The global automotive accessories market is experiencing robust expansion, driven by rising consumer demand for vehicle personalization, enhanced safety, and improved comfort. According to Grand View Research, the market was valued at USD 298.9 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. This growth is further supported by increasing sales of passenger vehicles, advancements in automotive electronics, and the growing adoption of aftermarket solutions in both developed and emerging economies. Mordor Intelligence also highlights a CAGR of approximately 6.5% over the forecast period (2024–2029), citing expanding e-commerce channels and the integration of smart technology in accessories—such as advanced dash cams, driver assistance systems, and connected infotainment—as key market drivers. As demand intensifies, a select group of manufacturers are leading innovation, scale, and global reach in this competitive landscape.

Top 10 Automotive Accessories Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ACDelco: OEM & Aftermarket Auto Parts

Domain Est. 1996

Website: gmparts.com

Key Highlights: ACDelco offers the only aftermarket parts backed by GM. ACDelco’s Gold and Silver lines of premium aftermarket parts offer a precise fit for GM vehicles….

#2 OEM Auto Parts Store

Domain Est. 2015

Website: oempartsonline.com

Key Highlights: Shop OEM Parts and Accessories Online for All Major Makes and Models and Find All The Parts You Need From Our Complete OEM Parts Catalogs!…

#3 Genuine Parts Company

Domain Est. 1995

Website: genpt.com

Key Highlights: The Automotive Parts Group is a leading global service provider of replacement parts, accessories and solutions across North America, Europe and Australasia….

#4 Custom Accessories

Domain Est. 1996

Website: causa.com

Key Highlights: Custom Accessories is the leader in the automotive aftermarket accessories marketplace. We serve a variety of car care products retailers….

#5 CARR.com Automotive Accessories

Domain Est. 1997

Website: carr.com

Key Highlights: Over 75 years of innovative, American made products. Find steps, light bars, and other automative accessories manufactured for a precise fit….

#6 Proform Parts

Domain Est. 1997

Website: proformparts.com

Key Highlights: View our full line of performance auto parts & accessories including carbs, engine building tools and engine dress up for Chevy, Ford and Mopar….

#7 Automotive Service Parts and Accessories

Domain Est. 2000

Website: denso.com

Key Highlights: The company provides automotive service parts that contribute to safer and more fuel efficient driving, and car accessories that enhance the pleasure of your ……

#8 Keystone Automotive

Domain Est. 2003

Website: keystoneautomotive.com

Key Highlights: The automotive aftermarket is the largest market serviced by Keystone, encompassing all parts and accessories for replacement, appearance, comfort, convenience, ……

#9 Bosch Auto Parts

Domain Est. 2004

Website: boschautoparts.com

Key Highlights: Keep your vehicles moving. Experience our full portfolio of auto parts and solutions. Explore our virtual garage ; Get to Know Robert Bosch. We invite you to ……

#10 DENSO Auto Parts

Domain Est. 2006

Website: densoautoparts.com

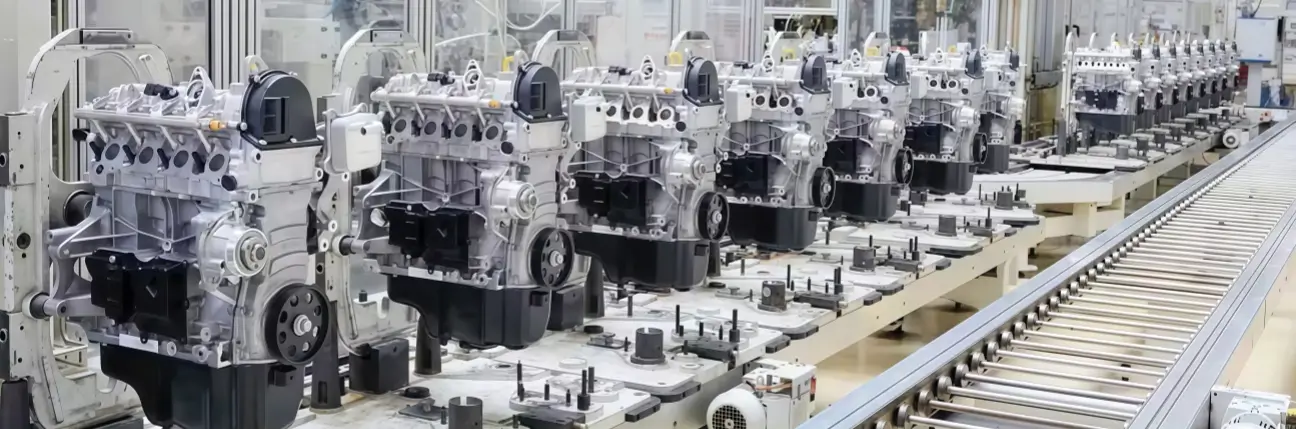

Key Highlights: DENSO is a global choice for top automakers, with multiple vehicle models rolling off the assembly line with DENSO auto parts under the hood….

