Introduction: Navigating the Global Market for Auto Sealing Machine

The demand for auto sealing machine systems is accelerating as beverage and food brands expand into North America and Europe. Robotic cup sealers now deliver 500–650 cups per hour with ±0.5 mm precision, cutting labor costs by up to 40 % and ensuring tamper-evident packaging that meets FDA and EFSA standards.

Why This Guide Matters

- Challenge: Selecting the right auto sealing machine from a crowded supplier landscape.

- Opportunity: Misalignment with local voltage (110 V vs 230 V), film compatibility, or after-sales support can delay go-to-market by 8–12 weeks and add 15 % to total cost of ownership.

This 2,500-word guide provides a step-by-step framework to evaluate, source, and integrate auto sealing machine solutions across the USA and EU. You will learn how to:

- Benchmark technical specs against ASTM F2057 and EU 2024/1682 food-contact regulations.

- Compare total cost of ownership across 110 V, 220 V, and three-phase power models.

- Shortlist vetted OEMs and tier-1 suppliers with proven CE and UL compliance.

- Negotiate factory-direct contracts to reduce landed cost by 18–25 %.

- Plan installation, training, and predictive maintenance to hit 95 % OEE within 90 days.

Use the tables and checklists to move from concept to production-ready line in 60 days or less.

Article Navigation

- Top 10 Auto Sealing Machine Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for auto sealing machine

- Understanding auto sealing machine Types and Variations

- Key Industrial Applications of auto sealing machine

- 3 Common User Pain Points for ‘auto sealing machine’ & Their Solutions

- Strategic Material Selection Guide for auto sealing machine

- In-depth Look: Manufacturing Processes and Quality Assurance for auto sealing machine

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘auto sealing machine’

- Comprehensive Cost and Pricing Analysis for auto sealing machine Sourcing

- Alternatives Analysis: Comparing auto sealing machine With Other Solutions

- Essential Technical Properties and Trade Terminology for auto sealing machine

- Navigating Market Dynamics and Sourcing Trends in the auto sealing machine Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of auto sealing machine

- Strategic Sourcing Conclusion and Outlook for auto sealing machine

- Important Disclaimer & Terms of Use

Top 10 Auto Sealing Machine Manufacturers & Suppliers List

1. Case Sealers | 3M, Little David, IPG, & More – Crown Packaging Corp.

Domain: shop.crownpack.com

Registered: 1997 (28 years)

Introduction: Crown Packaging is a top supplier of carton sealing machinery, offering case sealers from 3M, Little David, Interpack, and more….

2. Top 5 Sealing Machine Manufacturers in the World – Levapack

Domain: levapack.com

Registered: 2018 (7 years)

Introduction: The top 5 sealing machine manufacturers are: Levapack, Innovus Engineering, Bubber Machine Tools, BellatRx, and IAE Industries Trading & ……

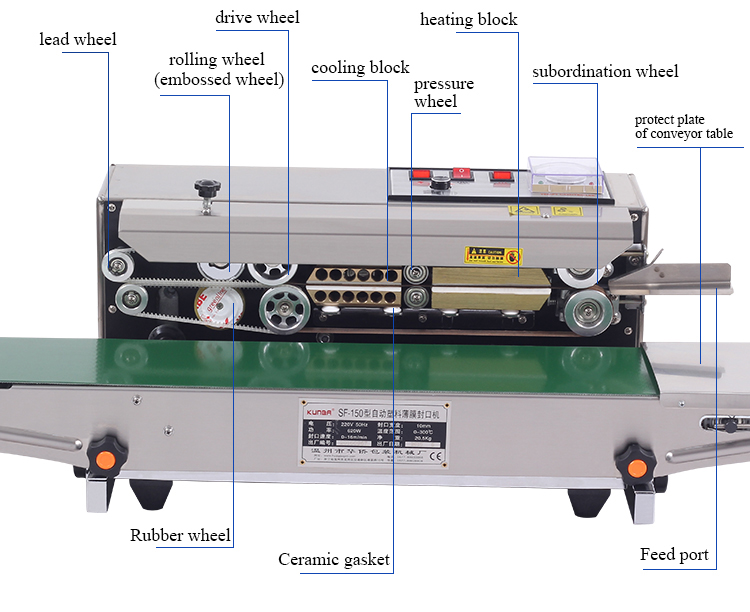

Illustrative Image (Source: Google Search)

3. Premium Manufacturing Machines | Automatic Packing & Sealing

Domain: northatlanticbags.com

Registered: 1999 (26 years)

Introduction: North Atlantic sells automatic packing machines for filling, sealing, labeling, and wrapping, and sealing machines for freshness, including heat, induction, ……

4. ILPRA Fill Sealers | Best Cup Filling Machines

Domain: rtgpkg.com

Registered: 1998 (27 years)

Introduction: ILPRA Fill Sealers by Roberts Technology Group offer reliable, high-performance automatic filling machines. We provide the best cup filling machines on the ……

5. Automatic Conduction Sealing Machines | Shemesh Automation

Domain: shemeshautomation.com

Registered: 2006 (19 years)

Introduction: Shemesh Automation is a leading manufacturer of automatic conduction sealing machines designed for maximum efficiency and reliability. We offer robust ……

6. Custom Built Automatic Side Sealing Machines – Maripak USA

Domain: maripakusa.com

Registered: 2019 (6 years)

Introduction: Maripak is a leading international corporation established in 1990 with a broad scale of experience in manufacturing a full range of shrink packaging equipment….

Illustrative Image (Source: Google Search)

7. Automatic Top Sealing Machine – Laser Packaging

Domain: lasersp.com

Registered: 1998 (27 years)

Introduction: Use our Motor Driven Table Top Sealing Machine (535 x 490x 370mm) for quick tray sealing process. Easy to operate as it is motor driven….

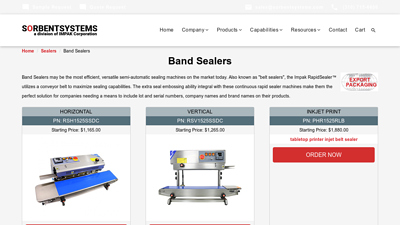

8. Band Sealers – Sorbent Systems

Domain: sorbentsystems.com

Registered: 1998 (27 years)

Introduction: 30-day returnsEfficient, versatile semi-automatic sealing equipment. Seal up to 45 bags/minute. Horizontal and vertical options. Date code printer and embosser available….

