The global backhoe loader market is experiencing steady growth, driven by rising infrastructure development, urbanization, and increased investment in construction and mining activities. According to Mordor Intelligence, the backhoe loader market was valued at approximately USD 6.8 billion in 2023 and is projected to grow at a CAGR of over 4.2% through 2029. This expansion directly fuels demand for high-quality replacement parts, particularly for critical components housed within the backhoe case assembly such as hydraulic cylinders, linkages, and pivot pins. As equipment utilization increases and fleet ages, the aftermarket for durable, precision-engineered backhoe parts cases is becoming increasingly vital. Selecting reliable manufacturers is essential for minimizing downtime and ensuring operational efficiency. Based on production capacity, geographic reach, OEM partnerships, and customer reviews, the following six manufacturers have emerged as leaders in supplying backhoe parts cases globally.

Top 6 Backhoe Parts Case Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 OEM Case IH Parts & Accessories (In

Domain Est. 2000

Website: messicks.com

Key Highlights: Messick’s has industry’s largest ready-to-ship, in-stock Case IH parts inventory with an impressive selection of 30000+ unique part numbers….

#2 CASE Construction Genuine Parts

Domain Est. 2019

Website: mycnhstore.com

Key Highlights: Get Genuine OEM Parts and Replacement Parts for Case CE. Discover special offers and seasonal sales and events….

#3 Parts

Domain Est. 1995

Website: casece.com

Key Highlights: Research, identify and order parts, attachments, batteries, filters, fluids and lubricants, lights, power equipment, precision construction systems, tools, ……

#4 Tractor Backhoe Attachment

Domain Est. 1995

Website: caseih.com

Key Highlights: The Case IH backhoe attachment delivers powerful digging performance, ideal for construction and land improvement tasks….

