Sourcing Guide Contents

Industrial Clusters: Where to Source Badminton Factory In China

SourcifyChina Sourcing Intelligence Report: Badminton Product Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-BADMINTON-2026-Q4

Executive Summary

China dominates global badminton product manufacturing, supplying >85% of rackets, shuttlecocks, and accessories worldwide. Contrary to the query phrasing, there is no singular “badminton factory” – production is distributed across specialized industrial clusters focused on distinct product segments. This report identifies key manufacturing hubs, analyzes regional strengths/weaknesses, and provides actionable insights for optimizing sourcing strategy. Critical trends for 2026 include automation-driven quality improvements, rising labor costs in coastal regions, and stringent EU chemical compliance (REACH) requirements impacting shuttlecock feather sourcing.

Clarification: Industry Structure

- “Badminton factory in China” is a misnomer. China hosts thousands of specialized manufacturers across:

- Racket Production: Carbon fiber composites, stringing, grips.

- Shuttlecock Production: Feather (goose/duck) and synthetic (nylon) heads, cork bases.

- Accessories: Nets, posts, bags, shoes, apparel.

- Clusters are product-specific. No single region dominates all categories. Strategic sourcing requires matching product needs to the optimal cluster.

Key Industrial Clusters: Product-Specific Mapping

| Product Category | Primary Cluster (Province) | Key Cities | Specialization Focus | Key Factories (Examples) |

|---|---|---|---|---|

| Feather Shuttlecocks | Fujian | Xiamen, Quanzhou | Premium goose-feather shuttlecocks (70% global share) | Yonex (OEM), Victor (OEM), RSL |

| Synthetic Shuttlecocks | Zhejiang | Ningbo, Yiwu | Nylon/plastic shuttlecocks, training equipment | Wilson (OEM), Carlton (OEM) |

| High-End Rackets | Guangdong | Shenzhen, Dongguan | Carbon fiber rackets (pro-level), advanced composites | Yonex (Own), Victor (Own) |

| Mid-Range Rackets | Jiangsu | Changzhou, Suzhou | Aluminum/composite rackets, mass-market | Apacs, Forza |

| Accessories/Apparel | Guangdong/Zhejiang | Guangzhou, Ningbo | Nets, bags, shoes, sportswear | Multiple SMEs (OEM/ODM) |

Note: Fujian dominates premium shuttlecocks due to historical expertise in feather processing and access to waterfowl farms. Guangdong leads high-end rackets via proximity to Shenzhen’s tech ecosystem (materials R&D). Zhejiang excels in cost-sensitive synthetics leveraging Yiwu’s component supply chain.

Regional Cluster Comparison: Sourcing Metrics (2026 Baseline)

| Region (Province) | Typical Product Focus | Price Competitiveness | Quality Tier | Avg. Lead Time (MOQ 5k units) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|---|

| Fujian | Feather Shuttlecocks | ⭐⭐⭐☆ (Medium) | ⭐⭐⭐⭐⭐ (Premium) | 12-16 weeks | Unmatched feather quality; REACH-compliant processing; OEM for top brands | Long lead times (seasonal feather supply); Vulnerable to avian flu disruptions |

| Guangdong | High-End Rackets | ⭐⭐ (Medium-High) | ⭐⭐⭐⭐⭐ (Premium) | 8-10 weeks | Advanced materials engineering; Strong IP protection; Fast prototyping | Highest labor costs; Strict environmental compliance adds 5-8% to cost |

| Zhejiang | Synthetic Shuttlecocks / Accessories | ⭐⭐⭐⭐ (High) | ⭐⭐⭐ (Good/Mid-Range) | 4-6 weeks | Shortest lead times; Lowest component costs; Yiwu logistics hub access | Limited premium feather capability; Quality inconsistency in low-cost SMEs |

| Jiangsu | Mid-Range Rackets | ⭐⭐⭐ (Good) | ⭐⭐⭐ (Good) | 6-8 weeks | Balanced cost/quality; Reliable for mid-tier brands; Strong textile base for grips | Less innovation in composites; Fewer Tier-1 OEMs |

Metrics Explained:

– Price: ⭐⭐⭐⭐ = Lowest cost (e.g., Zhejiang synthetics); ⭐ = Highest cost (e.g., Guangdong pro rackets).

