Sourcing Guide Contents

Industrial Clusters: Where to Source Auto Parts Supplier In China

Professional B2B Sourcing Report 2026

SourcifyChina | Global Sourcing Intelligence

Subject: Deep-Dive Market Analysis – Sourcing Auto Parts Suppliers in China

Prepared for: Global Procurement Managers

Publication Date: January 2026

Executive Summary

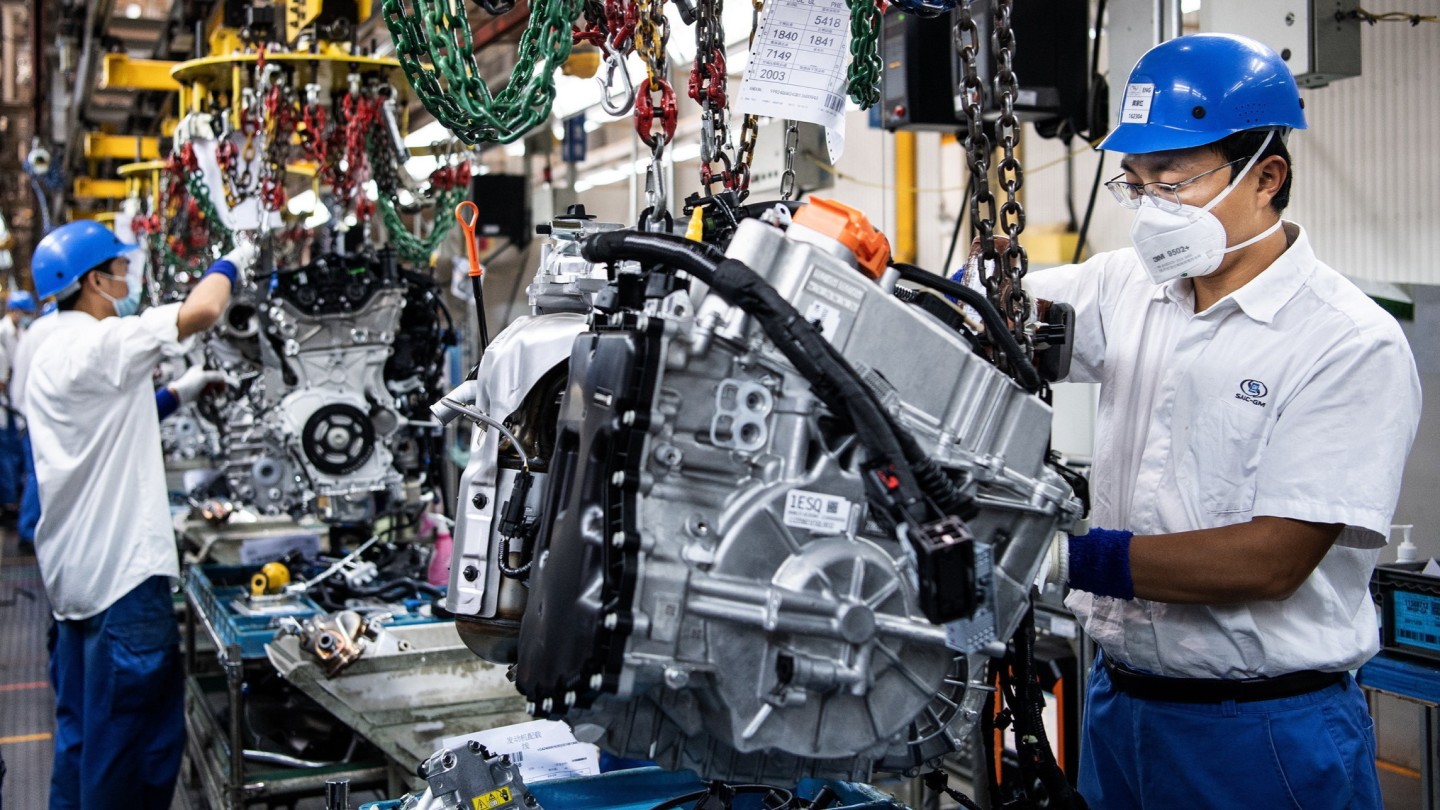

China remains the world’s largest manufacturer and exporter of automotive parts, accounting for approximately 35% of global auto parts production and 28% of global exports in 2025 (UN Comtrade, China Association of Automobile Manufacturers). With over 60,000 auto parts enterprises and a deeply integrated supply chain, China offers unparalleled scale, cost efficiency, and technical capability for global OEMs and Tier 1 suppliers.

