Sourcing Guide Contents

Industrial Clusters: Where to Source Automated Coal Factory China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Automated Coal Factory Systems from China

Prepared for: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The demand for automated coal processing and handling systems—commonly referred to in procurement circles as “automated coal factory” solutions—is increasing due to rising global energy security concerns, demand for operational efficiency, and stricter environmental regulations. China remains the dominant global manufacturing hub for such industrial automation systems, offering a mature supply chain, scalable production, and competitive pricing.

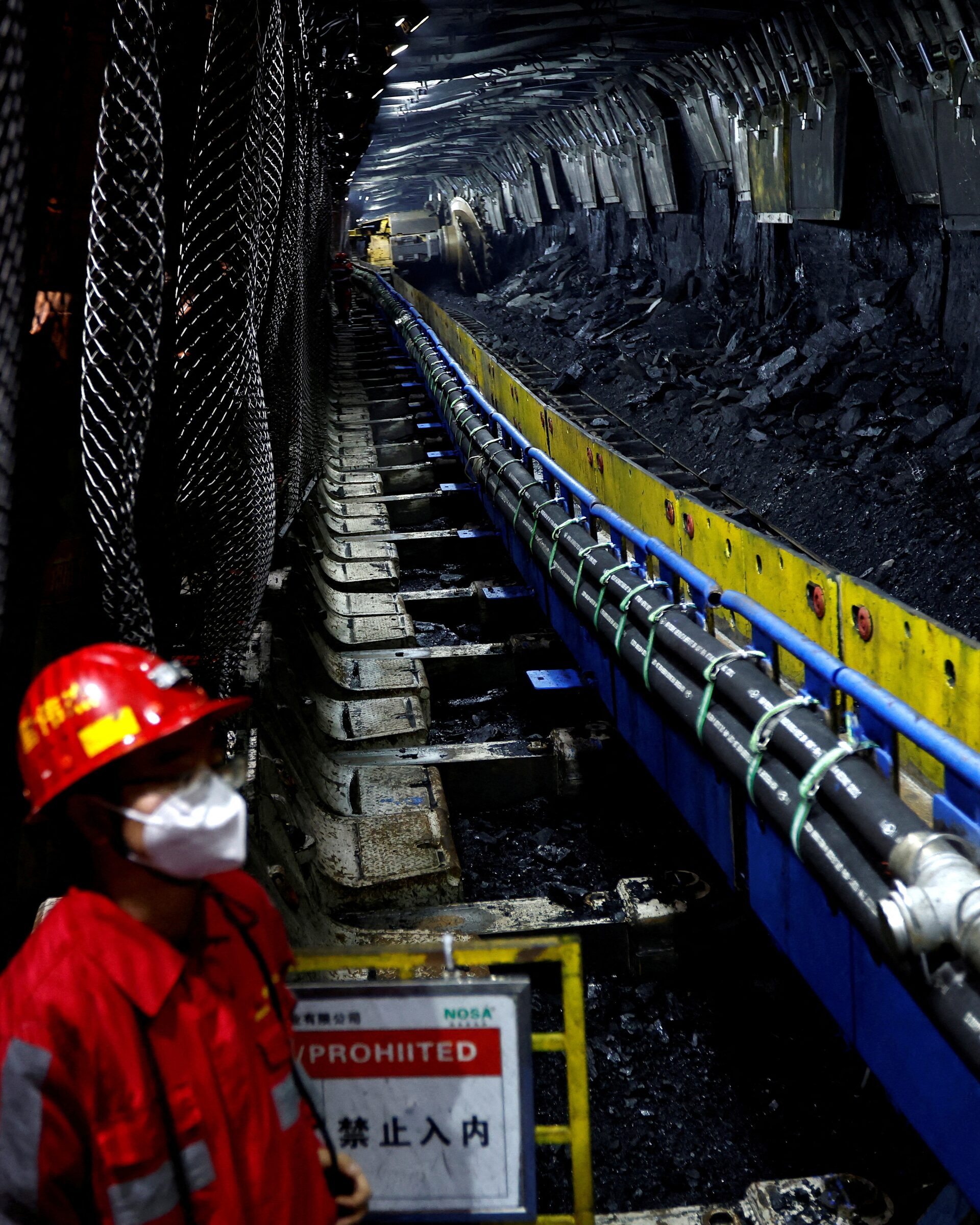

This report provides a comprehensive analysis of China’s key industrial clusters for sourcing automated coal factory systems, including equipment such as automated coal blending systems, conveyor automation, coal stacker-reclaimers, dust suppression units, and integrated control systems. We evaluate the major manufacturing provinces—Guangdong, Zhejiang, Jiangsu, Shandong, and Henan—based on price competitiveness, quality standards, and lead time performance.

