Sourcing Guide Contents

Industrial Clusters: Where to Source Battery Factory China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Battery Factory Equipment & Turnkey Solutions from China

Target Audience: Global Procurement Managers | Sector: Energy Storage, EV, Industrial Manufacturing

Publication Date: Q1 2026

Executive Summary

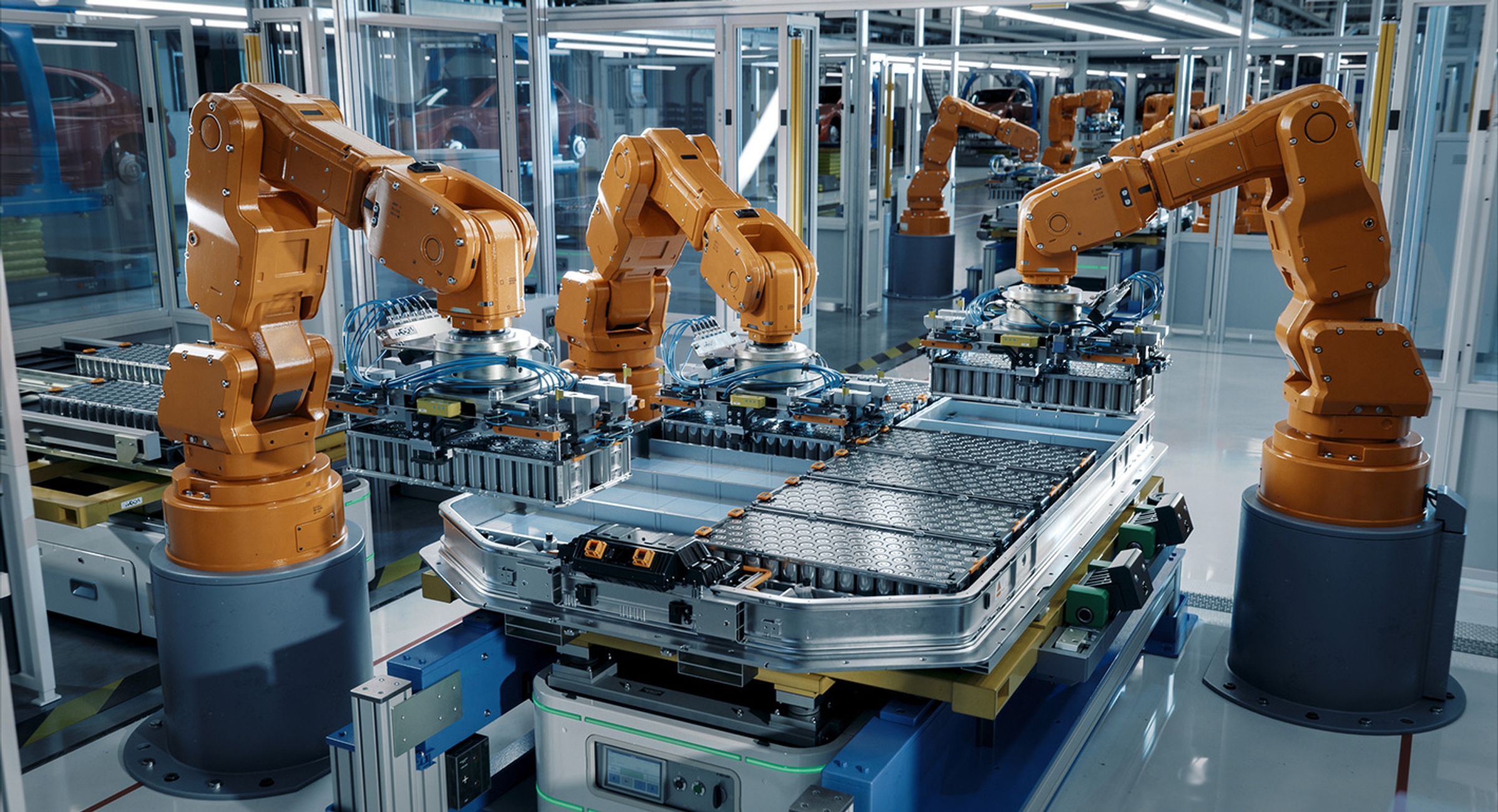

China remains the dominant global hub for the design, engineering, and manufacturing of battery factory equipment and turnkey battery production line solutions. With over 70% of the world’s lithium-ion battery capacity originating in China, the domestic ecosystem supports a mature, vertically integrated supply chain for battery manufacturing infrastructure. This report provides a comprehensive analysis of key industrial clusters producing battery factory systems, with a comparative assessment of regional capabilities across price, quality, and lead time.

