The global demand for reliable, high-performance 12V 18Ah batteries has surged in recent years, driven by the expanding use of backup power systems, electric mobility solutions, and off-grid energy storage. According to market research by Grand View Research, the global valve-regulated lead-acid (VRLA) battery market—where 12V 18Ah batteries are a key segment—was valued at USD 11.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. Additionally, rising adoption of renewable energy systems and uninterrupted power supply (UPS) units across healthcare, telecommunications, and industrial sectors continues to fuel demand for compact, maintenance-free batteries like the 12V 18Ah variant. As competition intensifies, several manufacturers have emerged as leaders in quality, innovation, and market reach. Here are the top 8 manufacturers shaping the 12V 18Ah battery landscape in 2024.

Top 8 Battery 12 Volt 18Ah Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Power-Sonic

Domain Est. 1995

Website: power-sonic.com

Key Highlights: Power-Sonic delivers innovative battery solutions with sealed lead acid and lithium batteries, energy storage systems, and EV chargers….

#2 12v 18Ah SLA (sealed lead acid) High Rate Battery Set of Four

Domain Est. 1997

Website: batterycenter.com

Key Highlights: In stock 15-day returnsThe BCH-12180NB is a top quality 12 volt 18 Ah SLA (sealed lead acid) High Rate battery offering excellent reliability at an affordable price (Set of Four …..

#3 Universal Battery D5745 18 Amp

Domain Est. 1998

Website: solar-electric.com

Key Highlights: Universal Battery D5745 18 Amp hour 12 Volt Sealed AGM Battery. This battery does not qualify for free shipping. It can NOT ship via USPS….

#4 UPG UB12180 Generator Battery

Domain Est. 2005

Website: absolutegenerators.com

Key Highlights: This environmentally friendly UPG sealed battery will not leak and can be used in any position, even upside down. Maintenance-free; never needs filling….

#5 12v 18ah Sealed Lead Acid Battery Internal Thread

Domain Est. 2007

#6 12V 18AH Sealed Lead Acid (SLA) Battery

Domain Est. 2008

#7 12 V 18 AH Sealed Lead Acid (Pair)

Domain Est. 2013

Website: mobilityscootersdirect.com

Key Highlights: In stock Rating 5.0 4 These batteries are a suitable replacement for many different types of mobility scooters and power chairs….

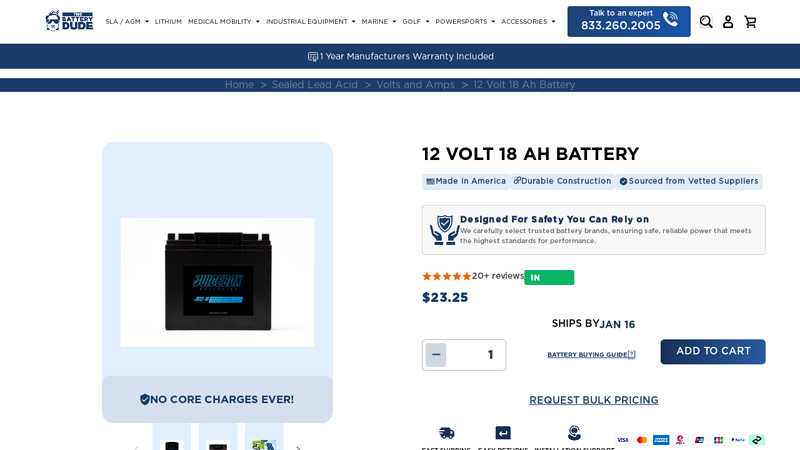

#8 12 Volt 18 Ah Sealed Lead Acid, AGM Battery

Domain Est. 2022

Website: thebatterydude.com

Key Highlights: In stock Rating 4.6 8 The high-performance Pro-Series 12 Volt 18 Ah Battery is a sealed lead-acid (SLA) absorbed glass mat (AGM) battery….