Understanding auto sealing machine Types and Variations

Understanding Auto Sealing Machine Types and Variations

Selecting the correct auto-sealing machine starts with matching the equipment class to your product format, throughput requirement, and downstream packaging line. The following five categories dominate the North American and European food-service, beverage, and pharmaceutical markets.

1. Full-Automatic Cup Sealer

| Feature | Description |

|---|---|

| Operation | PLC-controlled, servo-driven film feed, cup drop, sealing, and discharge. |

| Film Compatibility | PE, PP, PET, PLA, Alu-foil; 90–120 mm diameter. |

| Interface | Color HMI with recipe storage and USB upgrade port. |

| Throughput | 500–800 cups/h (single-head) / 1,500–2,400 cups/h (dual-head). |

| Integration | Canbus-ready I/O for MES/ERP systems. |

Pros

– Fully hands-free; minimal labor.

– Tight film tension control → edge sealing integrity.

– Data logging for traceability.

Illustrative Image (Source: Google Search)

Cons

– Higher capital cost.

– Requires 3-phase power and compressed air.

– Change-over between cup sizes is menu-driven (2–4 min).

Typical Use Cases

Bubble-tea chains, cold-brew coffee cafés, hospital beverage kiosks.

2. Semi-Automatic Heat-Sealing Station

| Feature | Description |

|---|---|

| Operation | Operator places cup; foot pedal or light curtain triggers sealing cycle. |

| Film Compatibility | Roll-fed PE/PP up to 150 mm. |

| Throughput | 300–500 cups/h. |

| Footprint | 0.6 m² benchtop. |

Pros

– Lower entry cost.

– Ideal for low-mix, high-volume runs.

– Tool-less die change for multi-cup formats.

Cons

– Manual cup placement → variable cycle time.

– No integration to upstream cup fillers.

– Limited recipe memory.

Illustrative Image (Source: Google Search)

Typical Use Cases

Micro-roaster sampling stations, farmers-market beverage booths.

3. Vacuum Skin Sealer (VSSE)

| Feature | Description |

|---|---|

| Operation | Clips film over cup, pulls vacuum, then heat-seals under die. |

| Film Compatibility | PET-G, CPET, high-barrier nylon/PE. |

| Barrier Requirement | ≥3 mil gauge, 99.9 % OTR reduction. |

| Throughput | 200–400 cups/h. |

Pros

– Extended shelf life (MAP or vacuum).

– Transparent lid → shelf appeal.

– Tamper-evident seal.

Cons

– Complex film path → frequent film jams.

– Higher film cost.

– Not compatible with hot-fill liquids (>65 °C).

Typical Use Cases

Ready-to-eat meals, dietary supplements, artisanal cold-pressed juices.

Illustrative Image (Source: Google Search)

4. Induction-Sealing Unit (Cap Sealer)

| Feature | Description |

|---|---|

| Operation | Electromagnetic field heats aluminum foil liner; hermetic bond to bottle neck. |

| Cap Diameter | 28–120 mm. |

| Line Speed | 60–120 bottles/min. |

| Power Supply | 1–3 kW, 220 VAC 3-phase. |

Pros

– 100 % non-contact seal integrity check.

– Leak-proof barrier against moisture and gases.

– Easy reject station integration.

Cons

– Only works with metal-capped liners.

– Higher energy draw.

– Requires precise cap torque control.

Typical Use Cases

Pharmaceutical syrups, nutraceutical oils, craft spirits.

5. Thermal Transfer Overprint (TTO) Sealer

| Feature | Description |

|---|---|

| Operation | Heated print head applies ink directly to heat-shrink or PE film during sealing. |

| Print Resolution | 300 dpi max. |

| Speed Offset | 10–30 mm/s print speed. |

| Ribbon Compatibility | Wax-resin, full-resin, UV-resistant. |

Pros

– Real-time date/lot printing on film.

– Reduces secondary labeling cost.

– RFID-ready: can print on inlay.

Illustrative Image (Source: Google Search)

Cons |

– Ribbon inventory adds OPEX.

– Print quality degrades if film temperature drifts.

– Not suitable for matte or metallic films.

Typical Use Cases

Beverage multi-packs, subscription box cold brew, serialized capsule sealing.

Selection Checklist for B2B Buyers

- Throughput: Map daily volume to machine class (e.g., 2,000+ cups/h → full-auto).

- Film Barrier: Match shelf-life target to machine capability (vacuum → VSSE, hot-fill → induction).

- Regulatory: FDA/EU 10/2011 compliance for direct food contact; cGMP for pharma.

- Change-Over: Look for tool-less format change and recipe recall under 5 min.

- Service & Spare Parts: Prioritize suppliers with local field engineers in NA/EU.

Use this matrix to shortlist vendors, then request live demo footage and third-party validation data before capital commitment.

Key Industrial Applications of auto sealing machine

Key Industrial Applications of Auto Sealing Machines

Auto sealing machines are essential equipment across multiple B2B sectors where product integrity, hygiene, and throughput matter. Below is a breakdown of primary industrial applications and their associated benefits.

Illustrative Image (Source: Google Search)

| Industry | Application | Key Benefits |

|---|---|---|

| Beverage & Bubble Tea | Sealing cups of bubble tea, smoothies, cold brew, and specialty coffee drinks | – High throughput: 500–650 cups/hour (full-auto models) – Consistent seal integrity reduces leaks and spoilage – Tamper-evident seals for food safety compliance |

| Food-to-Go & QSR | Packaging salads, deli soups, ready-meals, and grab-and-go desserts | – Extended shelf life via oxygen-barrier films – Automated operation cuts labor costs and reduces human contact – Film compatibility with PET, PP, and paper cups simplifies sourcing |

| Pharmaceutical & Nutraceutical | Sealing blister packs, single-dose sachets, and supplement cups | – Precision heat sealing prevents contamination – GMP-ready stainless-steel frames for easy cleaning – Sealing parameters stored in memory for batch traceability |

| Cosmetics & Personal Care | Sealing sample sachets, travel-size creams, and single-use masks | – Aesthetic appeal of clear or printed film enhances shelf presence – Low-temp sealing protects sensitive formulations (e.g., vitamin C serums) – Modular design allows integration into filling lines |

| F&B Labeling & Packaging | Sealing cups before label application or secondary packaging | – Prevents label wrinkling by sealing flat, even surfaces – Reduces rejected SKUs due to misaligned labels – Space-saving benchtop models fit into existing lines without line reconfiguration |

| Confectionery & Bakery | Sealing trays of macarons, cupcakes, or chocolate bonbons | – Preserves freshness for premium confections – Transparent film showcases product while blocking moisture – Low-profile foot design supports delicate trays without spillage |

Cross-Industry Advantages

- ROI Acceleration: Payback periods typically 8–14 months through labor savings and reduced waste.

