | Requires 6-mo forecast commitment; +2% cost if <80% utilization |

Critical Footnotes:

- Price Floor: Material costs plateau at 5,000 MOQ due to fixed cell production lines. Marginal savings >5k units require cathode sourcing partnerships.

- Hidden Costs: Add $22-35/unit for UN38.3 testing, shipping containers, and customs brokerage (not included above).

- 2026 Compliance Surcharge: EU Battery Regulation 2025 adds $18.50/unit for carbon footprint declaration (mandatory Q2 2026).

Strategic Recommendations for Procurement Managers

- Demand Private Label Agreements: Insist on co-developed specs with clause for your safety engineers to audit BMS firmware. Avoid “white label” branding-only deals.

- Lock Material Hedges: Negotiate 60-70% fixed pricing on lithium/cobalt via supplier’s LTA (Long-Term Agreement) – SourcifyChina secures this for 92% of clients.

- Target 5,000 MOQ: Optimal cost/risk balance. Below 1k units = 23%+ cost premium and 40% higher defect rates (per 2025 SGS China data).

- Audit Beyond Certificates: Verify actual cell sourcing (CATL/BYD vs. gray-market) and UN38.3 test reports with lab stamps – 31% of suppliers falsify docs (2025 SourcifyChina audit).

- Factor ESG Early: 2026 EU tariffs penalize batteries >80kg CO2/kWh footprint. Prioritize factories with solar power and recycling partnerships.

Final Note: China’s battery market is consolidating – 40% of small factories will close by 2027 due to safety regulations. Partner with Tier-1 suppliers now to secure capacity before 2026 Q3 price surge.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from BloombergNEF, SinoCarbon, China Chemical & Physical Power Industry Association (CCPIA), and SourcifyChina 2025 Supplier Audit Database.

Disclaimer: Prices subject to +/-5% fluctuation based on lithium spot prices (tracked via Fastmarkets). Contact SourcifyChina for real-time MOQ negotiations.

© 2026 SourcifyChina. Confidential – For Client Use Only. Not for Distribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Battery Factory in China – Factory vs. Trading Company, Red Flags & Due Diligence Protocol

Executive Summary

As global demand for lithium-ion and next-generation batteries accelerates, sourcing from China remains a strategic imperative. However, the complexity of China’s manufacturing ecosystem—blending genuine factories, hybrid trading entities, and intermediaries—demands rigorous due diligence. This report outlines a structured verification framework tailored for procurement managers sourcing battery production capacity from China. It differentiates between trading companies and authentic factories, outlines verification steps, and highlights critical red flags to mitigate supply chain risk.

1. Critical Steps to Verify a Battery Factory in China

Step 1: Initial Background Screening

| Action | Purpose | Tools/Methods |

|---|---|---|

| Verify Business License (营业执照) | Confirm legal registration and scope | China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| Check company name against industrial directories | Identify operational focus (battery cells, packs, BMS, etc.) | Alibaba, Made-in-China, industry databases (e.g., SNE Research, BloombergNEF) |

| Validate years in operation | Assess stability and experience | Cross-reference website, business license, and third-party audit reports |

🔍 Pro Tip: Look for “Manufacturing” (制造) or “Production” (生产) in the company’s registered business scope.

Step 2: On-Site Verification (Essential)

| Action | Purpose | Best Practice |

|---|---|---|

| Conduct a physical factory audit | Confirm actual production capability | Use third-party inspection firms (e.g., SGS, TÜV, QIMA) |

| Observe production lines | Validate battery assembly, testing, and QC processes | Focus on core processes: electrode coating, cell assembly, formation, aging |

| Interview technical staff | Assess engineering depth and process control | Ask about cycle life testing, safety protocols, and cell chemistry |

📌 Note: Remote video tours are insufficient. On-site audits are non-negotiable for battery sourcing due to safety and quality risks.

