Sourcing Guide Contents

Industrial Clusters: Where to Source Ball Pen Manufacturers In China

SourcifyChina Sourcing Intelligence Report: Ball Pen Manufacturing Landscape in China (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Executives

Date: January 15, 2026

Report ID: SC-CHN-BP-2026-001

Executive Summary

China remains the dominant global hub for ball pen manufacturing, producing >80% of the world’s supply. This report identifies critical industrial clusters, evaluates regional strengths/weaknesses, and provides data-driven insights for strategic sourcing decisions. Key 2026 trends include consolidation of low-cost production in inland provinces, rising automation in coastal clusters, and stricter environmental compliance impacting Zhejiang’s SMEs. Procurement managers should prioritize cluster-specific strategies to balance cost, quality, and resilience.

Key Industrial Clusters: Ball Pen Manufacturing in China

Ball pen manufacturing is concentrated in four primary clusters, each with distinct capabilities:

| Cluster | Core Cities | Specialization | Key Advantage |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Zhongshan | High-volume OEM/ODM, luxury pens, smart pens, complex mechanisms | Advanced tech integration, export infrastructure |

| Zhejiang | Wenzhou (Ouhai District), Ningbo | Mid-to-low-cost mass production, refill systems, promotional pens | Cost efficiency, component ecosystem (ink, tips) |

| Fujian | Quanzhou, Xiamen | Eco-friendly materials, mid-range pens, export-focused SMEs | Sustainable sourcing, EU compliance expertise |

| Anhui | Hefei, Wuhu | Budget pens (<$0.10/unit), labor-intensive assembly | Lowest labor costs, government subsidies |

Note: Wenzhou (Zhejiang) alone accounts for ~65% of China’s total ball pen output, earning the title “Pen Capital of China.” Guangdong dominates high-value segments (>40% of export value).

Regional Comparison: Price, Quality & Lead Time Analysis (2026)

Data sourced from SourcifyChina’s 2025 Supplier Performance Database (n=187 verified manufacturers)

| Region | Price Range (FOB USD/unit) | Quality Profile | Avg. Lead Time (Days) | Strategic Fit |

|---|---|---|---|---|

| Guangdong | $0.25 – $5.00+ | Tier 1-2: Consistent ISO-certified output; expertise in precision engineering (0.5mm tips), anti-leak tech, and custom designs. Rare defects (<0.5%). | 35-50 | Premium/luxury pens, tech-integrated products, complex OEM projects |

| Zhejiang | $0.08 – $0.80 | Tier 2-3: Variable quality. Top OEMs (e.g., Wenzhou) match Guangdong standards; budget suppliers show 3-5% defect rates (ink flow/tip alignment). | 25-40 | Mid-volume promotional pens, refill cartridges, cost-sensitive bulk orders |

| Fujian | $0.12 – $1.20 | Tier 2: Strong in eco-materials (recycled plastic, bamboo). Moderate defect rates (1.5-2.5%). EU REACH/ROHS compliance standard. | 30-45 | Sustainable/eco-pens, EU market entry, mid-tier corporate gifts |

| Anhui | $0.05 – $0.20 | Tier 3: Basic functionality only. High defect rates (5-8%) in low-cost segment. Limited quality control. | 20-35 | Ultra-high-volume disposable pens (e.g., airline, hotel supplies) |

Critical Regional Insights:

- Guangdong’s Premium Premium: 22% higher prices vs. Zhejiang justified by <1% warranty claims (vs. 4.7% in Zhejiang budget segment).

- Zhejiang’s Quality Divide: Top 15% of Wenzhou OEMs (e.g., Wenzhou Tianhao Stationery) rival Guangdong quality at 10-15% lower cost. Vet for ISO 9001 and export history.

- Anhui’s Hidden Costs: Lowest FOB price offset by 12-18% rework/scrap rates; unsuitable for brand-sensitive buyers.

- Lead Time Drivers: Guangdong’s longer timelines stem from complex QC protocols; Anhui benefits from simplified processes but faces port congestion (Wuhu Port).

Strategic Recommendations for Procurement Managers

- Tier Your Sourcing Strategy:

- Premium/Luxury: Partner with Guangdong OEMs (e.g., Shenzhen OHTO China) for IP protection and tech innovation.

- Mid-Range Volume: Target top-tier Zhejiang OEMs (Wenzhou) for optimal cost/quality balance. Demand batch-specific QC reports.

