The global automotive computer programming market is experiencing robust expansion, driven by rising demand for advanced driver-assistance systems (ADAS), electric vehicles (EVs), and vehicle connectivity solutions. According to Grand View Research, the automotive software market was valued at USD 31.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.7% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of over 9.5% during the forecast period of 2023–2028, fueled by increasing integration of AI, over-the-air (OTA) updates, and autonomous driving technologies. As vehicles evolve into software-defined platforms, a select group of manufacturers are leading innovation in embedded systems, real-time operating systems, and vehicle network programming. Below are the top 10 automotive computer programming manufacturers shaping the future of mobility through cutting-edge software solutions.

Top 10 Automotive Computer Programming Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 OEM Service Websites

Domain Est. 1995

Website: dgtech.com

Key Highlights: We provide automotive service websites to help you with your repairs. Reprogramming may be the only way to fix some of these issues….

#2 BPM Microsystems to program Devices Programming Systems

Domain Est. 2006

Website: bpmmicro.com

Key Highlights: BPM Microsystems is the leading global provider of device programming systems for test and measurement systems, factory integration software, and solutions for ……

#3 J2534 Programmers and Flashers for Automotive Diagnostics

Domain Est. 1996

Website: aeswave.com

Key Highlights: 2-day delivery> Flash Programming ; CarDAQ Plus 3 with Bluetooth. (AES# DT-CDP3+BT). $2,220.00. $61 / mo. Add to Cart. More · CarDAQ Pro. (AES# DT-CD-pro)….

#4 Autel

Domain Est. 2008

Website: autel.us

Key Highlights: Future-proof your shop with Autel Webinars covering ADAS calibration, TPMS Service and Advanced Vehicle Diagnostics. Get the know-how your shop needs with….

#5 High-Quality Vehicle Keys and Diagnostics

Domain Est. 2009

Website: advanced-diagnostics.com

Key Highlights: AD manufacture high quality vehicle key-programming and programming diagnostics software. Specifically developed for auto technicians, engineers and garages….

#6 Automotive Computer Reprogramming, Vehicle Programming …

Domain Est. 2016

Website: airprodiagnostics.com

Key Highlights: Reduce downtime and improve accuracy with AirPro’s remote vehicle computer reprogramming. Our expert Brand Specialists deliver fast, reliable solutions for ……