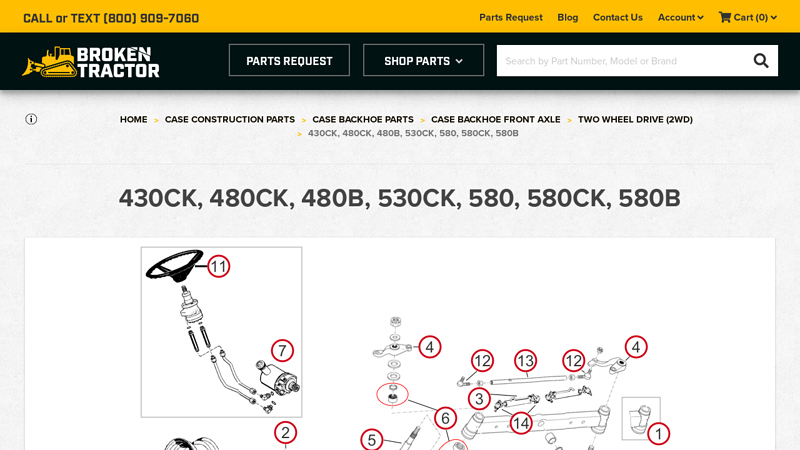

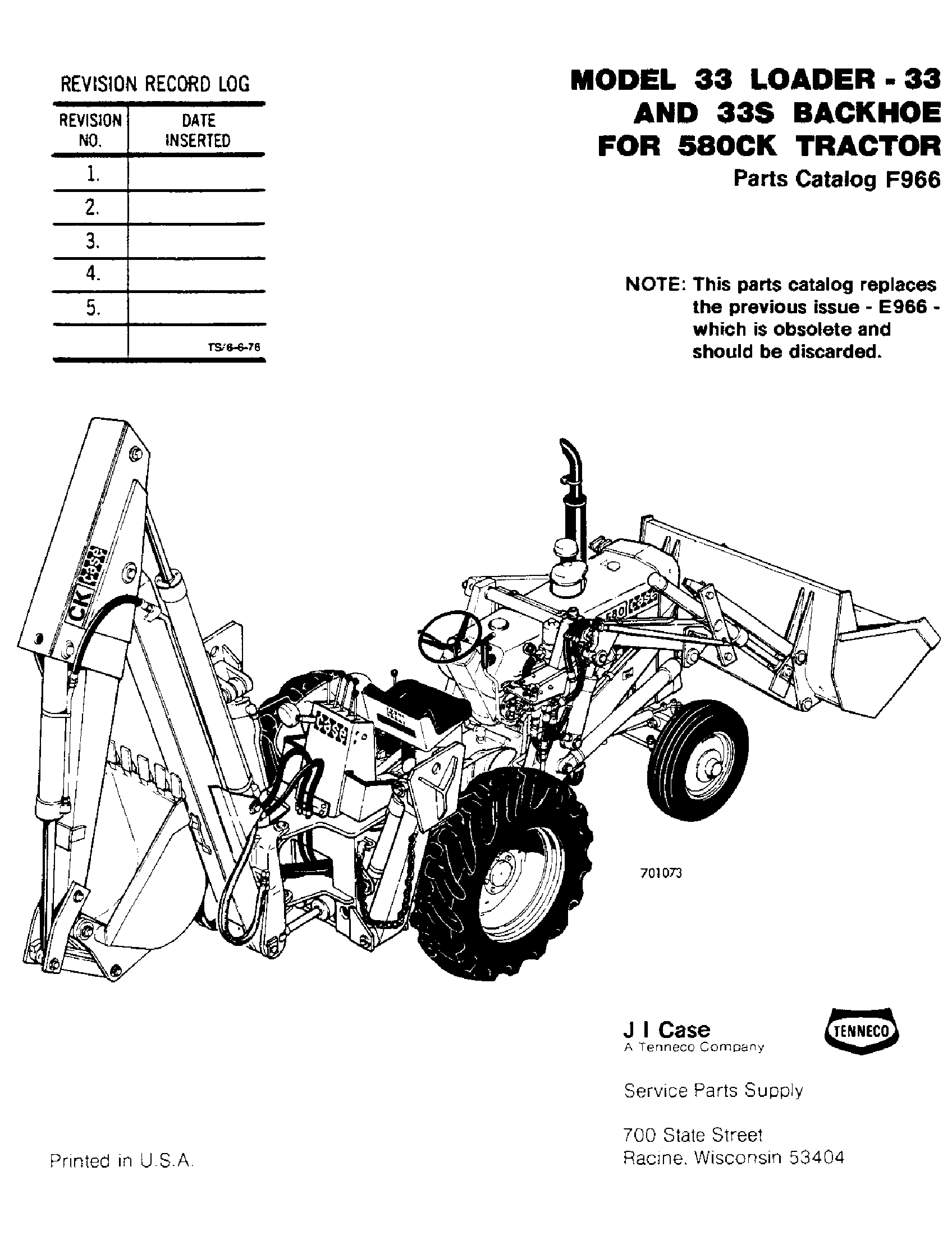

#5 430CK, 480CK, 480B, 530CK, 580, 580CK, 580B

Domain Est. 2004

Website: brokentractor.com

Key Highlights: 1–7 day delivery · 30-day returnsA comprehensive range of essential components designed specifically for Case backhoes and forklifts, particularly models such as the 580, 580CK, 4…

#6 Case 580CK Backhoe Parts

Domain Est. 2015

Website: hwpartstore.com

Key Highlights: We offer all kinds of parts for Case backhoes, including cylinders and seal kits, brake and clutch parts, front axle parts, and backhoe transmission parts….

Expert Sourcing Insights for Backhoe Parts Case

H2: 2026 Market Trends for Backhoe Parts – Case Study Analysis

The global market for backhoe loader parts is poised for significant transformation by 2026, driven by technological innovation, sustainability demands, and evolving construction needs. This analysis explores key trends shaping the backhoe parts sector, with a specific focus on Case Construction Equipment—a leading brand known for its durable and technologically advanced machinery. Understanding these trends is critical for manufacturers, suppliers, and end-users in strategic planning and investment decisions.

1. Increased Demand for Aftermarket Parts

By 2026, the aftermarket for backhoe parts is expected to grow at a CAGR of approximately 5.8%, outpacing original equipment manufacturer (OEM) part sales in many regions. With the average lifespan of Case backhoes extending due to improved engineering and maintenance programs, operators are increasingly turning to cost-effective aftermarket components for replacements. However, there is a rising preference for OEM-equivalent or certified aftermarket parts that guarantee compatibility and reliability, particularly for critical components like hydraulic pumps, control valves, and boom assemblies.

2. Digitalization and Predictive Maintenance

Case has been a pioneer in integrating telematics and IoT-enabled systems into its backhoe loaders (e.g., Case SiteWatch™). By 2026, predictive maintenance will become standard across fleets, influencing parts demand. Sensors monitoring engine health, hydraulic pressure, and wear on buckets or dipper sticks enable proactive part replacement, reducing downtime. This shift is driving demand for smart parts and data-compatible components, creating new opportunities for digital supply chain integration.