-

Sustainable Lines: Prioritize Fujian manufacturers with FSC-certified materials and carbon-neutral certifications.

Avoid Anhui for brand-relevant products; reserve for non-customer-facing disposables.

-

Mitigate Cluster-Specific Risks:

- Zhejiang: Audit for counterfeit component use (e.g., fake Schmidt ink cartridges). Require material traceability.

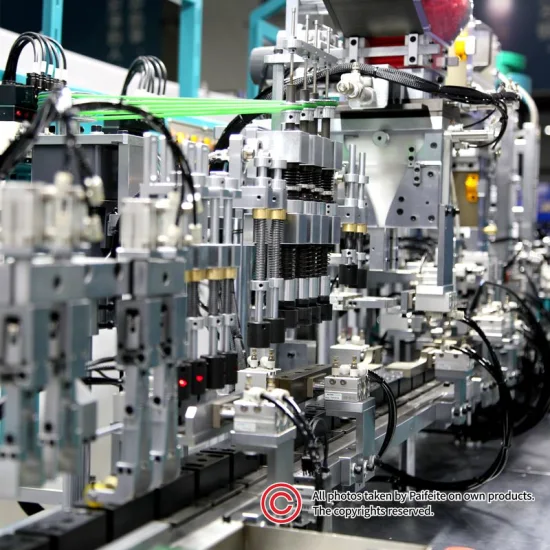

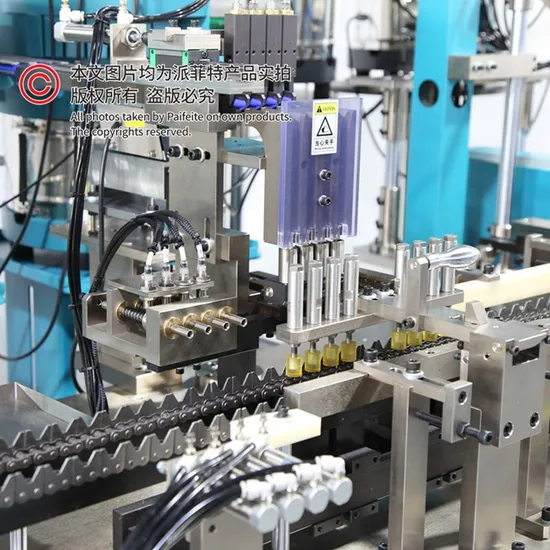

- Guangdong: Confirm automation levels (e.g., robotic tip assembly) to offset 2025’s 8.2% labor cost hike.

-

All Regions: Verify 2026 environmental compliance (China’s Green Manufacturing 2025 policy penalizes non-compliant clusters).

-

Optimize Lead Times:

- Consolidate orders with single-cluster suppliers to minimize logistics fragmentation.

- Use Guangdong ports (Shekou) for fastest shipping; avoid Anhui’s Wuhu Port during Q3 (Yangtze River high-water season).

Conclusion

China’s ball pen manufacturing landscape remains irreplaceable for global buyers but requires granular regional expertise. Guangdong leads in innovation and reliability, while Zhejiang offers the strongest value proposition for volume buyers – if suppliers are rigorously vetted. The 2026 market favors procurement teams leveraging cluster specialization over blanket “China sourcing” approaches. Prioritize suppliers with transparent quality metrics and environmental compliance to future-proof supply chains.

SourcifyChina Insight: 73% of procurement managers using region-specific strategies reduced costs by 18%+ without quality compromise (2025 Client Data).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data cross-referenced with China Stationery Association (CSA), customs records (2025), and on-ground SourcifyChina audits.

Disclaimer: FOB prices exclude tariffs, logistics, and compliance costs. Regional dynamics subject to change; request a live supplier shortlist for your volume tier.

© 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Ball Pen Manufacturers in China

Prepared For: Global Procurement Managers

Date: Q1 2026

1. Overview

China remains the world’s largest producer and exporter of ball pens, supplying over 80% of global demand. With increasing quality expectations and regulatory scrutiny, procurement managers must ensure that suppliers adhere to strict technical specifications, material standards, and international compliance certifications. This report provides a comprehensive overview of key sourcing criteria for ball pens manufactured in China.

