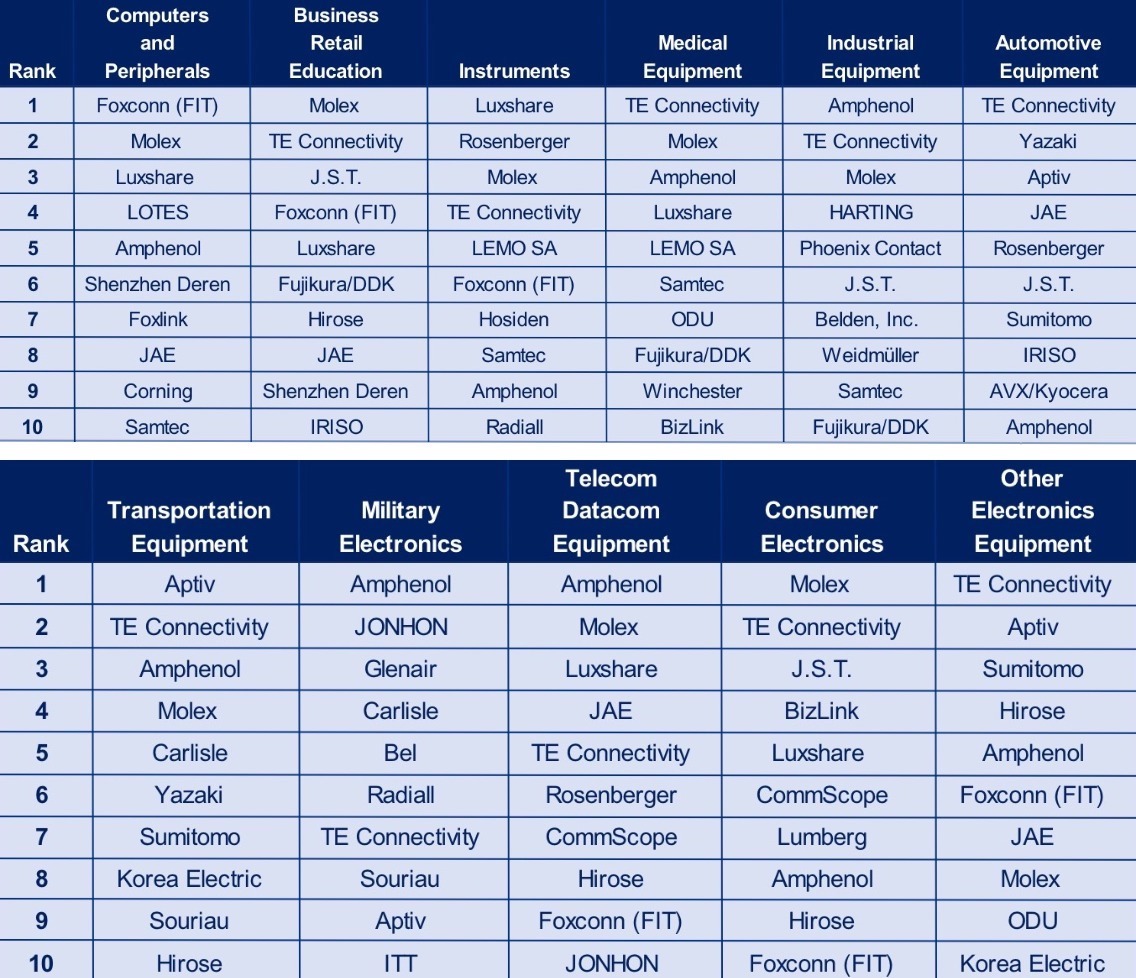

The global backshell connector market is experiencing steady expansion, driven by rising demand for ruggedized and environmentally protected electrical connections across aerospace, defense, industrial automation, and telecommunications sectors. According to Mordor Intelligence, the global circular connector market—which includes backshell-integrated solutions—is projected to grow at a CAGR of over 6.5% from 2023 to 2028. Similarly, Grand View Research estimates that the global connector market size was valued at USD 74.9 billion in 2022 and is expected to expand at a CAGR of 4.7% from 2023 to 2030, underpinned by increasing deployment in harsh environment applications. As electromagnetic interference shielding, moisture resistance, and mechanical durability become critical performance factors, backshell connectors have evolved from ancillary components to essential elements in reliable interconnect systems. With North America and Europe leading in aerospace and defense spending, and Asia Pacific witnessing rapid industrialization, the competitive landscape is increasingly shaped by innovation in materials, sealing technologies, and modular designs. Against this backdrop, we identify the top 9 backshell connector manufacturers leading in product innovation, global reach, and industry certifications.

