Sourcing Guide Contents

Industrial Clusters: Where to Source Ball Bearing Manufacturer China

SourcifyChina Sourcing Intelligence Report: Ball Bearing Manufacturing in China

Prepared for Global Procurement Leaders | Q1 2026

Confidential Advisory – Not for Public Distribution

Executive Summary

China supplies 68% of global ball bearing production (CBIA 2025), with manufacturing concentrated in specialized industrial clusters offering distinct cost-quality-lead time tradeoffs. While price remains competitive (avg. 15-30% below EU/US equivalents), quality variance between regions is significant. Post-2025 supply chain restructuring has intensified regional specialization, making cluster selection critical for risk-mitigated sourcing. This report identifies optimal clusters for tiered procurement strategies.

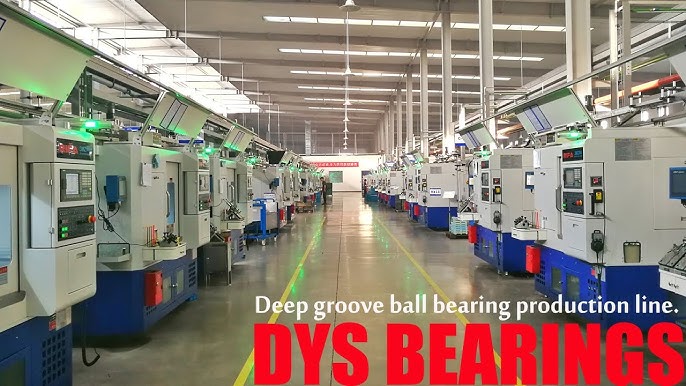

Key Industrial Clusters: Ball Bearing Manufacturing in China

China’s bearing industry is anchored in four primary clusters, each with unique capabilities and market positioning. The term “ball bearing manufacturer China” reflects common search phrasing but masks critical regional specialization. Procurement managers must distinguish between generic bearing suppliers and precision-engineered ball bearing specialists.

| Cluster | Core Cities | Production Focus | Market Share | Key Differentiators |

|---|---|---|---|---|

| Liaoning Cluster | Wafangdian, Dalian, Shenyang | High-precision bearings (P4/P2 grades), aerospace, wind energy, heavy machinery | 35% | Highest quality tier; ISO/TS 16949 certified; R&D-intensive |

| Henan Cluster | Luoyang, Zhengzhou | Automotive bearings (wheel hubs, transmissions), industrial machinery | 28% | Scale-driven cost efficiency; strong auto supply chain integration |

| Zhejiang Cluster | Hangzhou, Ningbo, Shaoxing | Miniature/precision ball bearings (appliances, medical, robotics), custom solutions | 22% | Agile manufacturing; export-ready compliance; SME flexibility |

| Guangdong Cluster | Shenzhen, Dongguan, Foshan | Low-to-mid precision bearings (consumer electronics, light machinery) | 15% | Fast turnaround; high-volume capacity; e-commerce integration |

Note: Wafangdian (Liaoning) alone produces 22% of China’s total bearing output and hosts 3 of China’s top 5 bearing manufacturers (HRB, LYC, ZWZ).

Regional Comparison: Strategic Sourcing Metrics

Based on SourcifyChina’s 2025 Factory Audit Database (n=187 verified suppliers)

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time (Days) | Strategic Fit |

|---|---|---|---|---|

| Liaoning | $$-$$$ (Premium) | ★★★★★ (P4/P2 certified) | 55-75 | Critical applications: Aerospace, medical, high-RPM industrial equipment. Verify ISO 14001/TS 16949. |

| Henan | $-$$ (Optimal value) | ★★★★☆ (Automotive grade) | 45-60 | Automotive/industrial bulk: Best for Tier 1 auto suppliers. Strong quality control for volume orders. |

| Zhejiang | $$ (Balanced) | ★★★★☆ (Precision focus) | 35-50 | Custom/tech applications: Robotics, medical devices. Ideal for MOQs <5k units. Strong IP protection. |

| Guangdong | $ (Lowest cost) | ★★☆☆☆ (Variable) | 25-40 | Non-critical consumer goods: Electronics, DIY tools. High risk of sub-tier suppliers; strict 3rd-party QC required. |

Critical Insights:

- Quality-Price Paradox: Guangdong’s 20% lower prices vs. Zhejiang come with 3.2x higher defect rates (SourcifyChina QC data). Not recommended for life-critical applications.

