The global automatic ignition system market is experiencing robust growth, driven by rising demand for efficient and reliable combustion solutions across residential, commercial, and industrial applications. According to Grand View Research, the global ignition system market size was valued at USD 9.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is fueled by advancements in combustion technology, increasing adoption of smart heating systems, and stringent environmental regulations pushing for cleaner and more efficient energy use. As automation becomes increasingly integrated into heating and power generation systems, manufacturers of automatic ignition technologies are at the forefront of innovation, delivering solutions that ensure safety, reliability, and performance. Based on market presence, technological capabilities, and product range, here are the top 10 automatic ignition system manufacturers shaping the industry’s future.

Top 10 Automatic Ignition System Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 TIS

Domain Est. 2003

Website: ignition.com.tw

Key Highlights: Taiwan Ignition System Co., Ltd. is a manufacturer supplying the Ignition Module, Ignition Coils, MAP Sensor, Camshaft Position Sensor, MAF Sensor & Crank ……

#2 Altronic Ignition Systems

Domain Est. 1996

Website: exline-inc.com

Key Highlights: Altronic II is an alternator-powered, capacitor discharge ignition system for 3 to 20 cylinder, 2 or 4 cycle low speed, high BMEP engines….

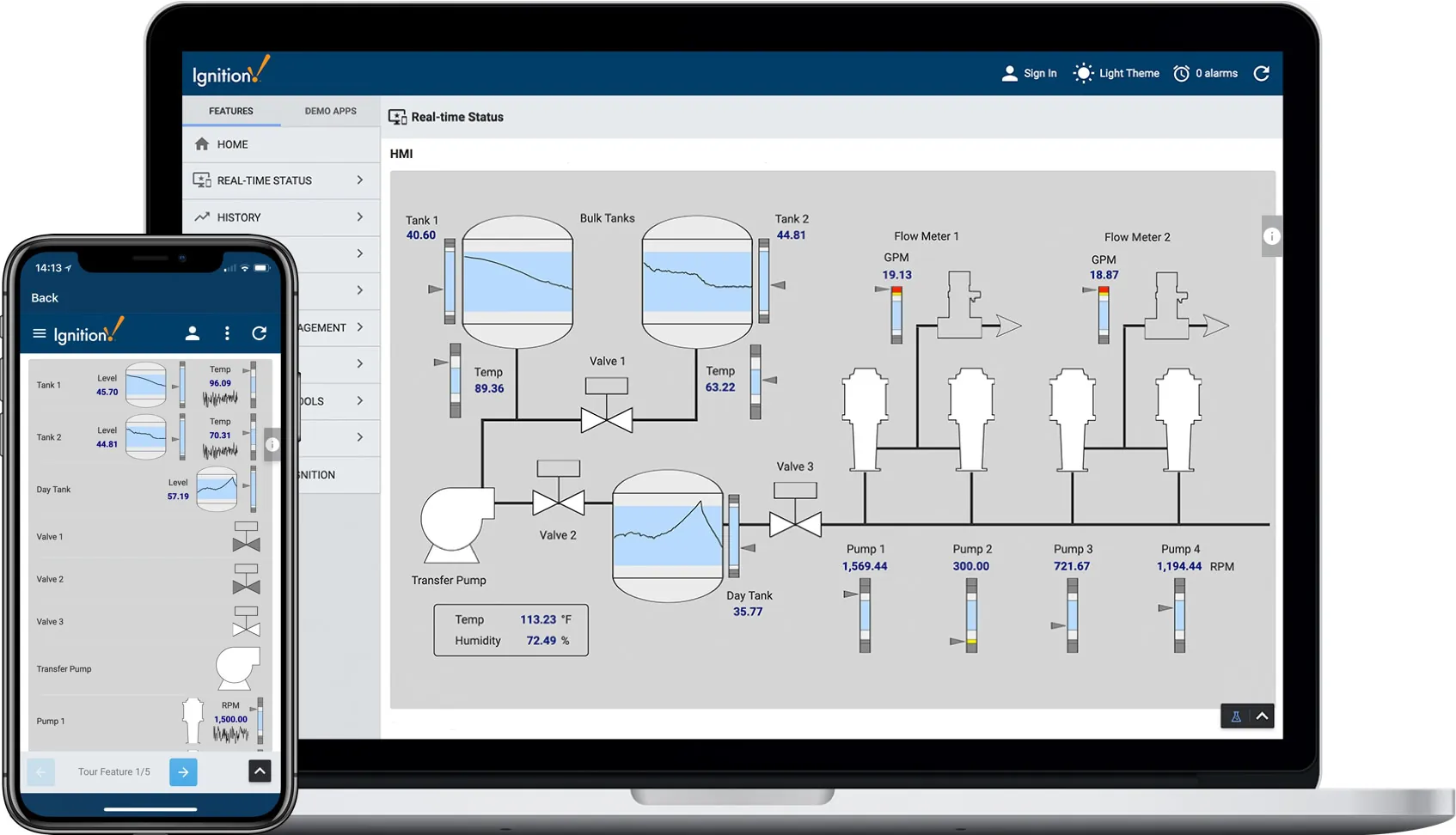

#3 Industrial Automation Software Solutions by Inductive Automation

Domain Est. 2005

Website: inductiveautomation.com

Key Highlights: Inductive Automation provides SCADA software and industrial automation solutions. Ignition software is the universal platform for automation industry needs….

#4 MSD Ignition

Domain Est. 1995

Website: msdignition.com

Key Highlights: MSD was the first company to develop and offer the multiple sparking, capacitive discharge ignition for engines. The line of MSD 6-Series Ignitions are the most ……

#5 Mallory

Domain Est. 1995

Website: holley.com

Key Highlights: Free delivery over $149 · 90-day returnsMallory manufactures high-quality ignition and fuel system components for classic Chevrolet, Ford, and Dodge engines….

#6 Power Arc

Domain Est. 1998

Website: powerarc.com