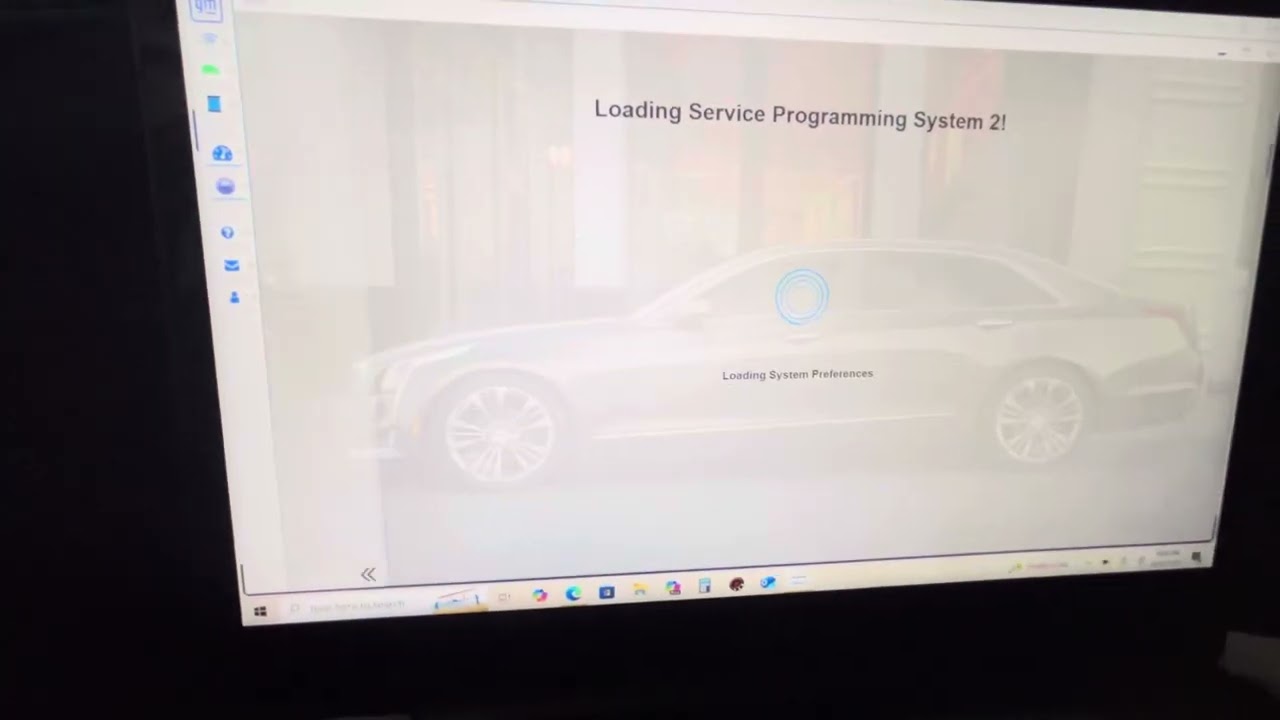

#7 ACDelco TDS

Website: acdelcotds.com

Key Highlights: ACDelco Technical Delivery System is General Motors’ service information, diagnostics, and service programming portal to the automotive aftermarket….

#8 Softing Automotive

Website: automotive.softing.com

Key Highlights: Softing Automotive is with the core areas of expertise diagnostics and testing at the cutting edge of key technologies in vehicle electronics….