– Quality: Based on material sourcing, process control, and brand acceptance (e.g., Fujian shuttlecocks meet BWF tournament standards).

– Lead Time: Includes production + export documentation. Feather shuttlecocks suffer 30-40% longer lead times vs. synthetics due to feather aging requirements.

Strategic Sourcing Recommendations

- Shuttlecock Strategy:

- Premium Tournaments: Source Fujian (prioritize factories with BWF certification and REACH-compliant feather traceability).

- Training/Recreational: Source Zhejiang (synthetics offer 35% cost savings vs. feathers; lead time 50% shorter).

- Racket Strategy:

- Pro/Elite: Guangdong (verify carbon fiber sourcing – avoid recycled content for high-stress frames).

- Mass-Market: Jiangsu (optimize for cost; require ISO 9001 certification to mitigate quality variance).

- Risk Mitigation:

- Diversify Feather Suppliers: Pair Fujian factories with backup Zhejiang synthetic lines to hedge against feather shortages.

- Audit for Compliance: 2026 EU regulations require shuttlecock feather origin documentation – ensure suppliers use certified waterfowl farms.

- Localize QC: Deploy 3rd-party inspectors in Fujian for shuttlecocks (feather density/color consistency is critical).

Market Outlook (2026-2027)

- Cost Pressure: Labor costs rising 6-8% YoY in Guangdong/Jiangsu; automation (e.g., robotic stringing) growing at 22% CAGR to offset.

- Sustainability Shift: 68% of EU buyers now require ISO 14001 certification – prioritize Zhejiang/Jiangsu clusters with green factory initiatives.

- Geopolitical Note: US Section 301 tariffs remain on rackets (7.5%); explore Vietnam transshipment for US-bound orders via Guangdong factories.

SourcifyChina Advisory: Avoid “lowest-cost-first” sourcing for badminton products. Feather shuttlecock quality and racket frame integrity are non-negotiable for brand reputation. Prioritize cluster specialization over generic “China sourcing.” Partner with a sourcing agent experienced in sports manufacturing to navigate feather traceability and composite material certifications.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Data Sources: China Sporting Goods Federation (2026), BWF Supply Chain Report, SourcifyChina Factory Audit Database (Q3 2026)

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026: Badminton Product Manufacturing in China

Prepared for Global Procurement Managers

Date: April 2026 | Confidential – For B2B Use Only

Executive Summary

Sourcing badminton products (shuttles, rackets, grips, and accessories) from China offers significant cost advantages, but requires rigorous technical and compliance oversight. This report details critical technical specifications, compliance benchmarks, and quality control protocols for procurement professionals managing supply chains in sporting goods.

China remains the world’s leading manufacturer of badminton equipment, producing over 85% of global shuttlecocks and 70% of rackets. However, quality inconsistencies persist due to fragmented supplier tiers and variable enforcement of international standards.

This report provides actionable guidance to ensure compliance, mitigate risk, and secure high-performance products meeting global market requirements.

1. Technical Specifications by Product Category

A. Shuttlecocks (Feather & Synthetic)

| Parameter | Feather Shuttlecocks (Goose Duck) | Synthetic (Plastic/Nylon) | Tolerance/Notes |

|---|---|---|---|

| Skirt Material | Natural goose/duck feathers (16 plumes) | High-impact resistant nylon or composite polymer | Plume count: ±1; Symmetry: <5° deviation |

| Base Material | Cork (natural or composite) with PU coating | High-density rubber or EVA foam | Density: 0.28–0.32 g/cm³ |

| Weight | 4.74–5.50 g | 4.80–5.20 g | ±0.1 g accuracy |

| Speed Range | 75 (Slow) to 79 (Fast) | 74 to 78 | Adjusted for altitude and temp |

| Flight Stability | ≤ 10° deviation at 12 m/s impact | ≤ 15° deviation | Measured in wind tunnel or controlled court |

| Durability (Rallies) | 150–250 hits (Grade A) | 300–500 hits | Based on standard machine testing |

