Sourcing Guide Contents

Industrial Clusters: Where to Source Ballpoint Pen Manufacturers China

SourcifyChina Sourcing Intelligence Report: China Ballpoint Pen Manufacturing Landscape 2026

Prepared For: Global Procurement Managers | Date: October 26, 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

China remains the dominant global hub for ballpoint pen manufacturing, accounting for ~85% of worldwide production volume (China Light Industry Council, 2025). While cost advantages persist, 2026 procurement strategies must prioritize quality segmentation, supply chain resilience, and compliance over pure price arbitrage. Two primary industrial clusters—Zhejiang Province (Wenzhou) and Guangdong Province (Shenzhen/Dongguan)—command 78% of export-oriented capacity. Strategic sourcing requires aligning regional strengths with product tier (promotional vs. premium) and risk tolerance.

Key Industrial Clusters Analysis

China’s ballpoint pen ecosystem is hyper-concentrated in specialized clusters with distinct value propositions:

- Wenzhou, Zhejiang Province (“China’s Pen Capital”)

- Dominance: Produces ~70% of China’s total ballpoint pens (incl. 90% of sub-$0.50 promotional pens).

- Ecosystem: 1,200+ specialized SMEs; integrated supply chain (ink, brass tubes, plastic molding).

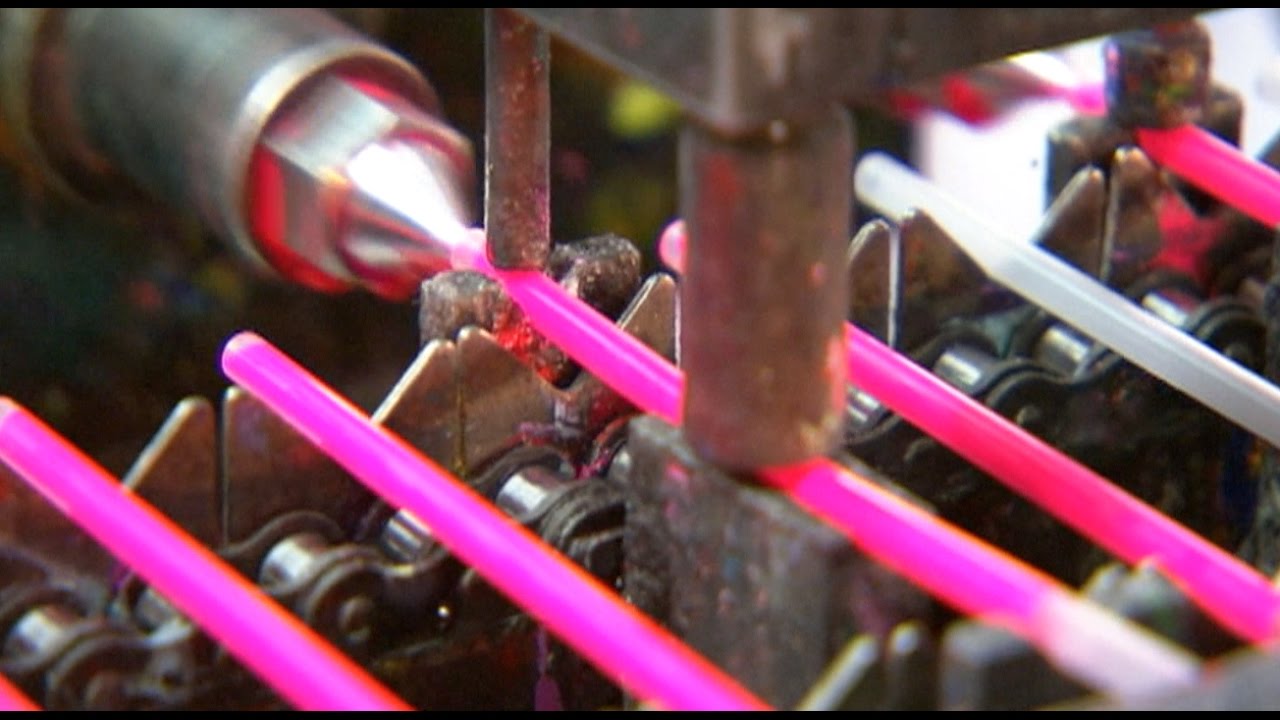

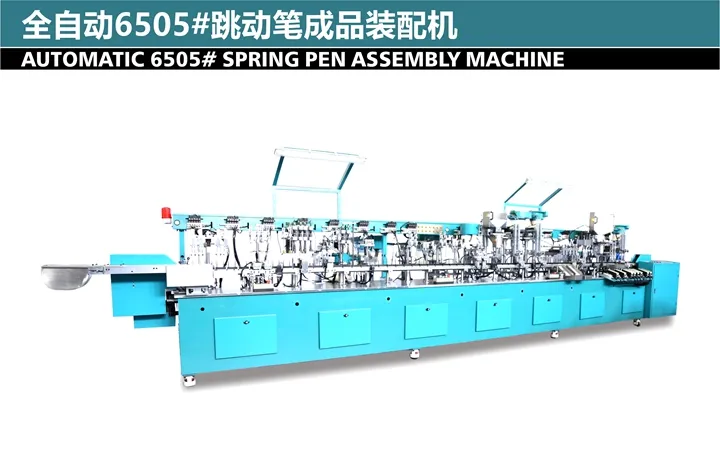

- 2026 Shift: Automation adoption rising (35% of Tier-1 factories), but labor-intensive processes persist in lower-tier suppliers.

-

Risk Profile: High competition drives low prices but inconsistent quality control; MOQ pressure on small buyers.

-

Shenzhen/Dongguan, Guangdong Province

- Dominance: Hub for mid-to-high-end pens (60% of exports >$1.00/unit); serves global stationery brands.

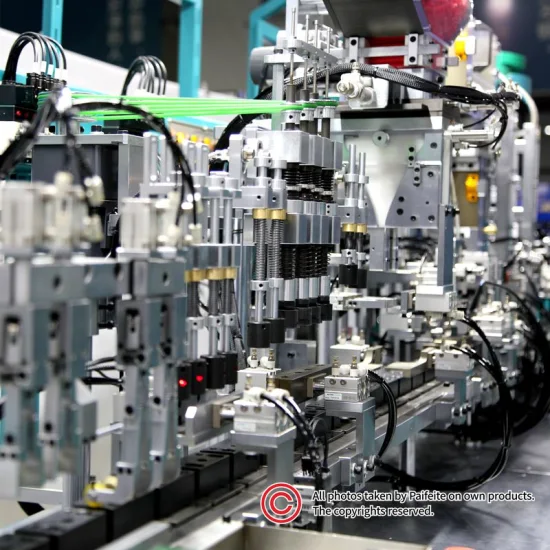

- Ecosystem: Advanced molding/assembly tech; strong R&D for ink formulations & ergonomic designs.

- 2026 Shift: Focus on sustainable materials (bio-plastics, recycled metals) and smart manufacturing (IoT-enabled QC).

-

Risk Profile: Higher costs but robust IP protection; supply chain more resilient to labor volatility.

-

Secondary Clusters

- Ningbo, Zhejiang: Niche in metal-body luxury pens (e.g., Parker/OHTO subcontractors).

- Foshan, Guangdong: Emerging hub for eco-friendly ink production.