3. Focus on Sustainability and Remanufactured Parts

Environmental regulations and corporate ESG (Environmental, Social, and Governance) goals are pushing demand for sustainable solutions. Case’s remanufactured parts program—where used components like transmissions and engines are restored to OEM specifications—is gaining momentum. By 2026, the remanufactured parts segment is projected to capture over 25% of the backhoe parts market in North America and Western Europe. These parts offer up to 50% cost savings and reduce environmental impact by minimizing raw material use and landfill waste.

4. Regional Infrastructure Development Driving Demand

Emerging markets in Asia-Pacific (especially India and Southeast Asia), Africa, and Latin America are investing heavily in infrastructure, boosting demand for construction equipment—including Case backhoes. As these machines operate in harsh conditions, wear-and-tear parts such as undercarriage components, cutting edges, and hydraulic hoses are in high demand. Localized distribution networks and regional warehousing will be key for timely part availability.

5. Supply Chain Resilience and Localization

The disruptions caused by global events in the early 2020s have led OEMs like Case to reevaluate supply chains. By 2026, there will be greater emphasis on regional manufacturing and localized sourcing of backhoe parts to reduce lead times and mitigate risks. Case’s partnerships with regional suppliers in India, Poland, and Mexico are expected to expand, ensuring faster delivery of parts like pivot pins, bucket cylinders, and electrical control modules.

6. Electrification and Alternative Powertrains

Although full electric backhoes are still in early adoption, hybrid and low-emission models are becoming more common. Case has introduced Tier 5/Stage V compliant engines, reducing the need for certain traditional parts (e.g., complex exhaust after-treatment components) while increasing demand for advanced cooling systems and electronic control units. By 2026, parts related to battery systems, electric actuators, and regenerative hydraulics will see growing interest, especially in urban construction zones with strict emissions regulations.

Conclusion

The 2026 landscape for Case backhoe parts will be defined by digital integration, sustainability, and regional diversification. Companies that adapt to predictive maintenance models, expand remanufacturing capabilities, and strengthen localized supply chains will be best positioned to capitalize on these trends. For Case, continued innovation in durable, smart, and eco-friendly parts will reinforce its position as a market leader in the evolving global construction equipment ecosystem.

Common Pitfalls When Sourcing Backhoe Parts for Case (Quality and Intellectual Property Concerns)

Sourcing backhoe parts for Case equipment—whether for repairs, maintenance, or replacement—can be a complex process, especially when balancing cost, quality, and legal compliance. While the appeal of lower-priced alternatives is strong, several common pitfalls can compromise equipment performance, safety, and legal standing. Below are key challenges related to quality and intellectual property (IP) to avoid.

Poor Quality and Substandard Materials

One of the most frequent issues when sourcing backhoe parts is encountering components made from inferior materials or with poor craftsmanship. Non-OEM (Original Equipment Manufacturer) parts may appear identical but often fail to meet the durability and performance standards of genuine Case parts. This can lead to premature wear, increased downtime, and higher long-term maintenance costs.

Lack of Compatibility and Fitment Issues

Even parts labeled as “compatible” with Case backhoes may not fit properly due to slight dimensional variances or design differences. Poorly manufactured aftermarket parts can cause misalignment, leaks, or mechanical failure, especially in critical systems like hydraulics or the drivetrain.

Misrepresentation of OEM Parts (Gray Market and Counterfeits)

Some suppliers falsely advertise counterfeit or gray market parts as genuine Case components. These parts may lack proper certification, traceability, and quality assurance. Using such parts can void equipment warranties and expose operators to safety risks.

Intellectual Property (IP) Infringement

Manufacturers like Case invest heavily in engineering and design. Sourcing unlicensed copies of patented parts—such as custom hydraulic valves, control systems, or structural components—can constitute IP infringement. While enforcement against end-users is rare, businesses risk legal exposure, especially in regulated industries or government contracts.

Absence of Warranties and Support

Non-genuine parts often come without warranties or technical support. If a part fails, resolving the issue can be time-consuming and costly. In contrast, genuine Case parts typically include warranty coverage and access to manufacturer support, aiding quicker resolution of problems.

Supply Chain Transparency Issues

Many low-cost parts originate from suppliers with opaque supply chains. This lack of traceability raises concerns about ethical sourcing, regulatory compliance, and part authenticity. It also makes it difficult to respond to recalls or safety alerts.

Compliance and Safety Risks

Using substandard or non-compliant parts can result in equipment that fails to meet safety or emissions standards. This not only endangers operators but can also lead to fines, failed inspections, or liability in the event of an accident.

