The global automotive plastic painting market is experiencing robust growth, driven by increasing demand for lightweight vehicle components, aesthetic customization, and enhanced durability. According to Mordor Intelligence, the automotive coatings market is projected to grow at a CAGR of over 5.8% from 2023 to 2028, with plastic painting playing a pivotal role due to the rising adoption of polymer-based exterior and interior parts. Lightweighting initiatives to improve fuel efficiency and meet emissions regulations are accelerating the use of plastic components in bumpers, grilles, trim, and lighting housings—all of which require high-performance painting solutions. Additionally, consumer preference for premium finishes and color variety is pushing OEMs and tier suppliers to partner with specialized plastic coaters. As vehicle production rebounds and electric vehicle (EV) adoption increases—vehicles that often feature more plastic to reduce weight—the demand for advanced plastic painting technologies continues to rise. The following list highlights the top 10 automotive plastic painting manufacturers recognized for their technological capabilities, global footprint, innovation in eco-friendly coatings, and strategic partnerships with leading automakers.

Top 10 Automotive Plastic Painting Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Automotive & Transportation

Domain Est. 1995

Website: automotive-transportation.basf.com

Key Highlights: From advanced materials and fluids to sustainable technologies and solutions, our comprehensive portfolio is designed to empower automotive manufacturers and ……

#2 U.S. Paint

Domain Est. 1997

Website: uspaint.com

Key Highlights: U.S. Paint is a leading manufacturer of high performance paints, primers, and clearcoats for automotive, power sports, and industrial markets….

#3 Automotive OEM Coatings, OEM Paint Systems & Color Leaders

Domain Est. 1990

Website: ppg.com

Key Highlights: PPG Automotive OEM Coatings is a global leader in high-performance auto paints and technologies including powder primers, clearcoats, and color leadership….

#4 World Leader in Specialty Coatings

Domain Est. 1996

Website: rpminc.com

Key Highlights: RPM International Inc. owns subsidiaries that are world leaders in specialty coatings, sealants, building materials and related services….

#5 Automotive

Domain Est. 1999

Website: sames.com

Key Highlights: We specialize in automotive OEM solutions, including carbody manufacturing, painting, and bonding to ensure high-quality vehicle production….

#6 Engineered Plastic Components, Inc.

Domain Est. 2007

Website: epcmfg.com

Key Highlights: EPC is your one-stop shop for your plastic injection molded products. With world-class quality and manufacturing standards, state of the art equipment and ……

#7 Automotive plastic parts manufacturers

Domain Est. 2017

Website: novaresteam.com

Key Highlights: Novares is a global plastic solutions provider that designs, manufactures complex components & systems serving the future of the automotive industry….

#8 AkzoNobel

Domain Est. 1995

Website: akzonobel.com

Key Highlights: Since 1792, we’ve been supplying the innovative paints and coatings that help to color people’s lives and protect what matters most….

#9 Jones Plastic

Domain Est. 1996

Website: jonesplastic.com

Key Highlights: We are a full-service supplier of engineering services, product design and integration, and contract manufacturing of a wide variety of injection-molded ……

#10 Top quality plastic products

Domain Est. 2009

Website: geigerautomotive.com

Key Highlights: Geiger Automotive GmbH stands for top-quality products made of plastic. Your international partner for system solutions….

Expert Sourcing Insights for Automotive Plastic Painting

H2: 2026 Market Trends for Automotive Plastic Painting

The automotive plastic painting market is poised for significant transformation by 2026, driven by evolving consumer preferences, stringent environmental regulations, and advancements in material science and manufacturing technologies. As automakers increasingly prioritize lightweighting to enhance fuel efficiency and meet emissions standards, the use of plastic components continues to grow—necessitating advanced painting solutions tailored to polymer substrates.

