The global automotive battery market is experiencing robust growth, driven by the rising production of vehicles—particularly electric and hybrid models—along with increasing demand for advanced energy storage solutions. According to Grand View Research, the global automotive battery market was valued at USD 51.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. This growth trajectory directly impacts ancillary components such as battery covers, which play a critical role in safety, thermal management, and vibration resistance within vehicle battery systems. As original equipment manufacturers (OEMs) and Tier-1 suppliers prioritize enhanced battery protection and compliance with evolving safety standards, the demand for high-performance battery covers has surged. In this competitive landscape, a select group of manufacturers have distinguished themselves through innovation, material expertise, and scalable production capabilities. Based on technological advancements, market reach, and customer adoption, here are the top 9 automotive battery cover manufacturers shaping the industry today.

Top 9 Automotive Battery Cover Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 NEI Corporation

Domain Est. 2003

Website: neicorporation.com

Key Highlights: NEI Corporation is a leading manufacturer of protective and functional coatings, lithium-ion and sodium-ion battery materials, and custom specialty ……

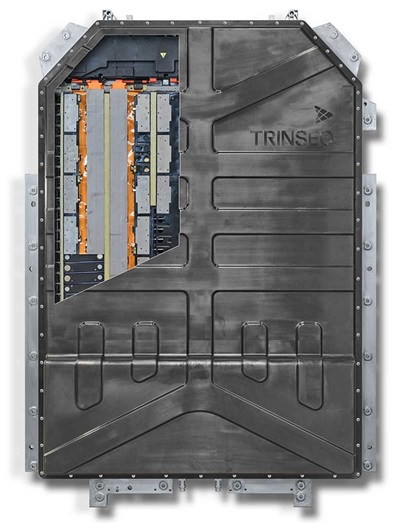

#2 Thermoplastic Battery Enclosures

Domain Est. 2010

Website: trinseo.com

Key Highlights: High performance trays and covers made from thermoplastics, changes the game for EV OEM’s without compromising performance or protection….

#3 Battery Enclosures

Domain Est. 1991

Website: magna.com

Key Highlights: Magna provides a comprehensive range of battery enclosure production and engineering solutions, available in steel, aluminum, and innovative one-piece designs….

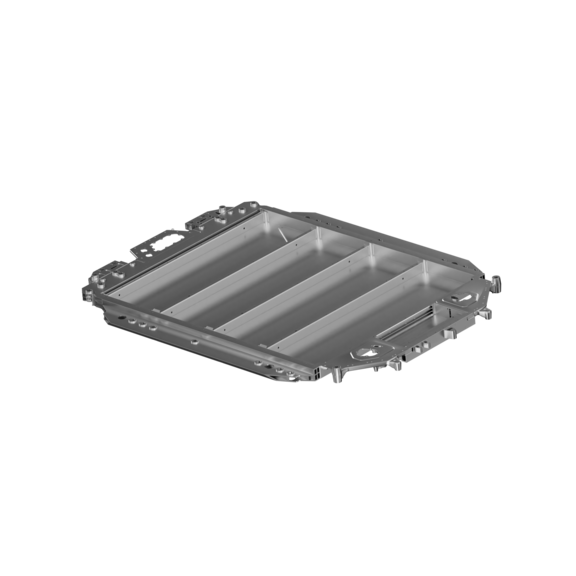

#4 BENTELER Battery trays

Domain Est. 1995

Website: benteler.com

Key Highlights: BENTELER already has many years of experiance in the production of battery trays. The first tray was manufactured by BENTELER in 2014 at our plant in Jablonec, ……

#5 Battery Cases for Electric Vehicles

Domain Est. 1997

Website: sglcarbon.com

Key Highlights: SGL Carbon manufactures high-quality battery cases made from fiber composite materials for the electromobility….

#6 Crown Battery

Domain Est. 1998

Website: crownbattery.com

Key Highlights: Crown Battery, the Power Behind Performance. Designed with advanced plate and internal construction to be the finest engineered batteries available….

#7 Pentatonic Battery Enclosures

Domain Est. 2001

Website: kautex.com

Key Highlights: Our fully composite, lightweight Pentatonic cell to pack and cell to module battery enclosures can be manufactured to fit any of our customers’ EV needs….

#8 Battery cases

Domain Est. 2007

Website: lyondellbasell.com

Key Highlights: Moplen, Pro-fax & Hostacom resins create reliable battery cases with dimensional stability, impact resistance & excellent weldability….

#9 Eleo

Domain Est. 2020

Website: eleo.tech

Key Highlights: Eleo, a Yanmar company, manufactures a full range of battery packs, specifically designed for off-highway applications….

