The global bamboo fabric market is experiencing robust growth, driven by rising consumer demand for sustainable and eco-friendly textiles. According to Grand View Research, the global bamboo fiber market size was valued at USD 2.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 12.4% from 2023 to 2030. This growth is fueled by increasing environmental concerns, stricter regulations on synthetic fibers, and a shift toward renewable materials in the apparel and home textile industries. As sustainability becomes a competitive differentiator, bamboo fabric—known for its softness, breathability, and biodegradability—has emerged as a preferred alternative to conventional cotton and polyester. With Asia-Pacific leading production due to favorable growing conditions and established supply chains, a select group of manufacturers are driving innovation, scalability, and quality in bamboo textile manufacturing. Below are the top 9 bamboo fabric material manufacturers shaping the future of sustainable textiles.

Top 9 Bamboo Fabric Material Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hire Bamboo Clothing Manufacturers

Domain Est. 2012

Website: billoomifashion.com

Key Highlights: We at Billoomi Fashion source finest quality of bamboo fabric and make 100% made-to-order garments as per your custom design and specification….

#2 Top 7 Bamboo Fabric Manufacturers, Suppliers USA, CA

Domain Est. 2018

Website: wellfabric.com

Key Highlights: Companies such as Greene Textile, WELL FABRIC, Simplifi Fabric, Nick of Time Textiles, and Kinderel have been at the forefront of producing bamboo fabrics and ……

#3 Comfortable & Sustainable Bamboo Clothes

Domain Est. 1996

Website: boody.com

Key Highlights: Sustainable, soft, and ethically crafted bamboo clothing. Shop bamboo clothes for women, men and babies at Boody US. Get free shipping on orders $60+!…

#4 Robert Kaufman Fabrics

Domain Est. 1997 | Founded: 1942

Website: robertkaufman.com

Key Highlights: Wholesale supplier of quality textiles and fabrics for quilting, fashion and manufacturing since 1942….

#5 bamboo fabric

Domain Est. 2001

Website: knitfabric.com

Key Highlights: $8.95 delivery 14-day returnsMade from renewable bamboo plants, this 4-way stretch fabric feels incredible against skin and works beautifully for dresses, tops, pajamas, and baby c…

#6 Shanghai Tenbro Bamboo Textile Co.,Ltd.

Domain Est. 2002

Website: tenbro.com

Key Highlights: Shanghai Tenbro is the earliest and most professional bamboo fiber supplier in China , and the patent holder of bamboo fiber products…… …(MORE)….

#7 Bamboosa

Domain Est. 2004

#8 Bamboo Fabric Store

Domain Est. 2006

Website: bamboofabricstore.com

Key Highlights: We sell fabric that’s spun and knit from long, strong, soft fibers derived from the pulp of bamboo plants….

#9 Heelium

Domain Est. 2016

Website: heelium.in

Key Highlights: 10-day returnsIndia’s #1 bamboo-based athleisure brand that makes bamboo socks, towels, bandanas, innerwear and more. We solve everyday problems like foul odour & skin ……

Expert Sourcing Insights for Bamboo Fabric Material

2026 Market Trends for Bamboo Fabric Material

Growing Demand for Sustainable Textiles

By 2026, the global demand for sustainable and eco-friendly textiles is expected to significantly drive the growth of the bamboo fabric market. As consumers become more environmentally conscious, bamboo fabric—renowned for its biodegradability, low environmental impact, and rapid renewability—will gain increased preference over conventional cotton and synthetic fibers. The material’s ability to grow quickly without pesticides or extensive irrigation strengthens its appeal in the green fashion and home textile sectors.

Expansion in Fashion and Apparel Industries

The fashion industry is projected to be a major adopter of bamboo fabric by 2026. Leading apparel brands are incorporating bamboo textiles into their sustainable product lines due to their softness, moisture-wicking properties, and natural antibacterial qualities. With the rise of eco-conscious luxury and athleisure wear, bamboo blends are expected to feature prominently in activewear, underwear, and casual clothing, especially in North America and Europe.

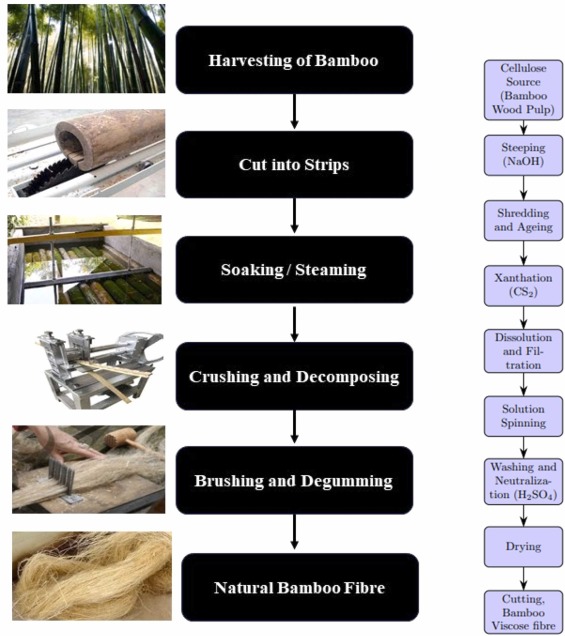

Technological Advancements in Processing

By 2026, innovations in closed-loop manufacturing processes are anticipated to reduce the environmental footprint of bamboo fabric production, particularly in addressing concerns related to chemical-intensive viscose methods. More companies are expected to adopt lyocell-type processes that recycle solvents and minimize waste. These advancements will improve the sustainability profile of bamboo textiles and enhance market credibility among eco-certification bodies and consumers.