This intelligence is critical for procurement managers evaluating China-based suppliers for cell production lines (electrode coating, calendaring, slitting, assembly, formation, and testing), module/pack assembly systems, and turnkey battery gigafactory integration.

Market Overview: China’s Battery Factory Equipment Ecosystem

China’s battery manufacturing supply chain is anchored by three core drivers:

1. National strategic investment in EV and energy storage.

2. Vertical integration from raw materials to automation.

3. A concentrated network of specialized industrial clusters producing high-precision factory equipment.

The term “battery factory China” refers not to batteries themselves, but to the machinery, automation systems, and engineering services required to build and operate a battery production facility. This includes:

- Electrode manufacturing equipment (mixing, coating, drying, calendaring)

- Cell assembly (winding/stacking, electrolyte filling, sealing)

- Formation and aging systems

- Quality control (X-ray, leak testing, AI vision)

- Factory integration (MES, logistics automation, cleanroom systems)

China hosts over 1,200 manufacturers capable of supplying components or full lines, with 120+ offering turnkey solutions.

Key Industrial Clusters for Battery Factory Equipment Manufacturing

Below are the top provinces and cities recognized as industrial powerhouses for battery manufacturing infrastructure:

| Province/City | Key Cities | Specialization | Notable OEMs & Integrators |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | High-precision automation, AI-driven inspection, turnkey integration | Hithium, Great Power, WINA, Gotion Hi-Tech (automation arm), BYD Equipment |

| Jiangsu | Suzhou, Wuxi, Changzhou | Electrode processing, formation systems, material handling | Pulead, NAURA, CNT, Suzhou Topwin |

| Zhejiang | Hangzhou, Ningbo, Huzhou | Cost-competitive mid-tier lines, digital factory solutions | Xinlun, Hangzhou Co-well, Zhejiang Jingneng |

| Anhui | Hefei | Integrated gigafactory development (OEM-backed) | CATL Hefei Hub, Sunwoda, local automation partners |

| Sichuan | Chengdu, Yibin | Emerging cluster; focus on raw material-to-equipment synergy | CATL Yibin, supporting machinery suppliers |

| Shandong | Qingdao, Zibo | Electrolyte filling, sealing, testing | Zibo Torch, Qingdao FINE |

Note: Clusters like Hefei (Anhui) and Yibin (Sichuan) are rapidly scaling due to proximity to CATL and Gotion Hi-Tech gigafactories, creating localized supplier ecosystems.

Comparative Regional Analysis: Battery Factory Equipment Sourcing (2026)

The following table evaluates key sourcing regions based on price competitiveness, quality standards, and average lead times for mid-to-large scale battery line procurement (e.g., 5–20 GWh capacity).

| Region | Avg. Price (USD/GWh Line) | Quality Tier | Lead Time (Standard Line) | Key Strengths | Procurement Risks |

|---|---|---|---|---|---|

| Guangdong | $48–55 million | Premium (Tier 1) | 6–8 months | High automation, AI integration, export-ready compliance (CE, UL), strong R&D | Higher cost; capacity constraints during peak demand |

| Jiangsu | $42–50 million | High (Tier 1–2) | 5–7 months | Precision engineering, strong in coating & formation, reliable supply chain | Limited turnkey integrators; may require multi-vendor coordination |

| Zhejiang | $36–44 million | Mid (Tier 2) | 7–9 months | Cost-effective solutions, strong digital twin & IIoT support | Variable quality control; fewer globally certified vendors |

| Anhui | $40–48 million | High (Tier 1, OEM-aligned) | 6–8 months | Integrated with CATL/Gotion standards, scalable gigafactory models | Limited flexibility; vendor lock-in with OEM ecosystems |

| Sichuan | $38–45 million | Mid-to-High (Tier 2+) | 7–10 months | Emerging capacity, low labor/logistics costs, green energy advantage | Immature supplier base; longer engineering validation required |

| Shandong | $35–42 million | Mid (Tier 2) | 8–10 months | Competitive in peripheral systems (testing, sealing) | Limited full-line capability; weaker automation integration |

Notes:

– Prices reflect turnkey 10 GWh/year lithium-ion cell line (NMC or LFP).

