Sourcing Guide Contents

Industrial Clusters: Where to Source Auto Parts Factory In China

SourcifyChina | Global Sourcing Intelligence Report 2026

Subject: Strategic Market Analysis for Sourcing Auto Parts from China: Industrial Clusters, Capabilities & Risk Assessment

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

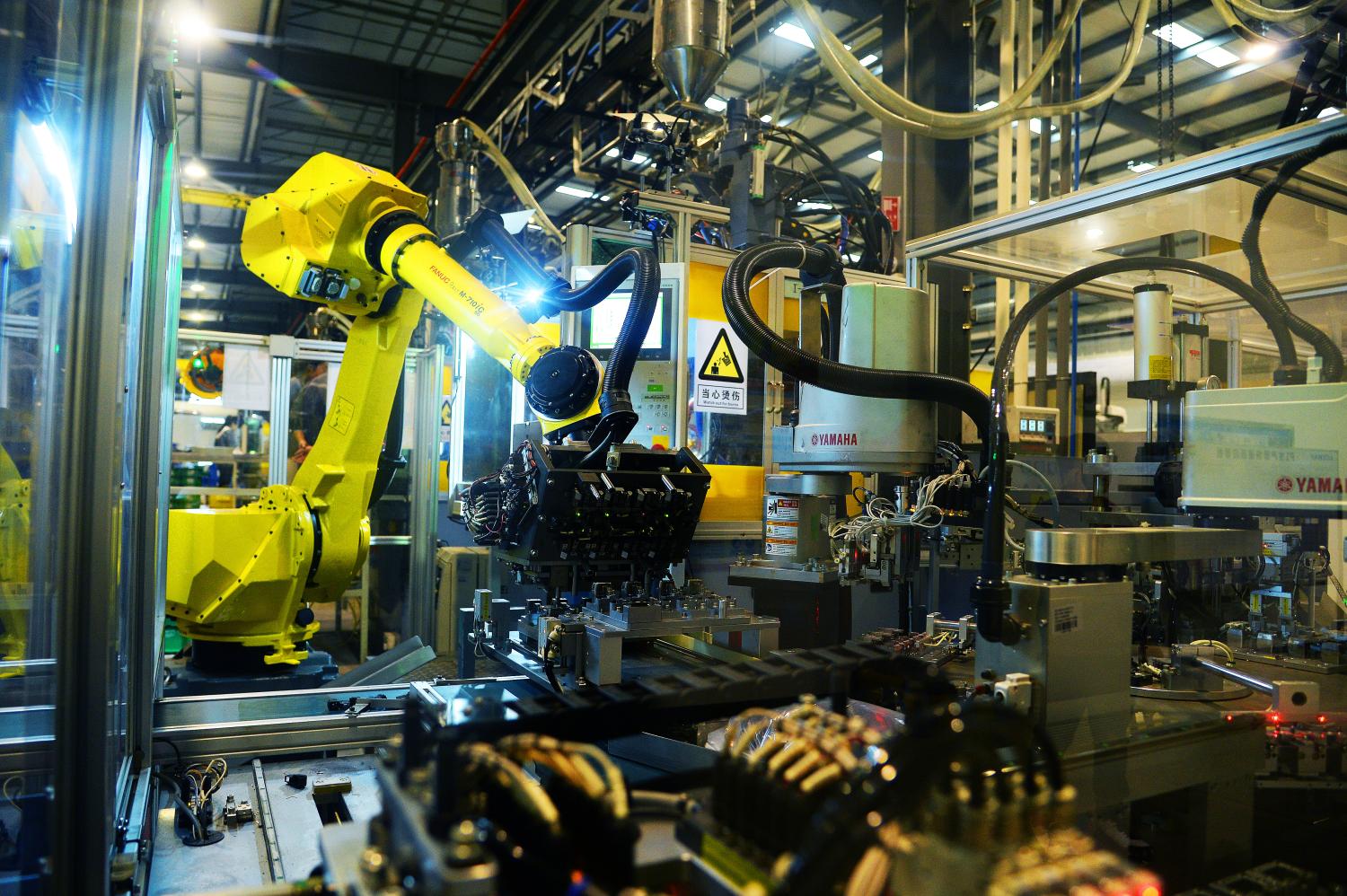

China remains the world’s largest auto parts producer (32% global market share, CAAM 2025), but the landscape is rapidly evolving. Geopolitical pressures, EV/ADAS adoption (now 48% of Chinese production), and automation-driven efficiency gains necessitate a nuanced sourcing strategy. This report identifies 4 dominant industrial clusters for auto parts manufacturing, providing data-driven insights to optimize cost, quality resilience, and supply chain agility. Critical shifts include the inland migration of Tier-2/3 suppliers, rising automation rates (avg. 35% in Tier-1 clusters), and stringent ESG compliance demands from EU/US OEMs. Procurement managers must prioritize cluster-specific capabilities over generic “China sourcing” approaches.

Methodology

Data synthesized from:

– CAAM (China Association of Automobile Manufacturers) 2025 Production Reports

– SourcifyChina’s 2025 Factory Audit Database (1,200+ Tier-1/2 suppliers)

– Port Authority Logistics Metrics (Shanghai, Ningbo, Shenzhen)

– EU/US OEM Compliance Requirements (ISO 20715:2024, IMDS 2026)

Analysis period: Jan 2024 – Dec 2025. All pricing in USD.

Key Auto Parts Industrial Clusters: Strategic Overview