Top 9 Backshell Connector Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Connector Backshells and Accessories

Domain Est. 1995

Website: glenair.com

Key Highlights: Glenair makes backshells for every connector manufacturer’s product, including Amphenol, Deutsch, Cannon, and others. Home > Connector Backshells and ……

#2 Compaero

Domain Est. 1996

Website: compaero.com

Key Highlights: Compaero designs and manufactures high-reliability backshells, adapters, and shielding solutions for aerospace and defense applications — combining certified ……

#3 Isodyne

Domain Est. 1998

Website: isodyneinc.com

Key Highlights: Isodyne manufactures MIL-Spec EMI/RFI connector backshells for land, sea, air, space, military, and commercial platforms….

#4 Connector Backshells

Domain Est. 2021

Website: connectorbackshells.com

Key Highlights: Find the right backshell for your connector. Use the tools below to search all options from leading manufacturers. Search by Connector. Search by Connector ……

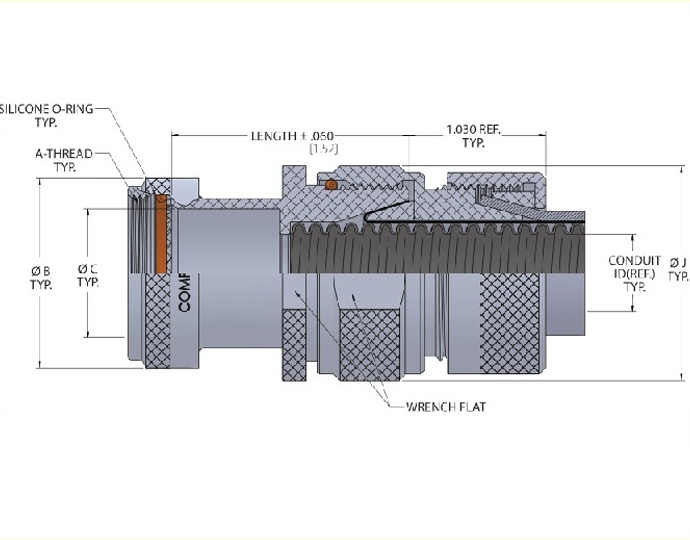

#5 POLAMCO Connectors & Backshells

Domain Est. 1992

Website: te.com

Key Highlights: Providing high precision connectors, backshells, interconnect accessories, and custom connectivity solutions for use in rugged applications….

#6 Full Product List – Connectors & Solutions

Domain Est. 1995

Website: ittcannon.com

Key Highlights: ITT Cannon’s Aluminum D-Sub Backshells are a lightweight, high-performance solution providing over 50% weight reduction on standar D-Sub backshells without ……

#7 NorComp

Domain Est. 1998

Website: norcomp.net

Key Highlights: NorComp is a leader in design, worldwide manufacture, & marketing of I/O interconnect products, offering a wide range of premium high reliability ……

#8 Backshells Archives

Domain Est. 2003

Website: amphenolpcd.com

Key Highlights: Amphenol’s Backshells offer dependable strain relief, environmental protection, and EMI/RFI shielding for the termination area of virtually any circular ……

#9 Connector Backshells & Accessories

Domain Est. 2022

Website: apollo-aerospace.com

Key Highlights: Connector backshells are an accessory fitted to the circular connector to reduce strain at the interface between the cable wires and the connector contacts….

Expert Sourcing Insights for Backshell Connector

H2: 2026 Market Trends for Backshell Connectors

The backshell connector market is poised for significant evolution by 2026, driven by advancements in industrial automation, electric vehicles (EVs), aerospace modernization, and the expansion of 5G and IoT infrastructure. As critical components in ensuring the durability, shielding, and environmental protection of electrical connections, backshell connectors are becoming increasingly vital across high-reliability sectors.