Key Highlights: Power Arc’s proprietary optical ignition systems offer extreme stability. A truly different product, you will notice a difference with this ignition….

#7 Performance Distributors

Domain Est. 2000

Website: performancedistributors.com

Key Highlights: Performance Distributors produces the most advanced line of high-performance ignition systems on the market. Make us your source for your vehicle components to ……

#8 Electroair Electronic Ignition Systems

Domain Est. 2005

Website: electroair.net

Key Highlights: A high energy, variable timed, fully electronic ignition system that gave piston powered experimental aircraft an increase in useful power and lower fuel ……

#9 CSI Ignition

Domain Est. 2011

Website: csi-ignition.com

Key Highlights: The ultimate electronic distributor for your classic car! The origin of Classic Sport Ignition lies within our passion for classical cars….

#10 Pertronix High Performance Ignition & Exhaust Products

Domain Est. 2020

Website: pertronixbrands.com

Key Highlights: The experts at PerTronix are ready to help you choose the perfect high performance ignition and exhaust products. We’re enthusiasts too!…

Expert Sourcing Insights for Automatic Ignition System

H2: 2026 Market Trends for Automatic Ignition Systems

The global Automatic Ignition System (AIS) market is projected to experience substantial growth and transformation by 2026, driven by technological advancements, rising safety regulations, and increasing demand across automotive, industrial, and residential sectors. Key trends shaping the market include:

-

Increased Adoption in Electric and Hybrid Vehicles

As the automotive industry shifts toward electrification, automatic ignition systems are being integrated into hybrid and plug-in electric vehicles (EVs) to streamline startup processes and enhance user convenience. By 2026, key automakers are expected to adopt smart ignition technologies that interface seamlessly with mobile devices and biometric authentication systems. -

Integration with IoT and Smart Technologies

Automatic ignition systems are becoming increasingly connected through the Internet of Things (IoT). By 2026, a growing number of systems will feature remote ignition via smartphone apps, voice assistants, and cloud-based diagnostics. This connectivity enhances user experience and enables predictive maintenance in industrial applications. -