Regulatory Support and Certification Standards

Global regulatory frameworks promoting sustainable manufacturing and circular economies will likely support the bamboo fabric market. By 2026, stricter environmental regulations in regions like the EU and increasing demand for certifications such as OEKO-TEX, GOTS, and FSC are expected to incentivize transparent and ethical sourcing of bamboo fibers. This will help differentiate high-quality, responsibly produced bamboo fabrics in a competitive market.

Rising Investments and Market Players

The bamboo fabric industry is poised for increased investment from both startups and established textile manufacturers. By 2026, vertical integration—from bamboo cultivation to finished textiles—is expected to become a strategic focus, particularly in key producing countries like China, India, and Vietnam. Additionally, partnerships between fiber producers and fashion brands will likely accelerate product innovation and market penetration.

Challenges and Market Barriers

Despite positive growth indicators, the bamboo fabric market may face challenges in 2026, including greenwashing controversies, inconsistent labeling, and competition from alternative sustainable fibers like TENCEL™ and hemp. Consumer education and standardized labeling practices will be critical to maintaining trust and ensuring long-term market expansion.

Regional Market Outlook

Asia-Pacific will remain the dominant producer and consumer of bamboo fabric by 2026, driven by raw material availability and growing domestic demand. Meanwhile, North America and Western Europe are expected to lead in premium product adoption, fueled by strong sustainability regulations and consumer willingness to pay for eco-friendly materials.

Conclusion

The bamboo fabric market in 2026 will be shaped by sustainability trends, technological innovation, and heightened consumer awareness. As the textile industry shifts toward circular and low-impact models, bamboo fabric is positioned to play a key role—provided industry stakeholders address environmental concerns and uphold transparency in production.

Common Pitfalls Sourcing Bamboo Fabric Material (Quality, IP)

Sourcing bamboo fabric can offer sustainable advantages, but buyers often encounter significant challenges related to quality consistency and intellectual property (IP) concerns. Being aware of these pitfalls is crucial for making informed and responsible sourcing decisions.

Misleading Sustainability Claims and “Greenwashing”

One of the most prevalent issues is exaggerated or false environmental claims. While bamboo is a fast-growing, renewable resource, the process of converting it into fabric—especially viscose (rayon) from bamboo—often involves toxic chemicals like carbon disulfide and sodium hydroxide. Many suppliers market bamboo fabric as inherently eco-friendly without transparency about the chemical processing involved. This greenwashing can mislead buyers into believing they are sourcing a sustainable product when, in reality, the environmental footprint may be significant unless closed-loop production methods are used.

Inconsistent Fiber Quality and Performance

Bamboo fabric quality varies widely depending on the manufacturing process and supplier standards. Key quality issues include:

- Fiber Strength and Durability: Bamboo viscose fibers may be weaker than cotton or synthetic alternatives, leading to pilling or tearing, especially in lower-grade fabrics.

- Shrinkage and Dimensional Stability: Poorly processed bamboo fabric can shrink excessively after washing, affecting garment fit and product consistency.

- Dye Uptake and Colorfastness: Inconsistent fiber batches may absorb dyes unevenly, resulting in color variations and poor color retention over time.

Without clear specifications and third-party testing, buyers risk receiving subpar materials that fail to meet performance expectations.

Lack of Traceability and Certification

Many suppliers cannot provide full traceability from raw bamboo to finished fabric. This opacity makes it difficult to verify sustainable harvesting practices, ethical labor conditions, or environmental compliance. Relying on certifications such as OEKO-TEX®, FSC®, or the EU Ecolabel can help, but counterfeit or self-issued certifications are not uncommon. Buyers should demand verifiable documentation and conduct supplier audits to ensure authenticity.

Intellectual Property (IP) and Process Misrepresentation

A critical IP-related pitfall involves the mislabeling of bamboo fabric types. The FTC in the U.S. and similar bodies elsewhere require accurate labeling: fabric made through chemical processing must be labeled as “rayon from bamboo,” not simply “bamboo.” Some suppliers deliberately mislabel products to capitalize on bamboo’s eco-image, exposing buyers to legal and reputational risks.

Additionally, proprietary technologies—such as closed-loop lyocell processes for bamboo—may be protected by patents. Sourcing from manufacturers using patented methods without proper licensing can lead to IP infringement claims, especially in international markets. Buyers should confirm the legitimacy of production methods and ensure compliance with regional labeling and IP laws.