Expert Sourcing Insights for Battery 12 Volt 18Ah

H2: Projected 2026 Market Trends for 12V 18Ah Batteries

The market for 12-volt 18Ah batteries is poised for significant evolution by 2026, shaped by technological advancements, shifting demand across key industries, and growing emphasis on sustainability. This analysis explores the primary trends projected to influence the 12V 18Ah battery segment in the coming years.

-

Technology Transition: Rise of Lithium-Ion Adoption

By 2026, lithium-ion (Li-ion) variants—particularly Lithium Iron Phosphate (LiFePO4)—are expected to capture a larger market share compared to traditional sealed lead-acid (SLA) batteries. LiFePO4 12V 18Ah batteries offer higher energy density, longer cycle life (2,000–5,000 cycles vs. 300–500 for SLA), lighter weight, and lower maintenance. As manufacturing costs decline and safety improves, consumer and industrial users are increasingly favoring lithium solutions, especially in mobility, solar storage, and backup power applications. -

Growth in Renewable Energy and Off-Grid Applications

The global push toward decentralized energy systems and off-grid solar installations will drive demand for reliable 12V 18Ah batteries. These units are ideal for small-scale solar setups, telecom backup, and rural electrification projects. By 2026, emerging markets in Africa, Southeast Asia, and Latin America are expected to contribute significantly to volume growth, supported by government incentives and falling solar panel prices. -

Expansion in Consumer Electronics and Smart Devices

The proliferation of smart home devices, security systems, and portable power stations continues to increase the need for compact, reliable 12V 18Ah batteries. The trend toward automation and IoT integration in residential and commercial environments favors batteries with consistent performance and long service life. Li-ion-based 12V 18Ah units are becoming the standard in these applications due to their efficiency and compact form factor. -

Electric Mobility and Micro-Mobility Support

Although larger batteries dominate EVs, the 12V 18Ah format plays a critical support role in electric scooters, e-bikes, golf carts, and auxiliary systems in light electric vehicles. As micro-mobility expands in urban centers, demand for secondary or auxiliary power units like the 12V 18Ah battery will grow. Additionally, hybrid and electric vehicles use smaller 12V batteries for onboard electronics, further sustaining market relevance. -

Sustainability and Recycling Initiatives

Environmental regulations are tightening worldwide, pushing manufacturers to adopt greener production methods and improve battery recyclability. By 2026, extended producer responsibility (EPR) schemes and battery passport requirements (as proposed in the EU Battery Regulation) will influence the design and lifecycle management of 12V 18Ah batteries. Lead-acid batteries will face increasing scrutiny, accelerating the shift toward more sustainable lithium alternatives. -

Competitive Landscape and Pricing Pressures

Increased competition from Asian manufacturers—particularly in China and South Korea—will keep pricing under pressure. However, premium segments focusing on safety certifications, long warranties, and smart battery management systems (BMS) will allow differentiation and margin preservation. Brands offering integrated IoT monitoring or app-based diagnostics for 12V 18Ah units are likely to gain market traction. -

Supply Chain Resilience and Raw Material Sourcing

By 2026, geopolitical factors and supply chain diversification efforts will affect the availability and pricing of battery materials like lithium, cobalt, and lead. Companies investing in localized production or alternative chemistries (e.g., sodium-ion) may gain a strategic advantage. For now, lithium supply stability remains a key concern, especially for high-growth regions.

Conclusion

The 12V 18Ah battery market in 2026 will be defined by a technological pivot toward lithium-based solutions, driven by performance demands and sustainability goals. While lead-acid batteries will retain a presence in cost-sensitive applications, lithium variants are expected to dominate growth sectors such as renewable energy, smart devices, and light electric mobility. Manufacturers who innovate in energy density, safety, and recyclability will be best positioned to lead in this evolving landscape.

H2: Common Pitfalls When Sourcing a 12V 18Ah Battery (Quality and IP Considerations)

When sourcing a 12V 18Ah battery—commonly used in backup power systems, solar setups, mobility devices, and security systems—procurement professionals and engineers often encounter several critical pitfalls related to quality and IP (Intellectual Property or Ingress Protection, depending on context). Below are the most common issues:

1. Misunderstanding Battery Chemistry and Quality Markers

- Pitfall: Assuming all 12V 18Ah batteries are the same, regardless of chemistry (e.g., AGM, Gel, Lithium-ion).