Expert Sourcing Insights for Automotive Battery Cover

H2: 2026 Market Trends for Automotive Battery Covers

The global automotive battery cover market is poised for significant transformation by 2026, driven by evolving vehicle technologies, regulatory standards, and shifting consumer preferences. As automakers accelerate the transition toward electrification and enhanced safety protocols, battery covers—once a simple protective component—are becoming increasingly sophisticated. Below are the key market trends expected to shape the automotive battery cover landscape in 2026:

-

Rise of Electric Vehicles (EVs) Driving Demand

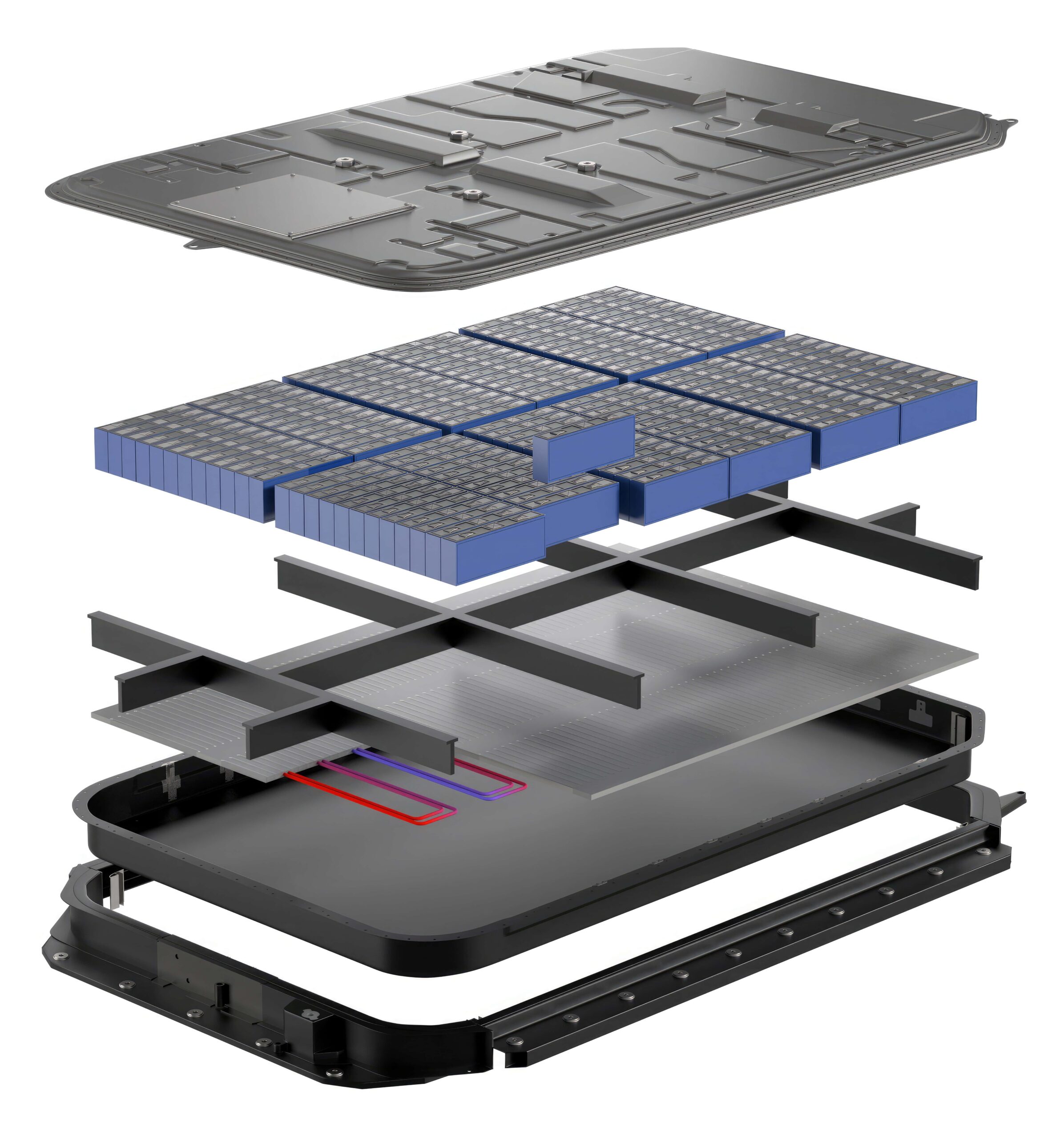

The exponential growth of the electric vehicle market is the primary catalyst for increased demand for advanced battery covers. With governments worldwide enforcing stricter emissions regulations and offering incentives for EV adoption, battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) are expected to account for over 20% of new vehicle sales by 2026. This surge directly increases the need for durable, thermally efficient, and lightweight battery enclosures and covers, especially for high-voltage traction batteries. -