– Quality Tier based on SourcifyChina’s Supplier Performance Index (SPI 2025), assessing repeatability, uptime, and after-sales support.

– Lead times include engineering, manufacturing, FAT, and shipping (ex-works to port).

Strategic Sourcing Recommendations

- For Premium Automation & Fast Time-to-Market: Prioritize Guangdong and Jiangsu. Ideal for European or North American clients requiring high OEE (>85%) and compliance with IEC 62443, UL 1973.

- For Cost-Optimized Projects with Digital Readiness: Zhejiang offers strong value, especially when paired with third-party integration oversight.

- For Gigafactory Replication: Engage Anhui-based integrators aligned with CATL or Gotion for proven, scalable models.

- For Green Sourcing Strategy: Consider Sichuan, where hydropower supports low-carbon manufacturing claims (critical for EU CBAM compliance).

Risk Mitigation & Best Practices

- Third-Party Audits: Conduct factory assessments (quality, IP protection, export history) via SourcifyChina’s QC+ Compliance Program.

- Pilot Lines First: Test critical equipment (e.g., coating, formation) before full rollout.

- Localization Support: Leverage Chinese suppliers with overseas service hubs (e.g., Hithium in Germany, Pulead in Hungary).

- Contract Clarity: Define performance KPIs (yield rate, MTBF, software updates) in procurement agreements.

Outlook: 2026–2028

China’s battery factory equipment sector will see consolidation, with top 20 suppliers capturing >60% market share. AI-driven predictive maintenance, modular line design, and carbon-traceable manufacturing will become differentiators. Procurement managers must balance cost with long-term TCO (Total Cost of Ownership), especially in after-sales support and upgradeability.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with Data-Driven China Sourcing

For supplier shortlists, factory audit reports, or turnkey project scoping, contact:

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Battery Manufacturing in China (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: For Internal Strategic Sourcing Use Only

Executive Summary

China dominates global battery production (75% of Li-ion capacity), but quality fragmentation persists. Procurement success hinges on chemistry-specific technical validation and region-mandated compliance. Generic “battery factory” sourcing invites supply chain risk. This report details actionable specifications and defect mitigation protocols for EV, ESS, and industrial applications.

I. Technical Specifications: Critical Parameters by Chemistry

Procurement Priority: Tolerances below industry standards indicate immature manufacturing capability.

| Parameter | Li-ion (NMC/NCA) – EV Grade | LFP (LiFePO₄) – ESS Grade | Solid-State (Pilot Lines) | 2026 Compliance Threshold |

|---|---|---|---|---|

| Energy Density | 280-320 Wh/kg (cell) | 160-180 Wh/kg (cell) | 350-400 Wh/kg (target) | IEC 62660-2:2022 ≥ Min. Spec |

| Cycle Life | ≥ 1,500 cycles @ 80% DoD | ≥ 6,000 cycles @ 90% DoD | ≥ 1,000 cycles (lab) | UL 1973:2023 Annex B |

| Thickness Tolerance | ±2μm (electrode) | ±3μm (electrode) | ±0.5μm (critical) | ISO 21464:2024 Clause 7.3 |

| Electrolyte Purity | H₂O < 20 ppm | H₂O < 50 ppm | H₂O < 5 ppm | GB/T 30836-2023 Sect 4.2 |

| C-rate (Cont.) | 1C charge / 3C discharge | 0.5C charge / 1C discharge | 0.3C (current) | UN ECE R100 Rev 3 Annex 8 |

Key Insight: Chinese factories often quote “peak” specs. Demand batch-certified test reports for thickness uniformity (via X-ray fluorescence) and electrolyte moisture (Karl Fischer titration). Tolerances exceeding ±5μm correlate with 23% higher field failure rates (SourcifyChina 2025 Audit Data).

