The global automatic transmission solenoid market is experiencing steady growth, driven by rising demand for fuel-efficient and high-performance vehicles. According to a report by Mordor Intelligence, the automotive transmission market—which includes automatic transmission components like solenoids—is projected to grow at a CAGR of over 6% from 2023 to 2028. This expansion is fueled by increasing adoption of automated and continuously variable transmissions (CVT/DCT), particularly in emerging economies. Additionally, Grand View Research valued the global automotive transmission market at USD 143.5 billion in 2022 and forecasts continued growth due to advancements in transmission technology and the electrification of powertrains. Automatic transmission solenoids, critical for seamless gear shifting and improved vehicle efficiency, are central to this trend. As OEMs and aftermarket suppliers strive to meet stricter emissions norms and enhanced driving experiences, innovation among leading solenoid manufacturers has intensified. Below are the top 9 automatic transmission solenoid manufacturers shaping the future of automotive transmission systems.

Top 9 Automatic Transmission Solenoid Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Curtiss-Wright Corporation

Domain Est. 1996

Website: curtisswright.com

Key Highlights: Customers rely on Curtiss-Wright’s long-standing relationships and established reputation as a trusted supplier of advanced technology for platforms and ……

#2 Transmission solenoid valves

Domain Est. 2016

Website: suntransmissions.com

Key Highlights: 4-day delivery 30-day returnsBuy online automatic transmission solenoid valves, solenoids, and connectors. Superior quality OEM standards. Free shipping with minimum order….

#3 Solenoids

Domain Est. 1996

Website: johnsonelectric.com

Key Highlights: Johnson Electric offers a diverse range of rotary and linear solenoids. These industry leading products include our high speed, short stroke rotary actuators.Missing: automatic tr…

#4 Solenoid valve, automatic transmission 1087.298.392

Domain Est. 1996

Website: aftermarket.zf.com

Key Highlights: 1087.298.392. Solenoid valve, automatic transmission. EAN: 4053202774855. Gross Weight (kg): 1.05. Find a Distributor. Specifications. Specifications ……

#5 Transmission Technologies

Domain Est. 2002

Website: borgwarner.com

Key Highlights: BorgWarner is the worldwide leader in automatic transmission clutch components and systems, BorgWarner supplies wet friction clutch modules, friction plates, ……

#6 DENSO Auto Parts

Domain Est. 2006

Website: densoautoparts.com

Key Highlights: DENSO is a global choice for top automakers, with multiple vehicle models rolling off the assembly line with DENSO auto parts under the hood….

#7 Variable

Domain Est. 2011

Website: bosch-mobility.com

Key Highlights: Durable and flexible for automatic transmissions. The variable-force transmission solenoid (VTS) controls the pilot pressure in automatic transmissions….

