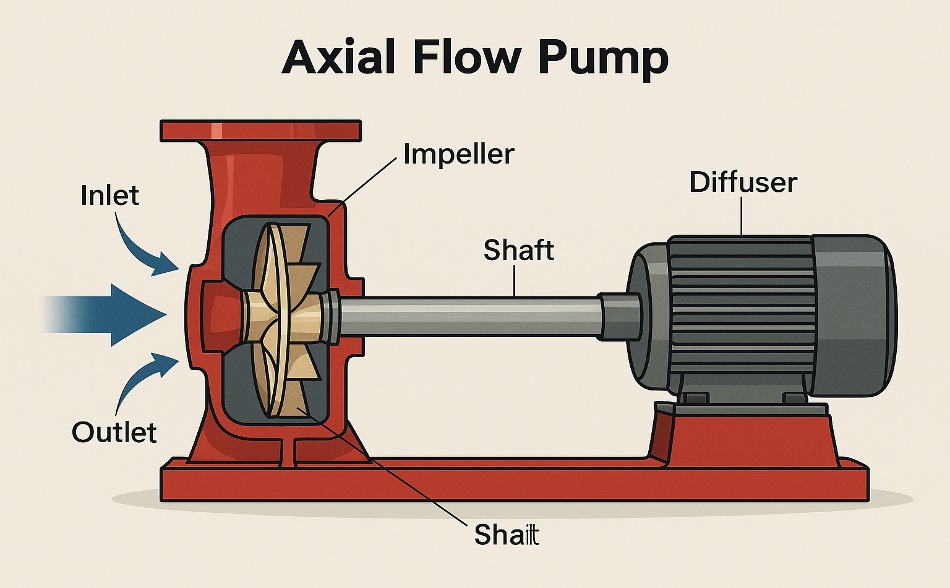

The global axial water pump market is experiencing steady growth, driven by rising demand across agricultural, industrial, and municipal applications. According to Mordor Intelligence, the water pump market is projected to grow at a CAGR of over 5.5% from 2023 to 2028, with axial flow pumps playing a critical role in large-volume, low-head pumping scenarios—especially in irrigation and flood control. Their efficiency in moving high flow rates with minimal energy input makes them a preferred choice in infrastructure and water management projects worldwide. As urbanization and climate-related water challenges accelerate, investment in reliable pumping solutions continues to rise. This demand has solidified the position of key manufacturers who combine innovation, durability, and scalable production. Based on market presence, technological advancement, and global reach, the following nine companies stand out as leading axial water pump manufacturers shaping the current and future landscape of fluid handling.

Top 9 Axial Water Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 MWI Pumps

Domain Est. 2008

Website: mwipumps.com

Key Highlights: MWI Pumps specializes in the design, manufacturing, rental, sale and servicing of large volume axial and mixed-flow propeller water pumps….

#2 Durability by Design Since 1873

Domain Est. 1996

Website: wilo.com

Key Highlights: American-Marsh Pumps, is a leading manufacturer of centrifugal & positive displacement pumps … Axial Flow pumps engineered for agricultural water wells ……

#3 Industrial Pumps Products

Domain Est. 1997

Website: flowserve.com

Key Highlights: The DVSH is a between bearings, axially split, single stage pump designed for continuous service in heavy duty pipeline services. With ……

#4 Axial Flow

Domain Est. 1995

Website: peerlesspump.com

Key Highlights: PL, Propeller pumps offer a wide range in both hydraulic and mechanical coverage for effective and economical application of pumps to big volume pumping jobs….

#5 Axial flow elbow pumps

Domain Est. 1996

Website: sulzer.com

Key Highlights: Sulzer offers a complete range of low and high pressure, horizontal and vertical axial flow pumps especially designed to handle severe pumping conditions….