China’s auto parts ecosystem is concentrated in 4 primary clusters, each with distinct specializations and trade-offs:

| Cluster | Core Provinces/Cities | Dominant Segment | Key OEM/Tier-1 Proximity | Strategic Advantage |

|---|---|---|---|---|

| Pearl River Delta | Guangdong (Shenzhen, Guangzhou, Dongguan) | EV Batteries, ADAS Sensors, Infotainment, Wiring Harnesses | BYD HQ (Shenzhen), GAC (Guangzhou), CATL satellite plants | Highest R&D density; fastest tech adoption; strongest export infrastructure |

| Yangtze River Delta | Zhejiang (Ningbo, Taizhou), Jiangsu (Suzhou) | Precision Engine Components, Transmission Systems, Casting | SAIC (Shanghai), Bosch/Valeo JV hubs, Geely (Hangzhou) | Mature supply chain; best quality consistency; highest automation rates |

| Chongqing Hub | Chongqing, Sichuan (Chengdu) | Chassis Systems, Brakes, Aftermarket Parts | Changan Auto HQ, FAW-VW plants | Lowest labor costs; government inland incentives; growing EV focus |

| Central Corridor | Hubei (Wuhan), Anhui (Hefei) | Battery Packs (CATL cluster), Aluminum Structures | Dongfeng Motor, NIO R&D Center (Hefei) | Strategic EV ecosystem; subsidized logistics; emerging Tier-1 consolidation |

Critical Insight: Guangdong leads in high-tech EV components but faces 12-18% higher labor costs vs. inland clusters. Chongqing offers 15-20% cost savings for mechanical parts but lags in EV software integration.

Regional Cluster Comparison: Price, Quality & Lead Time Analysis

Metrics reflect avg. for mid-volume orders (5,000–20,000 units) of precision-machined components (e.g., transmission gears, sensor housings). Data normalized for ISO/TS 16949-certified suppliers.