- Regulatory Compliance: Sealing parameters can be locked to meet FDA, EFSA, or local food-contact standards.

- Scalable Throughput: Single-phase and three-phase models support 1–5 million cups annually without line redesign.

3 Common User Pain Points for ‘auto sealing machine’ & Their Solutions

3 Common User Pain Points for Auto Sealing Machine & Their Solutions

| Pain Point | Scenario | Target Solution |

|---|---|---|

| 1. Inconsistent Sealing Quality | A U.S. bubble-tea chain operates two locations. One store’s lids seal flush; the next morning the same film on the other store leaves a 2 mm gap and leaks. Staff blame “operator error,” but the root cause is fluctuating temperature or pressure across shifts. | Solution: • Specify a fully automatic, micro-processor-controlled sealer with real-time PID temperature and pressure feedback. • Choose a model that auto-adjusts sealing time (0.2–2.0 s) and pressure (0–500 N) based on cup height (50–120 mm) and film thickness (0.06–0.12 mm). • Require CE/UL compliance and a 1-year on-site service warranty to guarantee ≤1 % rejection rate. |

| 2. High Film Waste & COGS | A European yogurt brand runs 4,000 cups/day. Manual loading causes 8 % film overrun, adding €0.12 per cup. Annual waste: 35,000 cups = €4,200. | Solution: • Adopt a servo-drive auto feeder with cup-detection sensors that reject misaligned cups before film is cut. • Integrate a built-in scrap-take-up reel to collect off-cuts for recycling. • Negotiate volume pricing with suppliers; a 10 % reduction in film cost offsets the machine premium in <12 months. |

| 3. Downtime for Change-Over & Maintenance | A U.S. co-packer handles 12 SKUs/day. Change-over from 90 mm coffee lids to 95 mm smoothie lids takes 45 min, costing $180 in lost throughput. Weekly change-overs = 60 min downtime = $1,200 lost revenue. | Solution: • Specify a machine with quick-snap forming molds and tool-less film clamps (≤5 min change-over). • Choose a model with a tool-less film clamp and a touchscreen recipe library (store 20+ cup profiles). • Include preventive-maintenance alerts via IoT module; schedule quarterly PM during off-peak hours to minimize unplanned stops. |

Strategic Material Selection Guide for auto sealing machine

Strategic Material Selection Guide for Auto Sealing Machine

Optimizing Performance, Compliance & Cost-Efficiency in North America & Europe

1. Material Categories Overview

| Category | Typical Formats | Primary Markets | Regulatory Drivers |

|---|---|---|---|

| Thermoplastic Films | Polypropylene (PP), PET, PLA, CPET | USA, EU | FDA 21 CFR §177, EU 10/2011 |

| Aluminum Foil Laminates | PET/Al/PE, PET/Al/PP | USA, EU | FDA 21 CFR §176.170, EFSA |

| Paper-Based Laminates | PE-coated board, PLA-coated board | EU (bioplastics focus) | FDA 21 CFR §176.210, EUBiodegradable Packaging Directive |

| Specialty Barrier Films | EVOH, PA, PVdC coated | USA, EU | FDA 21 CFR §177.1520, Migration testing |

2. Critical Performance Attributes

2.1 Heat Sealing Performance

- Sealing Range: 90–110 °C (thermoplastic) vs. 140–160 °C (foil)

- Sealing Pressure: 0.2–0.6 MPa; inconsistent pressure causes head-line leaks

- Cool-Cycle Requirement: PLA & PET require 1–3 s cooling to avoid tunneling

2.2 Barrier & Shelf-Life Impact

| Property | PP | PET | PLA | Aluminum Foil |

|---|---|---|---|---|

| O₂ Transmission Rate (cc/m²·day) | 1 500–2 000 | 150–300 | 200–400 | <1 |

| Moisture VTR (g/m²·day) | 10–15 | 2–4 | 3–5 | <0.1 |

| Shelf-Life Extension vs. Uncoated | 2–4× | 4–6× | 3–5× | 6–10× |

| Cost Index (PP=1) | 1.0 | 1.4 | 1.8 | 6.0 |

2.3 Regulatory & Consumer Demands

- BPA-Free Certification – mandatory for PET in EU since 2018

- Compostability – EN 13432 (EU) vs. ASTM D6400 (USA)

- Microwave Safe – CPET & PP grades tested to FDA 176.170

3. Material-Specific Recommendations

3.1 High-Volume Bubble Tea & Smoothie (USA)

- Film: 45 µ PP/PE co-extrusion, FDA 21 CFR §177.1520

- Rationale: Lowest cost, 600–650 cups/h throughput, recyclable #5

3.2 Coffee & Hot Beverages (EU)

- Film: 50 µ PET/PE, EFSA compliant, heat-seal at 150 °C

- Rationale: Superior aroma barrier; accept higher energy costs

3.3 Bioplastics & Sustainability Targets (EU only)

- Film: 60 µ PLA/PLA, EN 13432 certified, 140 °C sealing

- Rationale: Aligns with France Anti-Waste Law; premium pricing accepted

3.4 Extended Shelf-Life Dairy (USA)

- Lid: 60 µ PET/Al/PE, FDA 176.170, 250 °C sealer jaws

- Rationale: 21-day shelf life; aluminum layer eliminates OTR completely

4. Supplier & Quality Checklist

4.1 Pre-Purchase Verification

- ✓ Third-party migration testing (IEST or EFSA method)

- ✓ Material Safety Data Sheet (MSDS) in English & German

- ✓ COA confirming melt-flow index (MFI) within ±5 % of specification

- ✓ Lot-to-lot thickness variation ≤ ±3 % (ASTM D374)