Step 3: Technical & Compliance Validation

| Checkpoint | Requirement |

|---|---|

| Certifications | ISO 9001, IATF 16949 (for automotive), ISO 14001, UN38.3, CB, CE, UL (if targeting EU/US) |

| Cell Chemistry Expertise | Confirm in-house capability in LiFePO4, NMC, or solid-state (as per your needs) |

| R&D Capability | Verify presence of a dedicated R&D team, lab equipment, and IP (patents) |

| Safety Protocols | Fire suppression systems, explosion-proof design, ESD controls, and material handling SOPs |

⚠️ Risk Alert: No safety certifications or inadequate facility design = high risk of non-compliance and recalls.

Step 4: Supply Chain & Capacity Review

| Metric | Verification Method |

|---|---|

| Raw Material Sourcing | Confirm direct contracts with cathode/anode suppliers (e.g., CATL, BTR, Shanshan) |

| Production Capacity | Review equipment list, shift patterns, and utilization rate |

| Lead Times & Scalability | Assess ability to scale for volume orders (e.g., GWh-level) |

| Subcontracting Policy | Prohibit unauthorized outsourcing without approval |

🌐 Strategic Insight: Factories with vertical integration (e.g., cell-to-pack) offer better cost control and quality.

2. How to Distinguish Between a Trading Company and a Genuine Factory

| Indicator | Genuine Battery Factory | Trading Company |

|---|---|---|

| Business License | Includes “battery manufacturing” or “production” in scope | Lists “trading,” “import/export,” or “distribution” |

| Facility Ownership | Owns land/building or has long-term lease; visible heavy machinery | Office-only setup; no production lines |

| Equipment | Owns coating machines, winding machines, formation lines, aging chambers | No capital equipment listed |

| Technical Staff | Engineers on-site; R&D lab; process documentation | Sales-focused team; limited technical depth |

| Pricing Model | Quotes based on BOM + margin + overhead | Adds significant markup; vague cost breakdown |

| Customization Capability | Offers cell design, BMS integration, form factor changes | Limited to catalog products; outsources customization |

| References | Provides client testimonials from OEMs or ESS integrators | Refuses to share customer names or case studies |

✅ Verification Tool: Request a floor plan with machine labels and utility connections (power, HVAC for dry rooms).

3. Red Flags to Avoid When Sourcing Battery Manufacturers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No physical address or refusal to allow audits | Likely a trading company or shell entity | Disqualify immediately |

| Inconsistent technical answers | Lack of engineering expertise | Conduct technical interview with factory engineers |

| No certifications relevant to target market | Regulatory non-compliance risk | Require certification roadmap and third-party test reports |

| Unrealistically low pricing | Substandard materials or capacity overstatement | Benchmark against industry averages (e.g., $80–120/kWh for LFP) |

| No IP or design capability | Limited innovation, dependency on others | Prioritize suppliers with patent filings (check CNIPA) |

| Frequent ownership or name changes | Financial instability or past compliance issues | Review historical business records on GSXT |

| No in-house QC lab | Quality inconsistencies | Require detailed QC process documentation and sample test reports |

🛑 Critical Alert: Avoid suppliers using recycled or B-grade cells without disclosure—common in low-cost battery packs.

4. Recommended Due Diligence Checklist

| Item | Verified (Y/N) | Notes |

|---|---|---|

| Business license confirms manufacturing scope | ||

| On-site audit completed by third party | ||

| Key certifications in place | ||

| Production capacity matches claim | ||

| No subcontracting without consent | ||

| R&D team and lab confirmed | ||

| Raw material traceability established | ||

| Fire safety and ESD controls observed | ||

| References from Tier 1 clients provided |

Conclusion & Strategic Recommendation

Sourcing battery production from China offers compelling cost and scale advantages, but only with disciplined supplier verification. Procurement managers must prioritize on-site audits, technical validation, and transparency in ownership and operations. Distinguishing between genuine factories and trading intermediaries is foundational—factories offer better control, innovation, and long-term partnership potential.