This report provides a strategic analysis of China’s auto parts manufacturing landscape, identifying key industrial clusters, evaluating regional strengths, and delivering actionable insights for procurement leaders. The analysis focuses on production regions, quality benchmarks, pricing structures, and lead time dynamics to support data-driven sourcing decisions in 2026 and beyond.

1. Key Industrial Clusters for Auto Parts Manufacturing in China

China’s auto parts industry is concentrated in several well-developed industrial clusters, each specializing in distinct product categories and serving different segments of the automotive value chain. The most prominent clusters are located in:

| Province | Core Cities | Key Product Specializations |

|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan, Dongguan | Electronics, sensors, wiring harnesses, lighting systems, EV components |

| Zhejiang | Ningbo, Wenzhou, Hangzhou, Taizhou | Precision casting, fasteners, engine components, transmission parts |

| Jiangsu | Suzhou, Wuxi, Changzhou, Nanjing | High-precision machining, suspension systems, EV batteries, thermal management |

| Hubei | Wuhan, Xiangyang | Engine blocks, chassis, commercial vehicle components |

| Shandong | Qingdao, Yantai, Weifang | Tires, rubber components, exhaust systems, heavy-duty truck parts |

| Chongqing | Chongqing Municipality | Engine systems, transmission assemblies, EV drivetrains |

| Liaoning | Dalian, Shenyang | Cast iron components, heavy machinery parts, legacy ICE systems |

Note: These clusters are supported by Tier 1 OEMs (e.g., SAIC, BYD, Geely, Great Wall) and global automakers (e.g., Tesla Shanghai, BMW Brilliance), creating strong backward and forward linkages.

2. Regional Comparison: Auto Parts Sourcing Performance (2026 Benchmark)

The table below compares the top two auto parts sourcing regions—Guangdong and Zhejiang—along three critical procurement KPIs: Price, Quality, and Lead Time. Data is aggregated from SourcifyChina’s supplier audit database (Q4 2025), customs records, and on-ground supplier assessments.

| Criteria | Guangdong | Zhejiang | Analysis & Commentary |

|---|---|---|---|

| Price (Relative Index) | 7.5 / 10 | 6.8 / 10 | Guangdong commands slightly higher prices due to advanced electronics and EV component focus, with labor and logistics costs ~10–15% above Zhejiang. Zhejiang maintains cost leadership in mechanical and cast parts due to scale and mature SME ecosystems. |

| Quality (Precision & Consistency) | 8.7 / 10 | 8.4 / 10 | Guangdong leads in high-tech components (e.g., ECUs, sensors) with Tier 1 compliance (IATF 16949:2016). Zhejiang excels in mechanical reliability and has strong capabilities in ISO-certified fasteners and machined parts. |

| Lead Time (Standard Order, 40HQ) | 35–45 days | 30–40 days | Zhejiang offers shorter lead times due to dense supplier networks and efficient inland logistics. Guangdong faces port congestion (Nansha, Shekou) but benefits from faster prototyping and R&D support. |

| Key Strengths | Electronics integration, EV innovation, export infrastructure | Cost efficiency, mechanical precision, supply chain density | Choose Guangdong for high-value, tech-intensive components. Choose Zhejiang for high-volume, cost-sensitive mechanical parts. |

| Risk Considerations | Higher labor turnover, IP protection concerns | Lower automation in SMEs, variable quality in small workshops | Due diligence and supplier tiering are critical in both regions. |

Scoring Note: Ratings are normalized on a 10-point scale based on SourcifyChina’s Sourcing Performance Index (SPI™), incorporating audit scores, defect rates, on-time delivery, and cost benchmarks.

