The global laboratory consumables market, driven by increased investments in pharmaceutical R&D, environmental testing, and quality control across industries, has seen steady expansion over the past decade. According to Grand View Research, the global laboratory plastics market was valued at USD 20.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. A critical component within this segment is the autosampler vial—a key enabler of high-throughput and reproducible analytical workflows in HPLC, GC, and other instrumentation platforms. With rising demand for precision, inertness, and compatibility with automated systems, the market for autosampler vials has witnessed intensified innovation and manufacturing capabilities. The increasing adoption of UHPLC systems and stringent regulatory requirements in biopharma, combined with a surge in clinical diagnostics and environmental monitoring, are further accelerating demand. As laboratories worldwide seek reliable, high-quality vials to ensure data integrity and operational efficiency, the competitive landscape has evolved to include a select group of manufacturers offering advanced products across glass types, closures, and formats. Based on performance, material quality, compatibility, and global reach, we highlight the top 9 autosampler vial manufacturers shaping the industry today.

Top 9 Autosampler Vial Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

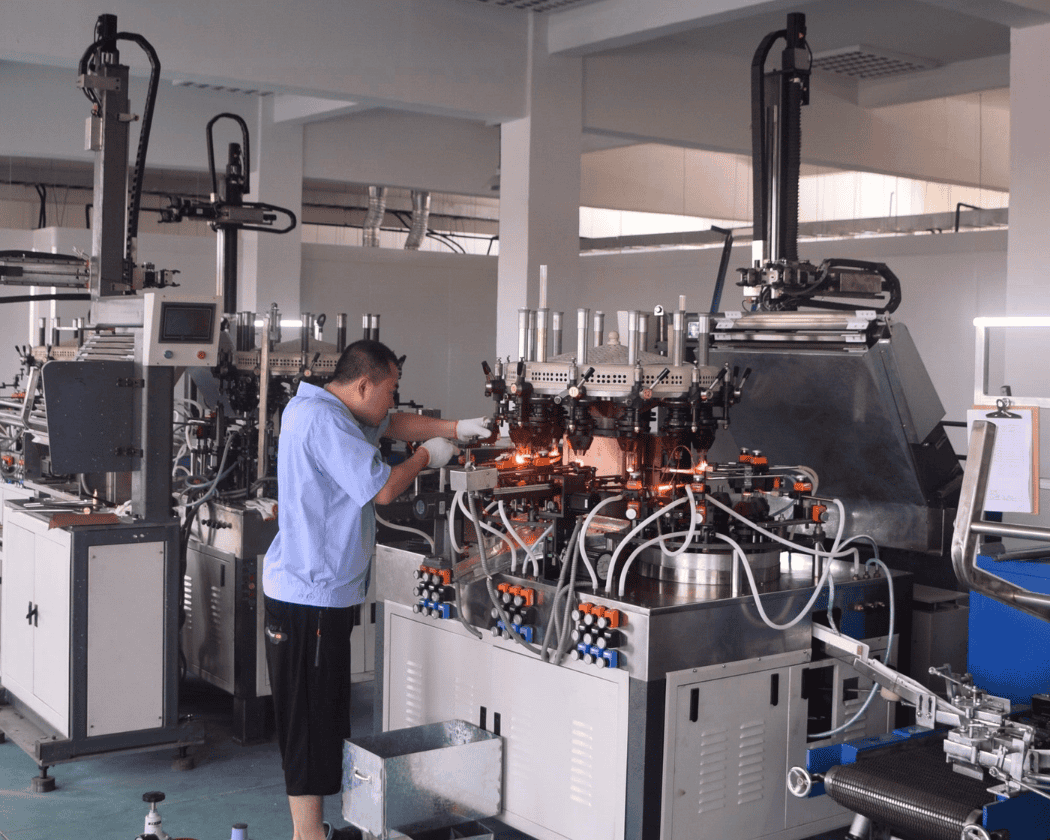

#1 Autosampler Vial, Hplc Vial, PTFE Silicone Septa with Cap, syringe …

Domain Est. 2011

Website: alwsci.com

Key Highlights: As a global leading supplier of sample vials, ALWSCI can supply a series of sample vials from 1ML to 1000ML. Both ODM & OEM business are optional. In ALWSCI, ……

#2 Autosampler Vials

Domain Est. 2003

Website: glasscolabs.com

Key Highlights: Best Manufacturer, supplier and exporter of high-Quality austosampler vials made with USP type-1 glass….

