The global Automated Guided Vehicle (AGV) market is experiencing robust growth, driven by rising demand for automation in manufacturing, warehousing, and logistics. According to a report by Mordor Intelligence, the AGV market was valued at USD 4.3 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 10.5% from 2024 to 2029. This expansion is fueled by advancements in navigation technologies—such as laser guidance, vision systems, and AI integration—as well as the increasing adoption of Industry 4.0 practices across key industrial sectors. As companies seek to enhance operational efficiency, reduce labor costs, and improve supply chain resilience, AGVs have become a cornerstone of modern material handling systems. With such strong momentum, identifying the leading manufacturers shaping this evolving landscape is critical for stakeholders aiming to leverage automation at scale.

Top 10 Auto Guided Vehicle Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Rocla AGV

Domain Est. 2002 | Founded: 1983

Website: rocla-agv.com

Key Highlights: Automated guided vehicle solutions from the industry pioneer. Since 1983, we have delivered thousands of automation solutions defined by our customers’ unique ……

#2 AMR & AGV: Autonomous Mobile Robots

Domain Est. 2015

Website: agilox.net

Key Highlights: AGILOX develops the world’s easiest AMR Solutions (AMR | AGVs). ✓ Find out more about our Autonomous Mobile Robots (AMRs) on our homepage!…

#3 Automated Guided Vehicle Manufacturers

Domain Est. 2016

Website: visionnav.com

Key Highlights: Headquartered in Atlanta, VisionNav® Robotics is a global leader in autonomous industrial vehicles (AMRs/AGVs) and logistics automation solutions….

#4 AGV (Automatic guided vehicle)

Domain Est. 1994

Website: murata.com

Key Highlights: Factory AutomationAGV (Automatic guided vehicle). Murata’s lineup of products for use in automatic guided vehicles (AGVs) is introduced here….

#5 Leading Automatic Guided Vehicle Manufacturers

Domain Est. 2002

Website: automaticguidedvehicles.com

Key Highlights: Automatic guided vehicles (AGVs) are computer-controlled robots that are also referred to as self guided vehicles, or self propelled vehicles….

#6 Automated Guided Vehicle Manufacturer

Domain Est. 2015

Website: jagco.com

Key Highlights: JagCo specializes in Automated Guided Vehicles solutions, offering robust Load Handling Equipment & innovative robotic process automation for manufacturing….

#7 Automated Guided Vehicles AGV for Material Handling

Domain Est. 1997

Website: swisslog.com

Key Highlights: Automated guided vehicles (AGVs) are significantly more flexible than fixed installations and are demonstrably lower costs above a certain layout size….

#8 Future of Manufacturing: Automated Guided Vehicle

Domain Est. 2008

Website: redviking.com

Key Highlights: Specializing in automated guided vehicles (AGV), autonomous mobile robots (AMR), custom automation, MES solutions, and Dynamic Testing Solutions….

#9 Automated guided vehicle system

Domain Est. 2015

Website: agvegroup.com

Key Highlights: AGVE® offers automated guided vehicle control solutions for applications ranging from a single vehicle to complex integrated multi-AGV systems. ➤ Welcome!…

#10 AGV

Domain Est. 2020

Website: ek-robotics.com

Key Highlights: Automated guided vehicles (AGVs) are revolutionizing intralogistics by automating transport processes, reducing operating costs, and increasing workplace safety ……

Expert Sourcing Insights for Auto Guided Vehicle

H2: 2026 Market Trends for Autonomous Mobile Robots (AMRs) – Intelligence, Flexibility, and Scalability Take Center Stage

By 2026, the Autonomous Mobile Robot (AMR) market is poised for significant transformation, moving beyond simple material transport to become a cornerstone of intelligent, adaptive, and highly efficient logistics and manufacturing ecosystems. Driven by advancements in AI, sensor fusion, and seamless integration, the key trends shaping the market will revolve around enhanced intelligence, operational flexibility, scalability, and expanded application scope.

1. Intelligence & Autonomy Leap: From Navigation to Cognitive Decision-Making

* AI-Powered Pathfinding & Optimization: AMRs will leverage sophisticated AI algorithms (reinforcement learning, predictive analytics) to dynamically optimize routes in real-time, considering not just static obstacles but also predicted human/vehicle traffic, congestion patterns, and task urgency. This moves beyond reactive obstacle avoidance to proactive flow management.

* Predictive Maintenance & Self-Healing: Integrated sensors and AI will enable AMRs to predict component failures (motors, batteries) before they occur, scheduling maintenance autonomously and minimizing unplanned downtime. Basic self-diagnostic and recovery routines will become standard.