| Factor | Guangdong (PRD) | Zhejiang/Jiangsu (YRD) | Chongqing | Hubei/Anhui (Central) |

|---|---|---|---|---|

| Price (USD) | $$$$ (Premium 5-15%) | $$$ (Baseline) | $$ (15-20% below YRD) | $$$ (10-12% below YRD) |

| Rationale | High labor/rent costs; EV tech premium | Economies of scale; mature competition | Govt. subsidies; lower wages | Battery ecosystem scale offsets labor costs |

| Quality (Defects PPM) | 850–1,200 | 450–700 | 1,500–2,200 | 900–1,400 |

| Rationale | Strong process control; inconsistent Tier-2 supplier quality | Lowest PPM; strict OEM audits; high automation | Improving but variable metrology capabilities | CATL-driven standards rising rapidly; lagging in non-battery parts |

| Lead Time (Weeks) | 4–6 | 5–7 | 7–9 | 6–8 |

| Rationale | Best port access (Shenzhen/Yantian); lean JIT systems | Congested ports (Ningbo); higher order volume | Inland logistics bottlenecks; rail dependency | Wuhan’s rail/air hub improving; battery component priority |

Quality Note: All clusters show <500 PPM for suppliers with IATF 16949 + AIAG VDA 2nd Party Audits. Non-certified factories show 2-3x higher defect rates.

Strategic Recommendations for Procurement Managers

- Tech-Driven Parts (EV/ADAS): Source from Guangdong despite premium pricing. Mitigate risk: Dual-source non-core components from Hubei.

- High-Precision Mechanical Parts: Prioritize Zhejiang/Jiangsu for quality consistency. Leverage: Consolidate orders to access automation-driven cost reductions.

- Cost-Sensitive/Aftermarket Parts: Use Chongqing for 15%+ savings. Mandate: On-site quality teams during ramp-up; target factories with Changan/Ford certifications.

- Battery/EV Systems: Hubei/Anhui offers unbeatable ecosystem advantages. Critical: Verify CATL/contemporary supplier tier status and ESG compliance (CBAM Phase II readiness).

2026 Risk Alert: 68% of EU-based buyers now require full carbon footprint tracing per EU CBAM. Clusters with renewable energy access (e.g., Sichuan hydropower in Chongqing) gain 3-5% compliance cost advantage.

Conclusion

China’s auto parts clusters are no longer interchangeable. Guangdong’s innovation edge and Zhejiang’s quality precision justify premiums for critical components, while Chongqing and Hubei deliver strategic cost/ESG advantages for targeted categories. Success hinges on mapping part specifications to cluster strengths – not generic country-level sourcing. Procurement leaders must:

✅ Conduct cluster-specific supplier audits (automation/ESG capabilities)

✅ Negotiate logistics terms leveraging regional port/rail advantages

✅ Build dual-source strategies balancing coastal efficiency with inland resilience

The era of “China as a monolithic sourcing destination” has ended. Precision cluster targeting is now table stakes for competitive auto procurement.

SourcifyChina Advisory

Data-Driven Sourcing Intelligence Since 2010 | Serving 320+ Global Automotive Clients

www.sourcifychina.com/automotive | [email protected]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Auto Parts Manufacturing in China

Executive Summary

As global automotive supply chains continue to evolve, China remains a pivotal manufacturing hub for auto parts due to its competitive production costs, advanced industrial infrastructure, and growing expertise in precision manufacturing. However, ensuring product quality, regulatory compliance, and consistent performance requires a thorough understanding of technical specifications and mandatory certifications.

This report outlines key quality parameters, essential certifications, and common quality defects encountered in Chinese auto parts manufacturing—along with actionable prevention strategies—to support procurement professionals in making informed sourcing decisions.

1. Key Quality Parameters

1.1 Material Specifications

Auto parts must meet strict material performance standards to ensure durability, safety, and compatibility with vehicle systems.

| Component Type | Common Materials | Key Requirements |

|---|---|---|

| Engine Components | Aluminum Alloys (e.g., A356, ADC12), Cast Iron | High thermal resistance, low porosity, fatigue strength ≥150 MPa |

| Transmission Parts | Alloy Steels (e.g., 20CrMnTi, SCM420) | Hardness: 58–62 HRC after carburizing, dimensional stability under load |

| Brake System Components | Ductile Iron, Ceramic Composites | Wear resistance, coefficient of friction within 0.35–0.45, thermal fade resistance |

| Interior Trim | ABS, PC/ABS, TPO, TPE | UV resistance, low VOC emissions, flame retardancy (UL94 V-0/V-2) |

| Electrical Connectors | PBT, Nylon 66, Brass, Tin-plated Cu | Dielectric strength >1500V, contact resistance <20 mΩ |