#3 Autosampler Glass Vials

Domain Est. 1995

Website: spectrumchemical.com

Key Highlights: 15-day returnsFind superior fit and compatibility with Spectrum’s selection of glass autosampler vials ideal for chromatography applications….

#4 Autosampler Vials

Domain Est. 1998

Website: chemglass.com

Key Highlights: Autosampler Vials · 9mm Thread 12x32mm · Crimp Top 12x32mm · Inserts · CERTIFIED LARGE OPENING VIALS, CLEAR VIALS, 9MM THREAD, 2.0ML · HIGH RECOVERY VIALS, SILANIZED ……

#5 Vials

Domain Est. 1998

#6 Autosampler Vials

Domain Est. 2000

Website: savillex.com

Key Highlights: Molded only from high purity virgin PFA, Savillex autosampler vials are the cleanest option for ultratrace metals analysis. Available in a wide range of sizes ……

#7 Autosampler Vials & Caps

Domain Est. 2004

Website: mtc-usa.com

Key Highlights: We offer “Different Tiers or Brands” with performance levels for autosampler vials & caps to meet every one of your needs in the modern laboratory….

#8 Autosampler Vials & Caps for HPLC & GC

Domain Est. 2006

Website: thermofisher.com

Key Highlights: We’ve organized SureSTART vials and closures into three performance levels to provide you with the affordability, compatibility and performance you need….

#9 BOENMED® Plastic Autosampler Vials

Domain Est. 2006

Website: boenmedical.com

Key Highlights: Plastic autosampler vials are designed to be chemically resistant, ensuring the integrity of samples and preventing contamination or leaching of substances from ……

Expert Sourcing Insights for Autosampler Vial

H2: Emerging Market Trends for Autosampler Vials in 2026

The global autosampler vial market is poised for significant evolution by 2026, driven by advancements in analytical technologies, increasing regulatory demands, and shifting industry needs across pharmaceuticals, environmental testing, and food safety sectors. Key trends shaping the market during this period include the rising adoption of high-throughput screening, growing emphasis on sample integrity, and the integration of smart features into vial design.

-

Increased Demand from Pharmaceutical and Biotech Sectors

By 2026, the pharmaceutical and biotechnology industries are expected to remain the largest end-users of autosampler vials. With accelerated drug discovery and development cycles—especially in personalized medicine and biologics—there is a surge in demand for reliable, high-performance vials that support reproducibility and precision in liquid chromatography (LC) and gas chromatography (GC) applications. -

Shift Toward Pre-Slit and Pre-Scored Seals

Convenience and contamination control are pushing manufacturers toward pre-slit septa and pre-scored crimp seals. These innovations reduce variability in sample introduction and minimize the risk of septum coring or particle shedding, ensuring consistent analytical results. By 2026, such enhanced sealing technologies are expected to dominate premium product offerings. -

Growth in Inert and Low-Adsorption Vials

As analytical sensitivity increases, there is a growing need for vials made from materials that minimize sample adsorption and reactivity. Inert glass (e.g., Type I borosilicate) and specialty coatings (e.g., silanized or fluoropolymer-coated vials) are gaining traction, especially for trace-level analysis in proteomics and metabolomics. -

Sustainability and Recyclable Packaging

Environmental regulations and corporate sustainability goals are influencing product design. By 2026, manufacturers are increasingly adopting recyclable packaging, reducing plastic use, and offering return-and-refill programs. Some companies are exploring bio-based polymers for vial caps and sleeves, aligning with green laboratory initiatives. -

Integration with Automation and Lab 4.0

With the expansion of automated laboratories and Industry 4.0 principles, autosampler vials are being designed for seamless integration with robotic systems. Features like barcode labeling, RFID tagging, and standardized dimensions are becoming more common, enabling better sample tracking, inventory management, and error reduction. -

Regional Market Expansion in Asia-Pacific

The Asia-Pacific region, particularly China, India, and South Korea, is anticipated to witness the fastest market growth by 2026. This is fueled by rising investments in R&D, expanding contract research organizations (CROs), and strengthened regulatory frameworks requiring robust quality control measures. -

Consolidation and Innovation Among Key Players

Major suppliers such as Thermo Fisher Scientific, Agilent Technologies, and Waters Corporation are expected to consolidate their market positions through strategic acquisitions and product innovation. New entrants from emerging economies are focusing on cost-effective alternatives, increasing competitive pressure on pricing.