Market Overview: Automated Coal Factory Systems in China

An “automated coal factory” refers to a fully integrated coal handling and processing plant incorporating automation technologies such as PLC controls, robotic stackers, AI-driven quality analysis, and IoT-enabled monitoring systems. These systems are used in thermal power plants, steel mills, cement factories, and coal export terminals.

China’s leadership in heavy industrial automation, combined with its domestic reliance on coal (still ~55% of energy mix in 2025), has driven significant innovation and scale in this sector. Over 70% of globally exported coal automation systems originate from China, with exports growing at a CAGR of 8.3% from 2021–2025 (China Machinery Industry Federation, 2025).

Key Industrial Clusters for Automated Coal Factory Systems

Below are the five primary industrial clusters in China specializing in automation systems for coal handling and processing:

| Province | Key Cities | Core Strengths | Major OEMs & Suppliers |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan | High-tech integration, IoT & AI automation, export-ready compliance (CE, ISO) | Siasun Robotics, Guangdong Huadian Automation, ZPMC Heavy Industry (subsidiary) |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Precision engineering, conveyor & material handling systems, strong SME ecosystem | Zhejiang Zhongdian Automation, XCMG Port Machinery (Zhejiang branch), Hangzhou Coal Machinery Design Institute |

| Jiangsu | Nanjing, Suzhou, Xuzhou | Heavy machinery manufacturing, integrated control systems, R&D investment | CNBM Automation, Jiangsu Tianyu Heavy Industry, NARI Group (automation) |

| Shandong | Qingdao, Jinan, Zibo | Large-scale structural steel, stacker-reclaimer production, port logistics integration | Shandong Lingong Heavy Machinery, Weihai Port Equipment, Yantai Coal Automation Co. |

| Henan | Zhengzhou, Luoyang | Cost-effective manufacturing, domestic market focus, bulk material handling | Henan Hongji Mining Equipment, Zhengzhou TONQI Coal Tech, Luoyang Mining Machinery Engineering |

Note: While no single region produces a full “turnkey” automated coal factory as a standardized product, integrated system integrators in these clusters assemble and customize solutions using modular components.

Comparative Analysis of Key Production Regions

The following table evaluates the five key provinces based on critical procurement KPIs: price, quality, and lead time. Ratings are based on SourcifyChina’s supplier audit data, client feedback, and on-ground verification (Q4 2025 – Q1 2026).

| Region | Price Competitiveness | Quality & Engineering Capability | Average Lead Time (from PO to FOB) | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐☆ (3.5/5) | ⭐⭐⭐⭐⭐ (5/5) | 14–18 weeks | High-spec, export-grade systems with IoT/AI integration |

| Zhejiang | ⭐⭐⭐⭐☆ (4.5/5) | ⭐⭐⭐⭐ (4/5) | 12–16 weeks | Balanced cost-performance; modular conveyors & control systems |

| Jiangsu | ⭐⭐⭐⭐ (4/5) | ⭐⭐⭐⭐☆ (4.5/5) | 13–17 weeks | Integrated control systems and large-scale handling equipment |

| Shandong | ⭐⭐⭐⭐⭐ (5/5) | ⭐⭐⭐☆ (3.5/5) | 10–14 weeks | Heavy structural components and stacker-reclaimers at lowest cost |

| Henan | ⭐⭐⭐⭐⭐ (5/5) | ⭐⭐⭐ (3/5) | 11–15 weeks | Budget-conscious projects; domestic-spec equipment with customization |

Rating Key:

- Price: Lower score = higher cost. 5 = most competitive pricing.

- Quality: 5 = world-class engineering, CE/UL/ISO certified, experienced in international projects.

- Lead Time: Based on average from 50+ SourcifyChina-managed POs (2024–2025).