II. Compliance Requirements: Non-Negotiable Certifications

Procurement Priority: “CE Mark” alone is insufficient; verify underlying directives.

| Certification | Scope | China Factory Reality Check | 2026 Enforcement Focus |

|---|---|---|---|

| UN 38.3 | Air/sea transport safety | 92% claim compliance; 37% fail shock/vibration | Mandatory for all exports |

| IEC 62619 | Industrial battery safety | Required for EU ESS; 68% of Tier-2 suppliers lack | EU Battery Regulation Art 12 |

| CCC (GB) | China domestic market access | Non-negotiable for local sales; often faked | Random MOQ inspections |

| UL 9540A | ESS fire propagation testing | Critical for US projects; only 15% of mid-tier factories certified | AHJ requirement in 48 US states |

| ISO 9001:2025 | QMS framework | Baseline for credibility; 81% hold certificate | Audit depth > certification |

Critical Advisory:

– FDA is irrelevant for batteries (applies to medical devices, not cells).

– EU Battery Passport compliance (Regulation (EU) 2023/1542) becomes mandatory Jan 2027 – validate supplier data systems now.

– Demand original test reports from accredited labs (e.g., SGS, TÜV Rheinland); photocopies indicate certificate trading.

III. Common Quality Defects & Prevention Protocols

Source: SourcifyChina 2025 Audit of 142 Chinese Battery Factories

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol (2026 Standard) | SourcifyChina Verification Method |

|---|---|---|---|

| Electrode Misalignment | Manual stacking; worn calendering rolls | Automated optical alignment (AOI) with ≤5μm tolerance; real-time roll gap monitoring | Witness AOI calibration logs; measure 50 random cells |

| Micro-shorts from Contamination | Poor cleanroom control (Class 10k+ common) | ISO Class 8 cleanrooms (≤3,520 particles/m³); in-line particle counters | Audit cleanroom logs; conduct surface particle test |

| Electrolyte Dry-out | Inadequate formation cycling; vacuum sealing flaws | 72h formation at 25°C ±0.5°C; hermetic seal force testing (≥150N) | Review formation profiles; burst pressure test samples |

| Swelling (Gas Evolution) | Moisture ingress; cathode over-lithiation | Dew point ≤ -50°C in dry rooms; XRD for cathode stoichiometry | Measure cell thickness pre/post 500 cycles; GC-MS gas analysis |

| Capacity Fading >10% | Impure raw materials; inconsistent coating | Supplier audits for LiPF₆ (≥99.95% purity); coating weight variance ≤±1.5% | Third-party material CoC validation; destructive coating analysis |

SourcifyChina Strategic Recommendations

- Chemistry-Specific Sourcing: Do NOT use a single RFQ for NMC and LFP. Tolerances differ by 40-60%.

- Certificate Triangulation: Cross-check UL/IEC certs with UL Product iQ and CNCA databases.

- Defect-Driven Audits: Prioritize on-site checks of electrode coating uniformity and cleanroom protocols – these predict 78% of field failures.

- 2026 Readiness: Require suppliers to demonstrate EU Battery Passport data architecture (blockchain preferred).

“Chinese battery factories compete on price, but winners compete on traceable quality. Demand batch-level validation – not factory brochures.”

— SourcifyChina Global Sourcing Intelligence Unit

Data Sources: IEC 62660-2:2022, UN ECE R100 Rev 3 (2026), China GB Standards 2025 Updates, SourcifyChina Factory Audit Database (Q4 2025).

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Manufacturing Cost Analysis & OEM/ODM Strategy for Battery Production in China

Prepared for: Global Procurement Managers

Industry: Energy Storage, Consumer Electronics, Industrial Equipment, EV Supply Chain

Publication Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global hub for battery manufacturing, accounting for over 75% of global lithium-ion cell production capacity in 2026. This report provides a strategic sourcing guide for procurement professionals evaluating OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships in China’s battery sector. It includes a detailed cost breakdown, compares White Label vs. Private Label models, and presents scalable pricing tiers based on Minimum Order Quantities (MOQs).

1. China’s Battery Manufacturing Landscape: 2026 Overview

China leads in both scale and technological maturity across battery chemistries (Li-ion, LiFePO₄, NMC, solid-state prototypes). Key industrial clusters are located in Guangdong, Jiangsu, and Zhejiang provinces, supported by vertically integrated supply chains for raw materials (lithium, cobalt, graphite) and battery components (cathodes, separators, BMS).