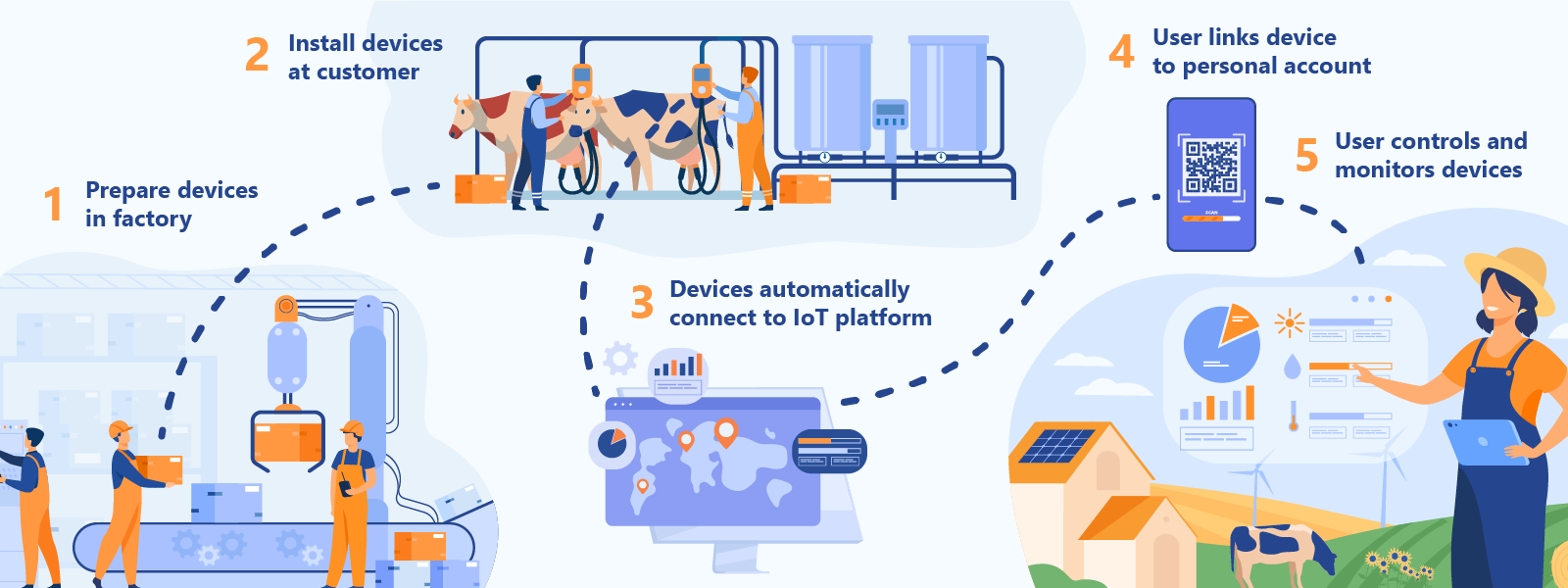

#9 Automated Device Programming & IoT Security Provisioning Solutions

Website: dataio.com

Key Highlights: Data I/O is the leading global provider of automated semiconductor device programming and IoT security provisioning solutions….

#10 The Ultimate Guide to Automotive Computer Programming

Website: rochasautomotive.com

Key Highlights: Need a new or used module programmed? Rochas Automotive offers expert automotive computer programming for all vehicles, ……

Expert Sourcing Insights for Automotive Computer Programming

2026 Market Trends for Automotive Computer Programming

Increasing Integration of AI and Machine Learning

By 2026, artificial intelligence (AI) and machine learning (ML) are expected to play a central role in automotive computer programming. Automakers and software developers are increasingly embedding AI into vehicle systems to enable advanced driver-assistance systems (ADAS), predictive maintenance, and personalized user experiences. Machine learning algorithms will be used to process real-time data from cameras, radar, and lidar sensors, improving decision-making for semi-autonomous and autonomous driving functions. This trend will drive demand for skilled programmers with expertise in neural networks, computer vision, and data analytics.

Growth in Electric and Connected Vehicles

The shift toward electric vehicles (EVs) and connected car technologies will significantly influence automotive software development. By 2026, most new vehicles are projected to offer some level of connectivity, requiring robust programming for over-the-air (OTA) updates, telematics, and cloud integration. Automotive programmers will need to focus on energy management systems, battery optimization, and vehicle-to-everything (V2X) communication protocols. This evolution will expand the complexity of in-vehicle software stacks and increase the need for secure, scalable, and real-time computing solutions.

Emphasis on Cybersecurity

As vehicles become more connected and software-dependent, cybersecurity will be a top priority in automotive programming. By 2026, regulatory standards and consumer expectations will require automakers to implement advanced security protocols within vehicle software. Automotive programmers will be tasked with developing intrusion detection systems, secure boot mechanisms, and encrypted communication channels. The demand for professionals skilled in secure coding practices and automotive-specific cybersecurity frameworks (e.g., ISO/SAE 21434) will surge.

Rise of Software-Defined Vehicles

The concept of software-defined vehicles (SDVs) will gain momentum by 2026, where core functionalities are controlled primarily by software rather than hardware. This shift enables greater flexibility, faster innovation cycles, and enhanced user customization. Automotive computer programming will focus on modular software architectures, service-oriented designs, and centralized computing platforms. Programmers will work extensively with middleware like AUTOSAR Adaptive and cloud-native technologies to support dynamic feature deployment and continuous integration/continuous delivery (CI/CD) pipelines.

Expansion of Autonomous Driving Technologies

Autonomous driving systems will continue to advance, with many automakers targeting Level 3 and conditional Level 4 autonomy by 2026. This progression will require sophisticated programming for sensor fusion, path planning, and real-time control systems. Automotive software engineers will need expertise in real-time operating systems (RTOS), high-performance computing, and simulation environments for testing and validation. Investment in autonomous driving software is expected to grow significantly, especially in urban mobility and logistics applications.

Talent Demand and Skill Evolution

The evolving landscape will create a high demand for skilled automotive software developers. By 2026, employers will seek professionals with hybrid expertise in embedded systems, cloud computing, AI, and automotive engineering. Programming languages such as C++, Python, and Rust will be in high demand, alongside tools for model-based design and simulation. Educational institutions and training programs are expected to expand curricula to meet these industry needs, emphasizing hands-on experience with automotive-grade development environments.

