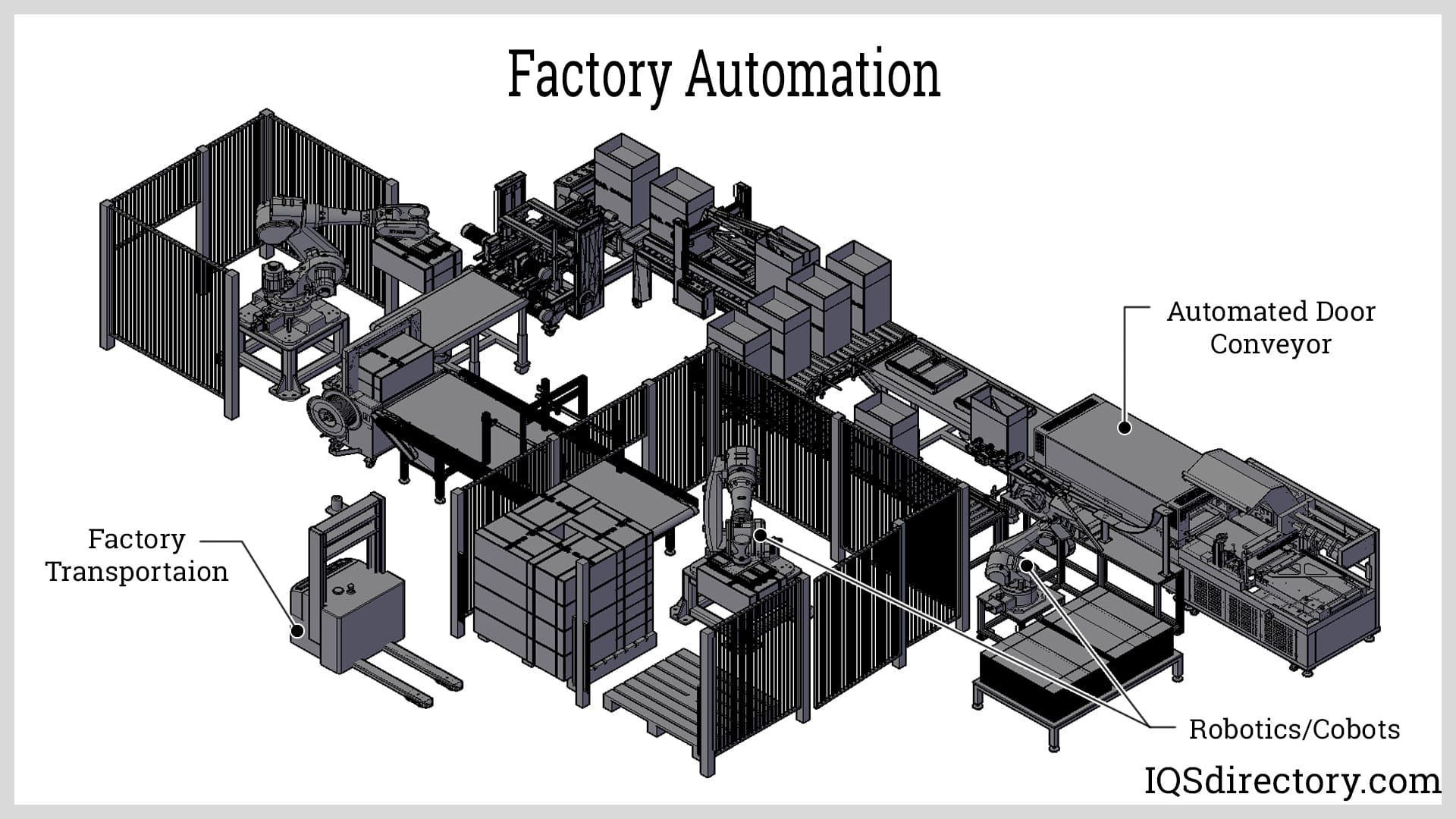

The global automated equipment manufacturing market is experiencing robust expansion, driven by increasing demand for operational efficiency, precision, and scalability across industries such as automotive, electronics, pharmaceuticals, and consumer goods. According to a 2023 report by Grand View Research, the global industrial automation market was valued at USD 187.6 billion and is projected to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. Similarly, Mordor Intelligence forecasts the industrial robotics market—core to automated equipment—to expand at a CAGR of over 11% during the same period, citing rapid adoption of smart manufacturing technologies and Industry 4.0 initiatives. As manufacturers increasingly integrate automation to reduce labor costs, minimize errors, and enhance throughput, innovation leaders in this space are setting new benchmarks in reliability, integration, and intelligent system design. Below are the top 10 automated equipment manufacturers shaping the future of industrial automation.