Expert Sourcing Insights for Automotive Accessories

H2: 2026 Market Trends for Automotive Accessories

The automotive accessories market is poised for dynamic transformation by 2026, driven by technological innovation, evolving consumer preferences, sustainability demands, and shifts in vehicle ownership models. Here’s a comprehensive analysis of the key trends shaping this sector:

H2: Technological Integration and Digitalization

By 2026, seamless connectivity and smart functionality will dominate the automotive accessories landscape. Drivers increasingly expect their vehicles to mirror the digital experience of smartphones and smart homes. This trend manifests through:

– Advanced Infotainment Add-ons: Aftermarket head units with built-in AI assistants, 5G connectivity, and cloud-based navigation systems will gain traction.

– Smartphone Integration Hubs: Accessories enabling wireless CarPlay and Android Auto, along with multi-device charging and gesture control, will become mainstream.

– IoT-Enabled Accessories: Devices like smart dashcams with AI-powered driver monitoring, predictive maintenance sensors, and connected tire pressure monitoring systems (TPMS) will offer real-time diagnostics and safety alerts.

H2: Electrification and EV-Specific Accessories

As electric vehicle (EV) adoption accelerates globally, a parallel ecosystem of EV-specific accessories will flourish:

– Charging Solutions: Portable Level 2 chargers, universal adapters, and smart charging cables with app-based monitoring will see strong demand.

– Range Extension Tools: Aerodynamic add-ons, solar roof accessories, and regenerative braking kits may emerge as niche yet innovative solutions.

– Interior Comfort for EVs: Given longer charging times, accessories like foldable seating, climate-controlled cabin coolers, and in-car entertainment systems for charging stops will grow in popularity.

H2: Personalization and Lifestyle-Oriented Design

Consumers are increasingly treating vehicles as extensions of their personal style and lifestyle, fueling demand for customizable and aesthetic accessories:

– Interior Customization: Premium upholstery, ambient lighting kits, bespoke floor mats, and acoustic enhancement systems will appeal to luxury and performance segments.

– Exterior Styling: Aerodynamic body kits, LED lighting upgrades, and custom wheel covers will remain popular, especially among younger demographics.

– Adventure and Utility Accessories: Roof racks, rooftop tents, off-road lighting bars, and modular cargo organizers will thrive with the rise of outdoor recreation and remote work lifestyles.

H2: Sustainability and Eco-Conscious Materials

Environmental responsibility will become a key differentiator. By 2026, consumers and regulators alike will prioritize sustainability:

– Recycled and Biodegradable Materials: Accessories made from recycled plastics, natural fibers, and plant-based leather alternatives will gain market share.

– Energy-Efficient Products: Solar-powered coolers, low-power LED lighting, and accessories that reduce drag (improving fuel efficiency) will attract eco-minded buyers.

– Circular Economy Models: Refurbished accessories, take-back programs, and modular designs enabling repairability will grow in appeal.

H2: Enhanced Safety and Driver Assistance Add-Ons

Even as OEMs integrate advanced driver-assistance systems (ADAS), the aftermarket will offer affordable retrofit solutions:

– Aftermarket ADAS Kits: Blind-spot monitoring, lane departure warnings, and forward-collision alerts will become accessible for older or budget vehicles.

– 360-Degree Camera Systems: Affordable panoramic view systems will enhance parking safety and off-road navigation.

– Emergency Preparedness Kits: Smart kits with GPS locators, automatic SOS alerts, and integrated power banks will appeal to safety-conscious consumers.

H2: E-Commerce and Direct-to-Consumer Growth

Online retail will continue to dominate, with brands leveraging digital platforms for sales, customization, and customer engagement:

– Augmented Reality (AR) Try-Ons: Virtual fitting tools will allow customers to preview accessories in their vehicle before purchase.