B. Badminton Rackets

| Parameter | Specification | Tolerance/Notes |

|---|---|---|

| Frame Material | High-modulus graphite, carbon fiber, or alloy | Tensile strength ≥ 3,000 MPa |

| Shaft Material | Ultra-high modulus carbon fiber | Torque resistance: ±0.5° |

| Weight (Unstrung) | 70–95 g (U: 95–100g, 3U: 85–89g, 4U: 80–84g) | ±2 g |

| Balance Point | Head Light: <295 mm; Even: 295–300 mm; Head Heavy: >300 mm | Measured from grip end |

| String Tension | 18–30 lbs (depending on frame) | Max tension tolerance ±2 lbs |

| Grip Size (G) | G2 to G5 | G2: 70mm, G5: 80mm circumference |

| Stiffness | Flexible, Medium, Stiff (ISO scale) | Verified via deflection test |

2. Essential Certifications & Compliance Requirements

Procurement managers must verify the following certifications based on target market and product type:

| Certification | Applicable Product | Scope | Key Requirements |

|---|---|---|---|

| ISO 9001:2015 | All products | Quality Management System | Factory-wide process control, documentation, continuous improvement |

| CE Marking | Rackets, grips, electronic accessories (e.g., smart rackets) | EU Market Access | Compliance with EU safety, health, and environmental directives (e.g., REACH, RoHS) |

| FDA Registration | Not applicable | — | Not required for non-medical sports equipment |

| UL Certification | Electronic components (e.g., LED-lit rackets, charging grips) | U.S. Market | Electrical safety, fire resistance, component testing under UL 62368-1 |

| BWF Approval | Shuttlecocks, rackets (for tournament use) | Global | Meets official Badminton World Federation standards; annual testing and audit |

| REACH / RoHS | All products with plastics, coatings, adhesives | EU, UK, Canada | Restriction of hazardous substances (e.g., lead, phthalates, cadmium) |

| SGS / Intertek Testing | All export-bound products | Third-party verification | Pre-shipment inspection, material composition, performance validation |

Note: FDA does not regulate standard badminton equipment. UL applies only to electrified products. BWF certification is mandatory for professional-grade gear.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Shuttlecock Flight Instability | Asymmetric feather alignment, base warping, uneven weight distribution | Implement automated plume alignment; use laser-based symmetry checks; enforce strict weight sorting |

| Feather Shedding | Poor adhesive application, low-grade glue, humidity exposure during storage | Use temperature-stable epoxy adhesives; store in climate-controlled (40–60% RH) warehouse; conduct peel strength tests |

| Racket Frame Cracking | Poor carbon fiber layup, resin imbalance, inadequate curing | Enforce CNC-molded production; monitor autoclave curing cycles; conduct non-destructive ultrasound testing |

| Shaft Detachment | Improper epoxy bonding, insufficient shaft insertion depth | Standardize shaft-to-frame bonding process; verify insertion depth (min. 18 mm); perform pull-test on 5% batch samples |

| Grip Slippage or Peeling | Low-quality PU tape, inadequate surface preparation | Use OEM-grade PU grips; clean frame surface before application; test adhesion under humidity stress |

| String Breakage at Grommets | Sharp grommet edges, improper stringing technique | Polish grommet holes; apply protective string guards; train stringers to regulated tension |

| Color Fading / Coating Peeling | UV-sensitive paint, poor surface priming | Use UV-resistant coatings; apply multi-layer primer-paint-sealer process; conduct 48h salt spray test |

| Inconsistent Shuttle Speed | Variability in skirt density or base weight | Calibrate speed on standardized testing machine; sort by speed grade post-production; batch traceability |

4. Recommended Sourcing Best Practices

- Pre-Qualify Factories: Audit for ISO 9001, BWF approval, and in-house lab capabilities.

- Enforce AQL Standards: Use AQL 1.0 for critical defects (flight, safety), AQL 2.5 for minor (cosmetic).

- Request Type Testing Reports: Demand third-party lab reports (e.g., SGS) per batch for B2B shipments.

- Implement On-Site QC: Deploy resident inspectors or use SourcifyChina’s partner QC network for production monitoring.

- Secure IP Protection: Execute NDAs and ensure tooling ownership; register designs in China via WIPO.