One of the dominant trends shaping the 2026 landscape is the rising demand for sustainable and eco-friendly painting processes. Water-based coatings are gaining widespread adoption over traditional solvent-based systems due to their lower volatile organic compound (VOC) emissions. Regulatory bodies in North America, Europe, and China are enforcing stricter environmental standards, compelling OEMs and Tier-1 suppliers to invest in greener coating technologies. This shift is accelerating R&D in low-cure and waterborne primers and topcoats specifically engineered for plastic adhesion.

Another key trend is the integration of digitalization and automation in painting lines. By 2026, smart factories are expected to leverage AI-driven quality control systems, robotic spraying with real-time feedback, and digital twin simulations to optimize paint application on complex plastic parts. This enhances consistency, reduces waste, and supports mass customization—especially critical as automakers expand their electric vehicle (EV) lineups with unique design aesthetics.

Aesthetic innovation is also a major driver. Consumers increasingly expect premium finishes on exterior and interior plastic components, such as gloss, matte, metallic, and textured effects. This has led to advancements in in-mold decoration (IMD), physical vapor deposition (PVD), and functional coatings that combine visual appeal with UV resistance and scratch protection.

Additionally, the expansion of electric vehicles is influencing plastic painting requirements. EVs often feature larger plastic body panels and aerodynamic components, increasing the surface area requiring coating. Moreover, the emphasis on noise, vibration, and harshness (NVH) reduction in EVs favors sound-dampening plastic parts that must still be painted to OEM standards.

Lastly, regional dynamics are shifting. Asia-Pacific, led by China, India, and South Korea, is expected to dominate market growth due to expanding automotive production and rising middle-class demand. Meanwhile, North America and Europe are focusing on high-value applications and recycling-compatible coatings to support circular economy goals.

In conclusion, by 2026, the automotive plastic painting market will be defined by sustainability, technological innovation, and design sophistication. Strategic investments in eco-conscious materials, automation, and advanced surface engineering will be critical for suppliers aiming to capture value in this evolving sector.

Common Pitfalls in Sourcing Automotive Plastic Painting (Quality, IP)

Sourcing automotive plastic painting services involves significant technical, quality, and intellectual property (IP) challenges. Failure to address these can lead to product defects, supply chain disruptions, or legal exposure. Below are some of the most common pitfalls encountered.

Quality Inconsistencies

One of the primary risks in sourcing automotive plastic painting is inconsistent paint quality. Variations in color matching, gloss levels, film thickness, and adhesion can occur due to unstandardized processes, especially with overseas suppliers. Differences in substrate preparation, paint formulation, or curing conditions can result in surface defects such as orange peel, blistering, or peeling—issues that are unacceptable in automotive applications where appearance and durability are critical.

Lack of Process Control and Certification

Many suppliers, particularly in low-cost regions, may lack adherence to recognized quality management systems such as IATF 16949. Without proper process controls, audit trails, and statistical process control (SPC) methods, it becomes difficult to ensure repeatability and traceability. This increases the risk of batch failures and non-compliance with OEM specifications.

Inadequate Environmental and Durability Testing

Automotive components are exposed to extreme conditions, including UV radiation, temperature cycling, humidity, and chemical exposure. A common pitfall is sourcing from vendors who do not perform or document full environmental testing (e.g., QUV, thermal shock, salt spray). Without rigorous validation, painted parts may fail prematurely in real-world conditions, leading to warranty claims and brand damage.

Poor Substrate Compatibility and Adhesion

Plastic materials such as PP, ABS, or PC/ABS require specific surface treatments (e.g., flame, plasma, or chemical priming) before painting. Suppliers may cut corners by using improper or inconsistent pre-treatment methods, leading to poor paint adhesion. This can manifest as delamination during impact or environmental stress, especially in bumpers or exterior trims.

Intellectual Property Risks

When outsourcing painting processes—especially for proprietary colors, matte finishes, or specialty coatings—there is a risk of IP leakage. Suppliers may reverse-engineer formulations or share sensitive data with competitors. Contracts often lack strong IP protection clauses, non-disclosure agreements (NDAs), or audit rights, leaving OEMs vulnerable to imitation or unauthorized use of proprietary technology.