-

Growing Demand in Electric Vehicles and Automotive Electrification

The rapid adoption of EVs is a primary driver for backshell connectors. With increasing voltage systems (e.g., 800V architectures) and the need for robust electromagnetic interference (EMI) shielding, backshells are essential for securing high-power and high-data-rate connections. By 2026, automotive OEMs and Tier-1 suppliers are expected to prioritize connectors with enhanced thermal resistance, vibration tolerance, and IP-rated sealing, especially in battery packs, powertrain systems, and charging infrastructure. -

Expansion in Aerospace and Defense Applications

The aerospace and defense sectors will continue to demand high-performance backshell solutions due to the need for MIL-STD compliance, EMI/RFI shielding, and resistance to extreme temperatures and moisture. As defense modernization programs and commercial space ventures grow—especially in satellite constellations and unmanned systems—the demand for lightweight, corrosion-resistant backshells made from advanced composites and aluminum alloys is expected to rise significantly by 2026. -

Integration with 5G and Telecommunications Infrastructure

The global rollout of 5G networks requires reliable connectivity in base stations, edge computing units, and data centers. Backshell connectors play a crucial role in protecting high-frequency signal integrity. By 2026, there will be an increased emphasis on miniaturized, high-density backshells with superior shielding effectiveness to support mmWave frequencies and dense deployment environments. -

Industrial Automation and Industry 4.0 Adoption

Smart factories and industrial IoT (IIoT) systems necessitate ruggedized connectors capable of withstanding harsh industrial conditions. Backshells that offer EMI protection, mechanical strain relief, and IP67/IP68 ratings are becoming standard in robotics, programmable logic controllers (PLCs), and sensor networks. The market will see growth in modular and quick-install backshell designs to reduce downtime and improve maintenance efficiency. -

Material and Design Innovation

By 2026, manufacturers are expected to invest heavily in innovative materials such as conductive polymers, lightweight alloys, and 3D-printed components to enhance performance while reducing weight and cost. Additionally, smart backshells with integrated sensors for monitoring connection integrity and environmental conditions may begin to emerge in premium applications. -

Regional Market Dynamics

Asia-Pacific, led by China, Japan, and South Korea, will remain the largest market due to strong manufacturing bases in electronics, EVs, and telecommunications. North America and Europe will see steady growth driven by defense spending, renewable energy projects, and automotive innovation. Sustainability regulations may also push suppliers toward recyclable materials and eco-friendly manufacturing processes. -

Consolidation and Supply Chain Resilience

The backshell connector market may witness consolidation among suppliers aiming to offer integrated connectivity solutions. Companies will focus on vertical integration and regional supply chain resilience to mitigate geopolitical and logistical risks, especially following recent global disruptions.

In summary, by 2026, the backshell connector market will be shaped by technological demands across high-growth sectors, with innovation in design, materials, and functionality playing a central role in meeting performance and reliability requirements. Companies that adapt to these trends—particularly in EVs, aerospace, and digital infrastructure—will be well-positioned for sustained growth.

Common Pitfalls When Sourcing Backshell Connectors (Quality and IP)

Sourcing backshell connectors—critical components for securing and protecting electrical connectors—requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these aspects can lead to product failures, compliance issues, and legal risks. Below are common pitfalls to avoid:

Quality-Related Pitfalls

1. Substandard Materials and Construction

Using low-grade metals or plastics can compromise durability, EMI shielding, and environmental resistance. Cheap backshells may corrode, crack under stress, or fail to provide proper strain relief, leading to connector failure in harsh environments.

2. Inconsistent Dimensional Tolerances

Poor manufacturing precision results in improper fit with mating connectors. This can cause gaps that undermine sealing effectiveness, reduce vibration resistance, and impact ingress protection (IP) ratings.

3. Inadequate Environmental Sealing

Many suppliers claim IP ratings (e.g., IP67, IP68), but without proper validation, these claims may be misleading. Pitfalls include missing or low-quality O-rings, improper gland design, or insufficient strain relief, all of which compromise sealing integrity.

4. Lack of EMI/RFI Shielding Performance

Backshells are often used to maintain electromagnetic compatibility. Low-quality versions may provide incomplete 360-degree shielding or poor contact with cable shields, leading to signal interference and compliance failures.

5. Insufficient Testing and Certification

Reputable backshells undergo environmental, mechanical, and electrical testing. Sourcing from suppliers without documented test reports (e.g., salt spray, vibration, pull tests) increases the risk of field failures.

Intellectual Property (IP) Pitfalls

1. Counterfeit or Clone Products

Some suppliers offer copies of well-known backshell designs (e.g., Amphenol, ITT Cannon) at lower prices. These clones may infringe on patents or trademarks and often lack performance validation, exposing buyers to legal liability and reliability risks.

2. Unauthorized Use of Registered Designs

Backshell designs, especially those with unique locking mechanisms or sealing systems, may be protected by design patents. Sourcing replicas without license agreements can lead to IP infringement claims, customs seizures, or product recalls.