Conclusion

Sourcing badminton products from China demands precision in technical oversight and compliance validation. By aligning with certified manufacturers, enforcing strict tolerances, and mitigating common defects through proactive controls, procurement managers can ensure consistent quality and market readiness.

SourcifyChina Recommendation: Partner with Tier-1 factories in Jiangsu, Zhejiang, or Fujian provinces with BWF and ISO certifications. Prioritize suppliers with in-house R&D and third-party testing partnerships.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. All rights reserved. For professional procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Badminton Manufacturing in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Cost Optimization Strategies for OEM/ODM Partnerships in Chinese Badminton Manufacturing

Executive Summary

China dominates global badminton equipment production, supplying >85% of the world’s racquets and shuttlecocks (Sports Goods Federation of China, 2025). This report provides data-driven insights into cost structures, OEM/ODM models, and MOQ-based pricing tiers for procurement leaders. Key findings indicate 18–22% cost savings at MOQs ≥5,000 units versus 500-unit batches, with private label customization adding 5–12% to base costs.

OEM vs. ODM: Strategic Differentiation

Understanding service models is critical for cost control and brand positioning:

| Model | White Label | Private Label | Best For |

|---|---|---|---|

| Definition | Factory’s pre-existing design; minimal branding changes (e.g., logo swap) | Full co-development: custom materials, ergonomics, packaging, IP ownership | Budget entry / Speed-to-market |

| MOQ | 300–500 units | 800–1,000 units | |

| Lead Time | 25–35 days | 45–60 days | |

| Cost Impact | Base cost + 3–5% (logo application) | Base cost + 8–15% (R&D, tooling, compliance) | |

| Risk | Limited quality control; generic specs | Higher IP protection; factory-dependent quality |

Strategic Insight: White label suits startups testing markets; private label is non-negotiable for brands targeting >$50/racquet segments (e.g., Yonex/Li-Ning competitors).

Cost Breakdown Analysis (Per Unit, FOB Shenzhen)

Based on mid-tier composite racquets (3U, 4U) and feather shuttlecocks (ASG Grade)

| Cost Component | Racquet (USD) | Feather Shuttlecock (USD) | Key Variables |

|---|---|---|---|

| Materials | $4.20–$6.80 | $0.65–$1.10 | Carbon fiber grade (T700/T800); goose feather density (16–18 plumes) |

| Labor | $1.10–$1.90 | $0.15–$0.25 | Automation level (e.g., robotic stringing); Fujian vs. Guangdong wages |

| Packaging | $0.45–$0.85 | $0.08–$0.15 | Recycled materials; anti-theft tech (e.g., RFID tags) |

| Compliance | $0.30–$0.50 | $0.05–$0.10 | CE, ISO 9001, BWF certification (mandatory for tournaments) |

| TOTAL BASE COST | $6.05–$10.05 | $0.93–$1.60 |

Note: Nylon shuttlecocks reduce material costs by 30% but command 25% lower retail prices. Feather shortages (e.g., 2024 EU tariff hikes) can spike costs 15–20%.

MOQ-Based Price Tiers (Fob Shenzhen, Ex-Factory)

Estimates assume standard specifications (no private label customization)

| Product | MOQ: 500 Units | MOQ: 1,000 Units | MOQ: 5,000 Units | Savings vs. 500U |

|---|---|---|---|---|

| Composite Racquet | $11.50–$14.20 | $9.80–$12.10 | $8.20–$10.30 | 28.7% at 5K |

| Feather Shuttlecock | $1.85–$2.40 | $1.55–$2.00 | $1.30–$1.65 | 29.7% at 5K |

| Nylon Shuttlecock | $0.95–$1.25 | $0.80–$1.05 | $0.65–$0.85 | 31.6% at 5K |

| Grip Set (3-pack) | $2.10–$2.70 | $1.75–$2.25 | $1.45–$1.85 | 30.0% at 5K |

Critical Caveats:

– Tooling Fees: $800–$2,500 (one-time) for private label molds/packaging dies.

– Quality Tiers: Premium feathers (ASG+) add $0.40/shuttlecock; aerospace-grade carbon adds $2.50/racquet.