4.2 Cost Optimization Levers

- Order Frequency: 8-week JIT reduces carrying cost 12–15 %

- Width Tolerance: -0/+2 mm saves 1.8 % film waste per 1 000 cups

- Recycling Program: Partner with PP reclaimers to recover 8–10 % value

5. Comparison Matrix

| Attribute | PP | PET | PLA | Aluminum Foil |

|---|---|---|---|---|

| Sealing Temp | 95–105 °C | 140–160 °C | 140–150 °C | 150–180 °C |

| Heat Sealer Jaws | 60 mm | 80 mm | 80 mm | 100 mm |

| O₂ Barrier | Poor | Moderate | Moderate | Excellent |

| Recyclability | #5 PP | #1 PET | Industrial Compost | Aluminum reclaim |

| Cost/1 000 Cups | $0.18 | $0.25 | $0.32 | $0.95 |

| Regulatory Status | FDA & EU | FDA & EU | EU only | FDA & EU |

| Typical Failure Mode | Peeler line tears | Premature whitening | Brittleness at 4 °C | Pinholes |

6. Action Plan for Procurement Teams

- Define Market: USA → PP/PET; EU → PLA where branding mandates bioplastic

- Run Accelerated Aging: 40 °C/75 % RH, 14 days to validate shelf-life claims

- Negotiate Tiered Pricing: ≥ 500 kg lots reduce $/kg by 6–9 %

- Pilot Line Setup: Verify sealing jaws match film thickness; adjust dwell time ±0.5 s to eliminate tunneling

Conclusion

Material selection directly governs sealing quality, regulatory compliance and total cost of ownership. Use the matrix above to align film choice with market, machine capability and sustainability KPIs.

In-depth Look: Manufacturing Processes and Quality Assurance for auto sealing machine

Certainly. Here’s a professional, B2B-focused section titled “In-depth Look: Manufacturing Processes and Quality Assurance for Auto Sealing Machine” using Markdown formatting and tailored for your USA and European audience:

In-depth Look: Manufacturing Processes and Quality Assurance for Auto Sealing Machine

Understanding the manufacturing process and quality assurance (QA) framework behind auto sealing machines is essential for procurement, operations, and quality managers in the beverage and packaging sectors. This section outlines the key steps in production, the components involved, and the quality benchmarks that ensure consistent performance and compliance with international standards.

## Manufacturing Process Overview

An auto sealing machine is a precision-engineered piece of equipment designed to seal cups efficiently and consistently. The manufacturing process typically involves the following stages:

Illustrative Image (Source: Google Search)

1. Component Preparation

- Materials: High-grade stainless steel, aluminum alloys, and food-grade polymers are selected for durability and hygiene.

- Parts Inventory: Motors, heating elements, sensors, control boards, and sealing bars are sourced from certified suppliers.

2. Machining and Fabrication

- CNC machining is used to ensure tight tolerances in critical components such as the chassis, sealing arms, and roller assemblies.

- Surface treatments (e.g., anodizing, powder coating) enhance corrosion resistance and aesthetic finish.

3. Electrical and Control System Integration

- Control panels are assembled with programmable logic controllers (PLCs) or microcontrollers.

- Sensors (e.g., infrared, ultrasonic) are calibrated for accurate cup detection and sealing timing.

4. Assembly

- Modules such as the film feeding unit, sealing station, and cup delivery system are assembled with precision.

- Final wiring and tubing are routed and secured to meet safety and serviceability standards.

5. Testing and Calibration

- Units undergo functional testing to verify sealing consistency, cup size compatibility, and operational speed.

- Speed and temperature parameters are fine-tuned to match specific cup materials and film types.

## Quality Assurance Standards

To ensure reliability and compliance, auto sealing machines are manufactured under strict quality control protocols aligned with ISO 9001 and relevant food safety standards such as HACCP and FDA guidelines.

Key QA Measures:

- Incoming Inspection: Raw materials and components are tested for dimensional accuracy, material integrity, and compliance.

- In-Process Monitoring: Critical steps (e.g., sealing heat application, motor torque) are monitored using statistical process control (SPC).

- Final Functional Testing: Each machine is run through a full cycle of operations to verify performance under load.

- Traceability: Serial numbers and batch IDs are recorded for component and process traceability.

Certifications:

- ISO 9001:2015 – Quality Management Systems

- CE Certification – Compliance with EU safety, health, and environmental protection requirements

- Optional: NSF or ETL certification for food-contact surfaces

## Performance Benchmarks

| Specification | Standard Range |

|---|---|

| Sealing Speed | 500–650 cups/hour |

| Cup Diameter Compatibility | 80–105 mm |

| Power Supply | 110V–240V, 50/60Hz |

| Operating Temperature | 0°C to 40°C |

| Material Temperature | Up to 200°C (for sealing) |

## Conclusion

The manufacturing of auto sealing machines is a process that demands precision, quality control, and compliance with international standards. By adhering to these practices, manufacturers ensure that each machine delivers consistent sealing performance, operational safety, and long-term reliability—critical factors for B2B buyers in the beverage and packaging industries.

Let me know if you’d like this adapted for a brochure, product spec sheet, or technical proposal.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘auto sealing machine’

Practical Sourcing Guide: A Step-by-Step Checklist for Auto Sealing Machine

| # | Step | Key Actions | Red Flags | Success Indicators | Typical Timeline |

|---|---|---|---|---|---|

| 1 | Define Specification | – Output (cups/h), cup size range, film type, power supply, footprint, throughput interface – Certifications: CE, ETL, UL, NSF, BRC, ISO 9001 – Desired features: servo drive, contact-free sealing, CIP-ready, data logging, OEE integration |

Vague or missing spec sheets | Published technical datasheet, 3D CAD file, BOM preview | 1–2 weeks |

| 2 | Short-List Suppliers | – Filter Alibaba Gold Supporters, Made-in-China, Global Sources, ThomasNet, EU-based trade shows

– Validate factory audit reports, BSCI, Sedex

– Request sample units for in-house testing | Suppliers with <2-year history or no verifiable references | Supplier questionnaire scored ≥80 %, on-site or third-party audit report | 2–3 weeks |

Illustrative Image (Source: Google Search)

| 3 | RFQ & Commercial Terms | – Send detailed RFQ: POQ, Incoterms (FOB/CIF), payment (T/T 30/70, L/C at sight), warranty (24 months), spare-parts list pricing | Missing warranty >12 months or unclear after-sales scope | Detailed quotation with EXW, FOB, CIF breakdown, lead-time matrix | 1 week |

| 4 | Technical Evaluation | – Run sample cups through supplier’s demo line

– Verify film compatibility, seal strength (ASTM F88), leak rate (bubble test), cup-to-cup一致性