Top 10 Automated Equipment Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Automation Equipment Manufacturer

Domain Est. 1996

Website: eaminc.com

Key Highlights: EAM, Inc. is an automation equipment manufacturer for both standard and custom equipment for your unique needs and process. Learn more!…

#2 Factory Automation Solutions

Domain Est. 1996

Website: us.mitsubishielectric.com

Key Highlights: Factory automation solutions from Mitsubishi Electric Automation deliver on quality, performance, and compatibility with technology empowering companies to ……

#3 Trusted Partner in Helping to Solve the Biggest Challenges of …

Domain Est. 1995

Website: emerson.com

Key Highlights: As a global automation leader, Emerson is poised to transform industrial manufacturing. Explore the next-generation automation architecture designed to ……

#4 Industrial Automation Equipment & Flex Feeders

Domain Est. 1996 | Founded: 1946

Website: feedall.com

Key Highlights: Since 1946, Feedall Automation has delivered the best in automation equipment. With the most advanced and comprehensive line of parts feeding systems available….

#5 Automation Equipment Supplier & Manufacturing Systems

Domain Est. 1997

Website: acro.com

Key Highlights: Leading automation equipment company offering automation systems, robotic manufacturing systems, and custom solutions for industrial automation. Contact us….

#6 Omron Automation

Domain Est. 1997

Website: automation.omron.com

Key Highlights: Your trusted partner in industrial automation and safety. Omron Automation works with customers to develop solutions for their manufacturing challenges….

#7 Products

Domain Est. 2001

Website: deltaww.com

Key Highlights: 10/20/2025Delta’s Digital Twin Solution Accelerates Allring Tech’s Multi-Head Dispensing Equipment Development · 10/14/2025Delta and SKYTECH’s Energy-Saving Pump ……

#8 Brooks Automation

Domain Est. 1995

Website: brooks.com

Key Highlights: Delivering an. Automated Advantage for our Customers · Collaborative Robotics · Robotics · Vacuum and Atmospheric Systems · Carrier Clean · Reticle Storage · Services….

#9 ATS Corporation

Domain Est. 1996

Website: atsautomation.com

Key Highlights: ATS Corporation, an industry leading automation solutions provider, is a publicly traded company listed on the TSX and NYSE. To find the latest financials ……

#10 ATC Automation

Domain Est. 2013

Website: atcautomation.com

Key Highlights: For more than four decades, ATC Automation has provided highly engineered solutions and systems for a variety of industries….

Expert Sourcing Insights for Automated Equipment

H2: 2026 Market Trends for Automated Equipment

By 2026, the automated equipment market is poised for significant transformation, driven by converging technological advancements, evolving economic pressures, and shifting global priorities. Key trends shaping this landscape include:

1. AI and Machine Learning Integration Accelerates Intelligence: Automation is moving beyond pre-programmed routines. By 2026, AI-powered predictive maintenance, real-time adaptive control, and generative AI for optimizing production schedules and design will be standard in advanced equipment. This enables self-optimizing systems that learn from data, reducing downtime and improving efficiency.

2. Robotics Proliferation Beyond Traditional Factories: While industrial robots remain core, expect explosive growth in collaborative robots (cobots) and mobile robots (AMRs) across warehouses, logistics, agriculture, and even healthcare. Lower costs, improved safety features, and easier programming will democratize robotics, making them accessible to SMEs.

3. Focus on Resilient and Flexible Automation: Geopolitical instability and supply chain disruptions have highlighted the need for agility. Automated equipment will increasingly emphasize reconfigurability, modular design, and rapid reprogramming to handle smaller batch sizes, customized products, and quick shifts in production (mass customization).

4. Convergence of OT and IT (Industry 5.0 & Smart Factories): Seamless integration between Operational Technology (OT – machinery, sensors) and Information Technology (IT – cloud, data platforms) will be critical. Digital twins, edge computing, and robust Industrial IoT (IIoT) platforms will enable holistic factory optimization, real-time decision-making, and closed-loop quality control.