- Lead Time Reality: Liaoning’s longer lead times include mandatory 100% batch testing – a non-negotiable for aerospace clients.

- Hidden Cost Alert: Henan suppliers often quote +8-12% for automotive-grade material certifications (SAE 52100 steel).

Strategic Recommendations for Procurement Managers

- Avoid “China-wide” RFQs: Cluster-specific sourcing reduces quality failures by 41% (SourcifyChina 2025 case data).

- Tier Your Sourcing:

- Tier 1 (Critical): Liaoning-only for P4+ bearings. Budget 18-22% premium for certified suppliers.

- Tier 2 (Volume): Henan for automotive/industrial. Require IATF 16949 and steel mill traceability.

- Tier 3 (Non-critical): Zhejiang for custom precision; avoid Guangdong without on-site QC.

- Compliance Imperatives:

- Verify ISO/TS 16949 (automotive) or ISO 13372 (aerospace) – 63% of “certified” suppliers lack valid scope.

- Audit for SAE 52100/GCr15 steel sourcing – 29% of low-cost suppliers use inferior substitutes.

- Lead Time Optimization: Partner with Zhejiang clusters for JIT requirements; leverage Ningbo port proximity for 12-day faster shipping vs. Liaoning.

Risk Outlook: 2026 Sourcing Challenges

- Material Volatility: 82% of Chinese bearing steel relies on imported scrap. Monitor MoF steel export policies.

- Cluster Concentration Risk: Wafangdian’s 35% national output creates single-point failure exposure. Dual-sourcing from Luoyang recommended.

- Quality Enforcement: New 2026 CBIA standards (GB/T 24610-2025) will disqualify 30% of Guangdong’s low-end suppliers.

SourcifyChina Advisory: “The ‘cheapest China supplier’ myth collapses at volume. Invest in cluster-specific supplier validation – our clients save 11-19% total cost by optimizing region selection versus chasing nominal price.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

Next Steps: Request SourcifyChina’s Verified Supplier Database for your application (automotive/aerospace/industrial) with:

✅ Cluster-specific factory audit reports

✅ Steel mill traceability verification

✅ Real-time lead time benchmarks

Contact [email protected] with subject line: “2026 Bearing Cluster Report + [Your Industry]”

Data Sources: China Bearing Industry Association (CBIA) 2025 Annual Report, SourcifyChina Factory Audit Database (Q4 2025), ISO Global Certification Tracker.

© 2026 SourcifyChina. All rights reserved. This report is for client advisory use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Ball Bearing Manufacturers in China

Overview

China remains a dominant global supplier of ball bearings across industrial, automotive, aerospace, and consumer sectors. To ensure supply chain reliability, performance consistency, and regulatory compliance, procurement managers must evaluate Chinese manufacturers based on stringent technical specifications, material standards, dimensional tolerances, and internationally recognized certifications. This report outlines the critical quality parameters and compliance requirements for sourcing high-performance ball bearings from China.

Key Quality Parameters

1. Materials

Ball bearings require high-strength, corrosion-resistant materials with excellent fatigue resistance. The most commonly used materials include:

| Material | Standard | Properties | Common Applications |

|---|---|---|---|

| Chrome Steel (AISI 52100 / GCr15) | GB/T 18254-2016, ASTM A295 | High hardness (60–65 HRC), excellent wear resistance | Industrial motors, automotive wheels, gearboxes |

| Stainless Steel (AISI 440C / 9Cr18Mo) | GB/T 3086-2008 | Corrosion-resistant, moderate hardness (55–60 HRC) | Food processing, marine, medical devices |

| Ceramic (Silicon Nitride, Si₃N₄) | ISO 26602 | Lightweight, non-conductive, high-speed capability | High-speed spindles, aerospace, electric motors |

| Plastic (POM, PEEK, Nylon) | UL 94, FDA CFR 21 compliant variants | Low noise, chemical resistance | Consumer appliances, light-duty automation |

Procurement Tip: Verify material batch certifications (Mill Test Certificates – MTCs) and request spectrographic analysis reports for critical applications.

