The global automotive aftercare market is experiencing robust growth, driven by rising vehicle ownership and increasing consumer focus on vehicle aesthetics and longevity. According to Mordor Intelligence, the automotive aftercare market was valued at approximately USD 28.6 billion in 2023 and is projected to grow at a CAGR of over 6.5% through 2029. A key segment within this space is oxidation removal solutions, essential for restoring faded paintwork and protecting exterior surfaces from environmental degradation. As demand for premium detailing products rises—fueled by both professional service providers and DIY enthusiasts—the market for high-performance automotive oxidation removers is expanding accordingly. With technological advancements in chemical formulations and growing awareness of protective maintenance, manufacturers are innovating to meet stringent quality standards and consumer expectations. This growth trajectory underscores the importance of identifying the leading players who are setting benchmarks in efficacy, sustainability, and product reliability. The following list highlights the top 9 automotive oxidation remover manufacturers shaping this dynamic market.

Top 9 Automotive Oxidation Remover Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Automotive Products

Domain Est. 1995

Website: meguiars.com

Key Highlights: RESTORE LIKE-NEW LOOK: Meguiar’s Ultimate Black Plastic Restorer revives faded exterior trim, vinyl, and rubber with advanced UV protection. This car trim ……

#2 Mothers® Polish

Domain Est. 1995

Website: mothers.com

Key Highlights: Mothers is your go-to online resource for finding the auto detailing supplies you need to give your vehicle the ultimate shine, both inside and out….

#3 Oxidation Remover For Cars

Domain Est. 2003

Website: chemicalguys.com

Key Highlights: Free delivery over $75 · 30-day returns…

#4 Car Detailing Products

Domain Est. 2003

Website: autofinesse.com

Key Highlights: Clean your car with car detailing products, cleaners, polishes and waxes. Car care manufactured in the UK by Auto Finesse® Designed, Developed & Trusted by ……

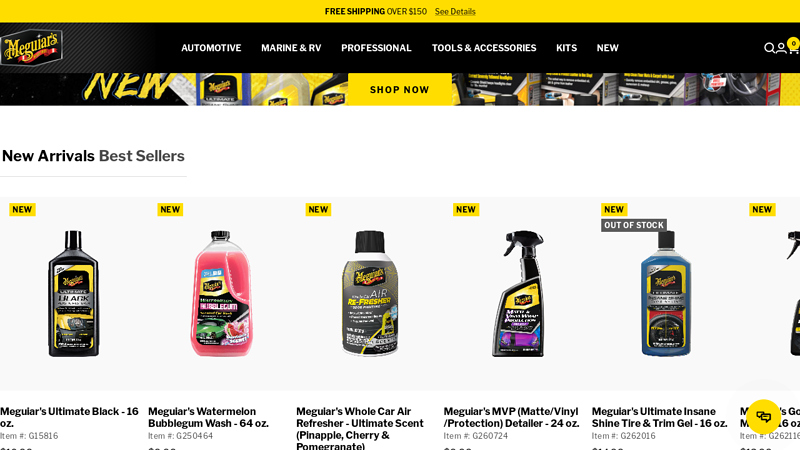

#5 Meguiar’s Direct

Domain Est. 2008

Website: meguiarsdirect.com

Key Highlights: Free delivery over $150 30-day returnsMeguiarsDirect.com is the Official site for Meguiar’s, the trusted experts … Cleaning & Oxidation Removal · Polish, Wax & Protect · Vinyl & …

#6 Meguiars Inc M-4901

Domain Est. 2008

Website: autotoolworld.com

Key Highlights: In stock Rating 4.4 252 Meguiars Inc M-4901 | Marine/RV Heavy Duty Oxidation Remover, 1 Gallon. Removes moderate oxidation, scratches, stains and tough water spots on all ……

#7 Malco Automotive

Domain Est. 2010

Website: malcoautomotive.com

Key Highlights: The Detailing Choice of the Pros: We offer over 150 automotive detailing and car care products. From degreasers to ceramic coatings, we cater to every car ……

#8 Wipe New

Domain Est. 2012

Website: wipenew.com

Key Highlights: Restore. Protect. Shine. Professional interior & exterior detailing supplies for car lovers. Explore Products….

#9 How to Fix a Car with Oxidation: A Step

Domain Est. 2020

Website: phillipsbuickgmctruck.com

Key Highlights: Using a clay bar helps to restore car paint oxidation by removing embedded contaminants that could prevent the next stages of oxidation repair….