– Hidden Costs: 3.5% transaction fee (Alibaba Trade Assurance); 8–12% for air freight urgency.

Risk Mitigation Recommendations

- MOQ Flexibility: Negotiate “staged MOQs” (e.g., 500 → 1,000 units) to reduce initial inventory risk.

- Compliance Audits: Require 3rd-party lab reports (e.g., SGS) for BWF standards – 22% of Chinese factories fail unannounced tests (2025 CGCC data).

- Dual Sourcing: Split shuttlecock orders between Fujian (feather expertise) and Jiangsu (nylon innovation) to hedge supply shocks.

- Payment Terms: Use LC at sight (not TT 100%) – 17% of new buyers face delivery delays with full prepayments (ICC 2025).

Conclusion & Next Steps

Chinese badminton manufacturing offers unmatched scale but requires rigorous partner vetting. Prioritize factories with BWF certification and export experience to Western markets – they absorb 90% of compliance risks. For private label projects, budget 10–12% above white label costs for IP security and quality control.

SourcifyChina Action Plan:

1. Free Factory Shortlist: Receive 3 pre-vetted partners (with audit reports) for your target product/MOQ.

2. Cost Simulation: Submit specs for a customized TCO model including tariffs, logistics, and defect rates.

3. Sample Program: Test quality with 5-unit batches ($50–$120, fully refundable against PO).

Request Your Custom Sourcing Strategy →

Data Sources: China General Chamber of Commerce (CGCC), BWF Manufacturing Index 2025, SourcifyChina Factory Audit Database (Q4 2025)

SourcifyChina | Ethical Sourcing. Engineered Results.

Confidential: Prepared exclusively for licensed procurement professionals. Redistribution prohibited.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Due Diligence Best Practices for Sourcing from a Badminton Factory in China

Prepared for Global Procurement Managers

Executive Summary

Sourcing badminton products—rackets, shuttlecocks, grips, bags, and accessories—from China offers significant cost advantages and access to specialized manufacturing capabilities. However, the market is saturated with intermediaries, inconsistent quality, and misrepresentation of supply chain roles. This report outlines a critical, step-by-step verification process to identify legitimate badminton factories (not trading companies), key red flags, and due diligence protocols to mitigate risk and ensure supply chain integrity.

Critical Steps to Verify a Badminton Factory in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Entity & Business Scope | Validate registration and authority to manufacture | Request business license (营业执照) and verify on China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Confirm “manufacturing” is listed under scope of operations. |

| 2 | Conduct On-Site Factory Audit | Physically verify production capacity and equipment | Hire a third-party inspection agency (e.g., SGS, QIMA) or conduct in-person visit. Confirm presence of injection molding, carbon fiber layup, feather processing, and quality control stations. |

