The global automotive sound deadening materials market is experiencing robust growth, driven by increasing consumer demand for enhanced in-cabin comfort and rising production of electric vehicles, which prioritize noise, vibration, and harshness (NVH) reduction. According to Grand View Research, the market was valued at USD 3.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. This growth is further fueled by stringent noise emission regulations and the expanding premium vehicle segment. As automakers and aftermarket suppliers focus on improving acoustic performance, sound deadening mats have become a critical component in vehicle design. The competitive landscape is marked by innovation in material technology—such as butyl rubber, bitumen, and eco-friendly composites—and growing investments in R&D. In this evolving market, a select group of manufacturers are leading the charge in performance, scalability, and technological advancement. Here are the top 10 automotive sound deadening mat manufacturers shaping the industry.

Top 10 Automotive Sound Deadening Mat Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Design Engineering Inc.

Domain Est. 1997

Website: designengineering.com

Key Highlights: DEI specializes in heat and sound insulation products. This includes heat wrap for headers or exhaust systems, heat shields, sleeve products, & more….

#2 CTK

Website: ctk.world

Key Highlights: CTK is a leading manufacturer of advanced sound dampening solutions. We offer the best car noise insulation products to reduce unwanted noise, vibration and ……

#3 Number 1 trusted name in sound deadening and heat insulation

Domain Est. 1996

Website: dynamat.com

Key Highlights: Dynamat is a thin, flexible, easy to cut and mold sheet that actually stops noise causing resonance and vibration….

#4 Thermo

Domain Est. 1997

Website: thermotec.com

Key Highlights: $5 delivery Free 30-day returnsAdhesive-Backed Heat Barrier · $17.55 ; CLEARANCE ITEM – Adhesive Backed Heat Barrier 5″ x 20″ 6 pieces · $57.73 ; CLEARANCE ITEM – Thermo-Sleeve 5/8…

#5 Sound Dampening, Vibration Damping, Thermal Insulation for …

Domain Est. 2003

Website: hushmat.com

Key Highlights: HushMat, pioneering top-of-the-line products for sound deadening, vibration control, and thermal insulation in the automotive market….

#6 LizardSkin

Domain Est. 2003

Website: lizardskin.com

Key Highlights: LizardSkin reduces heat and noise for your vehicle. LizardSkin Insulation is developed by Mascoat, leader in insulating coatings….

#7 Kilmat

Domain Est. 2016

Website: kilmat.com

Key Highlights: Kilmat presents sound deadening and insulation materials for cars. Kilmat sound deadening mat – excellent soundproofing at a bargain price….

#8 SoundSkins Global

Domain Est. 2017

Website: soundskinsglobal.com

Key Highlights: Buy the best sound deadening material for car audio in the USA & Canada. Find top-quality products near me for sale at SoundSkins Global. Shop online now!…

#9 SoundShield

Domain Est. 2018

Website: soundshieldusa.com

Key Highlights: Our industry leading formula and triple layer composition make it an unbeatable solution for any premium sound environment and need….

#10 ResoNix Sound Solutions

Domain Est. 2019

Website: resonixsoundsolutions.com

Key Highlights: Premium Automotive Sound Deadening Materials – ResoNix Sound Solutions. Use code CLDCLEARANCE at checkout for 15% off!…

Expert Sourcing Insights for Automotive Sound Deadening Mat

H2: 2026 Market Trends for Automotive Sound Deadening Mat

The global automotive sound deadening mat market is poised for significant evolution by 2026, driven by shifting consumer expectations, technological advancements, and broader industry transformations. Key trends shaping the landscape include:

1. Dominance of Electric Vehicles (EVs) & Noise Profile Shift

- Changing Noise Sources: The near-silence of EV powertrains amplifies previously masked noises (road, wind, tire, HVAC). Sound deadening is no longer just about comfort but about defining the premium acoustic signature of EVs.

- Increased Demand & Strategic Placement: EV manufacturers are investing heavily in NVH (Noise, Vibration, Harshness) solutions. Mat usage is increasing, particularly targeting wheel arches, floors, and underbody areas to combat road noise. Expect higher overall material volume per vehicle, especially in premium and mainstream EVs.

- Focus on High-Frequency Attenuation: EVs lack low-frequency engine noise, making higher-frequency road and wind noise more perceptible. Mats with optimized performance in these ranges will gain importance.

