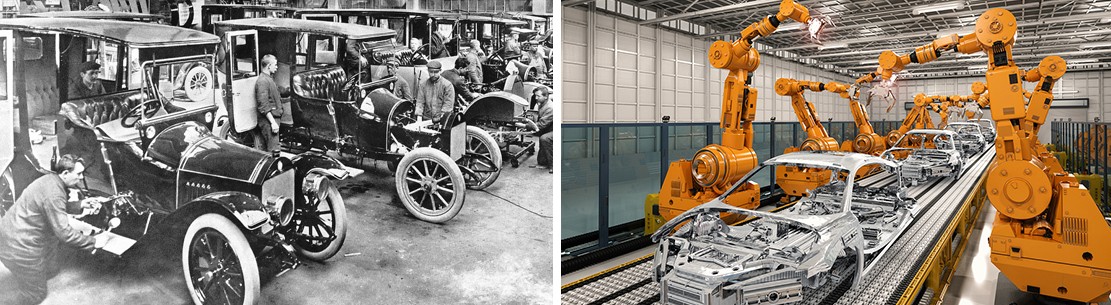

The global automotive aftermarket industry is experiencing robust expansion, driven by increasing vehicle ownership, rising demand for vehicle performance enhancements, and the growing preference for cost-effective maintenance solutions over new vehicle purchases. According to a 2023 report by Mordor Intelligence, the market was valued at USD 688.27 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.37% from 2024 to 2029, reaching an estimated USD 939.61 billion by 2028. This sustained growth is further fueled by the increasing average vehicle age, particularly in mature markets like North America and Western Europe, where consumers are opting to extend the lifespan of their vehicles through aftermarket parts and services. Additionally, technological advancements in electric vehicles (EVs) and advanced driver-assistance systems (ADAS) are creating new aftermarket opportunities. As demand intensifies, leading manufacturers are investing heavily in R&D, geographic expansion, and digital distribution channels to capture market share. In this evolving landscape, the following ten companies have emerged as key players, demonstrating innovation, global reach, and strong financial performance in the auto aftermarket sector.

Top 10 Auto Aftermarket Companies Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Genuine Parts Company

Domain Est. 1995 | Founded: 1928

Website: genpt.com

Key Highlights: Established in 1928, Genuine Parts Company is a leading global service provider of automotive and industrial replacement parts and value-added solutions….

#2 Advancing the Vehicle Supplier Industry

Domain Est. 1997

Website: mema.org

Key Highlights: Join MEMA to drive the vehicle supplier industry forward. Our influential network unites manufacturers, leaders, and startups for collective advocacy ……

#3 MAHLE Aftermarket North America

Domain Est. 2000

Website: mahle-aftermarket.com

Key Highlights: MAHLE Lifecylce and Mobility is the world’s leading manufacturer of more than 100,000 OE and aftermarket parts, including MAHLE gaskets, CLEVITE engine bearings ……

#4 DENSO Auto Parts

Domain Est. 2006

Website: densoautoparts.com

Key Highlights: For over 70 years, DENSO has been on the cutting edge of automotive technology by contributing new products, materials, and designs to the OE and aftermarket ……

#5 TRW

Domain Est. 1996

Website: aftermarket.zf.com

Key Highlights: TRW Aftermarket strives to be the industry leading provider of safety related car parts and service. Our Vision is to be the global leader in automotive ……

#6 Dorman Products

Domain Est. 2001

Website: dormanproducts.com

Key Highlights: Dorman gives auto repair professionals and vehicle owners greater freedom to fix cars and trucks by focusing on solutions first….

#7 Keystone Automotive

Domain Est. 2003

Website: keystoneautomotive.com

Key Highlights: Automotive. The automotive aftermarket is the largest market serviced by Keystone, encompassing all parts and accessories for replacement, appearance, comfort, ……

#8 Bosch Auto Parts

Domain Est. 2004 | Founded: 1997

Website: boschautoparts.com

Key Highlights: World Leader and Supplier of Diesel Fuel Injection Systems. Since 1997, Bosch common rail injectors have been the industry standard for Diesel Fuel systems….

