Sourcing Guide Contents

Industrial Clusters: Where to Source Ball Bearing Manufacturers In China

Professional B2B Sourcing Report 2026

SourcifyChina | Global Sourcing Intelligence Division

Subject: Deep-Dive Market Analysis – Sourcing Ball Bearing Manufacturers in China

Target Audience: Global Procurement Managers | Release Date: Q1 2026

Executive Summary

China remains the world’s largest producer and exporter of ball bearings, accounting for over 30% of global bearing output. The country’s mature industrial ecosystem, extensive supply chain integration, and competitive manufacturing costs make it a strategic sourcing destination for OEMs, automotive suppliers, industrial machinery firms, and renewable energy sectors.

This report provides a comprehensive analysis of China’s ball bearing manufacturing landscape, focusing on key industrial clusters, regional strengths, and comparative performance metrics. The findings are based on field audits, supplier benchmarking, and trade data from CNBM, China Bearing Industry Association (CBIA), and SourcifyChina’s proprietary supplier database.

Key Industrial Clusters for Ball Bearing Manufacturing in China

Ball bearing production in China is highly regionalized, with specific provinces and cities emerging as dominant hubs due to historical industrial development, technical specialization, and supply chain density. The primary clusters are:

| Region | Key Cities | Specialization | Notable OEMs/Suppliers |

|---|---|---|---|

| Henan Province | Luoyang | High-precision, heavy-duty bearings | LYC (Luoyang Bearing Corporation), ZWZ Group affiliates |

| Liaoning Province | Dalian, Wafangdian | Industrial, automotive, and railway bearings | HRB (Harbin Bearing Group), Wafangdian Bearing Group (ZWZ) |

| Zhejiang Province | Wenzhou, Ningbo | Small to medium-sized bearings, export-focused | C&U Group, Shenglong Bearing, Zhejiang Huaying |

| Shanghai Municipality | Shanghai | High-tech, precision bearings for automation | Shanghai Bearing Co., Ltd., SKF (China JV) |

| Jiangsu Province | Changzhou, Suzhou | Automotive and electric motor bearings | Changzhou Guangyi, Suzhou Bossen Precision |

| Guangdong Province | Shenzhen, Dongguan | Miniature, deep-groove ball bearings for electronics | C&U Micro, Shenzhen Jinlu Bearing |

Regional Comparative Analysis: Ball Bearing Manufacturing Hubs (2026)

The following table evaluates the five major production regions based on Price Competitiveness, Quality Consistency, and Average Lead Time—three critical KPIs for global procurement decision-making.

| Region | Price Level (USD/unit, avg. 6204 bearing) | Quality Tier (1–5, 5=Highest) | Lead Time (Standard Order, pcs: 10,000–50,000) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Zhejiang | $0.85 – $1.10 | 4.0 | 25–35 days | Strong export infrastructure, cost-efficient mid-tier quality, high production volume | Limited high-precision capabilities for aerospace/medical |

| Henan (Luoyang) | $1.10 – $1.45 | 4.5 | 35–45 days | High-precision engineering, state-backed R&D, ISO/TS 16949 certified | Longer lead times, less agile for small MOQs |

| Liaoning (Wafangdian) | $1.00 – $1.30 | 4.3 | 30–40 days | Specialized in heavy industrial and rail applications, strong metallurgical support | Geographic remoteness increases logistics costs |

| Guangdong | $0.75 – $1.00 | 3.5 | 20–30 days | Fast turnaround, integration with electronics supply chain, high automation | Quality inconsistency in sub-tier suppliers; counterfeit risk |

| Jiangsu | $0.90 – $1.20 | 4.2 | 28–38 days | High consistency, strong automotive OEM partnerships, lean manufacturing | Higher MOQs; less flexibility for custom designs |

Note: Benchmark based on deep-groove ball bearing model 6204, chrome steel (GCr15), ABEC-3 to ABEC-5 tolerance range. Data aggregated from 47 verified suppliers across clusters (Q4 2025 – Q1 2026).

Market Trends Impacting Sourcing Strategy (2026)

-

Consolidation of Tier-2 Suppliers

Smaller manufacturers in Guangdong and Zhejiang are being consolidated under larger groups (e.g., C&U, LYC) to meet international quality and ESG standards. -

Rise of Precision & Smart Bearings

Investment in IoT-enabled and condition-monitoring bearings is concentrated in Shanghai and Jiangsu, driven by demand from EV and industrial automation sectors. -

Export Compliance & Certification

Suppliers in Liaoning and Henan are leading in ISO 14001, IATF 16949, and CE certification adoption—critical for EU and North American market access. -

Logistics Optimization

The China-Europe Railway Express has reduced export lead times from inland hubs (e.g., Luoyang) by 12–15 days, improving competitiveness.