Stringent Safety and Emission Regulations

Governments worldwide are enforcing stricter safety and emission standards. Automatic ignition systems contribute to reduced cold-start emissions and improved fuel efficiency by optimizing ignition timing. Regulatory compliance is accelerating adoption in emerging markets, particularly in Asia-Pacific and Latin America. -

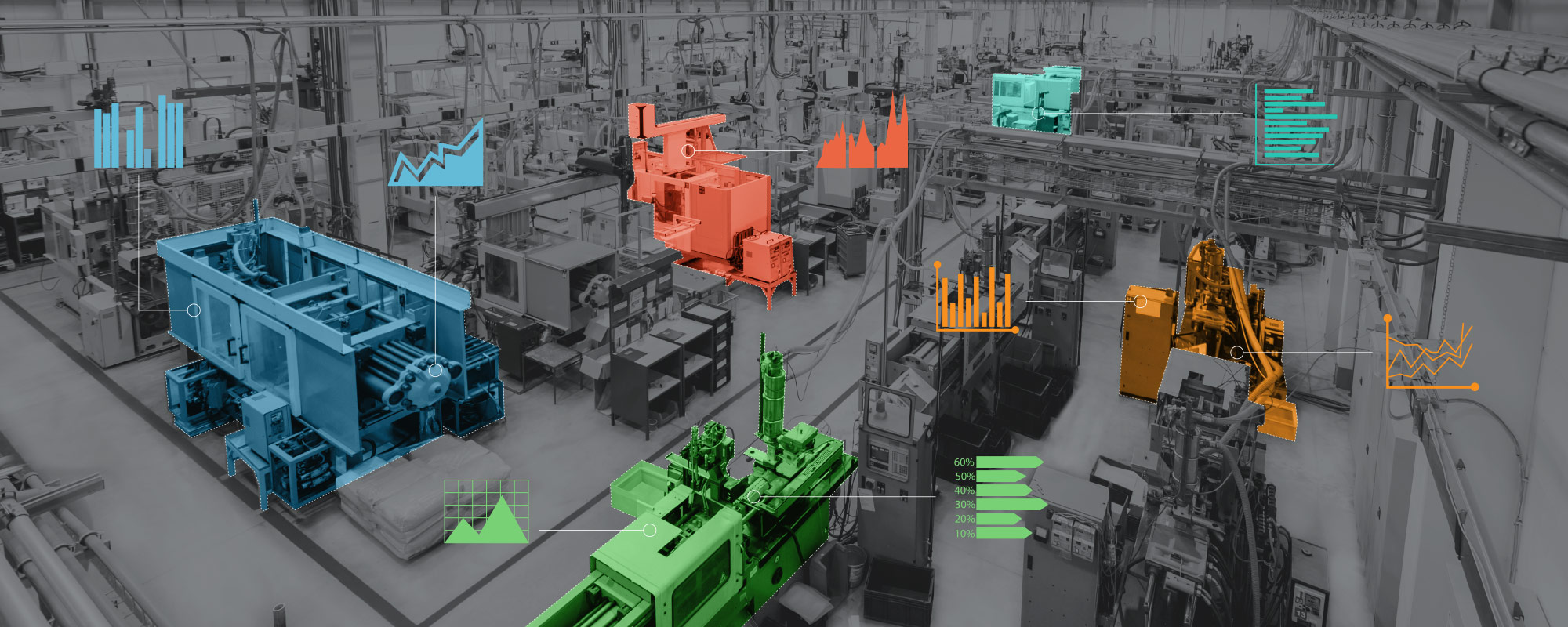

Growth in Industrial and Commercial Applications

Beyond the automotive sector, demand is rising in industrial boilers, gas turbines, and HVAC systems where reliable and fail-safe ignition is critical. The push for automation in manufacturing and energy production is fueling investments in advanced ignition solutions with self-diagnostics and flame detection capabilities. -