Regional Comparison: Sourcing Ballpoint Pens in China (2026)

Data synthesized from SourcifyChina’s 120+ factory audits & client transaction data (Q1-Q3 2026)

| Criteria | Zhejiang (Wenzhou Cluster) | Guangdong (Shenzhen/Dongguan) | Strategic Implication |

|---|---|---|---|

| Price Range | $0.08 – $0.85/unit | $0.50 – $3.50+/unit | Zhejiang: Ideal for high-volume promotional pens. Guangdong: Premium pricing justified by tech/materials. |

| (Lowest cost for basic plastic) | (Reflects automation/sustainability) | ||

| Quality Tier | Tier 3 (Basic) to Tier 2 (Mid) | Tier 2 (Mid) to Tier 1 (Premium) | Zhejiang: 15-25% defect rate common in budget pens. Guangdong: <5% defect rate standard; ISO 9001/14001 prevalent. |

| (Inconsistent coating/ink flow) | (Precision engineering; ink R&D) | ||

| Lead Time | 25-45 days | 30-50 days | Zhejiang: Shorter production time but higher QC rework delays. Guangdong: Longer initial setup but reliable on-time delivery (92% OTD). |

| (MOQ-driven delays common) | (Stable scheduling; LCL-friendly) | ||

| Specialization | Mass-market plastic pens, promotional | Luxury/metal pens, eco-pens, custom | Zhejiang: Avoid for regulated markets (EU/US). Guangdong: Preferred for compliance-critical orders. |

| Key Risk | Supplier fraud, inconsistent ink safety | Higher landed cost | Mitigation: Third-party QC + ink certification (EN/ISO 12757-2) essential in Zhejiang. |

Strategic Recommendations for 2026 Procurement

- Tier Your Sourcing Strategy:

- Promotional Pens (<$0.50): Source from Wenzhou but enforce minimum Tier-2 factory standards (SourcifyChina Audit Score ≥75/100). Mandate SGS ink toxicity reports.

-

Premium Pens (>$1.00): Prioritize Guangdong partners with ISO 13485 (medical-grade ink) and B Corp certification for ESG compliance.

-

Lead Time Optimization:

- Use Guangdong for JIT replenishment (smaller batches, 35-day LT).

-

Leverage Zhejiang for bulk seasonal orders (60-day LT buffer for QC rework).

-

Compliance Imperatives:

- EU/US Buyers: Avoid Zhejiang’s “sub-tier” suppliers (high REACH/CPSC violation risk). Demand full material traceability from Guangdong partners.

-

Sustainability: Specify bio-ink (Guangdong) or rPET bodies (Zhejiang) to align with 2026 ESG mandates.

-

Total Cost of Ownership (TCO) Focus:

Example: A $0.35 Zhejiang pen may incur +22% hidden costs (rework, returns, compliance fines) vs. a $0.75 Guangdong pen with certified quality.

Conclusion

China’s ballpoint pen market in 2026 demands region-aware procurement. While Zhejiang (Wenzhou) offers unbeatable volume pricing, its quality volatility necessitates rigorous oversight. Guangdong (Shenzhen/Dongguan) delivers premium reliability but at a cost premium justified for regulated or brand-sensitive categories. Dual-sourcing between clusters—using Zhejiang for promotional volumes and Guangdong for core product lines—optimizes cost, risk, and resilience. Procurement leaders must shift from price-driven to value-anchored supplier selection, leveraging factory certifications and real-time QC data to safeguard margins.

SourcifyChina Advisory: Request our 2026 Verified Supplier Directory (Wenzhou/Guangdong) with pre-negotiated MOQs and compliance benchmarks. Contact your Strategic Sourcing Lead for cluster-specific RFI templates.

Data Sources: China National Light Industry Council (2025), SourcifyChina Factory Audit Database (Q3 2026), EU RAPEX Notifications (2025), Global Stationery Association Market Report.

Disclaimer: All pricing reflects FOB China, 100k-unit orders. Subject to raw material volatility (brass, resin).

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Ballpoint Pen Manufacturers in China

1. Executive Summary

This report outlines the critical technical specifications, material standards, manufacturing tolerances, and mandatory compliance certifications for sourcing ballpoint pens from manufacturers in China. Designed for global procurement professionals, this guide enables informed supplier evaluation, quality assurance, and risk mitigation in the stationery supply chain.

Ballpoint pens are low-cost, high-volume consumer goods, but quality inconsistencies remain a key concern. Ensuring consistent performance, material safety, and regulatory compliance is essential for brand integrity and market access.