Expert Sourcing Insights for Automotive Oxidation Remover

H2: 2026 Market Trends for Automotive Oxidation Remover

The global automotive oxidation remover market is poised for steady growth through 2026, driven by increasing vehicle ownership, rising consumer awareness about vehicle maintenance, and the growing demand for aesthetic preservation of automotive finishes. As vehicles are exposed to environmental stressors—such as UV radiation, pollution, and moisture—oxidation of paintwork becomes a prevalent issue, particularly in aging vehicles. This has led to a surge in demand for effective oxidation removers that restore paint luster and protect surface integrity.

A key trend shaping the 2026 market landscape is the shift toward eco-friendly and biodegradable formulations. Consumers and regulatory bodies alike are prioritizing sustainable automotive care products, prompting manufacturers to innovate with water-based, non-toxic, and VOC-compliant oxidation removers. This green transition is especially prominent in North America and Europe, where environmental regulations are stringent.

Additionally, the expansion of the aftermarket automotive care sector is fueling market growth. With the average age of vehicles on the road increasing in regions like the U.S. and Western Europe, there is a growing need for products that rejuvenate older paint finishes. Oxidation removers are increasingly being integrated into comprehensive detailing kits, enhancing their visibility and accessibility through e-commerce platforms and auto retail chains.

Technological advancements are also playing a crucial role. By 2026, many oxidation removers are expected to feature advanced nano-polishing agents and ceramic-compatible formulas that not only remove oxidation but also leave behind protective coatings. These hybrid solutions appeal to both professional detailers and DIY consumers seeking long-lasting results.

Geographically, the Asia-Pacific region is anticipated to witness the highest growth rate due to rising middle-class income, increased car ownership in countries like India and Indonesia, and a growing culture of vehicle customization and care. Meanwhile, strategic partnerships between chemical manufacturers and automotive brands are expected to drive product innovation and distribution efficiency.

In summary, by 2026, the automotive oxidation remover market will be characterized by sustainability-driven innovation, technological integration, and expanding consumer demand across both mature and emerging markets, positioning it as a vital segment within the broader automotive care industry.

When sourcing an Automotive Oxidation Remover, especially one based on hydrogen (H₂)-related technologies or processes (e.g., catalytic hydrogenation, H₂-based surface treatments, or formulations stabilized with H₂ donors), several common pitfalls can impact both quality and intellectual property (IP) integrity. Below is a structured breakdown using the H₂ context as a guiding principle:

🔹 1. Misunderstanding H₂-Based Formulation Efficacy

Pitfall: Assuming that “H₂-infused” or “hydrogen-activated” implies superior oxidation removal.

- Reality: Molecular hydrogen (H₂) itself is not a direct oxidant or cleaner. Its role is typically indirect—e.g., as a reducing agent in catalytic systems or for stabilizing reactive components.

- Risk: Suppliers may market products with minimal or ineffective H₂ content, misleading buyers about performance.

- Mitigation:

- Request third-party lab validation of redox potential and oxidation layer removal efficiency.

- Verify if H₂ is catalytically delivered (e.g., via nano-bubble dispersion or metal-hydride release) rather than just dissolved.

🔹 2. Inconsistent Quality Due to H₂ Stability Issues

Pitfall: H₂-based formulations degrade quickly if not properly stabilized.

- Issue: Hydrogen gas (H₂) has low solubility and high diffusivity, leading to rapid off-gassing unless encapsulated or chemically bound.

- Consequence: Inconsistent product performance across batches.

- Mitigation:

- Source from suppliers using stabilized delivery systems (e.g., H₂-releasing molecules like sodium borohydride or magnesium hydride).

- Require batch-specific gas retention data and shelf-life testing.

- Check for hermetic packaging or on-site H₂ generation mechanisms.

🔹 3. Intellectual Property (IP) Risks in H₂-Activated Technologies

Pitfall: Unknowingly sourcing a product that infringes on patented H₂ delivery or catalytic methods.

- Examples:

- Patented nano-catalysts (e.g., Pd/Ni composites) that enable H₂ reduction at ambient temps.

- IP-protected electrochemical H₂ generation systems for on-demand oxidation removal.

- Risk: Legal exposure, supply chain disruption, or forced reformulation.

- Mitigation:

- Conduct freedom-to-operate (FTO) analysis before adoption.

- Require suppliers to warrant IP non-infringement in contracts.

- Audit supplier R&D disclosures for patent citations.

🔹 4. Overlooking Material Compatibility with H₂ Processes

Pitfall: H₂-based removers may embrittle certain metals (e.g., high-strength steel) or damage rubber/plastic trims.