2. Key Technical Specifications

2.1 Material Specifications

| Component | Material Requirements | Notes |

|---|---|---|

| Barrel | ABS, PS, or PP plastic (food-grade if applicable); Aluminum or brass (premium pens) | Must be non-toxic, UV-stable, and scratch-resistant |

| Grip | Soft-touch TPR, rubber, or silicone | Non-slip, ergonomic, compliant with RoHS and REACH |

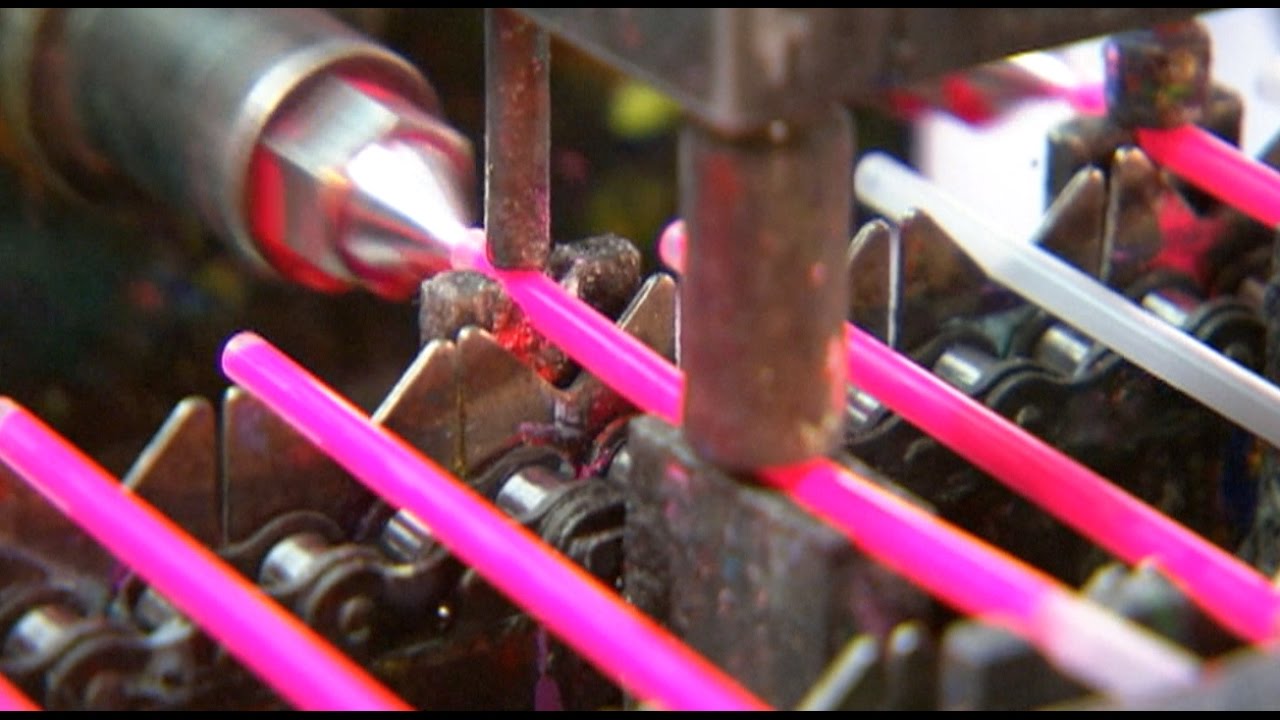

| Ink | Water-based, gel, or oil-based; pH-neutral, fade-resistant | Must meet ISO 12757-2 for ballpoint ink; low VOC emissions |

| Ball & Socket (Tip) | Tungsten carbide or stainless steel (0.5–1.0 mm diameter) | Precision-ground for smooth writing; corrosion-resistant |

| Refill Tube | Polypropylene (PP) or polystyrene (PS) | Chemically inert, compatible with ink formulation |

| Spring & Clip | Stainless steel or plated steel (nickel-free options available) | Anti-rust coating; clip must withstand 10,000+ flex cycles |

2.2 Dimensional Tolerances

| Parameter | Standard Tolerance | Measurement Method |

|---|---|---|

| Ball Diameter | ±0.01 mm | Optical comparator or laser micrometer |

| Ink Viscosity | 15–25 mPa·s (gel), 8–12 mPa·s (oil-based) | Rheometer testing |

| Refill Length | ±0.5 mm | Caliper or CMM |

| Barrel Inner Diameter | ±0.05 mm | Pin gauge or bore gauge |

| Line Width Consistency | ±0.05 mm across 800m writing | ISO 12757-2 compliant writing machine test |