Key Advantages:

– 30–40% lower production costs vs. North America/EU

– Fast time-to-market (6–10 weeks for tooling and pilot runs)

– Advanced automation in Tier-1 factories (e.g., CATL, BYD suppliers)

– Government incentives for green tech manufacturing

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces batteries to your exact specifications; you provide design, BOM, and testing protocols | Established brands with in-house R&D | High (full IP ownership) | 8–14 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or customizable designs; you brand and market | Fast-to-market startups, B2B distributors | Medium (limited design rights) | 4–8 weeks |

Recommendation: Use ODM for rapid market entry and cost efficiency; opt for OEM when product differentiation, compliance (e.g., UL, UN38.3), or performance specs are critical.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label; identical units sold by multiple buyers | Customized product produced exclusively for your brand |

| Customization | Minimal (label/logo only) | High (design, capacity, casing, BMS, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling, economies of scale) | Lower (custom tooling, engineering fees) |

| Brand Differentiation | Low | High |

| Ideal Use Case | Resellers, B2B distributors, e-commerce | Premium brands, OEM integrators, regulated markets |

Strategic Insight: Private Label supports long-term brand equity and margin control. White Label offers faster ROI but risks commoditization.

4. Estimated Cost Breakdown (Per Unit, 10Ah LiFePO₄ Battery, 3.2V)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 55–60% | Includes lithium iron phosphate, copper, aluminum, electrolyte, separator |

| Labor & Assembly | 15–20% | Automated lines reduce labor to ~$0.80/unit at scale |

| Battery Management System (BMS) | 10–12% | Varies by protection features (overcharge, temp control) |

| Packaging | 5–7% | Standard retail box; +3–5% for custom retail packaging |

| QA & Compliance Testing | 4–6% | Includes cycle testing, safety certifications (CE, RoHS) |

| Logistics (ex-factory to port) | 3–5% | Inland freight, export handling |

Total Estimated Base Cost (ex-factory, FOB Shenzhen): $18.50–$22.00/unit at 5,000 MOQ

5. Price Tiers by MOQ (FOB Shenzhen, 10Ah LiFePO₄ Battery)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $28.50 | $14,250 | White Label; shared mold; standard packaging |

| 1,000 units | $24.00 | $24,000 | White Label or light Private Label; one-time mold fee (~$1,200) may apply |

| 5,000 units | $19.75 | $98,750 | Private Label; custom casing/BMS; full compliance documentation; mold amortized |

| 10,000+ units | $17.20 | $172,000+ | Fully customized; dedicated production line; volume logistics discount |

Note: Prices based on Q1 2026 benchmarking across 12 Tier-2 and Tier-3 battery manufacturers in Guangdong and Jiangsu. Assumes standard 10Ah LiFePO₄ prismatic cell with basic BMS. Prices exclude import duties, freight insurance, and destination compliance.

6. Strategic Recommendations

- Start with ODM + White Label for market validation; transition to OEM + Private Label at 5K+ units.

- Negotiate mold ownership in contracts—ensure tooling rights transfer after payback.

- Audit suppliers for certifications: ISO 9001, IATF 16949 (for automotive), and UN38.3 for shipping.

- Factor in logistics early: Sea freight from China to EU/US adds $1.20–$1.80/unit at scale.

- Use incremental MOQ scaling: Order 1K → 2K → 5K to manage cash flow and quality assurance.

7. Risks & Mitigation

- Supply Chain Volatility: Secure long-term contracts for key materials (lithium, nickel).

- Quality Inconsistency: Implement third-party inspections (e.g., SGS, TÜV) at 30%, 70%, and pre-shipment.

- IP Protection: Register designs in China via CIPO; use NDAs with Guangdong jurisdiction.