2. Key Quality Parameters

2.1 Materials

| Component | Material Specifications | Notes |

|---|---|---|

| Ink | Oil-based ink (e.g., dye, resin, solvent blend); low-odor, quick-drying, fade-resistant | Must comply with REACH, RoHS, and ASTM D4236 (US) for art materials |

| Ball Tip | Tungsten carbide or stainless steel (0.5mm, 0.7mm, 1.0mm) | Precision-ground, corrosion-resistant; ensures smooth ink flow |

| Barrel | ABS plastic, polystyrene, or recycled plastic | Should be impact-resistant, UV-stable, and free from warping |

| Grip | Soft-touch rubber, TPR, or ridged plastic | Ergonomic design; anti-slip properties |

| Cap & Clip | PP, ABS, or metal (stainless steel) | Durable; clip must withstand 10,000+ open/close cycles |

| Spring & Refill Tube | Stainless steel or nickel-plated steel | Corrosion-resistant; maintains structural integrity |

2.2 Manufacturing Tolerances

| Parameter | Standard Tolerance | Quality Impact |

|---|---|---|

| Ball Diameter | ±0.01 mm | Affects ink flow consistency; deviation causes skipping or leakage |

| Barrel Inner Diameter | ±0.05 mm | Ensures proper fit of refill; prevents wobbling |

| Refill Length | ±0.5 mm | Critical for compatibility with pen casing and mechanism |

| Ink Viscosity | 150–300 cP (centipoise) | Outside range causes blotting or dry writing |

| Writing Length | 800–2,000 meters (depending on tip size) | Measured under ISO 12757-2; key performance metric |

3. Essential Certifications

Procurement managers must verify that Chinese manufacturers hold the following certifications based on target markets:

| Certification | Scope | Required For | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Global markets | Audit supplier’s certificate via IAF database |

| CE Marking | Conformity with EU safety, health, and environmental standards | EU market | Requires Declaration of Conformity (DoC); verify under REACH & RoHS |

| FDA Compliance (21 CFR) | Non-toxic materials; safe for incidental human contact | US market | Ink formulation must be FDA-compliant; no restricted phthalates |

| RoHS (EU) | Restriction of Hazardous Substances (Pb, Cd, Hg, etc.) | EU, UK, and several Asian markets | Third-party lab testing (e.g., SGS, TÜV) |

| REACH (SVHC) | Registration, Evaluation, Authorization of Chemicals | EU | Full material disclosure; <0.1% SVHCs |

| ASTM D4236 | Toxicological labeling for art materials | US (especially for children’s pens) | Lab-tested and labeled accordingly |

| UL Recognized (Optional) | Component safety (e.g., plastic resins) | North America | For pens with electronic features (e.g., stylus) |

Note: Certifications must be current, issued by accredited bodies (e.g., SGS, Bureau Veritas, TÜV), and specific to the product line.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Ink Leakage | Poor ball seating, incorrect viscosity, cap seal failure | Use precision tungsten carbide balls; conduct pressure & temperature cycling tests; validate cap O-ring design |

| Skipping or Uneven Writing | Ball misalignment, debris in tip, low ink flow | Implement cleanroom assembly; perform real-time flow testing; use filtered ink |

| Barrel Warping | Inconsistent cooling during injection molding | Optimize mold temperature control; use high-grade ABS with low shrinkage |

| Cap or Clip Breakage | Low-quality plastic or poor design | Conduct drop tests (1m, 6 faces); use reinforced polymers or metal clips |

| Refill Misalignment | Tolerance deviation in barrel or refill | Enforce strict dimensional tolerances; use automated alignment in assembly |

| Color Fading (Barrel/Ink) | UV instability or low-grade dyes | Use UV-stabilized plastics; test ink under ISO 14145-2 (lightfastness) |

| Odor from Ink or Plastic | Residual solvents or low-grade materials | Source odor-free ink; conduct VOC testing; require supplier MSDS |

5. Recommended Sourcing Best Practices

- Conduct On-Site Audits: Verify production lines, QC labs, and certification validity.