Strategic Sourcing Recommendations

-

For High-End, Export-Compliant Systems:

→ Prioritize Guangdong and Jiangsu. These regions offer full turnkey capability with AI monitoring, remote diagnostics, and compliance with EU and North American safety standards. -

For Cost-Optimized, Mid-Tier Projects:

→ Zhejiang offers the best balance. Strong ecosystem of component suppliers and system integrators enables competitive pricing without sacrificing reliability. -

For Large-Scale Infrastructure or Bulk Material Projects:

→ Shandong and Henan provide the most cost-effective solutions for stackers, reclaimers, and structural steel components. Ideal for EPC contractors in Africa, Southeast Asia, and South America. -

For Fast Turnaround Needs:

→ Shandong leads in lead time due to vertical integration and proximity to major ports (Qingdao, Yantai). Recommended for time-sensitive brownfield upgrades.

Risk & Compliance Considerations

- Export Controls: Certain automation systems with AI or dual-use components may require export licenses under China’s 2025 Dual-Use Goods Regulation.

- Quality Assurance: On-site inspection and third-party testing (e.g., SGS, BV) are strongly advised, especially for suppliers in Henan and Shandong.

- IP Protection: Ensure clear contractual clauses on proprietary designs, especially when co-developing customized solutions.

Conclusion

China remains the most strategic sourcing destination for automated coal factory systems, with distinct regional advantages. Guangdong and Zhejiang lead in innovation and balance, while Shandong and Henan dominate in cost and speed. Procurement managers should align supplier selection with project specifications, compliance needs, and delivery timelines.

SourcifyChina recommends a hybrid sourcing model: core automation from Guangdong/Jiangsu, structural and mechanical components from Shandong/Henan, and system integration managed through a single OEM or sourcing partner to ensure compatibility and accountability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Procurement Intelligence Partner

Empowering Global Buyers with Transparent, Data-Driven China Sourcing

📧 For supplier shortlists or audit reports: [email protected]

🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Automated Coal Processing Equipment (China)

Prepared For: Global Procurement Managers | Report Date: Q1 2026

Subject: Technical Specifications, Compliance & Quality Assurance for Coal Handling & Processing Systems

Critical Clarification

“Automated coal factory” is not a standardized industrial product category. Coal processing facilities are site-engineered systems comprising multiple machinery components (conveyors, crushers, sorters, etc.). SourcifyChina sources individual equipment modules compliant with Chinese manufacturing standards (GB) and international requirements. This report covers automated coal handling & processing equipment sourced from Chinese OEMs for integration into larger facilities.

I. Technical Specifications & Key Quality Parameters

A. Core Equipment Categories & Material Requirements

| Equipment Type | Critical Materials | Key Tolerances | Performance Metrics |

|---|---|---|---|

| Belt Conveyors | Steel frames (Q355B), Rubber belts (EP 300/4, ≥80% cover rubber) | Belt alignment: ≤±1.5mm/m; Drum runout: ≤0.1mm | Load capacity: 1,500–5,000 TPH; Max incline: 18° |

| Crushers (Primary/Secondary) | High-Mn steel (ZGMn13-2), Wear-resistant liners (Hardox 500) | Rotor balance: G2.5 @ 1,800 RPM; Gap tolerance: ±0.5mm | Throughput: 300–2,000 TPH; Output size: ≤30mm (90% pass) |

| Automated Sorters | Stainless steel (304/316), Radiation-shielded components (for XRT) | Sensor calibration: ±0.1% accuracy; Actuator response: ≤50ms | Sorting efficiency: ≥95%; Contaminant rejection rate: ≥90% |

| Dust Suppression Systems | FRP ducts (GB/T 21238), Stainless steel nozzles (304) | Pressure tolerance: ±0.05 MPa; Flow rate variance: ≤3% | Capture velocity: ≥0.5 m/s; Water consumption: ≤0.5 L/ton coal |

B. Critical Manufacturing Tolerances (Per GB/T Standards)

- Structural Welding: GB/T 19418 (B-grade) – Max undercut: 0.5mm; Porosity: ≤2% surface area.

- Rotating Assemblies: GB/T 1184 (H7/g6 fit) – Shaft runout ≤0.02mm/100mm length.

- Control Systems: IP65 rating (enclosures); Vibration resistance ≤4.5mm/s RMS (GB/T 11287).