- Hidden Risk: Hydrogen embrittlement can compromise vehicle structural integrity over time.

- Mitigation:

- Require material compatibility testing reports (per ASTM F1448 or ISO 7599).

- Prefer targeted formulations that limit free H₂ exposure to sensitive substrates.

- Use inhibitors or chelators in the formulation to control H₂ reactivity.

🔹 5. Lack of Process Control in H₂ Generation (On-Site Systems)

Pitfall: Sourcing equipment that generates H₂ on-demand (e.g., electrolytic removers) without proper controls.

- Issues:

- Inconsistent H₂ concentration → variable cleaning results.

- Safety hazards (H₂ is flammable at >4% in air).

- Mitigation:

- Ensure systems have real-time H₂ sensors and pressure regulation.

- Verify compliance with ISO 15869 (hydrogen fuel systems) or CGA G-5.5 standards.

- Prefer closed-loop systems with feedback controls.

🔹 6. Greenwashing Around “Hydrogen-Powered” Claims

Pitfall: Marketing emphasizes “H₂” for sustainability, but actual environmental benefit is negligible.

- Example: A product claims to be “eco-friendly due to hydrogen,” but uses energy-intensive H₂ production (e.g., SMR without CCS).

- Mitigation:

- Request life cycle analysis (LCA) data.

- Prefer H₂ generated via green electrolysis if sustainability is a goal.

- Validate claims against ISO 14040/44 standards.

✅ Best Practices Summary (H₂-Centric Sourcing)

| Area | Best Practice |

|——|—————|

| Quality | Demand H₂ concentration stability data, third-party redox testing |

| IP Protection | Conduct FTO search, secure IP indemnity clauses |

| Safety | Verify H₂ containment, pressure safety, flammability controls |

| Performance | Test on real-world oxidized substrates (paint, chrome, alloy) |

| Sustainability | Audit H₂ source (green vs. grey), packaging recyclability |

Conclusion:

Sourcing an effective Automotive Oxidation Remover with H₂-related technology requires due diligence beyond surface-level claims. Focus on verifiable H₂ delivery mechanisms, IP clearance, and real-world performance data to avoid costly quality failures or legal exposure. Prioritize suppliers with transparent chemistry, robust testing, and clear intellectual property positioning.

H2: Logistics & Compliance Guide for Automotive Oxidation Remover

H2: Logistics & Compliance Guide for Automotive Oxidation Remover

This guide outlines the critical logistics and compliance considerations for the safe handling, storage, transportation, and regulatory compliance of Automotive Oxidation Remover products. Adherence to these guidelines ensures safety, legal compliance, and operational efficiency across the supply chain.

1. Product Classification & Hazard Identification

Automotive Oxidation Remover typically contains chemical solvents, acids (e.g., oxalic or citric acid), or abrasive compounds designed to remove oxidation from metal or painted surfaces.

- UN Number: Varies by formulation. Common classifications include:

- UN1130: Flammable liquid, n.o.s. (if solvent-based)

- UN3264: Corrosive liquid, acidic, inorganic, n.o.s. (if acid-based)

- GHS Classification:

- Flammability: May be classified as Flammable Liquid (Category 3 or 4) if volatile solvents are present.

- Skin Corrosion/Irritation: Often Category 1B (corrosive) or Category 2 (irritant).

- Eye Damage: Category 1 (serious damage).

- Hazard Statements (Examples):

- H226: Flammable liquid and vapor.

- H314: Causes severe skin burns and eye damage.

- H318: Causes serious eye damage.

- Packaging Group: II (medium danger) or III (low danger), depending on concentration and formulation.

✅ Action: Confirm exact classification via Safety Data Sheet (SDS) and product testing.

2. Regulatory Compliance

a. Globally Harmonized System (GHS)

- Ensure all labels comply with GHS standards (pictograms, signal words, hazard statements, precautionary statements).

- Provide updated SDS (16-section format) in local language(s) for all markets.

b. U.S. Regulations (DOT, OSHA, EPA)

- DOT (Department of Transportation): Compliant packaging, labeling, and shipping papers per 49 CFR.

- Hazard Class: 3 (Flammable Liquids) or 8 (Corrosives).

- Proper shipping name: e.g., “Corrosive liquid, acidic, aqueous, organic, n.o.s.”.

- OSHA HazCom Standard: Employers must maintain SDS and train workers on chemical hazards.