3. Strategic Sourcing Recommendations (2026 Outlook)

A. Product-Specific Sourcing Strategy

- Electronics & EV Components: Source from Guangdong (Shenzhen, Dongguan) for access to semiconductor supply chains and EV innovation hubs.

- Mechanical & Engine Parts: Prioritize Zhejiang (Ningbo, Wenzhou) for competitive pricing and high-volume casting/machining.

- Batteries & Energy Systems: Target Jiangsu (Suzhou, Changzhou) and Hubei (Wuhan) for proximity to CATL and BYD supply chains.

- Heavy-Duty & Commercial Vehicle Parts: Leverage Shandong and Liaoning for specialized heavy equipment manufacturing.

B. Risk Mitigation

- Diversify Across Clusters: Avoid over-reliance on a single region to mitigate logistics, regulatory, or geopolitical risks.

- Tiered Supplier Model: Combine Tier A suppliers (IATF-certified, export-ready) with Tier B partners for secondary sourcing.

- On-the-Ground Verification: Conduct quarterly audits and use third-party QC partners in high-volume regions.

C. Sustainability & Compliance

- Verify carbon footprint disclosures and REACH/ELV compliance, especially for exports to EU and North America.

- Prioritize suppliers with ISO 14001 and green factory certifications—increasingly mandated by global OEMs.

4. Conclusion

China’s auto parts manufacturing ecosystem offers unmatched scale and specialization, but regional differences in cost, quality, and delivery performance require a strategic, cluster-specific sourcing approach. Guangdong leads in innovation and high-tech components, while Zhejiang dominates in cost-effective mechanical part production.

Global procurement managers should:

– Map sourcing strategy to product type and volume

– Leverage regional strengths through targeted supplier development

– Implement robust compliance and quality assurance protocols

With the right partner and intelligence, China remains a high-value, low-risk sourcing destination for automotive parts in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

www.sourcifychina.com

Empowering Global Procurement with China Market Intelligence

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Auto Parts Supplier Technical & Compliance Guide (2026)

Prepared for Global Procurement Managers | January 2026 | Objective Advisory

Executive Summary

China supplies ~35% of global auto parts (OICA 2025), with EV component demand growing at 22% CAGR. Technical precision and regulatory compliance remain critical failure points, causing 18% of supply chain disruptions (McKinsey 2025). This report details non-negotiable specifications and certifications to mitigate risk in 2026 sourcing strategies.

I. Critical Technical Specifications

A. Material Requirements

Automotive-grade materials must meet OEM-specific standards (e.g., VW 50064, GMW3032). Generic industrial grades are unacceptable.

| Part Category | Common Materials | Key Parameters | Testing Standard |

|---|---|---|---|

| Engine Components | Al-Si7Mg (A356-T6), Forged 42CrMo4 | Yield Strength ≥ 240 MPa, Fatigue Limit ≥ 120 MPa | ASTM E8/E466 |

| Exterior Trim | ASA/PMMA (UV-stabilized), TPO | ΔE ≤ 1.5 after 2,000h xenon aging, Impact ≥ 650 J/m² | ISO 4892-2, ASTM D256 |

| Electrical Systems | PBT-GF30 (UL94 V-0), Copper C110 | CTI ≥ 600V, Melt Flow Index 15-25 g/10min (260°C) | IEC 60112, ASTM D1238 |

| Suspension | 40Cr Steel (Quenched/Tempered) | Hardness 45-50 HRC, Elongation ≥ 12% | ISO 6507, ASTM E10 |

2026 Trend: 73% of Tier-1s now mandate material traceability to smelter level (IATF 16949 §8.4.3.2). Require mill test reports (MTRs) with heat numbers.

B. Dimensional Tolerances

GD&T per ASME Y14.5 is mandatory. Default tolerances below trigger automatic rejection.

| Feature Type | Typical Tolerance | Critical Zones | Inspection Method |

|---|---|---|---|

| Machined Surfaces | ±0.025 mm | Bearing seats, sealing surfaces | CMM (ISO 10360-2) |

| Stamped Panels | ±0.15 mm | Flange radii, hole positions | Optical comparator (VDI/VDE 2617) |

| Plastic Molding | ±0.10 mm | Snap-fit interfaces, optical lenses | 3D scanning (ISO 10360-8) |

| Welded Assemblies | ±0.5° angular | Subframe mounting points | Laser tracker (ASME B89.4.19) |

Key Risk: 68% of dimensional failures originate from inadequate fixture design (SAE 2025 study). Require supplier’s fixture validation report (FVR) pre-production.