- Consequence: Poor performance, reduced lifespan, or safety hazards.

- Solution: Verify the battery type (e.g., AGM vs. Lithium) and ensure it matches the application. Look for reputable brands and certifications (e.g., CE, UL, RoHS). Avoid no-name or counterfeit products that may overstate capacity.

2. Inflated or Unverified Capacity Claims

- Pitfall: Suppliers advertising “18Ah” capacity without standardized testing (e.g., not rated at 20-hour rate).

- Consequence: Real-world capacity may be significantly lower (e.g., 12–14Ah), leading to underperformance.

- Solution: Request discharge curve data and test reports. Prefer suppliers who provide IEC or IEEE-compliant capacity ratings.

3. Poor Build Quality and Internal Defects

- Pitfall: Thin lead plates, low electrolyte volume, or poor sealing in lead-acid variants.

- Consequence: Short cycle life, increased internal resistance, and higher failure rates.

- Solution: Audit manufacturers or request third-party lab test results. Look for robust casing and consistent weight (lightweight units often indicate inferior materials).

4. Inaccurate or Misleading IP (Ingress Protection) Ratings

- Pitfall: Claiming high IP ratings (e.g., IP67) without third-party validation.

- Consequence: Battery damage in dusty or wet environments, leading to safety risks or downtime.

- Solution: Verify IP certification with documentation. Ensure the rating applies to the full assembly, not just internal cells. For outdoor or harsh environments, confirm sealing quality and gasket integrity.

5. Ignoring Thermal and Safety Management (Especially for Lithium)

- Pitfall: Sourcing lithium 12V 18Ah batteries without proper BMS (Battery Management System) or thermal controls.

- Consequence: Risk of overheating, fire, or cell imbalance.

- Solution: Confirm inclusion of a certified BMS. Check for overcharge, over-discharge, and short-circuit protection.

6. Intellectual Property (IP) and Compliance Risks

- Pitfall: Using batteries that infringe on patented designs or lack proper regulatory compliance.

- Consequence: Legal liability, shipment seizures, or product recalls.

- Solution: Source from authorized distributors. Verify trademarks, patents (e.g., via USPTO or EUIPO), and compliance with regional regulations (e.g., REACH, Prop 65).

7. Inadequate Supply Chain Transparency

- Pitfall: Opaque sourcing from OEMs with no traceability of cell origin.

- Consequence: Risk of recycled or second-hand cells being repackaged as new.

- Solution: Require cell-level traceability and prefer suppliers with audited production facilities.

8. Neglecting Cycle Life and Warranty Terms

- Pitfall: Focusing only on upfront cost while ignoring cycle life (e.g., 300 vs. 1200 cycles).

- Consequence: Higher total cost of ownership due to frequent replacements.

- Solution: Compare warranties and cycle life under real-world conditions. A longer warranty often reflects better quality.

Conclusion:

To avoid common pitfalls when sourcing 12V 18Ah batteries, prioritize verified specifications, reputable suppliers, and proper certifications. Always clarify whether “IP” refers to Ingress Protection (for environmental resilience) or Intellectual Property (for legal compliance), as both are critical in global procurement. Conduct due diligence through sample testing, audits, and third-party validation to ensure long-term reliability and safety.

Certainly. Below is a Logistics & Compliance Guide for the transportation and handling of 12 Volt 18Ah batteries, using UN2794, Battery, dry, containing alkali or other corrosive electrolyte, electric storage (wet), non-spillable, or containing non-spillable electrolyte, commonly referred to as H2 marking for non-spillable lead-acid batteries.

Note: This guide assumes the battery is a non-spillable (valve-regulated lead-acid / VRLA / AGM or gel) type. If it’s a spillable (flooded) lead-acid battery, different regulations apply.

