The global bathtub components market is experiencing steady expansion, driven by rising residential construction, urbanization, and increasing consumer demand for premium bathroom fixtures. According to Grand View Research, the global bathroom fixtures market—of which bathtub components are a key segment—was valued at USD 85.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is further fueled by advancements in material technology, such as the shift toward lightweight composite materials and integrated antimicrobial surfaces, as well as the rising trend of smart bathroom solutions. With North America and Europe maintaining strong market shares due to renovation activities and high-end residential projects, and Asia-Pacific emerging as the fastest-growing region due to rapid urbanization and expanding middle-class populations, the competitive landscape for bathtub components manufacturers is becoming increasingly dynamic. In this evolving environment, innovation, supply chain efficiency, and product diversification are critical success factors. Below, we spotlight the top 10 bathtub components manufacturers leading the industry through technological advancement, global reach, and consistent performance.

Top 10 Bathtub Components Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Symmons

Domain Est. 1996

Website: symmons.com

Key Highlights: Symmons is renowned for its wide range of durable, reliable commercial-grade plumbing products for Educational, Healthcare, Hospitality, Industrial, and ……

#2 Luxury Kitchen and Bathroom Faucets Made in Brooklyn …

Domain Est. 1999

Website: watermark-designs.com

Key Highlights: Brooklyn based manufacturer of luxury faucets, showers, and bath accessories designed by world renown architects and designers….

#3 Bathtubs

Domain Est. 1994

Website: kohler.com

Key Highlights: Shop KOHLER bathtubs and find your perfect fit from our large collection of freestanding tubs, alcove tubs, and soaking tubs….

#4 Jacuzzi® Bathroom

Domain Est. 1995

Website: jacuzzi.com

Key Highlights: Capture the breathtaking beauty of a Jacuzzi® bathroom with an array of Jacuzzi® sinks, faucets, medicine cabinets, bathtubs, showers and accessories….

#5 All Bath Products

Domain Est. 1999

Website: brizo.com

Key Highlights: Products ; Single-Handle Lavatory Faucet 1.2 GPM · 65067LF-PC-ECO ; 13″ Wall Mount Shower Arm and Flange · 83867-PC ; Optional Wall Plate ……

#6 MTI Baths & Acquabella

Domain Est. 2010

Website: mtibaths.com

Key Highlights: Bathroom tubs, sinks and shower bases that are beautiful, functional and durable. Mineral Composite, with a chemically-bonded coated finish….

#7 Acrylic Bath Products & Custom Countertops in Houston, TX

Domain Est. 2017

Website: royal-mfg.com

Key Highlights: We make our bathtubs and shower pans from an exclusive high-gloss, cross-linked acrylic. This quality material is superior to builder-grade fiberglass and ……

#8 Gerber Plumbing Fixtures

Domain Est. 2020

Website: gerber-us.com

Key Highlights: Explore Gerber professional bathroom, kitchen, and commercial plumbing fixtures. Find toilets, faucets, sinks, showers and other plumbing products….

#9 Artos US

Website: artos.us.com

Key Highlights: We work hard to make everyday bathroom fixtures stylish and readily available. If you have a project you would like to discuss just get in touch using the ……

#10 Bestbath’s Official Store

Domain Est. 2020

Website: bestbathshop.com

Key Highlights: Bestbath is the world’s leading manufacturer of bathing products for people of all abilities. Bestbath’s products are designed to be functional and beautiful ……