Material Innovation: Shift Toward Lightweight Composites

Automakers are prioritizing weight reduction to improve vehicle efficiency and range. By 2026, there will be a pronounced shift from traditional steel and aluminum covers to advanced composite materials such as reinforced thermoplastics (e.g., PBT, PA6, and PPS) and carbon fiber-reinforced polymers. These materials offer high strength-to-weight ratios, superior corrosion resistance, and better thermal insulation—critical for battery safety and performance. -

Enhanced Safety and Thermal Management Features

Battery cover designs are being integrated with active and passive thermal management systems to prevent overheating and thermal runaway. By 2026, expect widespread adoption of covers with embedded cooling channels, flame-retardant coatings, and fire-suppression materials. Regulatory bodies such as UN R100 and NCAP are pushing for improved crash safety and fire containment, directly influencing cover design standards. -

Integration with Battery Management Systems (BMS)

Battery covers are increasingly being designed as functional components of the battery pack, incorporating sensors and wiring conduits for seamless integration with BMS. This trend supports real-time monitoring of temperature, pressure, and structural integrity, enabling predictive maintenance and enhanced safety—key selling points for premium EV manufacturers by 2026. -

Sustainability and Recyclability Focus

Environmental regulations and corporate ESG goals are pushing suppliers to adopt recyclable and bio-based materials in battery cover production. By 2026, leading manufacturers are expected to offer modular, easily disassembled covers that support battery recycling—a critical component of the circular economy in the EV supply chain. -

Regional Market Diversification

Asia-Pacific, particularly China, remains the dominant market due to robust EV production and government support. However, Europe and North America are catching up rapidly, driven by local battery gigafactory investments and onshoring trends. Regional variations in safety standards and material preferences will lead to customized battery cover solutions by 2026. -

Supply Chain Localization and Resilience

Ongoing geopolitical tensions and supply chain disruptions have prompted automakers to localize battery component manufacturing. By 2026, we anticipate more joint ventures between cover manufacturers and battery pack assemblers to ensure supply chain stability, reduce logistics costs, and comply with local content requirements.

In conclusion, the automotive battery cover market in 2026 will be defined by innovation, integration, and sustainability. As battery systems become more complex and safety-critical, the role of the battery cover will expand beyond mere protection to become an intelligent, multifunctional component essential to the performance and reliability of next-generation vehicles.

Common Pitfalls Sourcing Automotive Battery Covers (Quality and IP)

Sourcing automotive battery covers involves critical considerations beyond basic procurement. Overlooking quality standards and intellectual property (IP) rights can lead to costly recalls, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Poor Material Quality and Durability

Many suppliers offer battery covers made from substandard polymers that degrade quickly under heat, vibration, and chemical exposure. Low-quality materials may fail to meet OEM specifications for flame resistance (e.g., UL 94 V-0), UV stability, or mechanical strength, resulting in premature cracking or warping. Always verify material certifications and conduct environmental stress testing.

Inadequate Ingress Protection (IP) Rating Compliance

Battery covers must provide reliable protection against dust and moisture, especially in under-hood environments. A common pitfall is suppliers claiming high IP ratings (e.g., IP6K9K) without third-party validation. Misrepresentation or inconsistent sealing design can compromise electrical safety and lead to short circuits. Demand test reports from accredited labs and inspect gasket integration and enclosure integrity.

Non-Compliance with OEM and Industry Standards

Sourcing covers that don’t conform to OEM technical drawings or industry standards (e.g., ISO, SAE, or IATF 16949) risks integration failures and non-approval. Suppliers may offer “compatible” parts that deviate slightly in dimensions, mounting points, or venting requirements. Always cross-reference specifications and require first-article inspections (FAI).

Intellectual Property (IP) Infringement Risks

Using designs that replicate OEM covers without proper licensing exposes buyers to IP violations. Many battery cover designs are protected by design patents or trade dress rights. Sourcing from unauthorized manufacturers—even if functionally equivalent—can lead to legal action, shipment seizures, or forced redesigns. Ensure suppliers have legitimate design rights or offer IP indemnification.

Lack of Traceability and Quality Control

Suppliers with weak quality management systems may lack batch traceability, process controls, or documented testing. This increases the risk of inconsistent production quality and complicates root cause analysis during failures. Prioritize suppliers with IATF 16949 certification and robust production part approval processes (PPAP).

Hidden Tooling and MOQ Costs

Battery covers often require custom molds, and some suppliers understate tooling expenses or impose high minimum order quantities (MOQs). Unexpected costs and inflexible terms can disrupt project timelines and budgets. Clarify tooling ownership, amortization, and scalability before contract finalization.

Logistics & Compliance Guide for Automotive Battery Cover

Overview

This guide outlines the logistics and compliance requirements for the transportation, storage, and regulatory adherence of automotive battery covers. These components, while non-hazardous themselves, are often shipped alongside or in proximity to automotive batteries, necessitating careful attention to safety, packaging, and regulatory standards.