– Subscription and Rental Models: Emerging models for premium accessories (e.g., seasonal roof boxes or high-end audio systems) could gain traction.

– Social Commerce Influence: Influencer-driven marketing and user-generated content on platforms like TikTok and Instagram will shape purchasing decisions, especially among Gen Z.

H2: Regional Market Diversification

While North America and Europe will remain strong markets, growth will be increasingly driven by:

– Asia-Pacific Expansion: Rising disposable incomes in India, Indonesia, and Southeast Asia will boost demand for both functional and luxury accessories.

– Emerging Markets: In Africa and Latin America, rugged, durable accessories suited for challenging road conditions will see high demand.

Conclusion

By 2026, the automotive accessories market will be defined by intelligent, personalized, and sustainable products that enhance both functionality and lifestyle. Companies that prioritize innovation, digital engagement, and environmental responsibility will lead the market, while traditional players risk obsolescence without adaptation. The convergence of connectivity, electrification, and consumer-centric design will make this a pivotal era for automotive aftermarket growth.

Common Pitfalls in Sourcing Automotive Accessories: Quality and Intellectual Property

Sourcing automotive accessories involves navigating complex supply chains, varying quality standards, and stringent regulatory environments. Two of the most critical challenges buyers face are ensuring consistent product quality and avoiding intellectual property (IP) infringement. Overlooking these areas can lead to costly recalls, legal disputes, reputational damage, and supply chain disruptions.

Quality-Related Pitfalls

Inconsistent Manufacturing Standards

Suppliers, especially in low-cost regions, may lack adherence to international quality standards such as ISO/TS 16949 (now IATF 16949). This can result in inconsistent product performance, material defects, or non-compliance with safety regulations, particularly for accessories like dash cams, lighting systems, or electronic modules.

Poor Material Selection

To reduce costs, some suppliers substitute lower-grade materials (e.g., non-UV-resistant plastics, substandard wiring). These materials degrade quickly under heat, sunlight, or vibration, leading to premature product failure and potential safety issues in automotive environments.

Inadequate Testing and Validation

Many sourced accessories are not rigorously tested for environmental durability (e.g., thermal cycling, humidity, vibration) or electromagnetic compatibility (EMC). Without proper validation, accessories may malfunction when installed in vehicles, leading to customer complaints and warranty claims.

Lack of Traceability and Documentation

Suppliers may fail to provide batch traceability, material certifications, or test reports. This becomes a significant issue during quality audits, recalls, or when proving compliance with regional regulations like FMVSS (U.S.) or ECE (Europe).

Overlooking Fit, Form, and Function (FFF) Compatibility

Aftermarket accessories must integrate seamlessly with specific vehicle models. Poor dimensional accuracy or design flaws can result in improper installation, interference with OEM components, or aesthetic mismatches—leading to customer dissatisfaction and returns.

Intellectual Property (IP)-Related Pitfalls

Unintentional Infringement of Design Patents

Many automotive accessories, such as grilles, spoilers, or interior trim, closely mimic OEM designs protected by design patents. Sourcing generic versions without proper clearance can expose importers and distributors to legal action for patent infringement.

Copying Trademarked Branding or Logos

Suppliers may produce accessories featuring fake or replicated OEM logos (e.g., imitation emblems or branded styling). Distributing such products constitutes trademark infringement and can result in customs seizures, fines, and brand damage.

Use of Proprietary Interfaces or Software

Some smart accessories (e.g., infotainment upgrades, OBD-II devices) may reverse-engineer or mimic OEM communication protocols. This can violate software copyrights or circumvention laws (e.g., DMCA in the U.S.), especially if they bypass authentication mechanisms.

Lack of IP Warranty in Supplier Contracts

Many sourcing agreements fail to include indemnification clauses or IP warranties. If a third party asserts IP rights against the buyer, the supplier may disclaim responsibility, leaving the buyer liable for legal costs and damages.

Sourcing from IP-Infringing Manufacturers

Some factories specialize in producing “replica” or “compatible” accessories that deliberately infringe on OEM designs. Without due diligence, buyers may unknowingly partner with these suppliers, risking enforcement actions from rights holders.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct supplier audits and require IATF 16949 or equivalent certifications.

– Implement rigorous incoming quality inspections and third-party testing.

– Perform IP clearance searches and consult legal experts before launching new products.

– Include strong IP indemnification clauses in supplier contracts.

– Work with trusted suppliers and avoid overly low-cost options that may cut corners on quality or IP compliance.