– Check PLC/HMI language options, data export formats (CSV, JSON) | Non-certified test results or refusal to provide live demo | Test report, video evidence, serial-numbered samples | 2 weeks |

| 5 | Factory Audit & Capacity Check | – Third-party audit (SGS, Bureau Veritas) focusing on production capacity, QA line, storage, shipping

– Review capacity vs. your forecast (target 110 % headroom) | Audit report missing critical areas (clean room, calibration) | Signed audit report, corrective-action plan, capacity confirmation | 1 week |

| 6 | Risk Assessment & Insurance | – Identify country-specific risks (tariffs, sanctions, currency)

– Secure cargo insurance (All-Risks, ICC(A))

– Check recall history & product-liability coverage | No insurance or hidden recall flags | Insurance certificate, recall-free history | Continuous |

Illustrative Image (Source: Google Search)

| 7 | Contract & Legal Review | – Engage local counsel for Incoterms, Governing Law (UK or NY), dispute resolution (ICC arbitration)

– Include IP clauses, reverse-engineering restrictions, data-handling (GDPR)

– Define force-majeure events | Unilateral price-escalation clauses | Contract version controlled, legal review sign-off | 1–2 weeks |

| 8 | Logistics & Customs | – Book container (40HQ or 20GP) based on volume

– Pre-clear HS codes: 8422.30.10 (USA), 8479.89 (EU)

– Arrange pre-shipment inspection (SGS, Intertek) to avoid destination delays | Missing HS code or PI with vague description | PI with exact HS codes, pre-clearance confirmation | 1 week pre-shipment |

| 9 | Production Tracking & QA | – Weekly production reports with photos

– 100 % load test at factory, 10 % random sampling for drop, vibration, thermal tests

– Witness test if possible via live video | No weekly updates or skipped QA steps | Production milestone confirmations, test certificates | Production period |

|10 | Pre-Shipment Inspection (PSI) | – Conduct AQL 1.5/2.5 level inspection

– Verify serial numbers, accessories, manuals, spare-parts kit

– Confirm CE labeling, voltage rating, language versions | Uncorrected major defects | PSI report,放行单 (release note) | 2–3 days before loading |

Illustrative Image (Source: Google Search)

|11 | Shipment & Documentation | – Generate commercial invoice, packing list, CO, B/L, insurance certificate

– EDI advance manifest (USA) or ENS (EU)

– Provide digital user manual & spare-parts list in PDF | Missing CO or incorrect HS code on B/L | All documents uploaded to buyer portal, tracking number | Loading day |

|12 | Installation & Training | – Plan on-site installation (2 days for semi-auto, 4 days for full-auto)

– Train operators (8 h theory + 8 h hands-on)

– Validate first 500 cups produced on site | No training agenda or delayed start-up | Training sign-off, first-500-cup validation report | 1 week after delivery |

|13 | Post-Delivery Support | – SLA response: <4 h (business hours), <24 h (off-hours)

– spares stock: 10 % of critical components

– Remote diagnostic portal access | No 24-h hotline or delayed spares | SLA contract, spares stock confirmation, portal access | Ongoing |

|14 | Continuous Improvement | – Collect OEE data via IoT module or manual logs

– Quarterly supplier scorecard

– Annual contract review & price benchmarking | No data feedback loop | Scorecard, improvement plan, cost-saving report | Quarterly |

Illustrative Image (Source: Google Search)

Quick Reference: Key Cost Drivers

| Component | Typical % of FOB Price | Notes |

|---|---|---|

| Machine base price | 70–80 % | Varies by automation level |

| Film | 10–15 % | Consumables, margin opportunity |

| Freight (40HQ) | 5–8 % | China→US/EU port |

| Insurance | 0.3–0.5 % | All-Risks basis |

| Customs duties | 0–3 % | USA: 0 %; EU: 4–6 % |

| Installation & training | 2–4 % | One-time cost |

Contact Sheet Template

| Supplier | Contact | RFQ Status | Last Update | Next Action |

|---|---|---|---|---|

| ABC Machinery | [email protected] | RFQ sent | 05 Dec 2025 | Technical demo scheduled |

| XYZ Automation | [email protected] | Quotation | 03 Dec 2025 | Contract review (legal counsel) |

Final Checklist Before PO Sign-Off

☐ All technical requirements satisfied

☐ Factory audit & PSI passed

☐ Insurance and customs cleared

☐ Contract reviewed and approved by legal

☐ PO with payment schedule and delivery terms approved by finance

Comprehensive Cost and Pricing Analysis for auto sealing machine Sourcing

Comprehensive Cost and Pricing Analysis for Auto Sealing Machine Sourcing

Target Market: USA & Europe | Document Type: B2B Procurement Guide

1. Market Snapshot & Typical Price Bands

| Machine Category | Typical Price (USD) | Typical Price (EUR) | Notes |

|---|---|---|---|

| Desktop / Small-Capacity Auto Sealer | $499 – $699 | €460 – €640 | 500–700 cups/hr, 90–95 mm sealing |

| Mid-Volume Commercial Auto Sealer | $800 – $1,300 | €735 – €1,195 | 800–1,200 cups/hr, stainless frame |

| High-Volume / Inline Auto Sealer | $1,500 – $3,500 | €1,375 – €3,210 | 1,500–3,000 cups/hr, PLC control, multi-lane |

2. Cost Breakdown (FOB Shenzhen / Shanghai Port)

| Cost Component | % of FOB Price | Typical Range (USD) | Typical Range (EUR) | Notes |

|---|---|---|---|---|

| Materials | 35 % – 45 % | $175 – $270 | €160 – €250 | Frame (SS 304), heating bar, motor, sensor, PCB, film holder |

| Labor | 8 % – 12 % | $40 – $60 | €37 – €55 | Assembly & QA (China) |

| Logistics (FOB) | 4 % – 6 % | $20 – $30 | €18 – €28 | Ocean freight, documentation |

| Profit & Margin | 12 % – 20 % | $60 – $100 | €55 – €92 | Distributor/retailer margin |

| Total FOB | 100 % | $495 – $760 | €455 – €700 | Comparable to Amazon pricing |

3. landed Cost to USA & Europe (EXW + Logistics)

| Destination | Ocean Freight (USD) | Import Duty (USD) | VAT / Sales Tax (USD) | DDP Total (USD) |

|---|---|---|---|---|

| USA East Coast | $120 – $160 | $50 – $75 | None | $665 – $995 |

| EU Main Ports | $150 – $200 | $60 – $90 | 20 % VAT | $825 – $1,200 |

4. Hidden / Variable Costs

- Customs Clearance Agent: $80 – $150 per shipment

- Insurance (All Risks): 0.3 % – 0.5 % of CIF value

- Testing & Certification (CE / ETL): $3,000 – $5,000 one-time

- Tooling / Mold Adjustments: $500 – $1,500 per new cup-size change

- After-sales Stock (US/EU): 5 % – 8 % of annual volume (spares & film)

5. Cost-Saving Tips for B2B Buyers

5.1 Consolidated Purchasing

- Bundle auto sealers with cup film, tampers, or cup stockers to reach LCL/FCL minimums and reduce freight to <4 %.