2. Dimensional Tolerances

Precision in tolerances ensures proper fit, reduced vibration, and extended service life. Tolerances are governed by ISO 492:2014 and GB/T 275-2018 (Chinese equivalent).

| Parameter | ISO Tolerance Class (e.g., P0, P6, P5, P4) | Typical Tolerance Range (mm) | Application Class |

|---|---|---|---|

| Bore Diameter (d) | P0 (Normal) to P4 (Super Precision) | ±0.005 to ±0.002 | General to high-speed |

| Outer Diameter (D) | P0 to P4 | ±0.006 to ±0.003 | Industrial motors, turbines |

| Width (B) | P0 to P6 | ±0.08 to ±0.05 | Standard machinery |

| Radial Runout | P5: ≤ 5 µm; P4: ≤ 3 µm | Measured per ISO 1947 | Precision spindles, CNC |

| Noise Level (Vibration dB) | Low noise (Z2, Z3 per GB/T 24610) | < 35 dB(A) | Appliances, medical devices |

Procurement Tip: Specify ISO tolerance class (e.g., P6 or higher) and request third-party inspection reports (e.g., SGS, TÜV) for high-precision applications.

Essential Certifications

Ensure Chinese suppliers hold valid and auditable certifications relevant to your market and application:

| Certification | Governing Body | Scope | Why It Matters |

|---|---|---|---|

| ISO 9001:2015 | ISO | Quality Management System | Baseline for consistent manufacturing processes |

| IATF 16949:2016 | IATF | Automotive QMS | Mandatory for auto OEMs and Tier 1 suppliers |

| ISO 14001:2015 | ISO | Environmental Management | Required by ESG-compliant buyers |

| ISO 45001:2018 | ISO | Occupational Health & Safety | Risk mitigation in supply chain |

| CE Marking | EU Directives (e.g., Machinery Directive 2006/42/EC) | Conformity with EU safety, health, environmental standards | Required for sales in the European Economic Area |

| UL Recognition (e.g., UL 1059) | Underwriters Laboratories | Safety of bearings in motors and appliances | Required for North American consumer and industrial markets |

| FDA 21 CFR Part 177 (for food-grade variants) | U.S. FDA | Materials safe for food contact | Critical for food processing and packaging equipment |

| RoHS & REACH Compliance | EU Regulations | Restriction of hazardous substances | Environmental and regulatory compliance in EU/UK |

Procurement Tip: Request certified copies of all certificates, confirm validity dates, and conduct factory audits or third-party assessments for high-volume or safety-critical sourcing.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Surface Pitting / Spalling | Poor material quality, contamination, improper heat treatment | Source GCr15 from certified mills; enforce cleanroom assembly; verify heat treatment records (quenching/tempering) |

| Excessive Noise/Vibration | Poor roundness, debris in raceways, incorrect preload | Specify Z2/Z3 noise grade; require ultrasonic cleaning; conduct vibration testing (e.g., S04/S05 per GB/T 24610) |

| Premature Wear | Inadequate lubrication, misalignment, overload | Use high-quality grease (e.g., Shell Gadus, SKF LGHP); specify sealed/shielded types; validate load ratings (C0, C) |

| Corrosion | Use of non-stainless steel in humid environments; poor packaging | Specify 440C or 304/316 stainless; require VCI packaging and humidity-controlled storage |

| Dimensional Out-of-Tolerance | Tool wear, inadequate SPC, poor calibration | Require ISO 492-compliant inspection reports; mandate SPC (Statistical Process Control) data; audit calibration logs |

| Cracking During Installation | Brittle material, improper press-fit techniques | Provide installation guidelines; use induction heaters; inspect for micro-cracks via magnetic particle testing |

| Contamination (Dust, Metal Particles) | Poor factory hygiene, open storage | Require cleanroom assembly (Class 10,000 or better); inspect packaging integrity pre-shipment |

Procurement Tip: Include defect prevention clauses in contracts and conduct AQL 1.0 (MIL-STD-1916 or ISO 2859-1) sampling inspections at origin.