Unverified Paint Material Sources

Some suppliers source raw paint materials from unapproved or inconsistent vendors to reduce costs. This compromises batch-to-batch consistency and may introduce contaminants. Without access to material safety data sheets (MSDS), certificates of conformance (CoC), or restricted substance lists (e.g., REACH, ELV compliance), companies risk non-compliance with environmental regulations.

Insufficient Change Management Practices

Suppliers may implement undocumented changes in paint formulation, equipment, or process parameters without notifying the buyer. In the automotive sector, any process change requires validation and approval. Lack of a formal change notification system increases the risk of undetected quality deviations.

Limited Traceability and Documentation

Defective parts can be difficult to investigate without full traceability of paint batches, process parameters, and inspection records. Suppliers with poor documentation practices hinder root cause analysis and corrective action, prolonging resolution times during quality incidents.

Conclusion

To mitigate these pitfalls, automotive manufacturers should conduct thorough supplier audits, require certifications, enforce strict quality agreements, and include robust IP protection in contracts. Ongoing monitoring, sample testing, and collaboration with technically capable partners are essential for ensuring high-quality, compliant, and protected plastic painting operations.

Logistics & Compliance Guide for Automotive Plastic Painting

Overview of Automotive Plastic Painting Processes

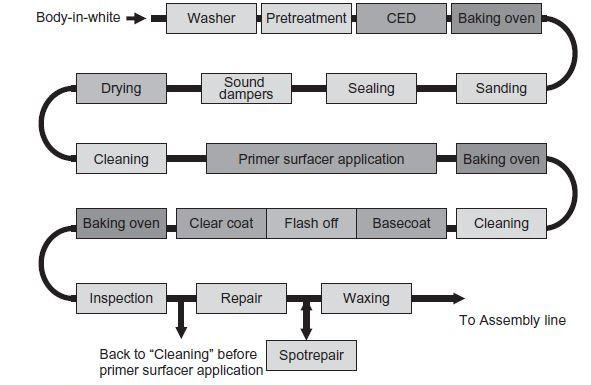

Automotive plastic painting involves applying coatings to plastic components such as bumpers, grilles, trim pieces, and interior parts to enhance aesthetics, durability, and resistance to environmental factors. This process typically includes surface preparation (cleaning, plasma treatment), primer application, basecoat coloring, and clearcoat finishing. Ensuring consistent quality, environmental compliance, and efficient logistics is critical in meeting OEM (Original Equipment Manufacturer) standards and regulatory requirements.

Regulatory Compliance Requirements

Environmental Regulations

Automotive plastic painting operations must comply with environmental protection standards, including:

– VOC (Volatile Organic Compound) Emissions Limits: Adherence to regional regulations such as the U.S. EPA’s National Emission Standards for Hazardous Air Pollutants (NESHAP), EU’s Industrial Emissions Directive (IED), and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals).

– Waste Management: Proper handling, storage, and disposal of hazardous waste (e.g., paint sludge, solvent residues) in accordance with local and international laws (e.g., RCRA in the U.S.).

– Air Quality Permits: Facilities must obtain and maintain air permits detailing coating processes, emission controls (e.g., regenerative thermal oxidizers), and monitoring protocols.

Chemical Safety and Handling

- GHS (Globally Harmonized System): Ensure all paints, primers, and solvents are labeled and shipped with Safety Data Sheets (SDS) compliant with GHS standards.

- OSHA and Local Workplace Safety Standards: Implement worker protection measures, including ventilation, PPE (Personal Protective Equipment), and exposure monitoring for hazardous substances.

- REACH and TSCA Compliance: Verify that all chemical substances used are registered and reported under EU REACH or U.S. TSCA (Toxic Substances Control Act) as applicable.

Product and Process Certification

- OEM-Specific Approvals: Maintain certifications from major automotive manufacturers (e.g., Ford, BMW, Toyota) for paint systems and application processes.