#6 AF Axial Flow Pumps

Domain Est. 1997

Website: gouldspumps.com

Key Highlights: Goulds line of axial flow pumps is unmatched in the industry for low head/high capacity pumping requirements, especially when corrosive or abrasive ……

#7 Axial Flow Pumps

Domain Est. 1999

Website: ddpumps.com

Key Highlights: The Axial Flow Pump is the pump of choice when pumping large volumes of clear water at maximum heads of 25 feet. Whether your needs are flood control, field ……

#8 Xylem A

Domain Est. 1999

Website: xylem.com

Key Highlights: WCXH, Xylem A-C Custom Pump’s horizontal axial flow pump, provides reliable pumping for exceptionally high flows at low heads….

#9 Axial Flow Pumps

Domain Est. 2016

Website: global.weir

Key Highlights: Our range of axial flow pumps are designed for heavy duty, efficient and continuous circulation of corrosive, abrasive, clean and solid contaminated fluids….

Expert Sourcing Insights for Axial Water Pump

H2: Market Trends for Axial Water Pumps in 2026

The global axial water pump market is poised for significant transformation by 2026, driven by technological advancements, increasing demand for energy-efficient infrastructure, and growing investments in water management systems. This analysis outlines key trends expected to shape the axial water pump sector in 2026 under the H2 framework—highlighting Hydro-infrastructure Development, High-Efficiency Technologies, and Hybrid and Smart Pumping Systems.

1. Hydro-infrastructure Development (H2 #1)

Expanding urbanization and industrialization, particularly in emerging economies across Asia-Pacific, Africa, and Latin America, are accelerating the need for robust water conveyance systems. Axial flow pumps, known for their high flow rate and low head capabilities, are increasingly being deployed in large-scale irrigation projects, flood control systems, and municipal water supply networks.

By 2026, government-led initiatives in countries like India, China, and Indonesia—focused on agricultural modernization and climate-resilient infrastructure—are expected to boost demand. For example, India’s Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) and China’s South-North Water Diversion Project are projected to significantly increase procurement of axial water pumps. Additionally, rising sea levels and increased frequency of extreme weather events will drive investment in drainage and stormwater management, further expanding market opportunities.

2. High-Efficiency Technologies (H2 #2)

Energy efficiency regulations and sustainability goals are pushing manufacturers to innovate. By 2026, axial water pumps are expected to incorporate advanced hydraulic designs, premium-efficiency motors, and variable frequency drives (VFDs) to reduce energy consumption by up to 30% compared to conventional models.

The adoption of computational fluid dynamics (CFD) in pump design will enhance performance optimization, minimizing cavitation and improving flow uniformity. Moreover, regulatory standards such as the EU’s Ecodesign Directive and the U.S. DOE efficiency mandates will compel manufacturers to phase out low-efficiency models, favoring high-efficiency axial pumps in both public and private sector applications.

3. Hybrid and Smart Pumping Systems (H2 #3)

Digital transformation is reshaping the pumping industry. By 2026, the integration of IoT sensors, predictive maintenance algorithms, and remote monitoring platforms will become standard in axial water pump systems. These “smart pumps” enable real-time performance tracking, fault detection, and adaptive control based on water demand fluctuations.

Hybrid systems combining axial pumps with renewable energy sources—particularly solar-powered pumping in off-grid agricultural areas—are expected to gain traction. Countries in Sub-Saharan Africa and South Asia are likely to lead in solar-axial pump adoption, supported by international funding and declining solar panel costs. This convergence of digital and green technologies will redefine operational efficiency and maintenance protocols across the sector.

Conclusion

By 2026, the axial water pump market will be shaped by three pivotal H2 trends: Hydro-infrastructure Development, High-Efficiency Technologies, and Hybrid and Smart Pumping Systems. Stakeholders—including manufacturers, governments, and engineering firms—must align with these dynamics to meet rising demand, comply with regulations, and leverage digital innovation. The result will be a more resilient, efficient, and intelligent water management ecosystem powered by next-generation axial pumps.

Common Pitfalls Sourcing Axial Water Pumps: Quality and Intellectual Property (IP) Risks

Sourcing axial water pumps, especially from lower-cost manufacturing regions, can present significant challenges related to quality consistency and intellectual property protection. Being aware of these common pitfalls is crucial for minimizing risk and ensuring long-term supply chain reliability.