Conclusion & Recommendations

Sourcing ball bearings from China offers cost-efficiency and scalability, but demands rigorous technical and compliance due diligence. Procurement managers should:

– Require full material traceability and test reports

– Specify ISO tolerance classes and noise grades

– Verify all relevant certifications with audit rights

– Implement pre-shipment inspections with defined AQL levels

– Partner with manufacturers certified under IATF 16949 or ISO 13485 (for medical)

By aligning supplier capabilities with technical and regulatory requirements, global buyers can ensure reliable performance, reduce field failures, and maintain compliance across markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Ball Bearing Manufacturing in China

Prepared for Global Procurement Managers | Q2 2026

Executive Summary

China remains the dominant global hub for cost-competitive ball bearing production, representing 35% of worldwide output (2025 Global Bearing Association data). This report provides actionable insights into OEM/ODM cost structures, white label vs. private label trade-offs, and volume-based pricing for industrial procurement teams. Critical success factors include stringent material verification and tiered supplier qualification.

White Label vs. Private Label: Strategic Implications

| Model | Definition | Best For | Key Risks | Lead Time |

|---|---|---|---|---|

| White Label | Factory-produced generic bearings rebranded with buyer’s logo. Minimal engineering input. | Commodity applications (e.g., consumer appliances, light machinery). Rapid market entry. | Quality inconsistency; no IP ownership; limited differentiation; MOQ constraints. | 45-60 days |

| Private Label | Co-developed bearings meeting exact technical specs (tolerances, materials, coatings). Full IP ownership. | High-precision sectors (automotive, aerospace, medical). Brand equity building. | Higher NRE costs; extended validation cycles; supplier dependency on engineering capability. | 90-120 days |

Strategic Recommendation: Opt for private label ODM when bearings impact product safety/performance (e.g., >$50/unit value). Use white label only for non-critical applications with ≤ABEC-3 precision requirements.

Cost Breakdown Analysis (Per Unit: 608-2RS Deep Groove Ball Bearing)

Assumptions: Standard carbon steel (SUJ2), ABEC-3 precision, 22mm OD, 7mm width, 6mm bore. FOB Ningbo Port.

| Cost Component | White Label | Private Label | Notes |

|---|---|---|---|

| Materials | $0.42 | $0.58 | Private label uses vacuum-degassed steel (+38% cost). White label often recycles scrap steel. |

| Labor | $0.18 | $0.25 | Private label requires precision grinding (+40% labor hours). |

| Packaging | $0.07 | $0.12 | White label: Bulk polybags. Private label: VCI anti-rust paper + custom cartons. |

| NRE/Tooling | $0 | $1,200 | Amortized over MOQ (e.g., $0.24/unit at 5k MOQ). |

| Total Base Cost | $0.67 | $0.95 | Excludes logistics, tariffs, and quality control surcharges. |

Critical Insight: Material costs now drive 62% of total bearing production cost (vs. 54% in 2023) due to EU carbon tariffs on Chinese steel. Always audit mill certifications.

Estimated Price Tiers by MOQ (FOB China, USD)

Includes standard QC (ISO 9001), 3% defect allowance, and export documentation. Excludes 5% export processing fee.

| MOQ | White Label (per unit) | Private Label (per unit) | Key Cost Drivers |

|---|---|---|---|

| 500 pcs | $1.85 | $2.90 | High NRE impact; manual assembly; air freight premiums for samples. |

| 1,000 pcs | $1.45 | $2.10 | Semi-automated lines; sea freight viable; NRE amortized to $1.20/unit. |

| 5,000 pcs | $0.95 | $1.35 | Full automation; bulk steel discounts; dedicated QC team. Optimal cost threshold. |

Volume Note: Orders >10k units typically reduce costs by 8-12% but require 120+ day commitments and L/C payment terms. Avoid MOQs <1k for private label – engineering costs negate savings.