2. Sustainability as a Core Driver

- Regulatory Pressure & Brand Image: Stricter environmental regulations (VOCs, recyclability) and strong ESG commitments push OEMs towards eco-friendly materials. Bio-based bitumen, recycled rubber, and natural fiber composites (jute, cork, flax) will see accelerated adoption.

- Lightweighting Synergy: Sustainable materials often align with lightweighting goals. Reducing mat weight contributes marginally to overall vehicle efficiency, a critical factor for EV range. Expect growth in lightweight composite mats and optimized application strategies (e.g., targeted placement vs. full coverage).

- End-of-Life Considerations: Design for recyclability and the use of mono-materials or easily separable composites will become more important criteria in material selection.

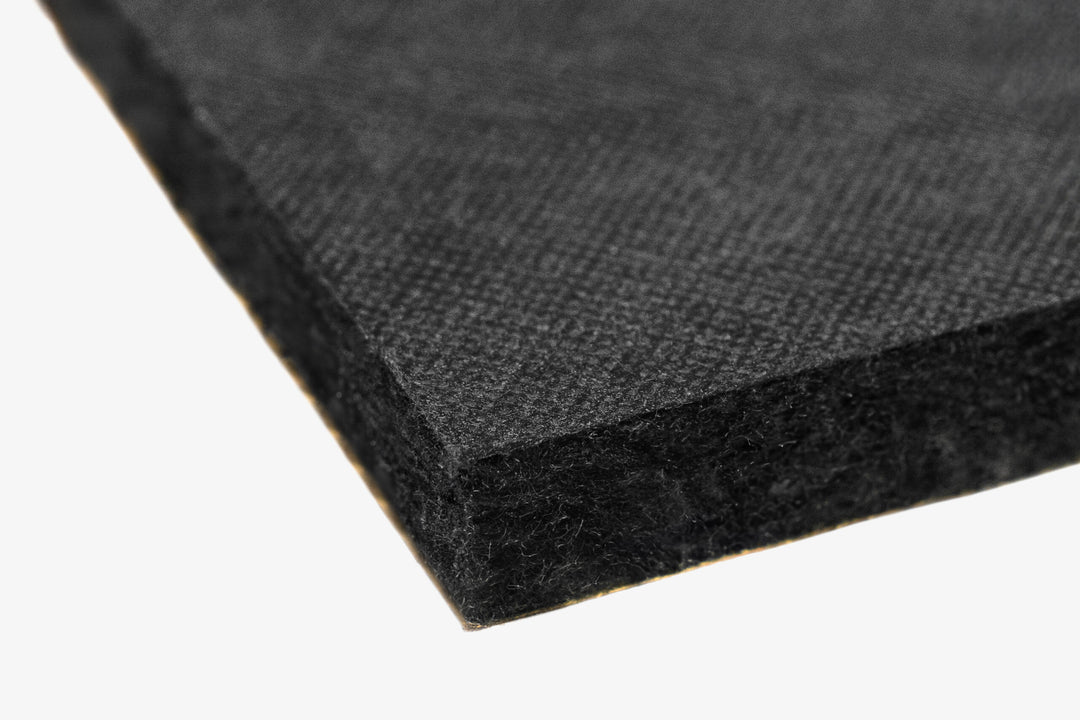

3. Advanced Materials & Hybrid Solutions

- Beyond Traditional Bitumen: While bitumen-based mats remain prevalent due to cost and performance, their market share will gradually erode. Hybrid mats combining bitumen with sustainable layers or advanced viscoelastic polymers offer balanced performance and improved environmental profiles.

- Growth of Viscoelastic & Butyl-Based Mats: These offer superior damping performance, lower weight, better temperature stability, and often lower VOC emissions compared to pure bitumen. Their use will expand, particularly in premium and performance segments.

- Innovation in Natural & Recycled Materials: R&D will focus on enhancing the acoustic performance and durability of natural fiber mats and improving the consistency and processing of recycled content mats to make them viable for broader applications.

4. Automation, Efficiency & Cost Optimization

- Manufacturing Integration: Demand will grow for mats compatible with automated application processes (robotic spraying, pre-cut kits) to improve precision, reduce labor costs, and ensure consistency in high-volume production (especially EVs).

- Pre-Cutting & Customization: Pre-cut kits tailored to specific vehicle models will gain traction, reducing waste, installation time (OEM and aftermarket), and improving fit/finish. Digital templating will support this.

- Cost-Effectiveness: Despite premium trends, cost pressure remains. Suppliers will focus on optimizing formulations, manufacturing processes, and supply chains to deliver high-performance solutions at competitive prices, particularly for the high-volume mainstream market.