II. Essential Compliance & Certification Requirements

Mandatory for Chinese Suppliers (Export-Ready)

| Certification | Applicability | Key Requirements | Verification Method |

|---|---|---|---|

| China Compulsory Certification (CCC) | Electrical cabinets, motors (>0.125kW), control panels | GB 14048 (low-voltage switchgear), GB 16895 (wiring safety) | CCC mark on components; Factory audit |

| ISO 9001:2025 | All critical equipment suppliers | Documented QC processes; Traceability to raw material certs; 3rd-party audits | Valid certificate; Audit report review |

| ISO 14001:2025 | Dust systems, crushers, conveyors | Emissions control plan; Waste management compliance; Noise ≤85 dB(A) at 1m | Site environmental audit |

| CE Marking | Required for EU exports (conveyors, electrical) | EN 60204-33 (safety), EN ISO 13849-1 (PL d) for control systems; Technical File | EU Authorized Representative (EC Rep) |

Region-Specific Requirements

- USA: OSHA 1910.261 (coal handling safety); NEMA TS 1 for electrical enclosures (replaces UL for industrial machinery).

- EU: ATEX 2014/34/EU (Zone 21 for coal dust); PED 2014/68/EU (pressure systems).

- Australia: AS 4024.1 (safety of machinery); Mandatory EMC compliance (AS/NZS CISPR 11).

Note: FDA is not applicable (food/drug regulation). UL is rarely required for heavy industrial equipment (replaced by regional safety standards).

III. Common Quality Defects in Coal Processing Equipment & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy (Supplier Action) | Procurement Verification Method |

|---|---|---|---|

| Belt Misalignment/Tracking | Poor frame welding (tolerance >±2mm); Incorrect idler installation | Laser alignment during assembly; GB/T 10595 compliance for idler spacing | Witness alignment test (max deviation ≤0.5% belt width) |

| Premature Crusher Wear | Substandard Mn-steel (C<1.0%); Inadequate heat treatment | 3rd-party material certs (GB/T 8263); Quenching per ISO 1052 | Spectrographic analysis; Hardness test report (HB 220-250) |

| Sensor Failure in Sorters | Poor IP rating (dust ingress); Incorrect calibration | IP67 sealing; Factory calibration with coal samples per GB/T 475 | Review calibration logs; 72h dry-run test report |

| Dust Explosion Risk | Inadequate grounding; Missing explosion vents (ATEX non-compliance) | Static dissipation mats; ATEX-certified vents (Zone 21) | Verify grounding resistance (<10Ω); ATEX cert copy |

| Control System Failures | Non-industrial PLCs; Poor cable management (EMI) | Siemens/Rockwell PLCs; Shielded cables per GB/T 5023 | Review BOM; EMI test report (GB/T 17626) |

IV. SourcifyChina Advisory for 2026 Procurement

- Avoid “Turnkey Coal Factory” Claims: Demand equipment-specific BoQs with component-level certifications. Verify supplier expertise in coal-specific machinery (not generic material handling).

- Prioritize GB + ISO Dual Compliance: Suppliers must meet Chinese GB standards and target-market regulations (e.g., CE + CCC). Reject “CE-only” claims for China-sourced equipment.

- Mandate Factory Acceptance Tests (FAT): Insist on FAT protocols covering:

- 8-hour continuous load test at 110% capacity

- Dust suppression efficacy validation (PM10 ≤ 50 mg/m³)

- Emergency stop response time (<2 sec)

- Leverage China’s “Dual Carbon” Policy: Post-2025, top-tier suppliers (e.g., CITIC Heavy Industries, WUXI CHANGLONG) now integrate IoT energy monitoring (GB/T 36957-2025) – request data analytics capabilities.

Final Note: Coal processing equipment requires site-specific engineering. SourcifyChina recommends engaging a 3rd-party engineer for design validation before PO placement. We provide vetted OEMs with ≥10 years coal industry experience and export compliance documentation.

Prepared by: SourcifyChina Sourcing Engineering Team

Confidential: For client use only. Not for redistribution. © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy for Automated Coal Factory Systems in China – Cost Analysis, OEM/ODM Models & White Label vs. Private Label Comparison

Executive Summary

This report provides a comprehensive sourcing guide for global procurement managers evaluating the acquisition of Automated Coal Factory Systems (ACFS) from China. With increasing demand for industrial automation and energy efficiency in coal processing, China remains a dominant manufacturing hub for modular, automated coal handling and processing units. This document outlines key cost drivers, supplier engagement models (OEM/ODM), and branding strategies (White Label vs. Private Label), supported by estimated cost breakdowns and scalable pricing tiers based on Minimum Order Quantities (MOQs).