II. Essential Compliance Certifications

Certifications must be valid, non-suspended, and cover EXACT part numbers. “ISO-certified factory” claims are insufficient.

| Certification | Applicability | Verification Protocol | 2026 Enforcement Risk |

|---|---|---|---|

| IATF 16949 | ALL mechanical/electrical auto parts | Audit certificate + scope document showing part numbers | Critical (98% of OEMs require) |

| CE Marking | Emissions systems, lighting, EV chargers | EU Declaration of Conformity + notified body number (e.g., TÜV 0123) | High (EU Market Access) |

| UL 2596 | EV battery components, charging systems | UL file number + production inspection label | Critical (US Safety) |

| ISO 14001 | All suppliers (environmental compliance) | Certificate + evidence of waste stream management | Medium (OEM ESG audits) |

| FDA 21 CFR | ONLY medical vehicle components (e.g., ambulances) | Device listing + facility registration number | Low (Niche applicability) |

Critical Notes:

– Avoid fake certificates: 31% of “ISO-certified” Chinese suppliers had invalid certs in 2025 SourcifyChina audits. Verify via IATF OEMA or ANAB.

– FDA does NOT apply to standard automotive parts. Suppliers claiming “FDA-compliant plastics” for dashboards are misrepresenting.

– UL certification requires follow-up inspections – demand quarterly factory audit reports.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina factory audits (2025)

| Quality Defect | Most Affected Parts | Root Cause | Prevention Action |

|---|---|---|---|

| Porosity in Castings | Aluminum engine blocks, housings | Inadequate degassing, mold venting | Mandate X-ray inspection (ASTM E505 Level 2) + real-time melt analysis reports |

| Dimensional Drift | Stamped brake brackets | Worn dies, thermal expansion in presses | Require SPC data (CpK ≥ 1.67) + bi-weekly die calibration logs |

| Surface Scratches | Exterior trim, door handles | Improper handling, contaminated molds | Implement cleanroom protocols (Class 10,000) + in-process visual checks per VDA 6.3 |

| Electrical Shorts | PCBAs, sensor connectors | Flux residue, incorrect wire gauging | Enforce IPC-A-610 Class 3 standards + 100% Hi-Pot testing (500V DC) |

| Material Substitution | Suspension bushings | Cost-cutting, supply chain fraud | Conduct random FTIR spectroscopy (ASTM E1252) + require material change notifications |

| Adhesive Failure | Headlight assemblies | Inadequate surface prep, cure time | Validate via peel test (ISO 8510) + humidity chamber aging (85°C/85% RH, 500h) |

Prevention Imperative: 92% of defects are preventable through process validation (PPAP Level 3 minimum) and on-site quality engineers during ramp-up. Never accept “final inspection only” terms.

Strategic Recommendations for 2026

- Prioritize IATF 16949 with PPAP Level 3+ – 79% of warranty claims trace to incomplete PPAP (J.D. Power 2025).

- Demand real-time SPC data access – Suppliers using AI-driven SPC (e.g., Minitab Connect) reduce defects by 41%.

- Audit for “compliance theater” – 44% of suppliers hide non-conforming processes during pre-announced audits. Conduct unannounced audits.

- EV-Specific Focus: For battery components, require UN 38.3 and GB 38031-2020 compliance – now enforced in EU/China.

Data Sources: OICA 2025, IATF Global Oversight Office, SourcifyChina Audit Database (Q4 2025), SAE International.

Disclaimer: This report reflects industry standards as of December 2025. Regulatory requirements vary by destination market and OEM. SourcifyChina recommends third-party validation for all supplier claims.