Quality-Related Pitfalls

1. Inconsistent Manufacturing Standards:

Suppliers may lack rigorous quality control processes, leading to variations in materials, dimensions, and performance between batches. This inconsistency can result in premature pump failure, reduced efficiency, and increased maintenance costs. Always verify adherence to international standards (e.g., ISO, ANSI, or DIN) and request documented QC procedures.

2. Substandard Materials and Components:

To cut costs, some suppliers may use inferior materials (e.g., low-grade cast iron, non-corrosion-resistant coatings, or undersized impellers). These compromises directly impact durability, hydraulic efficiency, and suitability for specific operating environments (e.g., saline or abrasive fluids).

3. Inaccurate Performance Claims:

Suppliers may overstate pump performance metrics such as flow rate, head pressure, or energy efficiency. Without independent testing or third-party certification, these claims can be misleading, leading to system design flaws and operational inefficiencies.

4. Lack of Testing and Certification:

Reputable suppliers conduct factory acceptance tests (FAT) and provide performance curves, vibration analysis, and NPSH (Net Positive Suction Head) data. Sourcing from vendors who skip these steps increases the risk of field failures and compatibility issues.

Intellectual Property (IP) Risks

1. Design and Technology Replication:

Sharing detailed technical specifications or proprietary designs with suppliers—especially without proper legal safeguards—can lead to unauthorized replication or reverse engineering. This exposes your company to counterfeit products and loss of competitive advantage.

2. Inadequate Legal Protections:

Operating in jurisdictions with weak IP enforcement increases vulnerability. Ensure robust contracts with clear IP ownership clauses, non-disclosure agreements (NDAs), and jurisdiction-specific legal protections before disclosing sensitive information.

3. Grey Market and Unauthorized Distribution:

Suppliers may sell your branded or custom-designed pumps through unauthorized channels, undermining pricing strategies and brand integrity. Implement strict supply chain monitoring and contractual controls to prevent diversion.

4. Co-Development and Joint Ownership Ambiguities:

If working closely with a supplier on custom designs, unclear agreements on IP ownership can lead to disputes. Define IP rights explicitly in development contracts to avoid future legal conflicts or loss of control over innovations.

Mitigating these pitfalls requires due diligence, clear contractual terms, ongoing supplier audits, and engagement with legal and technical experts familiar with both engineering standards and international IP law.

Logistics & Compliance Guide for Axial Water Pump

This guide outlines the key logistics and compliance considerations for the safe, efficient, and legal transportation, handling, and use of Axial Water Pumps. Adherence to these guidelines ensures product integrity, regulatory compliance, and operational safety.

Product Classification & Regulatory Compliance

Axial Water Pumps are often subject to various international, national, and regional regulations depending on their application (e.g., industrial, agricultural, marine). Key compliance areas include:

– Environmental Regulations: Compliance with directives such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) is mandatory in the EU. Ensure pumps do not contain restricted substances.

– Energy Efficiency Standards: Pumps may be subject to energy efficiency regulations such as the EU Ecodesign Directive (Lot 29) or U.S. DOE efficiency standards. Verify pump efficiency ratings meet local requirements.

– Pressure Equipment Directive (PED): If the pump is used in systems operating above specified pressure thresholds in the EU, it may fall under the PED and require CE marking with appropriate conformity assessment.

– Marine & Water Safety: For use in potable water systems, compliance with NSF/ANSI 61 (U.S.) or equivalent standards (e.g., WRAS in the UK) is required to ensure materials do not leach harmful substances into drinking water.

Packaging & Handling Requirements

Proper packaging and handling are essential to prevent damage during transit and storage:

– Secure Packaging: Use robust wooden crates or heavy-duty cardboard with internal foam or molded inserts to immobilize the pump. Protect shafts, flanges, and electrical components with caps or covers.

– Moisture Protection: Include desiccant packs and use moisture barrier bags or vapor corrosion inhibitors (VCI) if shipping to humid climates or by sea.