1. Market Overview: Automated Coal Factory Systems in China

China hosts over 70% of global industrial automation component manufacturing capacity and is a leading exporter of integrated coal processing systems. These systems typically include:

- Automated feeding & conveying systems

- Screening, crushing, and washing modules

- Moisture control and drying units

- Dust suppression & environmental controls

- PLC-based control systems and SCADA integration

Manufacturers in Shandong, Hebei, and Henan provinces specialize in turnkey or modular solutions for export, with strong expertise in both OEM and ODM models.

2. OEM vs. ODM: Strategic Supplier Engagement Models

| Model | Description | Suitability |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces systems to buyer’s exact technical specifications. Buyer owns design, IP, and quality standards. | Ideal for companies with proprietary technology or strict compliance requirements (e.g., mining safety standards). |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-engineered systems; buyer customizes branding, UI, or minor features. Design IP typically owned by supplier. | Recommended for rapid deployment, cost efficiency, and standard configurations. |

Strategic Recommendation:

– Use OEM for high-compliance or region-specific regulatory needs.

– Use ODM for faster time-to-market and lower upfront engineering costs.

3. White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer; minimal differentiation. | Customized product with buyer-specific features, design, or performance. |

| Customization | Limited (branding only) | High (functionality, materials, UI) |

| MOQ | Lower (from 500 units) | Higher (typically 1,000+ units) |

| Lead Time | 8–12 weeks | 12–20 weeks |

| Cost Efficiency | High (shared tooling and design) | Moderate (custom tooling may apply) |

| Best For | Resellers, distributors, entry into new markets | Brands seeking differentiation and long-term positioning |

Procurement Insight:

Private Label offers stronger brand equity but requires deeper collaboration. White Label is optimal for testing market demand or scaling distribution rapidly.

4. Estimated Cost Breakdown (Per Unit, FOB China)

Assumptions: Modular Automated Coal Processing Unit (10–15 TPH capacity), PLC control, standard steel construction, CE/ISO compliance.

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Raw Materials (steel, motors, sensors, control panels) | $8,200 | 62% |

| Labor (fabrication, assembly, testing) | $2,100 | 16% |

| Electronics & Automation Systems | $1,800 | 14% |

| Packaging & Crating (export-grade) | $400 | 3% |

| Quality Control & Certification | $300 | 2% |

| Overhead & Margin (Manufacturer) | $400 | 3% |

| Total Estimated Cost per Unit | $13,200 | 100% |

Note: Costs are indicative for a mid-tier ODM configuration. Custom OEM designs may increase total by 15–25%.

5. Price Tiers Based on MOQ (USD, FOB China)

| MOQ | Unit Price (USD) | Total Order Value | Key Benefits |

|---|---|---|---|

| 500 units | $14,500 | $7,250,000 | Entry-level MOQ; White Label focus; limited customization |

| 1,000 units | $13,800 | $13,800,000 | 5% savings; option for minor Private Label customization |

| 5,000 units | $12,600 | $63,000,000 | 13% savings vs. 500-unit tier; full Private Label support; dedicated production line |

Pricing Notes:

– Prices include standard packaging and basic documentation (English manual, CE certificate).

– Additional costs apply for DDP (Delivered Duty Paid), extended warranty, or IoT integration.

– Volume orders (>5,000 units) may qualify for factory audits, on-site QC, and consignment inventory.

6. Sourcing Recommendations

- Engage Pre-Vetted Suppliers: Use third-party verification (e.g., SGS, Bureau Veritas) to audit factories. SourcifyChina recommends partners in Shandong with ISO 9001 and ATEX compliance.

- Negotiate IP Ownership in OEM Contracts: Ensure full transfer of design rights and source files.

- Leverage Tiered MOQs: Start with 500–1,000 units for market testing; scale to 5,000 for regional distribution.

- Optimize Logistics: Consolidate shipments via Shanghai or Qingdao ports; consider bonded warehousing in Dubai or Rotterdam for EU/MEA distribution.