In conclusion, the 2026 autosampler vial market will be characterized by technological sophistication, enhanced performance standards, and a strong emphasis on sustainability and automation. Companies that invest in innovation, quality assurance, and eco-friendly solutions are likely to lead the next phase of market development.

Common Pitfalls When Sourcing Autosampler Vials: Quality and Intellectual Property Concerns

Sourcing autosampler vials—critical consumables in analytical laboratories—requires careful evaluation beyond price and availability. Overlooking quality consistency and intellectual property (IP) risks can lead to compromised data integrity, instrument damage, and legal exposure. Below are key pitfalls to avoid:

Inconsistent Quality and Material Specifications

One of the most frequent issues when sourcing vials, especially from lesser-known or offshore suppliers, is variability in material quality. Autosampler vials must be chemically inert, dimensionally precise, and free of contaminants to prevent interference with sensitive analyses (e.g., HPLC, GC-MS). Low-quality glass may leach ions or contain particulates, while poorly manufactured caps can cause leaks or inconsistent sealing. Variations in thread dimensions or crimping tolerances may lead to vial jams, failed injections, or sample loss—disrupting workflows and increasing downtime.

Use of Non-Original or Counterfeit Components

Many third-party suppliers offer vials advertised as “compatible” with major OEMs (e.g., Agilent, Thermo Fisher, Shimadzu). However, some may produce exact replicas of patented vial designs or use counterfeit seals and crimp caps that mimic branded products. While marketed as cost-effective alternatives, these may infringe on design patents or trademarks. Laboratories risk violating intellectual property rights, particularly if the supplier does not have proper licensing or if the product closely imitates protected designs.

Lack of Traceability and Regulatory Compliance

Reputable applications in pharmaceuticals, environmental testing, or forensics demand full traceability and compliance with standards (e.g., USP <381>, EP 3.2.1). Sourcing vials without documented manufacturing controls, lot traceability, or certification can invalidate analytical results during audits. Some suppliers may not provide Certificates of Analysis (CoA) or fail to adhere to cleanroom production standards, increasing the risk of cross-contamination or out-of-spec performance.

Hidden Costs from Performance Failures

Though low-cost vials may appear economical upfront, poor quality often leads to hidden expenses: increased system downtime, column contamination, recalibration needs, or repeat analyses due to failed runs. In regulated environments, non-compliant consumables can trigger audit findings or data integrity issues under GLP or GMP frameworks.

Mitigation Strategies

To avoid these pitfalls:

– Prioritize suppliers with ISO certification and transparent quality control processes.

– Verify compatibility without infringing on IP—opt for truly generic designs when possible.

– Request CoAs, material specifications, and compliance documentation.

– Evaluate total cost of ownership, not just unit price.

– Consult legal or procurement teams when sourcing “OEM-compatible” products to assess IP risk.

By addressing quality and IP concerns proactively, laboratories can ensure reliable analytical performance and regulatory compliance while avoiding costly setbacks.

Logistics & Compliance Guide for Autosampler Vials

Overview

Autosampler vials are essential consumables used in analytical laboratories for automated sample introduction into instruments such as HPLC (High-Performance Liquid Chromatography), GC (Gas Chromatography), and LC-MS (Liquid Chromatography-Mass Spectrometry). Proper logistics and compliance management are critical to ensure sample integrity, regulatory adherence, and operational efficiency.

Regulatory Compliance

1. Material Safety & Biocompatibility

Autosampler vials must comply with international standards regarding material safety:

– USP <661>: Ensures plastic components meet biocompatibility and leachability requirements.

– EP 3.1.3 and 3.2.1: European Pharmacopoeia standards for plastic containers and closures.

– FDA 21 CFR Part 177: Governs compliance of polymers used in food contact and pharmaceutical applications.

Ensure vials are certified as DNA/RNase-free, pyrogen-free, or sterile where required by application.