– Labeling: Clearly label packages with:

– Product name and model number

– “Fragile” and “This Side Up” orientation indicators

– Weight and dimensions

– Handling pictograms (e.g., no forklift on casing)

– Lifting Points: Use only designated lifting lugs or slings; never lift by motor or piping connections.

Transportation Logistics

Ensure safe and efficient movement from manufacturing to end-user:

– Mode of Transport:

– Road: Use climate-controlled or covered trucks for protection from weather. Secure loads with straps to prevent shifting.

– Sea Freight: Use ISO containers; ensure proper dunnage and ventilation to prevent condensation. Comply with IMDG Code if hazardous materials (e.g., lubricants) are included.

– Air Freight: Follow IATA regulations; confirm weight and dimensional constraints.

– Documentation: Prepare and verify:

– Commercial invoice

– Packing list

– Certificate of Conformity (CE, UL, etc.)

– Material Safety Data Sheet (MSDS), if applicable

– Export declaration and import permits (if required)

Import/Export Controls

Be aware of trade regulations affecting shipment:

– Customs Classification: Use correct HS (Harmonized System) code (e.g., 8413.70 for centrifugal pumps; confirm applicability to axial types).

– Export Licenses: Some high-efficiency or dual-use pumps may require export authorization depending on destination country and technical specifications.

– Duties & Tariffs: Research applicable tariffs, trade agreements (e.g., USMCA, EU-South Korea FTA), and anti-dumping measures.

On-Site Receiving & Storage

Ensure proper procedures upon delivery:

– Inspection: Check for visible damage, verify contents against packing list, and document any discrepancies immediately.

– Storage Conditions: Store in a dry, temperature-controlled environment (5°C to 40°C recommended). Keep pumps elevated off the floor and covered to prevent dust or moisture ingress.

– Inventory Management: Follow first-in, first-out (FIFO) principles. Rotate stock to avoid prolonged storage.

Installation & Operational Compliance

Ensure safe and compliant deployment:

– Electrical Safety: Comply with local electrical codes (e.g., NEC in U.S., IEC 60364 internationally). Ensure grounding, overload protection, and proper cable sizing.

– Mechanical Installation: Align shafts carefully; use flexible couplings if required. Follow manufacturer’s torque specifications for flange bolts.

– Environmental Permits: For pumps used in water abstraction or wastewater systems, confirm required environmental permits are in place (e.g., EPA regulations, local water authority approvals).

Maintenance & Disposal Compliance

Support lifecycle compliance:

– Scheduled Maintenance: Follow manufacturer-recommended service intervals. Maintain records of inspections and repairs.

– Used Oil & Fluid Handling: Collect and dispose of lubricants in accordance with local environmental regulations (e.g., EPA hazardous waste rules).

– End-of-Life Disposal: Recycle metal components and dispose of electronic parts per WEEE (Waste Electrical and Electronic Equipment) Directive or local e-waste regulations.

Adhering to this guide ensures regulatory compliance, minimizes logistical risks, and supports the reliable performance of Axial Water Pumps throughout their lifecycle. Always consult the manufacturer’s technical documentation and local authorities for region-specific requirements.

Conclusion on Sourcing an Axial Water Pump

In conclusion, sourcing an axial water pump requires a thorough evaluation of application-specific requirements such as flow rate, head pressure, power source, duty cycle, and operating environment. These pumps are best suited for high-flow, low-head applications, making them ideal for irrigation, drainage, cooling systems, and flood control. When selecting a supplier, key considerations include product quality, energy efficiency, material durability, compliance with industry standards, and availability of technical support and after-sales service.

Sourcing from reputable manufacturers or suppliers—whether local or international—can ensure reliability and long-term performance. Additionally, life-cycle cost analysis, including energy consumption and maintenance, should be prioritized over initial procurement cost. By carefully matching pump specifications with operational needs and partnering with trusted vendors, organizations can achieve efficient, sustainable, and cost-effective water management solutions.