#9 Delphi Autoparts

Domain Est. 2012

Website: delphiautoparts.com

Key Highlights: Delphi, a PHINIA brand, leads the global Aftermarket with next-gen talent, innovations, products, and smart services, shaping a connected future….

#10 DMA Industries

Domain Est. 2021

Website: dmaindustries.com

Key Highlights: DMA Industries is the trusted supplier to the North American Automotive Parts Aftermarket, serving the OES, big box retail, wholesale, and e-tail sales ……

Expert Sourcing Insights for Auto Aftermarket Companies

2026 Market Trends for Auto Aftermarket Companies

The automotive aftermarket industry is poised for significant transformation by 2026, driven by technological advancements, shifting consumer behaviors, and evolving vehicle technology. Auto aftermarket companies must adapt to these trends to maintain competitiveness and capture growth opportunities.

Rising Demand for Advanced Driver Assistance Systems (ADAS) Services

As ADAS features become standard in new vehicles, the need for proper calibration and repair in the aftermarket will surge. By 2026, an increasing number of vehicles in operation will require specialized tools, training, and OEM-level diagnostic software for repairs involving sensors, cameras, and radar systems. Aftermarket companies that invest in ADAS certification programs and technician upskilling will be well-positioned to meet this demand, turning a complex service into a high-margin opportunity.

Growth in Electric Vehicle (EV) Aftermarket Services

While EVs have fewer moving parts than internal combustion engine (ICE) vehicles, the aftermarket for EVs is expanding rapidly. By 2026, companies offering EV-specific services—such as battery diagnostics, thermal management system repairs, electric motor maintenance, and charging infrastructure support—will see growing demand. Aftermarket players must develop expertise in high-voltage systems and partner with battery recyclers or remanufacturers to offer cost-effective solutions for aging EV fleets.

Digitalization and E-Commerce Expansion

Consumers increasingly expect seamless online experiences, and the aftermarket is no exception. By 2026, e-commerce platforms, mobile apps, and digital inventory management systems will be essential. Companies leveraging data analytics, AI-driven recommendations, and augmented reality (AR) for part identification and installation guidance will enhance customer engagement and loyalty. Integration with supply chain systems to ensure real-time inventory visibility will further differentiate leading players.

Emphasis on Sustainability and Circular Economy

Environmental regulations and consumer preferences are pushing the aftermarket toward sustainable practices. Remanufactured parts, eco-friendly packaging, and closed-loop recycling programs will gain prominence by 2026. Aftermarket companies that promote the environmental and economic benefits of remanufactured components—such as engines, transmissions, and alternators—will appeal to cost-conscious and eco-aware consumers, especially as original equipment prices rise.

Labor Shortages and Workforce Development Challenges

A persistent shortage of skilled technicians will continue to impact service capacity. By 2026, companies investing in training academies, partnerships with vocational schools, and retention programs will have a competitive edge. Automation, remote diagnostics, and AI-powered troubleshooting tools will help offset labor constraints and improve service efficiency across repair networks.

Integration of Data and Predictive Maintenance

Connected vehicles generate vast amounts of data that aftermarket companies can leverage. By 2026, predictive maintenance platforms that analyze vehicle data to forecast part failures and recommend timely interventions will become mainstream. Aftermarket suppliers offering data-enabled services—such as proactive part replacement programs or fleet maintenance analytics—will create new revenue streams and strengthen customer relationships.

In conclusion, the 2026 aftermarket landscape will favor companies that embrace innovation, sustainability, and digital transformation. Success will depend on agility, strategic investment in technology, and a deep understanding of evolving vehicle platforms and consumer expectations.

Common Pitfalls When Sourcing Auto Aftermarket Companies (Quality, IP)

Sourcing from auto aftermarket suppliers can offer cost advantages and innovation, but it also comes with significant risks—particularly in the areas of quality control and intellectual property (IP) protection. Failing to address these pitfalls can lead to product failures, legal disputes, reputational damage, and financial losses.