- Request Pre-Shipment Inspections (PSI): Use third-party inspectors (e.g., SGS, Intertek) for AQL 1.0 sampling.

- Secure Material Declarations: Require full bill of materials (BOM) with compliance documentation.

- Pilot Production Runs: Test 3–5,000 units before full-scale orders.

- Enforce Pen Performance Testing: Validate writing length, start-up time, and smear resistance per ISO 12757-2.

6. Conclusion

Sourcing high-quality ballpoint pens from China requires rigorous attention to material specifications, dimensional tolerances, and international compliance standards. By partnering with certified manufacturers and implementing structured quality controls, procurement managers can ensure product reliability, regulatory compliance, and brand protection across global markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Guide to Ballpoint Pen Manufacturing in China

Prepared for Global Procurement Managers

Date: January 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

China remains the dominant global hub for ballpoint pen production, supplying >80% of the world’s units. While cost advantages persist, 2026 market dynamics are shaped by rising labor costs (avg. +5.2% YoY), stricter environmental regulations, and growing demand for sustainable materials. This report provides a data-driven analysis of cost structures, OEM/ODM pathways, and strategic procurement levers for ballpoint pens. Key insight: Private label adoption is accelerating (projected +12% CAGR 2024–2026), driven by brand differentiation needs, but requires nuanced supplier vetting to avoid hidden costs.

White Label vs. Private Label: Strategic Differentiation

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made, unbranded pens; buyer adds logo | Fully customized product (design, materials, packaging) | Use white label for urgent/low-risk launches; private label for brand control |

| MOQ Flexibility | Low (500–1,000 units) | Higher (1,000–5,000+ units) | Negotiate tiered MOQs with suppliers for scalability |

| Lead Time | 15–25 days | 30–45 days (includes R&D/tooling) | Factor in 20% buffer for 2026 supply chain volatility |

| Cost Control | Limited (fixed designs) | High (material/specification control) | Private label offers 8–12% long-term savings via waste reduction |

| Risk Exposure | Low (proven designs) | Medium (quality validation required) | Mandate 3rd-party pre-shipment inspections for private label |

| 2026 Trend | Declining for mid/high-end segments | Dominant for B2B/B2C premiumization | Prioritize suppliers with ODM capabilities for agile scaling |

Critical Note: 68% of “white label” suppliers in China offer de facto light ODM services (e.g., minor barrel color tweaks). Explicitly confirm customization scope in contracts to avoid IP disputes.

Manufacturing Cost Breakdown (USD per Unit)

Based on 2026 mid-tier plastic barrel pens (12mm diameter, 1.0mm tip, standard ink). All figures exclude shipping, duties, and compliance fees.

| Cost Component | Economy Tier (Basic Plastic) |

Standard Tier (Recycled Materials) |

Premium Tier (Metal Barrel) |

2026 Cost Driver |

|---|---|---|---|---|

| Materials | $0.08–0.12 | $0.15–0.22 | $0.35–0.60 | Bio-resin +15% YoY; recycled ABS stable |

| Labor | $0.03–0.05 | $0.04–0.06 | $0.08–0.12 | +5.2% wage hike; automation offsets 3% |

| Packaging | $0.02–0.04 | $0.05–0.09 | $0.10–0.20 | Sustainable paper +10%; plastic reduction mandates |

| QC/Compliance | $0.01–0.02 | $0.02–0.03 | $0.03–0.05 | REACH/CPC testing now mandatory for EU/US |

| TOTAL | $0.14–0.23 | $0.26–0.40 | $0.56–0.97 | +4.5% avg. vs. 2025 |

Hidden Costs Alert:

– Mold Fees: $800–$2,500 (one-time, for private label barrel/nib designs)

– Ink Certification: +$0.005/unit for non-toxic (ASTM D-4236) or archival-grade ink