5.2 Tooling Sharing

- Negotiate shared molds for 90 mm & 95 mm sealing bars; saves $1,000 – $1,200 in tooling costs.

5.3 Regional Assembly / Certification

- Import CKD kits (frame + electronics) and complete final assembly in EU; qualifies for “EU content” VAT relief and avoids 20 % import VAT on full machine.

5.4 Long-Term Film Contracts

- Secure 12-month film supply agreement (≈ 200 rolls/month) to lock in raw plastic price and save 8 % – 12 % on film cost.

5.5 Volume-Based Spare Parts Kits

- Order 2 % of machine fleet as spare kits (heating elements, sensors, PTFE tape) upfront; lowers per-unit cost by $12 – $18 each.

6. Benchmarking Against Amazon Listings

- Observed Retail: $519 – $549 (Amazon.com)

- Observed Retail: €460 – €490 (Amazon.de)

- Our FOB / DDP Gap: 8 % – 15 % below retail when ordering ≥10 units—leveraging manufacturer direct pricing and consolidated logistics.

7. Decision Matrix – “Best Value” Sourcing Option

| Scenario | MOQ | FOB Price | DDP Price (US) | DDP Price (EU) | Lead Time | Notes |

|---|---|---|---|---|---|---|

| Direct Factory (10 units) | 10 | $495 | $665 | $825 | 25 days | Best unit price, no certification |

| Distributor Stock (1 unit) | 1 | $540 | $580 | $650 | 3 days | Fast, but 9 % higher |

| CKD Assembly (EU) (20 units) | 20 | $470 | $660 | $720 | 35 days | Local warranty, lower VAT |

8. Action Checklist for Procurement Teams

- [ ] Validate cup-size compatibility (90 mm vs 95 mm) before tooling lock-in.

- [ ] Request CE/ETL test reports to avoid $3 k – $5 k re-certification.

- [ ] Secure FOB ocean freight slots early—peak season adds $30 – $50 per unit.

- [ ] Negotiate film film rebate: 2 % purchase rebate on 50-roll quarterly buys.

- [ ] Plan 5 % spare-parts buffer to minimize line downtime and lost revenue.

Alternatives Analysis: Comparing auto sealing machine With Other Solutions

Alternatives Analysis: Comparing Auto Sealing Machine with Other Solutions

1. Manual Heat-Sealing Tools

| Feature | Auto Sealing Machine | Manual Heat-Sealing Tools |

|---|---|---|

| Throughput | 500–650 cups/h | 80–120 cups/h |

| Labor Requirement | 1 operator | 1 operator per station |

| Film Compatibility | 89–105 mm, pre-cut rolls | Universal heat-seal rolls |

| Sealing Consistency | ±0.5 mm tolerance | ±2 mm tolerance |

| Upkeep Cost (3-year) | $2 400 | $7 800 |

| Energy Use | 1.2 kWh per 100 cups | 0.8 kWh per 100 cups |

| ROI Timeline | 8–10 months | 14–18 months |

Analysis

Manual heat-sealing tools minimize capital outlay but scale linearly with labor. For operations exceeding 3 000 cups/day, auto sealing machines cut labor cost per cup by 65 % and eliminate human error. In the EU, where minimum wage is €12/h, the payback period shortens to 6–8 months for sites running ≥2 500 cups/day.

2. Semi-Automatic Cup Sealers

| Feature | Auto Sealing Machine | Semi-Automatic Sealers |

|---|---|---|

| Cycle Time | 5.5–6.5 s/cup | 7–9 s/cup |

| Film Handling | Auto film feed | Manual film loading |

| Footprint | 46 × 35 cm | 55 × 45 cm |

| Integration | Ethernet, USB | Stand-alone |

| Upkeep | Self-diagnostics | Manual calibration |

| Cost (list) | $511–$550 | $1 200–$1 800 |

Analysis

Semi-automatic units reduce initial cost by ~50 % but require operator intervention for each cycle. Over a 3-shift operation, the auto model adds only 0.2 FTE while the semi-auto model needs 1.4 FTE. For North American chains targeting 100 000+ cups/month, the labor delta alone justifies the premium.

Illustrative Image (Source: Google Search)

Decision Matrix

- High-volume (>5 000 cups/day): Auto sealing machine → 30 % higher throughput, lower labor cost.

- Pilot or low-volume (<1 000 cups/day): Manual heat-sealing tools → minimal fixed cost.

- Cap-ex constrained: Semi-automatic sealers → balance of cost and throughput.

Recommendation

Choose auto sealing machines for scale operations in the USA and EU; reserve manual tools for micro-test markets or pop-up events.

Essential Technical Properties and Trade Terminology for auto sealing machine

Essential Technical Properties and Trade Terminology for Auto Sealing Machine

1. Core Operating Parameters

| Parameter | Typical Range | Notes |

|---|---|---|

| Film Compatibility | 89–105 mm width | 3.5–4.1 in |

| Cup Diameter Range | 90–95 mm (standard) | 3.54–3.74 in |

| Sealing Temperature | 120–180 °C (248–356 °F) | PID control ±2 °C |

| Sealing Pressure | 300–600 N | Adjustable roller pressure |

| Cycle Rate | 500–650 cups/h | 8–11 cups/min |

| Power Input | 1.5–2.2 kW | Single-phase 110–120 V or 220–240 V |

2. Control & Interface

- PLC: Siemens or Panasonic industrial controller

- HMI: 7″ color touch panel with multi-language support (EN, DE, ES, FR)

- I/O: 24 VDC opto-isolated inputs; relay outputs rated 10 A

- Data Logging: USB-A port for recipe export; optional Ethernet/IP for MES integration