Quality Inconsistencies

One of the most prevalent challenges when sourcing from auto aftermarket companies is inconsistent product quality. Unlike OEM (Original Equipment Manufacturer) parts, aftermarket components are not always held to the same rigorous standards.

- Lack of Standardization: Aftermarket parts can vary widely in materials, manufacturing processes, and performance. Suppliers may cut corners to reduce costs, resulting in parts that fail prematurely or under stress.

- Inadequate Testing and Certification: Many aftermarket suppliers do not invest in comprehensive testing (e.g., durability, temperature resistance, safety compliance), leading to parts that do not meet industry specifications such as ISO/TS 16949 or SAE standards.

- Poor Process Control: Without robust quality management systems, batch-to-batch variability can be high, increasing the risk of defective products entering the supply chain.

- Counterfeit and Substandard Components: Some suppliers may source raw materials or subcomponents from unverified vendors, introducing counterfeit or inferior materials that compromise final product integrity.

To mitigate these risks, buyers should conduct thorough supplier audits, require third-party certifications, and implement incoming inspection protocols.

Intellectual Property (IP) Infringement

Another major concern when sourcing from aftermarket suppliers is the potential for intellectual property violations.

- Unauthorized Design Copying: Some aftermarket companies replicate OEM designs without licensing, producing “pattern” parts that infringe on patents, trademarks, or design rights. While some jurisdictions allow reverse engineering for interoperability, outright copying can lead to legal action.

- Trademark and Branding Issues: Aftermarket parts may bear logos, part numbers, or branding that closely resemble OEMs, creating confusion in the market and exposing buyers to litigation for contributory infringement.

- Lack of IP Documentation: Suppliers may be unable or unwilling to provide proof of IP ownership or licensing agreements, leaving buyers vulnerable if a third party asserts IP claims.

- Gray Market and Export Risks: Sourcing from suppliers in regions with lax IP enforcement increases exposure to counterfeit goods and complicates enforcement options.

To protect against IP risks, buyers should conduct IP due diligence, require suppliers to warrant non-infringement, include indemnification clauses in contracts, and avoid suppliers known for replicating branded designs.

By proactively addressing these quality and IP pitfalls, companies can build more resilient and compliant supply chains in the competitive auto aftermarket landscape.

Logistics & Compliance Guide for Auto Aftermarket Companies

Navigating the complexities of logistics and regulatory compliance is critical for auto aftermarket companies to ensure timely delivery, maintain quality standards, and avoid legal or financial penalties. This guide outlines essential best practices and compliance considerations for businesses involved in manufacturing, distribution, and sale of automotive parts and accessories.

Supply Chain Management

Efficient supply chain management ensures the availability of quality parts while minimizing costs and delays. Auto aftermarket companies must establish strong relationships with suppliers, monitor inventory levels, and implement demand forecasting tools.

- Supplier Vetting: Conduct due diligence on suppliers to ensure reliability, quality control, and adherence to industry standards.

- Inventory Optimization: Utilize Just-in-Time (JIT) or vendor-managed inventory (VMI) models to reduce carrying costs while maintaining stock availability.

- Dual Sourcing: Establish backup suppliers to mitigate risks from supply disruptions.

Transportation and Distribution

Transportation plays a crucial role in delivering parts to distributors, repair shops, and end consumers. Choosing the right logistics partners and transport modes is essential.

- Freight Mode Selection: Balance cost and speed using a mix of ground, air, and sea freight based on product urgency and destination.

- Route Optimization: Use logistics software to plan efficient delivery routes, reducing fuel costs and delivery times.

- Last-Mile Delivery: Partner with reliable local carriers or leverage third-party logistics (3PL) providers for fast, accurate final delivery.

Warehousing and Inventory Control

Proper warehouse operations ensure parts are stored safely and retrieved efficiently. Implementing modern warehouse management systems (WMS) enhances accuracy and traceability.

