The global automotive vinyl wrap market is experiencing robust expansion, driven by rising demand for vehicle customization, cost-effective branding solutions, and advancements in adhesive and color technologies. According to a report by Mordor Intelligence, the market was valued at USD 2.78 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2029. This surge is further supported by Grand View Research, which highlights increasing adoption in commercial fleets and personal vehicles across North America, Europe, and the Asia Pacific. As demand escalates, a select group of manufacturers has emerged as industry leaders, consistently delivering high-performance, durable, and aesthetically versatile vinyl wrap rolls. The following overview highlights the top 8 manufacturers shaping this dynamic segment through innovation, scalability, and global reach.

Top 8 Auto Vinyl Wrap Roll Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Kay Premium Marking Films

Domain Est. 1999

Website: kpmf.com

Key Highlights: KPMF manufacturer of premium self adhesive products, available for our worldwide distribution network….

#2 3M Vehicle Wraps & Trims

Domain Est. 1988

Website: 3m.com

Key Highlights: Non-printable films used exclusively for covering or wrapping car surfaces….

#3 Supreme Wrapping Film™ SW900

Domain Est. 1993

Website: graphics.averydennison.com

Key Highlights: Outstanding durability and performance makes this one of the best vinyl wrap films · Excellent conformability around curves and recesses · Patented Avery Dennison ……

#4 Metro Restyling

Domain Est. 2008

Website: metrorestyling.com

Key Highlights: Free delivery over $99 30-day returnsWe offer many premium cast vinyl wraps from experienced major brands like 3M, Avery, KPMF, Hexis, Orafol, and Metro Wrap. Car wraps are availab…

#5 Quality car wraps, vinyl wraps, paint protection films & window films

Domain Est. 2012

#6 Wrapstock

Domain Est. 2012

Website: wrapstock.com

Key Highlights: Welcome to the design market place Wrapstock powered by Avery Dennison with more than 400 designs available 24/7. Our designs, fit to any type of car, makes a ……

#7 Teckwrap USA

Domain Est. 2013

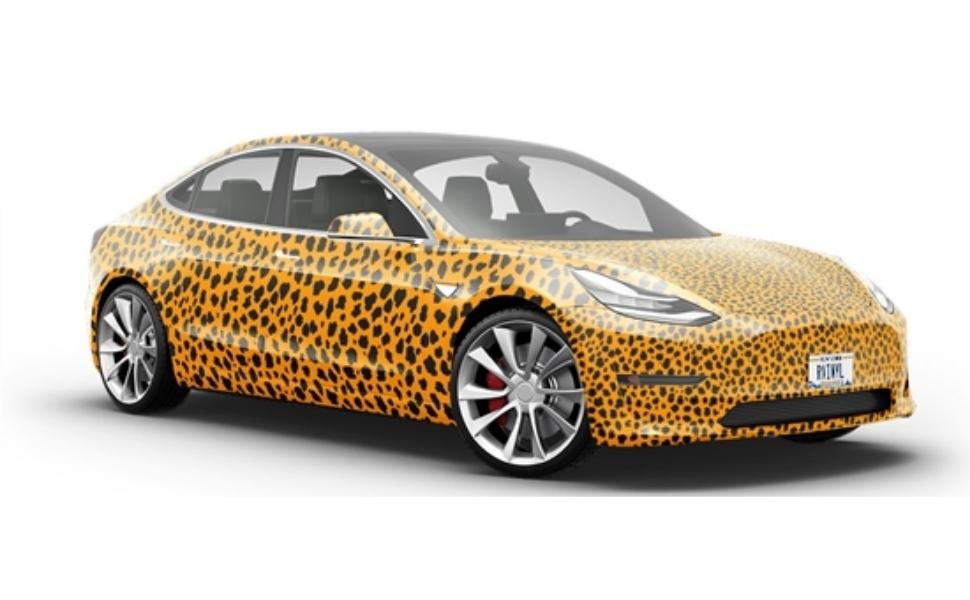

#8 CheetahWrap

Domain Est. 2014

Website: cheetahwrap.com

Key Highlights: CheetahWrap, supplier of easy-to-apply car wrap manufactured in the US. Automotive vinyl wrap designed for both professional and DIY wrap installers….