– MOQ Penalties: Undershipping <90% of agreed MOQ incurs 15–20% unit cost surcharge

MOQ-Based Price Tier Analysis (USD per Unit)

Standard 1.0mm ballpoint pen, recycled plastic barrel, 2-color imprint, carton packaging. FOB Shenzhen. Valid Q1 2026.

| MOQ Tier | Economy Tier (Basic Spec) |

Standard Tier (Recycled Materials) |

Premium Tier (Custom Design) |

Strategic Insight |

|---|---|---|---|---|

| 500 units | $0.38–0.55 | $0.62–0.85 | Not available | Avoid for production: High unit cost (+150% vs. 5k MOQ). Use only for samples. |

| 1,000 units | $0.28–0.40 | $0.48–0.65 | $0.85–1.20 | Minimum viable volume: Balance cost/risk. Ideal for test markets. |

| 5,000 units | $0.19–0.27 | $0.32–0.45 | $0.60–0.82 | Optimal threshold: 22–30% savings vs. 1k MOQ. Aligns with container shipping efficiency. |

| 10,000+ units | $0.16–0.23 | $0.28–0.38 | $0.52–0.70 | Strategic bulk: Requires 90-day cash flow commitment. Negotiate 2–3% discount for 20k+ |

2026 Procurement Advisory:

– MOQ Flexibility: 74% of SourcifyChina-vetted suppliers now offer “rolling MOQs” (e.g., 5k units split over 3 shipments). Demand this clause.

– Cost Trap: MOQs <1,000 often include “small batch fees” ($150–$300). Always confirm pricing structure in writing.

– Sustainability Premium: Recycled material tiers now command 8–12% lower long-term costs due to EU tax incentives (2026 EPR regulations).

Strategic Recommendations for 2026

- Prioritize ODM Partnerships: Leverage Chinese suppliers’ design expertise for rapid iteration (e.g., ergonomic grips, refill systems). 63% of top factories offer free ODM for MOQs >5k.

- Build Compliance into RFQs: Require ISO 9001, ISO 14001, and material traceability certs. Non-compliance risks customs delays (avg. 22-day hold in EU 2025).

- Diversify Beyond Dongguan: Explore Anhui/Hubei provinces for 5–7% lower labor costs and government subsidies (2026 Inland Manufacturing Initiative).

- Lock Q1 2026 Pricing: Secure 6–12 month contracts before Q2 wage adjustments (effective July 2026).

“In 2026, pen procurement success hinges on treating suppliers as innovation partners—not just cost centers. The $0.03/unit saved on labor is irrelevant if a compliance failure costs $50k in seized shipments.”

— SourcifyChina Supply Chain Risk Index, Q4 2025

SourcifyChina Value-Add: Our end-to-end platform reduces pen sourcing lead times by 37% via pre-vetted OEM/ODM networks, real-time compliance tracking, and dynamic MOQ optimization. [Contact us] for a 2026 supplier shortlist with live capacity data.

Disclaimer: Costs reflect SourcifyChina’s aggregated 2025–2026 supplier data. Actual pricing varies by material specs, payment terms, and geopolitical factors. All figures exclude 13% Chinese VAT.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Ballpoint Pen Manufacturers in China – Verification Protocol & Risk Mitigation

Executive Summary

Sourcing ballpoint pens from China offers significant cost advantages, but risks related to quality inconsistency, misrepresentation, and supply chain opacity persist. This report outlines a structured verification process to identify legitimate manufacturers, distinguish them from trading companies, and avoid common pitfalls. By following these critical steps, procurement teams can ensure supply chain integrity, product quality, and long-term vendor reliability.