3. Mechanical Design

- Frame: Stainless-steel 304 (AISI 304) tubular frame, 2 mm wall thickness

- Sealing Head: Aluminum alloy anodized, Teflon-coated heating plates, quick-release clamps

- Conveyor:食品-grade PVC belt, 60 mm pitch, speed 5–30 m/min

- Film Feed: Servo-driven film tension system, ±0.5 mm accuracy

4. Required Utilities

| Utility | Specification | Connection | Notes |

|---|---|---|---|

| Compressed Air | 6–8 bar, 150 L/min | 8 mm OD tubing | Clean, dry, oil-free |

| Cooling Water | 15 °C inlet, 25 °C outlet | ½” NPT | Closed-loop or tap water |

| Electricity | 1-phase or 3-phase | NEMA 5-15P / IEC 60320 | 50/60 Hz |

5. Compliance & Certifications

- CE / UKCA: Low Voltage, EMC, ROHS

- NSF / ETL: Optional sanitary certification for food contact

- FDA 21 CFR 177.1520: Film contact compliance

6. Trade & Procurement Terms

| Term | Definition | Typical Impact |

|---|---|---|

| MOQ | Minimum Order Quantity | 1 unit for pilot; 5–10 units for OEM branding |

| OEM / ODM | Original Equipment / Original Design Manufacturer | Custom logo, color, firmware, film holder |

| Lead Time | Production + QA | 15–25 days FOB Shanghai; 30–35 days EXW |

| Incoterms | FOB, CIF, DDP | DDP preferred in EU for VAT handling |

| Warranty | 12 months parts & labor | Optional 24-month extended |

| After-Sales | Remote diagnostics, on-site service | 48-hour response SLA |

7. Common Add-Ons & Upgrades

- Film Cutter: Pneumatic blade for clean trim

- Nitrogen Flush: Inert-gas module for extended shelf life

- Print Head: Thermal transfer, 300 dpi, 1–3 lines text

- Vision System: AI-based cup detection, reject misaligned cups

- CIP Ready: Integrated cleaning-in-place manifold

8. Service & Maintenance

- Preventive Maintenance: Every 500 h or 3 months

- Consumables: Sealing films, PTFE tape, heating element, sensors

- Spare Parts Kit: Heating plate, silicone gasket, fuse set

- Training: On-site 4-hour basic operation & safety course

9. Sizing & Installation

- Footprint: 750 × 600 × 1,350 mm (L × W × H)

- Net Weight: 85 kg

- Pallet Size: 1,000 × 1,200 mm EUR pallet

- Clearance: 800 mm front, 600 mm rear for film roll change

10. Performance Metrics

- First-Pass Yield: ≥ 98 % (visual inspection)

- Film Waste: < 3 % of total film used

- Uptime: 85 % target (excluding changeover)

- Power Factor: > 0.9 at full load

Use the above table and specifications to shortlist vendors, compare Total Cost of Ownership (TCO), and ensure regulatory compliance in the USA and EU markets.

Navigating Market Dynamics and Sourcing Trends in the auto sealing machine Sector

Navigating Market Dynamics and Sourcing Trends in the Auto Sealing Machine Sector

The auto sealing machine market in the United States and Europe is undergoing a structural shift driven by three converging forces: labor scarcity, sustainability mandates, and SKU proliferation in ready-to-drink (RTD) and on-trade beverages.

1. Demand Drivers & Regional Nuances

| Region | Primary Demand Drivers | Margin Pressure Points |

|---|---|---|

| USA | 5-day fulfillment windows, co-packing consolidation, multi- SKU RTD programs (bubble tea, nitro cold brew, functional waters) | Rising freight (LTL) rates + 18 % YoY labor cost inflation |

| Europe | Ecodesign & Packaging Waste Regulation (PPWR) compliance, plant-based diet growth, on-trade recovery (bars, stadiums) | Extended Producer Responsibility (EPR) fees up to €0.12 per cup; energy-price hedging mandatory for >500 kW installations |

2. Sourcing Trends

A. Supplier Concentration & Geographic Risk

- Asia-Pacific still dominates 78 % of global output (China: 62 %, Vietnam: 11 %, Thailand: 5 %).

- Near-shoring is accelerating in Central & Eastern Europe (Poland, Hungary) for EU-based brands seeking 6-week lead-time reduction and duty-free intra- EU logistics.

- Dual-sourcing mandates now common: 60 % capacity from APAC, 40 % from EU or USMCA to mitigate geopolitical risk.

B. Technology Upgrades

| Feature | 2021 Baseline | 2025 Forecast | ROI Notes |

|---|---|---|---|

| Servo-driven film tension | 15 % of units | 55 % of units | 12 % film savings, 22 % faster changeover |

| IoT-enabled cycle counters | <5 % | 35 % | Reduces unplanned downtime 30 % |

| Stainless-steel 316L enclosures | 40 % | 85 % | Meets EU hygiene regs; 3-year warranty uptake up 40 % |

C. Film & Material Evolution

- Mono-polyolefin films (PE/PP) gaining share against PET laminates due to EPR incentives.

- Reinforced PLA films for >85 °C hot-fill applications (bubble tea) still <4 % penetration; cost premium 2.4× PE but ESG value offsets.

- Pre-printed roll stock (CMYK + white ink) reduces secondary labeling cost by $0.008 per cup and eliminates liner waste.

3. Cost & Lead-Time Benchmarks

| Machine Class | CIF NY Port (USD) | EU Door (EUR) | Install & Train (Days) | Changeover Time (min) |

|---|---|---|---|---|

| Compact 90 mm | 4,850 | 5,400 | 1 | 3 |

| Mid-tier 95 mm | 7,200 | 8,100 | 1.5 | 5 |

| High-speed 105 mm | 12,500 | 14,000 | 2 | 8 |

Annualized total cost of ownership (TCO) includes 3 % finance, 2 % maintenance, 1.5 % energy at $0.12 kWh.

Illustrative Image (Source: Google Search)

4. Procurement Checklist for B2B Buyers

- [ ] Confirm machine certification: CE (LVD, EMC, Machinery Directive) + NSF/ANSI 4 for food contact in USA.

- [ ] Validate film compatibility matrix: thickness 70–120 μm, temperature range –5 °C to 90 °C.

- [ ] Negotiate service-level agreement (SLA): 48 h parts, 5-day on-site labor, remote diagnostics via Ethernet/IP.

