The global automotive A/C lines market is experiencing steady growth, driven by rising vehicle production, increasing demand for passenger comfort, and stricter regulations around fuel efficiency and emissions. According to a report by Mordor Intelligence, the automotive air conditioning market was valued at USD 48.9 billion in 2023 and is projected to reach USD 68.4 billion by 2029, growing at a CAGR of approximately 5.8% during the forecast period. This expansion is closely tied to the proliferation of electric vehicles, where efficient thermal management systems—including high-performance A/C lines—are critical for battery longevity and passenger comfort. As automakers prioritize lightweight materials and improved system reliability, the role of specialized A/C line manufacturers has become increasingly vital. In this evolving landscape, a select group of suppliers are leading the charge in innovation, quality, and global reach—shaping the future of vehicle climate control systems.

Top 10 Automotive Ac Lines Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hoses, Adapters & Accessories

Domain Est. 1997

Website: mastercool.com

Key Highlights: Mastercool Inc., Manufacturer of Air Conditioning, Refrigeration, Service Tools and Equipment….

#2 Vintage Air

Domain Est. 1996

Website: vintageair.com

Key Highlights: Our SureFit kits are complete, vehicle-specific integrated heat / cool / defrost systems designed to deliver a factory-installed look with modern performance….

#3 AGS Company Automotive Solutions

Domain Est. 1999

Website: agscompany.com

Key Highlights: Free delivery 30-day returnsAGS is the leading manufacturer of specialty lubricants, brake, fuel, and transmission lines. View all categories · NiCopp® picture · NiCopp®. 25′ – 100…

#4 AC Hose Manufacturer

Domain Est. 2022

Website: sanyeflex.com

Key Highlights: AC Hose Manufacturer. Air conditioning hose is widely used in air-conditioning systems of various vehicles (cars, machinery, trains, trams) as well as in ……

#5

Domain Est. 1995

Website: parker.com

Key Highlights: As the global leader in motion and control technologies, Parker Hannifin plays a pivotal role in applications that have a positive impact on the world….

#6 Durable AC Hoses for Automotive Cooling

Domain Est. 1997

Website: aircomponents.com

Key Highlights: Free delivery 365-day returnsOur AC hoses are crafted from durable materials resistant to wear, tear, and leakage, ensuring your air conditioning system operates efficiently for ye…

#7 WEG

Domain Est. 2004

Website: weg.net

Key Highlights: WEG provides global solutions for electric motors, variable frequency drives, soft starters, controls, panels, transformers, and generators….

#8 Car Air Conditioning Hose, A/C Refrigerant Line

Domain Est. 2007

Website: strongflex.com

Key Highlights: Air conditioning hose is for various cars to transfer R134a and R12 refrigerant, discount price and quick delivery….

#9 Auto Cooling Solutions

Domain Est. 2009

Website: autocoolingsolutions.com

Key Highlights: Auto Cooling Solutions is the leading online retailer specializing in aftermarket automotive AC lines and Cooling System parts and accessories, ……

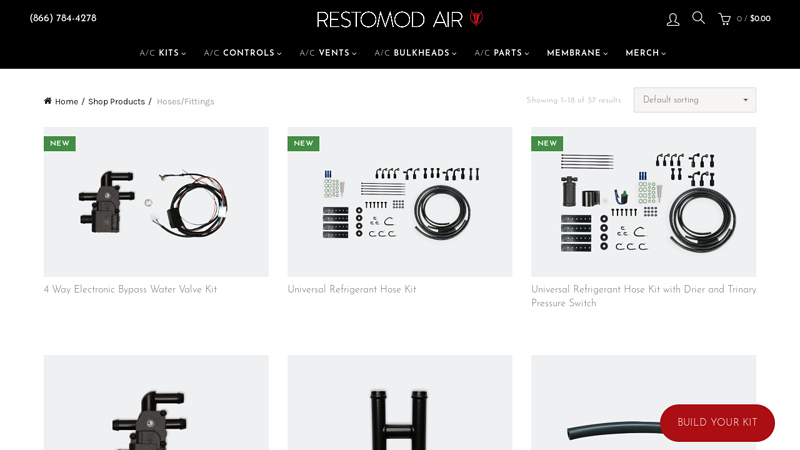

#10 Hoses & Fittings

Domain Est. 2011

Website: restomodair.com

Key Highlights: 10-day delivery 30-day returnsEnsure a leak-free A/C system with Restomod Air’s high-quality hoses and fittings. Built for durability and performance. Keep your ride cool and effic…

Expert Sourcing Insights for Automotive Ac Lines

Automotive AC Lines Market Trends in 2026

Industry Overview and Growth Drivers

The automotive AC (air conditioning) lines market is poised for significant transformation by 2026, driven by evolving vehicle technologies, regulatory mandates, and shifting consumer preferences. As vehicle electrification accelerates globally, the demand for efficient and compact climate control systems is reshaping the design and materials used in AC lines. The market is expected to grow steadily, with a compound annual growth rate (CAGR) of approximately 4.5% from 2021 to 2026, reaching an estimated value of USD 4.8 billion by 2026.

