The global automotive gasket materials market is experiencing robust growth, driven by increasing vehicle production, stringent emission regulations, and the rising demand for high-performance sealing solutions. According to Grand View Research, the market was valued at USD 6.9 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. This expansion is further fueled by advancements in material science, particularly the adoption of composite and elastomeric materials capable of withstanding extreme temperatures and aggressive fluids. As automakers prioritize durability, efficiency, and lightweight design, gasket material manufacturers are under growing pressure to innovate. In this competitive landscape, a select group of global suppliers are leading the charge in technology, quality, and scale. Based on market share, product innovation, and application reach, here are the top 10 automotive gasket material manufacturers shaping the industry’s future.

Top 10 Automotive Gasket Material Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Permatex®

Domain Est. 1995

Website: permatex.com

Key Highlights: Proven and Reliable OEM Partner. As a leader in supplying automotive sealants, Permatex offers superior R&D, production, distribution capabilities and more….

#2 Cometic Gasket

Domain Est. 1996

Website: cometic.com

Key Highlights: Cometic manufactures gaskets and engine sealing solutions for Automotive, Powersport, V-Twin, Marine, and OEM, as well as Remanufactured Engine, Agricultural, ……

#3 Gaskets

Domain Est. 2000

Website: mahle-aftermarket.com

Key Highlights: The MAHLE Performance gasket line is built from the ground up, using the latest technology and most advanced materials to seal and protect engines designed to ……

#4 Lamons

Domain Est. 2002

Website: lamons.com

Key Highlights: Lamons is one of the largest custom gasket, bolt, & seal manufacturers globally, committed to providing industry leading sealing solutions. Call us today!…

#5 Gaskets

Domain Est. 1995

Website: garlock.com

Key Highlights: Garlock gaskets are offered in a wide range of materials and configurations, including GYLON® Restructured PTFE, Compressed Fiber, GRAPH-LOCK® Flexible Graphite ……

#6 Mr. Gasket ()

Domain Est. 1995

Website: holley.com

Key Highlights: Free delivery over $149 · 90-day returnsMr. Gasket as the go-to gasket source for racers with a line of head gaskets, exhaust gaskets, oil pan gaskets, and fasteners that sealed p…

#7 Rubber Gaskets Seals, What is a Gasket?

Domain Est. 1995

Website: fst.com

Key Highlights: Gaskets produced by Freudenberg Sealing Technologies are designed as an integral part of a sealed system. Each gasket is engineered to exacting specifications….

#8 Fel-Pro Gaskets

Domain Est. 1998

Website: felpro.com

Key Highlights: Trust Fel-Pro gaskets for innovative sealing solutions for your engine. From gasket sets to rear main seals, we have what you need for that next repair….

#9 Durlon

Domain Est. 2000

Website: durlon.com

Key Highlights: Durlon is a sealing solutions company providing high-quality gasket materials across industries. Contact our experts for custom gasket solutions….

#10 Gasket Product Overview

Domain Est. 2009

Website: megagasket.com

Key Highlights: Mega gaskets offer several types of engine gasket kits and different engine gasket sets for Japanese, Korean, European, and American vehicles….

Expert Sourcing Insights for Automotive Gasket Material

H2: 2026 Market Trends for Automotive Gasket Material

The automotive gasket material market in 2026 is poised for significant transformation, driven by rapid technological advancements, stringent environmental regulations, and shifting vehicle architectures. Key trends shaping the landscape include:

1. Dominance of Advanced Elastomers and Composites

By 2026, high-performance elastomers such as Fluorocarbon (FKM/Viton®), Hydrogenated Nitrile Butadiene Rubber (HNBR), and Ethylene Acrylic (AEM) are expected to see increased adoption. These materials offer superior resistance to higher underhood temperatures, aggressive coolants, and new fuel formulations (including biofuels and e-fuels). Meanwhile, expanded graphite, PTFE composites, and multi-layer steel (MLS) gaskets will continue to grow in critical sealing applications like cylinder heads and exhaust systems due to their thermal stability and durability.

2. Electrification Driving Material Innovation

With the rise of electric vehicles (EVs), traditional engine gasket demand will decline. However, new opportunities emerge in battery thermal management systems, power electronics, and electric motor sealing. Materials resistant to dielectric fluids, offering excellent thermal conductivity, and ensuring long-term reliability under variable loads will be in high demand. Silicone-based gaskets and specialized thermoplastic elastomers (TPEs) tailored for EV-specific environments will gain traction.