Conclusion

To avoid these pitfalls, prioritize sourcing from authorized Case dealers or reputable suppliers with verifiable part histories. Invest in genuine or certified aftermarket parts, and always verify certifications, warranties, and compatibility. Doing so ensures operational reliability, protects against IP risks, and supports long-term equipment performance.

Logistics & Compliance Guide for Backhoe Parts Case

This guide outlines the key logistics and compliance considerations when shipping backhoe parts, ensuring safe, efficient, and legally compliant transportation. Whether shipping domestically or internationally, adherence to these protocols minimizes risks, avoids delays, and ensures parts arrive in optimal condition.

Packaging and Handling Requirements

Proper packaging is critical to prevent damage during transit. Use sturdy, weather-resistant crates or pallets for heavy or fragile components. Secure parts with foam, bubble wrap, or custom-cut inserts to minimize movement. Label all packages clearly with part numbers, serial numbers (if applicable), handling instructions (e.g., “Fragile,” “This Side Up”), and destination details. Ensure sharp edges are protected and hydraulic components are capped to prevent contamination.

Transportation Modes and Carrier Selection

Choose the appropriate transportation method—truck, rail, air, or ocean—based on part size, weight, urgency, and destination. For oversized or heavy components, flatbed trucks or specialized freight services may be required. Select carriers experienced in handling industrial machinery parts and confirm they provide tracking, insurance, and proper equipment (e.g., lift gates, cranes). For international shipments, use freight forwarders familiar with heavy equipment logistics.

Regulatory Compliance for Domestic Shipments

Domestic shipments must comply with Department of Transportation (DOT) regulations. Ensure load securement meets FMCSA standards to prevent shifting during transit. Verify weight limits per axle and obtain necessary permits for oversized loads. Maintain accurate bills of lading and shipping manifests. If transporting hazardous materials (e.g., residual hydraulic fluid), follow DOT hazardous materials regulations, including proper labeling and documentation.

International Export Compliance

For cross-border shipments, comply with export regulations such as the U.S. Export Administration Regulations (EAR) or equivalent in your country. Determine if backhoe parts require an export license, particularly if they contain controlled technologies. Complete required documentation, including commercial invoices, packing lists, and export declarations. Accurately classify parts using Harmonized System (HS) codes to ensure correct tariffs and customs clearance.

Import Requirements and Duties

Importing countries may impose specific standards, certifications, or labeling requirements. Research destination country regulations—such as CE marking in the EU or CCC in China—before shipping. Prepare for customs inspections by providing complete documentation, including certificates of origin and conformity. Account for import duties, taxes, and potential storage fees. Use Incoterms (e.g., FOB, DAP) clearly in contracts to define responsibility for compliance and costs.

Insurance and Risk Management

Obtain comprehensive cargo insurance covering damage, loss, or theft during transit. Declare accurate shipment values and specify coverage for high-value components. Consider additional coverage for delays or customs-related issues in international shipping. Conduct regular risk assessments of shipping routes, carriers, and handling procedures to mitigate potential disruptions.

Documentation and Recordkeeping

Maintain a complete digital and physical record of all shipping documents, including bills of lading, customs forms, certificates, and proof of delivery. Store records for a minimum of five years to support audits, warranty claims, or compliance reviews. Utilize inventory and logistics software to track shipments and automate compliance checks.

Environmental and Safety Compliance

Dispose of packaging materials in accordance with local environmental regulations. Recycle wood pallets and plastic where possible. Ensure staff handling parts are trained in safe lifting practices and use appropriate personal protective equipment (PPE). If parts contain hazardous substances (e.g., lead, oils), follow EPA or equivalent guidelines for handling and disposal.

Final Inspection and Delivery Confirmation

Before dispatch, inspect all parts and packaging to verify completeness and integrity. At delivery, require signed proof of receipt and conduct a joint inspection with the recipient to document condition upon arrival. Address any discrepancies immediately to resolve claims or replacements efficiently.

Conclusion:

In conclusion, sourcing backhoe parts requires a strategic approach that balances cost, quality, availability, and reliability. After evaluating various suppliers, assessing part authenticity, considering lead times, and analyzing total cost of ownership—including maintenance and downtime—selecting the right sourcing channel is critical to ensuring optimal equipment performance and operational efficiency. Whether sourcing OEM, aftermarket, or refurbished parts, establishing relationships with reputable suppliers, leveraging procurement best practices, and maintaining accurate inventory records can significantly reduce downtime and extend the lifespan of heavy machinery. Ultimately, a well-structured sourcing strategy not only supports efficient maintenance operations but also contributes to improved productivity and cost savings in the long term.