By proactively addressing quality and IP risks, companies can ensure reliable, compliant, and legally safe automotive accessory sourcing.

Logistics & Compliance Guide for Automotive Accessories

Overview of Automotive Accessories Supply Chain

The automotive accessories supply chain involves the movement of aftermarket products—ranging from floor mats and seat covers to performance parts and electronics—from manufacturers to distributors, retailers, and end users. Efficient logistics and strict compliance are critical due to diverse product types, global sourcing, and regulatory variability across markets.

Key Logistics Considerations

Inventory Management

Maintain accurate stock levels using inventory management systems to prevent overstocking or stockouts. Implement just-in-time (JIT) strategies where feasible, especially for high-turnover items like cabin air filters or wiper blades.

Warehousing & Storage

Store products in climate-controlled, secure facilities to prevent damage from moisture, temperature extremes, or theft. Segregate hazardous materials (e.g., adhesives, aerosol sprays) per safety regulations.

Packaging & Labeling

Use durable packaging to withstand shipping stress. Clearly label boxes with SKU, product description, country of origin, and handling instructions (e.g., “Fragile” or “Do Not Stack”). Include barcodes for efficient scanning and tracking.

Transportation Modes

Choose transportation methods based on cost, speed, and product sensitivity:

– Ocean Freight: Ideal for bulky, non-urgent shipments.

– Air Freight: Best for high-value or time-sensitive accessories.

– Ground Transportation: Common for regional distribution within North America or Europe.

Last-Mile Delivery

Partner with reliable carriers for timely delivery to retail outlets or direct-to-consumer orders. Offer tracking options and flexible delivery windows to enhance customer satisfaction.

Regulatory Compliance Requirements

Product Safety Standards

Ensure all accessories meet regional safety regulations:

– United States: Compliance with FMVSS (Federal Motor Vehicle Safety Standards) where applicable, and FTC labeling rules.

– European Union: Adherence to ECE Regulations and CE marking for certain electronic or safety-related accessories.

– Canada: Conformity with CMVSS (Canadian Motor Vehicle Safety Standards) for regulated items.

Environmental & Chemical Regulations

Monitor use of restricted substances under:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals.

– RoHS (EU and others): Restriction of Hazardous Substances in electrical and electronic components.

– Proposition 65 (California): Warning labels for products containing listed carcinogens or reproductive toxins.

Customs & Import Compliance

- Accurately classify products using HS (Harmonized System) codes.

- Provide commercial invoices, packing lists, and certificates of origin.

- Comply with import duties, tariffs, and trade agreements (e.g., USMCA, EU-UK Trade Agreement).

- Use licensed customs brokers to facilitate clearance.

Labeling & Documentation

Include required information on packaging and user manuals:

– Manufacturer name and address

– Country of origin

– Safety warnings

– Installation instructions

– Warranty information

Quality Assurance & Traceability

Implement quality control checks at manufacturing and receiving stages. Use batch/lot numbering and serialization to enable traceability in case of recalls. Maintain records for audits and regulatory inspections.

Reverse Logistics & Returns Management

Establish clear return policies for defective, incorrect, or unused items. Set up a returns processing center to inspect, refurbish, or dispose of returned accessories responsibly, in line with environmental regulations.

Sustainability Practices

Adopt eco-friendly logistics practices:

– Use recyclable or biodegradable packaging materials.

– Optimize shipping routes to reduce carbon emissions.

– Partner with suppliers committed to sustainable manufacturing.

Conclusion

Success in the automotive accessories sector depends on seamless logistics and rigorous compliance. By integrating robust supply chain practices with up-to-date regulatory knowledge, businesses can ensure product availability, customer trust, and market access worldwide. Regular training and compliance audits are recommended to stay ahead of evolving standards.

In conclusion, sourcing automotive accessories effectively requires a strategic approach that balances quality, cost, reliability, and compliance. By evaluating suppliers based on certifications, production capabilities, and track record, businesses can ensure a consistent supply of high-quality products. Leveraging both domestic and global supply chains, particularly from manufacturing hubs with specialized expertise, can offer competitive pricing and a wide range of options. Additionally, building strong supplier relationships, staying updated on industry trends and regulations, and incorporating sustainability considerations contribute to long-term success. Ultimately, a well-structured sourcing strategy enhances operational efficiency, supports brand reputation, and meets the evolving demands of the automotive market.