5. Sustainability as a Core Driver: Automation will be increasingly leveraged to achieve environmental goals. Energy-efficient motors, optimized processes reducing waste (material, energy, time), and automated systems for circular economy processes (e.g., precise sorting in recycling) will be major growth areas. Regulations and ESG pressures will accelerate this trend.

6. Workforce Transformation and Upskilling: Automation won’t eliminate jobs but will radically change them. Demand will surge for roles managing, maintaining, programming, and analyzing data from automated systems (e.g., robot technicians, data scientists, automation engineers). Significant investment in workforce reskilling and change management will be essential.

7. Expansion into New Sectors: Automation will penetrate deeper into traditionally manual or service-oriented sectors:

* Construction: Automated bricklaying, 3D printing, site surveying drones.

* Agriculture: Autonomous tractors, precision planting/harvesting, drone-based monitoring.

* Logistics & Warehousing: Fully automated sorting, goods-to-person systems, last-mile delivery robots.

* Healthcare: Surgical robots, automated lab testing, pharmacy dispensing systems.

8. Cybersecurity Becomes Paramount: As equipment becomes more connected, the attack surface expands. Robust cybersecurity protocols embedded in hardware and software, zero-trust architectures, and continuous monitoring will be non-negotiable requirements for automated systems.

9. Supply Chain Localization and Nearshoring: Automation enables cost-effective production closer to end markets. This “reshoring” or “nearshoring” trend, driven by risk mitigation and speed-to-market, will boost demand for automated solutions in regions like North America and Europe.

10. Focus on Total Cost of Ownership (TCO) and ROI: Buyers will move beyond initial purchase price, demanding clear proof of ROI through quantified efficiency gains, quality improvements, labor savings, and reduced downtime. Vendors will need to offer comprehensive service, support, and data analytics to demonstrate value.

In conclusion, the 2026 automated equipment market will be characterized by smarter, more flexible, connected, and sustainable systems. Success will depend on embracing AI, ensuring cybersecurity, enabling workforce adaptation, and delivering tangible economic and environmental value across an expanding range of industries.

Common Pitfalls in Sourcing Automated Equipment: Quality and Intellectual Property Risks

Sourcing automated equipment offers significant efficiency and productivity gains, but organizations often encounter critical challenges related to quality assurance and intellectual property (IP) protection. Overlooking these areas can lead to costly delays, operational failures, and legal exposure. Below are key pitfalls to avoid.

Quality-Related Pitfalls

Inadequate Supplier Vetting and Due Diligence

Failing to thoroughly evaluate a supplier’s track record, certifications (e.g., ISO 9001), and experience with similar projects can result in subpar equipment performance. Suppliers lacking robust quality management systems may deliver inconsistent or unreliable automation solutions.

Insufficient Specification and Requirement Definition

Vague or incomplete technical specifications increase the risk of receiving equipment that does not meet operational needs. Without clear performance metrics, integration standards, or environmental tolerances, discrepancies in quality are difficult to identify and enforce.

Lack of Factory Acceptance Testing (FAT) and Site Acceptance Testing (SAT)

Skipping or inadequately conducting FAT and SAT exposes buyers to undetected defects. These formal testing protocols are essential to verify functionality, safety, and compliance before and after installation.

Overlooking Long-Term Serviceability and Support

Equipment may perform well initially, but poor long-term quality often stems from inadequate documentation, unavailable spare parts, or unresponsive technical support. Ensuring service-level agreements (SLAs) and ongoing support is integral to sustained quality.

Intellectual Property-Related Pitfalls

Ambiguous Ownership of Customized Designs or Software

When equipment is tailored to specific processes, unclear contracts may result in disputes over IP ownership. Suppliers might retain rights to software, control logic, or mechanical designs, limiting the buyer’s ability to modify, maintain, or replicate the system.

Inadequate Protection of Proprietary Process Information

During the design and integration phase, buyers often disclose sensitive operational data. Without strong non-disclosure agreements (NDAs) and data security clauses, there is a risk of trade secret exposure or misuse by the supplier or subcontractors.

Use of Third-Party or Licensed Components Without Proper Licensing

Automated systems may incorporate third-party software or patented technologies. If the supplier fails to secure proper licenses, the end-user could face legal liability for infringement, even unintentionally.

Failure to Address Reverse Engineering and Modification Rights

Contracts that do not explicitly permit in-house or third-party maintenance and modifications can restrict operational flexibility. Suppliers may use IP claims to enforce exclusive service contracts, increasing long-term costs.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Conduct comprehensive supplier audits and request references.