Conclusion

The 2026 market for automotive computer programming is poised for transformative growth, driven by technological advancements in AI, electrification, connectivity, and autonomy. As vehicles evolve into mobile computing platforms, the role of software developers will become increasingly critical. Success in this domain will depend on adaptability, continuous learning, and a deep understanding of both software engineering principles and automotive-specific requirements.

Common Pitfalls in Sourcing Automotive Computer Programming (Quality, IP)

Sourcing automotive computer programming—whether for ECUs, infotainment systems, ADAS, or telematics—introduces complex challenges, particularly around quality assurance and intellectual property (IP) protection. Failing to address these can lead to product failures, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Inadequate Quality Standards and Processes

Many suppliers may claim compliance with automotive standards but lack rigorous implementation. A common pitfall is assuming that software developed for consumer electronics can be directly adapted for automotive use. Automotive software must meet stringent functional safety requirements defined by ISO 26262 and quality management standards like IATF 16949. Sourcing from partners without proven processes for requirements traceability, robust testing (including HIL and SIL), and defect management increases the risk of field failures and safety issues.

Lack of Functional Safety Compliance

Automotive software often controls safety-critical systems. A major pitfall is partnering with vendors who do not adhere to ASIL (Automotive Safety Integrity Level) requirements. Without proper hazard analysis, safety goals, and safety mechanisms embedded in the software design, the resulting code may not be certifiable. This can delay vehicle type approvals and expose OEMs to liability.

Insufficient Verification and Validation

Relying solely on supplier-provided test reports is risky. Many vendors perform basic functionality testing but skip rigorous regression, fault injection, or real-world scenario testing. Sourcing without demanding independent validation increases the likelihood of undetected bugs that manifest only under specific conditions—potentially leading to recalls or safety incidents.

Unclear Intellectual Property Ownership

Ambiguity in IP rights is a frequent and costly pitfall. Contracts that fail to explicitly define ownership of source code, algorithms, and tools can lead to disputes. For example, if a supplier retains rights to reusable code modules, the OEM may face licensing fees for future projects or lose control over software updates. Always ensure contracts specify that all custom-developed IP transfers to the buyer.

Use of Third-Party or Open-Source Components Without Proper Licensing

Suppliers may incorporate third-party libraries or open-source software (e.g., Linux, AUTOSAR modules) without proper license compliance. This can expose the OEM to legal risks, including GPL contamination or royalty obligations. Sourcing agreements must require full software bill of materials (SBOM) disclosure and proof of license compliance.

Poor Documentation and Knowledge Transfer

Automotive software must be maintainable over a vehicle’s 10–15 year lifecycle. A common pitfall is receiving poorly documented code with no architecture diagrams, API specifications, or test procedures. This hampers future updates, troubleshooting, and audits. Ensure sourcing contracts mandate comprehensive documentation and structured knowledge transfer.

Inadequate Cybersecurity Measures

With increasing connectivity, automotive software must be resilient to cyber threats. Sourcing from vendors without secure coding practices (e.g., MISRA C compliance) or threat modeling processes puts vehicles at risk. Verify that suppliers follow ISO/SAE 21434 for cybersecurity engineering and provide evidence of penetration testing.

Overlooking Long-Term Support and Maintenance

Software requires updates, patches, and compatibility fixes over time. A pitfall occurs when suppliers offer no clear maintenance roadmap or charge exorbitant fees for post-launch support. Ensure sourcing agreements include long-term support clauses, source code escrow, and clear ownership of future modifications.

Avoiding these pitfalls requires thorough due diligence, well-structured contracts, and active supplier management. Prioritizing quality processes and IP clarity from the outset safeguards both product integrity and business interests.

Logistics & Compliance Guide for Automotive Computer Programming

Overview

This guide outlines the logistical and compliance considerations involved in automotive computer programming, including software development, distribution, regulatory standards, and supply chain management. As vehicles become increasingly software-driven, ensuring secure, compliant, and efficient programming processes is critical.

Regulatory Compliance Requirements

ISO 26262 – Functional Safety

ISO 26262 is the international standard for functional safety in road vehicles. Automotive computer programming must adhere to its guidelines to ensure that software systems do not create hazards due to failures.