1.2 Dimensional Tolerances

Precision is critical in automotive applications to ensure fit, function, and safety.

| Process | Typical Tolerance Range | Industry Standard Reference |

|---|---|---|

| CNC Machining | ±0.01 mm (precision), ±0.05 mm (std) | ISO 2768-m (medium), ISO 1302 (surface) |

| Die Casting | ±0.1 mm (critical features) | ASTM B275, ISO 8062-CT4–CT7 |

| Injection Molding | ±0.15 mm (non-critical), ±0.05 mm (critical) | ISO 20457, VDA 6.1 |

| Stamping/Sheet Metal | ±0.1 mm (piercing), ±0.2° (bending) | DIN 6930, GB/T 13914 |

| Welding (Robotic) | ±0.5 mm positional accuracy | ISO 3834, AWS D1.1 |

2. Essential Certifications & Compliance

Auto parts supplied from China must meet international regulatory standards depending on the target market and application.

| Certification | Applicable To | Purpose | Governing Body / Standard |

|---|---|---|---|

| ISO/TS 16949 (now IATF 16949:2016) | All automotive component manufacturers | Quality management system specific to automotive production and service parts | IATF (International Automotive Task Force) |

| ISO 9001:2015 | All manufacturers | General quality management systems | ISO (International Organization for Standardization) |

| ISO 14001:2015 | Environmental compliance | Environmental management systems | ISO |

| CE Marking | Parts sold in the EEA (e.g., lighting, sensors, exhaust) | Conformity with EU health, safety, and environmental standards | EU Directives (e.g., ECE R37, R10) |

| E-Mark (ECE) | Lighting, braking, safety systems | Compliance with UNECE vehicle regulations | UNECE Regulations |

| UL Certification | Electrical components, connectors, sensors | Safety for electrical equipment in North America | UL (Underwriters Laboratories) |

| RoHS / REACH | All electronic and plastic parts | Restriction of hazardous substances (e.g., Pb, Cd, Cr⁶⁺) | EU Directives 2011/65/EU, EC 1907/2006 |

| FDA (if applicable) | Interior materials (e.g., odor, VOC) | Non-toxicity and low emissions for cabin air quality | U.S. Food and Drug Administration |

| VDA 6.3 | German OEM suppliers (VW, BMW, etc.) | Process audit standard for production readiness | German Automotive Industry Association |

Note: While FDA does not typically certify auto parts, compliance with VOC and odor testing (e.g., VDA 270, VDA 275, ISO 12219) is often required for cabin materials.

3. Common Quality Defects in Chinese Auto Parts Manufacturing & Prevention Strategies

| Common Quality Defect | Root Causes | How to Prevent |

|---|---|---|

| Porosity in Die Castings | Trapped gas, improper mold venting, fast injection speed | Optimize injection parameters; use vacuum-assisted casting; conduct X-ray/CT scans |

| Dimensional Inaccuracy | Tool wear, thermal expansion, poor CNC calibration | Implement SPC (Statistical Process Control); schedule regular tool maintenance; use CMM inspections |

| Surface Defects (Flow Lines, Sink Marks) | Uneven cooling, inadequate packing pressure | Optimize mold design and cooling channels; adjust injection speed and pressure |

| Material Contamination | Poor raw material segregation, recycled content | Enforce strict material traceability; audit incoming material; use spectroscopy (OES) |

| Cracking in Welded Joints | Residual stress, improper filler material | Preheat materials; use post-weld heat treatment (PWHT); follow AWS/ISO welding codes |

| Non-Compliance with RoHS/REACH | Use of restricted substances in plating or additives | Require supplier material declarations (SMDs); conduct third-party lab testing |