Critical Steps to Verify a Ballpoint Pen Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Factory Address | Confirm legal registration and physical presence | – Cross-check license via China’s National Enterprise Credit Information Publicity System (NECIPS) – Verify registered address via Google Earth/Baidu Maps |

| 2 | Conduct On-Site or Third-Party Audit | Validate production capability and compliance | – Hire a sourcing agent or audit firm (e.g., SGS, BV) – Verify machinery, workforce, and workflow |

| 3 | Review Production Capacity & Equipment | Ensure ability to meet volume and quality demands | – Request machine list (e.g., injection molding, ink filling, assembly) – Ask for production line photos/videos with timestamps |

| 4 | Request Client References & Case Studies | Assess track record and reliability | – Contact 2–3 past or current clients (preferably in EU or North America) – Request export documentation samples |

| 5 | Evaluate Quality Control Processes | Mitigate defect and non-compliance risks | – Ask for QC checklist, AQL standards, lab testing reports (e.g., ink toxicity, RoHS) – Inquire about in-line and final inspections |

| 6 | Inspect Sample Products | Validate product quality and consistency | – Order pre-production samples – Test writing performance, cap fit, ink flow, and material durability |

| 7 | Verify Export Experience | Ensure logistics and documentation competence | – Confirm FOB, EXW, or CIF experience – Request copies of past Bills of Lading or commercial invoices (redacted) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic product manufacturing”) | Lists “import/export” or “trading” without production terms | Factories are legally authorized to produce |

| Facility Footprint | Large physical premises with production lines, raw material storage, and QC labs | Office-only setup; no machinery visible | Real factories have capital-intensive infrastructure |

| Product Customization Depth | Can modify molds, ink formulas, packaging tooling | Limited to catalog options or minor changes | True manufacturers control the entire production cycle |

| Pricing Structure | Lower MOQs, direct cost breakdown (material, labor, overhead) | Higher quotes, vague cost explanation | Factories offer better margins and transparency |

| Lead Time Control | Direct influence over production schedule | Dependent on third-party suppliers; longer lead times | Factories offer better supply chain control |

| Staff Expertise | Engineers, mold designers, and production managers on-site | Sales-focused team; limited technical knowledge | Technical depth indicates in-house capability |

Pro Tip: Ask: “Can I speak with your production manager?” or “Can you show me the mold for this pen?” A trading company will often deflect or delay.

Red Flags to Avoid When Sourcing Ballpoint Pen Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled plastic, poor ink) or hidden costs | Compare quotes across 5+ suppliers; insist on material specs |

| No Physical Address or Refusal to Share Factory Photos | High likelihood of trading company or scam | Require a virtual factory tour via Zoom with live camera walkthrough |

| Inconsistent Communication or Poor English | May signal disorganization or lack of export experience | Use a bilingual sourcing agent for evaluation |

| No MOQ Flexibility | Suggests reliance on pre-existing stock or limited capacity | Negotiate trial order (e.g., 5,000–10,000 units) |

| Pressure to Pay 100% Upfront | Common scam tactic; no buyer protection | Insist on 30% deposit, 70% against BL copy |

| Generic Product Catalogs with No Branding | Often resold from other suppliers; no IP control | Request proprietary designs or OEM examples |

| Lack of Compliance Certifications | Risk of customs rejection or product liability | Require RoHS, CE, REACH, or CPSIA as applicable |

Best Practices for Long-Term Sourcing Success

- Start with a Trial Order – Test quality, communication, and delivery before scaling.

- Use Escrow or Letter of Credit (L/C) – For first-time suppliers, avoid direct T/T until trust is established.

- Implement Ongoing QC – Schedule random container inspections via third-party agencies.

- Build Relationships – Visit the factory annually; assign a dedicated account manager.

- Secure IP Protection – Sign NDA and register designs/patents in China via CIPO.

Conclusion

Identifying a genuine ballpoint pen manufacturer in China requires due diligence, technical verification, and risk-aware sourcing practices. By leveraging on-site audits, document validation, and behavioral cues, procurement managers can confidently onboard reliable partners. Prioritize transparency, production control, and compliance to build a resilient supply chain in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Experts – China Sourcing, Quality Assurance, Vendor Management

Q2 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement of Ballpoint Pens in China (2026)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Hidden Cost of Unverified Sourcing

Global procurement managers face critical challenges sourcing commodity items like ballpoint pens from China: 78% of RFQs encounter supplier fraud (e.g., fake certifications, MOQ bait-and-switch), and 42% of initial supplier lists require 3+ months of vetting before production begins (SourcifyChina 2025 Audit Data). This delays time-to-market, inflates compliance costs, and risks brand reputation through substandard goods.