Advancements in Sensor and AI Technologies

By 2026, artificial intelligence and machine learning will play a larger role in predictive ignition control. Systems equipped with adaptive learning algorithms can analyze environmental conditions and engine parameters to optimize ignition performance, reducing wear and improving efficiency. -

Expansion in Emerging Economies

Rapid urbanization and industrialization in countries such as India, Indonesia, and Brazil are driving demand for modern ignition systems. Local manufacturing partnerships and government incentives for clean technology adoption are expected to boost market penetration. -

Focus on Cybersecurity and System Reliability

With increased connectivity comes heightened cybersecurity risks. By 2026, manufacturers will prioritize secure communication protocols and encrypted firmware to protect ignition systems from unauthorized access and hacking attempts.

In conclusion, the 2026 landscape for automatic ignition systems will be defined by innovation, connectivity, and regulatory alignment. Stakeholders who invest in smart, secure, and sustainable ignition technologies will be well-positioned to lead in this evolving market.

Common Pitfalls When Sourcing an Automatic Ignition System (Quality & IP)

Sourcing an Automatic Ignition System (AIS) involves significant technical, quality, and intellectual property (IP) considerations. Overlooking these aspects can lead to operational failures, safety hazards, legal disputes, and financial losses. Below are key pitfalls to avoid:

Poor Quality Control and Substandard Components

One of the most frequent issues in sourcing AIS components—especially from low-cost suppliers—is inadequate quality assurance. Ignition systems operate under extreme conditions (high voltage, temperature fluctuations, vibration), and substandard materials or manufacturing can result in premature failure, misfires, or complete system shutdown. Buyers often encounter counterfeit parts, inconsistent tolerances, or non-compliance with industry standards (e.g., ISO 9001, IATF 16949 for automotive). Always verify supplier certifications, demand sample testing, and conduct third-party audits.

Lack of Compliance with Safety and Environmental Standards

Automatic ignition systems must meet rigorous safety certifications (e.g., UL, CE, ATEX for explosive environments) and environmental regulations (e.g., RoHS, REACH). Sourcing systems that lack proper certification exposes the buyer to liability, especially in industrial or consumer applications. Ensure that the supplier provides full documentation of compliance and that the design adheres to the target market’s regulatory requirements.

Inadequate Intellectual Property Protection

Many ignition systems incorporate proprietary technologies, such as specialized control algorithms, sensor integration, or patented ignition sequences. When sourcing, especially from overseas manufacturers, there is a high risk of IP theft or unintended reverse engineering. Suppliers may copy designs or reuse them for competing clients. To mitigate this, use robust legal agreements (NDAs, IP ownership clauses), work with trusted partners, and consider patent filings in key jurisdictions before disclosing technical details.

Insufficient Technical Documentation and Support

Low-cost suppliers may provide minimal or poorly translated technical documentation, making integration, troubleshooting, and maintenance difficult. Missing schematics, firmware versions, or calibration procedures can delay deployment and increase lifecycle costs. Insist on comprehensive, accurate documentation in your required language and confirm ongoing technical support availability before finalizing a supplier.

Hidden Dependencies on Proprietary Firmware or Software

Some AIS solutions are tied to proprietary software or firmware that the supplier controls. This can create vendor lock-in, limit customization, and hinder future upgrades or diagnostics. Evaluate whether the system uses open protocols or if source code access is available (under license). Understanding software licensing terms is critical to avoid long-term operational constraints.

Failure to Verify Long-Term Availability and Scalability

Suppliers may offer attractive pricing on initial orders but lack the capacity or commitment for long-term production. Discontinued parts or supply chain instability can disrupt operations. Confirm the supplier’s production scalability, component sourcing strategy, and product lifecycle roadmap. Consider dual-sourcing critical components to reduce dependency.

Overlooking Reverse Compatibility and Integration Challenges

An AIS must seamlessly integrate with existing control systems, fuel types, and mechanical setups. Sourced systems may not support legacy interfaces (e.g., analog vs. digital signals) or may require costly modifications. Conduct thorough compatibility testing during the prototype phase and involve system integrators early in the selection process.