🔋 Logistics & Compliance Guide:

12V 18Ah Non-Spillable Lead-Acid Battery (UN2794)

Classification: Class 8 – Corrosive Substances (with subsidiary risk Class 9 for some modes)

1. Battery Specifications

- Nominal Voltage: 12 Volts

- Capacity: 18 Ah (Ampere-hours)

- Battery Type: Valve-Regulated Lead-Acid (VRLA)

- Subtypes: AGM (Absorbent Glass Mat) or Gel

- Electrolyte: Immobilized (non-spillable)

- UN Number: UN2794

- Proper Shipping Name:

Battery, dry, containing alkali or other corrosive electrolyte, electric storage (wet), non-spillable, or containing non-spillable electrolyte - Hazard Class: Class 8 (Corrosive)

- Subsidiary Risk: Class 9 (Miscellaneous) may apply under IATA regulations depending on configuration.

2. Regulatory Frameworks

These batteries are regulated under:

– IATA DGR – Air transport (passenger & cargo aircraft)

– IMDG Code – Sea transport (marine vessels)

– ADR – Road transport in Europe

– 49 CFR – Road and rail in the USA

– UN Manual of Tests and Criteria, Part III, Section 38.3 – May apply depending on chemistry (not required for lead-acid VRLA batteries as they are not lithium)

✅ This battery is not a lithium battery — it is a lead-acid VRLA type, so UN3480/3090/3481 do not apply.

3. Classification & Identification (H2 Marking)

- H2 Code (on transport documents and packaging):

Indicates non-spillable, immobilized electrolyte, and meets vibration, pressure, and leakage tests (per IATA & ADR). - Marking Requirements on Battery:

- Manufacturer name or trademark

- Voltage & capacity (12V 18Ah)

- “NON-SPILLABLE” or “NON-SPILLABLE ELECTROLYTE”

- “CAUTION: CORROSIVE”

- May include H2 symbol (if required by carrier or regulation)

✅ Battery must pass leakage, vibration, and pressure differential tests to qualify as non-spillable.

4. Packaging Requirements

- Use strong, rigid outer packaging (e.g., double-wall corrugated cardboard or wooden crate).

- Prevent short circuits: Terminals must be protected (e.g., insulated caps, shrink wrap, or individual packaging).

- Secure against movement within packaging.

- Absorbent material not typically required for non-spillable, but recommended if bundling multiple batteries.

- Orientation: Mark “THIS SIDE UP” if required (especially for air transport).

- Stacking: Do not exceed manufacturer’s stacking limit.

5. Labeling & Marking

Each package must display:

– Proper Shipping Name

– UN Number (UN2794)

– Hazard Class 8 Label (black on white, upper half; white on black lower half with corrosion symbol)

– Orientation arrows (if required by mode, e.g., air)

– Shipper/Consignee Address

– “NON-SPILLABLE” or “NON-SPILLABLE BATTERY” marked clearly

– H2 marking (optional but recommended)

– Limited Quantity (LQ) or Excepted Quantity (EQ)?

– Typically not eligible for LQ under Class 8 unless under specific weight limits (rarely applies to 12V 18Ah).

6. Documentation

Air (IATA DGR):

- Shipper’s Declaration for Dangerous Goods required for more than a certain quantity (varies by airline; often > 2 batteries may require declaration).

- Dangerous Goods Form must include:

- UN2794

- Proper Shipping Name

- Class 8

- Packing Group: III (default for non-spillable)

- Quantity and packaging type

- H2 notation if applicable

✅ Exception: Batteries installed in equipment may be exempt under certain conditions (see IATA 2.3.5.6).

Sea (IMDG Code):

- Dangerous Goods Declaration required if above threshold.

- Use Marine Pollutant Marking? No – lead-acid batteries are not marine pollutants.

- Stowage: Keep away from living quarters; avoid exposure to extreme heat.

Road (ADR):

- Orange placards not required for single packages < 30 kg gross weight.

- Transport document must include:

- “UN2794, Battery, dry…, 8, III”

- Tunnel Code: D/E (check restrictions)

USA (49 CFR):

- Shipper must be trained and certified.