– Conduct Hazard and Risk Assessment (HARA)

– Implement ASIL (Automotive Safety Integrity Level) classification

– Follow safety lifecycle from concept to decommissioning

UN Regulation No. 155 (Cybersecurity)

Mandates cybersecurity management systems (CSMS) for vehicle manufacturers.

– Establish a Cybersecurity Management System (CSMS)

– Perform threat analysis and risk assessments (TARA)

– Ensure secure software updates and monitoring throughout the vehicle lifecycle

UN Regulation No. 156 (Software Updates)

Focuses on secure and reliable over-the-air (OTA) and offline software updates.

– Implement Secure Software Update Management System (SUMS)

– Validate update authenticity and integrity

– Prevent unauthorized modifications

GDPR and Data Privacy (EU)

Automotive software that collects personal data (e.g., location, driver behavior) must comply with GDPR.

– Conduct Data Protection Impact Assessments (DPIA)

– Obtain user consent for data collection

– Implement data minimization and encryption

Regional Regulations

Compliance varies by region (e.g., NHTSA in the U.S., CCC in China). Ensure adherence to local requirements for emissions, telematics, and driver assistance systems.

Software Development and Logistics

Secure Coding Practices

- Follow MISRA C/C++ guidelines for embedded systems

- Perform static and dynamic code analysis

- Integrate security-by-design principles

Version Control and Configuration Management

- Use version control systems (e.g., Git) with branching strategies

- Maintain traceability from requirements to code to testing

- Implement change management and audit trails

Over-the-Air (OTA) Update Logistics

- Establish secure delivery infrastructure

- Segment updates by vehicle model, region, and software version

- Monitor deployment success and rollback procedures

Supply Chain and Third-Party Software

- Vet third-party libraries and open-source components for vulnerabilities

- Maintain a Software Bill of Materials (SBOM)

- Ensure compliance with licensing terms (e.g., GPL, MIT)

Testing and Validation

Unit and Integration Testing

- Automate testing pipelines using CI/CD frameworks

- Validate behavior under real-time constraints

Hardware-in-the-Loop (HIL) and Vehicle Testing

- Simulate real-world conditions using HIL systems

- Conduct field trials with test fleets

Penetration Testing and Security Audits

- Regularly test for vulnerabilities in communication interfaces (CAN, Ethernet, Bluetooth)

- Engage third-party security firms for independent audits

Documentation and Audit Readiness

Required Documentation

- Functional safety case (per ISO 26262)

- TARA and CSMS documentation (per UN R155)

- SUMS documentation (per UN R156)

- Software design specifications, test reports, and release notes

Audit Preparation

- Maintain logs of software changes, approvals, and testing results

- Prepare for regulatory audits by certifying bodies (e.g., TÜV, DEKRA)

Incident Response and Recalls

Cybersecurity Incident Monitoring

- Implement threat detection and response mechanisms

- Report incidents to authorities as required (e.g., under R155)

Software Recall Procedures

- Define processes for identifying and addressing defective software

- Coordinate with regulatory agencies and dealerships for updates or recalls

Conclusion

Effective logistics and compliance in automotive computer programming require a holistic approach that integrates secure development practices, regulatory adherence, supply chain management, and robust testing. As vehicles evolve into software-defined platforms, maintaining compliance ensures safety, security, and market access.

In conclusion, sourcing automotive computer programming requires a strategic approach that balances technical expertise, industry compliance, and innovative capabilities. As vehicles become increasingly reliant on software for performance, safety, and connectivity, selecting the right partners—whether in-house teams, external vendors, or specialized tech firms—is critical. Key considerations include ensuring adherence to automotive standards (such as ISO 26262 and ASPICE), evaluating experience with embedded systems and real-time operating environments, and verifying competencies in emerging areas like electric vehicles, autonomous driving, and cybersecurity. Additionally, effective communication, scalability, and long-term support play vital roles in sustaining successful collaborations. By carefully assessing technical proficiency, regulatory alignment, and strategic fit, organizations can secure reliable programming resources that drive innovation, ensure safety, and maintain competitiveness in the rapidly evolving automotive landscape.