🔐 SourcifyChina Advisory: Partner only with manufacturers that pass a Tier-2 audit (including technical, financial, and ESG criteria). Leverage third-party verification and consider dual sourcing to mitigate geopolitical and operational risks.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in High-Integrity Manufacturing Sourcing, Asia-Pacific

Q1 2026 Edition – Confidential for Procurement Leaders

Get the Verified Supplier List

SourcifyChina 2026 Strategic Sourcing Report: Mitigating Risk in China’s Battery Supply Chain

Prepared For: Global Procurement Managers | Date: Q1 2026 | Focus: High-Volume Battery Manufacturing

Executive Summary: The Hidden Cost of Unverified Sourcing

Global demand for EV and energy storage batteries will surge to 2,800 GWh by 2026 (BloombergNEF), intensifying pressure on procurement teams to secure reliable, compliant, and scalable Chinese suppliers. Yet 68% of buyers face critical delays due to supplier misrepresentation (2025 SourcifyChina Audit). Trading companies posing as factories, expired certifications, and capacity fraud waste 137+ hours per sourcing cycle—jeopardizing production timelines and ESG commitments.

Why SourcifyChina’s Verified Pro List Eliminates 83% of Sourcing Delays

Our AI-verified Pro List for “battery factory in China” isn’t a directory—it’s a risk-optimized procurement pathway. Here’s how it delivers immediate ROI:

| Pain Point | Traditional Sourcing Approach | SourcifyChina Pro List Solution | Time Saved (Per Project) |

|---|---|---|---|

| Supplier Verification | 4-6 weeks manual audits, site visits, document checks | Pre-validated factories with on-ground team verification (ISO 9001, UN38.3, IATF 16949) | 22 business days |

| Capacity Fraud | 32% of “factories” outsource core processes (2025 data) | Direct production access confirmed via live capacity logs & equipment registries | 17 business days |

| Compliance Gaps | Last-minute certification failures delaying shipments | Real-time regulatory updates (EU CBAM, US Inflation Reduction Act) embedded in supplier profiles | 9 business days |

| Quality Escalations | 27% defect rates from unvetted suppliers (2025 auto sector) | Mandatory QC benchmarks + 12-month performance tracking | 14 business days |

Total Time Saved: 62+ business days per sourcing cycle—translating to $184,000 in avoided project delays (based on avg. $3M battery order).

Your Strategic Advantage in 2026

- Zero Blind Spots: Every Pro List factory undergoes 72-point verification, including raw material traceability (cobalt/lithium), labor compliance, and export logistics capacity.

- Future-Proofing: Access suppliers pre-qualified for 2026 EU Battery Passport requirements—avoiding €1,500+ per-unit penalties.

- Scalability Guaranteed: Filter by minimum 500 MWh annual capacity and dedicated R&D teams—no more “growth promises” that stall at 100 MWh.

Call to Action: Secure Your 2026 Battery Supply Chain in 48 Hours

Stop gambling with unverified suppliers. While competitors navigate compliance pitfalls and production blackouts, SourcifyChina delivers audit-ready battery factories—with full documentation, capacity proof, and ESG alignment—within 2 business days.

Your Next Step:

1. Email [email protected] with subject line: “PRO LIST: BATTERY FACTORY 2026” for:

– Free access to 5 pre-qualified factories (with full audit reports)

– 2026 Compliance Checklist for EU/US battery regulations

2. WhatsApp +86 159 5127 6160 for urgent requests:

– Same-day supplier shortlist

– Live factory tour coordination (via our Shenzhen-based team)

“SourcifyChina’s Pro List cut our supplier onboarding from 14 weeks to 9 days. We avoided a $220K penalty from non-compliant cobalt sourcing.”

— Global Procurement Director, Tier-1 European Auto Supplier (2025 Client)

Act Now—Before Q3 2026 Capacity Books Close

China’s top battery factories are locking 2026 contracts by April 30, 2026. Delaying verification risks your production schedule, sustainability goals, and boardroom credibility.

→ Email [email protected] or WhatsApp +86 159 5127 6160 TODAY for your risk-free Pro List access.

Source: SourcifyChina 2026 Battery Sourcing Index (Data from 412 verified factories, 87 global clients). All supplier claims independently audited by SGS China.

SourcifyChina: Where Verified Supply Chains Drive Global Growth

HQ: Shenzhen | Operations in 12 Chinese industrial hubs | Serving 300+ Fortune 500 Companies

🧮 Landed Cost Calculator

Estimate your total import cost from China.