The global bag hardware market has seen steady growth driven by rising demand in fashion accessories, travel, and functional luggage across both emerging and developed economies. According to Grand View Research, the global luggage market—closely tied to bag hardware demand—was valued at USD 41.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Meanwhile, Mordor Intelligence reports that increasing consumer preference for premium, durable, and design-forward accessories is accelerating demand for high-quality zippers, buckles, clasps, and metal trims. This surge is further amplified by the expansion of e-commerce and fast fashion, which rely on reliable, scalable hardware suppliers. As brands prioritize durability, aesthetics, and sustainability, sourcing from specialized bag hardware manufacturers has become a strategic advantage. The following list highlights the top 10 manufacturers shaping the industry through innovation, quality, and global reach.

Top 10 Bag Hardware Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Handbag Hardware Manufacturer

Domain Est. 2021

Website: yibihardware.com

Key Highlights: Yibi is a high-quality handbag hardware manufacturer, focusing on cooperating with international brands, OEM/ODM brand metal accessories for bags, ……

#2 Bag Hardware

Domain Est. 2022

Website: omyaltd.com

Key Highlights: OMYA METAL is a leading Luxury hardware manufacturer and supplier in China, is a 70% export factory, Specialize in manufacture luxury Bag metal accessories….

#3 Custom Brass Hardware Manufacturer for Handbags, Purses …

Domain Est. 1999

Website: iasltd.com

Key Highlights: International Advisory Service, Ltd. (IAS) is a custom hardware manufacturer that caters to the high-end, “Quality-Made,” leather goods and accessory industry….

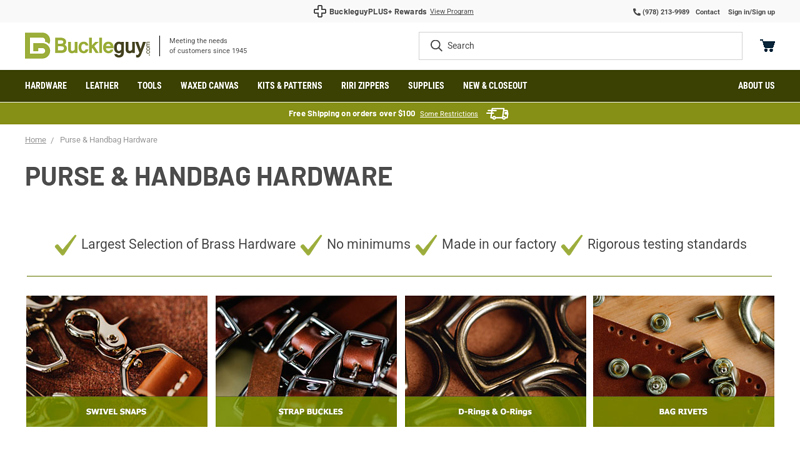

#4 Purse & Handbag Hardware

Domain Est. 2002

Website: buckleguy.com

Key Highlights: Buckleguy is the premier supplier of purse and handbag hardware for quality conscious crafters, manufacturers, and enthusiasts. Everything you need for bag ……

#5 Shin Fang

Domain Est. 2006

Website: shinfang.com

Key Highlights: Mainly produced handbag hardware accessories such as eyelets, grommets, rivets, corner protector, handle, cam buckle, belt buckle, metal chain, magnetic button….

#6 Bag Hardware

Domain Est. 2011

Website: emmalinebags.com

Key Highlights: 16–17 day deliveryWe have a variety of metal bag hardware in up to 7 finishes, and sizes that range from 1/2″ to 2″ wide….

#7 MMC COLOMBO

Domain Est. 2001

Website: mmcolombo.it

Key Highlights: MMC COLOMBO has been designing and producing high quality metal accessories for leather goods and the Fashion Industry since late 60’s….

#8 Bag Making Tools + Supplies

Domain Est. 2015

Website: klumhouse.com

Key Highlights: Free delivery over $250 30-day returnsStock your studio with these maker must-haves! Hand-selected bag making tools + supplies for all your makes….

#9 Serial Bagmakers

Domain Est. 2016

Website: serialbagmakers.com

Key Highlights: Free delivery 14-day returnsWe set out to help bagmakers of any level bring their own bag creations to life. In 2019, we developed a high-quality hardware collection and became a o…

#10 Bag hardware webshop in Budapest.