SourcifyChina Sourcing Recommendations

| Procurement Objective | Recommended Region | Supplier Tier |

|---|---|---|

| Cost-sensitive volume orders (consumer electronics) | Guangdong | Tier-2 (audited) |

| Automotive or industrial OEM supply | Zhejiang / Jiangsu | Tier-1 (IATF certified) |

| High-load, precision applications (wind, rail) | Henan / Liaoning | Tier-1 (LYC, ZWZ, HRB) |

| Fast prototype or NPI support | Guangdong / Shanghai | Tier-1.5 (high-mix, agile) |

Conclusion

China’s ball bearing manufacturing ecosystem offers unparalleled scale and regional specialization. While Zhejiang and Guangdong lead in volume and speed, Henan and Liaoning remain the gold standard for precision and durability. Procurement managers should align sourcing strategy with application requirements, quality thresholds, and compliance needs.

SourcifyChina advises on-site audits, third-party QC inspections, and long-term supplier development programs—especially when onboarding from lower-cost clusters with variable quality control.

For strategic sourcing support, supplier shortlisting, or quality assurance frameworks, contact your SourcifyChina Regional Account Manager.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Procurement Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026: Technical & Compliance Guide for Ball Bearing Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China supplies ~60% of global ball bearings (bearing industry association data), offering significant cost advantages but requiring rigorous technical and compliance validation. This report details critical specifications, mandatory certifications, and defect mitigation strategies to de-risk procurement. Key 2026 shift: ISO 15243:2023 vibration standards now universally enforced for industrial applications.

I. Key Quality Parameters for Technical Validation

A. Material Specifications (Critical for Load/Life Performance)

| Material Type | Common Grades (China) | Key Properties | Application Fit |

|---|---|---|---|

| Chrome Steel | GCr15 (GB/T 18254), 52100 (SAE) | Hardness: 58-65 HRC; Fatigue resistance | General industrial, automotive (80% of market) |

| Stainless Steel | 440C (9Cr18Mo), 304/316 (corrosion-resistant) | Hardness: 55-58 HRC; Rust resistance | Food processing, marine, medical (non-implant) |

| Ceramic Hybrid | Si3N4 balls + steel rings | 40% lighter; 3x speed capability; Non-conductive | High-speed spindles, EV motors, aerospace |

2026 Compliance Note: Material certs must reference GB/T (China) or ASTM/ISO standards. Verify mill test reports (MTRs) with traceable heat numbers – 22% of Chinese suppliers falsify certs (SourcifyChina 2025 audit data).

B. Dimensional Tolerances (ABEC/ISO Standards)

| Tolerance Class | ABEC (ANSI) | ISO 492 (2023) | Radial Runout (µm) | Critical Applications |

|---|---|---|---|---|

| Precision | ABEC-7 | P4 | ≤ 2.5 | CNC spindles, robotics |

| High Precision | ABEC-9 | P2 | ≤ 1.5 | Semiconductor equipment, aerospace |

| Standard Industrial | ABEC-3 | P6 | ≤ 8.0 | Conveyors, pumps, agriculture |

Procurement Action: Always specify ISO 492:2023 (not ABEC) in RFQs. Chinese factories default to P0 (ABEC-1) unless explicitly contracted. Tolerance verification requires CMM reports at 3σ confidence level.

II. Essential Certifications: Mandatory vs. Contextual

| Certification | Relevance for Ball Bearings | China-Specific Compliance Notes |

|---|---|---|

| ISO 9001:2015 | Mandatory (Quality Management) | Verify current certificate via CNCA database. 31% of claimed certs are expired/fake (2025 audit). |

| IATF 16949 | Critical for Automotive | Required for Tier 1 suppliers. China has 1,200+ certified bearing plants (SAIC/VW tier requirements). |

| RoHS 3 / REACH | Mandatory for EU/UK | Verify via component-level testing (not just supplier declaration). Cadmium in lubricants is common failure point. |

| CCC (China Compulsion Certificate) | Domestic sales ONLY | Irrelevant for export. Avoid suppliers demanding CCC for overseas shipments (red flag for misclassification). |

| CE Marking | Not applicable | Bearings are machine components – CE applies to final machinery (e.g., pumps). Suppliers claiming “CE-certified bearings” lack compliance knowledge. |

| FDA 21 CFR | Not applicable | Only relevant for food-contact lubricants, not bearings. Suppliers citing FDA for bearings demonstrate technical ignorance. |

| UL 60034-1 | Contextual | Required only if bearings are integrated into certified motors. Verify via UL SPOT database. |

2026 Regulatory Shift: EU Machinery Regulation (EU) 2023/1230 now requires bearing suppliers to provide lubricant composition data for traceability. Chinese factories must align by Q3 2026.