* Contextual Awareness & Interaction: AMRs will achieve higher levels of situational understanding. They will recognize specific objects, interpret basic human gestures or simple voice commands in noisy environments, and adapt behavior contextually (e.g., slowing down near break areas, yielding appropriately).

2. Flexibility & Scalability: The Rise of Heterogeneous Fleets & Cloud-Native Architectures

* Heterogeneous Fleet Orchestration: Warehouses and factories will deploy fleets combining different AMR types (payload carriers, tuggers, lift trucks, collaborative arms) seamlessly. Centralized orchestration platforms (cloud-based Fleet Management Systems – FMS) will intelligently assign tasks based on robot capability, location, and current load, maximizing overall efficiency.

* Plug-and-Play Deployment & Scalability: Deployment times will drastically reduce. New AMRs will automatically map environments, integrate with existing fleets via cloud FMS, and receive software updates over-the-air (OTA). Scaling fleets up or down will be a software-configurable task, not a major engineering project.

* Cloud-Native FMS & Digital Twins: FMS will be predominantly cloud-native, offering real-time visibility, remote monitoring, advanced analytics, and simulation capabilities. Digital twins of facilities will be used for testing fleet configurations, optimizing layouts, and predicting throughput before physical changes are made.

3. Application Expansion: Beyond Pallets and Carts into Complex Tasks

* Proliferation in Warehousing & E-Commerce Fulfillment: AMRs remain dominant in goods-to-person, put-away, and sorting applications, driven by relentless e-commerce growth and labor challenges. Expect wider adoption in last-mile micro-fulfillment centers.

* Deep Penetration into Manufacturing: Applications will expand beyond material delivery to include machine tending (loading/unloading CNCs, injection molders), in-process kit delivery, and quality inspection support. AMRs will integrate directly with MES and SCADA systems.

* Emerging Applications: Growth in healthcare (lab sample transport, linen delivery), hospitality (room service, luggage), and agriculture (greenhouse monitoring, harvest support). Specialized AMRs for hazardous material handling and construction site logistics will gain traction.

4. Integration & Ecosystem Maturity: Seamless Workflow Connectivity

* Deeper ERP/MES/WMS Integration: AMR systems will move beyond simple API connections to deeper, bidirectional integration. They will pull work orders directly from WMS/ERP, update inventory levels in real-time upon task completion, and trigger downstream processes autonomously.

* Standardization & Interoperability: Industry efforts (like VDA 5050) will gain significant adoption, enabling true multi-vendor fleet management and reducing vendor lock-in. Plug-and-play communication between AMRs and other automation (conveyors, robots, AGVs) will improve.

* Human-Robot Collaboration (HRC) Focus: Design and software will prioritize safe and intuitive interaction with human workers. This includes improved non-verbal signaling (lights, displays), predictable motion, and collaborative workflows where AMRs and humans seamlessly hand off tasks.

5. Cost & Accessibility Evolution: Democratization of Automation

* Lower TCO & Faster ROI: Continued hardware cost reduction (sensors, compute) and improved software efficiency will lower the Total Cost of Ownership (TCO). Combined with higher throughput and reduced labor costs, the ROI period will shorten, making AMRs accessible to smaller and mid-sized enterprises (SMEs).

* Robotics-as-a-Service (RaaS) Dominance: RaaS models will become the primary adoption path, especially for SMEs. This lowers upfront capital expenditure, bundles hardware, software, maintenance, and support into predictable operational expenses, and allows for easy scaling.

* Focus on Usability & Training: Vendors will invest heavily in intuitive user interfaces (UIs), simplified programming (no-code/low-code), and comprehensive training programs to reduce the skill barrier for deployment and daily operation.

Conclusion:

By 2026, the AMR market will be characterized by smarter, more adaptable, and deeply integrated robots operating within scalable, cloud-managed fleets. The focus will shift from isolated automation to creating intelligent, self-optimizing material flow systems that are easy to deploy, manage, and scale. Success will hinge on vendors offering not just hardware, but comprehensive, interoperable software platforms and flexible commercial models (like RaaS) that deliver tangible operational improvements across a widening array of industries. The AMR will transition from a tool to a core component of the autonomous, data-driven factory and warehouse of the future.

Common Pitfalls in Sourcing Auto Guided Vehicles: Quality and Intellectual Property Risks

Quality-Related Pitfalls

Insufficient Due Diligence on Manufacturer Capabilities

Organizations often underestimate the importance of thoroughly vetting AGV suppliers. Relying solely on marketing materials or third-party referrals without verifying production standards, testing protocols, or real-world performance data can lead to substandard equipment. Poor build quality, unreliable navigation systems, and frequent breakdowns are common outcomes when suppliers lack rigorous quality control processes.