- Barcoding and RFID: Use technology to track inventory in real time, reducing errors and stockouts.

- Storage Conditions: Store sensitive components (e.g., electronics, rubber parts) in climate-controlled environments to prevent degradation.

- Cycle Counting: Perform regular inventory audits to maintain data accuracy and identify shrinkage.

Regulatory Compliance

Auto aftermarket companies must comply with a range of local, national, and international regulations. Non-compliance can lead to fines, product recalls, or import/export restrictions.

Product Safety and Certification

- DOT and FMVSS Compliance: In the U.S., certain aftermarket parts (e.g., lighting, braking systems) must meet Department of Transportation (DOT) and Federal Motor Vehicle Safety Standards (FMVSS).

- EPA Regulations: Exhaust and emissions-related parts must comply with Environmental Protection Agency (EPA) standards; selling defeat devices is illegal.

- CARB Compliance: In California, parts must be certified by the California Air Resources Board (CARB) if they affect emissions.

- E-Mark and CE Marking: For European markets, parts must meet ECE Regulations and carry E-mark or CE marking where applicable.

Labeling and Packaging Requirements

- Accurate Product Labeling: Include part numbers, manufacturing date, country of origin, compliance marks, and installation instructions.

- Multilingual Packaging: For international sales, provide packaging and documentation in local languages.

- Hazard Communication: Clearly label hazardous materials (e.g., brake fluids, adhesives) per OSHA and GHS standards.

Import and Export Compliance

- HS Code Classification: Accurately classify products using Harmonized System (HS) codes for correct tariff application.

- Customs Documentation: Maintain complete records including commercial invoices, packing lists, and certificates of origin.

- ITAR and EAR: Be aware of export controls under the International Traffic in Arms Regulations (ITAR) or Export Administration Regulations (EAR) for certain high-tech components.

Environmental and Sustainability Practices

Growing regulatory and consumer demand for sustainability requires eco-friendly logistics and operations.

- Hazardous Waste Disposal: Follow EPA and local guidelines for disposal of oils, batteries, and chemicals.

- Recycling Programs: Implement take-back or recycling programs for used parts and packaging.

- Carbon Footprint Reduction: Optimize transport routes, use fuel-efficient vehicles, and source materials responsibly.

Data Security and Traceability

With increasing digitization, protecting customer and operational data is critical.

- GDPR and CCPA Compliance: Adhere to data privacy laws when handling customer information in the EU or California.

- Part Traceability: Maintain records of serial numbers, batch codes, and shipping details to support recalls and warranty claims.

- Cybersecurity Measures: Protect logistics and ERP systems from breaches with firewalls, encryption, and access controls.

Risk Management and Contingency Planning

Unforeseen events such as natural disasters, port strikes, or geopolitical issues can disrupt operations.

- Business Continuity Plans: Develop strategies to maintain operations during disruptions.

- Insurance Coverage: Secure cargo, liability, and business interruption insurance.

- Supplier Risk Assessment: Regularly evaluate supplier stability and geographic risk exposure.

Conclusion

A robust logistics and compliance framework enables auto aftermarket companies to deliver high-quality products efficiently and legally across global markets. By investing in technology, adhering to regulations, and planning for risks, businesses can enhance customer satisfaction, reduce costs, and maintain a competitive edge. Regular audits and staff training are essential to ensure ongoing compliance and operational excellence.

In conclusion, sourcing auto aftermarket companies requires a strategic and well-researched approach to ensure reliability, quality, and cost-effectiveness. By identifying key suppliers with strong industry reputations, evaluating their certifications and manufacturing capabilities, and considering factors such as geographic location, logistics, and compliance with international standards, businesses can build resilient supply chains. Leveraging both local and global suppliers offers competitive advantages, including innovation, scalability, and access to niche products. Establishing long-term partnerships, conducting regular performance assessments, and staying responsive to market trends further enhance sourcing success. Ultimately, a well-executed sourcing strategy in the auto aftermarket sector supports improved product quality, operational efficiency, and customer satisfaction in a highly competitive industry.