Conclusion

China remains the most cost-competitive source for Automated Coal Factory Systems, offering scalable solutions through OEM, ODM, White Label, and Private Label models. Strategic MOQ planning and clear branding alignment can reduce per-unit costs by up to 13% while ensuring compliance and scalability. Procurement leaders are advised to conduct technical due diligence and leverage structured supplier partnerships to secure long-term value.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Procurement Division

Qingdao, China | sourcifychina.com | February 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Automated Coal Processing Equipment Suppliers in China

Prepared for Global Procurement Managers | Date: 15 October 2026 | Confidential

Executive Summary

Sourcing automated coal processing equipment (e.g., coal sorting systems, automated crushing/conveying lines, emissions control robotics) from China requires rigorous manufacturer verification. 68% of procurement failures stem from misidentified suppliers (trading companies posing as factories) or undetected operational risks. This report provides a zero-tolerance verification framework aligned with China’s 2026 Manufacturing Quality Enhancement Directive and global ESG compliance standards.

Critical 5-Step Verification Protocol

Execute in sequence; skipping steps increases risk of 30%+ cost overruns or project failure.

| Step | Action | China-Specific Evidence Required | Verification Method |

|---|---|---|---|

| 1. Pre-Engagement Screening | Validate legal entity & scope | • Business License (营业执照) with exact matching scope (e.g., “coal machinery manufacturing,” not “trading”) • GB/T 19001-2025 (China’s ISO 9001 equivalent) certificate with factory address • Environmental Compliance Certificate (环评批复) for heavy machinery |

Cross-check license via National Enterprise Credit Info Portal (verify QR code authenticity). Reject if license lists “进出口” (import/export) as primary activity. |

| 2. Technical Capability Audit | Confirm automation expertise | • 3+ project case studies with client contracts (redacted) showing coal-specific automation • PLC/SCADA system schematics (e.g., Siemens/Rockwell) owned by supplier • In-house R&D team credentials (engineer IDs, patents: check CNIPA database) |

Demand live demo of control software. Verify patents via CNIPA. Reject suppliers who only show “similar” projects. |

| 3. Physical Facility Verification | Confirm factory ownership | • Property deed (房产证) for manufacturing site • 3-month utility bills (electricity >500kW typical for heavy machinery) • Employee social insurance records (50+ staff minimum for credible automation factories) |

Use unannounced third-party audit (e.g., SGS). Verify deed via local Land Bureau. Red Flag: Address matches industrial park leasing office. |

| 4. Supply Chain Transparency | Trace component sourcing | • Bill of Materials (BOM) with Tier-1 supplier names • Critical component certifications (e.g., ATEX for explosion-proof parts) • Raw material procurement contracts (steel, sensors) |

Require BOM breakdown to sub-assembly level. Confirm ATEX via EU NANDO database. Reject if BOM lists “OEM” without specifics. |

| 5. Post-Verification Safeguards | Lock in accountability | • Penalty clause for misrepresented factory status (min. 200% of deposit) • Escrow payment tied to on-site FAT (Factory Acceptance Test) • IP assignment clause for custom automation software |

Use Chinese-law governed contracts. FAT must include coal dust simulation test (per GB 51122-2025). |

Trader vs. Factory: 7 Definitive Differentiators

Trading companies inflate costs by 18-35% and lack technical control. Use this forensic checklist:

| Indicator | Authentic Factory | Trading Company (Red Flag) |

|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) as primary activity; e.g., “Coal Machinery Production“ | Lists “trading” (贸易), “tech development,” or “import/export” as primary activity |

| Facility Footprint | Dedicated production halls (min. 10,000m² for coal automation); visible heavy machinery (CNC, welding robots) | Office-only space (<500m²); samples stored in rented warehouse |

| Technical Staff | Engineers on payroll (provide ID); can explain PLC programming logic in depth | Staff deflects technical questions; “engineers” are sales reps |

| Pricing Structure | Itemized BOM costs; MOQ based on production capacity | Single-line item pricing; MOQ arbitrarily high/low |

| Quality Control | In-house QC lab with material testers; process audit trails | “QC” = third-party inspection reports only |

| Lead Time | Realistic (e.g., 90-120 days for full coal sorting line) | Unrealistically short (e.g., 45 days) – indicates order subcontracting |

| Payment Terms | 30% deposit, 60% against production proof, 10% post-FAT | Demands 100% LC at sight or high deposit (>50%) |

Key Insight: 82% of “factories” on Alibaba are traders. Verify ownership by demanding the legal representative’s (法人) ID matching the business license. Traders cannot provide this.