Expert Sourcing Insights for Bathtub Components

H2: 2026 Market Trends for Bathtub Components

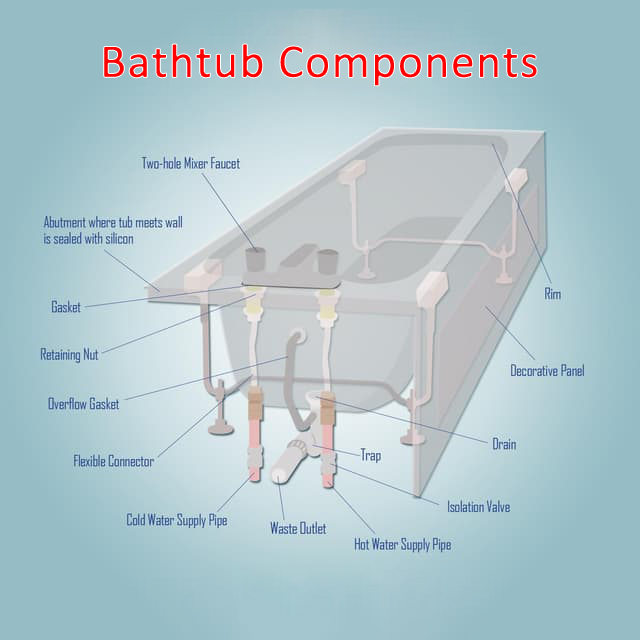

The bathtub components market is poised for significant transformation by 2026, driven by evolving consumer preferences, technological innovation, and increasing emphasis on sustainability and wellness. As part of the broader bathroom fixtures industry, bathtub components—including faucets, drains, overflow assemblies, showerheads, supports, and smart controls—are witnessing shifts influenced by design aesthetics, material advancements, and smart home integration.

-

Growth in Smart and Automated Components

By 2026, smart bathtub components are expected to dominate new installations, especially in developed markets. Innovations such as voice-activated fill controls, temperature-regulating systems, integrated LED lighting, and water-saving sensors are becoming standard in high-end and mid-tier bathrooms. Companies are increasingly incorporating IoT (Internet of Things) capabilities into components, allowing users to monitor water usage and schedule baths via smartphone apps. -

Sustainability and Water Efficiency

Environmental concerns are shaping product development. Regulatory standards, such as the U.S. EPA’s WaterSense program and similar EU directives, are pushing manufacturers to produce low-flow faucets, self-draining overflow systems, and recyclable component materials. By 2026, water-efficient designs are expected to be not only a competitive advantage but a regulatory requirement in many regions. -

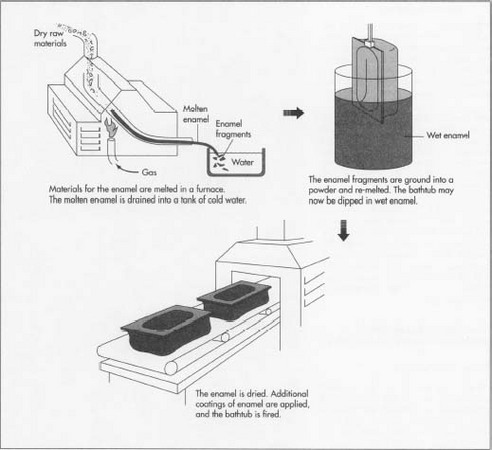

Material Innovation and Durability

There is a rising demand for corrosion-resistant, long-lasting materials such as brushed nickel, matte black finishes, and ceramic cartridges in faucets and valves. Additionally, manufacturers are shifting toward using recycled metals and bio-based polymers to reduce environmental impact without compromising performance or aesthetics. -

Rise in Customization and Luxury Design

Consumers are increasingly seeking personalized bathroom experiences. This trend is driving demand for modular and customizable bathtub components, including designer drains, multi-functional shower systems, and freestanding tub fittings. Premium finishes and minimalist designs are especially popular in urban and high-income housing markets. -

Influence of Aging-in-Place and Accessibility Needs

With aging populations in North America and Europe, there is growing demand for accessible bathtub components. By 2026, safety-focused features such as anti-scald valves, easy-grip handles, and low-threshold drain systems are expected to become mainstream, supported by universal design principles and government incentives for accessible housing. -

E-Commerce and Direct-to-Consumer Sales Growth

The distribution landscape is shifting, with online platforms playing a larger role in component sales. Brands are investing in augmented reality (AR) tools that allow customers to visualize components in their bathrooms before purchase. This trend is accelerating due to improved logistics and consumer comfort with online home improvement shopping. -

Regional Market Dynamics

North America and Europe remain key markets due to high renovation activity and disposable income. Meanwhile, the Asia-Pacific region—particularly China and India—is showing rapid growth due to urbanization and rising middle-class demand for modern bathrooms. Local manufacturers are adapting global designs to regional preferences, such as smaller, space-saving components.