Supply Chain Volatility and Scalability Issues

Despite bamboo’s abundance, reliable large-scale production of high-quality bamboo fabric remains limited. Many suppliers lack the infrastructure for consistent output, leading to supply disruptions. Geopolitical factors, export restrictions, or reliance on single-source manufacturers further increase risk. Diversifying suppliers and building long-term partnerships can mitigate these challenges.

Conclusion

To avoid these pitfalls, buyers should prioritize transparency, demand verifiable certifications, conduct rigorous quality testing, and ensure legal compliance in labeling and IP. Engaging with ethical, audited suppliers and investing in due diligence will help secure high-quality, responsibly sourced bamboo fabric while minimizing risks.

Logistics & Compliance Guide for Bamboo Fabric Material

Overview of Bamboo Fabric in Global Trade

Bamboo fabric, derived primarily from bamboo pulp through mechanical or chemical processing (e.g., viscose/rayon), is increasingly popular in the textile industry due to its sustainability claims. However, its production, labeling, and international shipment are subject to strict logistics and regulatory controls to ensure environmental responsibility, accurate marketing, and compliance with trade laws.

Sourcing and Production Compliance

Ensure that bamboo fabric is sourced from suppliers adhering to sustainable forestry practices certified by recognized organizations such as the Forest Stewardship Council (FSC) or Programme for the Endorsement of Forest Certification (PEFC). Production facilities—especially those using chemical processes like viscose—must comply with environmental regulations (e.g., REACH in the EU, EPA standards in the U.S.) to minimize hazardous effluent discharge. Audit suppliers for ISO 14001 (Environmental Management) and Oeko-Tex Standard 100 certification to verify low chemical content and safety.

Labeling and Marketing Regulations

Accurate labeling is critical due to regulatory scrutiny over “greenwashing.” In the United States, the Federal Trade Commission (FTC) requires that bamboo-derived rayon be labeled as “rayon from bamboo” rather than simply “bamboo fabric” to avoid misleading consumers about its natural origin. Similarly, the EU’s Textile Regulation (EU) No 1007/2011 mandates precise fiber content labeling. Mislabeling can result in fines, product recalls, or import bans.

Customs Classification and Tariff Codes

Proper HS (Harmonized System) code classification is essential for customs clearance. Bamboo fabric is typically classified under:

– 5516.11 or 5516.12 – Artificial staple fibers (e.g., viscose from bamboo)

– 5408.22 – Woven fabrics of artificial filament yarn

Confirm the exact code based on fabric composition, weave, and country of origin to avoid delays and incorrect duty assessments. Note that preferential tariffs may apply under trade agreements if rules of origin are met.

Import/Export Documentation

Standard international trade documentation is required, including:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin (required for preferential tariff treatment)

– Test Reports (e.g., for AZO dyes, formaldehyde, heavy metals)

Some countries may require additional declarations on environmental standards or proof of legal bamboo sourcing to prevent illegal logging.

Environmental and Sustainability Standards

Importers must comply with environmental import restrictions in destination markets. For example:

– The EU’s REACH regulation restricts the use of certain hazardous substances in textiles.

– California’s Proposition 65 requires warnings for products containing listed carcinogens or reproductive toxins.

– The Lacey Act (U.S.) prohibits trade in illegally sourced plants, including bamboo, requiring due diligence in supply chain transparency.

Transportation and Storage Logistics

Bamboo fabric should be packed in moisture-resistant, ventilated containers to prevent mildew during maritime transport. Use desiccants and avoid direct contact with container walls. Store in dry, temperature-controlled warehouses upon arrival. Consider lead times and port congestion, especially when shipping from major bamboo-producing regions like China, India, or Vietnam.

End-of-Life and Recycling Compliance

Prepare for emerging extended producer responsibility (EPR) laws in regions like the EU, which may require brands to report on textile waste and support recycling programs. Design products with recyclability in mind and provide clear care and disposal instructions to consumers.

Summary and Best Practices

To ensure seamless logistics and compliance:

– Verify sustainable and legal sourcing with documentation

– Accurately label products per FTC, EU, and local regulations

– Use correct HS codes and maintain complete shipping documents

– Conduct regular third-party testing for chemical compliance

– Partner with certified logistics providers experienced in textile shipments

Adhering to these guidelines mitigates legal risk, supports ethical branding, and ensures smooth international trade of bamboo fabric materials.

In conclusion, sourcing bamboo fabric presents a promising and sustainable option for eco-conscious brands and manufacturers. With its rapid growth, low environmental impact, and natural antibacterial properties, bamboo offers a renewable alternative to conventional textiles. However, careful consideration must be given to the processing methods—favoring closed-loop mechanical or lyocell processes over chemical-intensive viscose rayon production—to ensure environmental integrity and ethical standards. By partnering with certified, transparent suppliers and prioritizing sustainable practices throughout the supply chain, businesses can leverage the benefits of bamboo fabric while minimizing ecological harm. Ultimately, responsible sourcing of bamboo fabric supports a more sustainable textile industry and aligns with growing consumer demand for environmentally friendly products.