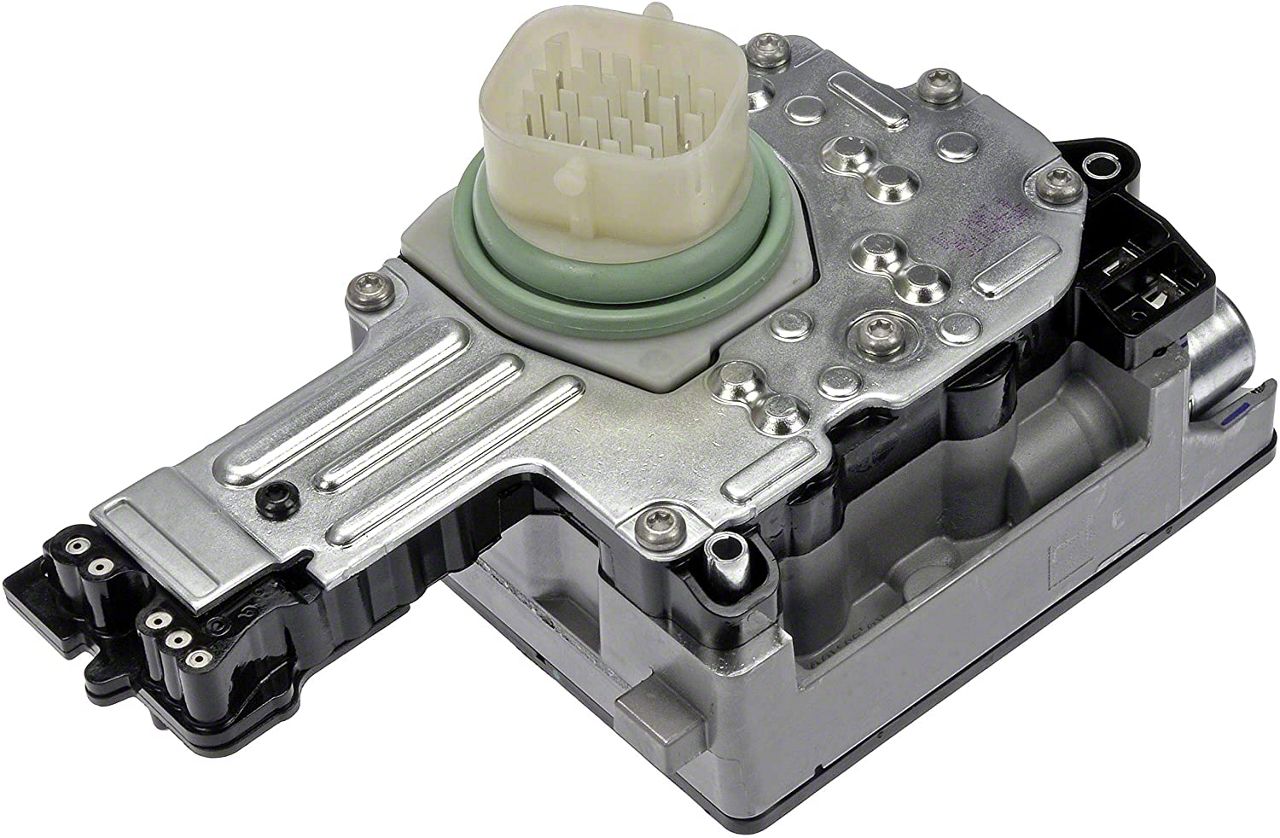

#8 AUTO TRANSMISSION SOLENOID

Domain Est. 2013

#9 Raybestos Powertrain

Domain Est. 2001

Website: raybestospowertrain.com

Key Highlights: Raybestos Powertrain is one of the largest manufacturers of premium American Made Automatic transmission parts. We specialize in OE and aftermarket ……

Expert Sourcing Insights for Automatic Transmission Solenoid

2026 Market Trends for Automatic Transmission Solenoid

The automatic transmission solenoid market is poised for significant transformation by 2026, driven by evolving automotive technologies, regulatory frameworks, and consumer preferences. Here are the key trends shaping the industry:

H2: Electrification Reshaping Demand Dynamics

While the rise of electric vehicles (EVs), which typically do not use traditional automatic transmissions, may reduce long-term demand for solenoids in pure EVs, the market will remain robust through 2026. Hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) continue to rely on complex automatic transmissions, sustaining solenoid demand. Additionally, the large installed base of internal combustion engine (ICE) and hybrid vehicles ensures ongoing replacement and aftermarket needs, offsetting some EV-related declines.

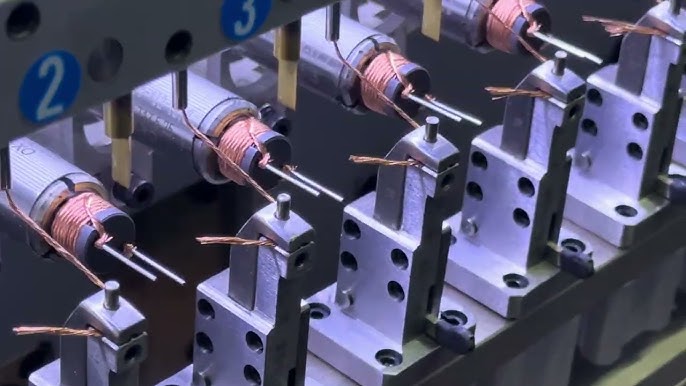

H2: Advancements in Solenoid Technology and Materials

Manufacturers are focusing on developing high-precision, energy-efficient solenoids with enhanced durability and faster response times. Innovations include the use of advanced materials like high-performance alloys and smart coatings to improve thermal resistance and reduce wear. Integration with electronic control units (ECUs) is enabling predictive maintenance and adaptive shift strategies, increasing the complexity and value of modern solenoids.