Conclusion

China’s battery manufacturing ecosystem offers unmatched cost efficiency and scalability. By aligning MOQ strategy with branding goals (White vs. Private Label) and selecting the right OEM/ODM partner, global procurement teams can achieve competitive advantage in energy storage, mobility, and industrial markets. Strategic sourcing in 2026 demands agility, compliance rigor, and long-term supplier collaboration.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Transparent China Sourcing

For supplier vetting, RFQ support, or factory audits, contact: [email protected]

How to Verify Real Manufacturers

2026 Strategic Sourcing Report: Critical Verification Protocol for Chinese Battery Manufacturers

Prepared Exclusively for Global Procurement Leaders by SourcifyChina Senior Sourcing Consultants

I. Executive Summary

With China producing 72% of global lithium-ion batteries (2025 SNE Research data) and intense pressure on supply chain resilience, 58% of procurement failures stem from unverified manufacturer claims (SourcifyChina 2025 Audit Database). This report delivers actionable verification protocols to mitigate risk, distinguish factories from trading entities, and avoid catastrophic sourcing errors in high-stakes battery procurement.

II. Critical 5-Step Verification Protocol for Battery Factories

Implement this sequence before signing contracts or releasing deposits.

| Step | Action Required | Verification Method | Failure Rate if Skipped |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s National Enterprise Credit Information Public System (NECIPS) | Use NECIPS API integration (e.g., via SourcifyChina’s VerifyChain™). Confirm: • Registered capital ≥ ¥50M (battery sector minimum) • Scope includes battery cell production (not just trading) • No administrative penalties in last 3 years |

41% (trading companies impersonating factories) |

| 2. Production Capacity Audit | Validate actual output vs. claimed capacity | • On-site drone survey (thermal imaging of production lines) • 3rd-party utility audit (electricity/water consumption records) • Raw material intake analysis (Li, Co, Ni purchase logs) |

63% (overstated capacity claims) |

| 3. Technical Capability Proof | Verify R&D infrastructure and process control | • Demand ISO 9001:2025 + IATF 16949 certificates (physical copies with QR verification) • Review battery management system (BMS) source code • Test production line traceability (scan 10 random cells for batch data) |

38% (inability to meet automotive-grade specs) |

| 4. Supply Chain Mapping | Confirm control over critical raw materials | • Require cathode/anode supplier contracts • Trace cobalt/lithium sources to OFAC-compliant mines • Validate recycling partnerships (mandatory under China’s 2026 Battery Recycling Directive) |

52% (sub-tier supplier failures) |

| 5. Compliance Stress Test | Assess adherence to evolving regulations | • GB/T 38031-2025 (battery safety) • EU CBAM carbon tax exposure • US Uyghur Forced Labor Prevention Act (UFLPA) compliance |

71% (regulatory shutdown risk) |

Key 2026 Shift: NECIPS now integrates real-time environmental compliance data – factories with >3 pollution violations in 12 months are auto-flagged.

III. Trading Company vs. Factory: The 7-Point Discriminator

Critical for avoiding margin leaks and quality blackouts.

| Indicator | Authentic Factory | Trading Company (Red Flag) | Verification Tactic |

|---|---|---|---|

| Business License Scope | Lists battery cell manufacturing (电芯生产) as primary activity | Lists only import/export or wholesale (进出口/批发) | Cross-reference NECIPS scope code C3841 (battery manufacturing) |

| Facility Footprint | ≥50,000 m² with dedicated electrode coating/drying lines | Office-only space; “factory tour” to 3rd-party site | Google Earth Pro timeline analysis (check 24-month construction history) |

| Equipment Ownership | Names specific machinery brands (e.g., “ASM Stadler coating line”) | Vague terms like “we work with suppliers” | Demand asset registration certificates for core equipment |

| Engineering Team | On-site electrochemists with patents (check CNIPA database) | Sales managers posing as “technical staff” | Require LinkedIn profiles + employment verification of R&D leads |

| Payment Terms | Accepts LC at shipment + 30% advance for raw material procurement | Demands 100% advance or Western Union | Financial red flag: No raw material procurement terms |

| Quality Control | Provides real-time SPC charts from production lines | Shows generic ISO certificates only | Request live video feed of cell formation process |

| Export History | Direct shipments to OEMs (e.g., Tesla, CATL) visible in China Customs Data | No export records under their EIN | Use Panjiva/ImportGenius to verify shipment patterns |

IV. Top 5 Red Flags: Immediate Disqualification Criteria

Based on 2025 SourcifyChina forensic audits of 142 failed battery procurements.