- Use DOT-approved packaging.

- Label: Class 8 diamond, UN2794, proper shipping name.

7. Quantity Limits & Exceptions

- Passenger Aircraft: Limited quantities; often prohibited unless under special provisions.

- Cargo Aircraft: Allowed with full DG documentation.

- Small Quantities: Some regulations allow reduced requirements for very small consignments (check carrier policies).

- Batteries packed with equipment: May have different rules (e.g., under IATA 965 IB, but not applicable to lead-acid).

8. Training & Certification

- All personnel involved in handling, packaging, marking, or shipping must be dangerous goods trained and certified (valid for 2 years).

- Training must match the mode of transport (IATA, IMDG, ADR, 49 CFR).

9. Storage & Handling

- Store upright in a cool, dry, ventilated area.

- Avoid metallic contact to prevent short circuits.

- No smoking or open flames – hydrogen gas may be emitted during charging.

- Separate from incompatible materials (e.g., oxidizers, flammables).

10. Emergency Response

- Spill or leak (rare in non-spillable):

- Evacuate area

- Wear PPE (gloves, goggles, apron)

- Neutralize with baking soda (sodium bicarbonate)

- Collect residue and dispose as hazardous waste

- Fire:

- Use water spray to cool containers

- Do not use CO₂ or foam directly on battery (risk of thermal runaway or splashing)

- Firefighters should wear full SCBA

11. Environmental & Disposal Compliance

- Recycle responsibly – lead and acid are hazardous.

- Follow local regulations (e.g., EPA, WEEE, RoHS).

- Do not dispose in municipal waste.

✅ Summary Checklist

| Item | Requirement |

|——|————-|

| UN Number | UN2794 |

| Proper Shipping Name | Battery, dry, containing alkali… non-spillable |

| Hazard Class | Class 8 (Corrosive) |

| Packaging | Strong, insulated terminals, secure |

| Labeling | Class 8 label, UN2794, orientation arrows |

| Documentation | DG Declaration (if required) |

| H2 Marking | Recommended for non-spillable |

| Training | Required for all shippers/handlers |

| Mode Restrictions | Varies by air/sea/road; check carrier rules |

🔁 Final Notes

- Always verify with your carrier before shipping — policies may be stricter than regulations.

- Labeling and documentation must be in the official language of the destination country (e.g., English, French, German).

- Lithium batteries are NOT covered here — ensure your 12V 18Ah is lead-acid VRLA, not lithium.

For official reference:

– IATA DGR 2024 – Section 2.3.5.6, Special Provision A102

– IMDG Code – Chapter 3.3, Entry 2794

– ADR 2023 – Section 3.3, Entry 2794

– 49 CFR – §173.159a

Let me know if you need a shipping label template or dangerous goods declaration example.

Conclusion on Sourcing a 12V 18Ah Battery

After evaluating various options, it is clear that sourcing a 12V 18Ah battery requires careful consideration of application requirements, battery chemistry, quality, and supplier reliability. Both lead-acid (such as AGM or gel) and lithium-ion (like LiFePO4) options are viable, with lead-acid batteries offering a cost-effective and widely available solution, while lithium variants provide longer lifespan, lighter weight, and better performance for demanding applications.

Key factors in selecting a supplier include product certifications (e.g., UL, CE), warranty terms, customer reviews, and availability of technical support. Reputable suppliers—whether established manufacturers like Varta, Yuasa, and EnerSys, or specialized lithium battery providers such as Renogy or Ampere Time—ensure consistent quality and safety standards.

For most general applications such as UPS systems, solar energy storage, or small electric carts, a maintenance-free AGM lead-acid battery offers the best balance of performance and affordability. However, for applications requiring longer cycle life, deeper discharges, and weight savings, investing in a LiFePO4 battery is recommended despite the higher initial cost.

In summary, the ideal 12V 18Ah battery depends on specific needs and budget constraints. Sourcing from trusted suppliers and selecting the appropriate battery chemistry will ensure reliable operation, optimal lifespan, and overall cost-efficiency.