3. Sustainability and Recyclability Pressures

Environmental regulations and OEM sustainability goals will push demand for recyclable, bio-based, and low-VOC (volatile organic compound) gasket materials. Manufacturers are investing in bio-sourced rubbers and halogen-free formulations to reduce environmental impact across the lifecycle. End-of-life recyclability of gasket composites, particularly in multi-material assemblies, will become a key differentiator.

4. Lightweighting and Material Efficiency

Continued focus on fuel efficiency and EV range will drive demand for lighter, thinner, yet high-strength gasket materials. Advances in nanocomposites and engineered non-asbestos materials will enable reduced thickness without compromising sealing performance. This trend supports vehicle lightweighting strategies while maintaining reliability.

5. Regional Market Divergence

Growth will be strongest in Asia-Pacific, particularly China and India, due to expanding EV production and domestic automotive manufacturing. North America and Europe will see steady demand driven by emissions regulations and premium vehicle production, with a strong emphasis on high-performance and sustainable materials. Supply chain localization will also influence material sourcing strategies.

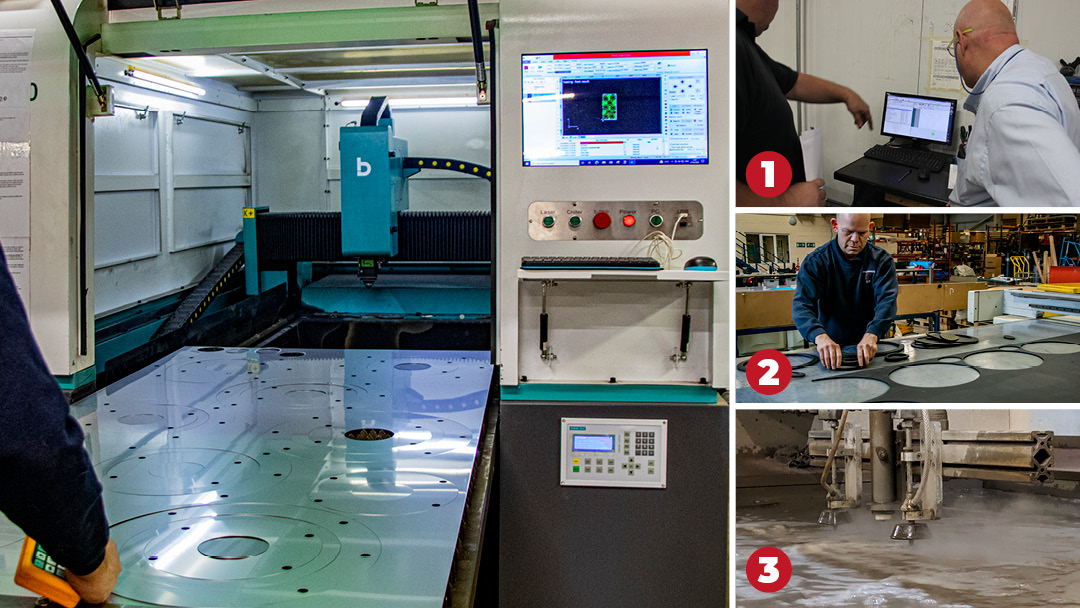

6. Digitalization and Smart Manufacturing

By 2026, digital twin technology and AI-driven material simulation will accelerate R&D cycles for new gasket compounds. Predictive maintenance and quality control using IoT sensors in manufacturing will enhance consistency and reduce defects, improving overall performance and cost-efficiency.

Conclusion

The 2026 automotive gasket material market will be defined by a shift toward high-performance, sustainable, and application-specific solutions. While traditional combustion engine materials remain relevant, innovation will increasingly focus on supporting electrification, reducing environmental impact, and enabling next-generation vehicle architectures. Suppliers who anticipate these changes and invest in R&D and sustainable practices will lead the market.

Common Pitfalls When Sourcing Automotive Gasket Material (Quality, IP)

Sourcing automotive gasket materials requires careful attention to both performance specifications and intellectual property (IP) considerations. Overlooking key factors can lead to component failure, regulatory non-compliance, legal disputes, and reputational damage. Below are common pitfalls in quality and IP management:

Quality-Related Pitfalls

1. Insufficient Material Specification Alignment

A frequent error is failing to match gasket material properties precisely to the application’s operating conditions—such as temperature, pressure, chemical exposure (e.g., oils, coolants, fuels), and mechanical stress. Using a general-purpose material instead of an engineered solution can result in premature failure, leaks, or safety hazards.