In summary, the 2026 bathtub components market will be characterized by smart technology integration, eco-conscious design, and enhanced user experience. Manufacturers who prioritize innovation, sustainability, and adaptability to regional needs will be best positioned to capture market share in this evolving landscape.

Common Pitfalls Sourcing Bathtub Components (Quality, IP)

Sourcing bathtub components involves navigating several potential challenges, particularly related to quality assurance and intellectual property (IP) protection. Overlooking these pitfalls can lead to costly delays, product failures, legal disputes, and reputational damage. Here are key areas to watch:

Inadequate Quality Control Standards

Suppliers may claim compliance with industry standards but fail to implement consistent quality control processes. Components such as acrylic shells, faucets, or drain assemblies can vary significantly in durability, finish, and dimensional accuracy. Without clear specifications and third-party inspections, substandard materials or workmanship may result in leaks, premature wear, or safety hazards.

Lack of Material Certification and Traceability

Many bathtub components—especially structural or water-contact parts—require certified materials (e.g., non-toxic resins, rust-resistant metals). Sourcing without proper documentation (such as RoHS, NSF, or ISO certifications) risks non-compliance with safety regulations and exposes the buyer to liability. Inadequate traceability also complicates recalls or quality investigations.

Misrepresentation of Intellectual Property Ownership

Suppliers may offer “custom” or “designer” components that closely resemble patented or trademarked products. Using such components can expose the buyer to IP infringement claims, especially in markets with strict enforcement (e.g., EU, USA). Verifying that the supplier holds legitimate rights or licenses to the designs is essential.

Unauthorized Use of Protected Designs or Technologies

Some components incorporate proprietary technologies (e.g., anti-slip surfaces, thermostatic mixing valves, or molded support frames). Sourcing clones or reverse-engineered versions without proper licensing not only risks legal action but may also compromise performance and safety due to inferior engineering.

Inconsistent Component Tolerances and Interoperability

When sourcing parts from multiple suppliers (e.g., tub shell from one vendor, overflow assembly from another), poor dimensional coordination can lead to fitment issues during assembly. Lack of adherence to agreed technical drawings or GD&T (Geometric Dimensioning and Tolerancing) standards often results in costly rework or production delays.

Failure to Secure IP Rights in Custom Tooling

When investing in custom molds or dies for unique components, buyers may assume ownership. However, if contracts don’t explicitly transfer IP rights or tooling ownership, the supplier may retain control, limiting production flexibility or enabling them to sell similar products to competitors.

Supply Chain Transparency Gaps

Hidden subcontracting or tier-2 sourcing can introduce unverified quality risks and IP vulnerabilities. Without audited supply chains, components may originate from unauthorized or non-compliant manufacturers, undermining both product integrity and legal compliance.

To mitigate these risks, conduct thorough due diligence, use IP-clear contracts, require material and process certifications, and perform regular on-site audits. Engaging legal and technical experts during the sourcing process is critical to ensuring both quality and IP safety.

Logistics & Compliance Guide for Bathtub Components

This guide outlines key logistics considerations and compliance requirements for the transportation, handling, and regulatory adherence of bathtub components, including acrylic shells, faucets, drains, overflow assemblies, support frames, and installation hardware.

Supply Chain Management

- Supplier Qualification: Ensure all component suppliers comply with relevant material safety, environmental, and labor standards (e.g., ISO 9001, ISO 14001, REACH, RoHS).

- Component Sourcing: Prioritize suppliers with stable lead times and geographic proximity where feasible to reduce transit risks and carbon footprint.