5. Aftermarket Growth & Consumer Awareness

- DIY Market Expansion: Consumer awareness of vehicle acoustics and the benefits of sound deadening is rising. The DIY aftermarket segment will grow, driven by online tutorials and accessible pre-cut kits. Ease of installation and clear performance claims will be key selling points.

- Focus on Health & Well-being: Marketing will increasingly link reduced noise pollution inside the cabin to reduced driver fatigue, improved concentration, and overall well-being, appealing to health-conscious consumers.

- Premiumization in Aftermarket: Demand for high-performance, eco-friendly, and aesthetically pleasing (e.g., colored or branded) aftermarket mats will increase, mirroring OEM trends.

6. Regional Dynamics

- Asia-Pacific Leadership: China, Japan, South Korea, and India will remain the largest manufacturing and consumption hubs, driven by massive automotive production (especially EVs in China) and growing domestic demand for comfort features.

- North America & Europe: Mature markets with strong focus on premium vehicles, EVs, and sustainability regulations. Growth will be steady, driven by EV adoption and replacement/upgrade cycles in the aftermarket. Stringent VOC regulations will accelerate the shift away from traditional bitumen.

- Emerging Markets: Growth potential in regions like Latin America and the Middle East, linked to rising middle-class car ownership and increasing expectations for comfort and quietness.

In Summary for 2026: The automotive sound deadening mat market will be defined by the EV revolution demanding superior high-frequency noise control, a strong push towards sustainability reshaping material choices, and technological innovation delivering lighter, more efficient, and automated solutions. Success will depend on balancing performance, environmental credentials, cost, and integration capabilities across both OEM and rapidly evolving aftermarket channels.

Common Pitfalls When Sourcing Automotive Sound Deadening Mat (Quality, IP)

Sourcing automotive sound deadening mats involves navigating several critical challenges related to quality consistency and intellectual property (IP) protection. Overlooking these pitfalls can lead to product failures, customer dissatisfaction, legal disputes, and reputational damage. Key areas of concern include:

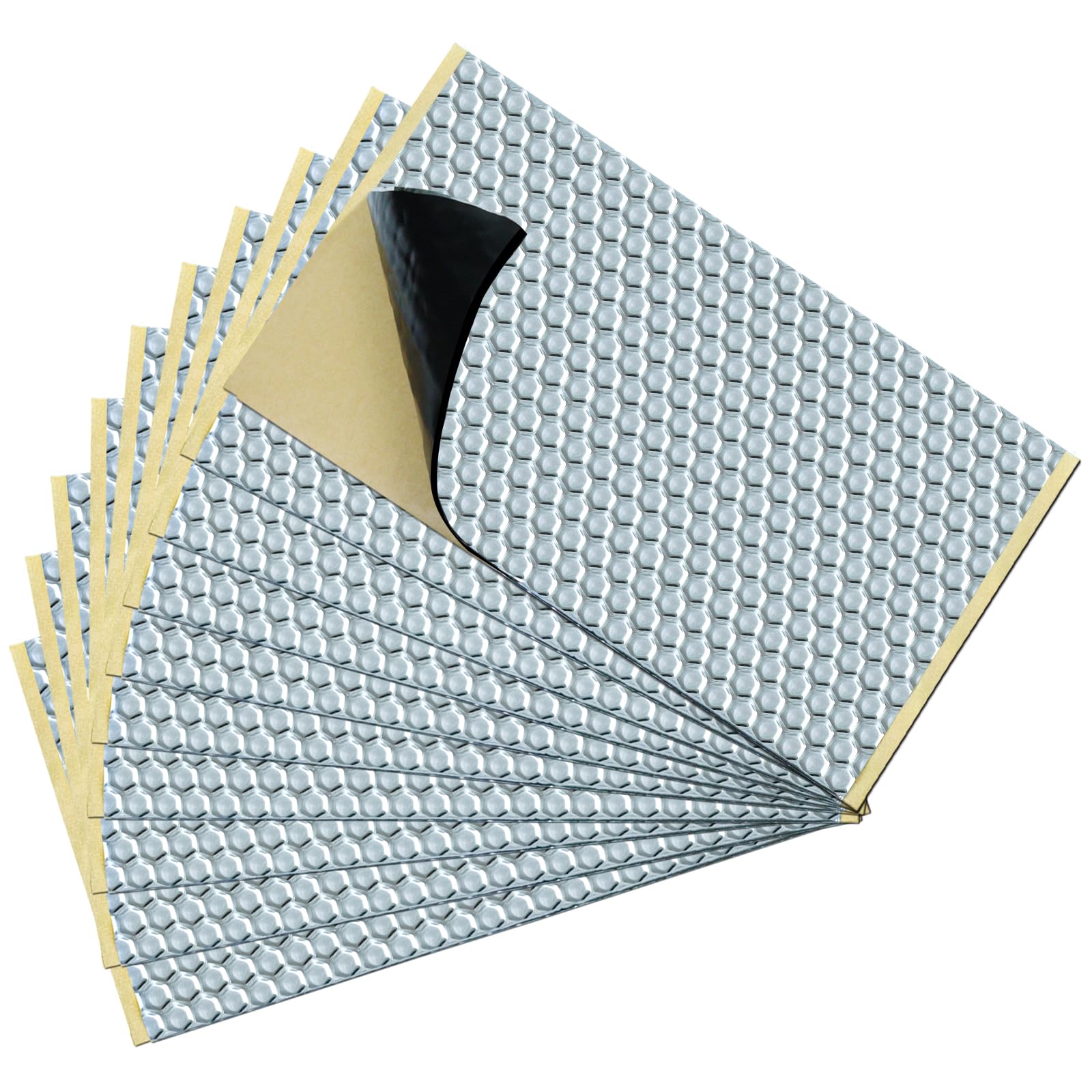

Inconsistent Material Quality and Performance

Suppliers, especially low-cost manufacturers, may use substandard raw materials—such as low-grade butyl rubber, recycled asphalt, or insufficient aluminum foil layers—to cut costs. This results in inconsistent sound dampening, poor heat resistance, and reduced durability. Buyers often discover too late that the mats fail to meet OEM or industry performance standards (e.g., ASTM E90 for sound transmission loss), leading to ineffective noise reduction and potential warranty claims.

Misrepresentation of Product Specifications

Some suppliers exaggerate product performance, claiming high damping coefficients (e.g., loss factor >0.3) or superior temperature resistance without verifiable test reports. Without third-party certifications or lab testing, it’s difficult to confirm claims about noise reduction (measured in dB), weight (affecting fuel efficiency), or environmental compliance (e.g., low VOC emissions). This misrepresentation can lead to integration issues in vehicle assembly lines or customer complaints about odor and performance.

Intellectual Property Infringement Risks

Many sound deadening mat designs—especially constrained layer damping (CLD) structures, proprietary adhesive formulas, or unique layer compositions—are protected by patents or trade secrets. Sourcing from manufacturers that replicate branded products (e.g., imitating 3M, Dynamat, or Hushmat designs) exposes buyers to IP infringement risks. Legal action, customs seizures, or forced product recalls can result, particularly in markets with strong IP enforcement like the US or EU.

Lack of Traceability and Compliance Documentation

Reputable suppliers provide material safety data sheets (MSDS), RoHS, REACH, and IMDS (International Material Data System) compliance records. However, some vendors offer incomplete or falsified documentation, raising red flags about chemical content (e.g., heavy metals, halogens) and recyclability. This lack of traceability can disqualify the product from use in environmentally regulated automotive supply chains.

Poor Adhesive Performance and Application Issues

The adhesive layer is critical for proper bonding to car panels. Low-quality adhesives may fail under temperature fluctuations, leading to delamination and rattling noises. Additionally, some mats require heat activation for proper adhesion—sourcing products without clear application guidelines or compatibility testing can lead to installation failures and increased labor costs.

Supply Chain and Scalability Risks

Even if initial samples meet quality standards, some suppliers cannot maintain consistency during mass production. Unreliable production capacity, lack of quality control (e.g., no ISO 9001 certification), or poor logistics can disrupt just-in-time automotive manufacturing processes. Buyers may face delays, rework, or line stoppages due to non-conforming batches.

Avoiding these pitfalls requires due diligence: conducting factory audits, demanding independent test reports, verifying IP status, and establishing clear quality agreements with suppliers. Partnering with trusted manufacturers and using legal safeguards (e.g., IP indemnification clauses) is essential for reliable, compliant sourcing.

Logistics & Compliance Guide for Automotive Sound Deadening Mat

Product Overview and Classification

Automotive sound deadening mats are specialized materials applied within vehicle panels to reduce noise, vibration, and harshness (NVH). Typically made from butyl rubber, asphalt, aluminum foil, or eco-friendly composites, these mats are classified under HS codes such as 3919.10 (self-adhesive plates/sheets of plastics) or 8708.29 (parts and accessories for motor vehicles), depending on composition and form. Accurate classification is critical for import/export compliance and tariff determination.