- EPA: May apply if product contains regulated VOCs or hazardous substances. Check TSCA compliance.

c. EU Regulations (CLP, ADR, REACH)

- CLP Regulation (EC) No 1272/2008: Align labeling and classification with EU standards.

- ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road): Required for cross-border transport.

- REACH: Confirm substance registration and communication in the supply chain.

d. Other Regions

- Canada: TDG (Transportation of Dangerous Goods) and WHMIS 2015 compliance.

- Australia: ADG Code and alignment with GHS (Safe Work Australia).

- Asia: Check local regulations (e.g., China’s MEA, Japan’s ISHL).

✅ Action: Maintain region-specific compliance documentation and verify updates annually.

3. Packaging & Labeling Requirements

- Use UN-certified packaging with proper closure, inner liners, and compatibility with chemical contents.

- Label with:

- Product identifier

- GHS pictograms (e.g., flame, corrosion)

- Signal word (“Danger”)

- Hazard and precautionary statements

- Supplier contact information

- Net quantity

- Secondary packaging (e.g., shrink-wrapped pallets) must protect primary containers.

✅ Action: Conduct compatibility testing between product and packaging materials.

4. Storage Guidelines

- Location: Well-ventilated, cool, dry area away from direct sunlight and heat sources.

- Segregation: Store away from:

- Flammables (if oxidizer present)

- Bases and reactive chemicals

- Food, feed, and personal care products

- Containment: Use spill pallets or bunds to contain leaks.

- Shelving: Non-combustible materials; acid-resistant coatings if corrosive.

✅ Action: Implement a chemical inventory system with expiration date tracking.

5. Transportation & Shipping

- Mode-Specific Rules:

- Road (e.g., ADR, DOT): Use placarded vehicles if shipping large quantities.

- Air (IATA): Limited or prohibited if flammable or corrosive above thresholds.

- Sea (IMDG): Proper stowage and segregation on vessels.

- Documentation:

- Dangerous Goods Declaration

- SDS

- Shipper’s Declaration (for air/sea)

- Training: Drivers and handlers must have DG training (e.g., IATA/ADR/DOT certified).

✅ Action: Partner with carriers experienced in dangerous goods logistics.

6. Emergency Preparedness & Spill Response

- Spill Kit: Include absorbents (non-combustible), PPE, neutralizers (for acids), and disposal bags.

- First Aid:

- Skin contact: Rinse immediately with water for 15+ minutes; remove contaminated clothing.

- Eye contact: Flush with eyewash station; seek medical attention.

- Inhalation: Move to fresh air.

- Reporting: Notify local authorities per regulatory requirements (e.g., CERCLA in U.S., EPCRA).

✅ Action: Conduct spill drills and maintain emergency contact list.

7. Worker Safety & Training

- Provide GHS-compliant SDS and train employees on:

- Hazard recognition

- PPE usage (gloves, goggles, aprons, respirators if needed)

- Safe handling and disposal

- Emergency procedures

- Maintain training records and update annually.

8. Disposal & Environmental Considerations

- Do not dispose of down drains or in regular trash.

- Follow local regulations for hazardous waste disposal.

- Recycle packaging where possible.

- Monitor VOC content for air quality compliance.

✅ Action: Partner with licensed hazardous waste disposal providers.

Summary Checklist

| Task | Status |

|——|——–|

| Confirm UN number and hazard class | ☐ |

| Prepare GHS-compliant labels and SDS | ☐ |

| Use UN-certified packaging | ☐ |

| Train staff in hazardous materials handling | ☐ |

| Implement safe storage procedures | ☐ |

| Partner with certified dangerous goods carriers | ☐ |

| Maintain emergency response plan | ☐ |

| Review compliance annually | ☐ |

By following this H2-level Logistics & Compliance Guide, distributors, retailers, and handlers of Automotive Oxidation Remover can ensure full regulatory adherence, protect personnel and the environment, and maintain smooth supply chain operations. Always consult the product-specific SDS and local authorities for exact requirements.

In conclusion, sourcing an effective automotive oxidation remover requires careful consideration of product quality, compatibility with various vehicle surfaces, environmental impact, and cost-efficiency. It is essential to partner with reliable suppliers who adhere to industry standards and offer consistent product performance. Evaluating factors such as active ingredient composition, ease of application, and customer feedback ensures the chosen solution effectively restores paint finish and enhances vehicle longevity. Ultimately, a well-sourced oxidation remover not only improves aesthetic appeal but also supports long-term vehicle maintenance and customer satisfaction in the automotive care industry.