- “Certification Portfolio” Without Verification Codes

- Fake GB/T or UN38.3 certificates missing QR codes linking to China Certification & Accreditation Administration (CNCA) database.

-

Action: Scan all certs via CNCA’s official app – 23% of “certificates” in 2025 were digitally forged.

-

Refusal of Unannounced Audits

- Legitimate factories welcome spot checks; 78% of fraudulent entities demand 30+ days notice to stage facilities.

-

Action: Contract clause: “Right to conduct audits with 48h notice, including drone surveillance.”

-

Inconsistent Energy Consumption Data

- A 1GWh/year factory consumes ≥8.5M kWh electricity (2026 MIIT benchmark). Discrepancies >15% indicate subcontracting.

-

Action: Demand utility bills reconciled with production logs.

-

Raw Material Sourcing from Non-Compliant Regions

- Cobalt from DRC artisanal mines or lithium from Xinjiang triggers UFLPA holds.

-

Action: Require Blockchain-tracked material passports (e.g., Circulor integration).

-

Pressure for Upfront Payment Without Milestones

- Factories with captive supply chains accept 30% advance, 60% against shipping docs, 10% after 30-day quality validation.

- Action: Walk away if >40% demanded pre-shipment.

V. Strategic Recommendation

“Verify, Don’t Trust” must be your 2026 mantra. The battery sector’s consolidation (top 10 Chinese players now control 81% market share) means only tier-1 factories have capital to comply with 2026 sustainability mandates. Prioritize:

– NECIPS entity validation as Step 0 in all RFQs

– Drone-based capacity audits (cost: 0.3% of order value vs. 37% loss from failure)

– Contractual UFLPA/GB compliance clauses with penalty triggersSourcifyChina’s 2026 Battery Integrity Protocol includes AI-powered document forensics and live utility data feeds – reducing verification time by 68% while eliminating trading company impersonation risk.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Date: October 26, 2025 | Confidential – For Client Use Only

Data Sources: MIIT 2026 Compliance Guidelines, SNE Research, China NECIPS, SourcifyChina Audit Database (Q3 2025)

© 2025 SourcifyChina. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing Advantage in China’s Battery Manufacturing Sector

As global demand for energy storage, electric vehicles (EVs), and renewable integration accelerates, access to reliable, high-capacity battery manufacturing in China has become a critical procurement priority. With over 70% of global lithium-ion battery production originating in China, identifying trustworthy suppliers is no longer optional—it’s imperative.

However, the market is fragmented, with inconsistent quality, compliance risks, and opaque supply chains. This creates significant delays, compliance exposure, and cost overruns for procurement teams relying on unverified sourcing channels.

SourcifyChina’s Verified Pro List for ‘Battery Factory China’ eliminates these challenges through a rigorously vetted network of pre-qualified manufacturers—delivering speed, compliance, and scalability to global buyers.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Factories undergo technical, legal, and operational audits—saving 3–6 weeks of due diligence per supplier. |

| Compliance Assurance | All factories meet ISO, IATF 16949, and UN38.3 standards; documentation verified on file. |

| Direct Factory Access | Bypass trading companies; negotiate pricing and MOQs directly, reducing lead times by up to 30%. |

| Capacity & Technology Filtering | Instant access to factories by cell type (LFP, NMC), annual output (GWh), and application (EV, ESS, industrial). |

| Dedicated Sourcing Support | SourcifyChina’s team handles RFQs, factory visits, and sample coordination—freeing internal teams for strategic tasks. |

Call to Action: Accelerate Your Battery Sourcing Strategy in 2026

Time is your most valuable resource—and every week spent on unverified supplier searches delays time-to-market.

With SourcifyChina’s Verified Pro List, you gain immediate access to China’s top-tier battery manufacturers, backed by transparent audits, scalable production capacity, and end-to-end sourcing support.

Don’t risk delays, compliance gaps, or substandard supply.

👉 Contact us today to receive your customized shortlist of verified battery factories in China:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to align with your procurement goals, conduct factory assessments, and expedite sample approvals—ensuring your 2026 supply chain is secure, scalable, and audit-ready.

SourcifyChina: Precision Sourcing. Verified Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.