3. Lack of Traceability and Documentation

Reputable manufacturers provide full traceability, including material certifications and compliance documentation (e.g., RoHS, REACH). Suppliers of unbranded or generic backshells often lack this, complicating audits and regulatory compliance.

4. Misrepresentation of Compatibility

Some suppliers falsely advertise compatibility with IP-protected connector series. While mechanical fit may appear similar, electrical performance and environmental protection may not meet original specifications, voiding warranties and increasing liability.

Best Practices to Avoid Pitfalls

- Source from authorized distributors or certified manufacturers.

- Request and verify test reports and compliance documentation.

- Conduct supplier audits and sample testing.

- Ensure contracts include IP indemnification clauses.

- Consult legal experts when sourcing near-clone or reverse-engineered components.

By addressing these quality and IP pitfalls proactively, companies can ensure reliable performance and mitigate legal and operational risks in their supply chain.

Logistics & Compliance Guide for Backshell Connectors

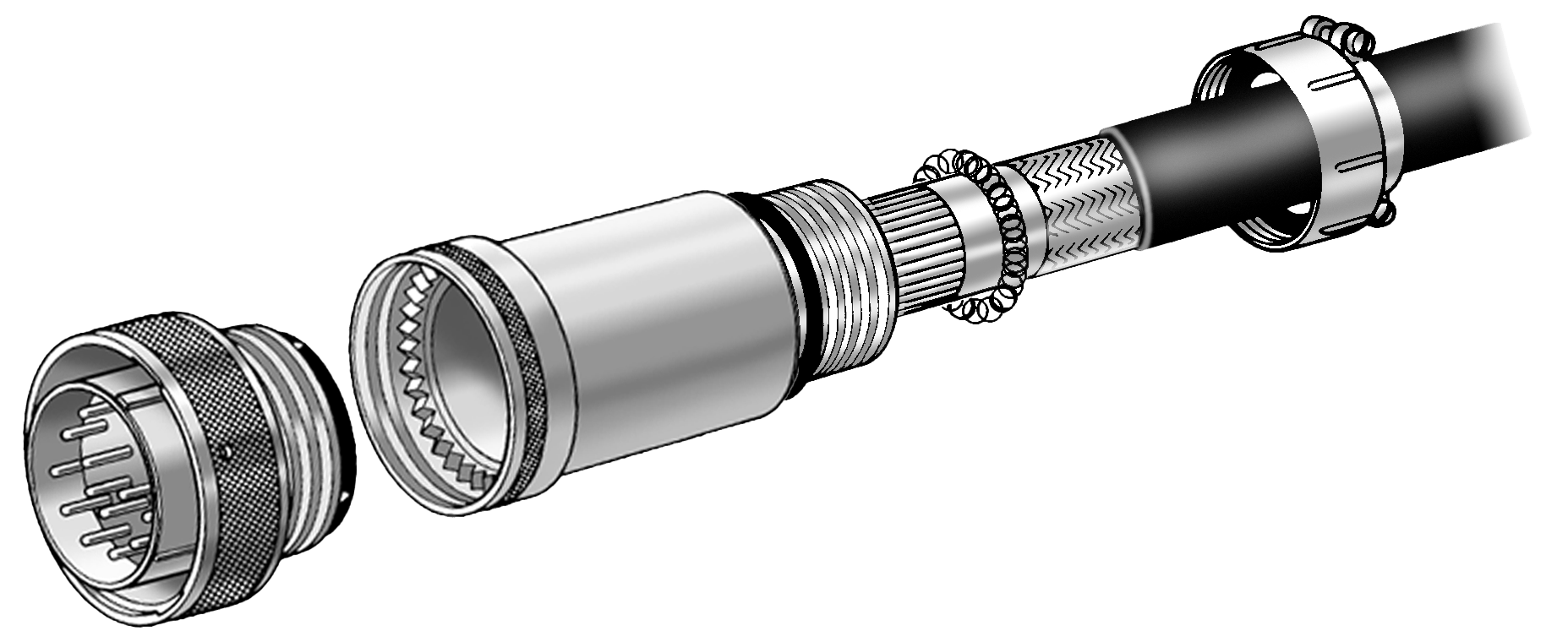

Product Overview

Backshell connectors are essential components used to secure and protect electrical connectors and cables from environmental stress, vibration, and mechanical strain. Proper logistics handling and regulatory compliance are critical to ensure performance, safety, and adherence to international standards.

Packaging and Storage Requirements

- Packaging: Backshell connectors must be packaged in anti-static, moisture-resistant materials to prevent corrosion and electrostatic discharge (ESD) damage. Individual components should be sealed in static-shielded bags with desiccants when applicable.