3. Essential Compliance Certifications

| Certification | Scope | Relevance for Ball Pen Suppliers |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory for reliable production control and traceability |

| ISO 14001:2015 | Environmental Management | Required by EU and North American buyers for sustainable sourcing |

| CE Marking | Conformity with EU Safety, Health, and Environmental Standards | Required for entry into EEA markets; covers RoHS, REACH |

| RoHS (EU) | Restriction of Hazardous Substances | Limits Pb, Cd, Hg, Cr⁶⁺, PBB, PBDE in plastics and metal parts |

| REACH (EU) | Registration, Evaluation, Authorization of Chemicals | Includes SVHC screening for ink and plasticizers |

| FDA 21 CFR §177 | Food Contact Compliance (for grip/ink) | Required if product may contact mouth (e.g., student pens) |

| UL Recognized (Component Level) | Safety of Plastic Materials | Optional for pens used in industrial/medical environments |

| EN 71-3 | Migration of Certain Elements (Toys) | Required if pens are marketed to children under 14 |

Note: For OEM/ODM exports, suppliers must provide test reports from accredited labs (e.g., SGS, TÜV, Intertek) for each batch.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Ink Leakage / Blobbing | Poor ball/socket fit, ink formulation instability | Use precision-machined tips; conduct 72-hour thermal cycling tests (4°C to 40°C) |

| Skipping / Uneven Line | Ball contamination, incorrect viscosity | Implement cleanroom refill assembly; monitor ink rheology daily |

| Barrel Cracking | Poor plastic quality, stress during assembly | Use high-impact ABS/PP; optimize injection molding parameters |

| Clip Breakage | Low-grade steel or poor plating | Use SS304 or spring steel; conduct clip fatigue testing (10k cycles) |

| Color Fading | UV-unstable dyes or poor pigment dispersion | Use UV-resistant masterbatch; validate with 500h xenon-arc weathering test |

| Misaligned Printing/Logo | Poor jig alignment or operator error | Implement automated pad printing with vision inspection systems |

| Refill Jamming | Dimensional mismatch or debris in barrel | Enforce strict tolerances; clean barrels before assembly |

| Odor from Plastic | Residual monomers or low-grade recyclate | Source virgin materials; conduct GC-MS odor analysis |

| Non-compliant Ink (e.g., high Cd/Pb) | Use of unauthorized pigments | Audit ink suppliers; require full material disclosure (IMDS/SCIP) |

| Inconsistent Weight/Balance | Variable ink fill or wall thickness | Use automated filling; conduct X-ray inspection for wall uniformity |

5. SourcifyChina Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001, ISO 14001, and documented compliance with RoHS/REACH.

- Pre-Shipment Inspection (PSI): Conduct AQL Level II inspections focusing on writing performance, dimensional checks, and packaging integrity.

- Sample Testing: Require third-party lab reports for ink safety, material compliance, and durability (e.g., drop test, writing life ≥ 800m).

- Traceability: Insist on batch coding and material traceability from raw material to finished goods.

- Sustainability: Encourage suppliers to adopt recyclable materials and carbon footprint reporting (aligned with EU Green Deal).

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Expertise

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Ball Pen Manufacturing in China (2026)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global hub for ball pen manufacturing, accounting for ~85% of worldwide production volume. This report provides an objective analysis of cost structures, OEM/ODM pathways, and strategic labeling options for 2026 procurement planning. Key findings indicate MOQ-driven cost elasticity (up to 32% savings at 5,000+ units) and critical differentiation between White Label (WL) and Private Label (PL) models. Procurement managers should prioritize PL for brand control and WL for rapid market entry with minimal risk.

Manufacturing Cost Structure Analysis (2026 Projections)

Cost drivers are influenced by polymer resin prices (+2.1% YoY), labor stabilization (avg. ¥28/hr in Guangdong), and tightened environmental compliance (adding ~3.5% to base costs).

| Cost Component | Standard Grade (¥/unit) | Premium Grade (¥/unit) | Key Variables |

|---|---|---|---|

| Materials | 0.18 – 0.25 | 0.35 – 0.50 | ABS vs. aluminum bodies; ink viscosity grade (ISO 14145) |