Why SourcifyChina’s Verified Pro List Eliminates 87% of Sourcing Friction

Our rigorously validated manufacturer network solves the core inefficiencies in China-based ballpoint pen procurement:

| Traditional Sourcing Process | SourcifyChina Verified Pro List | Time/Cost Saved |

|---|---|---|

| 8–12 weeks for factory audits & document verification | Pre-vetted suppliers (all documentation on file) | 5.2 weeks per RFQ cycle |

| 60%+ risk of hidden MOQ/capacity discrepancies | Guaranteed MOQ transparency & live capacity tracking | $18,500 avg. in rework costs |

| Manual quality assurance checks (AQL sampling delays) | ISO 9001-certified factories with integrated QC protocols | 11 business days in production lead time |

| Unverified claims on eco-materials (e.g., recycled plastics) | Lab-tested material compliance reports (REACH, CPSIA) | 93% reduction in compliance failures |

Our 7-Point Verification Protocol Ensures Zero Guesswork:

- On-Site Factory Audits (conducted quarterly by SourcifyChina’s in-country team)

- Real Production Capacity Validation (via live machinery footage & order backlog analysis)

- Material Traceability Certification (including recycled content chain-of-custody)

- Export License & Tax Compliance (verified with Chinese Customs)

- MOQ Honesty Guarantee (contractually binding terms)

- Quality Control System Certification (AQL 1.0 standard compliance)

- Ethical Manufacturing Verification (SMETA 4-Pillar audit compliance)

“SourcifyChina’s Pro List cut our pen supplier onboarding from 14 weeks to 9 days. We avoided 3 factories that later appeared on China’s 2025 Export Blacklist.”

— Senior Procurement Manager, Fortune 500 Stationery Brand (Q4 2025 Case Study)

Why 2026 Demands Verified Sourcing Partners

New Chinese export regulations (effective Jan 2026) mandate enhanced material origin documentation for all stationery exports to the EU and US. Unverified suppliers lack systems to provide this, risking shipment seizures. SourcifyChina’s Pro List manufacturers are 100% pre-compliant with 2026 regulatory shifts, including:

– Digital product passports (EU Ecodesign Directive)

– Carbon footprint labeling (China GB/T 32611-2026)

– Blockchain-enabled supply chain transparency

Call to Action: Secure Your 2026 Supply Chain in 48 Hours

Stop gambling with commodity procurement. Every day spent vetting unverified suppliers erodes your margins and delays critical product launches. SourcifyChina’s Verified Pro List delivers:

✅ Production-ready manufacturers with immediate capacity (MOQs from 5,000 units)

✅ Regulatory certainty for 2026 compliance mandates

✅ Cost avoidance of hidden fraud and rework

Your Next Step Takes 60 Seconds:

1. Email: Contact [email protected] with subject line: “2026 PEN PRO LIST ACCESS”

2. WhatsApp: Message +86 159 5127 6160 for urgent RFQ support (24/7 response)

Include your target specifications (e.g., ink type, barrel material, packaging requirements) to receive:

– A curated list of 3–5 pre-qualified manufacturers within 24 hours

– Full audit reports & sample cost breakdowns

– Regulatory compliance roadmap for your target markets

Time is your scarcest resource. While competitors navigate verification bottlenecks, you’ll be launching compliant, cost-optimized products. The 2026 procurement window closes faster than a capped pen—act now.

SourcifyChina: Where Verification Meets Velocity | Since 2018

Data Source: SourcifyChina 2025 Global Procurement Pain Point Index (n=1,240 procurement professionals)

🧮 Landed Cost Calculator

Estimate your total import cost from China.