– Define exact technical and performance requirements in procurement contracts.

– Mandate FAT/SAT procedures with clear pass/fail criteria.

– Negotiate IP clauses that secure ownership of custom elements and ensure access to source code and schematics.

– Include robust NDAs and data protection terms.

– Verify licensing compliance for all embedded technologies.

Proactively addressing quality and IP concerns during the sourcing phase is essential for ensuring reliable, secure, and legally sound automation investments.

Logistics & Compliance Guide for Automated Equipment

This guide outlines key considerations for the logistics and compliance aspects of deploying automated equipment across various industries, including manufacturing, warehousing, and logistics operations.

Equipment Classification and Regulatory Alignment

Identify the type of automated equipment (e.g., Autonomous Mobile Robots (AMRs), Automated Guided Vehicles (AGVs), robotic arms, automated storage and retrieval systems (AS/RS)) and determine applicable regulatory frameworks. Key standards include ISO 3691-4 (safety requirements for driverless trucks), ANSI/RIA R15.06 (industrial robot safety), and local occupational health and safety regulations. Ensure equipment is CE-marked (EU), UL/ETL listed (North America), or meets equivalent regional certifications.

Transportation and Handling Requirements

Automated equipment often requires specialized shipping due to size, weight, and sensitivity. Use climate-controlled and shock-monitored transport when necessary. Secure equipment with custom crating and ensure lifting points are clearly marked. Coordinate with freight forwarders experienced in handling high-value automation systems to minimize transit risks.

Import/Export Compliance

Verify compliance with international trade regulations, including export controls (e.g., U.S. EAR or EU Dual-Use Regulations) if equipment contains sensitive technology. Prepare accurate Harmonized System (HS) codes, commercial invoices, packing lists, and certificates of origin. For cross-border shipments, ensure adherence to customs procedures and anticipate potential tariffs or restrictions.

Installation Site Preparation

Confirm that the destination facility meets technical requirements such as floor load capacity, power supply specifications (voltage, frequency, grounding), network connectivity (Wi-Fi coverage, latency), and environmental controls (temperature, humidity). Conduct a site survey prior to delivery to prevent delays during commissioning.

Safety and Operational Compliance

Implement risk assessments (e.g., ISO 12100) and machine safeguarding per local regulations. Equip automated systems with emergency stops, light curtains, and collision avoidance sensors. Develop and maintain documented safety procedures, including lockout/tagout (LOTO), and ensure operators are trained per OSHA (U.S.) or equivalent standards.

Documentation and Traceability

Maintain comprehensive records, including equipment manuals, compliance certificates, software version logs, maintenance schedules, and incident reports. Use asset tracking systems to monitor location, service history, and compliance status throughout the equipment lifecycle.

Cybersecurity and Data Compliance

Ensure automated systems adhere to cybersecurity best practices (e.g., NIST, IEC 62443). Implement secure communication protocols, access controls, and regular software updates. Where data is collected (e.g., operational metrics or personnel movement), comply with data privacy laws such as GDPR or CCPA.

Maintenance and Regulatory Audits

Establish a preventive maintenance program aligned with manufacturer guidelines. Schedule regular audits to verify ongoing compliance with safety, environmental, and operational standards. Keep logs accessible for internal reviews or external inspections by regulatory bodies.

End-of-Life and Decommissioning

Plan for responsible decommissioning, including data sanitization, equipment recycling, and proper disposal of batteries or hazardous components per WEEE (EU) or RCRA (U.S.) regulations. Maintain records of disposal for compliance verification.

Conclusion for Sourcing Automated Equipment

Sourcing automated equipment represents a strategic investment that can significantly enhance operational efficiency, reduce labor costs, improve product quality, and increase production consistency. As industries continue to evolve in response to technological advancements and increasing market demands, automation has become a critical enabler of competitiveness and scalability.

The process of sourcing automated equipment requires careful evaluation of technical specifications, supplier reliability, total cost of ownership, integration capabilities with existing systems, and long-term maintenance support. Engaging with reputable suppliers, conducting thorough due diligence, and planning for change management are essential to ensure a successful implementation.

Ultimately, organizations that strategically source and deploy automated equipment position themselves for greater agility, improved productivity, and sustainable growth. By embracing automation, businesses not only optimize current operations but also lay a strong foundation for future innovation and digital transformation.