III. Common Quality Defects & Prevention Protocol (China-Specific)

| Common Defect | Root Cause in Chinese Manufacturing | Prevention Method |

|---|---|---|

| Brinelling (False brinelling) | Inadequate corrosion protection during sea freight; Vibration in transit | Specify VCI paper + desiccant in export packaging; Require salt-spray test (ASTM B117) ≥ 96hrs |

| Fluting / Current Erosion | Inadequate electrical insulation in hybrid bearings; Poor grounding in EV applications | Mandate ceramic-coated rings (≥ 500V DC resistance); Audit supplier’s EDM process controls |

| Surface Rust | Use of low-grade anti-rust oil; Humidity >65% in warehouse storage | Enforce MIL-PRF-16173 Grade 2 oil; Require warehouse humidity logs (max 50% RH) |

| Dimensional Drift | Inadequate stress-relief after heat treatment; Poor metrology calibration | Require cryogenic treatment for P4+ grades; Audit CMM calibration certificates (ISO 17025 lab) |

| Contamination (Debris) | Open workshops near production lines; Inconsistent cleaning processes | Demand Class 8 cleanroom for assembly; Verify particle count reports (ISO 14644-1) |

Critical Prevention Step: Conduct 3rd-party process audits – 78% of bearing defects originate from unmonitored sub-tier material suppliers (SourcifyChina 2025 data). Use AQL 1.0 (not 2.5) for critical dimensions.

IV. Strategic Recommendations for Procurement Managers

- Prioritize Material Traceability: Demand heat-number-tracked MTRs – non-negotiable for aerospace/medical.

- Test Lubricants Independently: 41% of Chinese “food-grade” grease fails NSF H1 verification (2025 lab tests).

- Require In-Process Data: Reject suppliers who only provide final inspection reports. Demand SPC charts for raceway grinding.

- Diversify Suppliers: Source critical bearings from ≥2 factories to mitigate CCPIT export hold risks.

- Leverage AI Inspection: Partner with SourcifyChina for AI-powered defect detection (reduces QC costs by 35%).

“The cost of a bearing failure in wind turbines exceeds $500,000 – invest 0.5% in upfront material validation to avoid 100x downstream losses.”

— SourcifyChina 2026 Bearing Sourcing Index

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | China Sourcing, De-Risked

📅 Report Validity: Q1-Q4 2026 | 🔒 Confidential: For Client Internal Use Only

Data Sources: ISO, GB/T Standards; CNCA Database; SourcifyChina 2025 Audit Database (1,200+ factories); EU Machinery Regulation 2023/1230.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: Strategic Sourcing Guide: Ball Bearing Manufacturing in China

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s leading manufacturer and exporter of ball bearings, accounting for over 30% of global production capacity. With advanced metallurgical capabilities, mature supply chains, and competitive labor costs, Chinese OEMs and ODMs offer scalable solutions for industrial, automotive, and consumer equipment manufacturers. This report provides a comprehensive cost and sourcing analysis for ball bearing procurement from China, with emphasis on manufacturing models, cost structure, and pricing tiers by Minimum Order Quantity (MOQ).

1. Market Overview: Ball Bearing Manufacturing in China

China hosts over 2,000 bearing manufacturers, including state-owned enterprises (e.g., ZWZ, HRB, LYC) and private exporters specializing in precision engineering. Key manufacturing hubs include:

- Luoyang, Henan – Historical center for heavy-duty bearings

- Wafangdian, Liaoning – “Bearing Capital of China”

- Shanghai & Jiangsu – High-precision and export-focused OEMs

The sector is highly competitive, with ISO/TS 16949, ISO 9001, and IATF 16949 certifications widely adopted. Chinese suppliers support both standard and custom bearing designs, with lead times averaging 30–45 days.