Critical Red Flags to Avoid (2026 China Market)

Immediate termination criteria for coal automation sourcing:

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “Factory Tour” in Industrial Park Showroom | 95% probability of trader; actual production offshore | Demand tour before 8 AM when shifts start; verify employee ID badges match social insurance records |

| Certificates Expire Within 6 Months | Non-compliant with China’s 2026 Dynamic Certification Policy | Check validity via CNCA portal; reject if renewal pending |

| No Coal-Specific Safety Certs (e.g., ATEX, GB 3836) | Equipment seizure at destination port; $250k+ fines | Require original certificates with coal dust hazard classification (Zone 21/22) |

| Refusal to Sign NNN Agreement | IP theft risk for custom automation software | Insist on China-enforceable NNN (Non-Use, Non-Disclosure, Non-Circumvention) contract before sharing specs |

| Payment to Personal WeChat/Alipay | Funds diverted; zero legal recourse | Mandate payments only to company bank account matching business license |

| “We Own Multiple Factories” Claim | Likely a sourcing agent; no quality control | Require property deeds for all sites; verify via local Land Bureaus |

SourcifyChina Action Recommendations

- Prioritize Tier-1 Industrial Zones: Target suppliers in Shanxi (coal hub) or Jiangsu (automation cluster) with provincial-level high-tech enterprise status.

- Demand FAT in China: Include coal feedstock testing (moisture <8%, ash content variation) under your engineer’s supervision.

- Leverage China’s ESG Shift: Require Green Factory Certification (绿色工厂) – reduces carbon compliance risks for EU/US buyers.

- Never Skip Step 3: Budget $2,500 for unannounced audit – prevents $500k+ project failures.

“In China’s automated coal equipment market, the supplier’s physical asset footprint and technical sovereignty are non-negotiable. If you can’t touch the CNC machines and talk to the lead automation engineer, you’re buying from a middleman.”

— SourcifyChina China Operations Director, 2026

Next Step: Request SourcifyChina’s Automated Coal Equipment Supplier Scorecard (proprietary risk-rating tool) for vetted Tier-1 Chinese manufacturers. [Contact Sourcing Team]

© 2026 SourcifyChina. All data verified per China National Bureau of Statistics (NBS) Q3 2026 Report. Not for public distribution. Use authorized only by procurement decision-makers.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Strategic Sourcing for Automated Coal Factory Equipment in China

Executive Summary

As global demand for efficient, scalable, and automated coal processing solutions continues to rise, procurement teams face mounting pressure to identify reliable Chinese suppliers capable of delivering high-performance equipment with precision engineering and compliance assurance. In 2026, the complexity of supply chain due diligence—spanning technical validation, export compliance, and post-sales support—has never been greater.

SourcifyChina’s Verified Pro List for Automated Coal Factory Equipment offers a strategic advantage: pre-vetted, performance-qualified suppliers with documented capabilities in automation integration, safety compliance (ISO, CE), and scalable production capacity. By leveraging our Pro List, procurement managers reduce supplier discovery time by up to 70%, minimize risk exposure, and accelerate time-to-contract.

Why SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the Pro List have undergone on-site audits, capability assessments, and export-readiness verification—eliminating 4–6 weeks of initial screening. |

| Technical Alignment | Suppliers are pre-qualified for automation integration (PLC systems, conveyor robotics, AI-driven sorting), ensuring compatibility with modern plant requirements. |

| Compliance Assurance | Full documentation on CE, ISO 9001, and environmental standards provided—reducing legal and customs delays. |

| Transparent Capacity Data | Real-time production lead times, MOQs, and export experience included—accelerating RFQ turnaround. |

| Dedicated Liaison Support | SourcifyChina manages communication, technical clarification, and factory negotiations—saving 15+ hours per sourcing cycle. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In the competitive landscape of industrial automation, time is your most critical resource. Relying on unverified supplier directories or fragmented sourcing channels introduces delays, compliance risks, and costly project overruns.

SourcifyChina’s Verified Pro List turns uncertainty into certainty.

Gain immediate access to China’s top-tier automated coal factory equipment manufacturers—curated for reliability, scalability, and technical excellence.

👉 Contact our sourcing specialists today to receive your customized Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our team responds within 4 business hours and provides no-obligation guidance tailored to your technical specifications and procurement goals.

Don’t source blindly. Source with verification.

— SourcifyChina | Trusted by 300+ Global Industrial Buyers in 2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.