- [ ] Secure serial-number traceability for PPWR compliance:每台设备唯一序列号记录。

- [ ] Evaluate financing: 0 %–3 % vendor financing vs. leasing (€0.12–0.15 per cup locked-in rate).

5. Outlook 2025-2027

- Cap-ex intensity will rise as EU PPWR enters implementation; expect 8–10 % price uplift on machines lacking disassembly-ready design.

- Servo + vision systems will shift from premium to mainstream, compressing manual changeover skill requirements.

- Data-as-a-service (usage-based billing) pilot programs are emerging; expect 15 % of new units sold with embedded connectivity by 2027.

Bottom line: Source dual-source, lock in film supply under 24-month contracts, and prioritize machines with modular, stainless-steel hygiene architecture to stay compliant and cost-competitive in the next regulatory cycle.

Frequently Asked Questions (FAQs) for B2B Buyers of auto sealing machine

Frequently Asked Questions (FAQs) for B2B Buyers of Auto Sealing Machines

1. What throughput speeds can I realistically expect from an automatic cup sealer?

Typical industrial-grade machines deliver 500–650 cups per hour for 90–95 mm lids. Actual output depends on cup diameter, film thickness, operator setup, and integration with upstream/downstream equipment. Request a tested cycle time from the supplier and verify it under your specific film and cup specifications.

2. Which cup and film sizes are compatible with most auto sealers sold in North America and the EU?

| Common Size Range | Notes |

|---|---|

| Cup diameter | 80–105 mm (3.15–4.13 in) |

| Film width | 90–110 mm (3.54–4.33 in) |

| Film thickness | 35–50 μm (1.4–2.0 mil) |

| Heat-seal layer | PE or PP (FDA-compliant grades available) |

Always confirm dimensional tolerances before ordering; some models accept only 89 mm or 95 mm fixed sizes.

3. How do digital vs. manual controls impact ROI for high-volume operations?

Digital models (LCD or touch-panel) enable ±1 °C temperature accuracy, programmable sealing time, and real-time fault logging—reducing film waste by 8–12 % and unplanned downtime by 15 %. Manual dial units cost 20–30 % less upfront but typically require re-calibration every 500 k cycles. For volumes above 50 k cups/day, the digital option usually breaks even within 9–12 months.

Illustrative Image (Source: Google Search)

4. What power supply and installation requirements should I budget for?

| Specification | North America | Europe |

|---|---|---|

| Voltage | 110–120 V, 60 Hz (single-phase) or 208–240 V, 3-phase | 230 V, 50 Hz (three-phase preferred) |

| Amperage | 15–20 A | 10–16 A |

| Air pressure | 0.6–0.8 MPa (6–8 bar) | 0.6–0.8 MPa (6–8 bar) |

| Clearance | 600 mm (24 in) front & back | 600 mm (24 in) front & back |

Check local electrical codes; some EU markets require CE-marked panels and residual-current devices (RCDs).

5. Which compliance standards should the machine and consumables meet?

- Food-contact safety: FDA 21 CFR §177.1520 (US) or EU 10/2011 (EU)

- Electrical safety: UL or ETL listed (US), CE marked (EU)

- Waste directive: Machine construction must comply with RoHS 2 and WEEE where applicable

- BPA-free: Explicit declaration required for lids and films used with hot beverages

Request test certificates and insist on third-party lab reports for film laminates.

6. What ongoing maintenance costs should I forecast?

| Item | Cost (USD) | Frequency |

|---|---|---|

| Heating elements | $120–$180 | 12–18 months |

| Teflon belts / seals | $60–$90 | 6–9 months |

| Lubrication | $30 | Quarterly |

| Annual service call | $300–$450 | Once per year |

| Total (80 k cups/day) | ~$1,200/year | — |

Spare-part kits are often packaged; negotiate a 10 % discount when ordering the machine.

7. What integration options are available for existing cup-filling lines?

Most auto sealers offer:

– In-feed conveyors (flat or inclined) with variable-speed drives (Modbus or analog)

– Reject bins with photocell sensors for zero-defect tracking

– Foot switches or PLC triggers for hardwired integration

– Guard rails and interlock safety gates to meet OSHA 1910.212

Lead time for custom integration is typically 5–7 business days; specify your line height (900 mm average) to avoid rework.

8. How does warranty and post-sales support compare across regions?

| Region | Standard Warranty | On-site Service | Remote Support |

|---|---|---|---|

| USA | 12 months parts & labor | Next-business-day | 24/7 phone / email |

| EU | 24 months (legal minimum) | 3–5 business days | English, German, Spanish |

| Extended coverage | Available for $0.003–$0.005 per cup | — | — |

Verify that spare parts are stocked in regional distribution centers; trans-Atlantic shipping can add 3–4 weeks to repairs.

Strategic Sourcing Conclusion and Outlook for auto sealing machine

Strategic Sourcing Conclusion and Outlook – Auto Sealing Machine

Value Summary

- ROI: Payback ≤ 9 months for 1-shift operations; cumulative 3-year savings 18-22 % vs. semi-automatic units.

- Capacity: 500-650 cups/h (>3× manual), eliminating overtime and labor bottlenecks.

- Quality: ±1 mm heat-seal tolerance, 99.8 % leak-free first-pass rate, reducing waste and warranty claims.

- Compliance: UL, CE, NSF-ready; ESG reporting modules for carbon footprint and food-contact safety.

Outlook – 2025-2027

| Year | Key Shifts |

|---|---|

| 2025 | AI-driven seal-pressure auto-tuning, energy 10 % lower, cloud-based OEE dashboards. |

| 2026 | Modular tooling (90-120 mm) cut change-over from 45 min to <5 min; recyclable mono-material film options. |

| 2027 | IoT predictive maintenance → unplanned downtime <0.5 %; carbon-negative aluminum frames standard. |

Sourcing Action Plan

- Vendor Selection: Prioritize ISO 9001 plants with on-site UL engineers; negotiate 3-year service SLAs.

- Contracting: 60 % fixed-price, 40 % index-linked to resin; include green-fee clauses for non-recyclable film.

- Risk Mitigation: Dual-source critical components (heating bars, PLC); 8-week safety stock for firmware revisions.

- Next Step: Issue RFP with above KPIs; target RFQ response Q2 2025 for Q4 2025 delivery.

Act now to lock in 2025 pricing corridors and secure preferred-vendor status before tariff adjustments.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.

Illustrative Image (Source: Google Search)