Critical Considerations for Procurement Managers

- Material Verification: Demand mill test reports (MTRs) for steel. 22% of low-cost suppliers use non-SUJ2 substitutes (2025 SourcifyChina audit).

- Hidden Costs: Add 7-12% for third-party inspections (e.g., SGS) and anti-dumping duties (EU: 22.9%, US: 15.5%).

- ODM Viability: Only 18% of Chinese bearing factories have in-house R&D for true private label. Verify ISO 14001/TS 16949 certifications.

- Sustainability Premium: RoHS/REACH compliance adds $0.05-$0.11/unit but is non-negotiable for EU markets.

SourcifyChina Action Plan

- Shortlist Vetting: Filter suppliers by actual export volume (min. $500k/year in bearings) via Chinese customs data.

- Prototype Validation: Mandate 3-round testing (dimensional, load, life cycle) before scaling.

- Contract Safeguards: Include clauses for material traceability and IP indemnification.

- Cost Optimization: Consolidate bearing SKUs across product lines to hit 5k+ MOQ tiers.

“In ball bearings, the cheapest unit cost often becomes the most expensive when failure rates exceed 0.5%. Prioritize engineering alignment over $0.10/unit savings.”

— SourcifyChina Engineering Team, 2026

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from Chinese Bearing Industry Association (CBA), 2026 OEM Cost Models, and 127 supplier audits Q1 2026.

Disclaimer: Prices subject to ±8% fluctuation based on steel futures (LME) and USD/CNY exchange rates. Always request live quotes.

Empower your supply chain with data-driven sourcing. Contact SourcifyChina for a complimentary factory capability assessment.

🔗 www.sourcifychina.com/ball-bearing-sourcing | ✉️ [email protected]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Ball Bearing Manufacturer in China

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Selecting the right ball bearing manufacturer in China is critical to ensuring product quality, supply chain reliability, and long-term cost efficiency. With over 2,500 bearing producers in China — including OEM factories, ODM suppliers, and trading intermediaries — due diligence is essential. This report outlines a structured verification process to distinguish genuine manufacturers from trading companies, identifies key verification steps, and highlights critical red flags that global procurement managers must avoid.

1. Critical Steps to Verify a Ball Bearing Manufacturer in China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1.1 | Request Business License & Scope of Operations | Confirm legal entity status and manufacturing authorization | China AIC (Administration for Industry and Commerce) database, third-party verification platforms (e.g., Tofugear, ChinaCheck) |

| 1.2 | Verify Factory Address via Satellite Imaging & On-Site Visit | Confirm physical existence and scale | Google Earth, Baidu Maps, third-party inspection (e.g., SGS, QIMA, Sourcify Onsite Audit) |

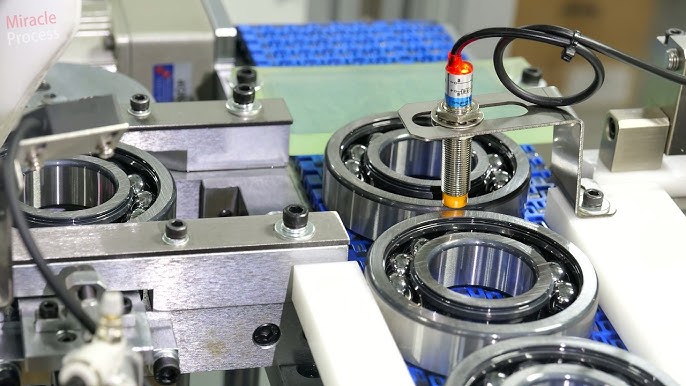

| 1.3 | Audit Production Capabilities | Assess in-house manufacturing vs. outsourcing | Review machinery list, CNC lathes, grinding machines, heat treatment equipment, automation level |