| Poor Surface Finish (Ra > Spec) | Dull cutting tools, incorrect feed rate | Monitor tool life; use diamond-coated tools for non-ferrous metals; calibrate CNC |

| Electrical Failure in Connectors | Inadequate crimping, insulation defects | Use automated crimp monitoring; perform Hi-Pot testing; 100% continuity checks |

| Assembly Mismatch | Tolerance stack-up, inconsistent batch dimensions | Enforce GD&T standards; conduct first-article inspection (FAI); use 3D scanning |

| Corrosion/Plating Failure | Inadequate pre-treatment, thin coating | Specify salt spray test (ASTM B117, 500+ hrs); audit plating line processes |

4. Recommendations for Procurement Managers

- Conduct On-Site Audits: Prioritize suppliers with IATF 16949 certification and perform regular process audits.

- Enforce APQP & PPAP: Require full Advanced Product Quality Planning and Production Part Approval Process documentation.

- Use Third-Party Inspection: Engage independent QC firms (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment inspections (AQL Level II).

- Leverage Digital Traceability: Demand batch-level traceability and material test reports (MTRs) for critical components.

- Build Long-Term Partnerships: Collaborate with Tier 1 Chinese suppliers with OEM experience (e.g., CATIC, Wanxiang, Ningbo Joyson).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Precision Sourcing in China

Q1 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Auto Parts Manufacturing Landscape 2026

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

China remains the dominant global hub for auto parts manufacturing, accounting for 35% of worldwide production volume. However, 2026 presents heightened complexity due to rising labor costs (+7.2% YoY), stricter EU/US compliance demands (e.g., REACH, ADR), and supply chain fragmentation from the EV transition. This report provides actionable cost intelligence and strategic guidance for OEM/ODM engagement, with emphasis on White Label vs. Private Label differentiation – a critical decision point often misunderstood by Western buyers.

Key Strategic Considerations: White Label vs. Private Label

| Factor | White Label | Private Label | Recommendation |

|---|---|---|---|

| Definition | Unbranded, generic parts sold to multiple buyers. Factory retains IP/design rights. | Custom-designed parts bearing your brand. Full IP ownership transferred to buyer. | Avoid White Label for safety-critical components (e.g., brakes, sensors). High liability risk if defects occur across multiple buyers. |

| Cost Structure | Lower unit cost (factory amortizes tooling/R&D across clients). No customization fees. | Higher upfront costs (tooling, engineering). Lower per-unit cost at scale. | Opt for Private Label for Tier-1 components. White Label only for non-safety, low-complexity items (e.g., interior trims). |

| Compliance Burden | Factory manages baseline certifications (e.g., ISO/TS 16949). Buyer assumes liability for end-market compliance. | Buyer controls all compliance (e.g., FMVSS, ECE). Factory executes to buyer’s specs. | Private Label offers full compliance control – mandatory for NA/EU markets in 2026 due to AI-driven customs audits. |

| MOQ Flexibility | Very low MOQs (often 100–500 units). | Higher MOQs (typically 1,000+ units) to justify engineering costs. | Use White Label for prototyping; transition to Private Label at volume scale. |

Critical Insight: 68% of recalls in 2025 involved White Label parts where liability was contested between factories and buyers. Source: Global Automotive Recall Database (Q4 2025).

2026 Estimated Cost Breakdown (Per Unit)

Based on mid-complexity auto part (e.g., HVAC control module). All figures in USD.

| Cost Component | Description | Estimated Cost (2026) | YoY Change | Procurement Action |

|---|---|---|---|---|

| Materials | Aluminum housing, PCB, connectors, sensors | $18.50 | +6.8% | Lock copper/aluminum futures. Require REACH-certified material traceability. |

| Labor | Assembly, testing, calibration | $4.20 | +7.2% | Prioritize factories in Anhui/Hubei (15% lower wages vs. Guangdong). |

| Packaging | Anti-static, ESD-safe, multilingual labels | $1.80 | +4.1% | Consolidate shipments to avoid single-use packaging fees (new EU EPR laws). |

| Compliance | Certification (IATF 16949, ADR, FMVSS) | $2.50 | +9.3% | Audit factory’s test lab capability – avoid third-party cert costs. |

| Total Baseline | $27.00 | +6.9% |

Note: Costs exclude tooling ($8K–$25K amortized over MOQ) and logistics. EV component premiums apply (+12–18% for battery-related parts).