2. Chemical Resistance & Inertness

- Vials and septa must resist leaching or adsorption when exposed to solvents (e.g., acetonitrile, methanol, acids, bases).

- Use certified low-binding glass (Type I borosilicate) or high-quality polymers (e.g., polypropylene).

- Confirm compatibility with intended analytes and solvents via manufacturer’s chemical resistance charts.

3. Environmental & Waste Compliance

- WEEE (Waste Electrical and Electronic Equipment): Not typically applicable to vials, but relevant for associated autosampler hardware.

- REACH & RoHS: Ensure vial components do not contain restricted substances (e.g., phthalates, heavy metals).

- Waste Disposal: Follow local regulations for disposal of solvent-contaminated vials. Segregate hazardous vs. non-hazardous waste appropriately.

Supply Chain & Logistics

1. Storage Conditions

- Store vials in a clean, dry environment at 15–25°C.

- Protect from direct sunlight and UV exposure to prevent polymer degradation.

- Maintain sealed packaging until use to prevent contamination.

2. Packaging & Handling

- Use tamper-evident, sterile packaging where applicable.

- Ensure vials are packed to prevent breakage (especially glass vials) during transit.

- Use anti-static packaging for polypropylene vials to minimize particulate attraction.

3. Shipping & Transport

- Classify vials as non-hazardous unless pre-filled with regulated substances.

- Use validated cold chain logistics if vials are pre-treated (e.g., coated, pre-filled).

- For international shipments:

- Provide commercial invoices with accurate HS codes (e.g., 7010.90 for glass vials).

- Include certificates of compliance (CoC), material declarations, and sterility reports if required.

- Comply with customs regulations (e.g., FDA prior notice for U.S. imports, CE marking for EU).

Quality Assurance & Documentation

1. Certifications & Traceability

- Maintain lot-specific certificates of analysis (CoA) for critical applications.

- Ensure full traceability from raw material to finished product.

- Audit supplier quality systems (e.g., ISO 9001, ISO 13485 if used in medical devices).

2. Incoming Inspection

- Verify vial dimensions (common: 12x32mm, 11x32mm) and compatibility with autosampler models (e.g., Agilent, Waters, Shimadzu).

- Check for particulates, cracks, or septa defects.

- Validate closure integrity (e.g., crimp seal strength for crimp-top vials).

3. Inventory Management

- Implement first-expiry, first-out (FEFO) or first-in, first-out (FIFO) rotation.

- Monitor shelf life—typically 2–5 years depending on material and storage.

Application-Specific Considerations

1. Pharmaceutical & Clinical Labs

- Follow GMP/GLP guidelines for vial use in regulated studies.

- Use certified DNase/RNase-free vials for molecular biology applications.

- Document vial lot numbers in lab notebooks or LIMS (Laboratory Information Management System).

2. Environmental & Food Testing

- Use low-metal or low-phthalate vials to avoid contamination.

- Comply with EPA, FDA, or EU food safety directives.

3. Research & Development

- Standard vials may suffice, but maintain records for reproducibility.

- Consider pre-slit septa or PTFE/silicone combinations for multiple needle punctures.

Conclusion

Proper logistics and compliance for autosampler vials ensure data integrity, regulatory adherence, and laboratory safety. Select vials based on application requirements, maintain robust documentation, and partner with certified suppliers to mitigate supply chain risks.

Conclusion on Sourcing Autosampler Vials

In conclusion, sourcing autosampler vials requires a careful balance between quality, compatibility, cost, and supplier reliability. The selection process should prioritize vials that are chemically inert, dimensionally accurate, and compatible with the specific analytical instrumentation and solvents used in the laboratory. Whether opting for glass (borosilicate or amber) or plastic vials, considerations such as sample stability, potential for adsorption, and exposure to light must be addressed.

Supplier evaluation is equally critical—reputable vendors offering consistent quality, regulatory compliance (e.g.,USP/EP standards), sterility (if required), and comprehensive documentation should be preferred. Bulk purchasing and long-term agreements may yield cost savings, but should not compromise on quality or traceability.

Ultimately, investing in high-quality autosampler vials from trusted sources enhances analytical reproducibility, reduces instrument downtime, and ensures the integrity of analytical results. A strategic sourcing approach—combining technical requirements with supply chain efficiency—will support reliable and cost-effective laboratory operations.