Expert Sourcing Insights for Auto Vinyl Wrap Roll

H2: 2026 Market Trends for Auto Vinyl Wrap Rolls

The global auto vinyl wrap roll market is poised for significant transformation by 2026, driven by technological advancements, shifting consumer preferences, and expanded applications across industries. As demand for vehicle customization, fleet branding, and protective finishes grows, several key trends are expected to shape the market landscape.

-

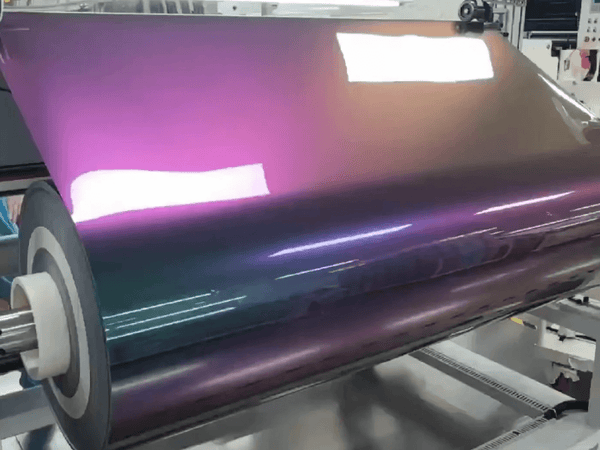

Increased Demand for Premium and Specialty Finishes

By 2026, there is a projected surge in consumer interest in high-end vinyl wraps featuring matte, satin, chrome, carbon fiber, and color-shifting finishes. Customization is becoming a mainstream trend, especially among younger demographics and urban vehicle owners. Manufacturers are responding with innovative textures and finishes that offer both aesthetic appeal and durability. -

Growth of the EV and Luxury Vehicle Segments

The rapid adoption of electric vehicles (EVs) and premium automobiles is fueling demand for vinyl wraps. EV owners, in particular, favor wraps for brand expression and to protect factory paint without compromising resale value. Luxury car owners are also embracing wraps as a cost-effective way to personalize vehicles without permanent modifications. -

Expansion of DIY and E-Commerce Channels

The DIY market for vinyl wraps is expanding rapidly, supported by online tutorials, improved product accessibility, and user-friendly application techniques. E-commerce platforms are becoming primary distribution channels, offering a wide range of vinyl wrap rolls directly to consumers and small installers. This trend is expected to lower barriers to entry and increase market penetration globally. -

Sustainability and Eco-Friendly Materials

Environmental concerns are influencing product development. By 2026, leading manufacturers are anticipated to invest in recyclable, biodegradable, or low-VOC (volatile organic compound) vinyl materials. Brands that prioritize sustainability in production and packaging are likely to gain a competitive edge, particularly in environmentally conscious regions such as Europe and North America. -

Technological Advancements in Adhesive and Durability

Innovation in adhesive technology is improving the longevity and removability of vinyl wraps. Air-release adhesives, repositionable films, and enhanced UV resistance are becoming standard, reducing installation errors and extending wrap life. These improvements are making vinyl wraps more appealing for commercial fleets and rental vehicles. -

Rise of Digital Printing and Custom Graphics

Advancements in large-format digital printing are enabling highly customized, high-resolution graphics on vinyl wraps. This is particularly beneficial for advertising and branding applications. By 2026, businesses are expected to increasingly adopt fleet wraps as a mobile marketing tool, driving demand for printable and durable vinyl films. -

Emerging Markets Driving Growth

While North America and Europe remain dominant markets, regions such as Asia-Pacific, Latin America, and the Middle East are witnessing accelerated growth. Rising disposable incomes, urbanization, and a growing car culture in countries like India, Brazil, and the UAE are expanding the customer base for auto vinyl wraps. -

Integration with AR and Design Software

Augmented reality (AR) tools and wrap design software are gaining traction among installers and consumers. By 2026, these digital tools will allow users to visualize wraps on their vehicles in real time, streamlining the selection process and reducing decision fatigue. This technological integration is expected to enhance customer engagement and boost conversion rates.

In conclusion, the 2026 auto vinyl wrap roll market will be defined by innovation, customization, and accessibility. With expanding applications in both consumer and commercial sectors, the industry is set for robust growth, provided manufacturers adapt to sustainability demands and digital transformation.