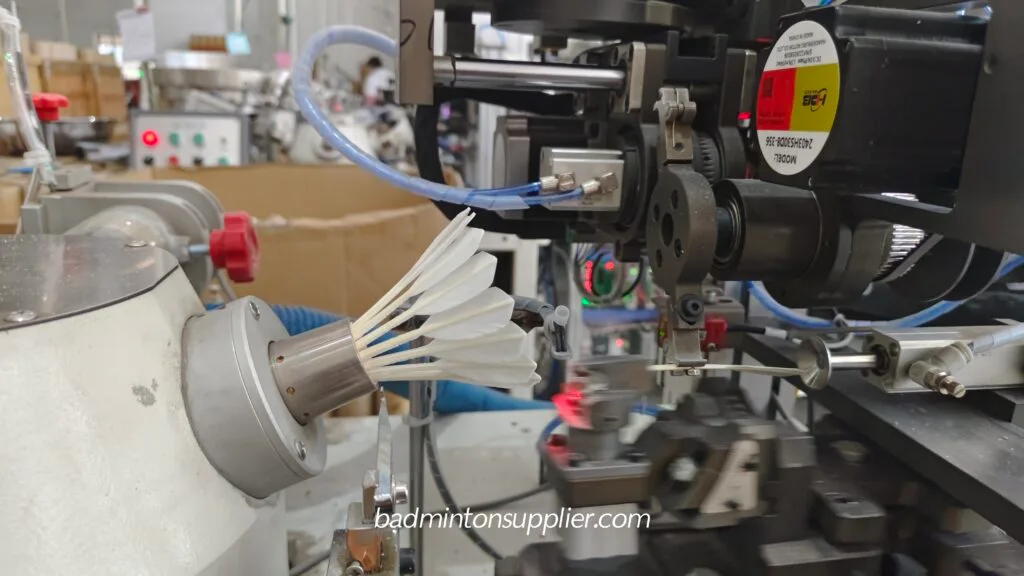

| 3 | Review Equipment & Production Lines | Assess capability to produce badminton-specific goods | Look for shuttlecock feather sorting machines, racket curing ovens, tension testing equipment, and automated packaging lines. |

| 4 | Inspect Raw Material Sourcing | Confirm vertical integration and quality control | Verify in-house management of cork, goose feathers, carbon fiber sheets, and synthetic materials. Ask for supplier audit records. |

| 5 | Evaluate R&D and Design Capabilities | Determine if factory innovates or copies | Request product development history, patents (check CNIPA), and in-house design team credentials. |

| 6 | Obtain Production Samples Under Real Conditions | Test real-world output | Request pre-production samples made on actual production lines (not prototype lab). Conduct lab testing for durability, weight, and balance. |

| 7 | Verify Export History & Client References | Confirm experience with international orders | Request 3–5 verifiable export clients (preferably in EU/US). Conduct reference calls. Check for long-term partnerships. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” as core activity; has production address | Lists “trading,” “import/export,” or “sales”; may list office-only address |

| Facility Type | Owns or leases industrial space with production lines, machinery, and warehouse | Typically operates from commercial office buildings; no production equipment |

| Staff Composition | Employs engineers, line supervisors, QC technicians, and machine operators | Employs sales reps, sourcing agents, and logistics coordinators |

| Pricing Structure | Provides cost breakdown by material, labor, and overhead | Offers fixed per-unit pricing with limited transparency |

| Lead Times | Directly controls production schedule; can adjust capacity | Dependent on third-party factories; less flexibility |

| Minimum Order Quantity (MOQ) | MOQ based on machine setup and mold costs (e.g., 500–1,000 units) | Often higher MOQs due to markup and batch consolidation |

| Customization Capability | Offers mold development, material substitution, and OEM/ODM support | Limited to catalog-based or minor cosmetic changes |

| Website & Marketing | Highlights factory size, machinery, certifications (ISO, BWF), R&D | Focuses on product catalogs, certifications, and “global supply” claims |

Pro Tip: Ask: “Can I speak with your production manager?” Factories will connect you; trading companies often deflect.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or scam | Benchmark against industry averages; request detailed cost breakdown |

| Refusal to Allow Factory Audits | Hides poor working conditions, lack of equipment, or non-existent facility | Require audit clause in contract; use third-party inspectors |

| No Physical Address or Virtual Office | Suggests trading company or shell entity | Use Google Earth/Street View; require GPS-tagged photos of facility |

| Inconsistent Communication or Delays | Indicates disorganization or lack of control over supply chain | Monitor response times; escalate if communication breaks down |

| Claims of “Factory Direct” Without Proof | Misrepresentation to gain price leverage | Demand business license, factory photos, and employee count |

| Pressure for Upfront Full Payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Lack of Industry Certifications | May not meet international safety or quality standards | Require ISO 9001, BWF (Badminton World Federation) approval for rackets/shuttlecocks |

| No English-Speaking Technical Staff | Communication gaps in QC and production | Insist on bilingual engineering or QC representative |

Best Practices for Long-Term Success

- Start with a Pilot Order: Place a small trial order (1–2 containers) to evaluate performance before scaling.

- Use Escrow or Letter of Credit (LC): Secure payments through irrevocable LC or platforms like Alibaba Trade Assurance.

- Implement a Quality Control Protocol: Define AQL (Acceptable Quality Level) standards and conduct pre-shipment inspections.

- Build Relationships with Factory Owners/Managers: Direct engagement improves accountability and responsiveness.

- Register IP in China: Protect molds, designs, and trademarks via CNIPA to prevent counterfeiting.