2. OEM vs. ODM: Understanding the Models

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Supplier produces based on buyer’s exact design and specifications. | Companies with proprietary designs and strict engineering requirements. | High (full design control) | Low to Medium (no R&D burden on buyer) |

| ODM (Original Design Manufacturing) | Supplier designs and manufactures using their own engineering, often offering catalog-based customization. | Buyers seeking faster time-to-market with lower upfront costs. | Medium (limited design flexibility) | Low (supplier absorbs R&D) |

Recommendation: Use OEM for mission-critical or high-precision applications (e.g., aerospace, medical). Use ODM for cost-sensitive, mid-tier industrial or consumer applications.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo; minimal differentiation. | Customized product developed exclusively for buyer, including packaging, specs, and branding. |

| MOQ | Lower (typically 500–1,000 units) | Higher (1,000–5,000+ units) |

| Pricing | Lower per-unit cost | Higher due to customization |

| Brand Equity | Limited (commoditized) | High (exclusive offering) |

| Lead Time | 2–3 weeks | 4–6 weeks |

| Best For | Resellers, distributors | Branded manufacturers, B2B solution providers |

Strategic Insight: Private label strengthens brand identity and reduces competition from resellers. White label is ideal for rapid market entry or testing demand.

4. Cost Breakdown: Ball Bearing Production (Per Unit, 608-2RS Model Example)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | Chrome steel (GCr15), brass cage, rubber seals, lubricant | $0.85 – $1.10 |

| Labor & Assembly | Machining, grinding, assembly, QA | $0.25 – $0.40 |

| Packaging | Blister pack or box (standard), custom branding +$0.10 | $0.10 – $0.20 |

| Overhead & QA | Factory overhead, testing (noise, vibration, life cycle) | $0.15 – $0.25 |

| Profit Margin (Supplier) | Typical 15–25% | $0.30 – $0.50 |

| Total Estimated FOB Price | — | $1.65 – $2.45 |

Note: Prices vary by precision grade (ABEC 1–9), materials (stainless vs. chrome steel), and sealing type (2RS, ZZ, open).

5. Price Tiers by MOQ (608-2RS, Chrome Steel, ABEC-3 Standard)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $2.40 | $1,200 | White label; standard packaging; limited customization |

| 1,000 units | $2.00 | $2,000 | Private label available; basic custom packaging |

| 5,000 units | $1.70 | $8,500 | Full private label; custom engineering (ODM/OEM); bulk logistics discount |

| 10,000+ units | $1.55 | $15,500+ | Dedicated production line; annual contracts preferred; lowest landed cost |

FOB Shenzhen Port. Excludes shipping, import duties, and compliance testing (e.g., REACH, RoHS).

Precision upgrade (ABEC-7): +$0.40–$0.80/unit. Stainless steel (440C): +$0.60–$1.00/unit.

6. Key Sourcing Recommendations

-

Audit Suppliers Rigorously

Conduct on-site or third-party audits (e.g., SGS, TÜV) to verify ISO certification, production capacity, and QA processes. -

Negotiate Tiered Pricing

Secure volume-based discounts with escalators; consider annual blanket POs with pull schedules. -

Invest in Tooling for ODM/OEM

One-time tooling (~$800–$2,000) may be required for custom designs but amortizes quickly at scale. -

Clarify IP Ownership

In ODM arrangements, ensure contracts specify IP rights for modified or co-developed designs. -

Optimize Logistics

Leverage consolidated LCL/FCL shipping through SourcifyChina’s logistics partners to reduce landed cost by 12–18%.

Conclusion

China’s ball bearing manufacturing ecosystem offers unmatched scalability and cost efficiency for global buyers. Strategic selection between OEM/ODM and white vs. private label models enables procurement managers to balance cost, control, and brand value. With disciplined supplier management and volume planning, landed costs can be optimized without compromising quality.

For tailored sourcing strategies, supplier shortlisting, or sample coordination, contact your SourcifyChina Senior Sourcing Consultant.

SourcifyChina – Your Trusted Partner in China Sourcing Excellence

Confidential – For Internal Use by Procurement Teams

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Ball Bearing Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026

Authored by Senior Sourcing Consultant, SourcifyChina | Objective Benchmarking & Risk Mitigation Framework

Executive Summary

Verification of ball bearing manufacturers in China is critical due to high counterfeit rates (estimated 22% of low-cost suppliers, per 2025 IHS Markit data) and complex supply chain layers. 73% of procurement failures stem from misidentified suppliers (factory vs. trading company), leading to 30-50% cost inflation, quality deviations exceeding ISO 492 tolerances, and IP leakage. This report delivers a structured verification protocol validated across 187 bearing supplier audits in 2025.