Website: baghardwareshop.eu

Key Highlights: All you need for bag making. High quality bag hardwares, worldwide shipping from Hungary, Europe….

Expert Sourcing Insights for Bag Hardware

H2: Projected 2026 Market Trends for Bag Hardware

The global bag hardware market is poised for notable transformation by 2026, driven by evolving consumer preferences, technological advancements, and sustainability imperatives. As fashion cycles accelerate and functional design gains prominence, bag hardware—encompassing zippers, buckles, clasps, rivets, and decorative elements—is becoming a key differentiator in both luxury and everyday accessories. This analysis outlines the major trends expected to shape the bag hardware industry through 2026.

1. Rising Demand for Sustainable and Recycled Materials

Environmental consciousness is significantly influencing material choices in bag hardware production. By 2026, manufacturers are anticipated to increasingly adopt recycled metals (such as aluminum and brass), bio-based alloys, and low-impact plating processes. Brands are responding to consumer demand for eco-friendly products by sourcing hardware with certified sustainable supply chains. Additionally, innovations like PVD (Physical Vapor Deposition) coating—offering durable, non-toxic finishes—are expected to gain wider adoption over traditional electroplating methods.

2. Integration of Smart and Functional Components

The convergence of fashion and technology is driving innovation in smart bag hardware. By 2026, expect to see an increase in hardware with embedded functionalities—such as anti-theft magnetic locks, GPS-enabled clasps, and USB-integrated zippers. These features cater to tech-savvy urban consumers seeking enhanced security and convenience. While currently niche, smart hardware is projected to grow as wearable and connected accessories become mainstream.

3. Customization and Brand Identity Enhancement

Bag hardware is increasingly being used as a canvas for brand storytelling and personalization. Luxury and mid-tier brands alike are investing in unique, signature hardware—like engraved buckles or proprietary zipper pulls—to strengthen brand recognition. Mass customization options, enabled by digital manufacturing techniques such as 3D printing, will allow consumers to select or design personalized hardware elements, further elevating the perceived value of accessories.

4. Growth in the Asia-Pacific Manufacturing and Consumption Hub

China, India, and Southeast Asian countries will remain central to both the production and consumption of bag hardware by 2026. Rising domestic fashion markets, coupled with advancements in local manufacturing capabilities, are fueling regional self-sufficiency. At the same time, global brands continue to leverage cost-effective production in the region, pushing suppliers to meet international quality and sustainability standards.

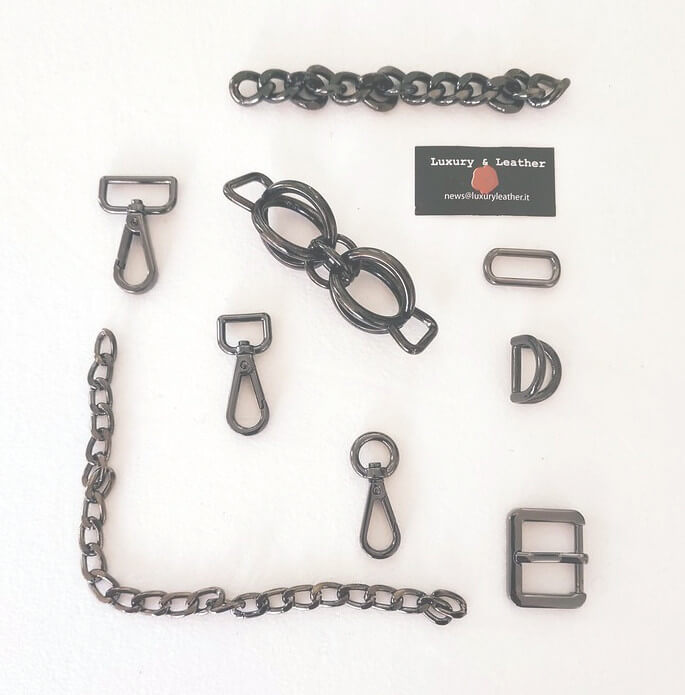

5. Emphasis on Durability and Minimalist Aesthetics

While ornate hardware had prominence in past decades, 2026 trends favor minimalist, functional designs with high durability. Consumers are prioritizing longevity and versatility in their purchases, shifting demand toward understated yet robust hardware in muted tones (e.g., matte black, antique brass, gunmetal). This aligns with the broader “quiet luxury” movement, where quality craftsmanship supersedes overt branding.