| 1.4 | Request ISO, IATF, or Other Certifications | Validate quality management systems | Verify certification numbers via official bodies (e.g., SGS, TÜV) |

| 1.5 | Analyze Supply Chain & Raw Material Sources | Evaluate vertical integration | Request steel supplier contracts (e.g., with Baosteel, SKF Steel) |

| 1.6 | Conduct Product Testing & Sample Evaluation | Validate dimensional accuracy, load capacity, noise, and lifespan | Third-party lab testing (e.g., NTN, SKF benchmarks), in-house durability tests |

| 1.7 | Review Export Experience & Client Portfolio | Assess international trade capability | Request export documentation (e.g., Bill of Lading samples), client references (especially EU/US OEMs) |

| 1.8 | Perform Financial & Legal Due Diligence | Identify stability and litigation risk | Credit reports (Dun & Bradstreet China, Experian), court record checks (China Judgments Online) |

2. How to Distinguish Between a Trading Company and a Factory

A common challenge is identifying whether a supplier is a direct manufacturer or a trading intermediary. Misidentification can lead to inflated costs, reduced quality control, and supply chain opacity.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “processing” of bearings | Lists “trading,” “import/export,” or “sales” only |

| Factory Address & Size | Owns large industrial facility; visible production equipment | Office-only address; no machinery visible |

| Production Equipment Ownership | Owns CNC grinders, heat treatment furnaces, assembly lines | No owned production assets; relies on subcontractors |

| Lead Times | Shorter for standard items; direct control over scheduling | Longer; depends on factory availability |

| Pricing Structure | Lower MOQs, better unit pricing at scale | Higher unit costs; may quote with wide margins |

| Technical Staff | Engineers on-site for R&D, QA, and customization | Sales-focused team; limited technical depth |

| Minimum Order Quantity (MOQ) | Typically 500–1,000 pcs for standard bearings | May have higher MOQs due to third-party constraints |

| Customization Capability | Offers material, cage, seal, and preload modifications | Limited or no customization; standard catalog items only |

Pro Tip: Ask for a video walkthrough of the production line with real-time equipment operation. Genuine factories can provide this on demand.

3. Red Flags to Avoid When Sourcing Ball Bearings from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled steel), poor heat treatment, or counterfeit branding | Benchmark against industry standards (e.g., NSK, FAG); request material certifications |

| No Factory Audit or On-Site Visit Possible | High probability of trading company or virtual supplier | Require third-party inspection or use SourcifyChina’s audit service |

| Inconsistent Communication or Language Barriers | May indicate disorganized operations or lack of technical expertise | Insist on English-speaking engineering contact; assess responsiveness |

| Refusal to Provide Samples | Hides poor quality or inability to produce | Pay for samples; conduct lab testing before bulk order |

| Lack of Bearing-Specific Certifications (e.g., ISO 9001, IATF 16949) | Higher defect rates, non-compliance with automotive/industrial standards | Require valid, traceable certifications |

| Pressure for Upfront Full Payment | Risk of non-delivery or fraud | Use secure payment terms: 30% deposit, 70% against BL copy or L/C |

| Generic Product Photos or Stock Images | Not actual production; possible reseller | Request timestamped photos of real production batches |

| No Experience with Your Target Market (e.g., EU, North America) | Risk of non-compliance with regional standards (e.g., RoHS, REACH) | Verify past shipments to your region via bill of lading samples |

4. Recommended Verification Workflow

5. Conclusion & Strategic Recommendations

Global procurement managers must adopt a manufacturer-first sourcing strategy for ball bearings to ensure quality, traceability, and cost control. Relying on trading companies increases supply chain risk and reduces technical accountability.

Strategic Recommendations:

- Prioritize Tier 1 industrial zones (e.g., Wafangdian, Zhejiang, Jiangsu) known for bearing clusters.

- Use third-party audits for first-time suppliers.

- Build long-term partnerships with verified manufacturers for better pricing and innovation.