Regulatory Compliance Requirements

Sound deadening mats must comply with regional and international environmental, safety, and chemical regulations. Key standards include:

– REACH (EU): Registration, Evaluation, Authorisation and Restriction of Chemicals – ensures restricted substances (e.g., PAHs, phthalates) are below thresholds.

– RoHS (EU/Asia): Restriction of Hazardous Substances – applicable if mats contain electronic or conductive layers.

– TSCA (USA): Toxic Substances Control Act – requires certification that products do not contain banned chemicals.

– China GB Standards: GB/T 27630-2011 for vehicle interior air quality; limits VOC emissions.

– VOC Emission Standards: California Air Resources Board (CARB) and EU Ecolabel may apply for low-emission claims.

Manufacturers must provide Safety Data Sheets (SDS) and compliance documentation with shipments.

Packaging and Labeling Guidelines

Proper packaging ensures product integrity during transit and regulatory compliance:

– Use moisture-resistant, durable packaging to protect adhesive surfaces.

– Label packages with: product name, batch/lot number, weight, dimensions, manufacturer details, and handling symbols (e.g., “Do Not Stack,” “Keep Dry”).

– Include regulatory labels such as REACH/RoHS compliance marks, country of origin, and hazard symbols if applicable.

– Ensure multilingual labeling for international shipments per destination country requirements.

Shipping and Transportation Considerations

Sound deadening mats are generally non-hazardous but require careful handling:

– Avoid extreme temperatures during transit, as high heat can degrade adhesive performance.

– Use palletized shipments with stretch-wrapping for stability; secure rolls or sheets to prevent shifting.

– Choose freight modes (air, sea, or ground) based on delivery urgency and cost; sea freight is typical for bulk shipments.

– Comply with IMDG Code (for sea), IATA (for air), or ADR (for road in Europe) if packaging includes regulated adhesives or backing materials.

Import/Export Documentation

Ensure all cross-border shipments include:

– Commercial Invoice (with HS code, value, and terms of sale)

– Packing List (itemizing contents per package)

– Bill of Lading or Air Waybill

– Certificate of Origin (for preferential tariff treatment)

– Regulatory Compliance Certificates (REACH, RoHS, TSCA, etc.)

– SDS (Safety Data Sheet) – mandatory in most jurisdictions

Engage licensed customs brokers to facilitate clearance and avoid delays.

Storage and Handling Protocols

- Store in a cool, dry environment (15–25°C recommended) away from direct sunlight.

- Keep rolls flat or vertically upright to prevent warping; limit stacking height to avoid compression damage.

- Rotate stock using FIFO (First In, First Out) to ensure product freshness, especially for adhesive-based materials.

- Handle with clean gloves to avoid contaminating adhesive surfaces.

Environmental and Disposal Compliance

- Inform end-users about proper disposal in accordance with local waste regulations.

- Asphalt-based mats may be subject to special waste handling; recommend recycling where available.

- Provide take-back or recycling program information if offered.

- Comply with Extended Producer Responsibility (EPR) schemes in regions like the EU.

Audit and Recordkeeping

Maintain records for a minimum of 5–7 years, including:

– Batch production and testing reports

– Supplier material certifications

– Shipping and customs documentation

– Regulatory compliance test results (e.g., VOC, flame retardancy)

Regular internal audits help ensure ongoing compliance with evolving regulations.

Conclusion: Sourcing Automotive Sound Deadening Mats

Sourcing high-quality automotive sound deadening mats is a critical step in enhancing vehicle comfort, reducing noise, vibration, and harshness (NVH), and improving overall acoustic performance. After evaluating various materials—including butyl-based composites, asphalt mats, and eco-friendly alternatives—alongside key factors such as thermal resistance, durability, ease of installation, and compliance with environmental and safety standards, it becomes evident that selecting the right supplier and material is essential.

Effective sourcing requires a balance between performance, cost-efficiency, and sustainability. Prioritizing suppliers with proven manufacturing capabilities, consistent quality control, and the ability to meet volume demands ensures reliable supply chain operations. Additionally, considering certifications (such as ISO, REACH, or RoHS) and material safety data sheets (MSDS) supports compliance with international regulations.

In conclusion, a strategic approach to sourcing automotive sound deadening mats—focused on material performance, supplier reliability, and regulatory compliance—will not only improve vehicle acoustics but also contribute to customer satisfaction and long-term brand reputation in the competitive automotive industry.