6. Supply Chain Resilience and Regionalization

In response to global disruptions experienced in recent years, bag hardware suppliers are expected to diversify sourcing and localize production where feasible by 2026. Nearshoring trends in North America and Europe will support faster turnaround times and reduced carbon footprints. Digital inventory systems and AI-driven demand forecasting will also optimize supply chain efficiency.

Conclusion

By 2026, the bag hardware market will be defined by sustainability, innovation, and personalization. As brands strive to meet the dual demands of aesthetic appeal and ethical production, hardware components will play a pivotal role in product differentiation. Companies that invest in eco-conscious materials, smart technologies, and agile manufacturing will be best positioned to lead in this evolving landscape.

Common Pitfalls Sourcing Bag Hardware (Quality, IP)

Poor Material Quality and Durability

One of the most frequent issues when sourcing bag hardware—such as zippers, buckles, D-rings, and clasps—is receiving components made from substandard materials. Low-grade metals may corrode, break, or discolor quickly, while plastic parts can become brittle and crack under stress. This compromises the overall durability and perceived value of the final product, leading to customer dissatisfaction and increased return rates.

Inconsistent Finishes and Dimensional Tolerances

Suppliers, especially those offering low-cost options, may lack strict quality control, resulting in inconsistent plating, color variations, or misaligned components. Even slight deviations in size or shape can prevent hardware from fitting properly during assembly, causing production delays and increased waste.

Lack of Compliance with Safety and Regulatory Standards

Some sourced hardware may contain restricted substances such as nickel, lead, or phthalates above permissible levels, especially if manufactured in regions with lax regulatory enforcement. This poses a risk of non-compliance with international standards like REACH, RoHS, or CPSIA, potentially leading to shipment rejections, fines, or product recalls.

Intellectual Property (IP) Infringement

Sourcing imitation or counterfeit hardware—such as knock-offs of branded zippers (e.g., YKK, Riri) or patented buckle designs—exposes companies to legal risks. Unauthorized use of protected designs or logos can result in IP lawsuits, customs seizures, and reputational damage. Many suppliers in certain regions may not prioritize IP compliance, making due diligence essential.

Misrepresentation of Supplier Capabilities

Some suppliers claim to offer high-quality hardware but subcontract to unveted third parties without transparency. This lack of traceability makes it difficult to ensure consistent quality or resolve issues when defects arise. Verifying the actual manufacturer and conducting on-site audits can help mitigate this risk.

Inadequate Testing and Certification Documentation

Reliable hardware should come with test reports for strength, corrosion resistance (e.g., salt spray testing), and longevity. However, many suppliers either skip testing or provide falsified documentation. Without proper certification, brands cannot confidently guarantee product performance or safety.

Hidden Costs from Rework and Returns

Initially low prices can be misleading when poor-quality hardware leads to higher long-term costs. Defective components may necessitate production line stoppages, rework, or post-sale repairs, eroding margins and damaging brand reputation.

Supply Chain Vulnerability and Lack of IP Protection Agreements

Relying on a single supplier, especially in high-risk regions, increases exposure to disruptions and unauthorized production of your custom designs. Without strong contractual IP protections (e.g., NDAs, design ownership clauses), suppliers may replicate or sell your custom hardware to competitors.

To avoid these pitfalls, brands should conduct thorough supplier vetting, demand third-party testing, secure IP rights legally, and maintain ongoing quality audits throughout the sourcing process.

Logistics & Compliance Guide for Bag Hardware

Overview

This guide outlines key logistics and compliance considerations for the import, export, storage, and handling of bag hardware components such as zippers, buckles, snaps, D-rings, rivets, and metal/plastic fittings used in luggage, handbags, backpacks, and fashion accessories.