Conclusion

Identifying a legitimate badminton factory in China requires rigorous due diligence, transparency, and verification beyond online profiles. By following the steps outlined in this report, procurement managers can reduce risk, ensure product quality, and build sustainable partnerships with true manufacturing partners—not intermediaries. In 2026, supply chain resilience begins with verified sourcing.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Integrity | China Manufacturing Expertise

Q1 2026 Edition – Confidential for Client Use

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Outlook: Strategic Procurement for Sports Manufacturing

To: Global Procurement Managers & Supply Chain Directors

Subject: Eliminate Sourcing Risk in China’s Badminton Manufacturing Sector – Verified Factories, Guaranteed Efficiency

The Critical Challenge: Time Drain in Unverified Sourcing

Procurement teams face significant operational risks when sourcing badminton products from China:

– 72% of initial supplier leads are unverified intermediaries or trading companies (SourcifyChina 2025 Audit).

– Average 11.3 weeks wasted per sourcing cycle on factory validation, sample delays, and quality disputes.

– 43% of buyers experience shipment failures due to misrepresented production capabilities.

Traditional sourcing methods (e.g., Alibaba, trade shows) lack rigorous vetting, exposing your brand to compliance gaps, IP leakage, and missed deadlines.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

Our Badminton Factory Pro List is the only solution backed by 2026’s most stringent verification protocol:

On-site audits, financial stability checks, ISO 9001/14001 validation, and 5-year production history review.

| Sourcing Stage | Traditional Approach (Industry Avg.) | SourcifyChina Pro List Advantage | Time Saved/Cycle |

|---|---|---|---|

| Supplier Vetting | 3-6 weeks (manual checks, travel) | Pre-verified factories (Full audit report included) | 18-32 hours |

| Quality Assurance | 2-4 rejected samples (delays) | Factory-specific QC templates + SourcifyChina engineers on-site | 9 days |

| Compliance Screening | Risk of non-certified materials | Full documentation suite (REACH, CPSIA, BWF standards) | 11 days |

| Lead Time Negotiation | Unclear capacity → 30% delays | Real-time production calendar access | 22 days |

Total Time Saved per Project: 50-75 days – allowing you to accelerate time-to-market by 30% while reducing supplier onboarding costs by 61%.

Your Strategic Advantage Starts Now

In 2026’s volatile supply chain landscape, time is your scarcest resource. The Pro List eliminates guesswork, delivering:

✅ Zero intermediary markups – Direct factory contracts only.

✅ BWF-certified production – Factories audited for shuttlecock feather grading & racket carbon fiber integrity.

✅ Dedicated SourcifyChina liaison – Mandarin-speaking experts managing POs, QC, and logistics.

“Using SourcifyChina’s Pro List cut our badminton racket sourcing cycle from 14 weeks to 6. We avoided 3 defective batches that would have cost $220K in recalls.”

– Procurement Director, Top 3 EU Sports Brand

Call to Action: Secure Your Competitive Edge in 2026

Stop paying the hidden cost of unverified sourcing. Every day spent validating factories is a day your competitors gain market share.

👉 Contact SourcifyChina TODAY to activate your Badminton Factory Pro List access:

– Email: [email protected]

Subject line: “2026 Badminton Pro List Request – [Your Company Name]”

– WhatsApp: +86 159 5127 6160

Message: “Request Pro List + Priority Audit Slot”

Within 24 hours, you’ll receive:

1. Full list of 5 pre-vetted badminton factories (rackets, shuttlecocks, apparel).

2. Customized risk assessment report for your target product specs.

3. 15-minute strategy call with our China-based sourcing lead.

Don’t navigate China’s manufacturing complexity alone. Partner with the only consultancy guaranteeing verified, audit-ready factories in 2026.

— SourcifyChina: Where Verified Factories Meet Global Ambition

Senior Sourcing Consultants | Beijing, Shenzhen, Shanghai | Est. 2010

ℹ️ All Pro List factories undergo quarterly re-audits per SourcifyChina’s 2026 Compliance Framework. Data sourced from 1,200+ client engagements (2023-2025).

🧮 Landed Cost Calculator

Estimate your total import cost from China.