- Inventory Planning: Maintain safety stock for high-lead-time items (e.g., cast iron bases, custom acrylic molds) while using just-in-time (JIT) practices for standard hardware.

Packaging & Handling

- Fragile Protection: Acrylic and porcelain components must be double-boxed with foam inserts or edge protectors to prevent cracking or chipping.

- Waterproofing: Use moisture-resistant packaging or vapor barriers for metal components (faucets, drains) to prevent corrosion during ocean or humid-land transport.

- Labeling Requirements: Clearly label packages with handling instructions (e.g., “This Side Up,” “Fragile”), component type, SKU, and country of origin.

- Stackability & Palletization: Design packaging for secure stacking. Use standardized pallet sizes (e.g., EUR, GMA) and stretch-wrap to prevent shifting.

Transportation & Distribution

- Mode Selection:

- Ocean Freight: Cost-effective for bulk shipments from overseas suppliers; use 20’ or 40’ dry containers with desiccants.

- Truckload (TL)/Less-Than-Truckload (LTL): Preferred for domestic distribution; ensure carriers have experience with fragile freight.

- Air Freight: Reserved for urgent, low-volume, high-value components (e.g., custom brass fittings).

- Route Optimization: Minimize handling points and avoid high-theft-risk zones. Use real-time GPS tracking for high-value shipments.

- Temperature Control: Avoid exposure to extreme temperatures (below freezing or above 120°F) that could degrade adhesives or warp acrylic.

Regulatory Compliance

- Import/Export Regulations:

- HTS Codes: Assign accurate Harmonized Tariff Schedule codes (e.g., 3922.10 for acrylic bathtubs, 8481.80 for faucets).

- Customs Documentation: Provide commercial invoices, packing lists, and certificates of origin. Comply with CBP (U.S.), EU Import Controls, or other local customs authorities.

- Product Safety Standards:

- Plumbing Codes: Ensure components meet ASSE 1002 (U.S.), CSA B61 (Canada), or EN 200 (EU) for faucets and waste fittings.

- Material Restrictions: Comply with lead content limits per U.S. Safe Drinking Water Act (lead-free plumbing) and EU REACH (SVHCs).

- Environmental Compliance:

- RoHS/REACH: Verify electrical components (e.g., whirlpool pumps) meet RoHS for hazardous substances.

- WEEE: If applicable, register products under Waste Electrical and Electronic Equipment directives in EU markets.

Quality Assurance & Traceability

- Incoming Inspection: Conduct dimensional checks, material verification, and visual inspections upon receipt.

- Batch Tracking: Implement lot numbering or QR codes to trace components back to production batches for recalls or quality issues.

- Non-Conformance Handling: Establish a process for quarantining and returning defective components, with root-cause analysis.

Installation & End-User Compliance

- Documentation: Provide installers with compliance certificates, installation manuals, and plumbing code references.

- Warranty & Liability: Ensure all components meet manufacturer warranty terms and relevant liability standards (e.g., ASTM F2529 for bathtub structural performance).

Sustainability & Reverse Logistics

- Recyclable Packaging: Use recyclable cardboard, biodegradable void fill, and avoid plastic wherever possible.

- Returns Management: Establish a returns process for damaged or excess components, including inspection, refurbishment, or recycling.

Adhering to this guide ensures efficient logistics operations and full compliance with international trade, safety, and environmental regulations for bathtub component supply chains.

In conclusion, sourcing bathtub components requires a strategic approach that balances quality, cost, and reliability. By carefully evaluating suppliers based on material standards, manufacturing capabilities, lead times, and compliance with industry regulations, businesses can ensure the procurement of durable and high-performing components. Additionally, establishing strong supplier relationships, considering sustainability, and staying informed about market trends contribute to long-term success. Effective sourcing not only enhances product quality but also supports efficient production and customer satisfaction, ultimately strengthening competitiveness in the bathroom fixtures market.