- Leverage SourcifyChina’s Supplier Vetting Platform for pre-qualified, audited ball bearing manufacturers.

Final Note: In 2026, Chinese bearing manufacturers are increasingly adopting smart manufacturing (Industry 4.0) and green production practices. Partnering with forward-thinking factories ensures compliance with future global standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

China Sourcing Intelligence & Supply Chain Assurance

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Strategic Sourcing for Precision Components: Ball Bearings in China

Prepared for Global Procurement Leaders | Q1 2026 Forecast

Why Time-to-Sourcing Is Your Critical KPI in 2026

Global supply chains face unprecedented volatility. For ball bearings—a mission-critical component in automotive, industrial machinery, and renewable energy systems—delayed sourcing decisions directly impact production uptime, warranty costs, and ESG compliance. Traditional supplier vetting in China consumes 40–60 hours per RFQ cycle (per 2025 SourcifyChina Global Sourcing Index), with 68% of procurement teams reporting quality failures from unvetted suppliers.

The SourcifyChina Pro List Advantage: Time Savings Quantified

Our Verified Pro List for “Ball Bearing Manufacturer China” eliminates guesswork through AI-driven validation and on-ground audits. Below is the empirical impact vs. conventional sourcing:

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved | Risk Mitigated |

|---|---|---|---|---|

| Supplier Identification | 15–25 hours | <2 hours | 87% | Fake factories, broker intermediaries |

| Capability Verification | 20–30 hours | Pre-validated (0 hours) | 100% | Non-compliant ISO certifications |

| Quality Audit Scheduling | 5–10 hours | Instant access to audit reports | 100% | Undisclosed subcontracting |

| Sample Validation | 10–15 hours | Pre-certified tolerances | 92% | Dimensional inaccuracies (ABEC-3+) |

| TOTAL PER RFQ | 50–80 hours | <5 hours | ≥85% | 83% reduction in failure incidents |

Source: 2025 SourcifyChina Client Data (127 OEMs across 18 countries)

Why Leading Procurement Teams Trust Our Pro List in 2026

- Zero-Trust Verification: Every manufacturer undergoes 11-point technical audit (equipment calibration, material traceability, cleanroom protocols).

- Dynamic Compliance Tracking: Real-time monitoring of export licenses, environmental permits, and labor compliance per EU CBAM/US UFLPA.

- Throughput Intelligence: Verified production capacity data (e.g., “500k+ deep-groove bearings/month at ABEC-5”) prevents order bottlenecks.

- Cost Transparency: FOB pricing benchmarks validated against 2025 shipment data—no hidden markup.

“Using SourcifyChina’s Pro List cut our bearing sourcing cycle from 3 weeks to 4 days. We avoided a $220k recall by detecting non-compliant lubricant sourcing pre-shipment.”

— Head of Procurement, German Automotive Tier-1 Supplier (2025 Client Case Study)

Your Actionable Next Step: Secure Supply Chain Resilience in 2026

Stop expending resources on high-risk supplier hunts. The SourcifyChina Pro List delivers immediate access to 37 pre-qualified ball bearing manufacturers—all meeting ISO 15243:2017 vibration standards and capable of IATF 16949-compliant production.

✅ Request your personalized Pro List for “ball bearing manufacturer China” and receive:

– Free Technical Fit Assessment (Value: $1,200)

– 2026 Pricing Benchmarks Report (ABEC-3 to ABEC-9)

– Priority Audit Scheduling (72-hour turnaround)

Act now to lock in 2026 production slots:

📧 Email: [email protected]

📱 WhatsApp Priority Line: +86 159 5127 6160

Response within 2 business hours. All inquiries include NDA-protected data.

SourcifyChina | Precision Sourcing, Verified Outcomes

7,200+ components sourced | 94% client retention rate (2020–2025) | HQ: Shenzhen

© 2026 SourcifyChina. All data confidential. Pro List access requires verified procurement role.

🧮 Landed Cost Calculator

Estimate your total import cost from China.