H2: Growth in Aftermarket and Remanufactured Components

As global vehicle fleets age, the aftermarket for transmission components, including solenoids, is expanding. Cost-conscious consumers and fleet operators are increasingly turning to remanufactured or aftermarket solenoids, creating opportunities for third-party suppliers. This trend is supported by improved quality standards and extended vehicle lifespans, particularly in emerging markets.

H2: Regional Shifts and Supply Chain Reconfiguration

Asia-Pacific, led by China and India, will remain the largest market due to rising vehicle production and ownership. However, geopolitical factors and supply chain resilience concerns are prompting manufacturers to diversify production bases, with increased investment in Southeast Asia, Eastern Europe, and North America. Localization strategies aim to mitigate risks and reduce logistics costs.

H2: Stringent Emission and Fuel Efficiency Regulations

Global regulations pushing for lower emissions and higher fuel efficiency are accelerating the adoption of advanced automatic transmissions such as dual-clutch (DCT) and continuously variable transmissions (CVT), which use multiple solenoids for precise control. This trend is boosting demand for high-performance solenoids capable of supporting complex transmission systems.

H2: Digitalization and Smart Diagnostics Integration

Integration of IoT and AI-driven diagnostics in vehicle maintenance is enabling real-time monitoring of transmission health. Solenoids equipped with embedded sensors can provide data on performance and wear, facilitating proactive maintenance and reducing downtime. This shift supports the growth of connected vehicle ecosystems and adds value to solenoid systems.

In conclusion, while the automatic transmission solenoid market faces structural challenges from vehicle electrification, technological innovation, regional growth, and regulatory demands will sustain its relevance through 2026. Companies that adapt to hybrid platforms, invest in R&D, and strengthen aftermarket offerings will be best positioned for success.

Common Pitfalls When Sourcing Automatic Transmission Solenoids (Quality & IP)

Sourcing automatic transmission solenoids—especially for replacement or aftermarket use—can be fraught with challenges related to both quality and intellectual property (IP). Avoiding these pitfalls is crucial to ensuring vehicle performance, reliability, and legal compliance.

Poor Quality Components

One of the most frequent issues is receiving solenoids that fail prematurely or underperform due to substandard manufacturing. Low-cost suppliers, particularly in unregulated markets, may use inferior materials such as low-grade copper windings, subpar seals, or weak plunger springs. These components may not withstand the high temperatures, pressure fluctuations, and electrical loads within an automatic transmission, leading to shift errors, harsh shifting, or complete transmission failure. Additionally, inconsistent calibration and lack of rigorous testing mean that even units that appear functional upon installation may degrade quickly.

Counterfeit or Non-OEM Spec Parts

Many solenoids marketed as “OEM-equivalent” are in fact counterfeit or reverse-engineered without proper validation. These parts often mimic the appearance of genuine components but fail to meet original equipment manufacturer (OEM) performance standards. They may lack proper resistance to electromagnetic interference, have incorrect duty cycles, or exhibit poor response times. Using such parts can trigger diagnostic trouble codes (DTCs), compromise transmission control module (TCM) functionality, and void warranties on related repairs.

Intellectual Property Infringement

Sourcing solenoids from unauthorized manufacturers risks IP violations, especially when designs, logos, or part numbers are copied without licensing. Major automotive suppliers like ZF, Aisin, or BorgWarner hold patents and trademarks on solenoid designs and electronic control algorithms. Distributors or repair shops using counterfeit or cloned parts may face legal liability, particularly in commercial or fleet operations. Even if not enforced immediately, IP-infringing components often lack technical support, traceability, and compliance documentation required for regulatory or warranty claims.

Inadequate Documentation and Traceability

Many low-cost solenoid suppliers provide little or no technical documentation, such as performance curves, temperature ratings, or compatibility matrices. Without proper datasheets or certification (e.g., ISO/TS 16949), it is difficult to verify whether a solenoid meets the required specifications for a particular transmission model. Lack of batch traceability also complicates root-cause analysis in the event of a failure, making it harder to recall or replace defective units.

Misrepresentation of Compatibility

Solenoids are highly application-specific, varying by transmission model, year, and vehicle make. Some suppliers inaccurately list compatibility based on part number cross-references alone, without validating electrical or mechanical fit. This can lead to mismatches in connector type, voltage requirements, or plunger stroke length—resulting in improper shifting behavior or damage to the TCM.

Avoiding these pitfalls requires sourcing from reputable, certified suppliers, verifying part authenticity, and ensuring full compliance with both technical and legal standards.