- Labeling: Each package must include part number, revision level, lot/batch number, RoHS/REACH compliance status, and country of origin.

- Storage Conditions: Store in a clean, dry environment with temperatures between 15°C to 30°C and relative humidity below 60%. Avoid direct sunlight and exposure to corrosive gases.

Shipping and Transportation

- Domestic & International Shipping: Use UN-certified packaging for air freight when transporting metal components that may contain hazardous coatings or plating. Ensure compliance with IATA and IMDG regulations if applicable.

- Export Controls: Verify if backshell connectors fall under export control classifications such as ECCN (Export Control Classification Number). Common categories may include EAR99 or 3A999 depending on material and application (e.g., military, aerospace).

- Customs Documentation: Provide accurate commercial invoices, packing lists, and certificates of origin. Include HTS (Harmonized Tariff Schedule) codes—typically under heading 8536 or 8538 for electrical connector parts.

Regulatory Compliance

- RoHS (Restriction of Hazardous Substances): Confirm that backshells comply with EU Directive 2011/65/EU, restricting substances like lead, cadmium, and hexavalent chromium. Documentation must include RoHS compliance declarations.

- REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Ensure no SVHCs (Substances of Very High Concern) are present above threshold levels. Provide SCIP database notifications if required.

- Conflict Minerals (Dodd-Frank Act Section 1502): Disclose the use of tin, tantalum, tungsten, and gold (3TG) sourced from conflict-affected areas. Submit annual CMRT (Conflict Minerals Reporting Template) if supplying to U.S. markets.

- UL/CSA Certification: For use in safety-critical applications, verify that connectors are certified by recognized bodies such as UL (Underwriters Laboratories) or CSA (Canadian Standards Association).

Industry-Specific Standards

- Military & Aerospace: Backshells used in defense or aviation applications must comply with MIL-DTL-38999, AS/EN 3645, or equivalent standards. Traceability and lot conformance reports are mandatory.

- Rail & Transportation: Comply with EN 45545 (fire safety) and IP ratings for dust/water ingress protection (e.g., IP67, IP68).

- Industrial Equipment: Adhere to IEC 61076 standards for connector performance and durability.

Quality Assurance and Traceability

- Lot Traceability: Maintain full traceability from raw material to finished product, including heat numbers, manufacturing dates, and inspection records.

- Incoming Inspection: Verify dimensional accuracy, plating thickness, and material certifications (e.g., RoHS, material test reports) upon receipt.

- Non-Conformance Handling: Implement quarantine procedures for non-compliant shipments and initiate corrective actions via SCAR (Supplier Corrective Action Request) when necessary.

Sustainability and End-of-Life

- Recyclability: Design backshells for disassembly and material recovery. Provide recycling guidance in product documentation.

- WEEE Compliance: For products sold in the EU, adhere to Waste Electrical and Electronic Equipment (WEEE) Directive 2012/19/EU, including proper labeling and take-back programs.

Supplier and Vendor Compliance

- Approved Supplier List (ASL): Source backshell connectors only from qualified suppliers with ISO 9001 and/or IATF 16949 certification.

- Compliance Audits: Conduct periodic audits to verify adherence to environmental, safety, and quality standards.

Contact and Support

For compliance documentation, material declarations, or logistics inquiries, contact:

Compliance Team

Email: [email protected]

Phone: +1 (555) 123-4567

Documentation Portal: https://compliance.yourcompany.com

Conclusion: Sourcing Backshell Connectors

After thorough evaluation of technical requirements, supplier reliability, cost-effectiveness, and compliance standards, the sourcing strategy for backshell connectors has been finalized. The selected suppliers offer high-quality, durable backshells that meet necessary environmental, mechanical, and electrical specifications—including EMI shielding, environmental sealing, and cable retention—across diverse operating conditions.

Key factors such as material compatibility (e.g., aluminum, stainless steel, or composite), plating options, ease of assembly, and adherence to industry standards (e.g., MIL-DTL-38999, IP ratings) were prioritized to ensure long-term performance and reliability. Additionally, supplier lead times, geographic location, and capacity for bulk orders were assessed to support consistent production timelines.

In conclusion, the chosen backshell connectors and their suppliers align with both technical demands and supply chain efficiency, enabling improved system integrity, reduced maintenance, and enhanced overall product performance. Ongoing supplier performance monitoring and periodic re-evaluation will ensure continued quality and cost optimization.