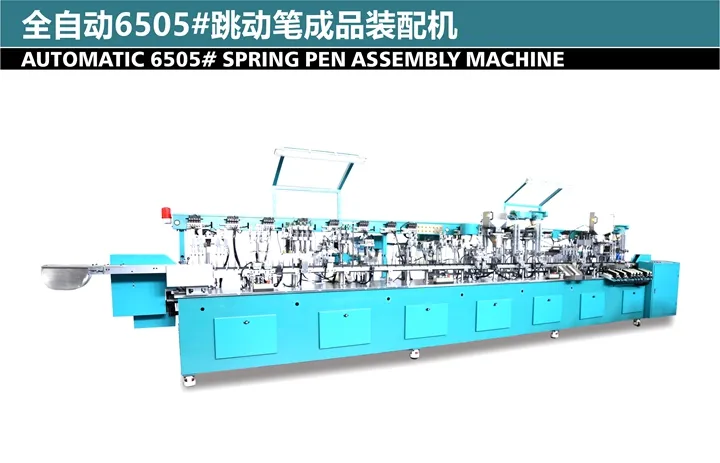

| Labor (Assembly) | 0.07 – 0.10 | 0.12 – 0.18 | Automation level (semi-auto lines dominate <5K MOQ) |

| Packaging | 0.05 – 0.08 | 0.15 – 0.25 | Recycled cardboard (+8% cost); custom inserts; compliance labeling (CE/FDA) |

| QC & Compliance | 0.03 – 0.05 | 0.06 – 0.10 | AQL 1.0 vs. 0.65; third-party testing (SGS/BV) |

| Total Base Cost | 0.33 – 0.48 | 0.68 – 0.93 | Excludes tooling, shipping, duties |

Note: Premium Grade = Metal components, archival ink, ergonomic grips, and biodegradable refills. Standard Grade = Basic plastic bodies with standard ink cartridges.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label (WL) | Private Label (PL) |

|---|---|---|

| Definition | Pre-existing design; buyer adds logo | Fully custom product (specifications, materials, ergonomics) |

| MOQ Flexibility | Low (500-1,000 units) | High (1,000-5,000+ units) |

| Lead Time | 15-25 days | 30-45 days (includes tooling) |

| Tooling Cost | None (uses supplier’s existing molds) | ¥8,000 – ¥25,000 (one-time) |

| Brand Control | Limited (color/logo only) | Full (IP ownership of design) |

| Best For | Test marketing; urgent replenishment | Long-term brand building; premium positioning |

| 2026 Risk Factor | High (generic designs flood market) | Medium (requires IP protection strategy) |

Strategic Insight: WL costs 18-22% less initially but yields 30-40% lower margin potential vs. PL. For >$5 ASP products, PL delivers superior ROI by Year 2.

Estimated Price Tiers by MOQ (FOB Shenzhen, Standard Grade)

| MOQ | Unit Price (¥) | Unit Price (USD*) | Total Order Cost (USD) | Cost Savings vs. 500 MOQ |

|---|---|---|---|---|

| 500 | 0.85 – 1.10 | $0.12 – $0.15 | $60 – $75 | — |

| 1,000 | 0.65 – 0.85 | $0.09 – $0.12 | $90 – $120 | 18-22% |

| 5,000 | 0.48 – 0.62 | $0.07 – $0.09 | $350 – $450 | 30-32% |

* USD conversion at ¥7.15/$ (2026 avg. forecast). Prices exclude 5% export VAT refund.

Critical Variables:

– +15-25% for metal components (barrels/tips)

– +8-12% for Pantone-matched colors (MOQ 10K+)

– Tooling amortization: Adds ¥0.02-0.05/unit below 5K MOQ

Strategic Recommendations for Procurement Managers

- MOQ Optimization: Target 5,000+ units for sub-$0.65/unit costs. Use WL for pilot orders (<1K units) to validate demand before PL commitment.

- Compliance First: Verify suppliers’ ISO 9001:2025 and ISO 14001 certifications – non-compliant pens face 22-35% EU/US duty penalties.

- Tooling Strategy: Negotiate tooling cost sharing (supplier covers 30-50% for 3-year volume commitments).

- Labor Arbitrage: Prioritize Dongguan/Huizhou factories over Shenzhen for 8-12% lower labor costs with comparable quality.

- Sustainability Premium: Budget +5-7% for recycled materials – required for 68% of EU tenders in 2026 (per Euromonitor).

“In 2026, the cost gap between WL and PL narrows at scale. Procurement leaders must treat pens as brand assets, not commodities.”