2. Inadequate Supplier Qualification

Relying on suppliers without rigorous vetting increases the risk of inconsistent quality. Pitfalls include selecting vendors based solely on price, ignoring certifications (e.g., IATF 16949), or lacking on-site audits. Unverified suppliers may provide off-spec or counterfeit materials.

3. Poor Batch-to-Batch Consistency

Even with qualified suppliers, variability in manufacturing processes can lead to inconsistent material thickness, durometer (hardness), or compressibility. Without robust incoming inspection and statistical process control (SPC), these variations may go undetected until field failures occur.

4. Incomplete Environmental and Regulatory Compliance

Gasket materials must meet automotive industry standards (e.g., ASTM, SAE, OEM-specific specs) and environmental regulations (e.g., REACH, RoHS). Overlooking restricted substances or failing to obtain proper compliance documentation can result in shipment rejections or penalties.

5. Inadequate Testing and Validation

Skipping real-world simulation tests—such as thermal cycling, compression set, or fluid resistance—can mask latent quality issues. Materials may perform well in lab conditions but fail under actual vehicle operating environments.

Intellectual Property (IP)-Related Pitfalls

1. Unauthorized Use of Proprietary Formulations

Some high-performance gasket materials (e.g., specialty elastomers or composites) are protected by patents or trade secrets. Sourcing equivalent materials without verifying freedom to operate can expose the buyer to infringement claims, especially if the substitute mimics a patented composition or manufacturing method.

2. Lack of IP Clauses in Supplier Agreements

Failing to include clear IP ownership and indemnification terms in contracts leaves the buyer vulnerable. If a supplier provides a material that infringes third-party IP, the automotive manufacturer may be held liable unless the contract shifts responsibility to the supplier.

3. Reverse Engineering Risks

Attempting to replicate OEM-approved gasket materials without proper licensing can violate patent or design rights. Even if the reverse-engineered material performs adequately, legal exposure remains significant, particularly in global markets with strong IP enforcement.

4. Inadequate Documentation of Material Origins

Without complete traceability—such as material data sheets, chain of custody, and IP disclaimers—proving lawful use during an audit or litigation becomes difficult. This is critical when supplying to OEMs that demand full supply chain transparency.

5. Overlooking Trademark and Branding Issues

Using supplier names, logos, or branded material names (e.g., “Viton™” instead of generic “FKM”) incorrectly in procurement or documentation can lead to trademark violations, even if the material itself is legitimate.

Avoiding these pitfalls requires a structured sourcing strategy that integrates technical validation, supply chain diligence, and proactive IP risk assessment. Partnering with legally compliant, certified suppliers and conducting thorough due diligence are essential to ensuring both quality and IP integrity in automotive gasket procurement.

Logistics & Compliance Guide for Automotive Gasket Material

This guide outlines the essential logistics and compliance considerations for handling, transporting, storing, and managing automotive gasket materials throughout the supply chain.

Regulatory Compliance Requirements

Automotive gasket materials must comply with a range of regional and international regulations. Key compliance areas include:

- REACH (EU): Registration, Evaluation, Authorisation and Restriction of Chemicals. Ensure all chemical constituents in gasket materials (e.g., elastomers, fillers, adhesives) are registered and comply with SVHC (Substances of Very High Concern) restrictions.

- RoHS (EU): Restriction of Hazardous Substances. Verify that gasket materials do not contain restricted substances such as lead, mercury, cadmium, hexavalent chromium, PBBs, or PBDEs above permissible limits.

- IMDS (International Material Data System): Required by most automotive OEMs. All gasket materials must be accurately documented in IMDS, including full chemical composition and material hierarchy.

- TSCA (USA): Toxic Substances Control Act. Confirm all chemicals used in gasket production are listed or exempt under TSCA.

- ELV (End-of-Life Vehicles Directive): Ensure materials support recyclability and do not contain banned substances; provide necessary data for vehicle recycling.

- Country-Specific Regulations: Comply with local environmental and safety standards (e.g., KC in Korea, CCC in China, JIS in Japan).