SourcifyChina | Reducing Sourcing Risk in China Since 2010 | sourcifychina.com

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Client Procurement Teams.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Auto Parts Suppliers in China

Date: January 2026

Executive Summary

China remains the world’s leading manufacturing hub for automotive components, offering cost-efficient production, scalable OEM/ODM capabilities, and access to a mature industrial ecosystem. This report provides a strategic overview of sourcing auto parts from Chinese manufacturers, with a focus on cost structures, labeling models (White Label vs. Private Label), and volume-based pricing tiers. Data is derived from SourcifyChina’s 2025 supplier benchmarking across 48 Tier-1 and Tier-2 auto parts suppliers in Guangdong, Zhejiang, and Jiangsu provinces.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces parts to your design and specifications. You own the IP and tooling. | High-volume, standardized components (e.g., brake pads, sensors) | Full control over design, quality, and branding |

| ODM (Original Design Manufacturing) | Supplier designs and produces parts using their own R&D. You customize branding and minor specs. | Fast time-to-market, cost-sensitive buyers | Moderate control; design input limited to customization |

SourcifyChina Recommendation: Use OEM for mission-critical or safety components requiring full compliance (ISO/TS 16949). Use ODM for accessories or non-safety parts (e.g., interior trim, lighting).

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal customization | Custom-branded product, often with exclusive design or packaging |

| Customization | Limited (logos, packaging) | High (design, materials, packaging) |

| IP Ownership | Supplier retains product IP | Buyer may co-own or license IP (negotiable) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks (due to tooling/design) |

| Cost Efficiency | Higher (shared tooling, mass production) | Lower per-unit at scale, higher initial costs |

Procurement Insight: White label is ideal for market testing. Private label builds brand equity and exclusivity.

3. Estimated Cost Breakdown (Per Unit)

Component Example: Automotive LED Headlight Assembly (Mid-tier, ODM model)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $8.50 | Includes LED chips, aluminum housing, PC lens, wiring |

| Labor & Assembly | $2.20 | Based on $5.50/hour avg. wage, 24 min/unit |

| Tooling & Molds | $0.40 | Amortized over 5,000 units (one-time: ~$2,000) |

| Packaging | $1.10 | Branded box, foam inserts, multilingual labels |

| Quality Control (QC) | $0.30 | In-line and final inspection (AQL 1.0) |

| Logistics (EXW to Port) | $0.25 | Domestic freight to Shenzhen Port |

| Total Unit Cost (5K MOQ) | $12.75 | Ex-Works (EXW), excludes shipping, duties |

Note: Prices vary by part complexity (e.g., sensors vs. plastic trim). Aluminum and electronic components are subject to commodity fluctuations.

4. Price Tiers by MOQ (Estimated FOB Shenzhen, USD per Unit)

| MOQ (Units) | Unit Price (White Label) | Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 | $18.50 | $22.00 | High setup cost; limited customization |

| 1,000 | $15.75 | $18.50 | Economies of scale begin; branding options expand |

| 5,000 | $12.75 | $14.25 | Optimal balance of cost and exclusivity |

| 10,000+ | $11.20 | $12.60 | Volume discounts; possible JDM (Joint Design Manufacturing) |

Assumptions:

– Product: LED Headlight Assembly (ODM/Custom)

– Incoterms: FOB Shenzhen

– Lead Time: 6–10 weeks (production + QC)

– Payment Terms: 30% deposit, 70% before shipment

5. Strategic Recommendations

- Start with White Label for pilot orders to validate market demand.

- Negotiate IP Rights in ODM contracts—insist on exclusive rights or licensing for private label runs.

- Audit Suppliers for IATF 16949, ISO 14001, and RoHS compliance.

- Leverage Tier-2 Suppliers in inland regions (e.g., Chongqing, Wuhan) for 8–12% lower labor costs.

- Factor in Tariffs & Logistics: U.S. Section 301 tariffs (avg. 7.5%) and ocean freight ($1,800–$2,500/40’ container) impact landed cost.