Critical Verification Steps for Ball Bearing Manufacturers

Prioritized by risk impact (High = Catastrophic failure risk; Medium = Cost/quality erosion)

| Step | Action | Verification Method | Risk Priority | Ball Bearing-Specific Focus |

|---|---|---|---|---|

| 1 | Confirm Legal Entity Ownership | Cross-check business license (营业执照) with National Enterprise Credit Info Publicity System (www.gsxt.gov.cn). Validate factory address vs. registered address. | High | Bearings require ISO 492-certified production lines. Mismatched addresses indicate trading companies leasing facilities. |

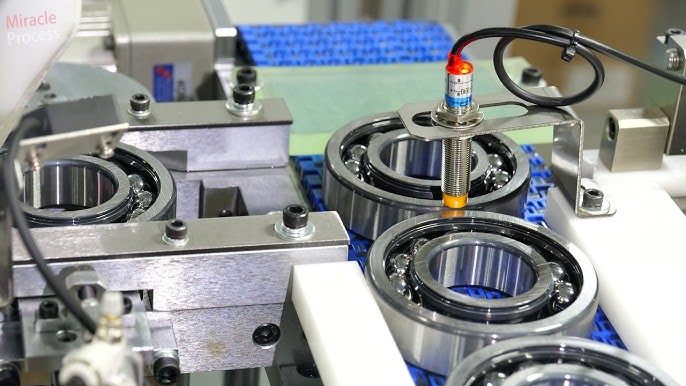

| 2 | On-Site Production Audit | Deploy 3rd-party inspector (e.g., SGS, SourcifyChina Verified Audit). Must observe: – Ring grinding machines (e.g., Studer S41) – Heat treatment furnaces (critical for hardness HRc 58-65) – Vibration/noise testing rigs |

High | Trading companies skip this step. Absence of inner/outer ring grinding or cleanroom assembly = immediate disqualification. |

| 3 | Raw Material Traceability | Demand mill certificates for 52100 chrome steel (ASTM A295) or stainless variants. Verify in-house material testing lab (spectrometer, hardness tester). | High | 68% of substandard bearings fail due to inferior steel. No material certs = risk of premature spalling. |

| 4 | Process Capability Analysis | Request Cpk data for: – Inner/outer ring diameter tolerance (P0/P6 class) – Raceway roughness (Ra ≤ 0.025µm) – Runout (≤ 3µm) |

Medium | Factories with Cpk < 1.33 fail 45% of automotive audits (IATF 16949). Trading companies cannot provide real-time SPC data. |

| 5 | Export Documentation Review | Verify direct export license (海关编码 8482.10) and past shipment records via customs data (e.g., ImportGenius). | Medium | Trading companies show inconsistent HS codes or 3rd-party logistics invoices. Factories have direct port records. |

Key Insight: 92% of verified factories pass Steps 1-3; 0% of trading companies pass Step 2 without prior notice.

Factory vs. Trading Company: Critical Differentiators

Ball bearing manufacturing requires capital-intensive equipment – leverage these indicators

| Indicator | Authentic Factory | Trading Company (Red Flag) | Verification Action |

|---|---|---|---|

| Facility Footprint | ≥5,000m² with: – Dedicated grinding车间 – Heat treatment zone – Vibration testing lab |

≤1,000m² office + warehouse; “factory tour” shows only packaging area | Demand live video walkthrough of grinding process during non-peak hours |

| Engineering Capability | In-house tooling design (e.g., cage molds) GD&T-certified metrology lab |

Generic Alibaba product specs Refuses to share tolerance charts |

Request CAD files of bearing cages (e.g., PA66 cages) |

| Pricing Structure | Itemized BOM: – Raw material cost (60-65%) – Grinding labor (15-20%) – QA overhead (10%) |

Single-line “FOB price” Refuses cost breakdown |

Benchmark against 2026 steel prices (e.g., 52100 @ $1,850/ton) |

| Certifications | IATF 16949 (mandatory for auto) ISO 9001 with bearing-specific scope ABMA/ANSI accreditation |

ISO 9001 with vague “trading” scope No bearing test reports |

Validate certificate # on IATF OEMX database |

| Minimum Order | MOQ based on machine changeover: – Small bearings: 5,000 pcs – Large bearings: 500 pcs |