Maintain up-to-date Safety Data Sheets (SDS) compliant with GHS standards for all gasket materials.

Packaging and Labeling Standards

Proper packaging and labeling are critical to ensure material integrity and regulatory compliance:

- Protective Packaging: Use moisture-resistant, dust-proof, and impact-resistant packaging (e.g., sealed polybags, corrugated cartons with cushioning). Prevent deformation of sheet materials or pre-cut gaskets.

- Labeling Requirements:

- Part number, material type (e.g., graphite, rubber, cork composite), and batch/lot number.

- Compliance marks (e.g., RoHS, REACH).

- Handling symbols (e.g., “Fragile,” “Do Not Stack,” “Keep Dry”).

- IMDS reference code.

- Traceability: Ensure batch-level traceability through barcode or QR code systems to support recalls and quality audits.

Storage Conditions and Shelf Life Management

Gasket materials are sensitive to environmental conditions; improper storage can degrade performance:

- Temperature: Store between 15°C and 25°C (59°F–77°F). Avoid exposure to extreme heat or cold.

- Humidity: Maintain relative humidity below 60% to prevent moisture absorption, especially in cork or cellulose-based materials.

- Light Exposure: Protect from direct sunlight and UV radiation to prevent material degradation.

- Shelf Life: Adhere to manufacturer-specified shelf life (typically 12–24 months for elastomeric materials). Implement FIFO (First-In, First-Out) inventory practices.

- Storage Positioning: Store flat and avoid stacking heavy items on top to prevent warping or compression set.

Transportation and Handling Procedures

Safe and efficient transportation ensures material quality upon delivery:

- Mode of Transport: Use enclosed, climate-controlled trucks or containers where possible, especially for temperature-sensitive materials.

- Load Securing: Prevent shifting during transit using straps, braces, or dunnage. Avoid compression of soft gasket sheets.

- Cross-Contamination Prevention: Segregate gasket materials from chemicals, oils, or abrasive substances during transit.

- Handling Equipment: Use non-abrasive tools and pallet jacks; avoid dragging or dropping packages.

- Documentation: Include shipping manifests, compliance certificates, and SDS with each shipment.

Supply Chain Traceability and Documentation

Robust documentation supports compliance, quality control, and customer requirements:

- Certificates of Compliance (CoC): Provide CoC with each shipment, confirming adherence to specifications and regulatory standards.

- Batch Traceability Logs: Maintain records linking raw materials, production batches, and shipped goods.

- OEM-Specific Requirements: Comply with automotive customer mandates (e.g., PPAP documentation, AS9100 or IATF 16949 quality system alignment).

- Audit Readiness: Store all compliance and logistics records for a minimum of 10 years, as required by automotive industry standards.

End-of-Life and Recycling Considerations

Support circular economy principles in line with automotive sustainability goals:

- Recycling Programs: Partner with certified recyclers for scrap or rejected gasket materials, especially metals or elastomers.

- Waste Classification: Classify waste according to local regulations (hazardous vs. non-hazardous) based on material composition.

- Take-Back Schemes: Where applicable, participate in OEM-led end-of-life material recovery initiatives.

Adhering to this logistics and compliance framework ensures that automotive gasket materials meet performance expectations, regulatory mandates, and sustainability objectives across global markets.

Conclusion: Sourcing Automotive Gasket Material

In conclusion, sourcing high-quality automotive gasket materials requires a strategic approach that balances performance, reliability, cost-efficiency, and compliance with industry standards. The selection of appropriate gasket materials—such as rubber (NBR, silicone), cork composites, graphite, or advanced elastomers—depends on specific application requirements including temperature resistance, chemical exposure, pressure loads, and durability.

Key considerations in the sourcing process include supplier credibility, material certifications (such as ISO/TS 16949), consistency in manufacturing quality, and the ability to meet volume and lead time demands. Partnering with specialized, experienced suppliers ensures access to technically validated materials and ongoing support for engineering and testing.

Additionally, emerging trends such as lightweighting, electric vehicle development, and stricter emissions regulations are driving innovation in gasket materials, making it essential for automotive manufacturers to stay agile and informed.

Ultimately, effective sourcing of gasket materials contributes significantly to engine reliability, emissions control, and overall vehicle performance. A well-structured sourcing strategy not only mitigates supply chain risks but also supports long-term product integrity and customer satisfaction in the competitive automotive market.