Logistics & Compliance Guide for Automatic Transmission Solenoid

Product Classification & HS Code

Automatic Transmission Solenoids are electromechanical components used in vehicle transmission systems to regulate fluid flow and engage gears. For international trade, they are typically classified under the Harmonized System (HS) Code 8505.90 (Electromagnets; parts thereof). However, exact classification may vary by country—consult local customs authorities or a trade compliance expert to confirm the appropriate HS code for import/export, as misclassification can lead to delays, penalties, or additional duties.

Import/Export Regulations

Compliance with import and export regulations is essential. Export controls may apply depending on the destination country, especially if the solenoid contains dual-use technologies. Verify whether export licenses are required under regulations such as the U.S. Export Administration Regulations (EAR) or the EU Dual-Use Regulation. Additionally, ensure adherence to country-specific automotive parts standards and avoid restricted destinations due to sanctions or embargoes.

Packaging & Labeling Requirements

Package solenoids in anti-static, moisture-resistant materials to prevent damage during transit. Each unit should be individually sealed and placed in sturdy, labeled cartons. Labels must include: product name, part number, batch/lot number, country of origin, weight, and handling symbols (e.g., “Fragile,” “This Side Up”). For international shipments, include bilingual labeling if required by the destination country. Barcodes and RFID tags may be used for inventory tracking.

Transportation & Handling

Use temperature-controlled and shock-minimized transport methods. Avoid exposure to extreme temperatures, humidity, or vibration. During handling, observe electrostatic discharge (ESD) precautions, particularly in dry environments. For air freight, comply with IATA Dangerous Goods Regulations if lithium components are present (rare but possible in integrated control units). Ground shipments should meet ADR regulations in Europe or equivalent local standards.

Customs Documentation

Prepare complete documentation for smooth customs clearance, including:

– Commercial Invoice (with detailed description, value, and HS code)

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin (preferably Form A or a manufacturer’s declaration)

– Import/Export License (if applicable)

– Product Compliance Certificates (e.g., ISO/TS 16949, RoHS, REACH)

Ensure all documents are accurate, consistent, and translated if required by the importing country.

Regulatory Compliance (Environmental & Safety)

Automatic Transmission Solenoids must comply with environmental and safety regulations:

– RoHS (EU): Restricts use of hazardous substances (e.g., lead, cadmium).

– REACH (EU): Requires declaration of Substances of Very High Concern (SVHC).

– ELV Directive (EU): End-of-Life Vehicles directive mandates recyclability and material reporting.

– Prop 65 (California, USA): Requires warning labels if containing listed chemicals.

Maintain compliance documentation and provide Material Declarations upon request.

Country-Specific Requirements

Different markets have unique requirements:

– USA: DOT/NHTSA regulations may apply if part of a safety-critical system; verify with FMVSS standards.

– EU: CE marking not typically required for individual components, but must conform to relevant directives when integrated.

– China: CCC (China Compulsory Certification) may apply to certain automotive parts—verify scope.

– Russia/EAEU: May require EAC certification for automotive components.

Always research destination-specific rules before shipping.

Warranty & Recall Logistics

Establish a clear process for handling warranty claims and potential recalls. Maintain traceability through batch/lot tracking systems. In case of a recall, coordinate with distributors and comply with local regulatory reporting timelines (e.g., NHTSA in the U.S., RAPEX in the EU). Designate a compliance officer to manage post-market surveillance.

Recommended Best Practices

- Partner with certified logistics providers experienced in automotive components.

- Conduct regular audits of compliance procedures.

- Train staff on ESD handling, packaging standards, and documentation accuracy.

- Use a Product Lifecycle Management (PLM) system to track compliance data and changes.

Adhering to this guide ensures efficient logistics operations and minimizes compliance risks for Automatic Transmission Solenoids in global supply chains.

In conclusion, sourcing an automatic transmission solenoid requires careful consideration of several key factors to ensure compatibility, reliability, and long-term performance. It is essential to identify the correct solenoid type based on the vehicle’s make, model, year, and transmission type. Prioritizing OEM or high-quality aftermarket components from reputable suppliers helps avoid premature failures and transmission issues. Additionally, evaluating supplier credibility, warranty offerings, and technical support can significantly impact sourcing success. Whether for repair, replacement, or inventory purposes, a strategic approach to sourcing ensures optimal functionality of the transmission system, minimizes downtime, and supports overall vehicle reliability.