Key drivers include the increasing penetration of electric vehicles (EVs), where thermal management systems are critical for battery performance and passenger comfort. Unlike conventional internal combustion engine (ICE) vehicles, EVs rely heavily on electrically powered HVAC systems, necessitating optimized AC line designs that reduce weight, improve insulation, and enhance durability under variable thermal loads.

Shift Toward Lightweight and High-Performance Materials

A major trend in 2026 is the widespread adoption of lightweight materials for AC lines, such as aluminum alloys and advanced polymer composites. These materials offer reduced weight, improved corrosion resistance, and better thermal efficiency compared to traditional steel lines. Automakers are prioritizing weight reduction to improve fuel economy in ICE vehicles and extend the range of EVs.

Additionally, manufacturers are investing in multi-layer extrusion technologies to develop flexible, high-pressure resistant hoses capable of handling next-generation refrigerants like R-1234yf and natural refrigerants such as CO₂ (R-744). These refrigerants require AC lines with enhanced barrier properties and tighter sealing standards to minimize leakage and meet environmental regulations.

Electrification and Integration with Thermal Management Systems

By 2026, the integration of AC lines into broader vehicle thermal management systems (TMS) will be a defining trend, especially in electric and hybrid vehicles. In EVs, AC lines are no longer isolated components but part of a unified system that manages battery, motor, and cabin temperatures. This integration demands smarter routing, compact designs, and the use of bidirectional cooling/heating loops.

Automotive suppliers are responding by developing modular AC line assemblies with embedded sensors and connectivity for real-time monitoring of pressure, temperature, and refrigerant flow. This enables predictive maintenance and improves system efficiency, aligning with the broader industry shift toward smart, connected vehicles.

Regional Market Dynamics

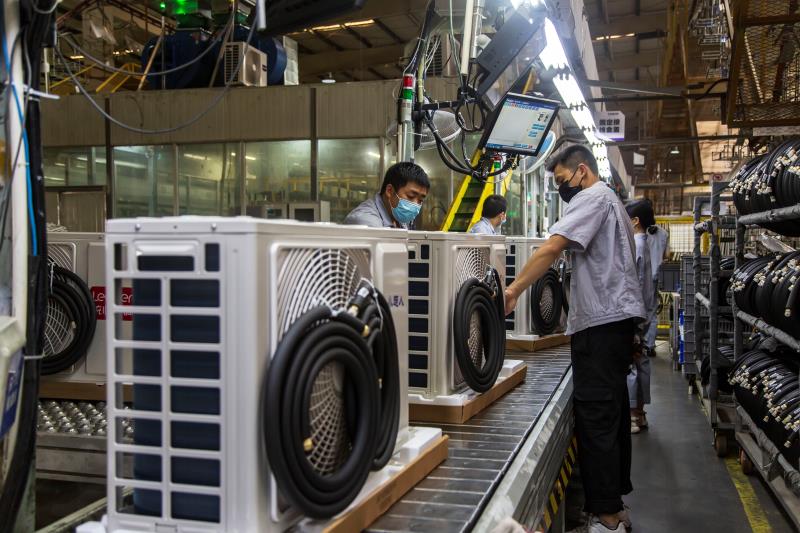

Regionally, Asia-Pacific is expected to dominate the automotive AC lines market in 2026, driven by robust vehicle production in China, India, and South Korea. Stringent emissions regulations in Europe, such as the EU’s Mobile Air Conditioning (MAC) Directive, continue to push automakers toward low-GWP (global warming potential) refrigerants, influencing AC line design and material selection. In North America, rising consumer demand for comfort and advanced climate control features supports market growth, particularly in light trucks and SUVs.

Sustainability and Regulatory Influence

Environmental regulations will play a pivotal role in shaping the 2026 market landscape. The phasedown of high-GWP refrigerants under the Kigali Amendment to the Montreal Protocol is compelling OEMs to redesign AC systems. This transition requires AC lines compatible with alternative refrigerants that operate under higher pressures or different thermodynamic properties.

Recyclability and end-of-life management of AC components are also gaining attention. Leading suppliers are exploring closed-loop recycling processes for aluminum and rubber components used in AC lines, aligning with circular economy principles and corporate sustainability goals.