- ISO Standards: Comply with ISO 9001 (Quality Management), ISO 14001 (Environmental Management), and ISO 45001 (Occupational Health & Safety).

- AQP (Approved Quality Product) or Equivalent: Meet OEM audit requirements for process consistency and traceability.

Logistics and Supply Chain Management

Raw Material Sourcing and Handling

- Supplier Qualification: Source paints, primers, and additives only from approved vendors meeting automotive industry specifications (e.g., GM 6040M, Ford WTP-01).

- Temperature-Controlled Storage: Maintain strict storage conditions (typically 15–25°C) for coatings to prevent degradation. Monitor humidity and avoid contamination.

- Shelf Life Management: Implement FIFO (First-In, First-Out) inventory rotation and track expiration dates to prevent use of expired materials.

In-Plant Material Flow

- Just-in-Time (JIT) Delivery: Coordinate with production schedules to minimize on-site inventory and reduce waste.

- Automated Mixing and Delivery Systems: Use closed-loop systems to reduce VOC emissions and improve paint consistency.

- Traceability: Use barcode/RFID systems to track material batches from receipt to application, ensuring full traceability for quality audits.

Finished Goods Handling and Distribution

- Packaging Standards: Package painted components in protective materials (e.g., anti-static film, custom dunnage) to prevent scratches, static damage, or contamination.

- Climate-Controlled Transport: Ship parts in temperature- and humidity-controlled vehicles to avoid coating stress or adhesive failure.

- Delivery Scheduling: Align shipments with OEM assembly line schedules using EDI (Electronic Data Interchange) systems for seamless Just-in-Sequence (JIS) delivery.

Waste and Emission Control

VOC Abatement Systems

- Install and maintain emission control technologies such as:

- Regenerative Thermal Oxidizers (RTOs)

- Catalytic Oxidizers

- Carbon Adsorption Units

- Conduct regular performance testing and reporting to regulatory agencies.

Waste Minimization Strategies

- Optimize paint application processes (e.g., robotic spraying, electrostatic coating) to reduce overspray.

- Implement paint reclaim systems where feasible.

- Recycle solvent waste via on-site or off-site distillation.

Spill Prevention and Response

- Maintain SPCC (Spill Prevention, Control, and Countermeasure) plans.

- Train personnel in spill response and containment procedures.

- Keep secondary containment systems for storage areas.

Documentation and Audit Preparedness

Required Records

- Material Safety Data Sheets (SDS) for all chemicals

- VOC content reports and emission monitoring logs

- Training records for personnel (safety, environmental, quality)

- Calibration records for application and monitoring equipment

- Traceability logs for raw materials and finished products

Internal and External Audits

- Conduct regular internal audits against ISO, OEM, and environmental standards.

- Prepare for unannounced OEM or regulatory audits with up-to-date documentation and facility readiness.

- Address non-conformances promptly with corrective and preventive actions (CAPA).

Conclusion

Effective logistics and compliance in automotive plastic painting require a holistic approach integrating environmental stewardship, regulatory adherence, supply chain efficiency, and quality assurance. By maintaining rigorous standards across chemical handling, emissions control, material traceability, and documentation, painting operations can ensure reliability, sustainability, and long-term partnership with automotive OEMs.

In conclusion, sourcing automotive plastic painting services requires a strategic approach that balances quality, cost, reliability, and technological capability. Selecting a supplier with industry-specific expertise, adherence to environmental and safety standards, and strong quality control processes is essential to ensure durable, consistent, and visually appealing finishes. Partnering with suppliers who utilize advanced painting technologies—such as robotic application, UV-curable coatings, and eco-friendly paint systems—can enhance efficiency and sustainability. Additionally, evaluating factors such as production capacity, geographic location, and supply chain resilience supports long-term success. Ultimately, effective sourcing in automotive plastic painting contributes to improved product performance, customer satisfaction, and competitiveness in the dynamic automotive market.