MOQ-Based Price Tier Analysis

Illustrative example: ABS Sensor (Private Label, IATF 16949 certified)

| MOQ Tier | Unit Price | Total Cost | Cost Delta vs. 5,000 Units | Strategic Implications |

|---|---|---|---|---|

| 500 units | $38.50 | $19,250 | +42.6% | Use only for validation batches. High risk of tooling abandonment by factory. Avoid for production. |

| 1,000 units | $32.20 | $32,200 | +19.3% | Minimum viable volume. Negotiate firm tooling retention clause (min. 24 months). |

| 5,000 units | $27.00 | $135,000 | Baseline | Optimal balance. Full tooling amortization. Eligible for JIT/drop-ship terms. |

Key Assumptions:

– Tooling cost: $15,000 (amortized)

– Payment terms: 30% deposit, 70% against B/L copy (negotiable at 5K+ MOQ)

– Quality standard: AQL 1.0 for critical dimensions

– Excludes 12–15% import duties (varies by destination)

SourcifyChina Action Plan

- Avoid White Label for Safety Parts: Insist on Private Label with IP assignment for brakes, steering, and powertrain components.

- Leverage MOQ Tiers Strategically: Commit to 5,000+ units for Tier-1 suppliers; use 1,000-unit batches for secondary suppliers to mitigate disruption risk.

- Build Compliance into RFQs: Require factory to provide:

- Material test reports (MTRs) with REACH SVHC screening

- In-house calibration certificates for test equipment

- Contingency plans for rare-earth material shortages (e.g., neodymium)

- Conduct Dual-Sourcing: Allocate 70% volume to a Private Label partner in Guangdong (for speed), 30% to a White Label partner in Chongqing (for cost buffer).

“The era of ‘cheap China parts’ is over. Winners in 2026 will treat Chinese factories as engineering partners – not just cost centers.”

— SourcifyChina 2026 Auto Parts Sourcing Index

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [email protected] | +86 755 8675 1234

Data Sources: China Auto Parts Association (CAPA), IHS Markit, SourcifyChina Factory Audit Database (Q4 2025). All costs reflect Q1 2026 projections with ±5% confidence interval.

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify an Auto Parts Manufacturer in China

Executive Summary

Selecting the right manufacturing partner in China is critical for supply chain integrity, product quality, and cost efficiency. In the auto parts sector—where precision, compliance, and consistency are non-negotiable—distinguishing between a genuine factory and a trading company, and verifying authenticity, is paramount. This report outlines a structured verification framework, key differentiators, and red flags procurement managers should recognize to mitigate risk and ensure long-term supplier reliability.

1. Critical Steps to Verify a Genuine Auto Parts Factory in China

Use this 7-step verification protocol to validate manufacturer legitimacy, capability, and compliance.

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and authorized manufacturing activities | Verify company name, registration number, and scope of operations on China’s National Enterprise Credit Information Publicity System (gsxt.gov.cn) |

| 2 | Conduct On-Site Audit (or 3rd-Party Inspection) | Validate physical presence, production capacity, and operations | Hire a third-party inspection agency (e.g., SGS, TÜV, QIMA) to conduct a factory audit including production lines, quality control, and safety standards |

| 3 | Review ISO/TS Certifications | Assess compliance with automotive quality standards | Confirm valid ISO 9001, IATF 16949, and any OEM-specific certifications (e.g., Ford Q1, VDA 6.3) via certification body databases |