Overlooking Environmental and Operational Compatibility

AGVs must perform reliably in specific environments (e.g., temperature extremes, dust, humidity, floor conditions). Sourcing vehicles without validating their suitability for the actual operating environment can result in premature wear, sensor failure, or navigation inaccuracies. Failure to test prototypes under real conditions increases the risk of post-deployment malfunctions.

Inadequate Validation of Safety and Compliance Standards

Choosing AGVs that do not meet regional safety certifications (e.g., CE, UL, ANSI/ITSDF B56.5) exposes companies to regulatory fines and workplace hazards. Some suppliers may claim compliance without full certification, especially in emerging markets. Skipping independent verification of safety features like emergency stops, obstacle detection, and fail-safe mechanisms can compromise worker safety.

Neglecting Software Reliability and Update Support

AGV performance heavily depends on firmware and control software. Sourcing from vendors with opaque software development practices or limited update cycles may result in bugs, cybersecurity vulnerabilities, or obsolescence. Without long-term software support, integration with warehouse management systems (WMS) or enterprise resource planning (ERP) platforms can degrade over time.

Intellectual Property-Related Pitfalls

Ambiguous Ownership of Customizations and Integrations

When AGVs are customized for specific workflows or integrated with proprietary systems, ownership of the resulting software, configurations, or interfaces may not be clearly defined. Suppliers might retain IP rights to modifications, limiting the buyer’s ability to modify, maintain, or transfer systems without vendor dependency.

Use of Third-Party or Unlicensed Technology

Some AGV manufacturers incorporate third-party navigation algorithms, sensor fusion software, or communication protocols without proper licensing. Buyers risk legal exposure if the deployed system infringes on patents or copyrights. Conducting IP audits and requiring indemnification clauses in contracts is essential but often overlooked.

Lack of Transparency in Core Technology

Suppliers may treat core components—especially AI-based pathfinding or fleet management logic—as “black boxes.” This opacity makes it difficult to assess innovation originality, troubleshoot issues, or ensure freedom to operate. Without access to technical documentation or source code (where applicable), buyers face long-term maintenance and scalability challenges.

Inadequate Protection of Buyer’s Operational Data

AGVs collect vast amounts of operational data (e.g., traffic patterns, inventory movement). Contracts that fail to specify data ownership, usage rights, and storage locations may allow suppliers to exploit or monetize sensitive information. Ensuring data sovereignty and including data protection clauses is critical to safeguarding competitive advantage.

Logistics & Compliance Guide for Auto Guided Vehicles (AGVs)

Introduction to AGVs in Logistics

Auto Guided Vehicles (AGVs) are mobile robots used in industrial and logistics environments to transport materials autonomously. They enhance operational efficiency, reduce labor costs, and improve workplace safety. This guide outlines key considerations for deploying AGVs with a focus on logistics integration and regulatory compliance.

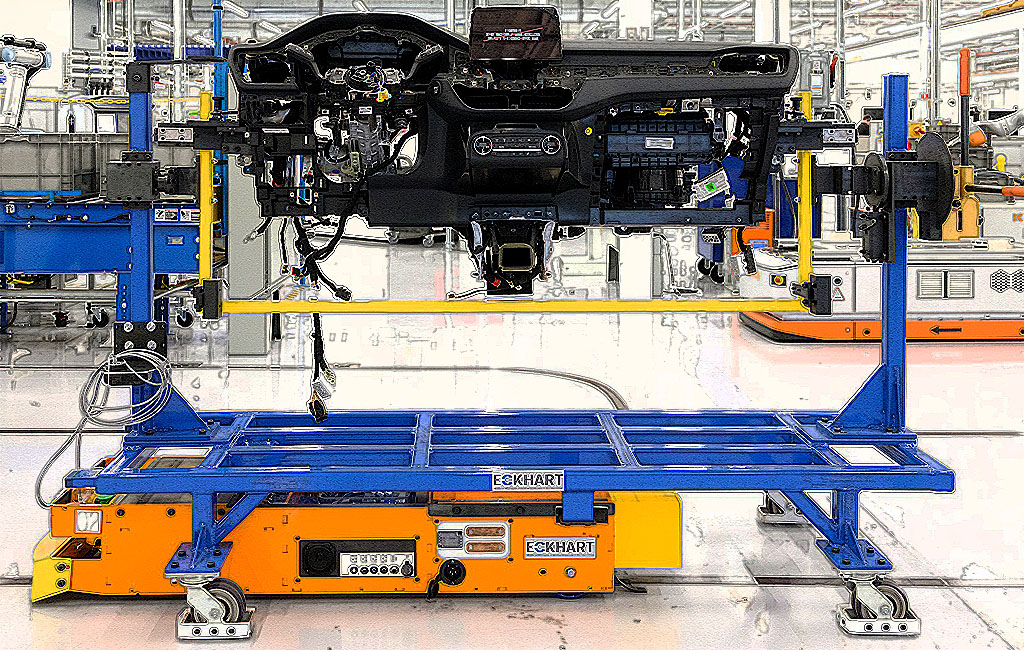

AGV Types and Applications

Different types of AGVs serve specific logistics functions:

– Towing AGVs – Pull carts or trailers for heavy loads.