Competitive Landscape and Innovation

The competitive environment is intensifying, with key players like Denso, Mahle, BorgWarner, and Hanon Systems focusing on R&D to develop next-generation AC line solutions. Strategic partnerships with EV startups and investments in automated manufacturing are enabling faster innovation cycles. 3D printing and digital twin technologies are being used to prototype and validate new AC line configurations tailored to specific vehicle architectures.

In conclusion, the 2026 automotive AC lines market will be characterized by material innovation, system integration, electrification, and regulatory compliance. As vehicles become more complex and sustainability-focused, AC lines will evolve from passive conduits to intelligent, performance-critical components within the broader thermal ecosystem of modern automobiles.

Common Pitfalls When Sourcing Automotive AC Lines: Quality and Intellectual Property (IP) Concerns

Sourcing automotive AC (air conditioning) lines requires careful attention to both quality standards and intellectual property (IP) considerations. Failing to address these aspects can lead to production delays, safety issues, legal disputes, and reputational damage. Below are the most common pitfalls related to quality and IP when procuring automotive AC lines.

Quality-Related Pitfalls

Inadequate Material Specifications

One of the most frequent quality issues arises from suppliers using substandard materials, such as incorrect aluminum or steel alloys, that do not meet OEM (Original Equipment Manufacturer) specifications. This can compromise the line’s durability, corrosion resistance, and performance under high pressure and temperature fluctuations.

Poor Manufacturing Tolerances

AC lines must be manufactured to tight tolerances to ensure proper fitment and sealing. Sourcing from suppliers with inconsistent fabrication processes—such as improper bending, flaring, or welding—can lead to leaks, vibration fatigue, or system inefficiencies.

Lack of Testing and Certification

Many non-OEM or gray-market suppliers fail to conduct rigorous testing, such as burst pressure tests, vibration testing, or thermal cycling. Without proper certifications (e.g., ISO/TS 16949, SAE J51), there’s no assurance the lines meet industry safety and performance standards.

Inconsistent Coating and Corrosion Protection

Automotive AC lines are exposed to harsh under-hood environments. Poor or inconsistent application of protective coatings (e.g., epoxy, E-coating) can result in premature corrosion, leading to refrigerant leaks and system failure.

Counterfeit or Recycled Components

Some suppliers may pass off remanufactured or recycled lines as new. These components often have hidden wear, internal contamination, or degraded seals, increasing the risk of field failures.

Intellectual Property (IP) Pitfalls

Unauthorized Replication of OEM Designs

Many AC line designs are protected by patents, trade secrets, or design rights. Sourcing from suppliers who reverse-engineer and replicate OEM parts without licensing can expose your company to IP infringement claims, especially in markets with strong enforcement like the U.S. or EU.

Lack of Design Ownership and Traceability

When working with third-party manufacturers, especially overseas, there may be ambiguity about who owns the tooling, CAD designs, and production data. This can limit your ability to switch suppliers or scale production and may result in disputes over IP rights.

Use of Proprietary Connector Configurations

OEMs often use proprietary fittings and connection systems (e.g., unique flare types or quick-connects) that are protected by IP. Sourcing lines with unauthorized copies of these features—even if functionally identical—can lead to legal liability.

Inadequate Documentation for Compliance

Suppliers may not provide full documentation proving design legitimacy or freedom-to-operate (FTO) analyses. Without proper legal vetting, companies risk importing or selling products that infringe on existing patents.

Exposure to Legal and Market Risks

IP violations can result in injunctions, product recalls, customs seizures, or costly litigation. Additionally, using copied designs can damage relationships with OEMs and reduce customer trust in your brand’s integrity.

Conclusion

To avoid these pitfalls, always source AC lines from reputable, certified suppliers who adhere to OEM specifications and can provide full traceability and IP clearance documentation. Conduct thorough due diligence, including on-site audits, material testing, and legal review of design rights, to ensure both quality and compliance.

Logistics & Compliance Guide for Automotive AC Lines

Overview of Automotive AC Lines

Automotive AC (air conditioning) lines are critical components in vehicle HVAC systems, responsible for transferring refrigerant between the compressor, condenser, evaporator, and other system parts. These lines are typically made from aluminum or steel and must meet stringent performance, safety, and environmental standards. Proper logistics and compliance procedures are essential to ensure product integrity, regulatory adherence, and timely delivery across the supply chain.

Regulatory Compliance Requirements

Automotive AC lines must comply with various international, regional, and industry-specific regulations. Key compliance standards include:

– SAE J51 – Standard for refrigerant tubing used in mobile air conditioning systems.

– EPA Section 608 (U.S.) – Governs refrigerant handling and emissions; applies indirectly to component design affecting refrigerant containment.

– EU F-Gas Regulation (No 517/2014) – Regulates fluorinated greenhouse gases, impacting refrigerant choice and system leak prevention.