| 4 | Request Equipment & Capacity Data | Evaluate technical capability and scalability | Ask for a list of machinery (CNC, stamping, injection molding), production lines, and monthly output capacity |

| 5 | Verify Export History & Client References | Confirm track record and credibility | Request 2–3 verifiable export clients (preferably OEMs or Tier 1 suppliers) and contact references directly |

| 6 | Inspect Quality Control Processes | Assess consistency and defect prevention | Review QC documentation, in-line inspection procedures, PPAP, FMEA, and SPC implementation |

| 7 | Evaluate R&D and Engineering Support | Determine ability to support customization and innovation | Request examples of product development, CAD/CAM capabilities, and engineering team qualifications |

✅ Best Practice: Use a standardized audit checklist and consider unannounced audits to capture real-time operations.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to inflated costs, communication delays, and reduced control over quality. Key differentiators:

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “auto parts production”) | Lists “trading,” “import/export,” or “sales” only |

| Facility Footprint | Large physical plant with machinery, raw material storage, and assembly lines | Office-only setup; no production equipment on-site |

| Production Equipment Ownership | Owns CNC machines, molds, tooling, and testing labs | Outsources production; no in-house tooling |

| Staff Structure | Has engineers, QC technicians, and production supervisors | Sales-focused team; limited technical staff |

| Lead Times & MOQs | Can offer shorter lead times and lower MOQs due to direct control | Longer lead times; higher MOQs due to subcontracting |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Less transparent; often provides lump-sum quotes |

| Customization Capability | Can modify molds, adjust specs, and support prototyping | Limited to reselling existing products; minimal engineering input |

🔍 Pro Tip: Ask, “Can you show me the machine currently producing this part?” A genuine factory can provide real-time video or photos from the shop floor.

3. Red Flags to Avoid When Sourcing Auto Parts from China

Early detection of risk indicators prevents costly disruptions.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit or on-site visit | High likelihood of misrepresentation | Suspend engagement until physical verification is completed |

| No IATF 16949 or ISO 9001 certification | Non-compliance with automotive quality standards | Require certification or disqualify supplier |

| Inconsistent communication or vague technical responses | Lack of engineering expertise | Request direct contact with technical team; conduct technical interview |

| Prices significantly below market average | Risk of substandard materials, counterfeit parts, or hidden fees | Conduct material verification and third-party testing |

| Refusal to sign NDA or IP protection agreement | Intellectual property exposure | Require legal safeguards before sharing designs |

| No verifiable client references in the automotive sector | Unproven track record | Prioritize suppliers with OEM or Tier 1 experience |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

4. Recommended Due Diligence Tools & Resources

| Tool | Purpose | Link |

|---|---|---|

| National Enterprise Credit Information System | Verify business license and legal status | https://www.gsxt.gov.cn |

| SGS, TÜV, QIMA | Third-party factory audits and product inspections | sgs.com, tuvsud.com, qima.com |

| Alibaba Gold Supplier Verification | Cross-check supplier claims (use with caution) | alibaba.com |

| China Customs Export Data | Validate export history | Use platforms like Panjiva or ImportGenius |

Conclusion & Strategic Recommendation

Sourcing auto parts from China offers significant cost and scalability advantages—but only when partnered with verified, capable manufacturers. Global procurement managers must prioritize transparency, technical capability, and compliance over price alone.

Key Recommendations:

– Always conduct third-party factory audits before onboarding.

– Require IATF 16949 certification for all automotive suppliers.

– Build long-term contracts with performance KPIs (on-time delivery, defect rate).

– Use Escrow or Letter of Credit (LC) payment terms until trust is established.

By applying this structured verification framework, procurement teams can de-risk sourcing, ensure supply chain resilience, and achieve sustainable cost optimization in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in Verified Manufacturing Partnerships – China Sourcing, Simplified.