Common Pitfalls When Sourcing Auto Vinyl Wrap Rolls: Quality and Intellectual Property Issues

Logistics & Compliance Guide for Auto Vinyl Wrap Roll

Product Classification and Harmonized System (HS) Code

Auto vinyl wrap rolls are typically classified under the Harmonized System (HS) code 3919.10, which covers self-adhesive plates, sheets, film, foil, tape, and other flat shapes of plastics, non-cellular, of a width of less than 20 cm, not reinforced, laminated, or supported. However, confirm the exact code based on composition (e.g., PVC vs. polyurethane), width, and country-specific tariff schedules, as misclassification can lead to customs delays or penalties.

Packaging and Shipping Requirements

- Roll Protection: Wrap rolls in protective plastic film and use sturdy cardboard cores and outer cartons to prevent edge damage and creasing.

- Palletization: Secure cartons on wooden or plastic pallets using stretch wrap. Include edge protectors if stacking multiple layers.

- Labeling: Clearly label each package with product name, SKU, batch/lot number, dimensions, weight, and handling instructions (e.g., “Fragile,” “This Side Up,” “Keep Dry”).

- Shipping Modes: Suitable for air, sea, or ground freight. For international shipments, ensure compliance with IATA (air) or IMDG (sea) regulations if applicable—though vinyl wraps are generally non-hazardous.

Import/Export Documentation

Prepare and retain the following documents for smooth customs clearance:

– Commercial Invoice

– Packing List

– Bill of Lading (BOL) or Air Waybill (AWB)

– Certificate of Origin (may be required for preferential tariffs under trade agreements)

– Import/Export License (if required by the destination country)

Ensure all documents accurately describe the product and include correct HS codes and values to avoid delays or audits.

Regulatory Compliance

- REACH (EU): Comply with Registration, Evaluation, Authorisation and Restriction of Chemicals regulations. Ensure vinyl wraps do not contain restricted substances (e.g., certain phthalates).

- RoHS (EU/UK): Though primarily for electronics, confirm no overlap if used in electronic vehicle components.

- TSCA (USA): Comply with the Toxic Substances Control Act. Confirm all chemical components are listed or exempt.

- Proposition 65 (California, USA): Provide appropriate warnings if the product contains chemicals known to the state of California to cause cancer or reproductive harm (e.g., certain plasticizers).

Environmental and Safety Considerations

- Waste Disposal: Advise customers that used vinyl wraps should be disposed of in accordance with local regulations. PVC-based wraps may require special handling due to chlorine content.

- SDS Availability: Provide a Safety Data Sheet (SDS) upon request, especially for commercial or industrial users, detailing chemical composition and handling precautions.

- Recycling: Promote recyclability where possible and communicate end-of-life options to customers.

Country-Specific Requirements

- EU: CE marking is not typically required for vinyl wrap rolls, but ensure compliance with relevant directives if marketed for specific applications (e.g., vehicle safety).

- USA: No federal labeling requirement for wraps, but FTC guidelines apply to advertising claims (e.g., “UV resistant,” “10-year durability”).

- Canada: Comply with the Canadian Environmental Protection Act (CEPA) and ensure labeling in both English and French for consumer-facing materials.

Storage and Handling

- Store rolls vertically in a cool, dry place away from direct sunlight and extreme temperatures (ideally 15–25°C / 59–77°F).

- Avoid stacking heavy items on top of rolls to prevent deformation.

- Use proper manual handling techniques or equipment to prevent injury during loading/unloading.

Returns and Reverse Logistics

Establish clear return policies for damaged or incorrect shipments. Use traceable return labels and inspect returned rolls for resale eligibility. Dispose of non-reusable materials responsibly according to local waste regulations.

Recordkeeping and Audit Trail

Maintain records of shipments, compliance documentation, SDS, and customer communications for a minimum of 5 years (or as required by local law) to support audits and ensure traceability.

In conclusion, sourcing auto vinyl wrap rolls requires careful consideration of quality, supplier reliability, cost-efficiency, and product variety. Choosing the right vinyl wrap involves evaluating material durability, adhesive performance, and aesthetic options such as color, finish, and texture to meet customer demands. Establishing relationships with reputable manufacturers or distributors—preferably those offering warranties, certifications, and consistent supply—ensures long-term success. Additionally, staying updated on industry trends and advancements in eco-friendly or specialty films can provide a competitive advantage. Ultimately, a strategic sourcing approach that balances affordability with performance will support high-quality installations and customer satisfaction in the automotive detailing and customization market.