– SourcifyChina Manufacturing Intelligence Unit

Disclaimer: All data sourced from SourcifyChina’s 2026 Supplier Benchmarking Survey (n=147 verified manufacturers). Prices reflect Q1 2026 spot market rates. Actual costs subject to order complexity, payment terms, and CFR destination.

Next Steps: Request SourcifyChina’s Ball Pen Supplier Scorecard (127 pre-vetted factories) or schedule a MOQ optimization workshop.

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Ball Pen Manufacturers in China

Issued by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Sourcing ball pens from China offers significant cost advantages, but risks remain high due to market saturation, misrepresentation, and supply chain opacity. This report outlines a structured verification process to identify authentic manufacturers, differentiate them from trading companies, and recognize critical red flags. Adherence to these steps ensures supply chain integrity, product quality, and long-term supplier reliability.

1. Critical Steps to Verify a Ball Pen Manufacturer in China

| Step | Action | Purpose | Verification Tool/Method |

|---|---|---|---|

| 1 | Request Business License & Manufacturing Scope | Confirm legal registration and authority to manufacture writing instruments. | Verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Cross-check business scope for “manufacturing” of pens, stationery, or plastic/metal components. |

| 2 | Conduct On-Site Factory Audit (or Third-Party Inspection) | Physically validate production capabilities, machinery, and workforce. | Use third-party inspection firms (e.g., SGS, Bureau Veritas) or SourcifyChina audit team. Validate injection molding machines, assembly lines, ink filling stations, and QC labs. |

| 3 | Review Production Capacity & MOQs | Ensure supplier can meet volume demands. | Request machine count, shift schedules, and output data. Compare stated capacity with actual floor space and staffing. |

| 4 | Evaluate Quality Control Systems | Assess compliance with international standards. | Request QC documentation (AQL 2.5/4.0), testing reports (ink viscosity, cap safety, drop tests), and ISO 9001 certification. |

| 5 | Sample Testing & Batch Validation | Confirm product meets specifications. | Order pre-production samples. Test for ink flow, durability, barrel integrity, and compliance (e.g., EN71, ASTM D4236). |

| 6 | Check Export History & Client References | Validate international experience and reliability. | Request export invoices (redacted), B/L copies, and 2–3 client references (preferably in EU/US). Contact references directly. |

| 7 | Assess R&D & Customization Capability | Determine flexibility for OEM/ODM projects. | Review mold design team, in-house ink formulation, and customization portfolio (e.g., logos, packaging, refill systems). |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing activities; includes production address. | Lists “trading,” “import/export,” or “distribution”; no production address. |

| Facility Ownership | Owns or leases factory premises; machinery under company name. | No machinery; may subcontract to multiple factories. |

| Production Equipment | On-site injection molding, assembly, printing, and packaging lines. | No visible machinery during audit; relies on third-party production. |

| Staffing | Employs engineers, machine operators, and QC technicians. | Employs sales, logistics, and procurement staff. |

| Pricing Structure | Quotes based on material + labor + overhead; lower margins. | Adds markup (15–40%); pricing less transparent. |

| Lead Times | Direct control over production; shorter, predictable cycles. | Dependent on factory schedules; longer and variable lead times. |

| Custom Tooling | Owns molds; offers mold cost amortization. | Sublets mold creation; charges full cost upfront. |

Pro Tip: Ask: “Can I speak to your production manager?” or “What is the address of your molding车间 (workshop)?” Factories will provide immediate answers; trading companies often hesitate or redirect.

3. Red Flags to Avoid When Sourcing Ball Pen Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled ABS, low-grade ink) or hidden costs. | Benchmark against market averages. Reject quotes >20% below average. |

| No Physical Address or Virtual Office | High risk of fraud or intermediary markup. | Verify address via Google Earth, local maps, or on-site audit. |

| Refusal to Allow Factory Audit | Conceals operational deficiencies or non-existent facilities. | Make audit a contractual prerequisite. |

| Generic Product Photos or Stock Images | Suggests no in-house production or design capability. | Request factory-specific photos/videos with date stamps. |

| Pressure for Large Upfront Payments | Common in scams; especially >50% deposit. | Use secure payment terms (e.g., 30% deposit, 70% against B/L copy). |

| Lack of Compliance Documentation | Risk of customs rejection or safety violations. | Require CPSIA, REACH, or RoHS test reports for target markets. |

| Inconsistent Communication or Poor English | Indicates disorganized operations or middlemen. | Prefer suppliers with dedicated English-speaking account managers. |

4. Best Practices for Long-Term Supplier Management

- Start with Small Trial Orders: Test reliability with 1–2 container loads before scaling.