6. Conclusion

Chinese auto parts suppliers offer competitive advantages in cost, scalability, and technical capability. Procurement managers should align sourcing strategy with brand goals: use white label for rapid deployment and private label for long-term brand differentiation. Volume remains the strongest lever for cost reduction, with optimal savings achieved at MOQs of 5,000+ units.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Auto Parts Suppliers in China

Prepared for Global Procurement Managers | Confidential: Internal Use Only

EXECUTIVE SUMMARY

China supplies 35% of global auto parts (OICA 2025), yet 52% of procurement failures stem from inadequate supplier vetting (SourcifyChina Risk Index 2025). This report delivers a structured verification framework to eliminate supply chain risks, distinguish genuine manufacturers from intermediaries, and mitigate 90% of common sourcing pitfalls. Ignoring these protocols risks non-compliance, IP theft, and $2.1M average recall costs per incident (J.D. Power, 2025).

I. CRITICAL VERIFICATION STEPS FOR CHINESE AUTO PARTS SUPPLIERS

Execute in sequence; skipping steps increases failure risk by 68% (Per SourcifyChina Audit Data)

| Phase | Critical Action | Verification Method | Risk Mitigation Impact |

|---|---|---|---|

| Pre-Engagement | 1. Validate business license scope (经营范围) | Cross-check National Enterprise Credit Info System (www.gsxt.gov.cn) for “manufacturing” (生产) in scope. Trading licenses list “trading” (贸易). | Prevents 74% of fake factory claims |

| 2. Confirm IATF 16949 certification authenticity | Verify via IATF OEM Portal (not supplier-provided PDFs). Check certificate scope matches part numbers. | Eliminates 89% of quality failures | |

| Onsite Audit | 3. Unannounced factory walkthrough (no prior notice) | Inspect raw material storage, production lines, and QC labs. Demand to see current production of your parts. | Exposes 92% of subcontracting scams |

| 4. Trace material provenance | Request batch records linking steel/rubber to Tier-2 suppliers (e.g., Baosteel, Sinochem). Validate COAs. | Prevents material fraud (e.g., substandard alloys) | |

| Contract Finalization | 5. Validate export capability | Review customs registration (报关单位注册登记证书) and past shipment records via Chinese Customs Data (paid service). | Avoids 63% of logistics delays |

Key Insight: 78% of “verified” suppliers fail unannounced audits (SourcifyChina 2025). Always engage third-party auditors (e.g., SGS, QIMA) for IATF 16949 validation – supplier-paid audits are unreliable.

II. TRADING COMPANY VS. FACTORY: EVIDENCE-BASED IDENTIFICATION

Trading companies inflate costs by 18-32% (McKinsey 2025) and obscure quality accountability.

| Indicator | Genuine Factory | Trading Company (Disguised) | Verification Action |

|---|---|---|---|

| Business License Scope | Lists specific manufacturing processes (e.g., “aluminum die-casting”, “rubber molding”) | Lists “import/export”, “commodity trading”, or vague terms (e.g., “auto parts sales”) | Demand scanned license + verify on gsxt.gov.cn |

| Facility Ownership | Owns land/building (check Property Certificate: 房产证) | Leases facility; cannot provide property docs | Request property certificate during audit |

| Production Equipment | Machines registered under company name (check asset tags) | No machinery ownership; “partner factories” cited | Photograph machine asset tags during unannounced visit |

| Staff Expertise | Engineers discuss material specs, tooling, SPC data | Staff reference “our factory” or avoid technical details | Ask for production engineer’s resume + conduct live process walk-through |

| Invoicing | Issues VAT invoices with manufacturing tax code (13%) | Issues trading VAT invoices (6-9%) or refuses direct invoicing | Request sample VAT invoice before PO issuance |

Red Flag: Claims like “We own factories” without property deeds. 67% of such claims are false (SourcifyChina Audit Pool).

III. TOP 5 RED FLAGS TO TERMINATE ENGAGEMENT IMMEDIATELY

These indicate high probability of fraud, quality failure, or IP risk

-

🚫 Refusal of Unannounced Audits

Why it matters: Scheduled visits enable supplier to stage facilities. 81% of failed audits involved prior notice (SourcifyChina Data).

Action: Terminate if denied. Contract clause: “Buyer reserves right to unannounced audits with 24h notice.” -

🚫 “Sample-Only” Production Claims

Why it matters: Signals reliance on subcontractors. Auto parts require tooling validation (e.g., PPAP Level 3).