– Unit Load AGVs – Transport pallets or large containers.

– Forklift AGVs – Lift and stack materials like automated forklifts.

– Assembly Line AGVs – Deliver components to workstations in production environments.

– Pallet AGVs – Specialized for pallet handling in warehouses.

Choosing the right AGV depends on load type, facility layout, and workflow requirements.

Facility Integration and Logistics Planning

Successful AGV deployment requires careful logistics planning:

– Path Mapping – Define travel routes using magnetic tape, lasers, or vision-based navigation.

– Traffic Management – Implement fleet management software to avoid congestion and collisions.

– Dock and Storage Integration – Ensure AGVs can interact seamlessly with racking, conveyors, and loading docks.

– Throughput Analysis – Assess material flow needs to determine fleet size and scheduling.

Safety Standards and Compliance

AGVs must comply with national and international safety regulations:

– ANSI/ITSDF B56.5 – U.S. safety standard for low-lift and high-lift trucks, including AGVs.

– ISO 3691-4 – International standard for safety requirements of driverless industrial trucks.

– OSHA Regulations – Ensure workplace safety under U.S. Occupational Safety and Health Administration guidelines.

Key safety features include emergency stop buttons, obstacle detection sensors, warning lights, and speed control.

Risk Assessment and Mitigation

Conduct a thorough risk assessment before AGV implementation:

– Identify interaction zones with personnel and equipment.

– Install safety barriers, light curtains, or zone control systems.

– Perform regular safety audits and update risk assessments as operations change.

– Use safety-rated monitored speed zones in high-traffic areas.

Operational Compliance and Maintenance

Ongoing compliance requires structured operational procedures:

– Training – Train staff on AGV operation, emergency procedures, and safety protocols.

– Maintenance Schedules – Follow manufacturer-recommended maintenance to ensure reliability and compliance.

– Documentation – Maintain logs for inspections, repairs, and safety incidents.

– Software Updates – Apply firmware and software updates to address security and functionality issues.

Cybersecurity and Data Protection

AGVs connected to warehouse management systems (WMS) or cloud platforms require cybersecurity measures:

– Secure communication protocols (e.g., encrypted networks).

– Access controls to prevent unauthorized programming or operation.

– Regular vulnerability assessments and network monitoring.

– Compliance with data protection regulations such as GDPR or CCPA when applicable.

Environmental and Energy Considerations

AGVs contribute to sustainability when properly managed:

– Use energy-efficient models with regenerative braking.

– Optimize charging schedules to reduce peak energy demand.

– Choose AGVs with recyclable batteries and low-emission components.

– Monitor energy consumption as part of ESG (Environmental, Social, and Governance) reporting.

Regulatory Documentation and Audits

Prepare for compliance audits by maintaining:

– Equipment certification documents (e.g., CE marking, UL certification).

– Risk assessment reports and safety validation records.

– Training logs and incident reports.

– Facility layout diagrams showing AGV pathways and safety zones.

Conclusion

Integrating AGVs into logistics operations offers significant efficiency gains but requires strict adherence to safety, compliance, and operational standards. By following this guide, organizations can ensure safe, legal, and effective AGV deployment that supports long-term operational success.

Conclusion on Sourcing Automated Guided Vehicles (AGVs):

Sourcing Automated Guided Vehicles (AGVs) represents a strategic investment in modernizing material handling and enhancing operational efficiency within warehouses, manufacturing plants, and distribution centers. After thorough evaluation of available options, technological capabilities, and vendor offerings, it is evident that AGVs offer significant advantages in terms of labor cost reduction, improved accuracy, continuous operation, and scalability.

Key considerations such as navigation technology (e.g., laser, vision, or magnetic guidance), load capacity, integration with existing systems (like WMS or MES), safety features, and total cost of ownership must align with the organization’s specific operational requirements. Additionally, partnering with reputable suppliers offering strong after-sales support, customization options, and future-ready solutions ensures long-term success.

In conclusion, sourcing AGVs is a forward-looking decision that supports digital transformation, boosts productivity, and strengthens competitiveness in an increasingly automated industrial landscape. With careful planning, proper implementation, and ongoing optimization, AGVs can deliver a strong return on investment and serve as a cornerstone of smart logistics and Industry 4.0 initiatives.