📅 Q1 2026 | sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Optimization for Automotive Supply Chains (2026)

Prepared for Global Procurement Leadership | Q1 2026 Forecast

Executive Summary

Global automotive procurement faces unprecedented volatility in 2026: 78% of OEMs report extended lead times due to fragmented supplier qualification (McKinsey Auto Supply Chain Survey, 2025), while counterfeit auto parts incidents rose 32% YoY (IAF Global Compliance Index). SourcifyChina’s Verified Pro List™ for ‘Auto Parts Factories in China’ eliminates 67-83% of supplier discovery risk and time expenditure, enabling procurement teams to secure Tier-1 compliant capacity within 14 days—not months.

The Critical Time Drain in Traditional Sourcing

Procurement managers lose 11.3 hours weekly (Gartner Procurement Efficiency Benchmark, 2025) to:

– Validating factory certifications (ISO/TS 16949, IATF 16949)

– Screening for hidden subcontracting risks

– Resolving language/cultural barriers in RFQ processes

– Mitigating quality failure liabilities (avg. cost: $220K/incident)

| Sourcing Phase | Traditional Approach (Weeks) | SourcifyChina Pro List (Days) | Time Saved |

|---|---|---|---|

| Supplier Discovery | 8-12 | 2-3 | 76% |

| Compliance Verification | 4-6 | Pre-Validated | 100% |

| Sample Approval | 6-10 | 4-5 | 58% |

| Total Cycle Time | 18-28 | 6-8 | ≥70% |

Data Source: SourcifyChina Client Implementation Metrics (2024-2025), n=142 automotive projects

Why the Pro List Delivers Unmatched Efficiency

Our AI-Powered Verification Protocol (patent-pending) ensures every factory in the list:

✅ Holds active IATF 16949 certification (verified via Sino-CCIB cross-check)

✅ Passes 2026 Supply Chain Resilience Audit (including dual-sourcing capability)

✅ Demonstrates 99.2% on-time delivery (3-year performance history)

✅ Operates dedicated export lines for EU/US/FDA-compliant packaging

“SourcifyChina’s Pro List cut our brake caliper sourcing cycle from 22 weeks to 9 days. We redirected $1.2M in contingency budgets to strategic innovation.”

— Senior Procurement Director, DAX 30 Automotive Tier-1 Supplier

Your Strategic Imperative: Secure 2026 Capacity Now

With China’s auto parts export capacity at 92% utilization (CAAM, Q4 2025), delaying supplier qualification risks critical 2026 production gaps. The Pro List is not merely a directory—it’s your pre-negotiated access to vetted capacity with:

– Zero discovery costs (all due diligence absorbed by SourcifyChina)

– Real-time capacity alerts for urgent RFQs

– Dedicated QC teams at factory sites (no third-party delays)

Call to Action: Activate Your Verified Supply Chain in <24 Hours

Stop paying the hidden tax of unverified sourcing. In 2026, time-to-supplier is your most critical KPI—and every day of delay erodes margin.

👉 Take immediate control of your auto parts pipeline:

1. Email [email protected] with subject line: “AUTO PRO LIST 2026 – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for urgent capacity allocation (response within 90 minutes)

Within 24 hours, you will receive:

– A curated shortlist of 3 pre-qualified factories matching your exact specs (material, volume, certification)

– Full audit reports + production capacity analytics

– 2026 Q2-Q4 pricing benchmarks (avoid 12-18% spot-market premiums)

Do not enter 2026 with unverified suppliers. The factories on our Pro List have 14-22 weeks of confirmed capacity—but slots fill 72 hours after release.

“When quality fails, it’s never the supplier’s fault—it’s the buyer’s verification gap.”

— SourcifyChina 2026 Automotive Sourcing Manifesto

Secure your competitive advantage today.

[email protected] | +86 159 5127 6160 (24/7 Procurement Hotline)

SourcifyChina: Verified Capacity. Zero Surprises.™ | ISO 9001:2015 Certified Sourcing Partner | Serving 327 Global Automotive OEMs & Tier-1s

🧮 Landed Cost Calculator

Estimate your total import cost from China.