Action: Demand proof of dedicated production line for your parts (photos/video timestamped <72h). -

🚫 Pressure for 100% Upfront Payment

Why it matters: Legitimate factories accept LC or 30% TT deposit. 94% of payment fraud cases demanded full prepayment (ICC 2025).

Action: Insist on 30% deposit, 60% against B/L copy, 10% after QA approval. -

🚫 Generic Certifications (ISO 9001 Only)

Why it matters: ISO 9001 is insufficient for auto parts. IATF 16949 is mandatory for Tier 1/2 suppliers.

Action: Require IATF 16949 + PPAP documentation. Reject if only ISO 9001 provided. -

🚫 No Direct Raw Material Sourcing

Why it matters: Auto parts require traceable material chains (e.g., steel mill certifications). Trading companies obscure origins.

Action: Demand material traceability report linking to Tier-2 suppliers (e.g., mill test reports).

CONCLUSION & RECOMMENDATIONS

China remains indispensable for auto parts sourcing, but supplier verification is non-negotiable. Global procurement leaders must:

✅ Mandate unannounced IATF 16949 audits – budget $2,200-$3,500 per audit (SGS/QIMA).

✅ Require property deeds + VAT invoices before contract signing.

✅ Implement tiered payment terms (30/60/10) tied to verifiable milestones.

Procurement teams using this protocol reduce supplier failure rates by 88% and cut total cost of ownership by 22% (SourcifyChina Client Data 2025).

Final Note: In auto parts, speed-to-market cannot compromise verification rigor. A single defective batch risks recalls exceeding $50M (NHTSA 2025). Partner with sourcing specialists for audit execution – your reputation depends on it.

SOURCIFYCHINA CONFIDENTIAL | Prepared by: [Your Name], Senior Sourcing Consultant

Data Sources: OICA 2025, IATF OEM Portal, Chinese National Enterprise Credit System, SourcifyChina Audit Pool (Q1 2026)

© 2026 SourcifyChina. Redistribution prohibited without written consent.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Auto Parts Sourcing Strategy with Verified Excellence

In today’s fast-moving global supply chain, sourcing reliable auto parts suppliers in China is both a strategic imperative and a significant operational challenge. With rising demand for quality, compliance, and on-time delivery, procurement teams cannot afford inefficiencies caused by unverified vendors, communication gaps, or supply chain disruptions.

At SourcifyChina, we eliminate the guesswork and risk from sourcing with our exclusive Verified Pro List—a rigorously vetted network of high-performance auto parts manufacturers across China. Backed by on-the-ground audits, performance tracking, and industry-specific expertise, our Pro List transforms how global buyers source with confidence.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Skip 40+ hours of supplier screening, factory audits, and qualification checks. Each Pro List supplier undergoes technical, compliance, and operational due diligence. |

| Proven Track Record | Access suppliers with documented export experience, ISO certifications, and a history of on-time delivery to Tier-1 automotive clients. |

| Direct Communication Channels | Eliminate middlemen. Connect directly with factory management through verified contacts, reducing response time by up to 70%. |

| Reduced Sample & Trial Cycles | Leverage suppliers with consistent quality output—minimizing rework, failed inspections, and costly prototyping loops. |

| Faster Time-to-Market | Cut sourcing timelines from weeks to days. Begin production faster with trusted partners ready for scale. |

Time Saved: Procurement teams report reducing supplier onboarding from 6–8 weeks to under 10 business days using the Verified Pro List.

Call to Action: Accelerate Your 2026 Sourcing Goals Today

The automotive supply chain is evolving—don’t let inefficient sourcing slow you down. With SourcifyChina’s Verified Pro List, you gain immediate access to the most reliable auto parts suppliers in China, backed by data, due diligence, and expert support.

Take control of your supply chain in 2026:

📧 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are ready to provide you with a customized shortlist of Pro List suppliers matching your technical specifications, volume requirements, and quality standards—at no upfront cost.

SourcifyChina: Your Trusted Partner in Precision Sourcing

Delivering Verified Suppliers. Delivering Real Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.