By proactively addressing these pitfalls—focusing on quality assurance, regulatory compliance, IP protection, and technical support—organizations can ensure reliable, safe, and legally secure sourcing of Automatic Ignition Systems.

Logistics & Compliance Guide for Automatic Ignition System

Product Classification and Documentation

Ensure the Automatic Ignition System is correctly classified under the appropriate Harmonized System (HS) code for international shipping. Typical classifications may fall under HS 8536.50 (Electrical ignition or starter equipment for internal combustion engines). Maintain accurate technical specifications, user manuals, and safety data sheets (SDS) for customs and regulatory review. All documentation must be available in the local language of the destination country.

Export Controls and Licensing

Verify whether the Automatic Ignition System is subject to export control regulations such as the Export Administration Regulations (EAR) in the U.S. or similar frameworks in other jurisdictions. Assess if encryption components or dual-use technology are embedded. If applicable, obtain the necessary export licenses or submit a license exception declaration (e.g., EAR99 classification) prior to shipment.

Safety and Electromagnetic Compliance

Confirm the system meets essential safety and electromagnetic compatibility (EMC) standards, including:

– IEC 60950-1 or IEC 62368-1 (Safety of Information and Communication Technology Equipment)

– EN 55032 / CISPR 32 (EMI Emissions)

– EN 55024 / IEC 61000-6-2 (Immunity)

Provide Declaration of Conformity (DoC) and CE marking for shipments to the European Union. For markets in the UK, ensure UKCA marking compliance where required.

Environmental and Chemical Regulations

Comply with RoHS (Restriction of Hazardous Substances) and REACH regulations for shipments into the EU. Ensure all restricted substances (e.g., lead, cadmium, phthalates) are below permissible limits. For systems with batteries, adhere to transportation regulations under IATA/IMDG for lithium content, and include required labels and documentation.

Packaging and Transport Requirements

Package the Automatic Ignition System to withstand vibration, temperature fluctuations, and moisture during transit. Use anti-static materials where applicable. Clearly label packages with handling instructions, CE/UKCA marks, and product identifiers. For air freight, comply with IATA Dangerous Goods Regulations if the system includes rechargeable batteries.

Import Requirements by Region

- European Union: Provide Economic Operator Registration and Identification (EORI) number, complete customs declarations, and appoint an Authorized Representative if required.

- United States: File entry documentation with U.S. Customs and Border Protection (CBP); ensure compliance with FCC Part 15 for radio frequency interference.

- Canada: Meet ICES-003 emission standards and provide B3 form for customs clearance.

- Other Regions: Research local type approval requirements (e.g., KC mark for South Korea, CCC for China).

Warranty and After-Sales Compliance

Include multilingual warranty information and service contact details. Maintain records for product traceability and recall readiness under regional product safety laws (e.g., GPSR in the EU). Establish a process for reporting non-compliance or safety incidents to relevant authorities.

Recordkeeping and Audits

Retain all compliance documentation, shipping records, and certificates for a minimum of five years. Conduct annual internal audits to verify ongoing adherence to logistics and regulatory standards. Update compliance status promptly with changes in product design or international regulations.

Conclusion:

The sourcing of an automatic ignition system should be approached with careful consideration of reliability, compatibility, safety standards, and long-term maintenance requirements. After evaluating various suppliers, technical specifications, and cost factors, it is evident that selecting a high-quality, certified automatic ignition system from a reputable manufacturer ensures optimal performance, energy efficiency, and operational safety across diverse applications—ranging from industrial burners to residential heating systems.

Investing in advanced ignition technology not only minimizes the risk of failure and downtime but also contributes to improved environmental compliance through consistent and complete combustion. Furthermore, sourcing from suppliers offering strong technical support, warranty coverage, and spare parts availability enhances system longevity and reduces total cost of ownership.

In conclusion, a strategic sourcing approach that balances performance, cost, and support will lead to the successful implementation of an automatic ignition system, supporting safe, efficient, and uninterrupted operations in the target application.