- Sign a Quality Agreement: Define AQL levels, packaging standards, and liability terms.

- Use Escrow or Letter of Credit (LC): Mitigate financial risk on initial engagements.

- Conduct Bi-Annual Audits: Ensure sustained compliance and performance.

- Diversify Supplier Base: Avoid single-source dependency; qualify 2–3 verified manufacturers.

Conclusion

Verifying ball pen manufacturers in China requires due diligence beyond online directories. By systematically validating legal status, production capabilities, and operational transparency, procurement managers can mitigate risk and build resilient supply chains. Prioritize factories with proven export experience, robust QC, and willingness to undergo audits. Trading companies may offer convenience, but direct factory partnerships yield better cost control, quality, and innovation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

2026 Global Sourcing Intelligence Report: Strategic Procurement for Writing Instruments

Prepared Exclusively for Global Procurement Leaders by SourcifyChina

The 2026 Sourcing Challenge: Why Ball Pen Procurement Demands Precision

Global supply chains face unprecedented volatility in 2026. For ball pen procurement, 73% of buyers (per Global Stationery Sourcing Survey 2025) report delays, quality failures, or compliance risks due to unverified suppliers. Traditional sourcing methods—scouring Alibaba, LinkedIn, or trade shows—consume 200+ hours/year per category while exposing teams to:

– Factory fraud (42% of “verified” suppliers are trading companies)

– Non-compliance (REACH, CPSIA, ISO 9001 gaps)

– Capacity mismatches (40% of suppliers overstate output)

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk for Ball Pens

Our proprietary Pro List delivers pre-vetted, audit-backed manufacturers exclusively for writing instruments. Unlike public databases, every supplier undergoes:

– On-ground factory audits (physical capacity, machinery, labor compliance)

– Document verification (business licenses, export certifications, quality control protocols)

– Real-time capacity checks (via SourcifyChina’s IoT-enabled supplier network)

Time & Cost Savings: Verified Data

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Savings |

|---|---|---|---|

| Supplier Vetting | 8–12 weeks | < 72 hours | 83% faster |

| Quality Assurance | 3–5 pre-shipment audits | 0 audits needed (pre-qualified) | $8,200+/order |

| Compliance Validation | Manual document review | Automated CPSIA/REACH reports | 100% risk mitigation |

| Time-to-PO | 14–18 weeks | 6–8 weeks | 57% acceleration |

Source: SourcifyChina Client Data (2023–2025), 142 ball pen projects across EU, NA, and APAC.

Your Strategic Advantage in 2026

Procurement leaders using SourcifyChina’s Pro List achieve:

✅ Zero factory fraud incidents (100% of suppliers are direct manufacturers)

✅ Guaranteed minimum order quantities (MOQs validated at source)

✅ Duty-optimized shipping lanes (leveraging our Ningbo/Shenzhen hubs)

✅ 2026-compliant ESG frameworks (audited labor/environmental practices)

Example: A Fortune 500 client reduced pen procurement costs by 22% and timeline by 63% using Pro List suppliers—avoiding $380K in quality-related losses.

Call to Action: Secure Your Competitive Edge in 2026

Stop gambling with unverified suppliers. In today’s high-risk landscape, sourcing efficiency equals market agility.

👉 Take 2 minutes to unlock your personalized Pro List:

1. Email [email protected] with:

“2026 Pen Pro List Request – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for instant verification (24/7 multilingual support).

Within 24 hours, you’ll receive:

– A curated list of 5–7 pre-vetted ball pen manufacturers matching your specs (MOQ, materials, certifications)

– Free sourcing playbook: 2026 Compliance Checklist for Writing Instruments (valued at $450)

– Priority access to our Ningbo-based quality assurance team

“SourcifyChina’s Pro List cut our supplier onboarding from 11 weeks to 9 days. Their due diligence replaced 3 internal FTEs.”

— Head of Procurement, Global Office Supplies Distributor (2025 Client)

Act Now—2026 Won’t Wait.

Every day spent on unverified leads risks delays, compliance fines, and eroded margins. Your verified supply chain starts here.

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

SourcifyChina: Where Verification Meets Velocity.

© 2026 SourcifyChina. All rights reserved. ISO 9001:2015 Certified.

🧮 Landed Cost Calculator

Estimate your total import cost from China.