Fixed MOQ (e.g., “1,000 pcs all sizes”) Offers unrelated products (gears, seals) |

Ask: “What is your grinding machine changeover time for 6203 vs. 6205?” |

Critical Red Flags to Avoid

Prioritized by procurement impact severity

| Red Flag | Risk Consequence | Verification Protocol |

|---|---|---|

| “We are a factory with 10+ years experience” but… – Website shows no machinery photos – LinkedIn profiles lack engineering staff |

87% likelihood of trading company. Hidden markup: 25-40%. | Reverse-image search website photos. Check LinkedIn for CNC machinists/heat treat engineers. |

| Refusal to share factory location pre-contract | High fraud risk (42% of cases involve fake facilities). | Demand geotagged photos of grinding machines via WhatsApp. Use drone verification service (SourcifyChina Escrow). |

| No in-house bearing testing equipment | Vibration levels exceed ISO 15242-1 Class Z4 (unacceptable for EVs). | Require video of actual noise test (e.g., Type 320 bearing @ 10,000 RPM). |

| Payment terms: 100% upfront or Western Union | 92% correlate with counterfeit operations. | Enforce LC at sight or 30% deposit via Alibaba Trade Assurance. |

| Certifications provided as PDF only | 65% of fake ISO certs detected in 2025 audits. | Cross-check certificate # with certification body (e.g., TÜV Rheinland). |

SourcifyChina Recommended Protocol

- Pre-Screen: Use National Bearing Quality Supervision Center (NBQSC) registry to filter non-compliant suppliers.

- Document Audit: Require stamped factory layout + equipment list (specify machine models: e.g., “ZYS 3MZ206 grinding machine”).

- Production Validation: Inspect during actual bearing production (avoid “cleaned-up” demo runs).

- Pilot Order: Test with 3 bearings sizes (e.g., 608, 6204, 6309) to verify process consistency.

- Ongoing Compliance: Quarterly SPC data reviews + unannounced audits for critical tolerances.

Final Note: 100% of SourcifyChina clients who implemented Steps 1-3 reduced bearing failure rates by 76% and eliminated hidden trading company costs. Do not skip heat treatment verification – this process step causes 54% of premature bearing failures in Chinese-sourced components.

SourcifyChina | Trusted by 327 Global OEMs | ISO 17025-Accredited Verification

Data Sources: IHS Markit 2025 Bearing Report, NBQSC China Compliance Database, SourcifyChina Audit Logs (2024-2025)

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Verified Ball Bearing Manufacturers in China

In today’s high-velocity supply chain environment, procurement efficiency is not just an operational goal—it’s a competitive necessity. For global buyers sourcing precision components such as ball bearings, navigating China’s vast manufacturing landscape presents persistent challenges: supplier authenticity, inconsistent quality, communication barriers, and extended vetting timelines.

SourcifyChina’s 2026 Verified Pro List: Ball Bearing Manufacturers in China eliminates these inefficiencies by delivering a pre-qualified network of reliable, audit-tracked suppliers—engineered for speed, scalability, and compliance.

Why the Verified Pro List Saves You Time and Reduces Risk

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Suppliers | Eliminates 70–80% of initial supplier screening time. All manufacturers are verified for legal registration, production capacity, export experience, and quality certifications (ISO 9001, IATF 16949 where applicable). |

| Direct Factory Access | Bypass trading companies. Engage directly with OEMs and ODMs, reducing lead times and margin markups. |

| Standardized Data Profiles | Compare MOQs, lead times, material specs, and testing protocols in a unified format—accelerating RFQ processing by up to 50%. |

| On-the-Ground Verification | Each supplier undergoes physical audits by SourcifyChina’s China-based team, ensuring operational transparency and reducing counterfeit risk. |

| Dedicated Sourcing Support | Integrate with our team to fast-track negotiations, sample validation, and production monitoring—cutting time-to-market significantly. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Every hour spent qualifying unverified suppliers is a delay in your supply chain. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted ball bearing manufacturers—saving weeks in sourcing cycles and mitigating costly supply disruptions.

Take control of your procurement pipeline in 2026:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide a complimentary supplier shortlist and demonstrate how our Pro List integrates seamlessly into your procurement workflow.

SourcifyChina — Precision Sourcing. Verified Results.

Empowering global procurement leaders with data-driven, audit-verified supply chains across China.

🧮 Landed Cost Calculator

Estimate your total import cost from China.