– REACH & RoHS (EU) – Restrict hazardous substances in automotive components; AC lines must be free of restricted materials such as lead, cadmium, and certain phthalates.

– IATF 16949 – Quality management standard for automotive production; suppliers must be certified to ensure consistent quality and traceability.

– DOT & Transport Canada Regulations – Govern the safe transport of pressurized or refrigerant-charged components, if applicable.

Packaging and Handling Standards

Proper packaging is critical to prevent contamination, damage, and corrosion during storage and transit:

– Use moisture-resistant, sealed packaging with desiccants to prevent internal condensation.

– Plug or cap both ends of AC lines to avoid ingress of dirt, moisture, or debris.

– Employ anti-corrosion coatings or VCI (Vapor Corrosion Inhibitor) materials, especially for steel lines.

– Use corrugated fiberboard or reusable containers with internal dividers to prevent abrasion and bending.

– Label packages clearly with part numbers, batch/lot numbers, and handling symbols (e.g., “Fragile,” “This Way Up”).

Transportation and Logistics Considerations

AC lines are typically shipped as unassembled components to OEMs or Tier 1 suppliers. Logistics best practices include:

– Mode of Transport: Primarily shipped via truck for regional distribution; ocean freight for international shipments (ensure containers are dry and temperature-stable).

– Temperature and Humidity Control: Avoid extreme temperatures and high humidity during storage and transit to prevent condensation and corrosion.

– Stacking and Load Security: Follow weight limits and stacking guidelines to prevent crushing. Secure loads with straps or dunnage to avoid movement.

– Just-in-Time (JIT) Delivery: Align with automotive manufacturing schedules; use EDI and Kanban systems for inventory synchronization.

– Cold Chain Not Required: Unlike refrigerants, AC lines themselves do not require temperature-controlled transport unless pre-charged (rare).

Documentation and Traceability

Complete and accurate documentation ensures compliance and supports quality audits:

– Certificates of Compliance (CoC) – Must accompany shipments, certifying adherence to SAE, IATF 16949, and material specifications.

– Material Test Reports (MTRs) – Provide evidence of material composition and mechanical properties.

– Lot/Batch Traceability – Each production batch must be traceable from raw material to final shipment for quality control and recall readiness.

– Customs Documentation – Include commercial invoices, packing lists, and HS codes (e.g., 8708.29 for AC parts) for international shipments.

– SDS (Safety Data Sheet) – Required if lines contain residual oils or cleaning agents; though typically not classified as hazardous.

Environmental and Sustainability Compliance

Automotive AC lines contribute to vehicle efficiency and environmental performance:

– Design compatibility with low-GWP (Global Warming Potential) refrigerants such as R-1234yf.

– Recycling programs for aluminum and steel lines at end-of-life; support circular economy initiatives.

– Compliance with ELV (End-of-Life Vehicles) Directive in the EU, including material labeling and restricted substance management.

– Minimize packaging waste through reusable or recyclable materials.

Returns and Non-Conformance Management

Establish procedures for handling defective or non-compliant shipments:

– Define acceptance criteria for visual, dimensional, and functional inspection upon receipt.

– Use a formal Non-Conformance Report (NCR) process to document defects (e.g., dents, leaks, missing caps).

– Coordinate return logistics with carriers; use original packaging when possible.

– Conduct root cause analysis and corrective actions in line with IATF 16949 requirements.

Conclusion

Effective logistics and compliance management for automotive AC lines ensures product quality, regulatory adherence, and supply chain efficiency. By following industry standards, maintaining traceability, and implementing best practices in packaging and transport, suppliers can support the reliable performance of automotive HVAC systems while meeting environmental and safety obligations.

Conclusion on Sourcing Automotive AC Lines

Sourcing automotive AC lines requires a strategic approach that balances quality, compatibility, cost, and reliability. Whether for original equipment manufacturing, aftermarket replacements, or custom installations, selecting the right supplier and product is critical to ensuring optimal performance and longevity of the vehicle’s air conditioning system. Key considerations include material quality (such as seamless aluminum or rubber-composite hoses), proper fittings and flare types (e.g., SAE or JIC), adherence to industry standards, and compatibility with refrigerants like R-134a or R-1234yf.

Working with reputable suppliers—whether OEM partners, established aftermarket brands, or custom fabrication specialists—helps mitigate risks related to leaks, inefficiency, or premature failure. Additionally, evaluating lead times, minimum order quantities, and technical support capabilities can significantly impact supply chain efficiency, especially for high-volume operations.

In summary, successful sourcing of automotive AC lines hinges on thorough due diligence, a clear understanding of technical specifications, and strong supplier relationships. By prioritizing these factors, businesses and technicians can ensure reliable cooling performance, regulatory compliance, and customer satisfaction across a diverse range of vehicle applications.