Regulatory Compliance

International & Regional Regulations

Automotive battery covers must comply with regional safety and environmental standards, including:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals – ensure materials used (e.g., ABS, PP) do not contain restricted substances.

– RoHS (EU/Global): Restriction of Hazardous Substances in Electrical and Electronic Equipment – applicable if the cover includes electronic components or coatings.

– IMDS (International Material Data System): Required by many OEMs; material composition must be documented and submitted.

– EPA & DOT (USA): Ensure no hazardous materials are used in manufacturing; verify compliance with applicable federal motor vehicle safety standards (FMVSS).

– China GB Standards: Comply with national standards for automotive components if imported into or sold in China.

Material & Environmental Compliance

- Use recyclable materials (e.g., polypropylene, ABS) where possible.

- Include appropriate recycling symbols and material identification on product or packaging.

- Avoid substances listed under conflict minerals regulations if applicable.

Packaging Requirements

Protective Packaging

- Use durable corrugated cardboard or reusable containers to prevent deformation.

- Employ inner lining (e.g., foam inserts, bubble wrap) to protect surfaces from scratches.

- Stackable designs encouraged to optimize pallet space.

Labeling

- Clearly label each package with:

- Part number and description

- Quantity per package

- Manufacturer and batch/lot number

- Handling symbols (e.g., “Do Not Stack,” “Fragile,” “This Side Up”)

- Include barcodes or QR codes for traceability.

Transportation & Handling

Modes of Transport

- Road: Standard freight; ensure secure loading to prevent shifting. Use temperature-controlled vehicles if stored with batteries in extreme climates.

- Sea (Container): Avoid moisture exposure; use desiccants in containers if shipping long distances.

- Air (Dangerous Goods Consideration): Battery covers alone are non-hazardous; however, if shipped with batteries, follow IATA Dangerous Goods Regulations. Clearly segregate if mixed load.

Palletization & Unit Load

- Stack uniformly on standard pallets (e.g., EUR/EPAL or ISO).

- Max load height: 1.8 meters to ensure stability.

- Secure with stretch wrap or strapping; avoid over-compression.

Storage Conditions

Environmental Controls

- Store in dry, well-ventilated areas.

- Temperature: 10°C to 35°C; avoid prolonged exposure to UV light or extreme heat.

- Humidity: Below 70% RH to prevent mold or material degradation.

Shelf Life & Inventory

- No strict expiration date, but inspect periodically for warping or brittleness.

- Follow FIFO (First In, First Out) inventory management.

Safety & Risk Management

Handling Safety

- No special PPE required for handling battery covers.

- Use mechanical aids (e.g., pallet jacks) for heavy loads to prevent injury.

Risk of Contamination

- Keep separated from hazardous materials (e.g., acids, oils, solvents).

- Do not store directly on the floor; use pallets or shelves.

Documentation & Traceability

Required Documentation

- Certificate of Compliance (CoC) for material and manufacturing standards.

- Packing list and commercial invoice for international shipments.

- IMDS report (if required by customer).

- Bill of Lading (BOL) or Air Waybill (AWB).

Traceability

- Maintain lot traceability for at least 10 years per automotive industry standards.

- Record batch numbers, production dates, and shipment details in a quality management system (e.g., ISO 9001 or IATF 16949 compliant).

Returns & Reverse Logistics

- Define clear return authorization (RMA) process.

- Inspect returned items for damage or contamination before restocking.

- Recycle damaged or non-reusable covers in accordance with local environmental regulations.

Conclusion

Proper logistics and compliance practices ensure that automotive battery covers reach customers safely, efficiently, and in accordance with global regulations. Adherence to packaging, transport, and documentation standards supports supply chain integrity and customer satisfaction in the automotive sector.

Conclusion for Sourcing Automotive Battery Cover

In conclusion, sourcing automotive battery covers requires a strategic approach that balances quality, cost-effectiveness, regulatory compliance, and supply chain reliability. As a critical component in vehicle safety and performance, the battery cover must meet stringent durability, heat resistance, and vibration-damping standards while complying with automotive industry regulations such as ISO/TS 16949 and RoHS.

Through careful evaluation of material options—such as ABS, PP, or PC/ABS blends—and engagement with qualified suppliers who demonstrate proven track records in automotive manufacturing, OEMs and Tier-1 suppliers can ensure consistent product quality and long-term reliability. Additionally, local vs. global sourcing decisions should consider lead times, logistics costs, and geopolitical risks, while also supporting sustainability goals through recyclable materials and environmentally responsible production processes.

Ultimately, effective sourcing of automotive battery covers hinges on strong supplier partnerships, rigorous quality assurance protocols, and proactive risk management. By adopting a comprehensive sourcing strategy, automotive manufacturers can secure high-performance components that support vehicle safety, efficiency, and regulatory compliance in an increasingly competitive market.