International Trade Compliance

Customs Classification (HS Codes)

Bag hardware is typically classified under:

– HS 7326: Other articles of iron or steel (e.g., metal buckles, D-rings, rivets)

– HS 8308: Clasps, frames with clasps, buckles, buckle-clasps, hooks, eyes, eyelets, and similar articles, of base metal

– HS 5908: Labels, badges, and similar articles of textile materials

– HS 9606: Slide fasteners (zippers) and parts thereof

Note: Final classification must be verified per country-specific tariff schedules and material composition.

Country of Origin Marking

- All hardware components must be clearly marked with the country of origin (e.g., “Made in China”) if sold in markets like the U.S., EU, and UK.

- Markings must be permanent and legible, typically via engraving, stamping, or etching.

Import/Export Documentation

Required documentation includes:

– Commercial Invoice (with detailed description, value, and HS code)

– Packing List

– Certificate of Origin (for preferential tariffs under trade agreements)

– Bill of Lading or Air Waybill

– Import licenses (if required by destination country)

Regulatory Compliance

Restricted Substances (REACH, RoHS, CPSIA)

- REACH (EU): Ensure compliance with SVHC (Substances of Very High Concern) and restrict heavy metals like lead, cadmium, and nickel.

- RoHS (EU/UK): Applies to electrical components (e.g., magnetic closures with electronic features).

- CPSIA (U.S.): Limits lead (max 100 ppm) and phthalates (max 0.1%) in hardware used in children’s bags or accessories.

- Proposition 65 (California): Requires warnings if hardware contains listed chemicals (e.g., lead, nickel).

Product Safety Standards

- Hardware must withstand standard stress and durability tests (e.g., tensile strength for buckles, zipper cycle testing).

- Sharp edges must be minimized to avoid consumer injury.

- Magnetic closures should meet safety standards if used in children’s products (e.g., ASTM F963).

Logistics & Packaging

Packaging Requirements

- Use anti-corrosion packaging (e.g., VCI bags) for metal components to prevent rust during transit.

- Segregate different finishes (e.g., matte black, chrome) to prevent scratching.

- Label packages with part numbers, quantities, and handling instructions (e.g., “Fragile,” “Do Not Stack”).

Storage Conditions

- Store in dry, temperature-controlled environments (15–25°C, RH <60%).

- Elevate pallets off the floor to prevent moisture absorption.

- Rotate stock using FIFO (First In, First Out) to avoid aging or obsolescence.

Transportation Considerations

- Use secure pallets and stretch wrap to prevent shifting.

- For air freight, comply with IATA regulations for metal components (e.g., sharp objects).

- For sea freight, ensure containers are sealed and desiccants are used to control humidity.

Sustainability & Environmental Compliance

Recyclability & Material Disclosure

- Provide material composition data for hardware (e.g., zinc alloy, brass, polyamide).

- Label recyclable components per local regulations (e.g., EU Packaging Waste Directive).

- Avoid hazardous coatings (e.g., hexavalent chromium) in plating processes.

Conflict Minerals (U.S. Dodd-Frank Act)

- If hardware contains tin, tantalum, tungsten, or gold (3TG), conduct due diligence on supply chains.

- Report annually if sourced from conflict-affected regions (e.g., DRC).

Best Practices

- Partner with suppliers who provide compliance documentation (e.g., test reports, SDS).

- Conduct third-party lab testing for restricted substances and durability.

- Maintain traceability records (batch numbers, supplier details) for recalls or audits.

- Regularly review regulatory updates in target markets.

By adhering to this logistics and compliance guide, businesses can ensure smooth global operations, reduce risk, and maintain product quality and safety standards for bag hardware.

In conclusion, sourcing bag hardware manufacturers requires a strategic approach that balances quality, cost, reliability, and scalability. Key factors such as material standards, production capabilities, minimum order quantities (MOQs), lead times, and compliance with environmental and ethical standards must be carefully evaluated. Establishing strong relationships with reputable manufacturers—whether local or overseas—can significantly enhance product consistency and reduce supply chain risks. Leveraging industry networks, trade shows, and online B2B platforms can help identify suitable partners, while due diligence through sample testing and factory audits ensures alignment with brand requirements. Ultimately, a well-executed sourcing strategy for bag hardware not only supports product durability and aesthetics but also contributes to overall brand integrity and long-term success in the competitive fashion and accessories market.